🎶 It’s the most wonderful time of the year🎶

It’s also that time of the year when newsletter writers dust off their crystal balls and jot down their bold predictions for the new year.

I have to admit when I first met Ivan, his crystal ball both astonished and scared me. It was the beginning of Covid. And to greatly understate, he had very different views about how it would all pan out.

It didn’t take long before he earned himself the “conspiracy theorist” tag. Twitter even suspended him for a while.

But in the end, Ivan was right. Most of his then unpopular calls became the new norm. Let’s take a quick look.

Prediction and Results

Prediction: In March 2020, when COVID-19 was first announced as a pandemic, Ivan suggested that there would be a global vaccination program. This program would then be a spring board for digital vaccine passports.

Result: How’s your QR code or vaccination passport working out for you now?

Prediction: In July 2020, Ivan showed you why the PCR test is highly inaccurate, easy to contaminate, and should have never been used to determine if someone has COVID. He also did a full-dive on this topic in November 2020, which you can find here.

Result: Two years later, the CDC is removing the PCR test.

Why? Just take a look at these headlines…

C.D.C. Virus Tests Were Contaminated and Poorly Designed, Agency Says

Report Says CDC’s First COVID Tests had Design Flaw

And Via USNews:

“(CDC Director Rochelle Walensky) said that PCR tests can turn up positive results for up to 12 weeks after infection, which is long past when a person is contagious. And she added that the agency doesn’t know if rapid at-home antigen tests “give a good indication of transmissibility at this stage of infection.””

Funny how fact-checkers like to claim that it’s because of “demand” issues…

Via USA Today:

“The CDC’s PCR test will be removed from the list of tests under emergency use authorization because the demand for it has decreased with the authorization of other diagnostic tests – not because it confuses viruses.”

Prediction: He also mentioned that hospitalizations and deaths were being blown out of proportion because someone has to simply die with COVID symptoms, or test positive for COVID, to be labeled a COVID death or COVID hospitalization. Was Ivan right?

Result: Just ask the Governor of New York.

Via the Governor of New York, Jan 2, 2022:

“We talked about the hospitalizations. I have always wondered, we’re looking at the hospitalizations of people testing positive in a hospital. Is that person in the hospital because of COVID or did they show up there and are routinely tested and showing positive and they may have been asymptomatic or even just had the sniffles. Someone is in a car accident, they go to the emergency room, they test positive for COVID while they’re there. They’re not there being treated for COVID. Now, someone’s conditions can worsen while they’re in the hospital, I’m not saying that won’t happen, but I’ve just been doing a random call around to some of the hospital leaders that I touched base with them. I’m seeing numbers from 20, sometimes 50 percent, but we don’t have clear data right now. Now, that’s anecdotal. Beginning tomorrow, we’re going to be asking all hospitals to break out for us. How many people are being hospitalized because of COVID symptoms? How many people are happened to be testing positive just while they’re in there for other treatments.”

In fact, in some cases, up to 50- 65% of New York hospitalized covid patients actually had incidental covid – meaning, they weren’t in the hospital for COVID, but tested positive once they were there.

Prediction: In November 2020, Ivan suggested that as soon as the weather got colder, cases would spike again leading to continued lockdowns.

Result: Well, despite being two years into the “pandemic,” social distancing, mask-wearing, schools closing, small businesses shutdowns, and being near fully vaccinated, many places are once again locking down. In fact, Quebec still has a curfew – and, at one point, even prevented its citizens from walking their dogs past 10pm.

Prediction: Ivan has repeatedly stated the vaccines don’t prevent spread, and, in fact, may cause a wider spread. He also stated that once the US and Canada are mostly close to being fully vaccinated, cases will spike again.

Result: Do you really need proof of this now?

Prediction: In March 2020, Ivan claimed that this pandemic wasn’t anything to really worry about, and that stocks will continue to climb.

Result: Two years later, the stock market is at an all-time high.

In hindsight, it was all so obvious. The facts were there – you just had to look at things with an open and critical mind.

Yet, when we sit down to turn these isolated trends into a longer-term economic view, it’s almost guaranteed that we’ll debate for hours before reaching the same conclusion:

It depends.

That doesn’t surprise or bother me anymore.

I’ve spent a good part of my career working with New York Times best-selling economists and some of America’s most successful fund managers. And if there is one thing I’ve learned, it’s that the economy is an abyss of infinite outcomes.

There are simply too many variables with an overwhelmingly large number of possible results.

This is why economics is so often called a “dismal science.” And why some of the smartest people on earth get it so wrong.

So, this year, we decided to do something different.

Instead of putting out a piece with rather speculative New Year predictions— riddled with mights, mays, and ifs, not to mention asterisk upon asterisk—let’s talk about the fallacy of economic predictions.

Extrapolating the Past

Statistical forecasting may sound like rocket science, but at its heart, it’s a simple extrapolation.

You take data from the past and stretch it out into the future using formulas like moving average. Then you fine-tune its trajectory based on your opinions about the future. And voilà, you’ve got yourself a CNBC-worthy market prediction.

Extrapolation is the basis of all forecasting models, but it has a few big caveats.

First, to extrapolate a past trend, you must aggregate it into a model. But how do you accurately summarize the past?

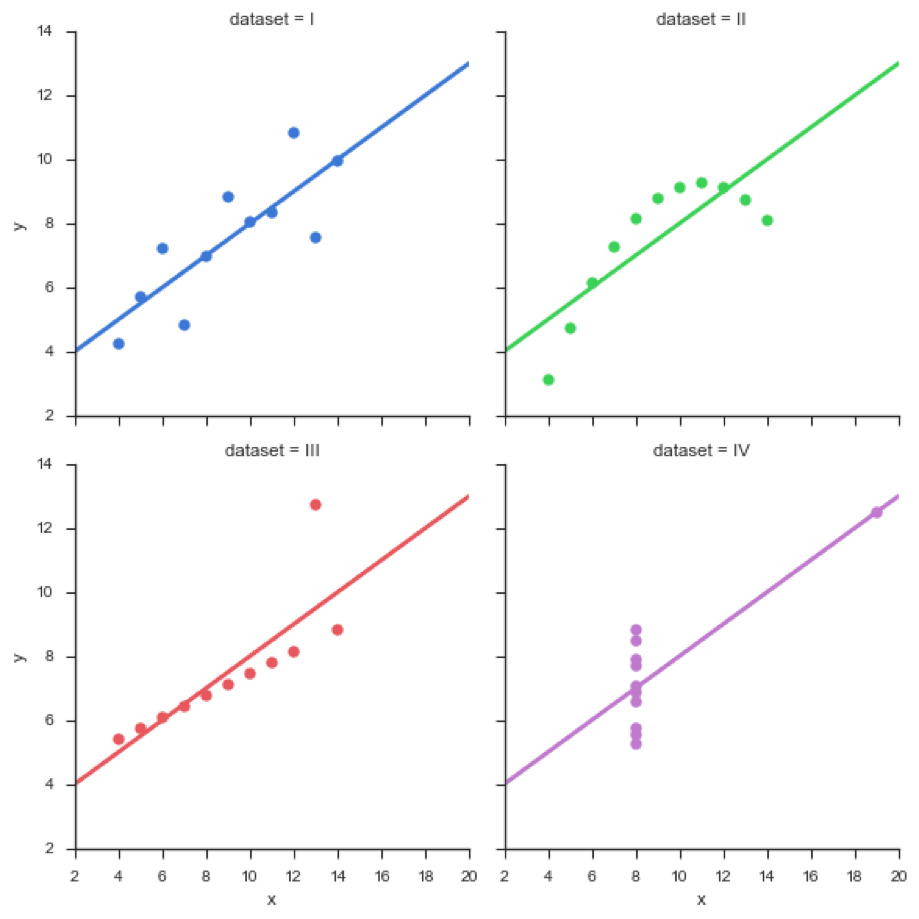

Take a look at four different regression models made out of vastly different data points:

See how completely different data points were aggregated into an identical linear line?

A good practical example is historical stock performance.

Any financial advisor will tell you stocks are most likely to generate ~7-10% in the coming years. How do they get to this number? They simply extrapolate the average stock performance over the past 100-something years.

But there’s a catch: in the real world, stocks rarely perform around averages.

For example, from 1926 to 2020, the stock market returned between 8% and 12% only eight times. Most of the time, stocks do much better than average or much worse than average.

In fact, between 1999 and 2009, the S&P 500 averaged a -5.1% real return in its worst 10-year stretch ever.

There’s a running joke among statisticians: if a woman loves you more each and every day, by the theory of linear regression, she hated you at the time you first hooked up.

This is a perfect illustration of how the statistically “summarized” past creates an illusion of clarity that reflects anything but the real world. And then, we extrapolate this fallacy to form a delusional opinion about the future.

Second, the economy goes in cycles.

Just like trees don’t grow to the sky, stocks don’t perpetually grow. And unlike end-of-the-world predictions that crises bring out, very rarely do things go to zero and collapse.

The problem is, extrapolation always ignores the turns (see top right regression model above)

If you extrapolate the here and now, for you, things will either be always good or always bad. This means you will miss the turning points—the most pivotal moments in the markets when you can lose or make the most money.

It’s funny how financial experts like to bang on the “economy is cyclical” drum. Yet when they predict the markets, they always extrapolate as if the economy moves in one perpetual direction.

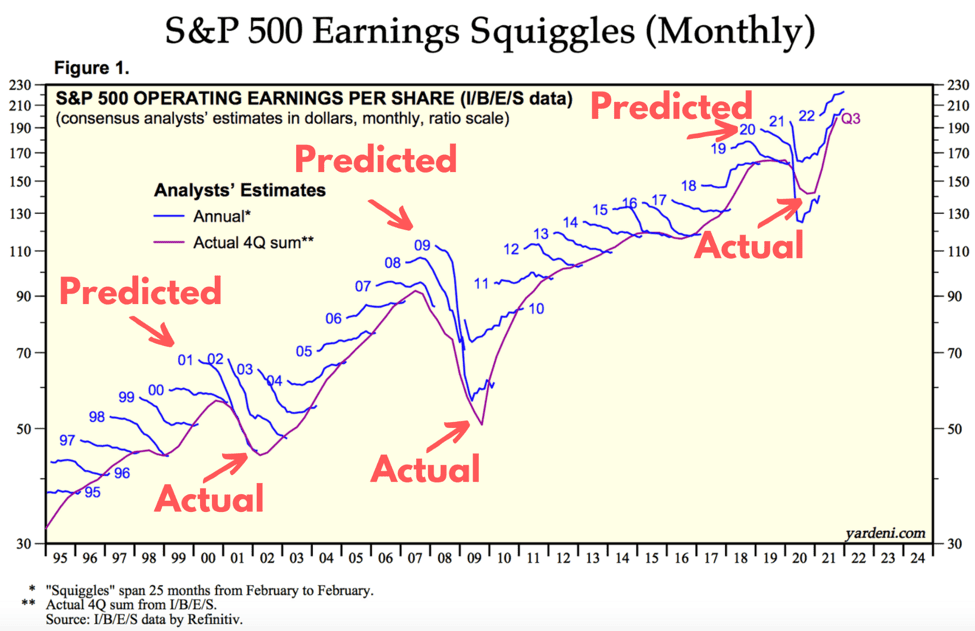

Take a look at the Wall Street earnings projections the media is crawling with. They’ve never anticipated a turning point:

Had you traded based on these extrapolations, you’d have lost your shirt in every single recession. You’d have overinvested at the peaks and underinvested in the troughs of the cycle—the time when you can score life-changing gains.

Finally, there are black swan events. These are totally unpredictable shocks, such as wars, natural disasters, or otherwise systematic crises that can send the entire financial system into a tailspin.

Think 9/11, or most recently, Covid. No extrapolation or forecasting model could have predicted that. There were no pundits on CNBC screaming about the risk of planes crashing into skyscrapers.

And yet, these are the very events that lead to some of the biggest capital wipeouts.

Correlation or Causation

Another statistical method to which investors turn to model the future performance of their portfolios is correlation. As you may know, correlation measures the strength of the relationship between two variables.

Say, if historically X went up when Y went down, in the future, you’d naturally expect X to go up when Y goes down. And vice versa, if X takes a dip, you’d expect Y to leap up.

This is why we hold bullcrap-earning things like government bonds that are negatively correlated to stocks. It’s not as much an investment as it is insurance against stocks.

The problem here is that correlation does not equal causation. Just because two events occur simultaneously doesn’t mean they have anything to do with each other – even if they move in perfect lockstep.

It could just be a coincidence.

A textbook example is ice cream sales and drownings. As a rule, drownings jump when ice cream sales increase. But it’s obvious that people don’t drown because they eat more ice cream than usual.

It’s because higher ice cream sales coincide with the summer season when people spend more time in the water.

(Thank God we still get to buy ice cream in the summer. If policymakers interpreted this data as they do economics, they would probably ban ice cream on hot days.)

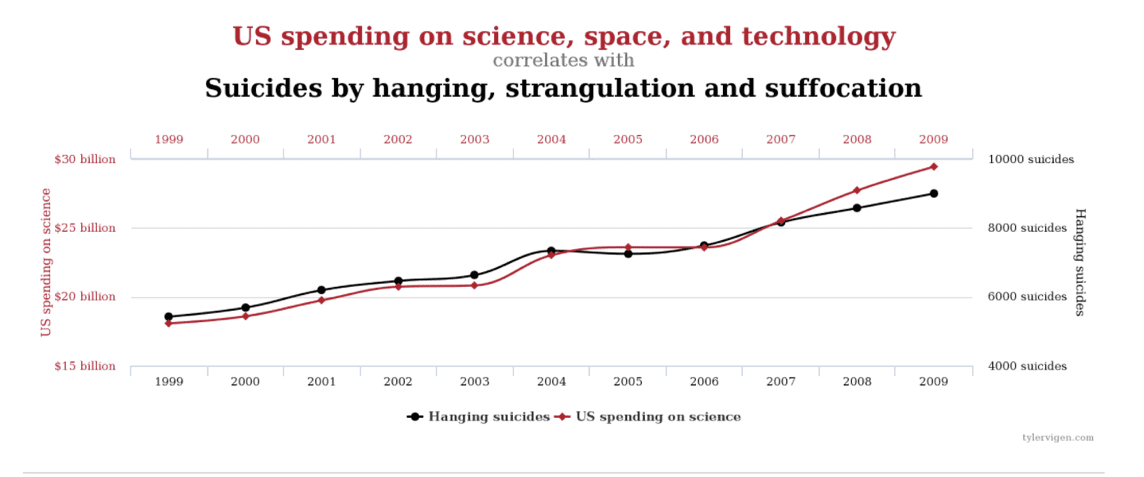

For another, more statistical example, take a look at the head-scratching r=.9979 (1 is max) correlation between US investments in science and hanging suicides:

These two unrelated trends have a near-perfect correlation and historically have moved in tandem. So does that mean that science contributed to suicides? Of course not.

There are multiple factors that affect suicides rates directly and indirectly, such as population growth. Investments in science just happened to coincide with those trends.

Now, those two examples are obvious fallacies. But there are more nuanced false relationships that may not be as apparent. And it’s those kinds of correlations that delude investors into ill-reasoned investment decisions.

For example, one of the biggest financial myths is that gold moves hand-in-hand with inflation. But As I showed in “The Gold and Inflation Peg is Wrong,” it doesn’t.

“For the most part, gold doesn’t have anything to do with inflation. And most of the time, it doesn’t move in tandem with inflation. In fact, gold tumbled in most inflationary periods after 1980.

In other words, investing in gold based on inflation has largely been a money-losing strategy. Had you used it since 1980, you’d have blown most of your money.

What gold really pays attention to is real interest rates.

In market talk, that’s the interest on “risk-free” debt minus the inflation rate. The higher the real rate, the more you earn in interest after inflation.

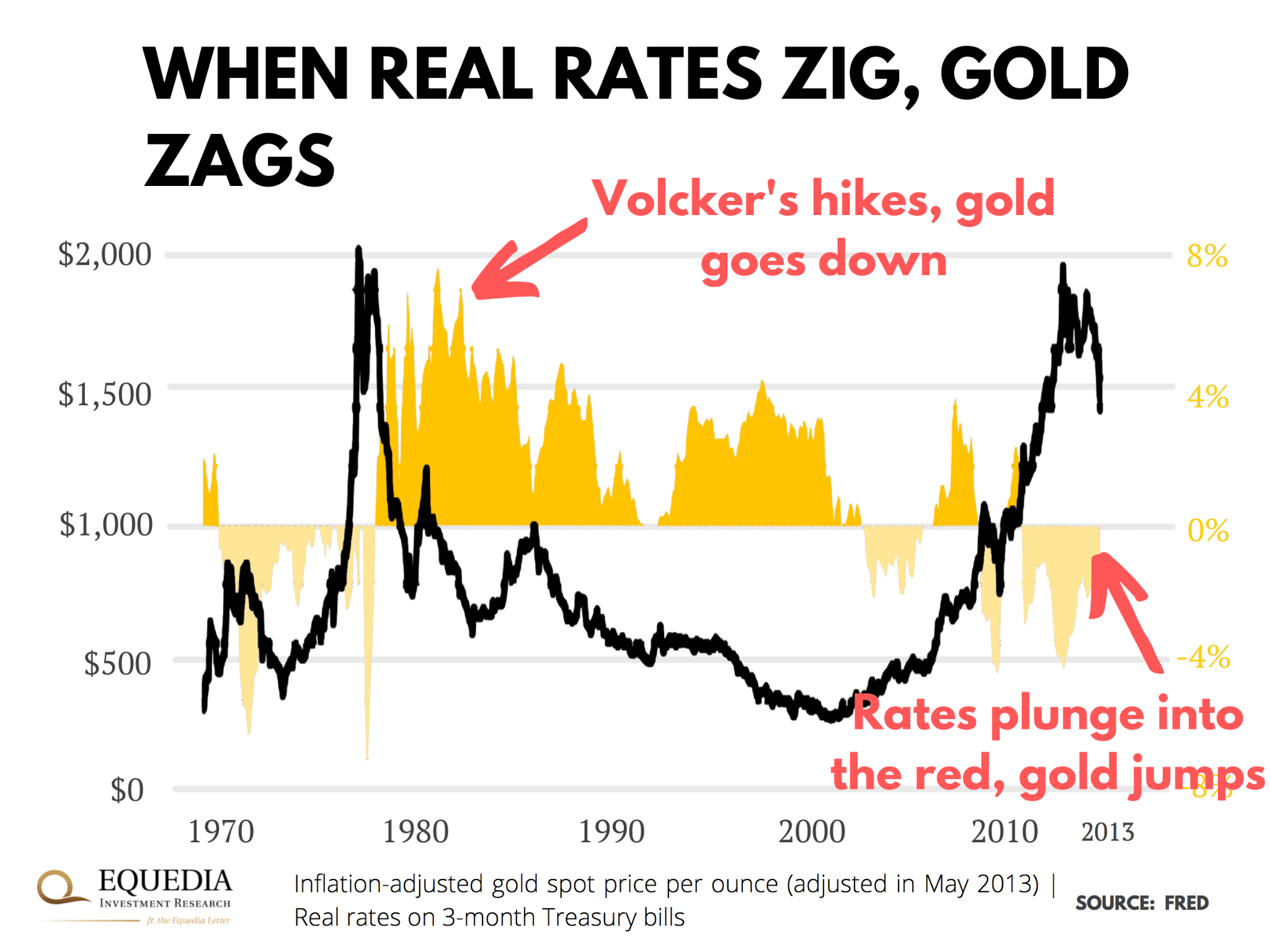

Take a look at this chart which shows gold’s near-perfect inverse relationship with real rates on 3-month Treasuries (common benchmark):

The confusion comes from the fact that higher inflation weighs down real interest rates because bonds earn less adjusted for inflation. But it’s not inflation that drives gold higher. It’s the lower rates that coincide with higher inflation.

If you had invested in gold based on this false gold-inflation peg, you would have lost money 6 out of 10 times.

Many stakeholders and unintended consequences

What makes economic forecasting especially hard is that, at the core, you’re trying to predict the behavior of an infinite number of stakeholders that affect the markets—all with their own biases, emotional triggers, and varying interests.

There are politicians who pass laws, such as tax cuts/hikes, that affect valuation multiples. There are corporate executives who can decide whether to reward investors or not through buybacks or dividends.

There are Wall Street whales whose bulk trades can crash or turbocharge the markets. And then there are retail investors, the latecomers who can exacerbate and prolong bubbles.

So, to make a spot-on prediction, it’s not enough to anticipate events. You also have to correctly simulate how each and every one of these largely irrational stakeholders will respond to them.

If you’ve been following the Equedia letter for some time, you know why all hyperinflation prophecies didn’t come to pass after the post-2008 stimulus. (Read full letter here)

For a quick recap, when the Fed started printing in 2008, investors thought the printed money and low rates would urge companies to borrow boatloads of cheap money. Then they’d use that money to reinvest in CAPEX and new jobs.

This way, the money would trickle down to the rest of the economy and spark inflation.

However, this forecast failed to predict that corporate executives — who look out for their own interests — wouldn’t reinvest printed money back into the business because they were still worried about economic growth. So, instead, they bought back their stock to plump up their share prices and bonuses.

That’s an unintended consequence that flipped an otherwise valid thesis on its head. And instead of inflation in consumer prices, asset prices ballooned.

(Side note: this is why everyone today is so complacent with insane asset valuations. They think the Fed will cave in and won’t back down. The stimulus money will go into buybacks and asset prices will keep chugging higher— just as they did in the last decade.)

But what if there’s another unintended consequence that will break this pattern?

Maybe things will boil over, and a political crisis will break out. Maybe buybacks will be banned. Maybe the Fed will be politically forced to rein in inflation at the expense of the market to a political backlash.

Anything can happen.

Know What You Don’t Know

The human brain craves answers.

We want to know what’s going on, why things happen the way they do, and how it will all play out in the future. Our survival instinct denies the unknown at all costs.

But the hard truth is, the market is too complex to boil down to a simple answer. And our inability to explain it urges us to come up with these compelling yet largely oversimplified and often false narratives.

People tend to think it’s what you don’t know that puts you in danger—quite the opposite. The unknown keeps people grounded and alert. (Unless, of course, you are just downright ignorant.)

It’s the overconfidence in a false truth that compels people into making outsized investments that blow them up.

Think the dot com, the housing boom, and, potentially, the current rally driven by the firm belief that stimulus won’t ever let up.

As Mark Twain famously said: “It ain’t what you don’t know what gets you into trouble. It’s what you know for sure that just ain’t so.”

Takeaways?

First, know what you don’t know and make peace with it. Second, diversify your views, so you aren’t betting your financial future on a single guess—be it an opinion of a pundit, our analysis, or your own gut.

Because let’s face it, most predictions are just that: a guess.

On that note…

Happy New Year, Equedia readers! I hope this year will bring all the success, monetary or otherwise, you truly deserve. But most importantly, I wish you intellectual humility and cool heads as we muddle through one of the most uncertain years in history.

Seek the truth,

Carlisle Kane

I ONLY HAVE ONE THING TO SAY, THANK YOU DEMO-RAT VOTERS FOR THE NEW COMMUNIST PARTY AND THE DEATH OF AMERICA. WHAT I JUST READ ABOUT OUT BORDERS AND AMNESTY, TAXES ON MILEAGE DRIVEN, FAKE NEWS, NO BORDERS AND OVER 2 MILLION MORE ILLEGAL ALIENS JUST THIS PAST YEAR ALONE AND NOW OUR COLORADO QUEER GOVERNOR COMMUTING A 110 YEAR SENTENCE TO 10 YEARS FOR HOMICIDE OF 4 PEOPLE SECURING 3 MILLION MEXICAN VOTERS AMERICA IS GONE !! THANKS AGAIN DEMO-RAT VOTERS FOR COMMUNISM !!!!!!!! VIETNAM VET 67-68

I think today’s discussion touches the surface on another sensitive subject called ‘Our Belief Systems’. Whether you have one or not, forming beliefs is a basic and important feature of the mind, and the concept of our beliefs plays a critical role in both philosophy of mind and epistemology (or the theory of knowledge). Belief systems have a set of principles & underlying assumptions that helps us interpret & make decisions about everyday things in our world (including forecasts) & our values stem from those.

Forecasts are usually educated guesses from the professional community with access to research & data to formulate their opinions. Of course there’s skepticism, so doing your own research & getting a consensus of opinion would probably go a lot farther in reaffirming the validity of your belief.