Dear Reader,

Politicians, athletes, and even movie stars have caught the deadly coronavirus strain known as COVID-19.

Yet, none of them are, well, dead.

In fact, most of them are doing just fine.

While COVID-19 is being made out to be a deadly disease killing millions, it’s nowhere near that – not by a very long shot.

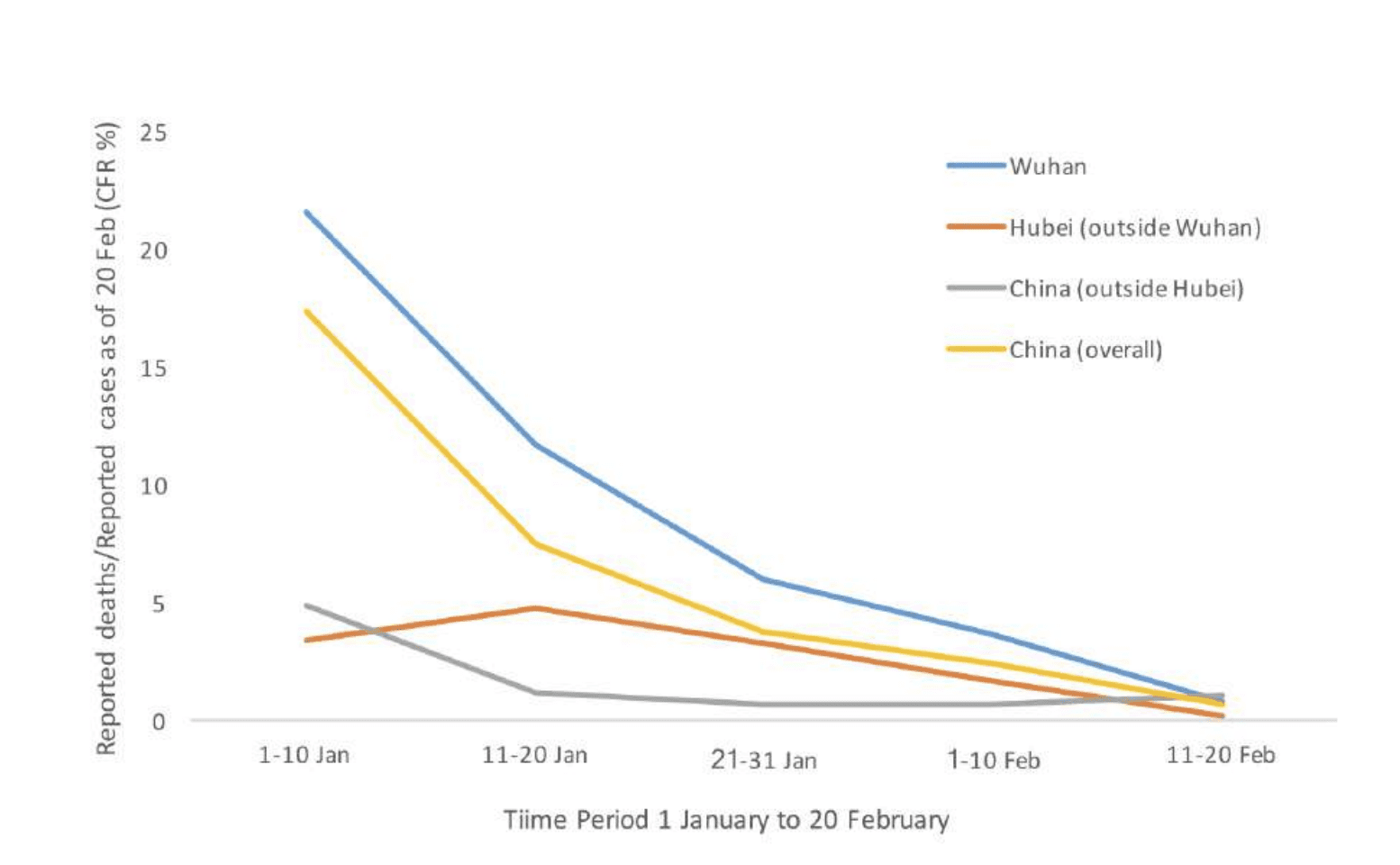

Take a look at this graph from the World Health Organization:

This graph shows the dramatic decline of deaths in reported cases of COVID-19 in China.

This graph shows the dramatic decline of deaths in reported cases of COVID-19 in China.

In just a month’s time, the overall CFR rate dropped from a whopping 17.3% for cases with symptom onset to only 0.7%.

And while that number is still higher than the seasonal flu – which sits at a CFR rate of 0.1% – one could argue the CFR rate for COVID-19 could be much lower once more tests are available; even more so now that we know what it is.

Furthermore, in just a few months’ time, the weather is going to get warmer.

Why is that important?

You see, COVID-19 is a disease caused by the virus SARS-CoV-2.

Via NCBI:

“SARS-CoV-2 belongs to the betaCoVs category. It has round or elliptic and often pleomorphic form, and a diameter of approximately 60–140 nm.

Like other CoVs, it is sensitive to ultraviolet rays and heat.

Furthermore, these viruses can be effectively inactivated by lipid solvents including ether (75%), ethanol, chlorine-containing disinfectant, peroxyacetic acid and chloroform except for chlorhexidine.”

In other words, the virus responsible for COVID-19 is wrapped in an envelope of fat. In warmer climates, the heat gets rid of the fat layers of the virus much faster. Without that fat, the virus can’t survive.

Ever wonder why Thailand, whose total tourist footfall is 30% from China, only has 82 confirmed cases of COVID-19 thus far?

Now, don’t get me wrong. We should be worried; it is a new virus, after all.

But I need you to understand what COVID-19 is so that you can understand my investment prediction towards the end.

Before I do that, let’s take a look at the markets from John Top’s more logical perspective.

John’s insight below takes out all of the noise from the media by using charts to explain where we are today.

Dow Jones Weekly Chart From 2008: Full of Worry or Hope?

The last time markets got shaken this badly was in 2008.

Let’s use that as a starting point and see what a weekly chart for the Dow looks like using two different methods – from that, we can gauge the key level for the Dow Jones Index.

First, we will see what insights we can derive from a very standard way of looking at charts; Fibonacci Retracements. Second, we’ll have a look for any chart patterns that may catch our eye.

Let’s get started.

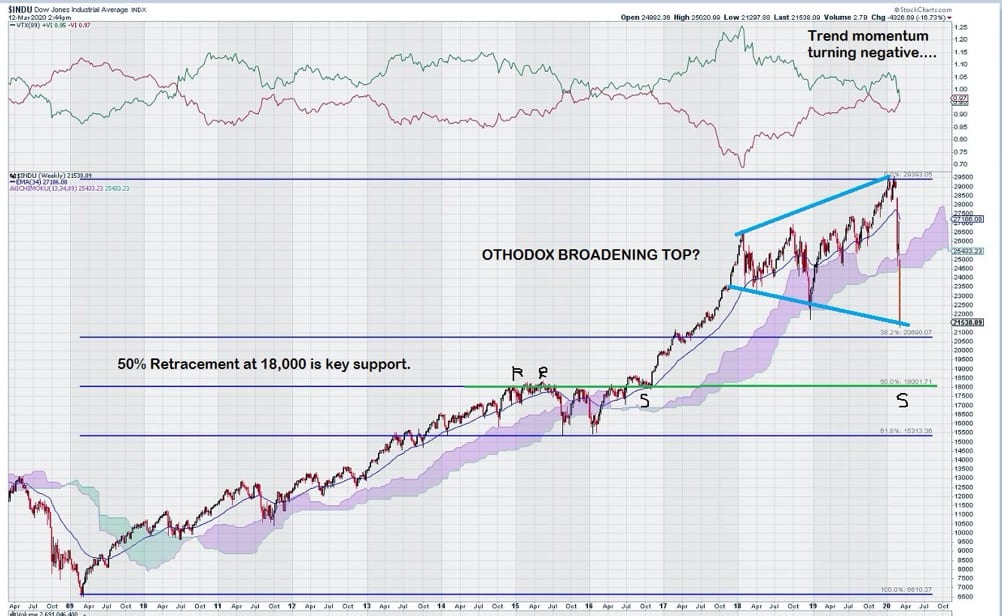

Fibonacci Retracements are commonly used by technical analysts to find areas of anticipated support once a new high has been established. For our purposes, this “new high” was around 29,500 for the Dow weekly chart. We also are defining our “low” at the low reached in 2008, the last time markets saw significant dislocation.

So what does this analysis tell us?

Well, one of the obviously overlooked features of the weekly chart for the Dow is the absence of any meaningful retracements since the 2008-low of just under 7000. In many ways, it is remarkable that the stock market was a “one-way bet” for so long.

But now, more than a full decade later, at least according to this chart, we are getting a “meaningful retracement.” That, in and of itself, is not shocking or unexpected. Why investors are undergoing such angst and worry is simply a function of the time it took for a correction to occur.

The Case for Hope

This chart clearly identifies the 18,000 level as one to watch. Not only is it at the 50% retracement level, but also, 18,000 was a resistance level for the period 2015 – 2016. So we have strong embedded support at 18,000. The “Hope” is that this level holds, and the chart can start to rebuild itself.

Regular readers of this site may have been informed in the past of what happened to gold during the mid-1970s. A quick review of the long term chart for gold shows a 50% decline from $200 back down to $100 before the impressive upward move to around $850.

So you see, while painful at the time, a 50% retracement does not mean that a chart will “fail.”

The Case for Worry

The words “Orthodox Broadening Top” don’t sound that ominous or threatening. After all, markets make “tops” all the time.

So what is the big deal?

Well actually, orthodox broadening tops are a really big deal because they don’t form very often, and when they do, they can be “trend ending.”

In the chart above, we can see the Dow weekly chart changing its previous decade long pattern as it starts to make higher highs AND higher lows; this is important to take note of because this is the pattern of an orthodox broadening top. I will leave it to the reader if they want to absorb more “worry” or even fear by learning more about this particular formation on their own.

The Future?

Our focus is on the close this Friday, and subsequent “Friday closes” as the closing price on Friday is what counts on weekly charts. We are keenly aware that an orthodox broadening top may be forming, and this is something to keep a close eye on.

Additionally, should markets continue to decline further, the 50% retracement level at 18,000 is a key level. Declines of more than 3% below this level would be a concern.

A strong case can be made that the 18,000 level has embedded support that it “earned” by taking two years to penetrate it, so there is sound technical evidence that this level can repel the current decline.

-John Top

Conclusion: A Bold Prediction on How to Invest

The virus, even if proven no more deadly than the flu, has shown us just how fragile our interconnected global economy really is.

Which is why I could tell you about the reports that claim this virus was created and used by the US military – as some Chinese officials believe.

And why not?

The two biggest threats to the US are China (from an economic standpoint) and Iran (from a military standpoint).

These two countries have been hit the hardest.

China’s economy will require a significant bailout to survive, and Iran’s nuclear ambitions have likely been put on ice.

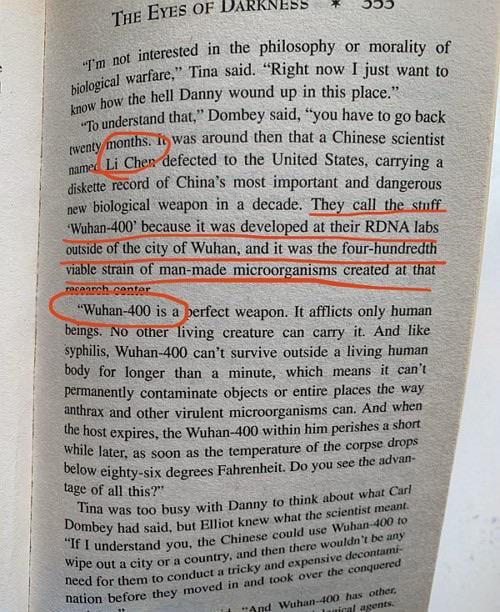

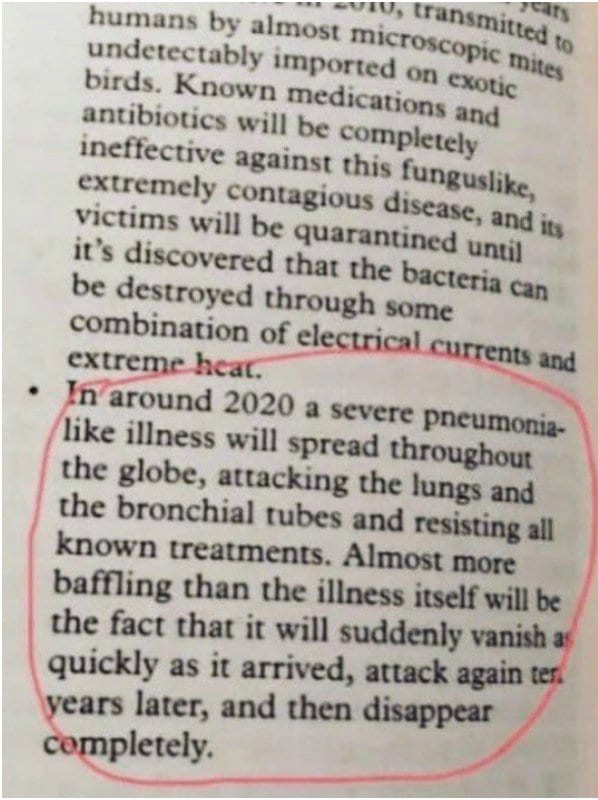

I could also tell you that COVID-19 was created based off a science fiction novel written by Dean Koontz in 1981 titled, “The Eyes of Darkness.” Just go to page 333:

I could even tell you a psychic named Silvia Browne predicted this back in 2008 in her book, End of Days:

Heck, there are even rumours that COVID-19 was caused by the democrats to dethrone President Trump.

And while I believe that COVID-19 is this decade’s most powerful economic warfare weapon, it really doesn’t matter – it’s all hearsay.

What’s important is how we should invest at this point.

How to Invest During the Coronavirus Pandemic

I have no doubt that the spread of the COVID-19 disease will dwindle in the coming months. Like most outbreaks, it will plateau – especially given the extreme measures the world is taking in unison.

Combine that with the warmer months ahead, we should see a dramatic decline of the disease.

But in the meantime, the world will lose a quarter of GDP growth – effectively equalling a global recession. Meanwhile, credit markets are on the brink of failure.

As a result, we’re already seeing massive rate cuts around the world and creative stimulus across many nations.

President Trump has already announced a payroll tax cut that could be worth over US$1 trillion – that’s already more than the bailout of 2008. Meanwhile, the Fed has already begun a repo program worth $1.5 trillion, with an additional $500 billion every week for the next month.

Combined, that’s already a whopping $5 trillion worth of monetary injections.

And I bet there’s more coming.

If the spread of COVID-19 subsides in the coming months, which I suspect it will, and provided that credit markets don’t completely collapse, we’re going to see stocks rebound and strong asset classes such as gold climb.

The summer could be a boon for those willing to take risks by investing in stocks and gold-related assets.

But as the summer fades away and fall comes, the weather will get colder – making it easier for the COVID-19-causing virus to come back for another round.

(In fact, most outbreaks often plateau, subside and come back for another round.)

By that time, we would have learned much about the virus, and a vaccine may even be close.

However, that won’t stop the volatility of the stock from coming back.

Why?

Because Trump will be defending his title. And the democrats will throw everything, including the kitchen sink and COVID-19, to dethrone him.

In short:

Buy when the weather gets hot. Sell before the weather gets cold.

Seek the Truth,

Ivan Lo

Your analysis seem very plausible. I work for a well known gold producer and i have not seen a share price at this level. Like you, i feel that the panic will calme down as fast as it started and our stock price will gain 50% in a very short period of time. That is my guess anyway.

Nice article again

IMPORTANT New Corona Study. Please READ !

Wolff, Greg G. Influenza Vaccination and Respiratory Virus Interference Among DOD Personnel. Vaccine 38 (2020) 350-354.

They downplayed the Corona results in their discussion because Corona and one other virus were the only ones with a negative response; their “conclusions” fell on the side of the “majority” of viruses. I’m sure their discussion would have been much different if the study was published today, rather than a month before Corona became a global concern. Their results clearly show that the flu vaccine increases susceptibility to Corona by ~ 35%.

I think this is very important because even State health agencies, Dr Oz, and the (Fake) New York Times are saying to get a flu shot to help with Corona; that is total bullshit, and not supported scientifically! Most people are still being encouraged to get a flu shot; they should not! Since our military personnel are compelled to get flu shots, it will be interesting to see if they are hit harder than an un-vaccinated population.

Feel free to print this, forward it, post it, etc – as you see fit.

Insightful and informative article.

covid-19 is terrible: but brings back jobs to the USA! it reboots realty,lowers gas prices,brings families together. Teaches WE,not [me] will close the borders. Common sense is a survival skill, forces individual responsibility,stops globalism,flushes political korrectness. brings back prayer,wages go up,opens USA factories,destroys the new world order. this event will reelect Donald trump,gives him more authority. gives George soros a yellow shower,while the liberal cure is toilet paper,if you can find any?!

I would like to subcribe to your newsletter

I do not agree in any way that the USA was responsible fore the outbreak of COVID-19.

It is one of the many diseases carried by Flying foxes, similar to our own Hendra Virus that killed many horses and some people in Australia.

I think it is both offensive grossly inaccurate to suggest the USA had anything to do with it when even the Chinese said it originated in an illegal market selling all sorts of animals, some really weird, for human consumption, including dogs and bats.

Please don’t play politics. Stiock tgo the facts and preferably the share market.

Don Nixon

I’m a regular reader of your letters. I’ve learned a lot from them. But I expected better from you then spreading rumors and “fake news”.

Thanks Don. But perhaps you misinterpreted the satire nature of the statement: “Which is why I could tell you…”

More importantly, “And while I believe that COVID-19 is this decade’s most powerful economic warfare weapon, it really doesn’t matter – it’s all hearsay.

What’s important is how we should invest at this point…”

What I was saying is that no matter what the rumour is or how the virus came about – be it from a lab or an animal – it’s out of our hands and darn near impossible to prove. We should focus on the facts.

Hi E. Wagner, please see my response to Don Nixon.

Someone asked about Hong Kong resistant to get infected…. The months long riots, with fire throwers, water dispersal, tear gas and etc could have burnt, drowned and choked the virus off their lives. Therefore, i would invest in flame thrower………

Covid 19 is God-given. It occurs when humans try to break the law of karma that prohibits the eating of poisonous animals and insects. When people also forget to keep clean or no longer care about the touch of dirty things, everyone has to bear the consequences.

If we break the karmic investment of stocks, then we will fall, too.

Insightful. I agree that summer months will see a market rebound. However, the magnitude of the economic decline of businesses closing will have a compounding effect which could take quite a while to recoup. Either way- I feel it’s time to start buying in. Maybe a bit early, but I’ll “cost dollar average” this recession all the way down. When there’s “blood in the streets…”

I like this analysis in the middle of the panic.