Back in March 2020, at the beginning of the global lockdowns from the COVID-19 outbreak, I made many bold stock market and COVID-19 predictions.

For anyone that missed it, here it is:

https://www.equedia.com/how-to-invest-in-the-coronavirus-pandemic-should-you-buy-or-sell-stocks-now/

At the time, much of what I wrote was extremely controversial. In fact, not only did I receive many comments saying I was wrong about my stock market and COVID-19 predictions, but a small few even went so far as to saying I was killing people simply by giving my prediction.

To each their own, of course. But the beauty of time is the truth eventually comes out.

So let’s see how my COVID-19 predictions have played out since March, 2020.

From my Letter on March 15, 2020, “How to Invest in the Coronavirus Pandemic: Should You Buy or Sell Stocks Now?”

“Politicians, athletes, and even movie stars have caught the deadly coronavirus strain known as COVID-19.

Yet, none of them are, well, dead.

In fact, most of them are doing just fine.

While COVID-19 is being made out to be a deadly disease killing millions, it’s nowhere near that – not by a very long shot.

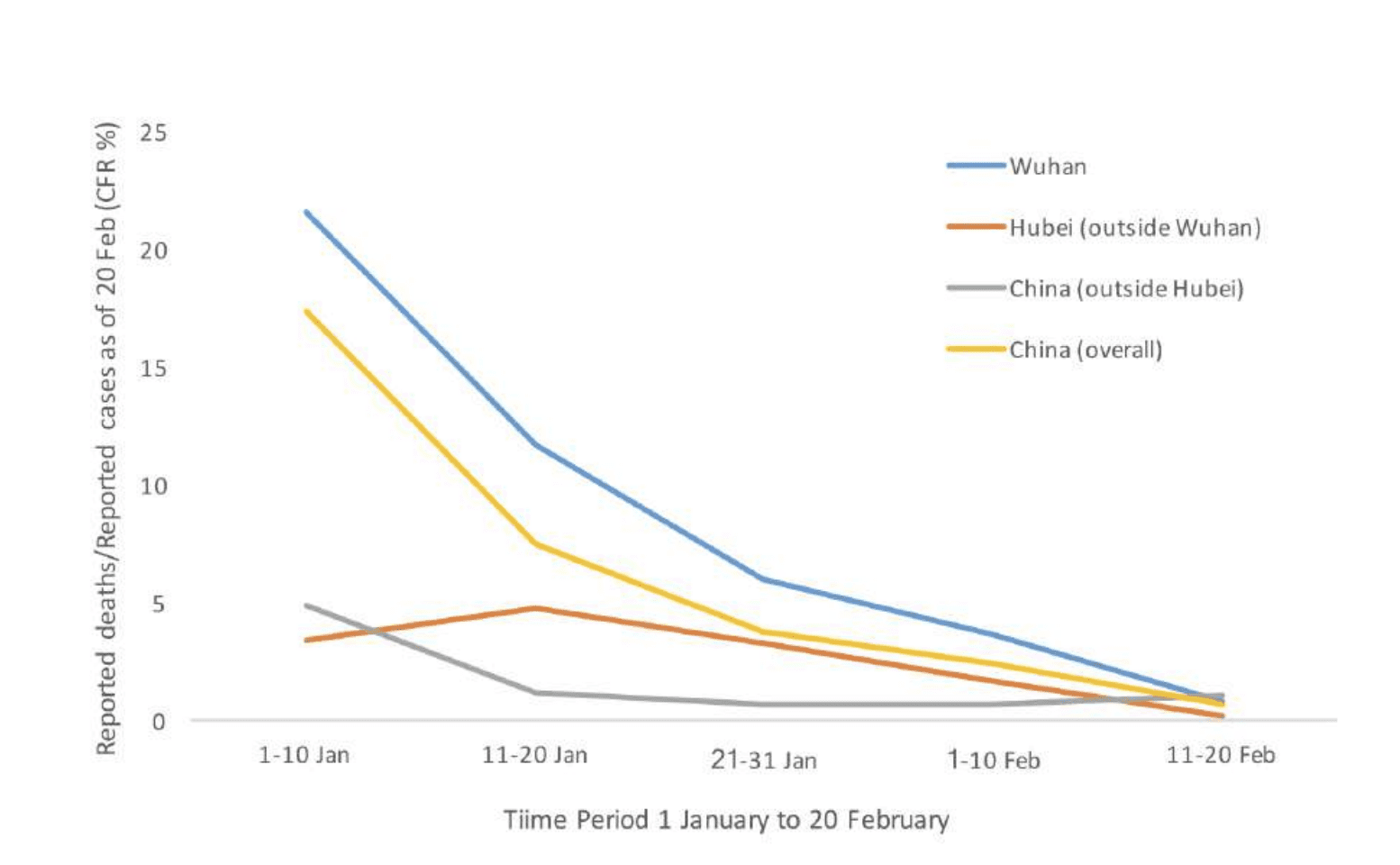

Take a look at this graph from the World Health Organization:

This graph shows the dramatic decline of deaths in reported cases of COVID-19 in China.

In just a month’s time, the overall CFR rate dropped from a whopping 17.3% for cases with symptom onset to only 0.7%.

And while that number is still higher than the seasonal flu – which sits at a CFR rate of 0.1% – one could argue the CFR rate for COVID-19 could be much lower once more tests are available; even more so now that we know what it is.

Furthermore, in just a few months’ time, the weather is going to get warmer.

Why is that important?

You see, COVID-19 is a disease caused by the virus SARS-CoV-2.

Via NCBI:

“SARS-CoV-2 belongs to the betaCoVs category. It has round or elliptic and often pleomorphic form, and a diameter of approximately 60–140 nm.

Like other CoVs, it is sensitive to ultraviolet rays and heat.

Furthermore, these viruses can be effectively inactivated by lipid solvents including ether (75%), ethanol, chlorine-containing disinfectant, peroxyacetic acid and chloroform except for chlorhexidine.”

In other words, the virus responsible for COVID-19 is wrapped in an envelope of fat. In warmer climates, the heat gets rid of the fat layers of the virus much faster. Without that fat, the virus can’t survive.

Ever wonder why Thailand, whose total tourist footfall is 30% from China, only has 82 confirmed cases of COVID-19 thus far?

Now, don’t get me wrong. We should be worried; it is a new virus, after all.

But I need you to understand what COVID-19 is so that you can understand my investment prediction towards the end.”

So what exactly was my prediction?

COVID-19 Predictions

Continued from “How to Invest in the Coronavirus Pandemic: Should You Buy or Sell Stocks Now?”

“I have no doubt that the spread of the COVID-19 disease will dwindle in the coming months. Like most outbreaks, it will plateau – especially given the extreme measures the world is taking in unison.

Combine that with the warmer months ahead, we should see a dramatic decline of the disease.

But in the meantime, the world will lose a quarter of GDP growth – effectively equalling a global recession. Meanwhile, credit markets are on the brink of failure.

As a result, we’re already seeing massive rate cuts around the world and creative stimulus across many nations.

President Trump has already announced a payroll tax cut that could be worth over US$1 trillion – that’s already more than the bailout of 2008. Meanwhile, the Fed has already begun a repo program worth $1.5 trillion, with an additional $500 billion every week for the next month.

Combined, that’s already a whopping $5 trillion worth of monetary injections.

And I bet there’s more coming.

If the spread of COVID-19 subsides in the coming months, which I suspect it will, and provided that credit markets don’t completely collapse, we’re going to see stocks rebound and strong asset classes such as gold climb.

The summer could be a boon for those willing to take risks by investing in stocks and gold-related assets.”

So, two big predictions:

Prediction 1. COVID to subside in the coming months

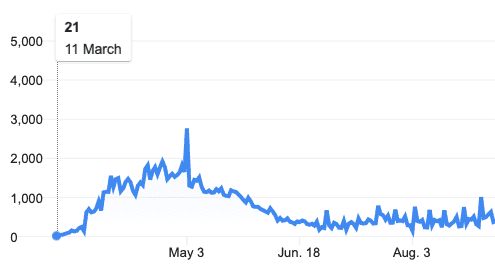

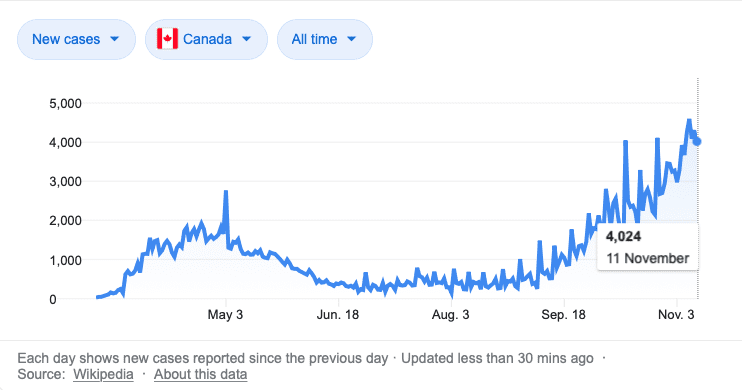

Result: We’ll use Canada as an example, since Canada only tests if you have symptoms.

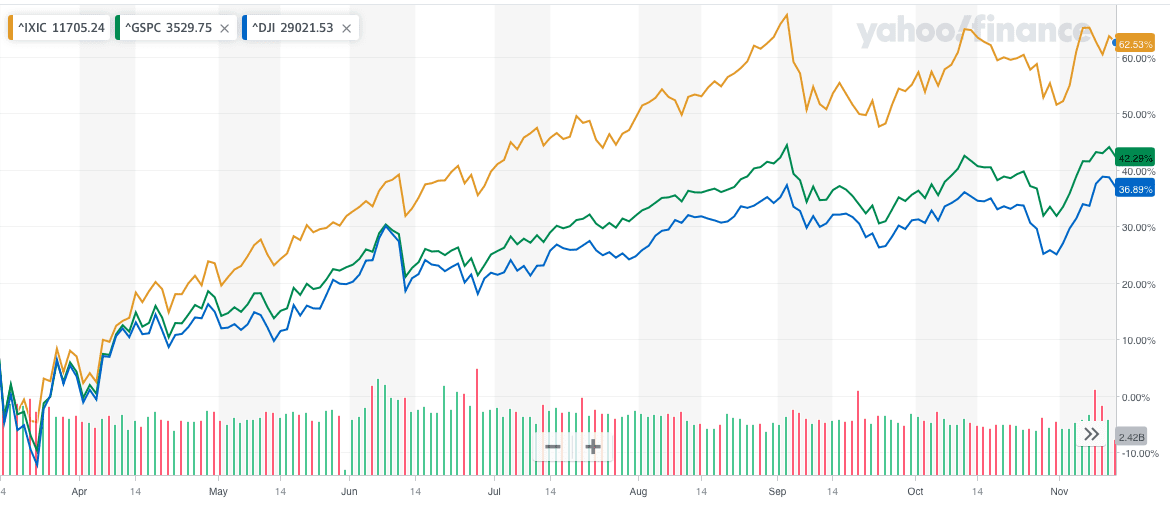

Prediction 2: Stocks to climb

Result: This one is easy. Here are the stock charts for the NASDAQ, Dow Jones, and S&P 500:

This might seem an obvious prediction now, but keep in mind that when this Letter was originally written on March 15, 2020, a global lockdown was occurring, shutting down the entire world’s economic engine. Almost every one thought the world was about to collapse.

After those COVID-19 predictions, I then wrote:

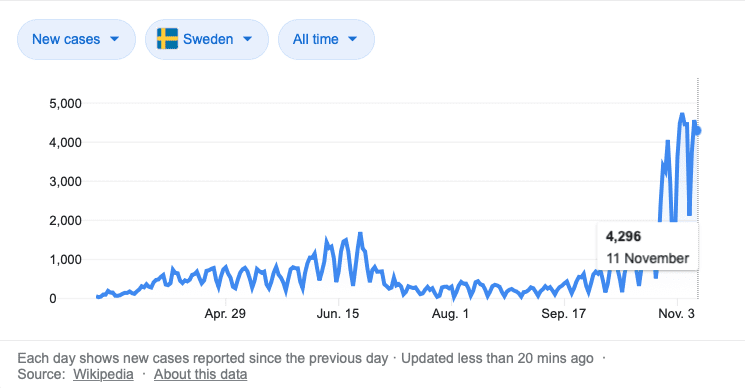

“But as the summer fades away and fall comes, the weather will get colder – making it easier for the COVID-19-causing virus to come back for another round.

(In fact, most outbreaks often plateau, subside and come back for another round.)

By that time, we would have learned much about the virus, and a vaccine may even be close.”

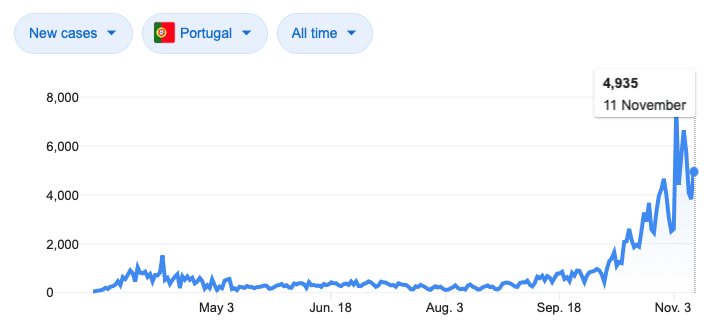

And were we right about the timing of COVID coming back?

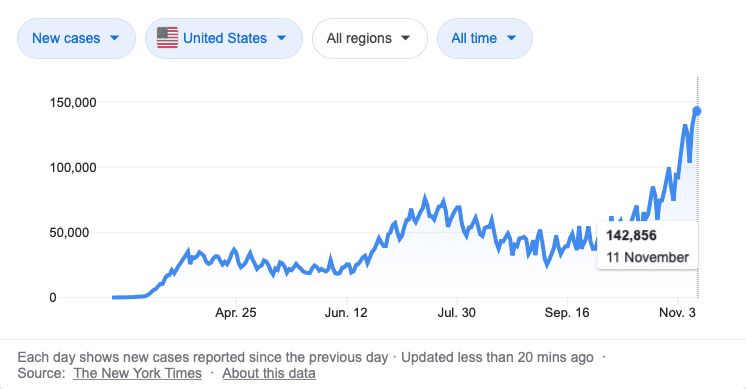

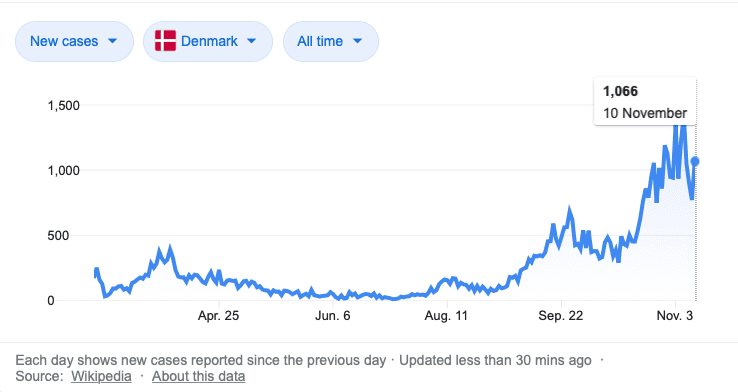

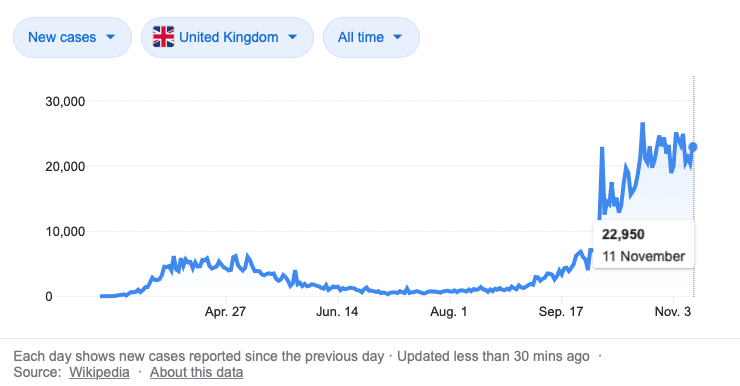

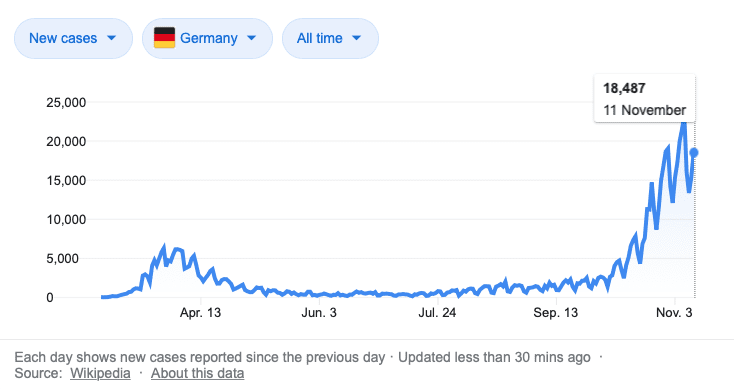

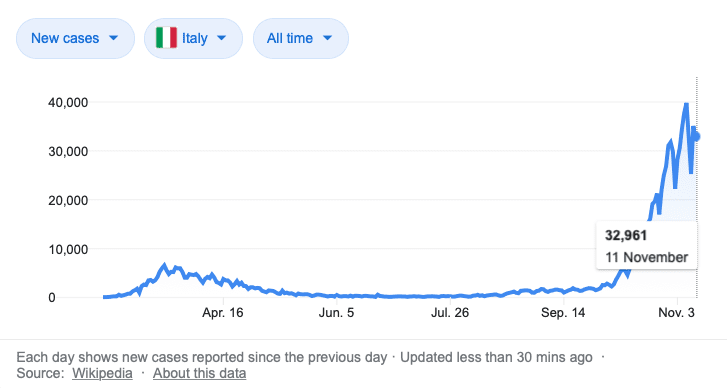

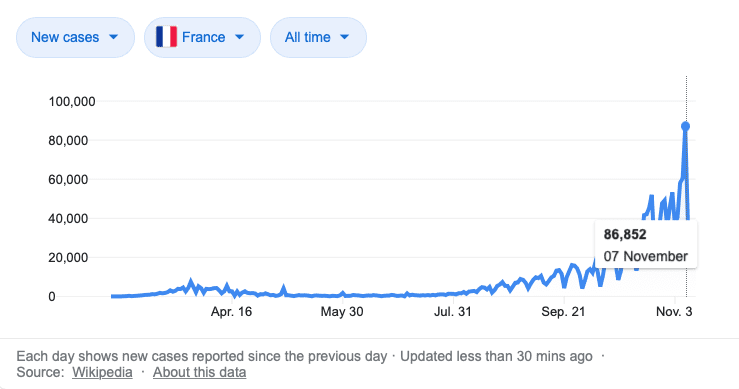

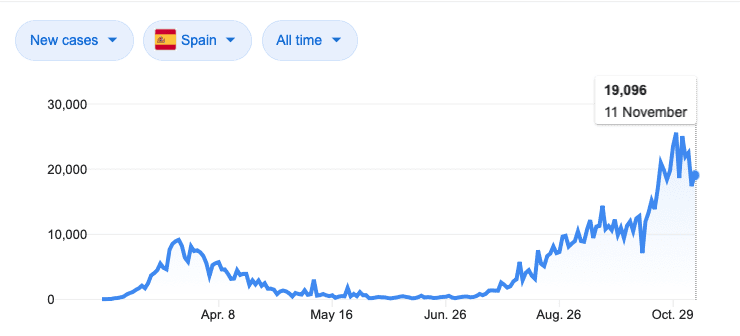

Let’s take a look at the countries around the world that are heading into the winter months.

These charts clearly show cases spiking as the weather gets colder.

Could it simply be that as the weather gets colder, more people get sick?

Perhaps next time your local government blames its people for the rise in cases for not following social-distancing rules, just show them these charts. Surely, there isn’t a concerted effort between all of these countries and its citizens to not social-distance?

Now, lastly, as it relates to the market.

The news of positive vaccine trials has thus far held the stock market up. However, there could be further global lockdowns, as predicted, which could impact the stock market negatively. Expect some volatility – but take any major dips as a buying opportunity.

As I mentioned in the last Letter, no matter who wins, stimulus is coming. Keep in mind there is still a slim chance that Biden could win the Senate. If he does, that’s when I would take my non-gold related holdings slightly off the table. Increased regulation for the financial markets generally means less liquidity, and that is a problem.

Seek the truth,

Ivan Lo