How to Play the Boom

Dear Reader,

It should have been the most challenging time for investors – or anyone trying to protect their money.

Interest rates remain at all-time lows, making it impossible to beat inflation via “safe” GIC’s or bonds. Meanwhile, we’ve been hit with a global economic crisis.

Yet, stocks continue to hit new highs.

Given the volatility and global political pandemic, should we be selling stocks now? Is the stock market bubble about to pop?

If you knew what was happening behind-the-scenes, then the answer is no.

Here’s why…

The Rise of the Retail Investor

It only took about ten years, but the retail investor is back – and back with a vengeance.

According to Jefferies, retail trading has nearly doubled, making up for 44% of trades – up from 25% in 2009.

Speculative investing has also doubled.

Via WSJ:

“Trading in speculative stocks with low share prices has surged this year, fueled by a huge influx of individuals using zero-commission investing apps and online brokerages.

During several months this spring and summer, more than 25% of the shares traded in the U.S. stock market were in companies with a share price below $5, according to data from the New York Stock Exchange.

From 2012 to 2019, that percentage mostly hovered between 10% and 15%, the NYSE data show…”

While the global lockdown has forced people inside and away from casinos and sporting events, stimulus checks and free money from governments around the world have turned the stock market into the biggest casino on earth.

Especially with the advent of free online stock trading offerings from Robinhood, Charles Schwab, E-Trade, and T.D. Ameritrade.

But it’s not only the U.S. where this is happening.

In Canada, free stock trading platforms like Wealthsimple have also led to a surge in retail investor participation.

Via Financial Post:

“In the first quarter of 2020 alone, discount online brokerages in Canada added 500,000 new accounts, according to Investor Economics, meaning that they’re growing at three times their normal pace.”

The same thing is happening overseas.

China, home to one of the world’s biggest stock markets, is also seeing a massive rise in trading from retail investors.

Via Financial Times:

“Average daily turnover on China’s stock market has hit Rmb874bn ($129bn) this year, according to data from Goldman Sachs, up nearly 60 per cent from the average of the past five years, as the coronavirus crisis has driven interest in online equity trading.”

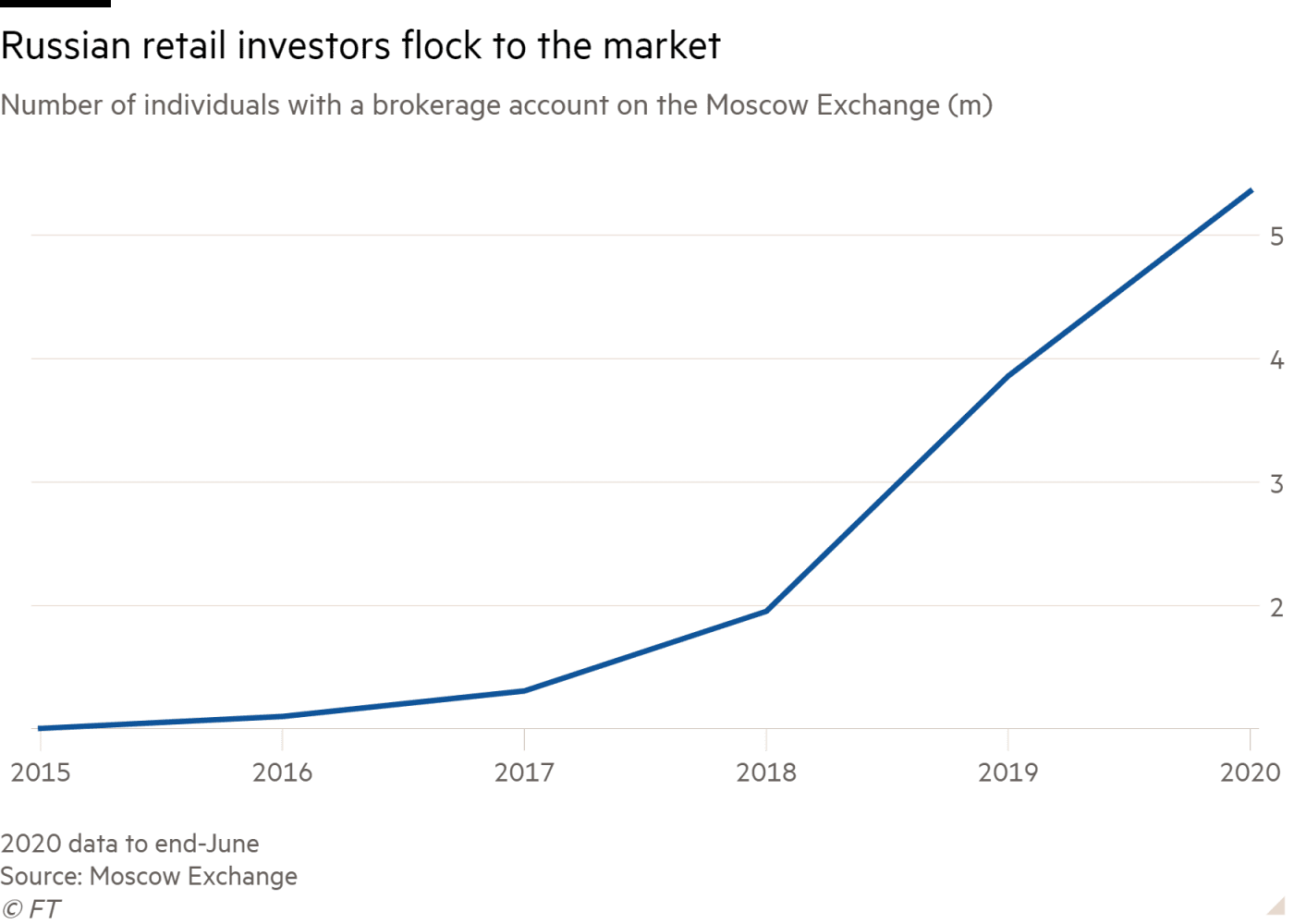

There’s a massive boom in Russia, too.

Via Financial Times:

“Millions of Russians are pushing their savings into local stocks and bonds, helping to steady a market that has long been at the mercy of swings in sentiment among foreign investors.

…Retail investors accounted for 42 per cent of trading volumes on the exchange in June, up from 34 per cent a year earlier. More than 5.3m individual Russians now have brokerage accounts for trading stocks on the local stock market, a rise of 1.5m since January.”

Let’s not forget the U.K.

Via Business Insider:

“I.G. Group, one of the U.K.’s biggest retail trading platforms, reported booming financial results for its fiscal year in 2020, boosted by frenzied growth of day-trading and increased market volatility during the coronavirus pandemic.

The UK-based financial derivatives platform grew its client base by 34% from onboarding 96,900 new clients in the year. I.G. Group currently has 239,600 active members, compared to 178,000 at the same time last year.

The platform saw average daily trade volumes exceed 1 million in March, up from an average of only 336,000 a year ago.”

With such a dramatic global boom in retail investor participation, you can bet the smaller countries want some of the action.

Starting next year, even Turkey will have its own free online trading platform.

Via Bloomberg:

“Turkey’s first commission-free trading platform intends to be ready to start operating early next year, tapping into burgeoning demand among locals to invest in the stock market.”

You get the point.

After years of institutional support and corporate buybacks, the retail investor is now next in line to prop up the stock market.

Now, one could argue that retail investors are usually the ones who bear the biggest losses in a stock market collapse – that they are the ones that always end up holding the bag.

And I would agree.

But I don’t think the collapse is coming anytime soon.

In fact, I have been predicting this for many years now with astounding accuracy.

Via my Letter from April 2019, “A Most Radical Prediction”:

“(Trump) will unleash a new fiscal policy that will change everything.

He will lower taxes on the rich and those who are job creators; he will give huge incentives to businesses in the U.S. via tax breaks; he will borrow a boatload of money and begin a massive infrastructure spending spree, which will create jobs.

Heck, he may even convince the Fed to do QE4 – all of which will lead to a bigger bubble.

…In other words, he will do whatever it takes to prop up the economy and the stock market.

…If the market can hold off until the U.S. elections next year, we may see yet another burst of enthusiasm in stocks.

The rich will certainly get richer under Trump, but he will create more jobs and make many blue-collared Americans happy.”

So far, the above has played out exactly as predicted – even despite a global lockdown.

But don’t think Trump winning again is the only thing that’s going to prop up the market.

You see, regardless of whether Trump is in power after the U.S. election, neither Republicans nor Democrats can stop stimulus – it would be economic suicide.

In other words, I suspect that the market boom will likely continue – I just believe it will last a little longer under Trump.

And if the actions of the big institutions are any indication, then my prediction of a continued bull market could prove true once again.

Big Players Ante Up

What actions am I talking about?

Via CNBC:

“Fidelity just announced it plans to hire 4,000 people in the next six months, plus is recruiting 1,500 college students for internships and full-time work.

Morgan Stanley is buying Eaton Vance after snapping up E-Trade earlier this year, as it continues to pivot from Wall Street to Main Street.

BlackRock–a major institutional player–said it’s been capturing more retail money, too.”

When big firms switch strategies from Wall Street to Main Street, you know they expect big things from the retail investor.

Now, there are certainly counter-arguments to this theory.

For example, Cole Smead, president of Smead Capital Management, recently told CNBC that “young, dumb” investors have created a “total nightmare” in the current climate.

Via Market Watch:

“…Smead went on to say that these nosebleed valuation levels are an example of a “stock market failure” at the hands of these inexperienced millennials who have gotten lured in to taking oversized risks in equities for the first time in their lives.

“They are buying bullish call options that expire inside two weeks. There was ($500 billion) of bullish call options bought in a four-week stretch by small retail traders,” Smead said. “In ’99 it was $100 billion, in ’07, it was $100 billion.”

We’ve reached next-level buying fever in U.S. stocks. When it turns, it could get ugly, according to Smead, who said that despite the accommodative monetary policy, the Federal Reserve ultimately “can’t save a stock market” – especially one that’s this top-heavy.

Smead told the Wall Street Journal in an interview published last week that, “We spend half our time right now telling people how dangerous things are.”

Smead’s not wrong on the ignorance of retail investors and valuation. But I believe he is wrong that the Fed can’t save the stock market.

As I have always said, follow the Fed – it’s been a winning strategy for almost all of the Fed’s history. And when the Fed prints, so does everyone else around the world.

Let me explain how simple this is.

When these new millennial retail traders lose their “easy-earned” stimulus checks via losing trades, another stimulus check will be on the way – especially given how aggressive COVID policies have become.

That’s all before factoring in the “young, dumb” investors who have won big since the beginning of this COVID lockdown – like one who turned $35,000 into $1,000,000, and then lost it all.

But the reality is this: Smead, with his models and graphs, is likely just sour from getting beat by kids with little-to-no experience trading out of their bedrooms.

“…However amateur these investors maybe, they have performed surprisingly well as a group. According to David Kostin, chief U.S. equity strategist of Goldman Sachs, “estimated retail investors in the U.S. outperformed American hedge funds (up 61 and 45 per cent, respectively) during the market comeback.”

The Robinhood cohort and their tumultuous rallies may expedite the cyclical nature of the market, causing short-term gains of their own creation.”

In other words, stocks have become art – it’s worth what someone else is willing to pay.

And if someone is willing to pay $300 million for some lines and paint, then surely retail investors paying more than 1100x earnings for TSLA shares shouldn’t be a surprise.

Especially if the Fed keeps pumping out money. And if you think they’ve stopped, think again.

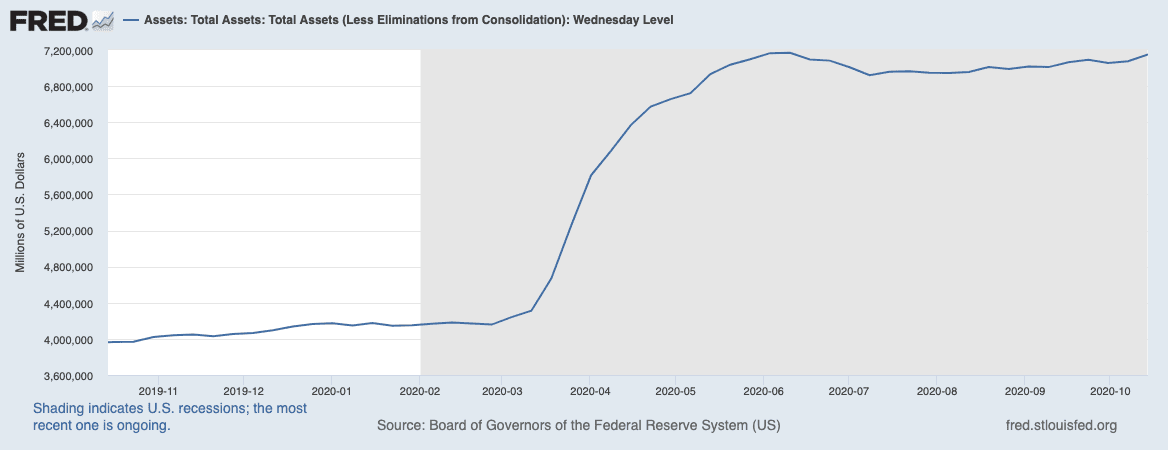

The Fed Quietly Prints

Quietly behind the scenes, the Fed has continued to inject liquidity into the market.

Since the start of 2020, the Fed has expanded its balance sheet from $4.1 trillion to more than $7 trillion today.

But that’s not all.

Take a look at a prediction I wrote back in 2016:

Via my Letter, “Can the Fed Buy Stocks“:

“If you look at the statements made around the world by central banks, you’ll notice that many are signaling to “coordinate policy” under a single directive.

In other words, one centralized central bank – much like the E.U. has done.

But in order to accomplish this, there needs to be what Christine Lagarde at the IMF calls an “economic reset.”

This could be in the form of an economic depression so powerful that it forces the complete control of assets from the private sector to the central banks.

This plan was evident in Fed Chair Janet Yellen’s last speech.

Via Reuters:

“Yellen, in her speech on Friday, said balance sheets would likely swell again in future recessions as the Fed snaps up assets to stimulate the economy.”

That means if the economy should fall into another recession – one potentially caused by rising rates – the Fed would own even more assets.

Because – they would say – “desperate times call for desperate measures.”

Even more disturbing are the hints Yellen gave suggesting the Fed could break policy and consider “some additional tools that have been employed by other central banks.”

This, of course, includes buying a wider range of assets or raising the inflation target – both of which means the Fed will own more, for less.

It could also mean that the Fed may buy equities in the future.”

So how did the Fed pump another $3 trillion into the system this time?

Well, exactly as I predicted in 2016, it not only purchased Treasuries and mortgage-backed securities but, for the first time, investment-grade and high-yield bonds.

Now, remember this: Historically, the Fed has popped previous bubbles by raising rates – it did it with the dotcom boom, and it did it again with the housing bubble.

Will it do it again during the greatest economic shutdown in history?

It’s In Your Head

Millions of jobs have been lost, and millions are unsure if they will ever return to their old jobs again. Those who have jobs are no longer going out after a long work week to unwind at the bars and clubs.

Not only will people get sick from loneliness with social distancing in place, but the stress will soon become unbearable.

Meanwhile, the coronavirus pandemic’s financial pain is much worse than expected, especially for low-income minority households.

Via NPR.org:

“Many of these problems are concentrated among Black and Latino households in the four cities, according to the poll, which gathered responses from July 1 through Aug 3.”

One must wonder if the stress from the pandemic has been the biggest fuel for the current BLM movement.

Remember, as I have said before:

“Racial inequality pits one group against another, whereas economic inequality pits citizens against the rulers of an empire.”

Given the massive global economic lockdowns from a virus that, statistically across all age groups, is no worse than the flu, one must wonder if this was all a manufactured pandemic to truly divide the rich and the poor. It’s no wonder investors are pouring their stimulus checks into the stock market; they can’t get by through hard work anymore – if they have work at all.

And with COVID not going away anytime soon, global lockdowns and social distancing will continue to keep people apart, causing further stress and deeper depression.

There won’t be vacations to sunny beaches, which means the only real thrill people will have is the thrill of making money.

I could write an entire essay on the actual numbers and science behind COVID and the unjustified extreme measures politicians are taking to protect their power – such as this declaration lead by the top experts in the world. Still, few will listen because most people, like retail traders who ignore valuations, simply do not want to believe reality.

They’d rather listen to one doctor, rather than the opinions of thousands upon thousands of epidemiologist, immunologists, virologists, and diseases experts from the top universities around the world.

They would rather take the blue pill, so to speak (see Blue Pill vs Red Pill.)

Do you think it’s a coincidence that marijuana is now legal in many parts of the world? Is it a coincidence that the legalization of psychedelics is now closer to becoming a reality? It’s almost as if the timing was perfectly planned for what’s happening today…

The powers-that-be need to dull the senses of civilization so that an uprising does not occur as income inequality climbs.

This leads us to the ultimate lesson for today: look for investments in the mental health space – because people will need to de-stress.

But I don’t just mean magic mushrooms or marijuana.

In short time, I will introduce some ideas that address society’s mental health aspect – and it’s something much different than just THC and psychedelics.

They are ideas that will appeal to a much bigger crowd.

You don’t want to miss the next massive wave of mental health investing.

Seek the Truth,

Ivan Lo

I wholeheartedly agree with this letter.

I will expect your next Equedia letter to arrive by e-mail tomorrow.. .

An incisive report. My investment philosophy has changed from speculative to long term positions primarily with dividends. Covid has affected much and my mindset as well.

“…If the market can hold off until the U.S. elections next year”

Excuse me, I thought the U.S. elections were this year! 🙁 (Correction required!)

That was an excerpt from a Letter in April 2019…last year…no correction required 🙂

Ivan…appreciate your consistently excellent work. Wondering what your thoughts are if Trump, or Biden, militarize the distribution and possibly military personnel doing the injections. Seems like all bets are off if that happens and chaos may ensue. What do you think ????

LMAO… “retail investment”?!?! or as Bloombullshit and CNBS call them “the bottom feeders”…. or as Mr Einstein would put it… Criminal, parasitic insanity – doing the same thing over and over again and then expecting different results…

You know the internet is full of phony ” investment experts ” talking crap ! But this letter: it’s just precious, invaluable insight. Thank you Sir, thank you very much.

How do you get in the retail investor investment ? How does it work ?