Dear Readers,

I have made many attempts to paint the true story of what’s really going on in both the markets and the economy.

Much of what I wrote in past Letters – including predicting a Trump victory a year before he was even elected – has come true.

Today, I am going to simplify my prediction.

And while you shouldn’t take it as gospel, you should certainly be aware that the scenarios I paint – however extreme – has a strong possibility of happening.

In fact, it would be rather unwise to believe that extremes cannot happen – especially when “extreme” is what one might label our current financial and political situations:

- An extremely divided housing-to-wage ratio (think inequality)

- Extreme levels of debt that continue to climb with no regard on how it will be serviced in the future

- Stock market setting record new highs despite fundamentals

- An extremely divided government under President Trump

- An extremely divided America

- An extremely divided World

When we reach the near extremities of modern civilization, the ultimate consequence is a complete reset of the financial system – a complete reset of government.

I am not saying that this will happen soon, if at all. I am just saying that it’s the inevitable outcome when reaching the peak of society.

Last month, I talked about how the world revolves around the Fed and it’s inflate/deflate cycles.

If you haven’t read that Letter, you can read it by CLICKING HERE.

I suggested that the Fed has already gone through the “inflate cycle” and is in the midst of preparing for the deflationary cycle that always follows. How quickly this occurs is unknown at this point, but if the Fed deflates too quickly, we will witness an extreme global economic and financial reset.

The question is: Are we at the peak of this era?

Today, I want to paint our current picture to give you a bird’s eye view.

It plays out like this (with many of these points overlapping one another):

- Inflate: Make people feel good by giving them cheap money through Quantitative Easing (QE) and low-interest rates – increase the money supply.

- Deflate: Take the good feeling away by taking away cheap money through Quantitative Tightening (QT) and higher rates – decrease the money supply.

- Control: Subdue the population by taking their focus away from the real situation. Think media control; think the increase of opioid usage and the legalization of marijuana; think President Trump; think billionaire-funded protests.

- Divide: Segregate society by inducing riots and hate crimes.

- War: Mask the international financial and economic crisis through the rhetoric of war, or even war itself.

- Reset: Global economic reset will be blamed on war; not the monetary actions of the powerful elite.

1. Inflation: The Give

Since the Fed increased the money supply with global Quantitative Easing, there is now over US$15 trillion of sovereign debt and equities in central bank balance sheets.

Furthermore, over $5 trillion of investment grade bonds trade at negative interest rates, while US equities – the biggest equities market in the world – has inflated to new record highs.

Housing is also on the rise and the costs of living have skyrocketed everywhere.

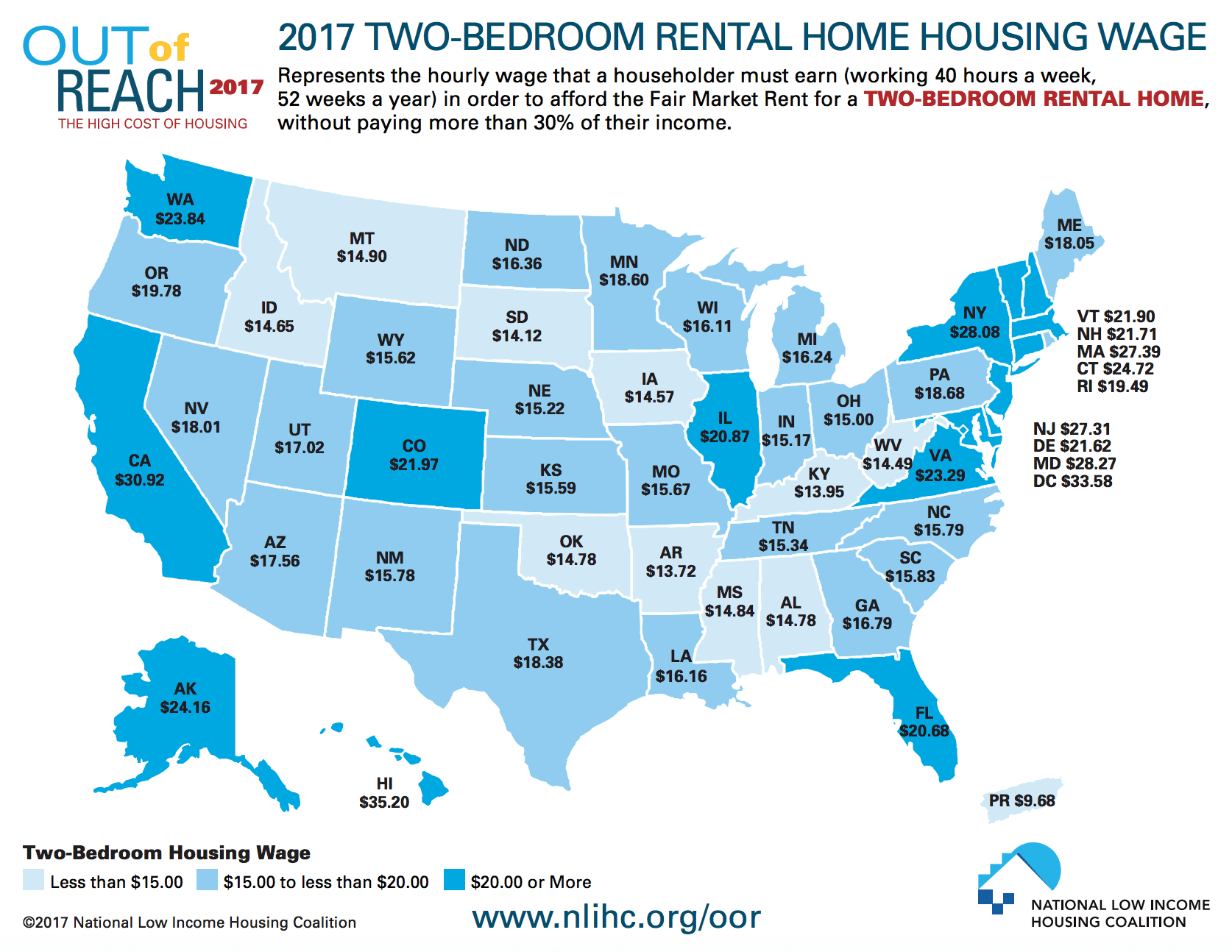

In fact, if you live in the US and make minimum wage, you can’t even afford a 2-bedroom apartment in any of the US states:

Think that’s bad?

Think that’s bad?

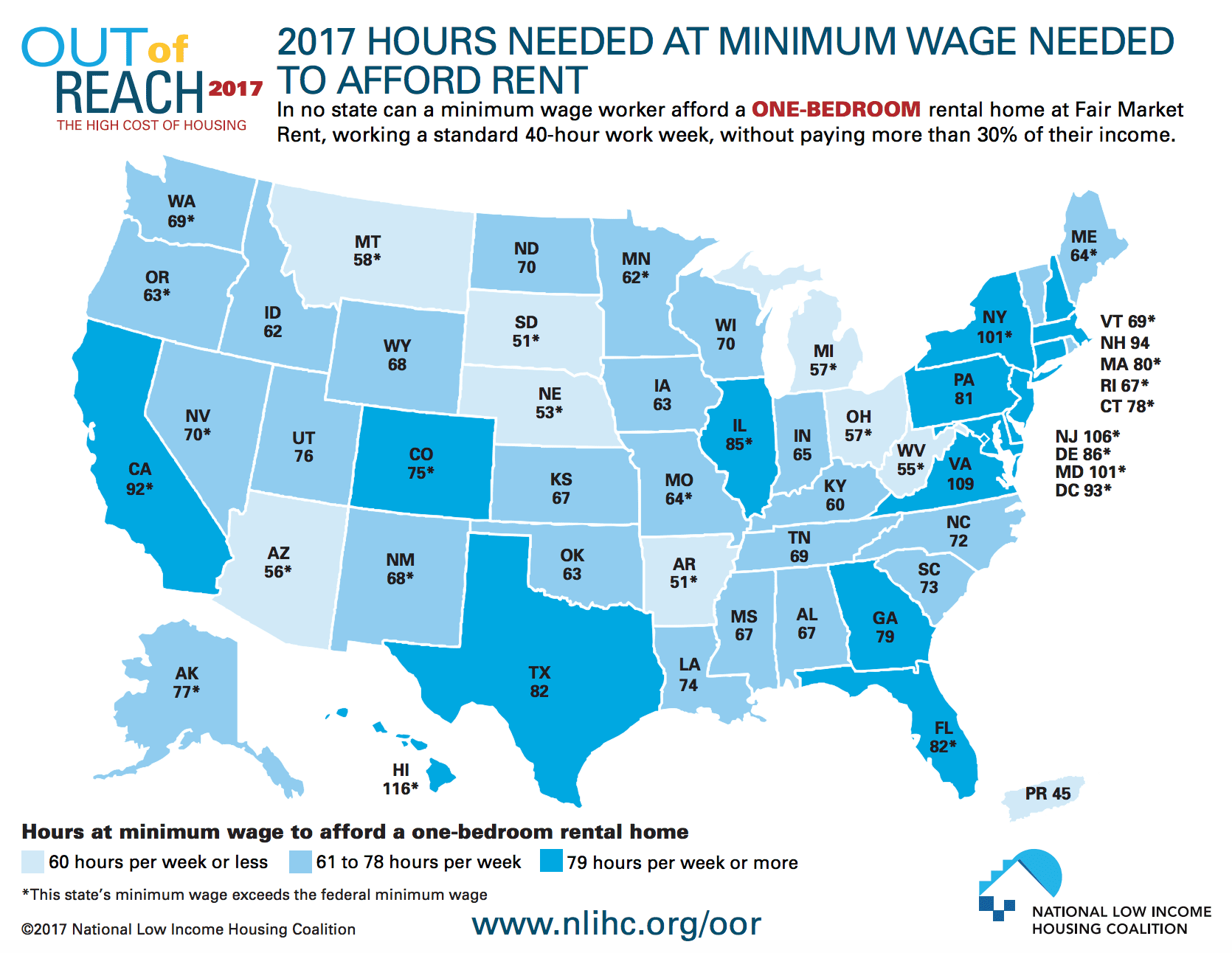

Just 0.1% of US minimum wage workers can afford a 1-bedroom apartment without being what the government calls “burdened.”

Take a look at how many hours a minimum wage worker has to work in order to afford a 1-bedroom apartment:

So how are people getting by?

So how are people getting by?

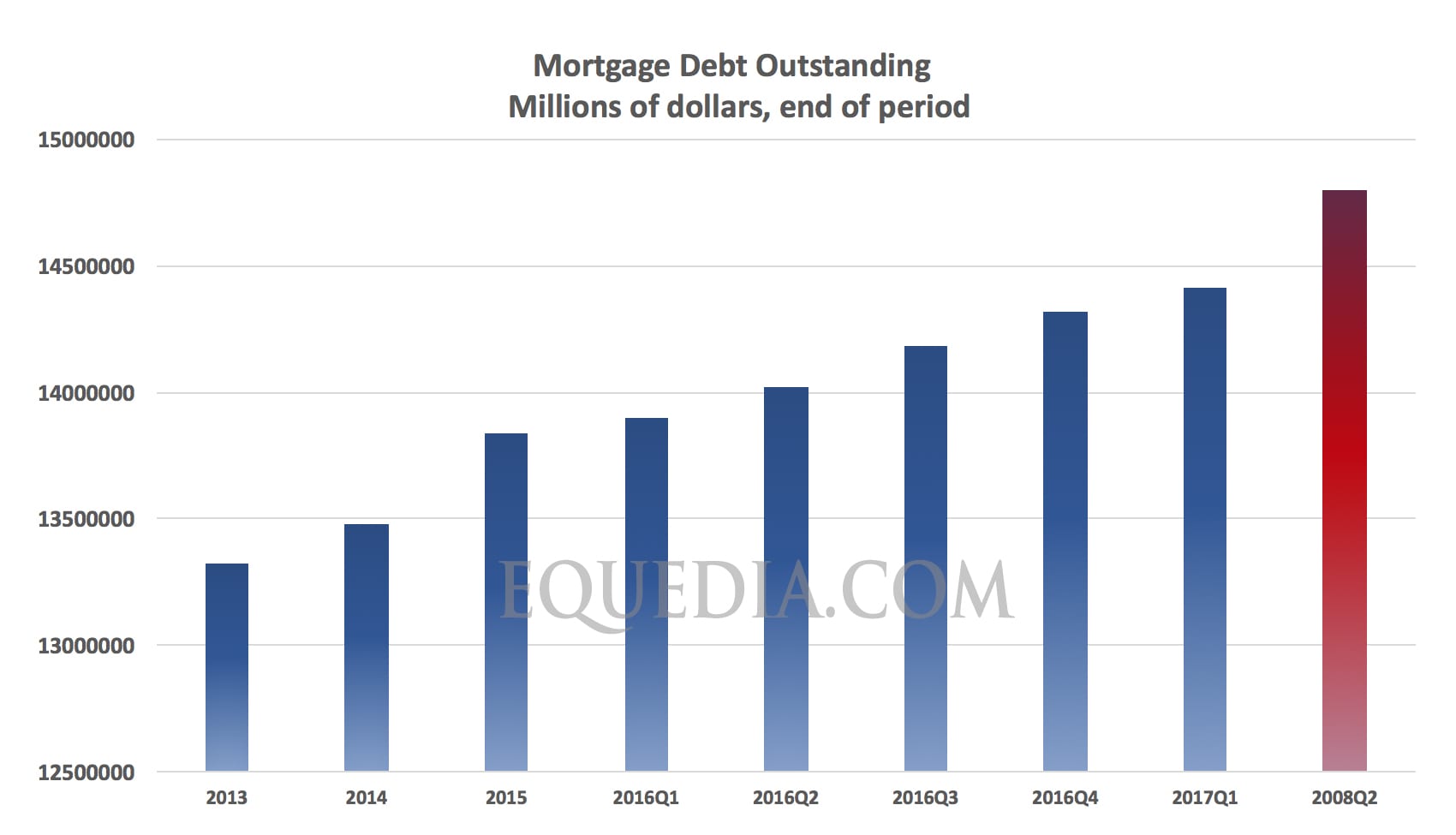

Through more debt.

It’s precisely why household debt continues to reach new highs.

Total mortgage debt outstanding at the end of the first quarter this year sits at over US$14.4 trillion – around $300 billion shy of the record-high set in the second quarter of 2008 of nearly $14.8 trillion.

Now consider this: Overall mortgage debt is rising by over $100 billion every quarter, with every quarter rising faster than the last. If this trend continues, we’ll breach the 2008 record by the end of this year.

Now consider this: Overall mortgage debt is rising by over $100 billion every quarter, with every quarter rising faster than the last. If this trend continues, we’ll breach the 2008 record by the end of this year.

Actually, we could reach it even sooner.

Why?

Recall my June Edition of the Equedia Letter, “What Happens When the Financial Bubble Pops“:

“…Starting in just a few weeks, millions of Americans are about to receive an artificial boost in their credit scores.

… a simple change from the credit bureaus – and not borrower habits – will boost the credit scores of 12 million Americans overnight.

The effects of this boost are already taking place and is about to set off a new wave of consumer credit.”

That might not sound like much but let me show you how damaging that can be.

If every one of those 12 million Americans are allowed to borrow just US$1 because of better credit scores, that’s $12 million of new debt.

If they borrow $10 each, it’s $120 million.

If they borrow $100 each, it’s $1.2 billion.

If they borrow $1,000 each, it’s $12 billion.

If they borrow $10,000 each, it’s $120 billion.

If they borrow $100,000 each (say on a mortgage), it’s $1.2 trillion.

Meanwhile, corporate debt continues to hit new record highs.

All of this debt has been issued and is being issued through low interest rates.

But while both corporate and consumer debt balloon, the Fed is expected to make all of this money more expensive…

2. Deflate: The Takeaway

In June, the Fed announced that it will slowly increase rates and slowly reduce the money supply. Simply put, it’s on the path to deflating.

And again, recall from my June Letter that when the Fed deflates, it has historically triggered a recession:

“History shows us when the Fed lowers interest rates and increases the money supply, the economy booms; when the Fed raises interest rates and decreases the money supply, the economy shrinks.”

As Bill Gross, one of the most prominent bond managers, recently put it:

“Most destructive leverage – as witnessed with the pre-Lehman subprime mortgages – occurs at the short end of the yield curve as the cost of monthly interest payments increase significantly to debt holders.

While governments and the U.S. Treasury can afford the additional expense, levered corporations and individuals in many cases cannot.

Such was the case during each of the three recessions…But since the Great Recession, more highly levered corporations, and in many cases, indebted individuals with floating rate student loans now exceeding $1 trillion, cannot cover the increased expense, resulting in reduced investment, consumption, and ultimate default.

Commonsensically, a more highly levered economy is more growth sensitive to using short term interest rates and a flat yield curve, which historically has coincided with the onset of a recession.“

If the Fed does indeed pull more money out of the system in the coming months and years and “normalize” rates, I have no doubt that it will trigger a recession. Much of our current debt, especially consumer debt, has ballooned as a result of low rates and easy lending.

What happens when rates rise and the cost to service that debt becomes too great?

Just think of all of the people who took out massive mortgages in the last five years at low-interest rates. A small increase in interest rates could significantly increase their mortgage payments.

Furthermore, when the Fed raises rates and reduces the money supply, it reduces consumption which leads to unemployment. How will the unemployed pay for the massive mortgage they took out?

This is an issue that has been lingering for years. I know it. You know it. Yet people continue to financially overextend themselves.

How is that possible?

3. Control: Look Over There, Instead

The trick to blindfolding society against the true economic and financial disasters about to take place is to subdue the people within it.

During the Roman era, the rulers did this through Gladiators.

Today, the rulers do it through sex-filled media, alcohol, and drugs. They take the focus away from the real economic dangers by giving us other things to talk about: fake news, marijuana legalization*, and the allowance of drugs into our nations.

*An important update on an investment will follow later in this report.

Consider some of the most read news stories in 2016 by some of America’s top news publications:

USA Today: Alligator kills toddler at Disney

NY Times: Why You Will Marry the Wrong Person

And the most watched video in 2016? Adele’s Carpool with James Corden.

The political realm is no different – focusing on everything but politics.

Lastly, as I mentioned before in a previous issue, America is in the middle of a massive opioid crisis. But we should ask ourselves: Are drug problems the result of a strong, booming economy, or the opposite?

Opioids are the strongest kinds of painkillers. And when do we take painkillers?

When we’re in pain…

4. Panic: Divide and Conquer

When the rich grow richer and the poor get poorer, riots, protests and the alike ensues.

Three years ago, I wrote a very important Letter regarding the growing tensions in the US and how racial and prejudice tensions were being ignited to distract us from the real problem at hand:

“Do we all need a reminder that during the financial crisis, politicians socialized losses, while allowing banks to privatize profits?

Do we need to be reminded that our rulers the government extended historical amounts of money to the banks who were the cause of the financial crisis, but did little to help the people who lost their jobs, homes, and families?

This is exactly what “they” want. They want us to be blind to the real problems in our society. And they do this by pitting us against each other; by using race as the focus of inequality, rather than economic inequality itself.

That’s because racial inequality pits one group against another, whereas economic inequality pits citizens against the rulers of an empire.

The more focused we are on racial inequalities via the Donald Sterling or Ferguson events, the less focused we are on the real inequalities separating America.”

Unfortunately, these types of hate-filled segregation scenarios, pitting Americans against each other, are getting worse.

” Hundreds of white marchers with blazing torches clashed briefly with counter-protesters on the Charlottesville campus of the University of Virginia on Friday, the eve of a rally planned by thousands of white nationalists, media said.”

“Violence erupted on Saturday as hundreds of white nationalists had gathered here for a rally and clashed with counter-protesters, resulting in at least one death and prompting the governor to declare a state of emergency.”

And it’s not just Black vs. White. Protests are spreading everywhere in America.

According to the Washington Post, more people protested in June than any other month since January.

It’s no different here in Canada. Just take a look at the recent Vancouver protest.

“…Plans for the far-right demonstration began circulating on social media earlier in the week, not long after a deadly white nationalist march in Charlottesville, Va.

…According to a Facebook page for the event, the rally is protesting Islam and the Canadian government’s immigration policies. The page is no longer live, but the demonstration was expected to begin around 2 p.m. PT.

By 3 p.m., a handful of far-right protesters appeared to have gathered. They held confederate flags and the “alt-right” symbols for Pepe and Kekistan. One wore a shirt in support of U.S. President Donald Trump.

…Counter-protesters…streamed into the city hall area – as well as the nearby SkyTrain station and surrounding streets – around 12:45 p.m. PT.”

I write this because it shows how easily it is for someone (anyone) to spread negativity and stir the pot. It shows how easy it is to influence the crowd.

I am not saying that these types of protest were staged, but I am saying that we should be aware that many of the protests in America have been funded by billionaires and other wealthy groups.

Why?

Racial inequality pits one group against another, whereas economic inequality pits citizens against the rulers of an empire.

Turns out, most of those protesting might not even really know why they’re protesting.

As Tina Lovgreen tweeted it best when she said “Sounds like more of a party than a protest. Listen:

Sounds like more of a party than a protest. Listen: pic.twitter.com/uzuWjstHpC

— Tina Lovgreen (@tinalovgreen) August 19, 2017

Listen to her Twitter post and tell me what you think.

CLICK HERE to Share Your Thoughts

All the while geopolitical tensions grow increasingly worse.

5. War: The Ultimate Bait and Switch

In 2013, I warned in my Letter, “A Nuclear Threat,” that the N. Korea threat was real.

More importantly, I warned of N. Korea’s involvement with Iran:

“…While you may have heard about North Korea’s threats, the media hasn’t told you the scariest part: Iran’s involvement.

Open Source Intelligence (OSINT) is now suggesting that as many as 100 Iranian nuclear weapons technicians and scientists are now in North Korea after an agreement was signed last year between the two countries that focused on scientific and technological cooperation. This comes on the heels that news of last month’s rocket launch was assisted by Iran.”

Then in 2015, I warned in my Letter, Nuclear Arms Race Threatens the World, of N. Korea’s ability to deliver an intercontinental ballistic missile capable of delivering a nuclear warhead, all with the help of Iran:

“…While officials and analysts in the U.S. and South Korea continue to downplay how close North Korea has come to acquiring a nuclear weapon small enough to be put on a missile or even its ability to deliver a nuclear warhead on an intercontinental ballistic missile, there’s something they haven’t mentioned: North Korea has help.

…Iran and North Korea have been working together on numerous ballistic missile programs, going back to the eighties.

So while North Korea may not have the resources or the know-how to create a nuclear weapon, Iran certainly does.

Here’s the scary part: Iran has already been working on atomic weapons and advanced implosion technology that’s small enough weapon to fit on – you guessed it – North Korean-supplied ballistic missiles.”

Fast forward a few years later and the media is finally catching on.

“…Iran’s official IRNA news agency reported Kim Yong Nam, head of North Korea’s parliament, arrived Thursday for the weekend inauguration of Iranian President Hassan Rouhani.

…But given he is expected to stay 10 days, the trip is being seen as a front for Pyongyang to perhaps increase military cooperation with Tehran and to boost the hard currency for the dynastic regime led by Kim Jong Un.”

While the focus is on N. Korea, let’s not forget that Iran is also a major threat. If Iran can give N. Korea nuclear capabilities, then surely N. Korea could just as easily give Iran intercontinental ballistic missiles.

How will the U.S. deal with an attack coming from both N. Korea and Iran at the same time?

And while that is going on, the U.S. continues to advance in the South China Sea, where US$5 trillion worth of cargo cross every year, aggravating China in the process.

Just last week, Reuters reported that a U.S. Navy destroyer carried out a “freedom of navigation operation”, coming within 12 nautical miles of an artificial island built up by China in the South China Sea.

It was the third “freedom of navigation operation” during Trump’s presidency.

The tensions are growing and I don’t see any of these countries backing down.

Which means the reset is already in motion…

6. Reset: Already in Motion

Nothing goes up forever. Not stocks, not the economy, not civilization.

I believe the next stage – although the exact time has yet to be determined – is a prolonged period of stagnation, recession, or depression.

Anytime society goes through such drastic changes, war included, people begin to accept different forms of political policies.

During the Great Depression, we saw the New Deal by President Franklin Roosevelt.

These included drastic changes including Roosevelt’s Emergency Banking Act, which reorganized the banks and closed the ones that were insolvent.

It also included the end of prohibition – which, some may argue, that marijuana legalization* is part of our modern day New Deal.

I have given you many reasons why I expect a reset – a New Deal – to happen. I have even talked about the idea of free money, dubbed basic income, many years ago before governments of the world announced it would be testing such theories.

But if you aren’t convinced, consider the following:

In 2009, the Trustees Report indicated that the value shortfall, or unfunded obligation, for the Old-Age and Survivors Insurance and Disability (OASDI) Trust Fund program was about $15.1 trillion.

Today, the latest report shows that value has risen to $34.2 trillion – more than double the amount less than 8 years ago.

Just how are Social Security and Medicare mostly financed? Payroll taxes on earnings paid by employees and their employers and income from investments. These investments are comprised of U.S. government bonds, which are directly affected by interest rates.

In other words, the only way to service Social Security is to have higher taxes and higher interest rates.

Meanwhile, there is around US$1.4 trillion in US student loans, and nearly 40% of borrowers are either in default or more than 90 days past due.

As Trump has already alluded: it’s time to renegotiate debt.

Or, rather, it’s time to reset.

A Grain of Salt

We can’t be sure when the Fed will raise rates, nor be sure if they will raise rates at all.

For all we know, the Fed may decide to do the opposite and extreme, like QE5.

For all we know, the Fed doesn’t have to reduce its balance sheet. Why would they have to when it’s all just a matter of accounting?

This Letter merely represents one unbiased perspective – there are many others.

Seek the truth,

Ivan Lo

The Equedia Letter

www.equedia.com

your statement about trump being the cause of the division in the USA is way of base,it was the left wing administration under Obams that fueled the division and now Trump is trying to fix the problem even when the corrupt media is so biased against him in their quest for New World Order that they will control and you should be smart enough to realize that fact

Congratulations, I ran ABCN through a stock scoring program I developed. It came out as the worse investment I have ever scored. It managed to reach 9. I had never previously seen anything below 20. A Canadian bank stock would score 70 or more. The only reason it got to 9 is due to the 236,273 volume of shares being traded. Why would anyone pay 91 cents for a stock with a book value of 3 cents, no operating margin, no price to earnings? Having said that I did find the statistics you provided interesting but your conclusions are questionable. In times of deflation usually prices and interest rates go down to get the economy moving. You are saying they are about to go up. In times of inflation, prices and interest rates go up. Due to technological changes things are becoming cheaper to bring to market which is leading to deflation not inflation. Unemployment figures are misleading for many reasons. There are a high percentage of the population looking for full time employment that do not show up in our unemployment figures but still are a factor in on going deflation of which there is no end yet in sight.

The ONLY answer to our debt problems is to reboot the dollar. To that end, Trump should meet with representatives of major countries and thrash out an agreement to value GOLD at or about $10,000 per ounce. Settlements as between countries should occur based on the new values.

The meeting and agreement should be done this year.

I totally agree.Gold should be a serious benchmark.I have increased my holdings in gold, in particular “BAR”Balmoral Gold as well as ABCANN due to their technology.

Mike

You have not included and analysed what world bankers are currently up to in particular the BIS and the IMF in relation to the value of the US dollar against world currencies and the potential for the BRICS to vote as a whole on the SDR’s allocation?

I enjoy reading your newsletter, but I find that the right-most 5 or 6 characters are always cut off, making it difficult to read, Can you try to find an alternate way to format it? pdf?

I think the US really want and are provoking a war against South Korea and would welcome Iran to join the party because they know how dominant their military powers are and with a NATO backstop, this war would probably end fast and be the end to the proliferation of nuclear arms in the world particularly by these ruthless and egotistical regimes.

Your world assessment is too shallow. China’s global ambition is expressed at the moment as demand for the Oil in the South China Sea and is one major driver for the South Pacific tensions. Kim Jong Un wants/needs the wealth in S. Korea and China uses that to tweak the US as the USN stands between the Oil and China.. Iran adds to the issues and lowers the cost (Money) to China.

Iran wants world Islamic conquest. It’s an open question whether Islam will get the Atomic Bomb by self manufacture or by conquering France, (or England),. The Islamic Bomb is a certainty, in my opinion … Just how they get it is the question.

Eventually Russia, China and/or the US will have to address the Islamic Bomb if they hope to survive. I see little hope of Europe playing a role in it’s own salvation. If Islam wins then all the world’s libraries and heritage will be lost. Despite extravagant claims Islam has contributed almost nothing to the world’s knowledge or public health. Knowledge the Arabs, Persians and others have contributed was before Islam.

Read the book by Henry Ford “The International Jew”.

Everything you have said is true and it’s all be done before.

The Golden Rule. He who has the Gold Rules.

For the most part, this piece has aged well (as of 2023).