Dear Readers,

Set aside your biases and hear me out.

That’s because what I am about to say may be hard to believe at first…

…that is until they become reality.

Back in early 2016, I said Donald Trump would become the President of the United States.

In return, I received hateful responses stating I was wrong.

Yet, today, Donald Trump is President.

Hold on to your hats because we’re about to go through extreme and radical global changes.

And the most important five years of this decade is about to unfold…

WATCH THE VIDEO VERSION:

HEAR THE PODCAST INSTEAD:

Apple Podcasts (click to download to your iPhone, iPad, or Mac): https://podcasts.apple.com/ca/podcast/the-equedia-letter-podcast/id1462392573

MP3 (right click > save as): http://traffic.libsyn.com/equedia/podcast_april_2019_-_2019-05-02_8.04_PM.mp3

Stock Market Worries? No Problem…

Take a good look at the global economy and financial markets.

The EU and its banking system are in trouble, China’s growth is slowing, and financial markets are exhibiting signs of exhaustion.

Furthermore, one of the steepest fiscal cliffs in history is coming later this year, unless Congress can agree on a new package.

It’s no wonder Citigroup, one of the biggest banks in the world, told clients earlier this month to lessen exposure to risky assets and prepare for a storm.

“We are only 15 minutes to midnight,” it said.

The bank even predicted that a recession would begin in December.

But we have heard statements like this, time and time again over the last ten years.

Take 2016, for example.

A bevy of macro indicators pointed to a global slowdown. Analysts were scared. People were afraid. And central banks were panicking.

The culmination of those sentiments led to a sharp drop in the stock market.

Only, it lasted all but a few weeks.

By mid-February, it was almost as if nothing happened.

What happened to the macro indicators that pointed to a global slowdown?

What happened to the scared analysts?

What happened to the panic?

In less than two years since that drop, the Dow climbed from under 16,000 to over 26,600.

So much for the global concerns…

But what caused things to turn around?

The answer is quite simple…

The Power of Central Bank Interference

Over the past decade, I have told investors to follow the actions of the Fed.

In short, the Fed’s (and other central banks) abilities to control the money supply have been the primary drivers of the global market.

They have done this by providing massive stimulus to the global economy.

And regardless of what anyone says, or the future consequences associated with central bank policies, it’s worked.

So much so that the same playbook they used in 2008 has worked many times over the last decade in avoiding a global crisis.

Unbeknownst to most, it worked again in 2016.

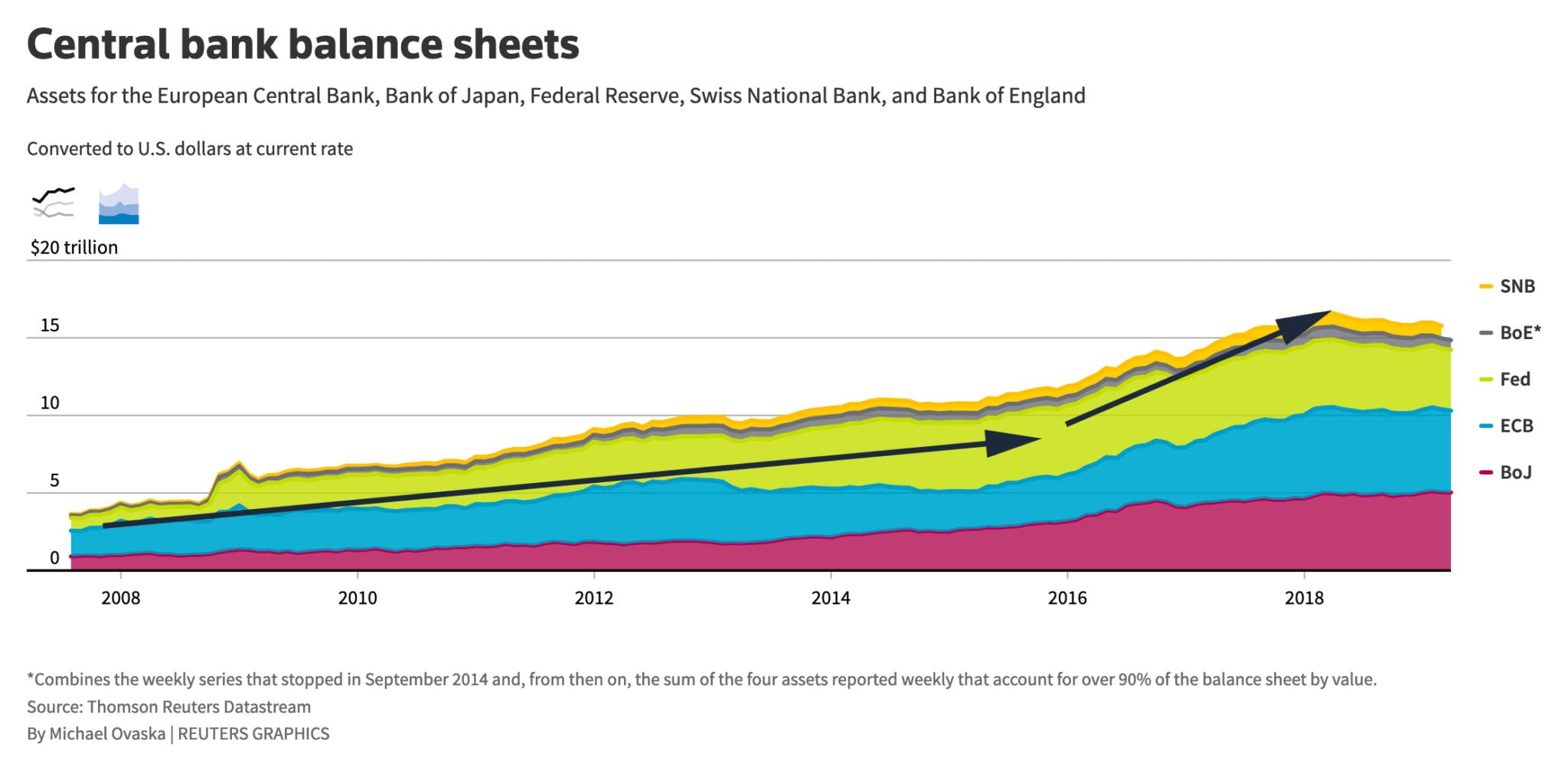

Between 2016 and up until the middle of 2018, the world’s biggest central banks unleashed a flurry of money into the global financial markets – more than ever in the history of our modern financial system.

Take a look.

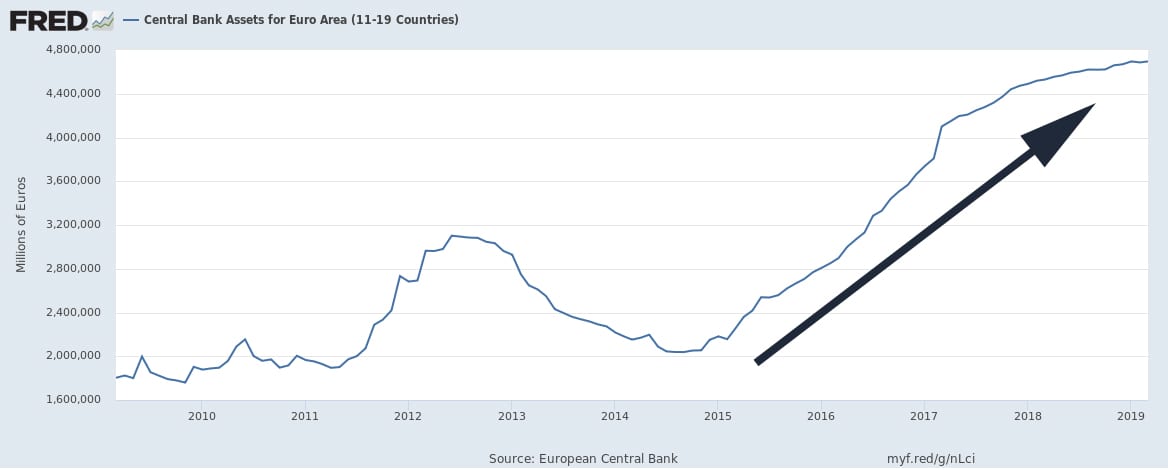

Here’s the EU, via the St. Louis Fed:

And here are the top central banks in the world together, via Reuters:

Their actions once again stabilized economic growth and sent the prices of stocks and other assets such as real estate soaring.

The problem is that without central bank intervention, the markets immediately come to a halt.

And that’s precisely what happened last year.

When stimulus stopped in mid-2018 (as noticed by the downturn in the above chart), the effects were immediately felt.

Starting in October 2018, the S&P 500 fell from over 2900, down to just 2351 on Christmas Eve.

“The economy is strong,” they told us.

“Global growth is picking up steam.”

And they were right – only they never emphasized that the primary reason things looked good was because they were propped up with stimulus – a record amount of it.

Without support, the market sank.

So the Fed went back to the same playbook and did what it does best: stepped in and interfered by telling the world it wouldn’t raise rates.

And the market immediately rebounded.

The question now is if the Fed and other central banks around the world will continue to ease pressures by maintaining low rates and injecting further stimulus.

China has already stepped on the gas, and I suggest they will do more.

And despite announcing to the world that it would end its €2.6 trillion (US$2.95 trillion) quantitative easing (QE) bond-buying program in January 2019, the EU is already delivering a fresh round of money.

Via Bloomberg:

“The European Central Bank delivered a fresh round of monetary stimulus in a bid to shore up the weakening economy as it cut its growth forecast by the most since the advent of its quantitative-easing program four years ago.

ECB President Mario Draghi said the euro-zone economy will now expand only 1.1 percent this year, a drop of 0.6 percentage point from forecasts just three months ago. A package of assistance from new loans for banks to a longer pledge on record-low rates is intended to expand existing stimulus, he said.”

If the Fed does indeed continue to intervene, it has more than enough firepower to prop the markets up until next year – especially since the other two economic superpowers, the EU and China, are already doing it.

And given that next year is an election year, President Donald Trump will undoubtedly look to monetize even more debt. He is, after all, a staunch supporter of borrowing money at low rates.

This is where the radical changes begin.

Don't Miss Our Next Report !

...get a free monthly subscription to one of the best-performing investment letters: the Equedia Letter

*Don't worry. We will never spam you and our subscription comes only once per month. You can unsubscribe anytime with a simple click.

Trump to Win in 2020

The Democrats and the far leaning left have tried everything in their power to remove President Trump from office.

They have tried sexual harassment allegations. They failed.

They even tried to involve the FBI. Again, they failed.

And every time they failed, Trump has garnered more support.

Heck, he just raised another $1 million for his upcoming campaign as a result of the Mueller debacle.

Via the New York Post:

“The Mueller report put another $1 million in President Trump’s campaign coffers.

“The release of the full Mueller report directly led to the campaign raising more than $1 million,” Trump campaign COO Michael Glassner told The Post.”

In fact, Trump has already garnered more campaign funding than his top two Democrat rivals combined:

“The Trump campaign had already reported a $30.3 million haul for the first quarter of the year, nearly equal to the donations of top Democratic rivals Bernie Sanders and Kamala Harris, who brought in $18.2 million and $12 million respectively.”

If President Trump gets his way with the fiscal cliff and the markets can sustain this exuberance, my bet is he will win the 2020 US elections and remain as President of the United States for another four years.

But that’s not all.

I suspect he will not only win the popular vote, but he will convincingly take the Electoral College.

In other words, Donald Trump will not only lead the Free World for another term, but he will be free to do as he pleases without much challenge.

And that means radical changes are coming.

Prepare for Radical Change

After Trump wins, he is going to go berserk.

Not only will he likely control the entire government, but he will unleash a new fiscal policy that will change everything.

He will lower taxes on the rich and those who are job creators; he will give huge incentives to businesses in the U.S. via tax breaks; he will borrow a boatload of money and begin a massive infrastructure spending spree which will create jobs.

Heck, he may even convince the Fed to do QE4 – all of which will lead to a bigger bubble.

After all, he will have nothing to lose – there’s no more election to win.

In other words, he will do whatever it takes to prop up the economy and the stock market.

But here’s the thing…

The Champion or Fall Guy?

If the market can hold off until the US elections next year, we may see yet another burst of enthusiasm in stocks.

The rich will certainly get richer under Trump, but he will create more jobs and make many blue-collared Americans happy.

For investors, the goal over the next couple of years is to make as much money as possible in the market before it comes crashing down. Because given the amount of exuberance in the market and the credit bubble that has been brewing for nearly a decade, things will break at some point.

And that some point will likely come during Trump’s last couple of years in office (if he wins) because he will unleash a fury during the first two.

But why? Why will things come crashing down if Trump will do whatever he can to make American great again?

The answer lies in the Letters I wrote back in 2016 and 2017.

From 2016, before Trump became President:

“For all we know, Trump, the master of the deal, may have already struck a deal with the bankers and politicians.

But as we know right now, Trump is anti-establishment and anti-globalization.

If Trump is elected under that presumption, we’re going to see the building blocks of the Establishment and globalization come under attack, and they won’t like it.

They will fight back, leading to major conflicts including riots, protests, and potentially even war and assassination attempts.

It is quite possible that the Establishment might even be allowing Trump to succeed in order to cause chaos to show the people that the Establishment is a necessity once all hell breaks loose.”

Note the last sentence.

“…What I write may be difficult to grasp at first, but as time passes, the light will shine.

Just keep in mind that throughout American history, whenever the Establishment has been challenged, it has always been followed by bear markets and economic contractions.”

Not the last sentence, again.

I then wrote in 2017, in my Letter, “Can Trump Stop the Establishment?“:

“Trump is directly attacking the Establishment.

In his inauguration speech, he directly focused on bringing the power back to the people; directly attacking and calling out the Establishment:

“For too long, a small group in our nation’s capital has reaped the rewards of government while the people have borne the cost. Washington flourished, but the people did not share in its wealth. Politicians prospered, but the jobs left, and the factories closed.

The establishment protected itself, but not the citizens of our country. Their victories have not been your victories. Their triumphs have not been your triumphs. And while they celebrated in our nation’s capital, there was little to celebrate for struggling families all across our land.

… For many decades, we’ve enriched foreign industry at the expense of American industry; subsidized the armies of other countries, while allowing for the very sad depletion of our military. We’ve defended other nations’ borders while refusing to defend our own.

…And spent trillions and trillions of dollars overseas while America’s infrastructure has fallen into disrepair and decay. We’ve made other countries rich, while the wealth, strength and confidence of our country has dissipated over the horizon.

One by one, the factories shuttered and left our shores, with not even a thought about the millions and millions of American workers that were left behind. The wealth of our middle class has been ripped from their homes and then redistributed all across the world.”

Backing his words with action, Trump has already signed a whole range of executive orders that challenges the very essence of the Establishment.

He’s already made an executive action to withdraw the United States from the Trans-Pacific Partnership – a partnership often viewed as a globalist policy. He’s frozen the hiring of new Federal employees in attempts to control Big Government. He’s done a lot in just a week.

And according to the New York Times, Trump is about to attack the Establishment head-on:

“The Trump administration is preparing executive orders that would clear the way to drastically reduce the United States’ role in the United Nations and other international organizations, as well as begin a process to review and potentially abrogate certain forms of multilateral treaties.

The first of the two draft orders, titled “Auditing and Reducing U.S. Funding of International Organizations” and obtained by The New York Times, calls for terminating funding for any United Nations agency or other international body that meets any one of several criteria.

Those criteria include organizations that give full membership to the Palestinian Authority or Palestine Liberation Organization, or support programs that fund abortion or any activity that circumvents sanctions against Iran or North Korea.

…The draft order also calls for terminating funding for any organization that “is controlled or substantially influenced by any state that sponsors terrorism” or is blamed for the persecution of marginalized groups or any other systematic violation of human rights.

…The second executive order, “Moratorium on New Multilateral Treaties,” calls for a review of all current and pending treaties with more than one other nation. It asks for recommendations on which negotiations or treaties the United States should leave.

The order says this review applies only to multilateral treaties that are not “directly related to national security, extradition or international trade,” but it is unclear what falls outside these restrictions.

For example, the Paris climate agreement (Globalist policy) or other environmental treaties deal with trade issues but could potentially fall under this order.”

Trump is cleaning house, and he has already purged the State Department. Many believe the CIA is next.

And it’s no secret that the CIA has attacked Trump leading up to his inauguration.

Just remember this: the last U.S. President to challenge the Establishment, the Shadow Government, and even the CIA, was the beloved John F. Kennedy.

President Kennedy did many of the things Trump is attempting to do today: Expose the shadow government, eliminate the CIA, ordered a complete withdrawal from Vietnam (Trump has boldly announced that he will bring back troops and not interfere with other nations’ internal affairs), and signed Executive Order 11110 – one that would return the responsibility of the money supply back over to the U.S and out of the Fed.

And we all know what happened to JFK following his actions.

…With Trump in power, the short-term success of America will be apparent*.

(*we’re seeing this today.)

However, the success of his policies means a gradual rise in inflation, and thus, interest rates.

Like the events leading up to the Great Depression, we have been exposed to a prolonged all-time low level of interest rates. This has led to irrational exuberance in the stock market which could lead to a dramatic depression when the bubble pops.

We have been so accustomed to low-interest rates that when interest rates tighten, it could spell doom for many Americans who are already stifled with debt. It could also spell doom for many emerging markets whose debt is mainly comprised of dollar-denominated assets.

And believe me, interest rates will rise in 2017*.

(*and they did.)

Now that Trump is in power, he could become the fall guy for the Establishment’s policies.

In fact, half of America has already been set up to blame Trump for every negative event that will happen over the next four years.

They will blame Trump for a stock market crash, and not for the irrational exuberance brought on by low interest rates and the loose monetary policies of the last decade – the same policies that led the U.S. to the Great Depression.

As Trump’s policies begin to see success, the Fed will likely raise rates and contract the money supply. They will need an excuse to do it, and what better excuse than a rise in inflation caused by Trump policies.

When this happens, another Great Depression could occur. Of course, following that, we’ll need to be “saved.”

And who better to “save” us than the Establishment.

Remember, the aftermath of the Great Depression was the creation of a monolithic central bank with complete control over the U.S. monetary system.

This time, it’s global. Can Trump stop it?”

As Trump attempts to make America great again, he will flood the media with his accomplishments. But in the end, it will be the central banks, and more importantly the Fed, who will truly control what happens.

Let’s face it: most of our current generation has no idea of how the global financial system works. They have no idea how certain actions affect the economy. They have no idea who is really in power. What the Fed gives, the Fed can take.

And the Fed has given a lot.

Our generation is consumed with laying blame to others. And when shit hits the fan, they will blame Trump – he is the perfect fall guy, after all.

They won’t blame cheap money. They won’t blame debt. They’ll blame the one in charge.

And the person in charge will likely be Donald Trump.

Moving On

It won’t just be lower taxes and massive spending that Trump will be responsible for.

That’s because, in order to correct the current global debt bubble, something massive will have to take place – something no one will be able to grasp until it happens.

During this time of radical change, countries around the world will be afraid and begin to defend themselves from the fall out of the credit bubble.

Unfortunately, massive global resets have only really occurred as a result of war.

Are we on that path?

In the next edition of the Equedia Letter, I’ll give you insight into what is really happening behind the scenes.

Stay tuned.

Thank God Trump is the president of the USA,he is the only one standing between the people and the Gloablists headed by the Rothchilds

What a shame that Trump doesn’t have support from his own party in congress. He would be unstoppable if he did.

The man is a monster. What do you see in him that so many others do not?

More importantly, what dilution in your mind keeps you from NOT SEEING what most insightful people find blindingly obvious?

Seriously…name ONE THING he has done for you and please back up your claim with at least ONE documentable FACT?

Your statement “Remember, the aftermath of the Great Depression was the creation of a monolithic central bank with complete control over the U.S. monetary system.” is inaccurate. The FED was created December 23, 1913. The Great Depression is generally recorded as having begun in 1929 and ended in 1941. While the FED may have been greatly expanded after the Great Depression it actually created before, not afterwards. The effect of that system has of course been devastating over time regardless of the date of its creation, however I think your case is stronger if historically correct. Just my opinion and please correct me if I’m wrong.

Hey Timothy, great question. While the Fed was created before, their true power didn’t come until 1933 when the banking act came in.

“The Act placed open market operations under the Fed and required bank holding companies to be examined by the Fed. Furthermore, Roosevelt recalled all gold and silver certificates, thus effectively ending the gold and any other metallic standard. Without these certificates, more reliance was plants on Fed dollars to replace the certificates.”

Hope this helps.

Excellent article. May God continue to bless and protect President Trump so that he may finish the work President Kennedy began.

Using Kennedy’s name in the same sentence with Trump’s is an abomination worthy of having one’s tongue cut out.

Kennedy was everything Trump will never be.

Kennedy ran headlong in war and the jaws of death…

Trump hid behind his bone spurs and spent his ‘war years’ snorting coke in his penthouse while his high paid hooker’s pissed on him.

The only thing I hope they will ever share…assassination.

Think of all the lives that would have been saved had guys like Andrew Jackson or Adolf Hitler had been taken out early in their political careers?

Many of you deserve a Trump but most of us…do not.

Hi Mr Lo. A couple of months ago you profiled Westleaf, since then it is down considerable, can you comment on this. Thanks Keith

I agree 100%.

Very well written article. I’m out of the stock market now, don’t trust it one bit. Keep up the good work and keep me informed, thank you

Read Tony Burman in the Weekend Toronto Star. He’s expecting Trump to pull a Nixon and resign before the election in exchange for a pardon. If he loses the election, he’s going to jail, which is the favored scenario.

After reading your post, I could not help but smile at the irony that central bank policies (mainly the FED) have caused the series of bubbles we have seen post Volcker, and at the end of this, central banks (The FED) will cause the crash leading to War.

No one is the wiser. History repeats. Those in power are too short sighted or don’t care to ever learn that this time is NOT different.

Look forward to your missive nest month, Ivan.

Anyone who believes that Trump will win the popular vote and the electoral college in 2020 is in my opinion living in la la land.

He is destroying the Republican Party and totally embarrassing USA to the rest of the Western World.

And if not voted out in 2020 will bring down our economy with a crash far worse than 2008.

That’s my opinion and I’m sticking with it.

This might actually be lala land. As horrible as most of the Democrats positions (green new deal, reparations, higher fed income tax,etc ) As depicable as many believe him to be Trump just might win again.

Nobody can and will beat the Establishment. Far too cunning.

If they push, you pull. If they pull , you push. But when the force is greater than you, Get Out Of The Way.

Said Lao Tzu

HI I’m Muhammad zeeshan from in Pakistan and live in village loshar khala and my email address is gujjarzeeshan275@gmail.com and my home address is village loshar khala post dhoda shrif district gujrat and my call and whataap contact is 03049795067and i want in work i so need a job

The most profitable job you can find is one you have made for yourself….

Find a shortage and supply it.

Find a need and fill it

As long as you depend on others for your income you will always be your slave.

economy

Go Trump; let the man do his job. He was put in office by GOD.

Every night the last prayer of the day is that a wise and benevolent God stops the evil black heart that beats inside Trumps chest only to awake in the morning to find that God is…neither.

The Republican party has, under Trump, has become a terrorist organisation and anyone that supports him or his party is the very definition of evil. Unless they are stopped they will be the death of us all.

Trump is that Anti-Christ… embarrassing him is to climb into Satan’s bed.

Buy ammo and stockpile food or die with the rest of the fools who don’t realize who Trump really is.

Thank you Ivan. Slowly but surly I see folks listening and pulling at threads of truth. Glad your providing some much needed light to flush out the dark.

Trump won , much rather had him in office then the other we were voting for or against. Much better the Obama who did nothing but drag the USA down for 8 years. Chet seems to dislike the president , I disliked Obama and Hillary, didn’t vote for either of them. I want him to clean up the swamps in Washington D C , would like to see 8 year max terms, not life terms , when we elect people to office. Crime is too high, people kill for no reason, or poor reasons. Maybe it is time to start killing the killers, why lock them up for life, let’s just end it like they did to somebody else. Build the wall, should slow down drugs, and 35,000 people coming over from the south. The Equedia investment Research letter is very informing

There has been a funny scenario in politics…….. we voted for change. We elected Trump with narrow wins. Then we regreted he was elected. We use issues to make him stumples and create things that make America looks like a fool…………(for example the latest suggestion to allow human bodies to be made compost; having foreign companies monopolize the supply chains within the country and in a stand still with every big power house in the world ………..) Let’s put it this way……… what would we do differently if we are the elected ones to make America great again?? If we can tell……… they can help us to do it or no?? Money game could be a fairly simple game of overall control if one desires or a complicated handling with mass involvement……….. If I’m the president aid………….. I would suggest…………………… (complete the sentence in 300 words)……………. lol

What does Equedia and anyone else think about Chicago? I’ve heard from some wealthy educated people that Chicago is set to go bankrupt in the next 4 years and the GDP of Chicago is enough to wipe out the growth of the entire US economy for 1 year and cause a mild recession since fed stimulus could take at least 12 months to have an effect on the market.

The first imppression on Chicago was Chicago Bull – (wikipedia) They are known for having one of the NBA’s greatest dynasties, winning six NBA championships between 1991 and 1998 with two three-peats. All six championship teams were led by Hall of Famers Michael Jordan, Scottie Pippen and coach Phil Jackson. The Bulls are the only NBA franchise to win multiple championships and never lose an NBA Finals series in their history.

Besides that……… Chicago is housing headquarters of many big companies (wikipedia) e.g. Boeing; McDonald’s; Kraft Heinz; Abbot etc……. “For the fiscal year that begins on Jan. 1 2019, the analysis pegged operating fund revenue at $3.74 billion, with expenses estimated at $3.84 billion. Chicago’s budget gap is projected to grow to nearly $252 million in fiscal 2020 and $362 million in fiscal 2021, according to the analysis”. https://www.reuters.com/…chicago-budget/chicago-eyes-shrinking-budget-gap-for-fis…… Unless the stock markets and trade centers in Chicaga are going to perform some circus tricks for entertainment….. Chicago will likely be going to grace the wind for change especially for climate change and flood and all………… to avoid flooding and fire out breaks from affecting those big headquaters…….. *wink*

I’ve been thinking along these lines for a while, except I think the NEXT election will be the excuse for the market crash. I don’t think a recession will hold out for another election cycle. The 2-10 year curve has already inverted which means that we have 12-18 months before the recession starts (based on history only).

The FED and other reserve banks seem to have been doing a great job at keeping the world economy growing and stable, with record growth stretches in the stock and other markets. This, of course, means that bubbles have had the longest time to inflate and markets to get overvalued. We now have a very high cliff to fall from,

I think the next election will be the trigger for the recession, either before or after. The next elections is ~18months away. Trump is seen both hero and villain depending on who you talk to. I think the narrative could be:

* During the lead up to the election, the pin is pulled and the global economy starts to take a tumble. Trump is painted as the villain for letting the economy tumble so badly and the establishment takes over to fix things

* The pin is pulled after the election where Trump loses and the incumbent is made to look like the villain and trump the hero. Increasing pressure to bring back Trump style control to fix things.

I don’t believe Trump will win the next election because he will not want to preside over an economy in recession. With the size of govt debt and the FED there will not be many leavers left to pull to fix things.

Looks like Joe Rogan reads the Equedia Letter!

https://www.youtube.com/watch?v=_JpgTrkkdPU

America needs to turn back to God. Without God, all is useless and vain. America has left the foundation of faith in God which is evidenced in our laws, behaviors and overall condition of our country.

America needs revival, we need to pray for our leaders, asking God give them wisdom and insight to what we are facing as a nation, as a people.

If we don’t turn, turn back to our awesome God, we will fail, and I hate to think of what that failure would entail!

Sounds to me like you Trump haters may be the riff-raff crowd that never had a job, didn’t want a job, and never will work until government programs (which is your income) are stopped or cut drastically. It will be a sight to see and shoot-at when the drastic cut of your support happens. Because you will parade, join the mob, break the laws, steal, damage and destruct anything others have, to prove your point that things are bad. But just remember . . . . . unless you stay low you are apt to be the receiver of bad news, instantly.

I enjoy your letters as you usually have some interesting points to make. However, you have shown that you don’t know who is actually running the show. God is in charge, not the establishment. The reason the establishment because so powerful is because people have fallen so far from God that judgment is upon us. It is God who raises up the Kings, and God who brings them down. It is God who brings prosperity, and we bring judgment upon ourselves when we reject God. Obama was further judgment upon the US because the people didn’t wake up when 9/11 occurred. If My(God) people would humble themselves, turn from their wicked ways, seek my face through fasting and prayer, I shall heal their land. That is a promise God gave us. I and others kept preaching that and finally during the latter term of Obama the sleeping Christians began to wake up and repent, turning back to God. Thus He raised up Trump and because of Trumps move to declare Jerusalem to once again be the capital of Israel, God has blessed the US. What you do to Israel shall be done unto you. God promised His believers, I shall curse those who curse thee, I shall bless those who bless thee. God always balances the books in His time. We believers are pressing in with fasting and prayer, and if Jesus doesn’t come back soon, we shall see a major victory through God. Each President who did something good for Israel had a good event follow, like the economy and stock market go up. Each President that has made decisions against Israel had a bad event follow like war, economic downturn, or market crash. Now you know a little more about who controls the Kings and the money. Your welcome and may God bless you.

“It is quite possible that the Establishment might even be allowing Trump to succeed in order to cause chaos to show the people that the Establishment is a necessity once all hell breaks loose.” So, whatever scenario you look at, the ‘Establishment’ is still required to correct things? What I struggle to figure out is who, or what, Trump really cares about. If his historical track record is anything to go by, it’s not authority, nor the common people. It has been his family name, and his business interests. That would lead me to believe that anything he does is to benefit those areas. America is suffering with some very deep-set problems, and one of the biggest ones is that the people have been pit against each other. I see the only way to help solve this is to elect someone fair, equitable and independent from conflicts of interest. Someone intelligent and trustworthy who will not be ‘bought out’. That’s a pretty steep hill to climb in the current climate. It is my hope that people will soon become over saturated with political agendas- ‘fake news’ and ‘alternative facts’ and won’t be led so easily by sides. Trump has always had this weird effect on people, like a hypnotic charmer, and that can’t last forever. Regardless of what happens at this election, by the following one he will be gone and everyone can come back to their senses. But wait- this is America we are talking about! *shrug*

Jason, what makes you think that God cares who is President of our country? I suppose you think there is a tooth fairy that cares about your old teeth and Santa Claus cares whether you have been naughty or nice. God created humans to watch and see what we do with the gift of life. That is all that God cares about and not politics. Grow up Jason. Join the mature people of this country and realize God only cares about how you live the life he gave you.

I hope you like the taste of newsprint, because nothing you claim will happen is going to happen and you will eat every page of your nonsense. Trump has zero understanding of trade. The US needs to fight the Chinese about stealing our technology, not by setting up our farmers and manufacturers to be screwed by Chinese tariffs. Soybean and pork producers are going broke every day, and related jobs are disappearing all through the agricultural states. Then he takes our money and uses it to pay off the farmers because his “policy” failed (within weeks)–and this is praiseworthy for you? This is effective public policy for you? This is what his agricultural base needs?. Most of US steel comes from Canada, not from China –I thought you knew that, because everyone else does. Trump’s steel tariffs are killing the automobile business, and that information is available to all. His rejection of the Iranian Agreement (which was working) and his toadying up to an international murderer in Korea has only increased the nuclear threat to the world. Trump is demanding deep interest rate cuts, when it is obvious that they will only make the eventual crash much worse–and you are worried that he might be blamed for that? I certainly hope so. Trump is kissing Putin’s butt, when Russia’s economy is decades behind the West and will never catch up. What is his fascination with tyrannical cowardly killers? Why is that a good thing? If you have such deep long-term insight, at least answer that. Multiple psychiatrists have repeatedly stated that Trump is a “malignant narcissicist, with psychotic and sociopathic tendencies”–hail your leader!

Trulife Distribution – Nutrition Distribution helps our clients achieve success in a complex, competitive retail environment. Our team of nutrition industry experts takes care of everything from importation compliance to marketing, sales and distribution at the ground level. There is no need to navigate the complicated intricacies of the American market when we have already done the work. Let us use our experience to expand your brand and put your product into the hands of American consumers. https://trulifedist.com/