“Will inflation eat away my retirement?”

My Uber driver recently asked me this. And he’s not the only one who’s asked me this question lately.

If you have been following this letter for some time, you know inflation was inevitable. You also know it’s not transitory, as the experts might tell you. Higher prices are here to stay.

So how do you protect your nest egg?

In fact, I’ll let you know about the most primitive investment strategy that has historically beat inflation 100% of the time.

That’s right, 100% of the time!

But first, let’s wind back to the last inflation scare for some hindsight…

The Hyperinflation That Wasn’t

Remember the inflation fears of 2009?

After the housing market collapse of 2008, the Fed began the grand experiment of excessive money printing (Q.E.).

In just five years, they printed nearly $3.5 trillion – an appalling sum at the time. And investors feared such unprecedented money creation would set inflation loose.

In fact, pundits predicted Weimar Germany-like hyperinflation. Legendary hedge fund manager Jim Rogers went as far as calling it an “inflation holocaust” on CNBC:

But the fears didn’t come to pass, and inflation remained stubbornly low.

Money Printing Alone Doesn’t Create Inflation

This seemingly illogical cause-and-effect wasn’t a one-timer.

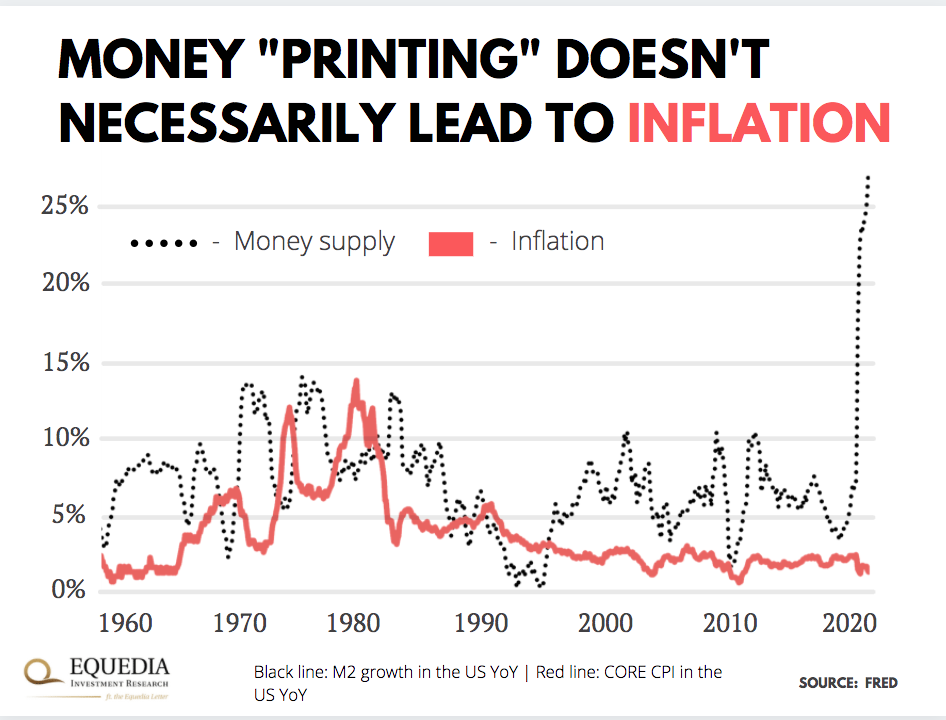

In the past 60 years, money printing has often failed to raise prices. Here’s a chart that plots money supply and inflation in the U.S. since 1960:

According to the Fed’s calculations, if money supply alone were enough to create inflation, inflation in the U.S. would have averaged 31% between 2008 and 2013.

And yet, deflation has been the biggest worry this past decade.

Why?

There are two reasons.

The first is what “they” openly tell you.

Imagine an auction where many millionaires turn up, but none bid a single dollar on auctioned items. Would those items sell for more than their starting prices?

Of course not.

The same concept applies to inflation. It’s not enough to print up a bunch of money to spur inflation – people have to actually spend it on stuff to bid up their prices.

And this is where a less-known economic term called “money velocity” comes into play.

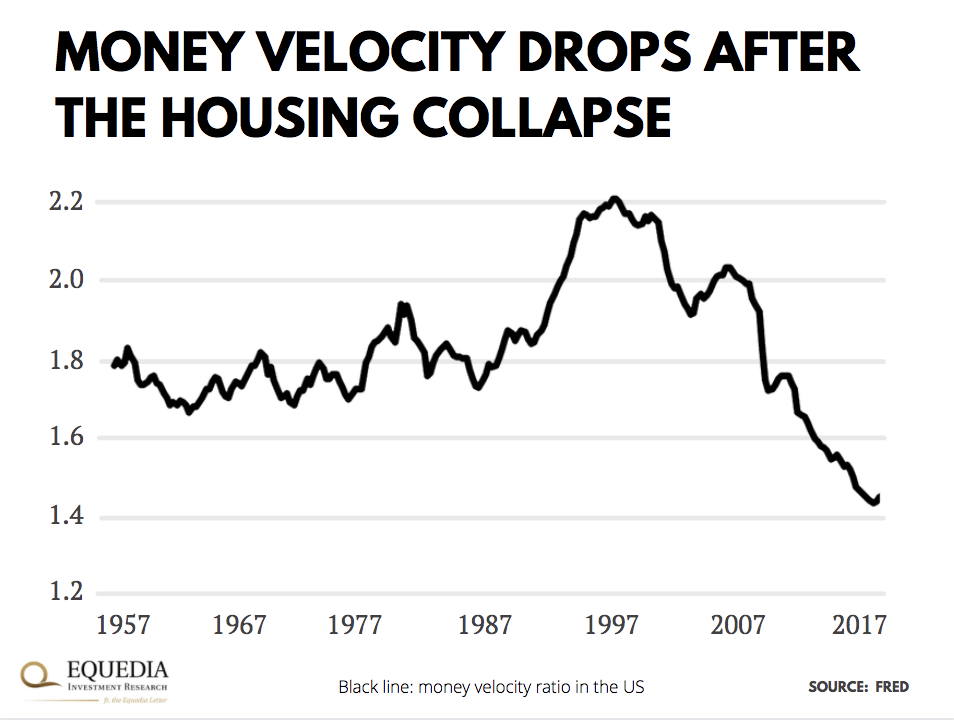

In the simplest terms, money velocity measures how often people use their money to buy goods and services. Here’s how it looked before and after 2008:

See how money suddenly stopped changing hands after 2008?

Afraid of an economic collapse, people tightened their belts. Printed money was stacked away in bank reserves and savings. And that offset the inflationary effect of excess money.

(Recall that we predicted many years ago that these bank reserves and savings would eventually leak into the stock market to create new highs. Here’s one example from 2013: How the Fed Influences the Stock Market)

The second is much more sinister – and is directly tied to the Fed’s ability to control prices from the top down. If you want to learn more on this subject, read Ivan’s letter from 2015 titled, “Why Isn’t Inflation Higher – Inflation Targeting.”

In a way, the first scenario is playing out again today.

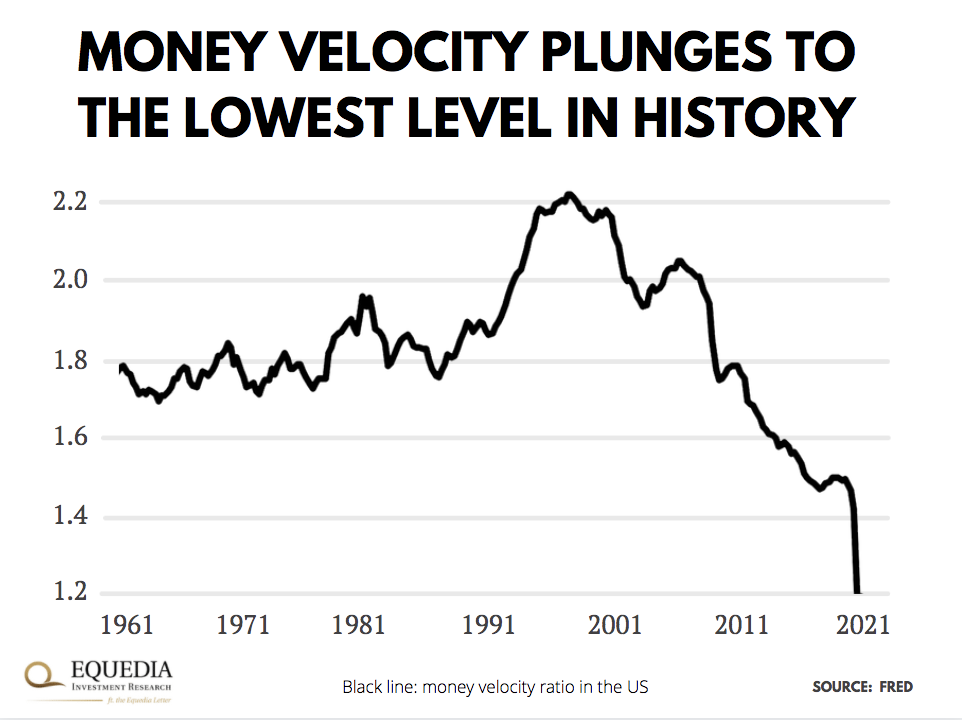

After Covid swept the world, the Fed printed a bunch of money – yet, money velocity fell to the lowest level on record. And it hasn’t bounced back since:

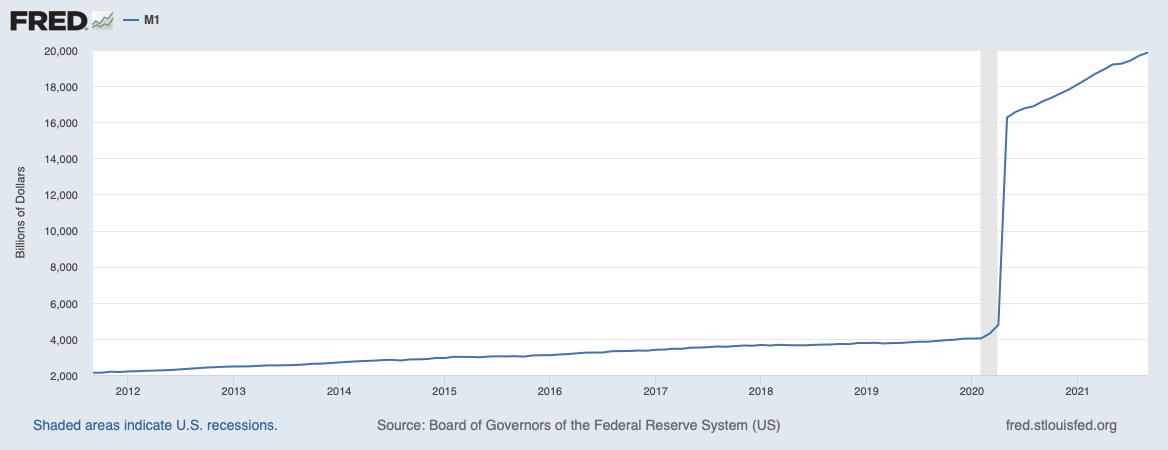

Here’s the Fed’s shocking version of the graph, via M1 money supply:

That’s right: M1 money supply has more than quadrupled since the beginning of 2020!

If we were so worried about deflation, then you’re probably thinking now…

“Why is inflation at 5%?”

The first has a lot to do with what I call extreme demand rotation.

Think about it.

Covid has turned our entire lives upside down overnight. Behavior and spending patterns suddenly changed, which threw the economy off balance.

For example, who would have thought that city dwellers would be dying to move back to the burbs? No builder had that many houses for sale. So housing inventory dried up, and home prices soared.

People also started gobbling up gaming consoles, PCs, and other stuff to work and have fun at home. The onslaught of pandemic orders caught many businesses by surprise. And they quickly sold out.

Even today, getting your hands on Sony’s Playstation 5 is difficult —and it was released nearly a year ago.

This increased demand for electronics and computers led to a shortage of chips. Chip shortage led to disruptions in car manufacturing. In fact, Ivan has been waiting for his F150 for nearly a year.

I could go on, but you get the point.

As a result, prices went parabolic – pushing up inflation measures we commonly track.

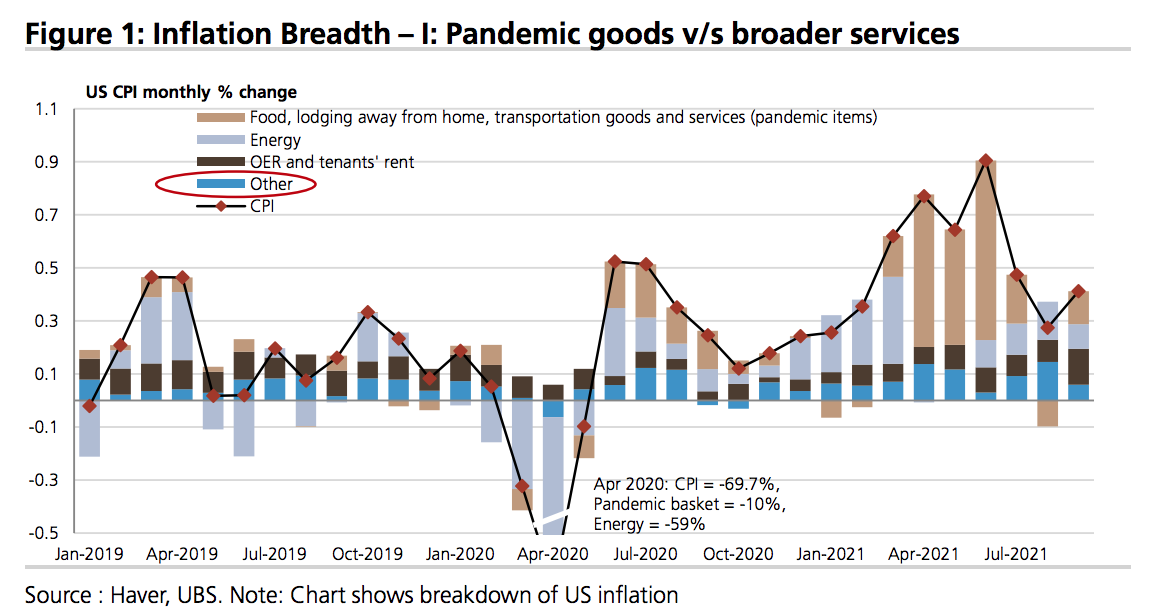

In fact, if you break down CPI by pandemic-related items, you’ll see that it’s mainly the Covid stuff that’s driving this inflation boom:

Meanwhile, other things are still within historical norms.

Which leads us to the second reason why inflation is at 5% – and it’s the same second sinister reason why deflation has been a big concern over the last decade: the Fed’s ability to control prices from the top down. Again, I urge you to read Ivan’s past letter from 2015 titled, “Why Isn’t Inflation Higher – Inflation Targeting.”

While many experts believe inflation will work itself out after 2023, they almost always fail to mention the most important part: real prices will remain higher.

In fact, inflation may be the biggest myth portrayed to the general public today. For example, if there is no inflation, all that means is that prices have not gone up. But if inflation is 5% this year, then 0% next year, prices are still higher by 5% heading into the third year!

So when the experts say inflation is transitory, they’re really referring to the inflation percentage rate – not the real price of goods and services themselves.

Luckily, contrary to what many believe, that’s not always a bad thing – if you know what to do.

Good Inflation is Good for Investors

Yes, there are bad kinds of inflation – like the ones the media and “doom and gloomers” often draw parallels with.

There’s all-destroying hyperinflation like the one in Venezuela. Since 2016, its prices have soared 5,126,208,957%, turning the nation into an economic and political madhouse.

And let’s not forget stagflation – when inflation is coupled with a recession. That’s bad too.

The last time it happened in the U.S. was during the 1970s. It was a perfect storm: the oil shock and the end of the gold standard crashed the dollar’s value and set off a nasty double-dip recession.

Of course, these kinds of inflation are extremely rare, especially in the developed modern world. In other words, apart from the extremes, inflation is really nothing to be afraid of.

The pick-up in inflation is often a sign of a healthy and growing economy. It signals that demand for stuff is increasing, and people can afford to pay higher prices.

This is actually great for investors.

That’s because, in a healthy economy, companies can pass on higher costs to customers, which can boost profits – and, of course, their stock price.

In fact, when inflation rose in the 80s… 90s… 00s… and 10s, the S&P 500 soared between 20% and 50%. And those gains far exceeded inflation.

Which brings me to the most reliable inflation hedge on the planet…

The Best Asset to Hold During Reflation

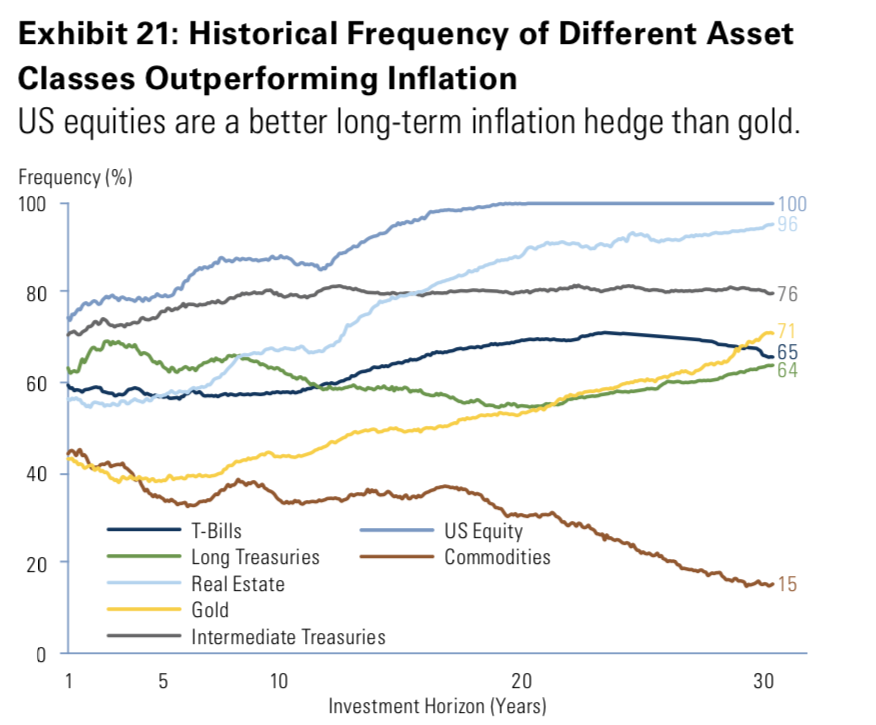

Goldman Sachs recently released a study on the most effective inflation hedges.

In short, they found there’s no more reliable inflation protection than stocks. In fact, “U.S. equities have outperformed inflation 100% of the time when held for 15 years or more.”

100% of the time!

Here’s a chart that stacks up stocks against other popular investment hedges:

In other words, If you hold stocks for at least 15 years, you are almost guaranteed to beat inflation – and likely to earn a good return on top.

This strategy would have even crushed the 70s’ stagflation in America.

Let’s do some simple math.

Since 1928, the S&P 500 has been up 9.8% per year, while inflation averaged a little over 3%. So stocks outgrew inflation by at least 7%. And the best part, they pulled that with 100% reliability.

Compare that to gold, which many consider the #1 inflation hedge. Unfortunately, the metal outperformed inflation only 50% of the time during the same period.

Of course, as you can see, real estate is a close second in beating inflation over a 15-year window. The costs of living are now higher than ever – and at this pace, it’s only getting worse. It would seem the “Great Reset” is in full motion.

If you don’t want to be one of the sheep that “owns nothing and is happy”, beat inflation by investing in stocks and hold on to them. Simple as that. History shows it always pays off in the long term.

– Carlisle Kane

Just as prices remain at new highs years after their inflationary move, gold has done the same.