A Graphic Eye-Opener

How the Monetary System Has Changed

Dear Readers,

Just the other day, the S&P 500 touched a record intraday high.

Despite the uncertainties around the world, the stock market continues to march on (as I mentioned they would likely do in my Letter, “What to Expect for 2014.“).

Last year, and every year post 2008, I was confident the stock market would continue to set new highs.

This year, I am much more cautious.

It’s been over five years since the great crash of 2008. The markets have climbed, creating new found wealth for the 0.001 per cent. Yet, as I sit here writing this, I can’t help but feel worried for our future.

The world is a much different place than it was just five short years ago. Never in our history has such transformation of the monetary system taken place. A picture is worth a thousand words, so below are charts showing just how much change has occurred.

When a Picture is Worth Trillions

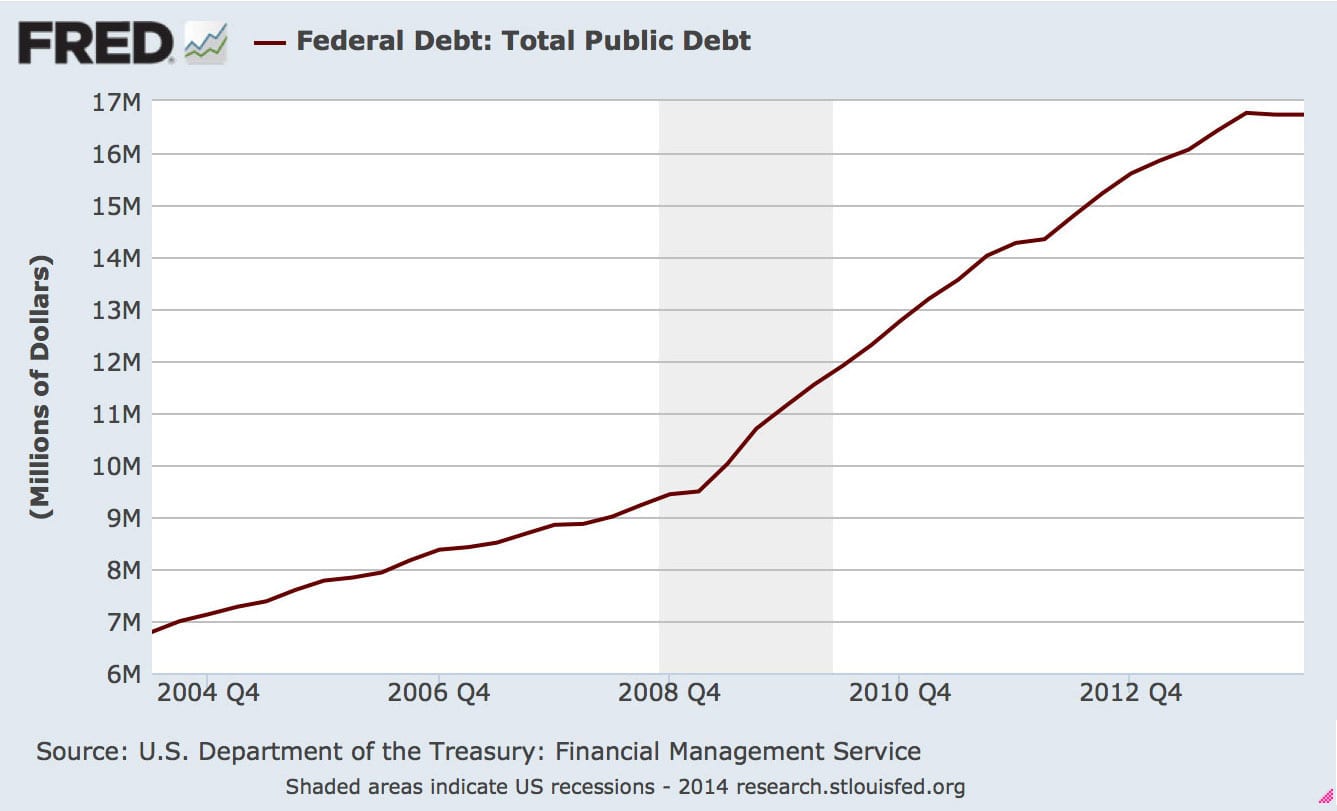

In the last decade, the U.S. federal government has more than doubled its debt, which means it has more than doubled its deficit spending (spending more money than it brings it, year after year.)

In order to support such recklessness, the U.S. has relied on borrowing money from other nations.

America has increased its borrowings from foreign and international investors by more than 270% in the last 10 years, with the majority of this rise occurring in the last five years. But even this wasn’t enough.

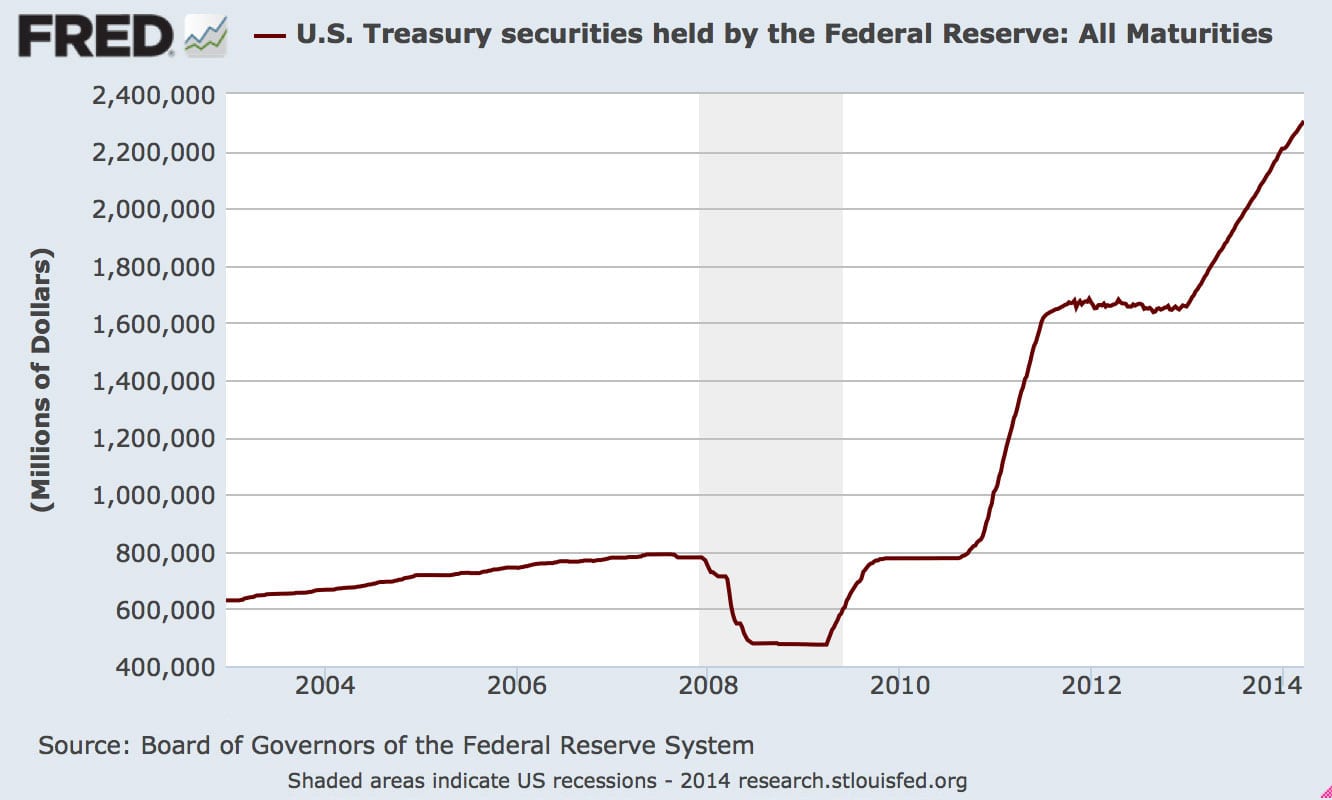

As a result, America had to rely on the lender of last resort, the Federal Reserve:

In the same time period, America has increased its debt-load to the Federal Reserve by nearly 250% – again, the majority of this rise occurring post-2008.

This massive debt issuance was supposed to increase economic conditions by encouraging spending; thus, bring stability back to the world.

But has it?

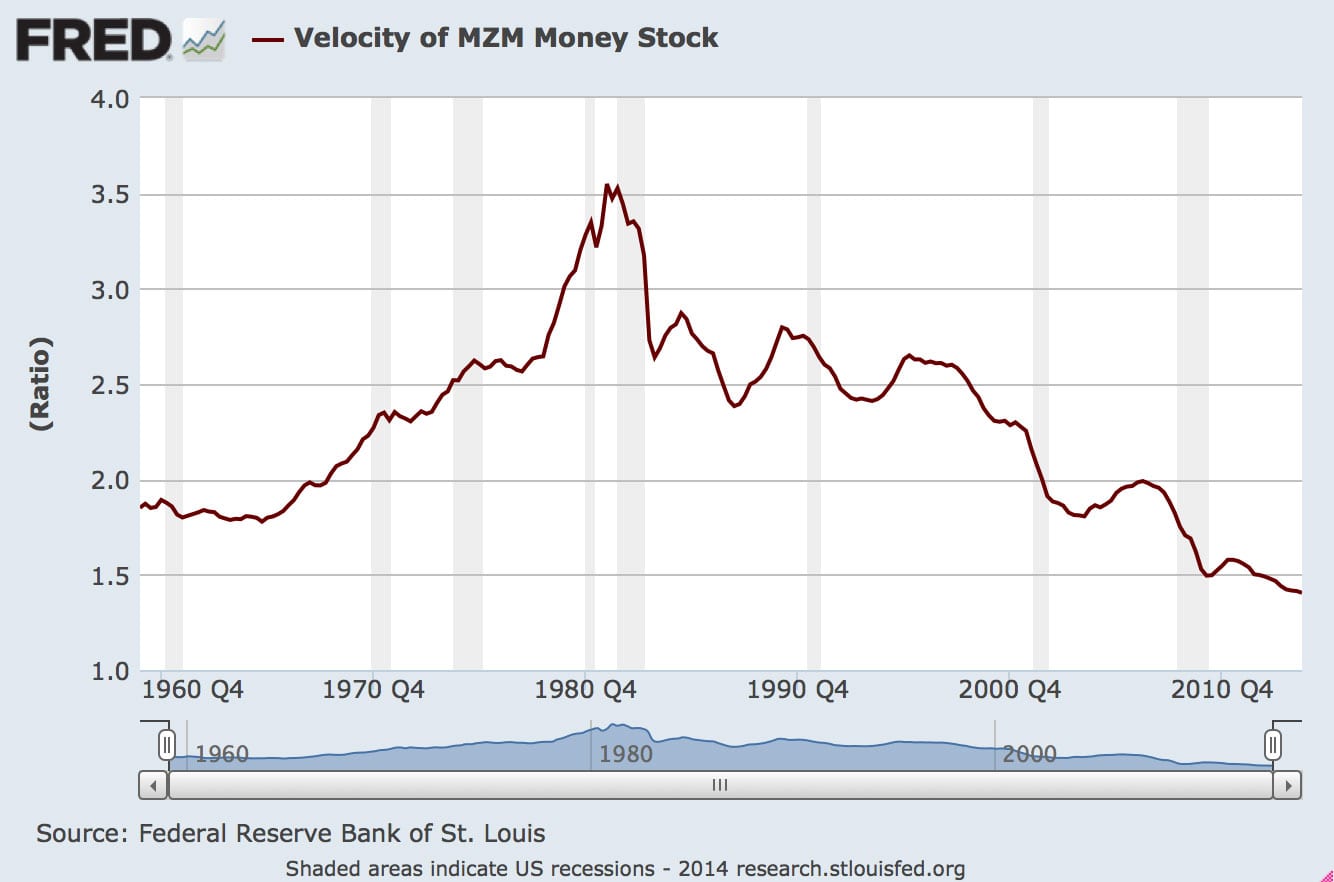

Here’s a chart showing the velocity of MZM money stock:

MZM money stock is a measurement of all liquid money within the economy. MZM represents all money in M2, less the time deposits, plus all money market funds. It has become one of the preferred measures of money supply because it better represents money readily available within the economy for spending and consumption.

As I explained in my letter “A Scary Prediction”:

“The velocity of money measures the rate at which money flows through an economy, in other words, how much money changes hands; it has to do with the amount of economic activity associated with a given money supply. It’s also is a key input in the determination of an economy’s inflation calculation.

A higher velocity means the same quantity of money is being used for a greater number of transactions. As a result, it means people are not just making money, they’re spending it. Economies that exhibit a higher velocity of money relative to others tend to be further along in the business cycle; thus, should have a higher rate of inflation, all things being constant.

But the opposite is true of lower velocity. A low velocity means people aren’t spending; thus, the economy struggles and inflation remains low.”

As you can see in the above chart, MZM velocity continues to drop, setting new record lows starting just prior to the 2008 crash.

But how can this be? Shouldn’t the stock market’s performance over the last five years indicate confidence and thus, encourage spending?

What do you think?

Share your comments by CLICKING HERE.

20 Years of Progress Wiped Out

Here’s a chart of the real median household income in the U.S.:

Despite the meteoric rise of the stock market, household incomes have actually dropped back to levels not seen for nearly 20 years!

There is a bright side to this, depending on how you look at it.

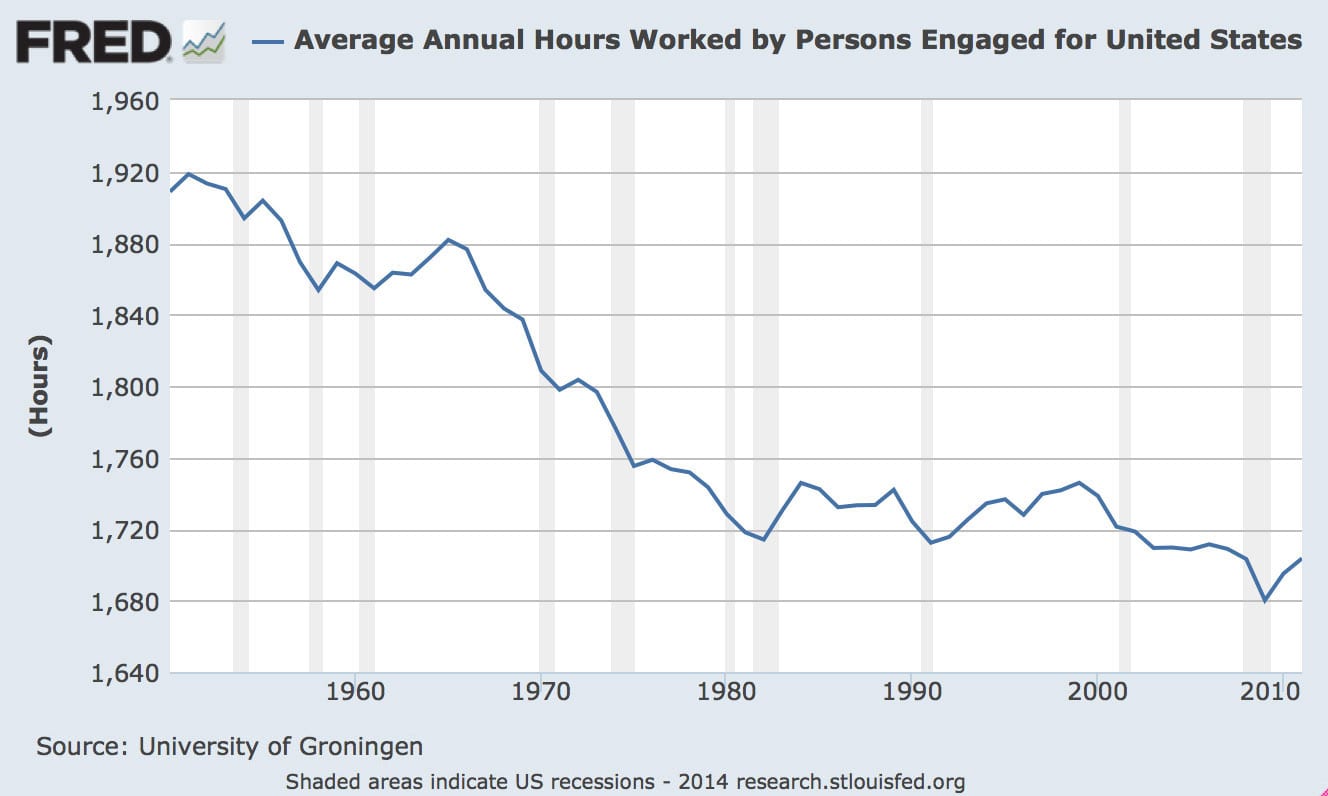

The average American either no longer has to work as hard for their living (efficiency), or is simply out of work:

We should note that the average annual hours worked also decreases when the number of part-time workers increase.

No Going Back

All of the above charts lead to my point that the monetary system has completely changed in the last decade.

Here’s a look at the monetary base:

In the last five years, the monetary base has increased by more than a whopping 360%! In other words, money has entered the system – just not to the people who need it the most.

The money supply has increased so much that MZM money velocity will never again return to the days of the Bretton Woods system.

The Fed and the U.S. government want need you to take risks. They want you to risk it in the stock market to create wealth because it creates the illusion that everything is good.

They certainly don’t want you parking your money in the bank.

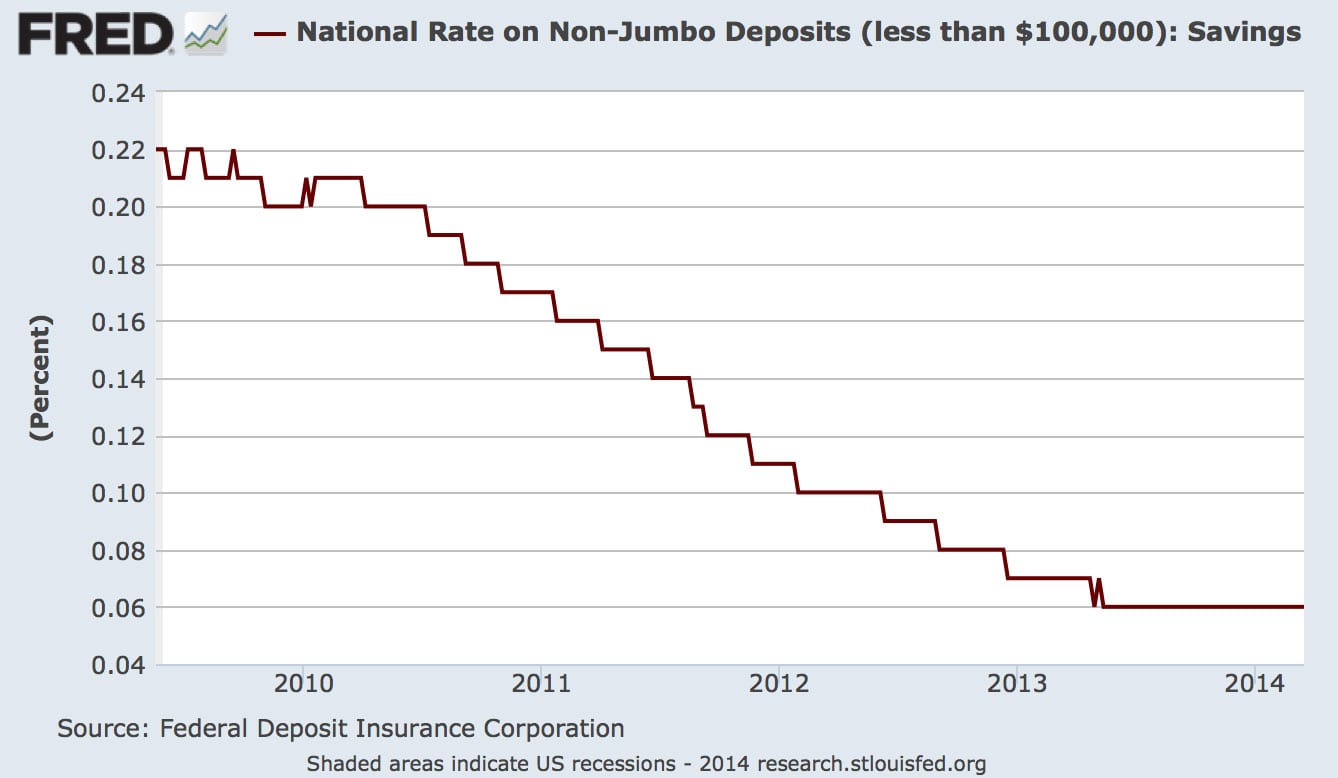

Here’s what parking money in the bank looks like for average citizens:

In other words, if you save, you lose money.

Are you saving money, or making big bets in the stock market?

Share your thoughts by CLICKING HERE

More Leveraged than Ever

Last year, I wrote about the subprime auto market that Obama was allowing.

Within that same letter, I reminded readers of Obama’s speech at the end of 2011 when he said:

“…thanks to some of the same folks who are now running Congress, we had weak regulation, we had little oversight, and what did it get us? Insurance companies that jacked up people’s premiums with impunity and denied care to patients who were sick, mortgage lenders that tricked families into buying homes they couldn’t afford, a financial sector where irresponsibility and lack of basic oversight nearly destroyed our entire economy.”

The Fed, the U.S. government, and the media have done a fine job at making you forget about the events of 2008. But they’ve done an even better job at making you believe that they’ve made the banking system safer.

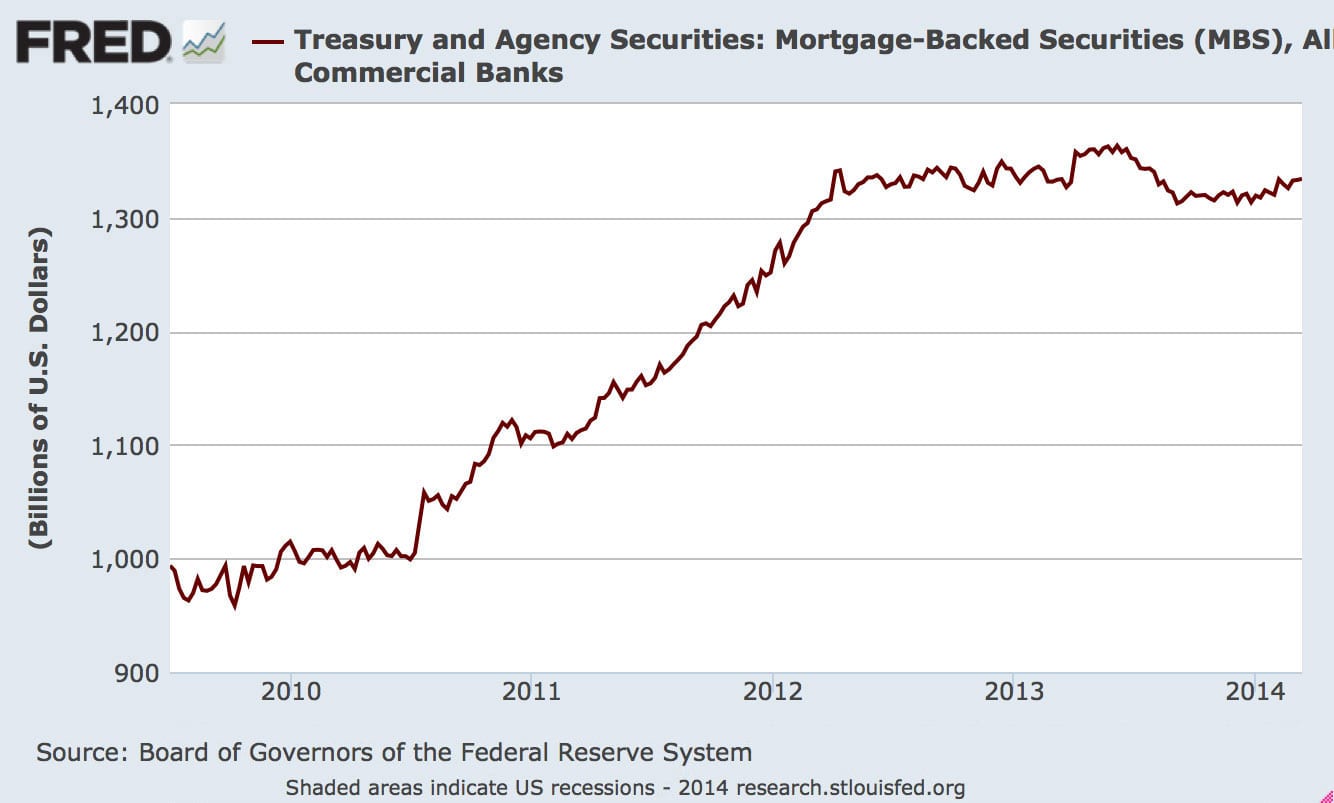

Here’s a chart showing the growth of mortgage-backed securities (MBS) – the same type of asset that caused the big meltdown in 2008:

So while Obama flaunts his MBS fraud investigations to the media, MBS continues to grow – right alongside U.S. foreclosures.

The World Engulfed

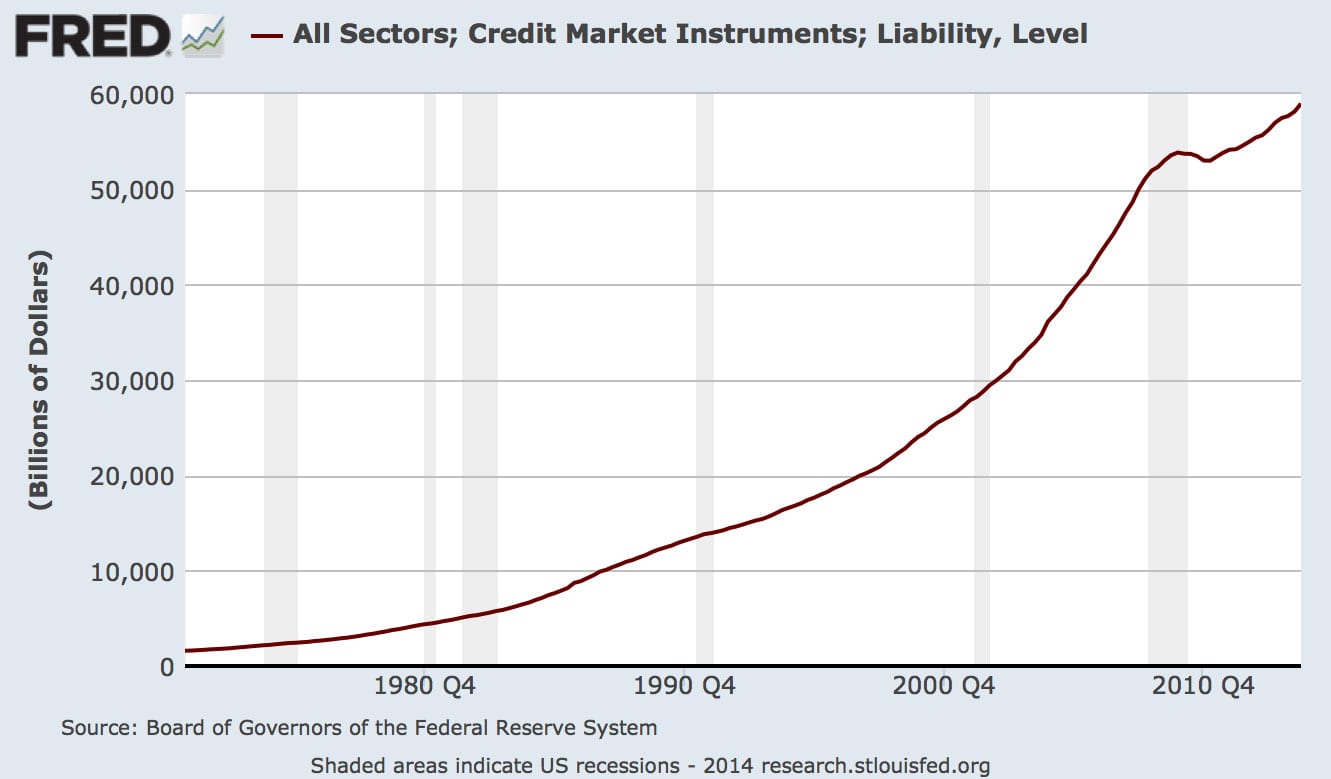

Here’s one last chart that you should see: a chart of all credit market instruments – or in Layman terms, debt:

It’s in billions of dollars, in case you didn’t notice.

What do you think of our monetary system now?

CLICK HERE to share your thoughts on these charts.

Unknown Consequences

I was reading the opinions of fund managers and analysts earlier this week and many wrote that shots being fired in Ukraine were unlikely because of how the market was reacting.

As I write this, Russian troops are moving and taking over Ukraine military bases, despite American sanctions.

Via CTV news:

“Pro-Russian forces stormed a Ukrainian air force base in Crimea, firing shots and smashing through concrete walls with armoured personnel carriers.

… Russian forces have been seizing Ukrainian military facilities for several days in the Black Sea peninsula, which voted a week ago to secede and join Russia.”

As I mentioned over the past months, the battle between Russia and America will continue to grow. You’re going to read and hear a lot of different opinions about this situation. Some will tell you that Russia isn’t a threat; others will say the opposite.

One of the biggest stories you will hear is about Russia’s gas exports to Europe; how Russia is more dependent on Europe, than Europe is on Russia.

Here’s a video explaining this topic:

But there is much more to this than the author in the video has discussed. Russia has an ace up its sleeve and it could change world trade forever.

I’ll explain more next week.

Meanwhile, as Russian moves to conquer territory, China is quietly seizing the moment to continue its claims over territorial waters.

According to Indonesia’s official news agency, Antara:

“China has included part of Natuna waters in Indonesia’s Riau Islands province in its territorial map, assistant deputy to the chief security minister for defense strategic doctrine Commodore Fahru Zaini stated.

“China has claimed Natuna waters as their territorial waters. This arbitrary claim is related to the dispute over Spratly and Paracel Islands between China and the Philippines. This dispute will have a large impact on the security of Natuna waters,” he noted here on Wednesday.

China has drawn the sea map of Natuna Islands in the South China Sea in its territorial map with nine dash lines, he pointed out.

The new map has even been included in the new passports of Chinese citizens, he explained.

“What China has done is related to the territorial zone of the Unitary Republic of Indonesia. Therefore, we have come to Natuna to see the concrete strategy of the main component of our defense, namely the National Defense Forces (TNI),” he explained.”

Both Russia and China are on a mission to claim territory and rise up as world leaders. The battle between the East and West will have consequences that will reshape this world.

The next five years will be one of dramatic change and I urge readers to take it seriously.

Another great write-up. Simple, concise, and to the point. Sadly, most people don’t understand how bad our system is. Forwarding this article to others and I suggest all to do the same. Change is coming and we need to be educated.

Putin is always two steps ahead of Obama. This won’t end pretty for the U.S.

I am afraid you are correct about the current high risk in the US economy. I cannot account, by the usual methods, for the rising stock market using the economic factors eg: High unemployment, High population on entitlement programs, lower household income, high inventory of homes facing foreclosure, rising National debt, rising prices, rising car inventory at dealerships, historically low Baltic Dry Index, etc etc etc. I conclude that some of the QE money is finding its way into the stock market and that money is responsible for the rising markets. Moreover many stocks are falling in value yet the indexes are rising suggesting deliberate selective buying. Dare I use the word manipulation. There is so much QE money I speculate that the manipulation can and will continue for a long time. Probably until the end of this administration (2016 or so). It seems the same arguments apply to the precious metals markets.

Well said Nelson. It’s pure manipulation and the richest 0.001 percent just keeps getting richer, making the poor, poorer.

We’ll see this week if the West (G7, EU and Obama) come up with much tougher sanctions on Russia, after all the ball is now in the West’s court. China’s land grab is just as diabolical — you’d almost think that both Russia and China are playing from the same playbook. Putin is after restoring the Soviet empire and China is after claiming the mineral-rich island areas in the South China Sea. Their method of operation is quite simple — stake out and claim a territory and basically dare anyone to oppose them. Russia and China both know that the West’s resolve is nothing more than that of a paper tiger. Plus the West is mired in crushing debt and is ill-able to mount a sustained military defense/offense. Also, Russia and China hold a lot of U.S. government debt and this is America’s Achilles Heel as there is most likely a fear that Russia and China may elect to dump their T-bills in the open market. Even the threat of doing this would cause markets world wide to collapse and gold to sky-rocket as it would be the only true currency. I do believe it’s the mutual intent of Russia and China to put the U.S. dollar’s status as the world’s reserve currency in jeopardy.

Finally, someone who is speaking some sense. Very bang on analysis gold eye!

I love your newsletter but I hate it when a link to a video takes me to a site that has nothing do do with the video in question.

Folks the anomaly that appears as stocks rising and unemployment continuing steady with debt and entitlement rising really has a more fundamental basis that goes back many more years than simply pointing to 2008. NAFTA shipped so many manufacturing jobs out of the US. Those plentiful jobs and the wages they represented, not to mention the ingenuity and pride in workmanship that went hand in hand with manufacturing, are lost to third worlds with lower wages paid, making the cost of production much lower. But the sales prices of all of those goods certainly has not reflected the more efficient cost to manufacture. And the ones enjoying the wider margins of profit are the stock holders who have more than token positions. Greed is an engine of a free economy, and it can be checked and balanced if not screwed up by meddling governments, the market will force corrections. But in the meantime we have permitted irresponsible electorate to elect officials who will do nothing more than continue the entitlements that have now grown so conditioned. It will last longer than 2016 if you follow the logic of why would an electorate vote to diminish the electorate’s share. If we look way back to the origins of our Constitution, there was great discussion over who should vote, and an emphasis was placed on Land Owners, that is Real Property owners. I would submit that in today’s world, it might very well extend to those who work and pay into the system that cares for the entitlement system, but hey the vote should not be tied to how much one owns, but simply the fact that voters are positioned enough to be responsible when they consider the entire waterfront and not just the gravy train sitting on the wharf. Somebody has to pay for the gravy train, and that somebody doesn’t particularly like the concept of “I earned an ‘A’, but my loafing classmate is going to share part of my A so s/he doesn’t fail; therefore I get only a B and they get a D.” None of this seems fair. And now we are talking about money, savings, retirement and the future of this Noble Experiment called America. Two other thoughts that are worrying me: 1) since the implementation of ACA has picked up steam, are you aware that 40% of all private practice medical offices have closed or retired across the country. They are being consumed by nearby hospitals or neglected as irrelevant because the new act will only pay X minus a lot and requires that care cure the patient; of course this neglects the fact that we are all dying, and will sooner or later. 2) Energy has enjoyed way too long the protections of the federal government. Why has it taken so long for us to produce massively efficient engines (30 – 40 Miles Per Gallon) or batteries that last and propel? Why is solar not carrying our energy far and wide? How is it that we should now send our Secretary of State to Europe and tell them to become Energy Independent while we languish where we are? Why, if we have discovered the greatest deposits of oil and natural gas in the entire history of the known world, are our pump prices still creeping north of $3.00 per gallon? Good luck out there; but do bear in mind that this is not going to get better on its own. We have to speak up and get involved. But we have to be clear about what our objectives are as we engage. I for one want entitlements to stop unless they the entitlement reflects having paid into the system (retirement plans and Social Security); I want an efficient military that does not rely exclusively on luck or technology; I want a tax code that encourages innovation, business, work, and married families (and I do not care if marriage is defined as gay, so long as the contract that binds the love together is verifiable and honored). I want integrity in office because I do not want us to have to waste time or money pursuing proof of malfeasance. I know how to conduct investigations, and I know what they cost; I know how invasive they can be. So if we must take that tact, then I want the punishment to be real and meaningful as well. Consequently, while I want us to extract energy out of the ground, I, for damn sure, want our environment protected, and cleaned up responsibly when it is fouled. Education- wise, should educate for the future, with an honest eye evaluating history. Education should emphasize thinking, reason, imagination, and innovation. It should also have room for blue collar industry that is celebrated for the value that it is. Ok, for the top of my meager little head, I have said enough. I sincerely believe we still live in the Greatest Country in the world, but we have to stand up for Her now.

Frank, nicely written. America is the greatest country in the world still and many of the immigrants I am friends with believe the same: A much greater standard of living than most countries and the ability for anyone to innovate and prosper through hard work.

However, if America continues on this path, I am afraid this won’t continue. when debt surpasses all it will be almost impossible to turn back.

Too many people believe Dollars are money.That they are a store of value and you can hold your savings in Dollars and be safe from all harm.That’s not true.Dollars are constantly being devalued by the Fed.You will receive less income,on Dollars,than they depreciate.So,if you hold Dollars,you are choosing a risky investment,that is guaranteed to be a loser,over the longer term.I think,that most countries have decided to throw all economic problems,onto their currencies.All countries,in the world today,are using 100% fiat currencies and their central banks have unlimited authority to issue any amount of fiat.I believe fiat currencies are very risky holdings and best used as temporary holdings,until you exchange them for real assets.So,I think holding 10-20% of your savings,in Dollars,would be the most.

None of this suprises me (or will). The course of events leading up to the fall of the West are not clear, yet it seems imminent none the less.

It has been laid out in prophetic scripture that the Great Bear from the North (Russia, of course), and the Dragon from the East (you get the picture) will descend upon the cradle of civilization for yet another attempt at annihilation.

Interestingly, there is no mention of a world power from the West even being involved… the fall of yet another decadent and corrupt society is no great surprise to even a casual observer of world history.

This isn’t doom and gloom… depending on where your treasure/heart is stored! 😉

Catch ya on the flip side all!

M.

Fiat money is not well understood here in the States I fear. Suffice it to say that if money is not metal currency, or paper backed by gold, silver or platinum, then there is nothing there but good faith and when that evaporates, there really will be a feeding frenzy on anything that will a) hold value or b) can be consumed. Because the :Fiat” paper being tendered will have nothing to offer in terms of value once good will and faith in government are gone from the scene. This is an event that I fear is not too far off with the steps our government has taken recently. We still enjoy the best opportunity to fix what’s wrong, but we do have to get in gear.

So who is going to fix this? I don’t see the opportunity anywhere.

I m pretty sure that lots of investors out there are using the stock market to increase there wealth as much as possible before retiring. The market has been very good but the money is just piling up in the banks and not finding its way back to the economy.

Ukraine issues resolved. What next will they play for us to keep us in confusion. North Korea, may be. confusion is a game that been played over and over. Follow the seasons of their reasoning. Gold and the dollar to do battle again. I would not be surprise if the FED banks continue to hedge the dollar with gold bullion. These guys are constantly making $$ up or down if not they create the necessary things for it to be so putting it lightly.

NOT SURE IF WE CAN TALK STOCK HERE but I will try. For those who wish to share ideias

THOMPSON CREEK METALS: symbol TCM in Toronto

Volume 5MM one day.is very not normal volume and is a very high volume bar for this stock in one day. But a close look there has been 5MM on previous weekly buying . WHO IS BUYING OR SELLING. based on a one day high volume.. online look up on insider buying but nothing much there. Are the hedge funds buying or selling. Mid last year there was a 6MM buy and are these folks getting out now as stock gone sideways . From experience I have learned best to do is to wait for a month see what it does, since chart trend is still down or wait to form a higher Low at least off this sideway range. Copper has done little this year and is a leading indicator for me .