This is the most powerful drug in the world.

Like most drugs, the first few hits feel incredible. But as you take more, the more addictive it becomes. That feeling of satisfaction soon becomes a feeling of dependance.

And once you’re hooked, it’s no longer about feeling good – it’s about survival.

But I am not talking about heroine or cocaine.

I am talking about something much more addicting and dangerous. I am talking about something no one can escape – not even you.

Over the last decade – and especially over the last two years – central banks and governments have become the biggest dealers of the most powerful drug on earth: money.

So, you may think they’re helping, but they’re not.

You may think they’re here to save you, but they’re not.

In fact, what they’re really doing is just giving you a little taste – just enough so you come back for more.

Eventually, you’ll depend on them for survival – just as addicts depend on their drug dealers.

Let me explain.

Look Away!

By definition, inflation is an increase in prices – or, on the flip side, a fall in the purchasing power of money.

There are many ways to measure it.

The media and policymakers often point to the Consumer Price Index (CPI), which tracks the price of a basket of goods and services that supposedly reflects the average person’s spending.

Today, inflation is around 5%. While that’s higher than normal, is it really that high when you consider how much money has been printed?

But we’re not overly concerned about this type of inflation because, in reality, it doesn’t affect us as much as true inflation.

What do I mean?

While policymakers have you focused on CPI, they leave out a much more important kind of inflation: asset inflation.

In a moment, you’ll see just how bad things things have become as a result of policymaker decisions and how the elite have used it to build fortunes at the expense of the average citizen.

But first, let me explain how we got here.

Where’s the Money, and Where’s Inflation?

Textbooks generalize that inflation happens when there is too much money chasing too few goods – the ol’ supply and demand theory.

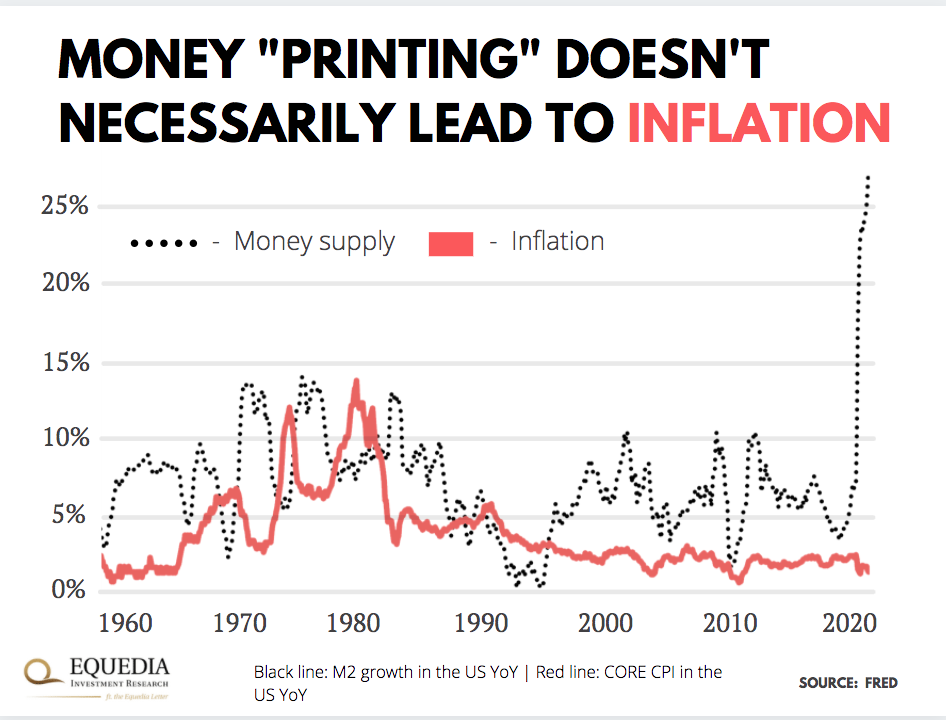

But if that’s true, why did inflation barely budge after the Fed shoved $3.5 trillion into the economy after 2008? Surely, with all that money chasing goods, prices should have gone up? Furthermore, why is money supply historically not really correlated to CPI?

It’s actually very simple. It’s because the Fed doesn’t hand out printed money directly to people and small businesses. Instead, it uses that money to buy bonds from commercial banks through a creative term called open market operations.

This money goes to the banks as reserves, who can then lend it out at their discretion.

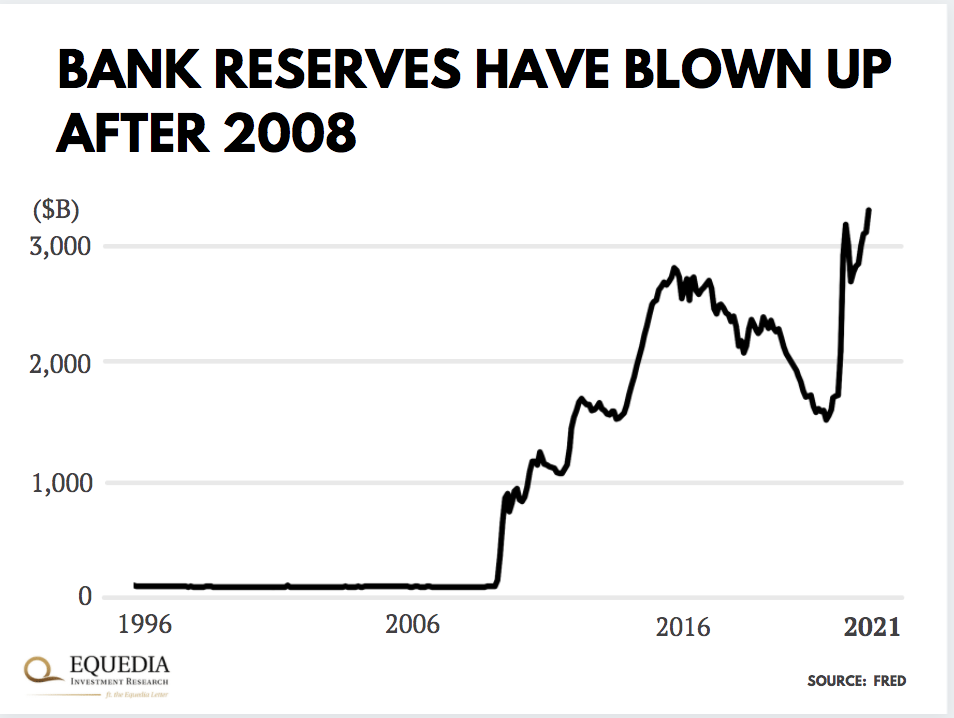

But after 2008, banks didn’t lend out most of those printed dollars. Instead, they hoarded it in their reserves as a cushion.

As we mentioned back in 2014, via How the Fed Influences the Stock Market:

“…it’s difficult for banks to lend to unqualified borrowers. And since the majority of Americans have been terribly affected by the economic crisis, many of them don’t meet the requirements for borrowing.

With so much stimulus, where has all the money gone?”

Take a look at how bank reserves blew up after 1) 2008 and 2) the beginning of Covid:

In the end, most of the stimulus money didn’t make it into the economy. Instead, it got stashed away in bank reserves – and somewhere else, which I’ll get to in a bit.

It’s no wonder we didn’t see much inflation in consumer prices.

(Side note: this is not a zero-sum game. Banks make a lot of money even if the printed dollars sit in reserves. For starters, the Fed pays a fat commission when it buys bonds from banks. And since 2008, they have earned interest on these reserves. Just take a look at how financials have performed since 2008 – and throughout this “pandemic.”)

But that’s not all.

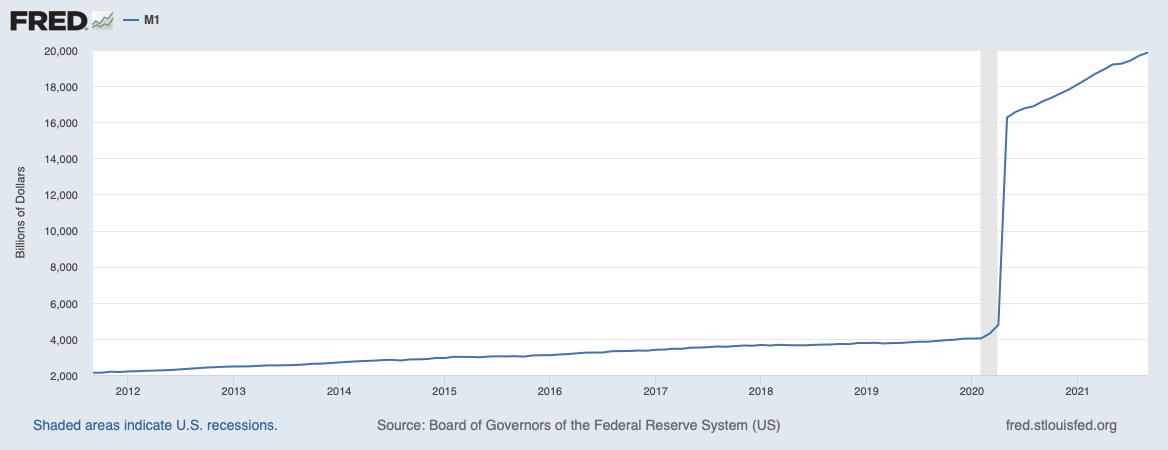

While this money printing hasn’t raised basic consumer prices, it has done something else – something much more important.

When the Fed buys government bonds by the trillions, it creates an artificially high demand for them. So their prices go up, and interest rates go down.

We’ve talked about this many times in the past.

This is how the Fed indirectly props up the economy.

True Inflation

When the economy topples, central banks do everything in their power to lower interest rates.

The idea is that cheap money urges companies to borrow more, who are supposed to reinvest that money through CAPEX and jobs; thus, trickling this money down to the rest of the economy.

That may work in Alice’s Wonderland economy, but it has the opposite effect in the real world.

Recall earlier when I referenced Ivan’s letter on how the Fed influences the stock market? Here’s the full excerpt:

“Since Fed policy dictates that it cannot directly buy stocks, the Fed has found other ways to encourage people to take risks.

I have talked about these strategies many times before.

One of these strategies is to force banks to lend.

The problem, however, is that its difficult for banks to lend to unqualified borrowers. And since the majority of Americans have been terribly affected by the economic crisis, many of them don’t meet the requirements for borrowing.

With so much stimulus, where has all the money gone?

To the people who meet the requirements: big corporations with cash.”

Take the aftermath of the post-2008 stimulus.

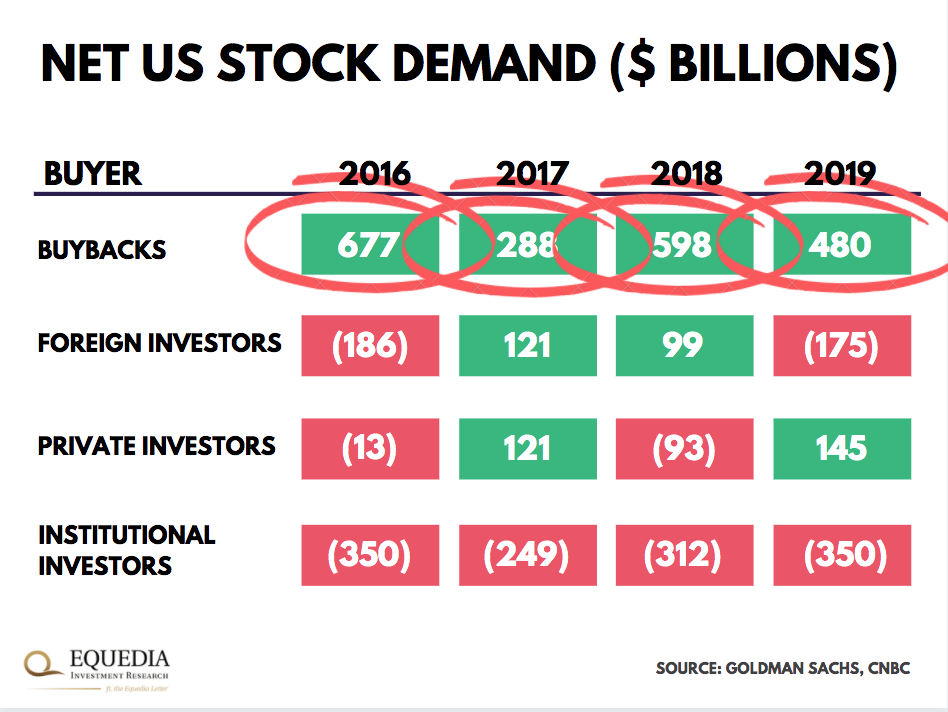

After 2008, businesses borrowed a boatload of money for cheap. But instead of reinvesting most of it to CAPEX and new hires, they leveraged it to buy back their own stock – supporting and increasing their share price.

Take a look:

- From 2018 through 2019, companies in the S&P 500 spent more money on buybacks than on CAPEX (source)

- Worse, more than half of these buybacks were financed by debt (source)

- During 2018 (when economic confidence was at the peak and buybacks hit a record), real wages in the U.S. dropped 1.4% (source)

- And for most of the 2010s, corporate America gobbled up more stock than institutional, retail, and foreign investors combined!

This is how Corporate America builds fortunes for the elites – at the expense of higher wages and new hires. Even their shareholders are left out because buyback programs can be masked by insider stock issuance programs that dilute them.

Via F.T.:

“When a company issues new shares to employees with one hand (at a low price) and buys back those shares on the open market with the other hand (at a higher price), that price difference multiplied by the number of traded shares equals value that never reaches shareholders at all. It is entirely captured by the recipients of the new shares.

This value is lost to shareholders and captured by the employees whether or not their new shares are sold back to the company in the open market buyback operation. It is an accounting identity. As the “Yay, stock buybacks!” crew likes to say, it is just maths.”

In other words, corporate execs receive stock as compensation. Then they have the company buy back its own shares, which often raises their value. In turn, once the share prices are higher, the corporate execs sell them back to regular investors.

The end result is that the stimulus doesn’t trickle down. It ends up in Corporate America’s pockets and the rich and elite institutions with enough capital to borrow mass amounts of money for free.

And instead of consumer price inflation, you get asset price inflation.

Same Playbook, Only Bigger

Stimulus money is still pouring into assets, sending prices through the roof.

As we wrote in the recent letter, “The Invisible Price Investors Pay for Trillions of Printed Dollars“:

“Seen the housing frenzy in America?

…the market is like a burning-hot frying pan. I was talking to my broker the other day. He told me his million-dollar listings are flying off the market in a matter of days…sight unseen!

No wonder house prices soared 54% in the past year alone. That’s the biggest home price growth in history—nearly 2x that during the peak of the 2003-2008 boom.

Imagine how many Americans have been priced out of homeownership.”

And I probably don’t have to tell you about the frenzy in the capital markets. Since the start of Covid-stimulus, nearly every asset class went into hyperdrive.

Bitcoin is up 10X, and smaller cryptos are showing 1,000-10,000% gains.

Meme stocks like Tesla, GameStop, and AMC have soared 14X, 72X, and 14X. Even the conservative S&P 500 doubled from its Covid-lows—the fastest recovery in history.

And it’s probably not the end.

Just as we saw in 2018, companies are plowing more money into buybacks than reinvesting back into the business. This year, they are on track to buy back $1 trillion worth of stock, and blow past the 2018 record.

Meanwhile, bonds—the supposed safe haven for retirees—have become so expensive that even junk earns a negative yield after inflation.

That’s the most significant asset inflation we’ve ever seen. Period.

And few realize this inflation is eating away their purchasing power and their ability to retire.

Asset Inflation: The Biggest Tax on Retirement

Let me illustrate this real quick.

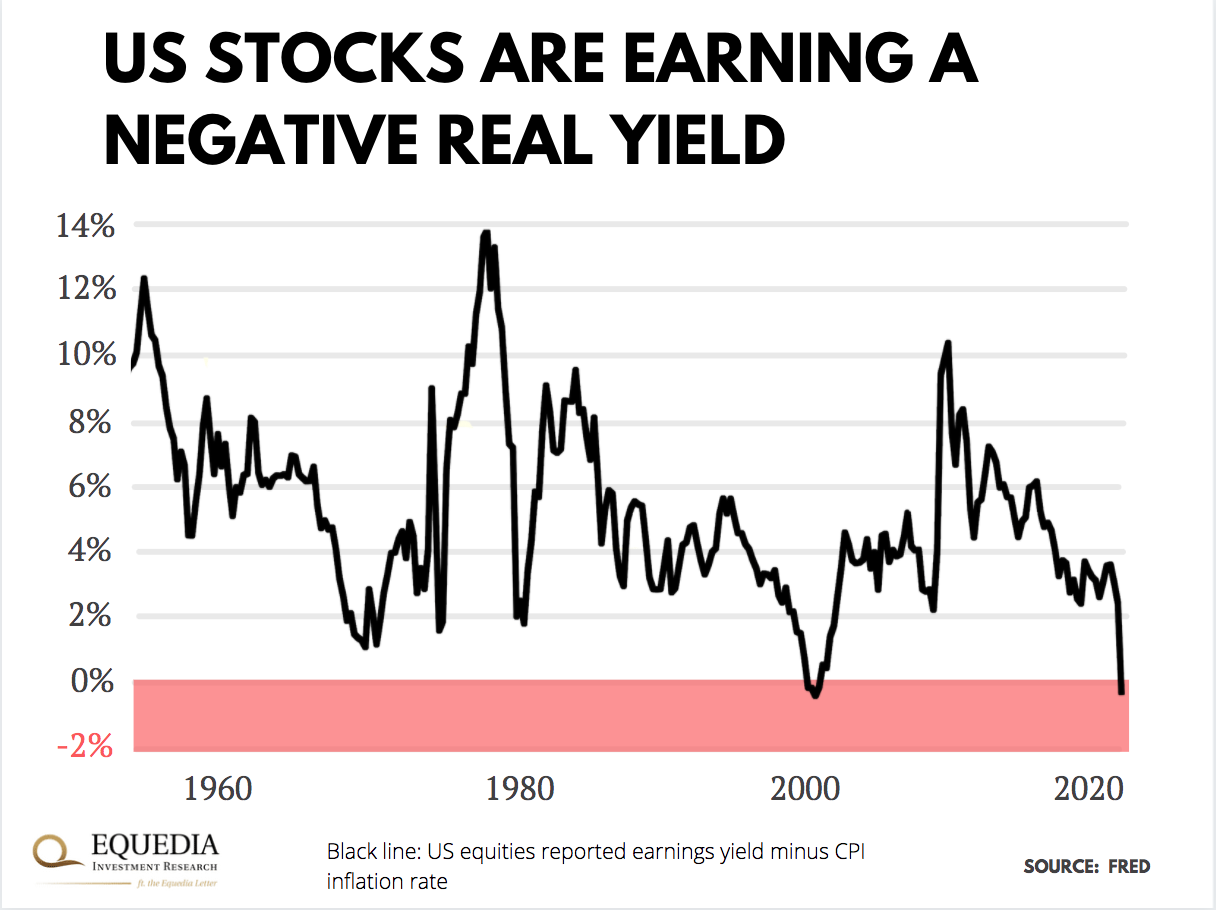

Here’s the real earnings yield of American stocks, which is simply P/E flipped upside down. It shows the inflation-adjusted “interest” you earn on stocks, just like with bonds:

Today, it’s in the red. The only other time U.S. equities earned a real negative yield was at the peak of the dot-com bubble.

That means when part of your paycheck goes to your 401k, IRA, RRSP, or personal portfolio, you are buying swollen-up stocks that don’t break even after inflation.

And that’s despite the booming economy and companies blowing away all earnings estimates.

In the meantime, cash is eroding at 5%. Bonds lose money, too.

The Rich Get Richer, the Poor, Well…

While it appears governments and central banks are helping everyone through tough times by offering free money, let’s never forget it was their policies that shut down the economy – both in 2008 and throughout this pandemic (which was labeled a pandemic with only a few deaths.)

There couldn’t be a more perfect scheme for the ultra-rich.

But if you are young and just beginning to accumulate assets, or someone catching up on retirement savings, you are paying a huge price.

Unless you got lucky on some overly-hyped crypto, of which 99.99% have zero real value, you probably missed out on the asset appreciation of the decade. But what’s worse is that you now have to pay an inflated price for assets that are supposed to feed you through retirement.

Never mind owning a home.

Asset inflation has blown up housing to a point that’s out of reach for most people—especially younger generations. In fact, according to Statista, at today’s prices, 74% of Millennials can’t afford to buy a house.

All of this creates an enormous void between the top and the bottom.

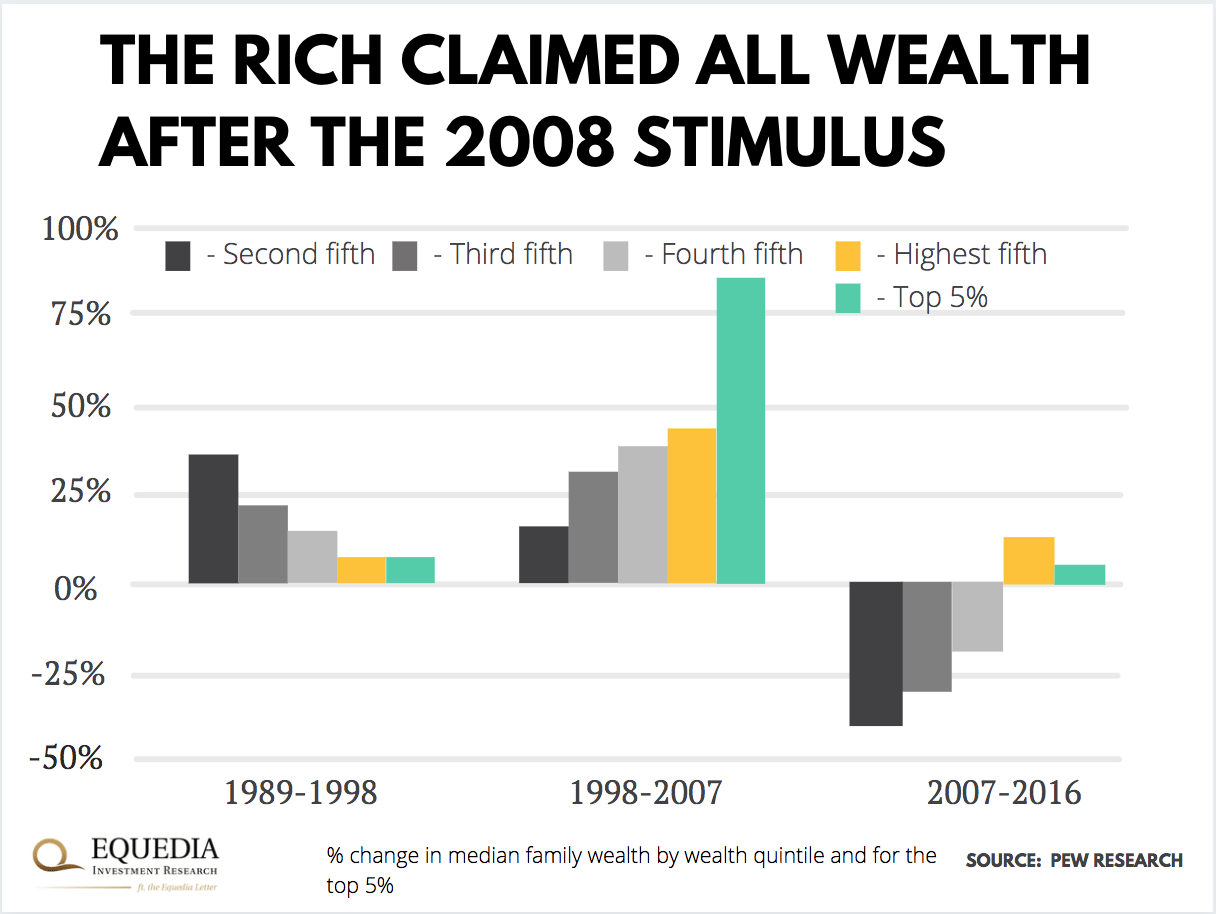

For example, in the fallout of the 2008 crisis, only the richest families grew their wealth.

Everyone else saw their nest eggs shrink by up to one-third.

Compare this wealth disparity to the earlier periods before 2008 when the Fed started fiddling with quantitative easing:

Today, it’s even worse.

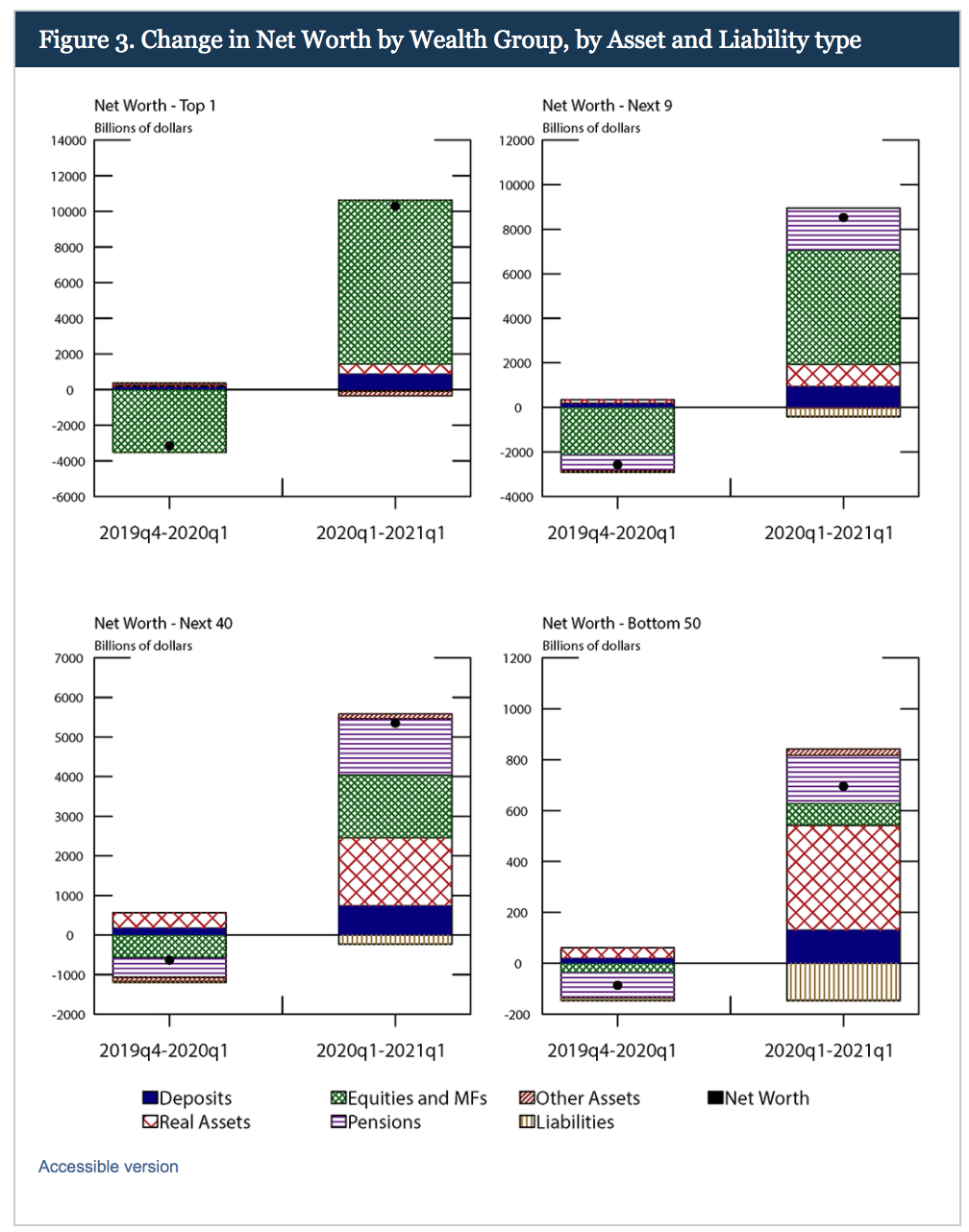

Here’s data from the Fed itself that shows how uneven wealth accumulation has been since 2020:

As asset inflation was raging full blast, the top 10% got richer by 10X more than the bottom 50% – in just one year!

And that’s the top 10%.

I’m not even talking about the crème de la crème of the rich like Elon Musk and Bill Gates, whose net worth have grown by the hundreds of billions of dollars – to the point that we’re even talking about the world’s next trillionaire.

The Failure of Trickle-Down Economics

There’s a theory called trickle-down economics that policymakers often use to justify such predatory policies.

In short, it argues it’s okay to let the rich accumulate disproportionally more wealth. That wealth, the theory goes, eventually trickles down to the rest of the economy through jobs and investments. And everyone is better off.

The Fed’s stimulus is trickle-down economics on steroids. It lets public companies leverage nearly free debt to build fortunes for themselves and their biggest shareholders.

Are those fortunes trickling down?

They didn’t after the Fed printed $3.5 trillion to save Wall Street’s overleveraged butts from the housing collapse. And clearly, they aren’t now.

In fact, Pew Research’s most recent study shows that median wages have actually fallen this year when adjusted for inflation.

Via Pew Research:

“The recent decline in wages, adjusted for inflation, is also partly due to an acceleration in the growth in U.S. consumer prices in 2021. Previously, consumer prices increased 1.4% from 2019 to 2020, compared with 2.3% from 2018 to 2019. This helped sustain higher earnings for workers in 2020. However, inflation has ticked up recently, with consumer prices registering an increase of 4.8% in the second quarter of 2021 compared with the second quarter of 2020. Thus, the earnings of workers have eroded in recent months, including for the matched sample of workers.”

This means that not only do people have to buy highly-inflated assets from the rich, but they also have to buy them with less income than they’ve had before

The Fed is by far the most powerful organization in the world. It controls the world’s money and, most frightening, is accountable to no one. Well, at least not to the masses that bear the burden of its policies.

It doesn’t have to pass its spending plan through the elected Congress. Nor does it have to raise taxes to fund its spending. Instead, it can print money at will – and most people won’t bat an eye.

That’s because asset price seems relatively painless in the short term. It doesn’t show up at the gas pump or grocery aisles. Heck, the government will even borrow from the Fed to give you a few thousand bucks.

Free money. What’s wrong with that, right?

But, obviously, these free trillions have a substantial invisible cost.

Unfortunately, most people will pay it with underfunded retirements, and most will never own a home debt-free. They just don’t know it yet.

As the Great Reset plan by the creators of the World Economic Forum has told the world, “You’ll own nothing. And be happy.”

In other words, “they” are the drug dealers. And every one else is just looking for their next fix.

Seek the truth,

Carlisle Kane, with help from Ivan Lo

So…. what’s the answer for poor people? Gold?

Good article, but calling 700K dead a small number is just wrong. Besides, fed was printing money with both Republicans and Democrats in power. Too politically motivated to be treated with respect

Hi Alexander – sorry, but not sure where we said 700k dead is a small number. Perhaps you mean this part? (which was labeled a pandemic with only a few deaths.)

This is correct.

The WHO declared a global pandemic when there were less than a few hundred cases in China, and only a few deaths.

We are specifically referring on when COVID-19 was labeled a global pandemic by the WHO.

Excellent article, as always!! Please keep it up so that we may always find the truth

Hi Ivan,

I enjoy reading your articles although I may only agree with some. I appreciate your point of view. I wholeheartedly agree with this latest letter except for how you attribute this to “socialism”. As you have noted, the scales are heavily favouring the elites and the top 1%. I know you have previously espoused some conspiracy theories, but this would be too much for even you. To suggest that socialist policies are to blame for the rich getting richer while the working class suffers clearly indicates you do not understand socialism as it exists in Canada at least. There are some very good books available regarding socialism in Canada, I would refer you to Anatomy of a Party, The National CCF by Walter Young, another more current book is Party of Conscience by Roberta Lexier et al. You may be confusing socialism with authoritarianism, one is an economic platform, the other is a means of governing. While it is true there have been authoritarian regimes espousing socialist policies, there are thousands of examples of socialist policies that require anything but an authoritarian style of governing. Think cooperatives, credit unions, organizations devoted to the triple bottom line and participatory managed corporations which are growing in number.

Keep digging for the truth and I will keep reading. Your research is appreciated, I just find your conclusions to be suspect.

Thanks David for your comment – and for your thoughtful response. This is certainly a debate that we could have for a lengthy period of time. To keep it as short as possible, as this could be a never-ending debate, my view is that socialist policies for the most part can’t last.

One reason is, as you have stated, that authoritarian rulers have used socialist policies in the past to enforce their rule. China is today’s closest modern example.

Second reason is that socialist policies almost always end in failure, as its often never strong enough to compete. You give examples of cooperatives and credit unions. Unfortunately, these structures never lend itself to winning and are often the first to fail in recessions and economic downturns. Feel free to count how many credit unions have failed in the past 10 years alone – it’s a very, very long list.

Thank you for your time Ivan. You are right, we could debate this a long time. I just want to clarify your point on credit unions. They typically merge, not fail. I know of no one who has lost their savings due to the failure of a credit union. There are several very successful and very large ones around today (I am sure I do not need to list them) who weathered the banking missteps of 2008. Again I implore you and others to read and learn about social democracy rather than use China, or the former Soviet Union as your sticking points. Back to your article, we agree that some massive change is required to get western democracies off this path that appears to be leading us to massive inequity of wealth and possibly back to a time of feudal lords or civil society run to suit a corporate agenda. To see who is really calling the shots, just follow the money. It’s not happening yet, but appears to be the path we are on.

“throughout this pandemic (which was labeled a pandemic with only a few deaths.) “

You don’t think this is a pandemic?

There have been 1,745,349 infections and 29,309 coronavirus-related deaths reported in the country since the pandemic began.

47 million cases and 762,000 deaths in the US

I think you’ve mistaken how this was written – in particular: (which was labeled a pandemic with only a few deaths.)

This is correct.

The WHO declared a global pandemic when there were less than a few hundred cases in China, and only a few deaths.

At Evolution of Democracy, we say, “End the Fed!”

I think you’ve made a very good case w/ facts about what happens when the FED intervenes when the economy blows up. Let me play devil’s advocate here. What would happen if the FED didn’t do its open market operations & QE? Well, we could easily conclude that many business would shut their doors, unemployment would sky-rocket, soup lines would implode, our assets (retirement money, home values etc.) probably cut in half, you name it, it would be chaos for many people. I also suspect violence, mischief, robberies, vandalism, murders etc. would escalate out of control where everyone would be walking around afraid & always looking behind them. Yes, we have some of that now, but it gets 100% worse without a socialist stimulus package & take many more years for the economy to fully recover. So, in short, doing nothing during a meltdown is inexcusable & unfortunately they have not found a better resolution, so the rich will continue to get richer before the rest of us prosper too or do we become a Communist regime.

run run the sky is falling………yes your logic and facts are pretty spooky……even for the top 1%…….when the bottom 99% see how the top 1% are hurting them will they turn and demand a reset? is this the precursor to a new russian/french style revolution?……..are we being mentally conditioned to expect less? is the pandemic and global warming crisis the means the 1% are trying to forstall the inevitable reset? jhc i am 75 i frankly do not care for me, but my children and their progeny have a spooky future and some life changing choices to make i am glad i will not be around……..yup i am beginning to sound like a kook even to myself………..have a good day

Great writing Carlisle! Keep it coming,

Not much hope/encouragement in this one, eh? So, I’m not sure whether to buy any more stocks atm… :/