Notice how quickly we got used to spending trillions?

There was a time it would have been taboo. Before Covid, Congress had never passed a ten-figure bill. And you would rarely hear a politician utter such astronomic numbers.

But boy have times changed.

Just look at America’s bills coming down the pipe:

● Cares Act passed in March 2020 — $2.2 trillion

● Paycheck Protection Program passed a month later — ~$500 billion

● Consolidated Appropriations Act signed into law last December — ~$1 trillion

● American Rescue Plan passed this past March — $1.9 trillion

● The bipartisan infrastructure bill just passed – $1 trillion

● And Biden’s most ambitious bill to fight climate change in the works —$3.5 trillion

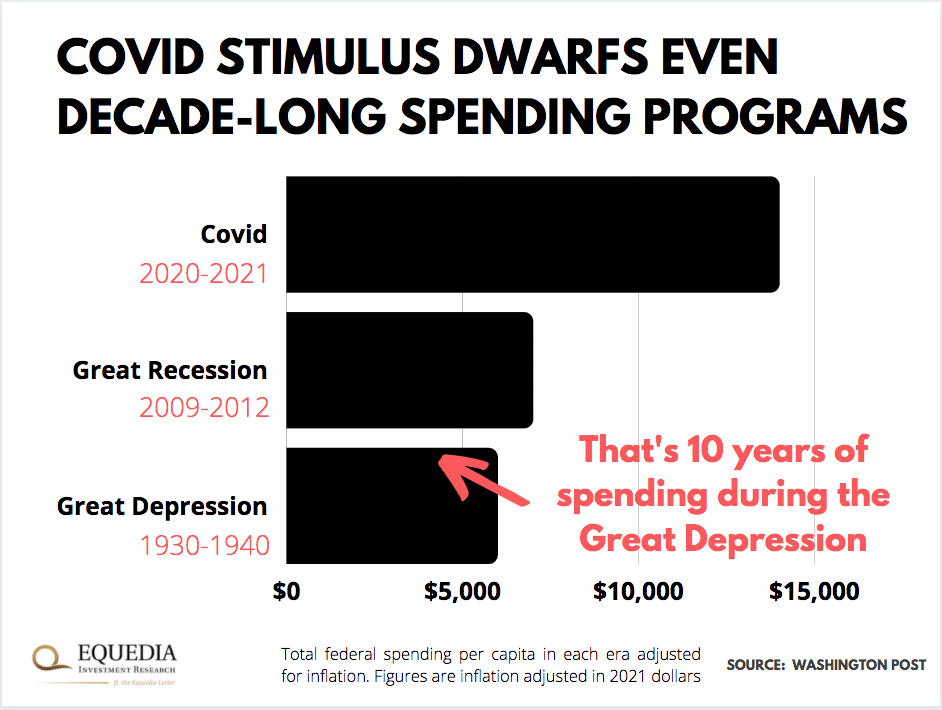

In all, Uncle Sam splashed out nearly ten trillion dollars in less than two years. That’s more than America’s last two biggest spending programs combined… one of which lasted a whole decade!

The worst part is this bailout didn’t need nearly that much money. In fact, there’s a massive surplus of cash in the economy as a result.

Where?

For starters, in benefits for millions of jobless Americans who refuse to come back to work while employers are desperate for workers…

… record inflows of money into the stock market…

… hundreds of billions spent on bogus NFTs and other speculative assets (e.g. a digital image of a Shiba Inu dog was recently sold for $4 million)…

… and bank reserves filled up to the brink with cash.

It may be fun and games for now, but this excess cash isn’t a free lunch. Eventually, investors are going to pay a heavy “toll.” In fact, they’re already starting to, most of them without realizing it.

And you’d better be ready.

In a moment, we’ll talk about one little-known defensive strategy for your portfolio. But first…

How printed trillions make their way into the economy—and the side effects it creates

There are two ways. I’ve already touched on federal spending, which is pretty straightforward.

Politicians draw up a bill to spend a certain amount of money on certain things—such as roads, bridges, or stimulus checks.

As always, the government doesn’t have that much cash because the budget’s been in deficit since 2000. So, it borrows the money by issuing and selling bonds to the Fed, who buys them with printed dollars.

The second way is less straightforward, yet in some cases, more powerful.

It’s called “quantitative easing.”

That’s a new monetary tool that Western central banks took to after 2008. In short, they print a bunch of money and buy long-term bonds from the government, banks, and public companies to inject money into a failing economy.

For example, after the housing collapse, the Fed bought ~$1.5 trillion of mortgage-backed securities from banks to ease their losses. And to keep the economy afloat during Covid, the Fed lent $4 trillion to the government and companies by buying their bonds.

This “artificial” bond-buying may keep the economy alive, but it also deprives investors of income, especially when inflation picks up.

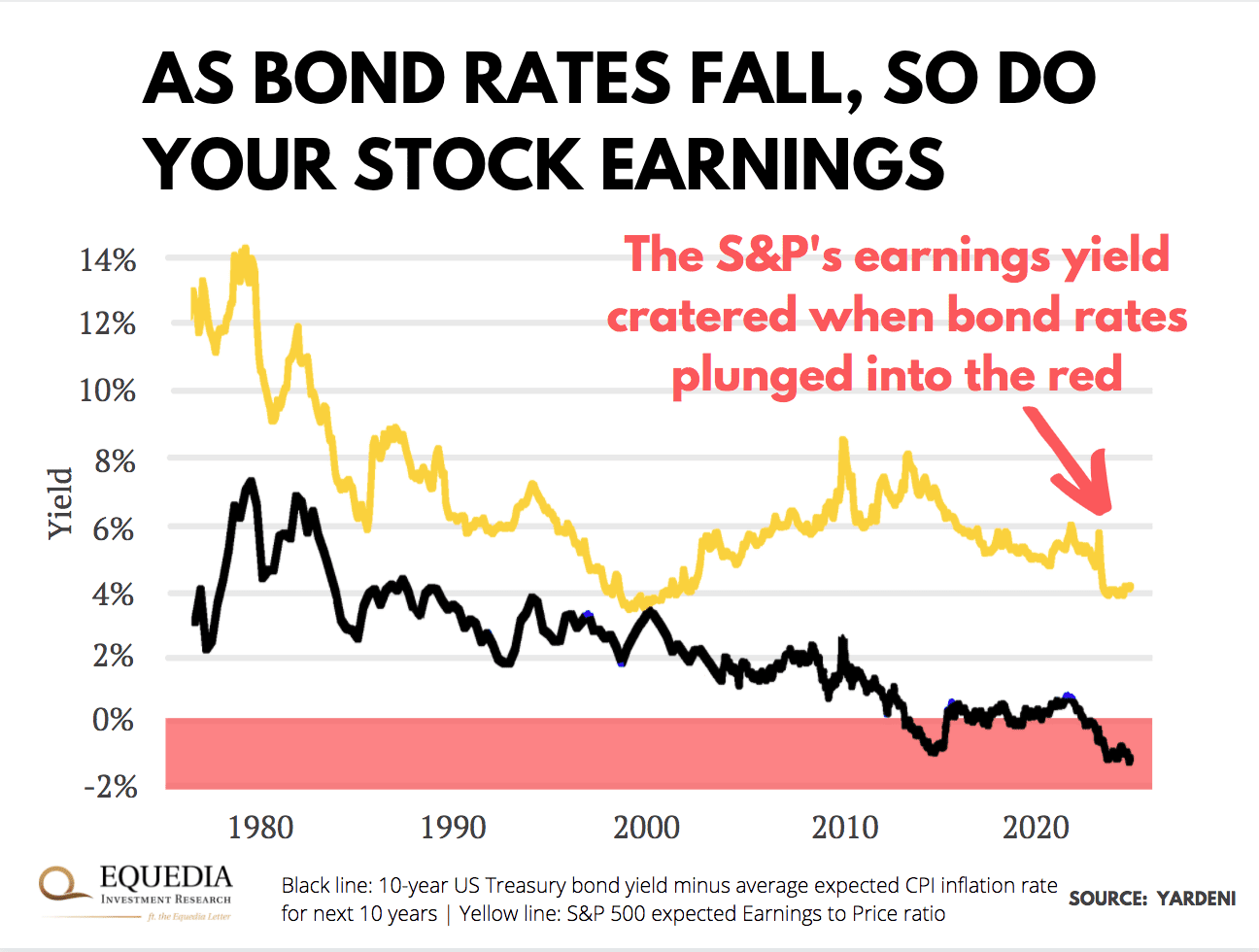

You see, when the Fed buys bonds by the truckload, it creates artificially high demand in the market. Prices go up, and interest on all debt goes down. Money gets cheaper. And bond investors earn less—or even lose money.

As we discussed last week, most bonds earn a negative real return today. Even risky junk bonds that could hand you 5% in real yield before Covid aren’t earning a thing now.

In other words, half the classic bond-stock portfolios most investors hold are essentially losing money. That’s one side of the “invisible price” investors pay for this spending.

But there’s also another…

Cheap debt prices investors out of other assets

Take the most obvious example of housing.

When interest rates go down, so do mortgage bills. More people can afford a house. So they scramble to buy and lock in better rates – even when house prices are through the roof.

Seen the housing frenzy in America?

The market is like a burning-hot frying pan. I was talking to my broker the other day. He told me his million-dollar listings are flying off the market in a matter of days…sight unseen!

No wonder house prices soared 54% in the past year alone. That’s the biggest home price growth in history—nearly 2x that during the peak of the 2003-2008 boom.

Imagine how many Americans have been priced out of homeownership?

In a way, the same happens in capital markets.

As a rule, most portfolios juggle between two asset classes. There are bonds that earn a stable income, and as a rule, are safer. And there are less stable stocks that are considered riskier.

To compensate for that risk, investors ask for a higher return from stocks. This extra return they get for buying stocks over safe bonds is called “equity risk premium.”

Now, when the Fed floods the bond market with cash, bond interest goes down. As bonds earn less, more investors pile into stocks. Share prices climb, and investors have to put up with fewer earnings for every invested dollar.

In financial lingo, that means their earnings yield goes down.

Here’s a chart that shows how falling bond rates drag down the S&P 500’s earnings yield:

And that’s the other part of the invisible price investors pay for Covid spending.

Printed dollars crowd investors out of safe bonds. They move to stocks and other assets, blow up their prices, and earn less for a disproportionally higher risk.

Because what’s the alternative? Sit on cash at 5% inflation?

The #1 risk today and one defensive stock strategy

So what happens if central banks slam on the brakes and put it all into reverse? In fact, the Fed is thinking to taper its spending this year already.

Of course, they’ll be very careful. They know the markets are still a house of cards resting on printed dollars. And they’ll do their best to back down without shaking it up.

That is unless they are forced to…

If inflation keeps ticking up, they’ll have no choice. They’ll turn off the taps to tame climbing prices at the expense of the market – just as they did in the ’70s. And that’s by far the biggest risk I see today.

That said, there are many ways to shield your portfolio.

Last week, we discussed gold as one potential hedge.

Today I’ll break down a little-known defensive strategy for your stock portfolio. It’s called investing in “inflation-protected” yield.

In simple terms, we buy dividend stocks in sectors that generally benefit from inflation. For example, stocks that extract raw materials (materials sector), make machinery (industrial sector), or, say, banks that can lend money at higher rates during inflation (financial sector).

The logic is simple. If inflation gets out of hand and central banks tighten, these stocks are more likely to hold out for two reasons.

First, the higher the inflation, the more money these stocks will rake in. And growing higher earnings will offset falling valuations in a market slump.

Second, dividends are safer. If things go south, the dividend is the very last expense executives will dare cut. That’s because it sends a bad message about the company’s financials and fends off investors.

In fact, companies avoid it so assiduously they often borrow money to pay out dividends.

This is why dividend stocks tend to weather downturns better than other stocks. And their investors ride them out with smaller losses and, most importantly, a steady income.

For those reasons, I’m banking on this strategy to add some counterweight to my portfolio. It may not make me rich, but if central banks turn off the taps and send the market into a tailspin, I want to hold stocks that will keep doling out.

It’s all about diversification.

– Carlise Kane

1 tend to agree with your basic premise….dividend payers weather the storm much better than stocks that do not pay dividends…..and rebound better in the next cycle

NFI (New Flyer): not sure whether this is in the manufacturing or the industrial sector, as it sometimes can be listed in either. On September 20th it fell $6.00. It pays dividends. Is there something else I should be looking at with NFI based on your most recent newsletter (inflation).

I really appreciate the wonderful info you provide.

Your article on the money game the FED’s and Congress play is spot-on.

And you go on to talk about Inflation Protected Yields.

However, dividend yields come with many different stocks and sectors.

Such as MLP’s, BDC’s, REIT’s, CEF’s, and others.

I was expecting some sort of recommendation on dividends and you FAILED

to mention any. Thus your article ended in a CRASH & BURN of worthlessness.

Next time do your readers a favor or don’t write at all.