Policymakers keep telling us that our economy is as strong as ever. And that we’ll get away with a “soft landing.”

But there’s a “scurrying” sound in the markets that tells an entirely different story.

I’m talking about the massive flight to cash.

Last week, investors moved more than $68 billion into cash funds. According to BofA, that’s more cash than in any other week since the depths of the pandemic.

Pundits claim that such a reallocation—or as they call it, “cash on the sidelines”— is a bullish signal.

But is it?

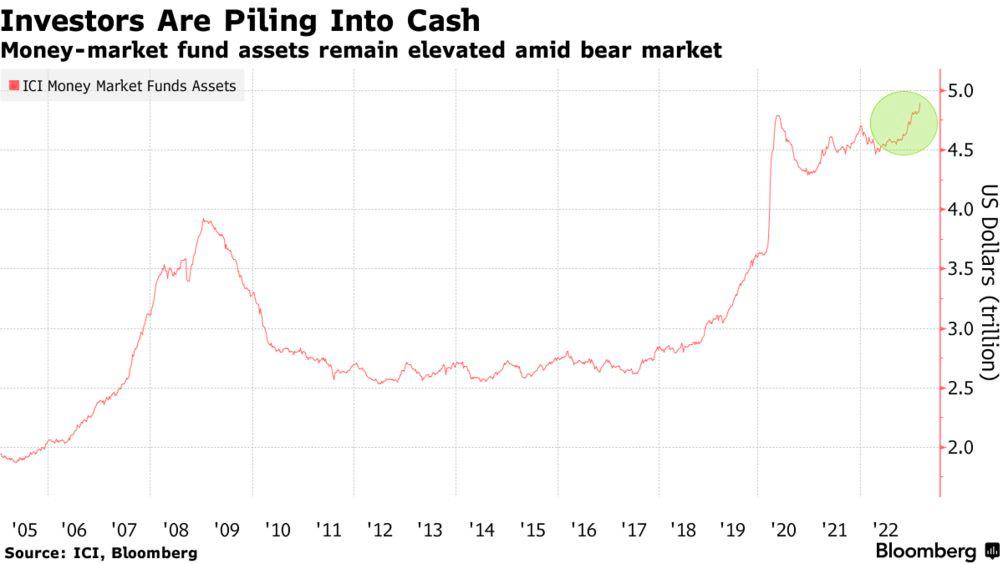

Take a look at the chart below that shows the Assets Under Management (AUM) of cash funds:

It doesn’t take an expert chartist to see cash building up just before the 2008 housing crisis and the credit squeeze when COVID hit (before the Fed’s bailout).

And it’s not just the last two crashes.

According to the St. Louis Fed, cash holdings had increased to record levels just before the dot-com bubble in 2000. And BIS (Bureau of Industry and Security) data shows that excess liquidity also preceded crashes in 1997, 1998, and 1987.

In other words, growing cash balances could be a tip-off that the stock market could soon crash. Like rats scurrying from a sinking ship, big money always moves to safe havens before the plunge.

But this time, they might be preparing for more than a single credit bust.

Listen to this via podcast instead

The Prolonged Experiment

In the thick of the Great Recession in 2008, the Fed began the most significant monetary experiment in history.

For the first time, America’s central bank brought its interest rates to zero and introduced quantitative easing (QE)—once an academic asset-buying concept that we’re too familiar with today.

For those unfamiliar with QE, it was a monetary policy by the Federal Reserve whereby they would buy a predetermined amount of government bonds or other financial assets to stimulate economic activity.

This new monetary policy was supposed to be a temporary “painkiller” with end dates and limited amounts.

But by the time the economy recovered, the drug that initially alleviated the pain had become an addiction.

Despite strong stock market performances and an economic rebound, the Fed held interest rates low and continued printing for the next ten years—fully aware that they would be out of bullets in the next crisis.

And so they were.

When the pandemic hit, there was only so much they could do with rock-bottom rates. So they kicked off another—but 5x more aggressive—QE program.

And it wasn’t just any QE program – this one included all sorts of “help” including two new facilities to directly support the flow of credit to US corporations by not only directly lending to corporations and buying their new bond issues, but also buying existing corporate bonds as well as ETFs with investment-grade corporate bonds.

In other words, the Fed directly influenced the success, or rather survival, of US corporations.

Collectively, the Fed printed north of $4.5 trillion in less than two years.

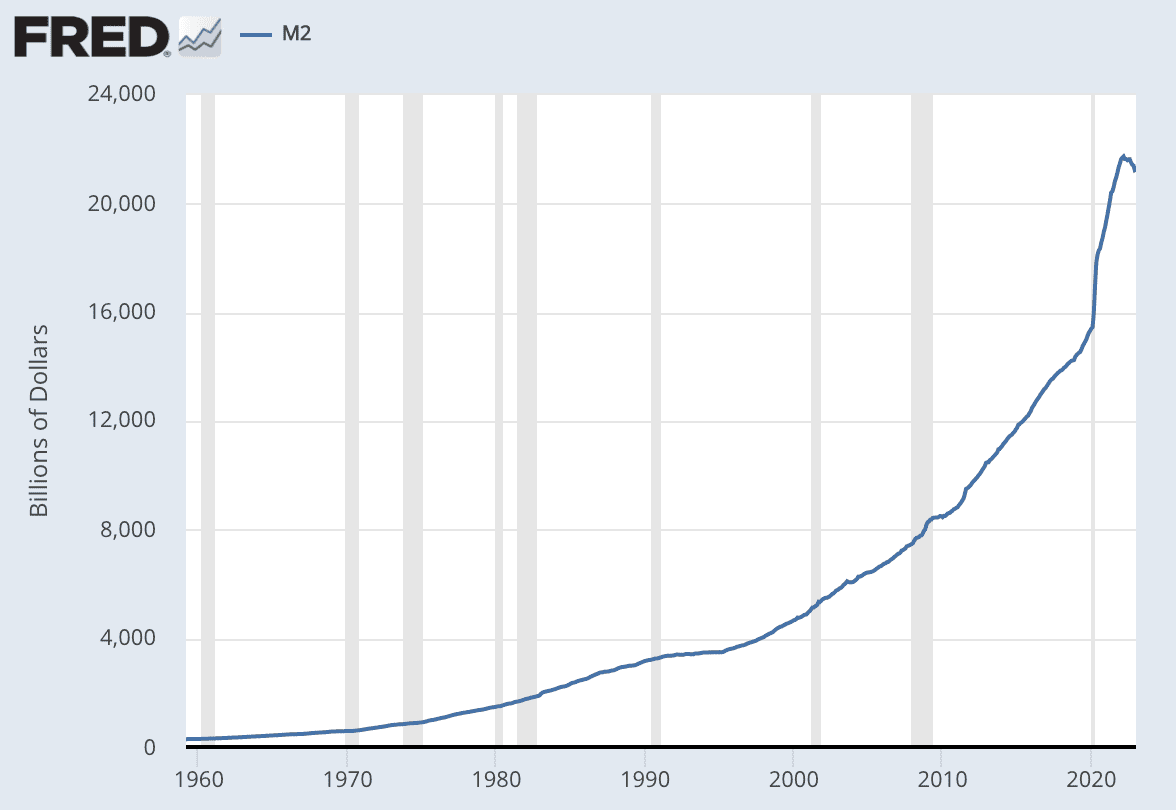

And the supply of dollars tripled from seven trillion at the beginning of the experiment to 21 trillion.

For some historical perspective, it took more than 50 years for the Fed to print half as much money before the Great Recession:

And, until very recently, the world experienced little inflation – despite massive amounts of new money entering the system.

In fact, the biggest headache for policymakers over the past decade was not enough inflation rather than too much of it.

But if those trillions weren’t monetized by way of inflation, where did all that money go?

The short answer? Higher-risk assets.

The heyday of speculators

As I explained in “The Biggest Dealer in the World,” unlike fiscal stimulus, most QE money ends up in big corp and in the pockets of the wealthy, who invest that money back into the capital markets.

And because of that, instead of CPI (consumer price index) inflation, we got asset inflation.

There are many technical reasons why QE tempted investors specifically into high-risk assets. And because we went through them in the RIP 60/40 series, I won’t get into much detail today.

But here’s what you need to know for the sake of this discussion.

The main unintended by-product of this monetary experiment was that it made low-risk assets like Treasuries unattractive.

As I wrote in “The Invisible Price Investors Pay for Trillions of Printed Dollars“:

“This “artificial” bond-buying may keep the economy alive, but it also deprives investors of income, especially when inflation picks up.

You see, when the Fed buys bonds by the truckload, it creates artificially high demand in the market. Prices go up, and interest on all debt goes down. Money gets cheaper. And bond investors earn less—or even lose money.

As we discussed last week, most bonds earn a negative real return today. Even risky junk bonds that could hand you 5% in real yield before Covid aren’t earning a thing now.

In other words, half the classic bond-stock portfolios most investors hold are essentially losing money. That’s one side of the “invisible price” investors pay for this spending.”

Investors had little choice but to invest in overvalued, higher-risk assets to protect themselves from inflation. There’s even a term on Wall Street for this period— TINA— or “there is no alternative.”

This is the reason we’ve witnessed appalling levels of speculation in:

- growth stocks trading at triple-digit P/Es (like Tesla)

- speculative real estate

- extremely illiquid private equity

- junk debt

And let’s not forget the wild swings of meme stocks, shitcoins, and monkey JPEGs.

But now the tide has turned.

The cost of money will double

This time, the Fed’s stimulus didn’t just inflate asset prices.

Combined with trillions in stimulus and policy-induced supply chain issues, consumer prices soared to the highest level in over 50 years.

And so, what is the Fed’s primary tool to fight this inflation? Reversing what it did to cause it.

In the past year alone, the Fed hiked interest rates by 4.5% (back to 2008 levels) and offloaded nearly a trillion in assets it bought during Covid.

And we doubt this is the end of the rate hikes and asset sales.

While inflation slowed, it’s still a far cry from the Fed’s target of 2%.

Recall from our PREVIOUS LETTER that in order for the Fed to tame inflation with interest rates, the interest rate has to be equal to the rate of inflation.

And at current inflation levels, that means interest rates might need to reach 8% to stop inflation.

Via Bloomberg:

“Dwor-Frecaut, a senior market strategist at the research firm Macro Hive, says the Fed will have to boost the federal funds rate to about 8% to win its battle to bring inflation fully under control. That’s based on her analysis using a Taylor Rule model with data stretching back to 1970.

“I’m even more confident about my 8% call after the nonfarm payrolls report,” Dwor-Frecaut, who previously worked in the New York Fed’s markets group, said in a telephone interview, referring to surprisingly-strong employment data published on Feb. 3. “The funds rate has to go much higher than is now predicted. Policy is still very easy.”

The question is, is inflation over?

Not according to Wall Street. In fact, Wall Street is now factoring higher inflation into its projections as a “secular trend“…

…meaning it could last decades!

Via Heisenberg Report:

“An era of extraordinary monetary policy is over,” BofA’s Michael Hartnett declared, dusting off a hodgepodge of go-to charts for this week’s installment of his popular “Flow Show” series. His tone was categorical. “Inflation is a secular reality not a cyclical theme,” he said. (So, you’re telling me it wasn’t “transitory”?) Those two propositions — that the easy money era is over and that we’ve seen the dawn of a new, inflationary epoch — were part of what Hartnett called “the secular script.”

In other words, if current levels of inflation persist, higher rates are inevitable.

What happens then?

The “everything credit bubble” will pop

When analysts simulate the collateral damage of this monetary reversal, they often miss one important detail:

The free money of the past decade didn’t just blow up asset prices.

It also urged corporate America to max out credit and borrow hundreds of billions of dollars more against the capital they attracted.

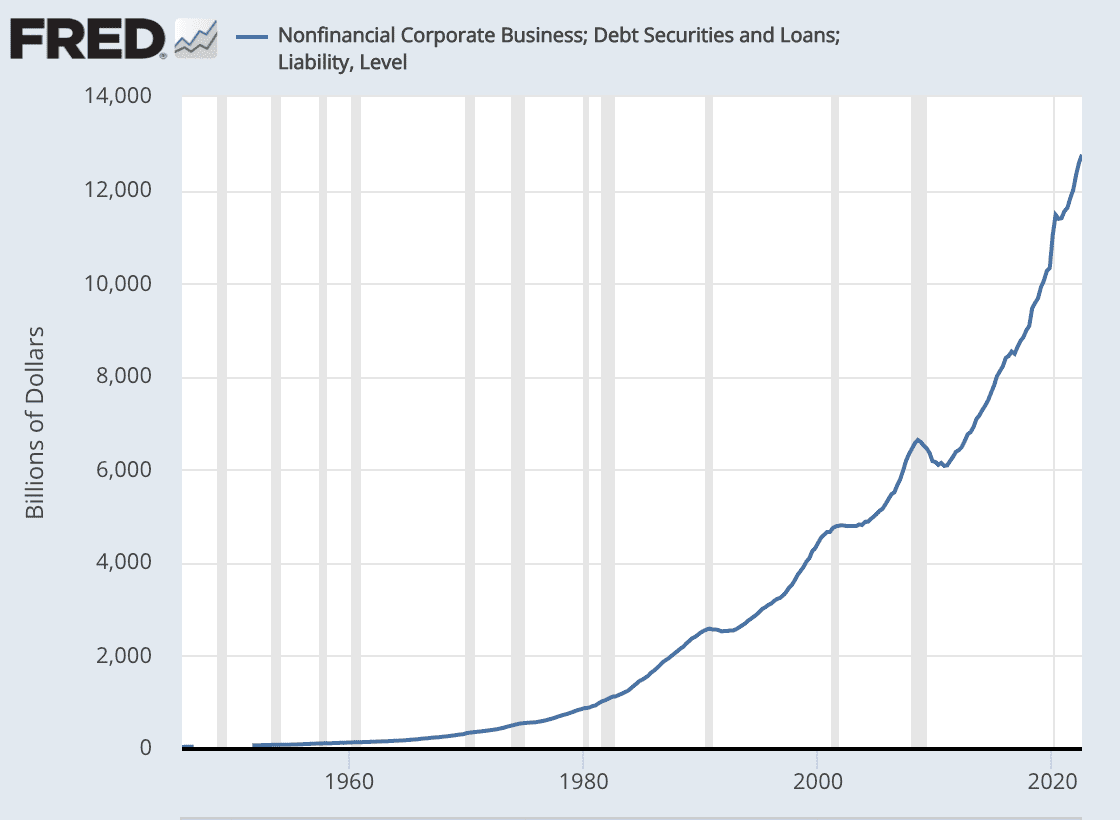

Exhibit #1: Here’s a hockey stick chart of corporate debt.

Since 2008, corporate America has piled up more debt than it did in the 65 years leading up to it.

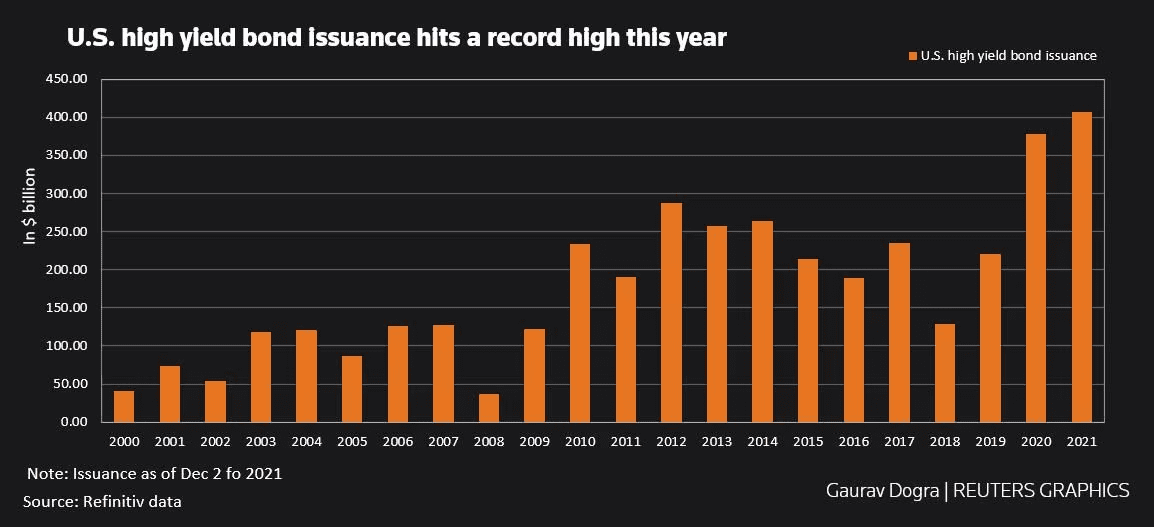

Even worse, lately, the most troublesome companies teetering on the edge of default are the ones that borrowed at the fastest clip. For example, take a look at the explosion of junk debt during Covid (2020-2021):

During the pandemic, they issued nearly twice as much debt as they used to in an average year. And the binge continued until the very last moment before the Fed reversed course.

But the era of free money is over. And sooner or later, these zombie companies will have to refinance at multi-fold higher rates. Will they be able to survive, then?

The same applies to speculative real estate, leveraged hedge funds, private equity funds… or anyone who worked their books as if free money would last forever.

It won’t.

Nor will it ever.

Seek the truth and be prepared,

Carlisle Kane

It would seem gold and silver are about to have their day ? One thing I really do believe the new

wave of investors are more gamblers than savers ? They never needed to learn how to save or

stockpile cash because its been damn near free to borrow for decades ! I personally think also

the sky’s are grey but hard to keep gamblers out of the market for long materials , miners and

metals are the ones with the predictable future IMO 🤔

Absolutely. Gold, for example, has been one of the best performing asset classes in 2023. But don’t “invest” in gold – treat it like an insurance policy. If you want to invest in gold, do so through the miners/explorers. The same goes with commodities and energy.

As usual, very good coverage.

Thank you Darragh! This was actually written prior to the collapse of $SIVB – should have posted this sooner.

I don’t know what to make of these posts.

The hyperinflation is inevitable, and for the first time is global. The food and energy crises will lead to people unable to afford living and will give riots then war. All inevitable, meanwhile the climate will change for the worse.

If you have kids, or plan to procreate, buy land in Siberia and make plans to emigrate to there. It’s above sea level and living is cheap (and miserable).

See this from five years ago: https://www.equedia.com/these-six-events-will-determine-our-future/

Excellent article. Godtering, us that are over 65 and were paying attention, experienced hyperinflation in the ’70’s. And it was globally. The only thing good about it was money market funds and saving accounts actually made money because interest rates were at and above where they should be normally, which is something that the banks hate to do, give you a fair interest rate on your savings. And yes, we will survive it again.