Have you ever watched Gene Roddenberry’s classic Star Trek series?

For those who haven’t, it features a socialist galaxy state in the 24th century.

By that time, technology was so advanced that people lived in absolute abundance.

All basic needs were covered, nobody had to work, and the concept of money didn’t exist.

Instead of pursuing wealth, people did things in the name of the greater good.

Now, what if I told you we are quickly heading toward a Star Trek-like economy?

Except this won’t be the egalitarian dream Roddenberry imagined…

Listen via Podcast Instead

The Threat

I may sound like a broken record, but A.I poses an immediate danger.

And it’s not what you’ve been told.

For most of the past decade, machines of any intellectual capacity were mostly a fad; they showed big promise on paper, but they didn’t materialize in any practical form.

Until now.

With the release of OpenAI’s ChatGPT, we’ve got a real sneak peek into what A.I. is truly capable of on a massive scale.

It’s still in an early “beta” stage, but the implications are already beyond mind-boggling.

(Read “More Powerful than Meta, Google, and Twitter. Combined,” for our demo session with ChatGPT and what it revealed.)

In fact, the level of disruption has already begun.

Last month, Buzzfeed—one of the world’s biggest publishers—laid off 12% of its staff.

And replaced them with OpenAI.

Via Metaverse Post:

“As the largest entertainment site in the U.S., BuzzFeed is no stranger to change. This week, the company announced that it was laying off 12% of its staff and replacing them with OpenAI tools. This decision has surprised many, as the company used to be a major employer of talent. However, it appears that the company is now ready to embrace the power of A.I. and machine learning in order to stay competitive in the ever-evolving digital media landscape.”

And that’s just the beginning.

In my Letter, “More Powerful than Meta, Google, and Twitter. Combined,” I showed how AI-powered tools like ChatGPT would soon replace journalists, academics, coders, and search engines.

But you don’t have to take my word for it.

A.I. has already become a mainstay in professions everywhere. Over 100 million workers—from journalists to computer engineers—are already using ChatGPT on a daily basis.

This is the fastest-growing tech product EVER.

And it will disrupt our entire economic system.

They Were Wrong

For the past century, capitalism has been the main driving force of the Western world.

And despite all the socialist hate, capitalism makes a lot of sense.

In theory, it rewards everyone based on merit instead of status or caste; it motivates society to work harder and innovate, which ultimately leads to a better standard of living.

In fact, capitalism is what lifted many people out of poverty after the feudalism era. It was the underlying force behind the birth of the middle class.

But while it was so effective in industrialized economies, it’s the opposite in a technology-first world.

For capitalism to work, most of society must have at least a chance to compete—that is, actually do the work. But as technology improves, more and more people are left out.

Think how many human workers you relied on just a few decades ago.

If you wanted to book a flight, you called a travel agent. Insurance? A personal broker. There was no Gmail for your correspondence. All your mail, newspapers, and bills came from a human mail carrier. And let’s not forget how many bank tellers it took to send a check in the ’90s.

Today, a few taps on your phone, and you’re set.

For all of the jobs technology has replaced, A.I. will replace even more.

It’s not a matter of if—but when—A.I. will be better than most statisticians, researchers, copywriters, accountants, paralegals, telemarketers, coders, digital markets…

Two years from now, A.I. could replace almost every middle-skill office job.

Via Stanford University:

“For the study, Stanford University doctoral candidate Michael Webb analyzed the overlap between more than 16,000 AI-related patents and more than 800 job descriptions and found that highly-educated, well-paid workers may be heavily affected by the spread of A.I.

Workers who hold a bachelor’s degree, for example, would be exposed to A.I. over five times more than those with only a high school degree. That’s because A.I. is especially good at completing tasks that require planning, learning, reasoning, problem-solving and predicting — most of which are skills required for white collar jobs.”

In other words, futurists were dead wrong.

It’s not blue-collar workers of the working class that will lose their jobs to robotics first – we’re still many years away before a robot can come to your house and unclog your sink.

But A.I. can destroy the swarms of office dwellers on the lowest rung of the corporate ladder.

For example, bookkeepers have already been replaced by online apps that read receipts and categorize them. As a result, what used to take ten bookkeepers now takes only one to oversee this process.

As A.I. gets exponentially smarter based on inputs from hundreds of millions of users, and computers grow more powerful (think quantum computing), there aren’t many white-collar jobs A.I. can’t replace.

The End of the Middle Class

We are now witnessing the early by-product of late capitalism: the ever-growing income inequality between the rich and the poor.

As we often say, “The poor get poorer and the rich get richer.”

It was inevitable.

As technology replaces more workers and makes elite-infested corporations more efficient, capital simply clusters at the top instead of trickling down.

But do you know what history has taught us right before a capitalist economy comes to an inevitable end?

Those in between get squashed.

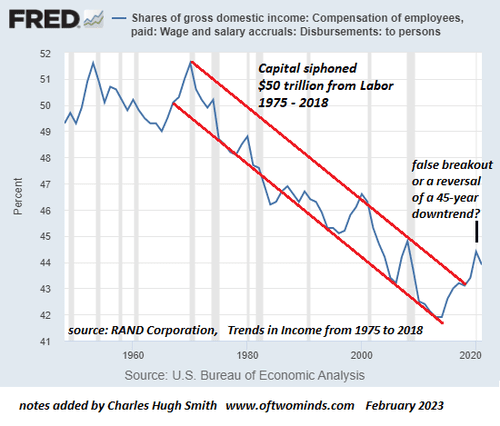

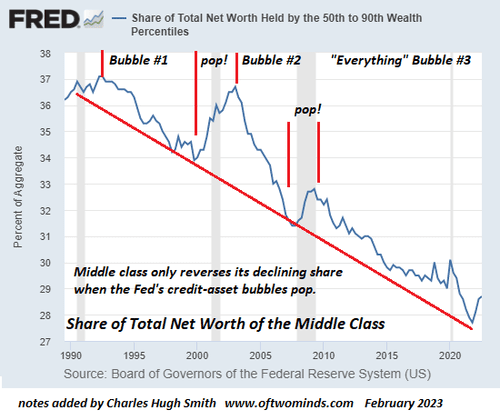

Take a look at this chart that shows the middle class’s share of income over the past 30 years:

Since the advent of the internet, middle earners have consistently made less money than everyone else. In 2020, the trend temporarily reversed, but that was just an outlier due to stimulus checks.

Same with accumulated wealth.

Is it a coincidence that the middle class began to shrink right when the internet took off?

A.I. will be the tipping point that finishes them off.

If you aren’t convinced yet, take any middle-class job and ask yourself: can A.I. fill that position in the next ten years? If you read my piece on ChatGPT, your answer will likely be yes in 9 out of 10 such cases.

And what happens when the middle class—the powerhouse of the economy—gets kicked out of the system?

To avoid revolt, policymakers will have to come up with ways to “feed” society.

In fact, the CEO of OpenAI is already urging policymakers to lay the groundwork for universal basic income (UBI) – a fancy term for social welfare whereby the government gives everyone a set amount of money on a regular basis.

Via Not Boring:

“On Friday, OpenAI’s Sam Altman wrote a post titled Planning for AGI and beyond in which he lays out the company’s plans to balance A.I. progress and safety. Near the end of the piece, he includes a little aside on how the company might help workers displaced by AGI. Its nonprofit can override for-profit interests, and do things like “sponsor the world’s most comprehensive UBI experiment.“

If you think this won’t happen, it already has.

In fact, we predicted this would happen in 2016 and revealed how governments were already “testing” basic income.

Via our Letter, Secret Government Experiments (2016):

“The only way out is to either raise taxes exponentially, which hurts the economy, or the last and final resort: helicopter money.

What is helicopter money?

Helicopter money is exactly what it sounds like: free money from the skies.

… Don’t think for one second that this is a far-fetched idea.

In fact, not only did Janet Yellen not raise rates this week, she actually alluded to the fact we could see helicopter money coming: “It is something that one might legitimately consider.”

In Europe, lawmakers are already urging the central bank to deploy free money to citizens.

… Don’t think Canada is out of the question. In fact, basic income experiments are underway – an experiment whereby the government gives people money for free, for nothing.

Don’t believe me? Check Trudeau’s pre-budget report, it’s in there.”

A few years after Ivan wrote that letter, the government gave “free” money via COVID checks.

And it will happen again.

But if you’re a socialist, don’t pop the cork yet.

Silicon Valley Bank Failure: The Truth

Over the last week, we’ve heard many experts tell us why the Silicon Valley Bank – and other smaller banks – failed.

But not one so-called expert mentioned this:

Via the Federal Reserve:

“As announced on March 15, 2020, the Board reduced reserve requirement ratios to zero percent effective March 26, 2020. This action eliminated reserve requirements for all depository institutions.”

A reserve requirement ratio is simply how much cash a bank has to have at all times.

In March 2020, this number became zero.

What does that mean?

Via our Letter from 2013, “How Government Borrows Money“:

“Currently, banks in the U.S. are required to have a certain amount of money in their system, known as reserves. These required reserves are normally in the form of cash stored physically in a bank vault (vault cash) or deposits made with the Fed.

In the U.S., the average fractional reserve-lending ratio is 3%* – meaning that if you deposit $100 at the bank, the bank can take $97 of it to make loans or gamble on the stock market.

…Not only are banks able to use most of your money to make big bets, they now have a record amount of money in deposits from selling bonds to the Fed.

And, as I mentioned last week, with so much money sitting in the banks, the banks are practically forced to invest and make even bigger bets on the stock market.”

The Fed’s policies forced banks to make bigger bets in a low-interest-rate environment.

And then it took it all away by rapidly raising rates.

The end result?

As we predicted via Twitter, many smaller banks will be swallowed up by the bigger banks.

$SIVB is not a true bailout – only depositors get their money back.

We will see other banks collapse and be swallowed up by bigger players soon, at pennies on the dollar.

— The Equedia Letter (@equedia) March 13, 2023

The next day?

We said pennies on the dollar yesterday.

We were wrong. It was a full dollar.

The U.K. Treasury and the Bank of England facilitated the sale of Silicon Valley Bank UK to HSBC, Europe's biggest bank, ensuring the security of 6.7 billion pounds ($11.1 billion Cdn) of deposits.…

— The Equedia Letter (@equedia) March 13, 2023

Just as the rich get richer and the poor get poorer, the big banks get bigger, and the small banks disappear.

And it was all planned and orchestrated with the expectations that AI and technology would replace human workers.

UBI via CBDC

It’s stunning how many people get excited when told that the government will give them free money.

They hear UBI, and their eyes light up. They think the government will shower them with cash, and they’ll live happily ever after in a Star Trek egalitarian idyll—never having to work again.

But as history has taught us, things never turn out well when people rely on the government or a ruling entity.

Remember our investigation into the “Hamilton” project?

As MIT documents revealed, the Fed is building a central bank digital currency, known as CBDC, to not only replace the fiat dollar but the entire depository banking system.

For starters, it would grant the Fed power to bypass all commercial banks and distribute money directly into the economy.

From “The End of the Monetary System As We Know It?“

“In theory, the central bank could simply issue and distribute money directly to citizens. They could even hold and control digital dollars directly—and maintain reserves that back that liability.

So, a digital dollar could, in principle, cut out depository institutions entirely.

In fact, the Fed’s report says a digital dollar would be a “near-perfect” substitute for commercial bank money. And that its implementation could substantially trim the deposits in the banking industry.”

In other words, citizens would no longer need to bank at small institutions.

Meanwhile, the Big Banks’ role will be relegated to managing financial services such as offering loans and investment banking.

And while that doesn’t seem like a bad idea, remember that the Fed’s CBDC tokens would be fully programmable, allowing the Fed to control your “cash” even if it’s already in your possession.

“In theory, the Fed could pursue some kind of neo-fiscal policy for lack of a better word. As a “wholesale lender,” it could fund select companies and organizations without commercial banks or even the backing of Congress.

The digital dollar has political utility, too. With programmable digital tokens, the authorities could easily tax and censor those opposing the status quo.”

Suppose we are heading to egalitarian socialism. Why are the powers-that-be designing a monetary system that looks more like the ultimate enforcement system than it does an equalizing tool?

If people rise up against the system, the ruling power will have the means to tame them – the same way China’s President Xi did during the Shanghai lockdowns.

And that ruling power will be whoever controls the money supply – just as the Rothschilds so infamously foretold.

Mark my words, if the Fed distributes UBI the way government manages the national budget—which I’m sure it will—the majority of the population will live hand-to-mouth.

This is precisely why the elites and those who control the monetary system ushered in this wave of cheap money and are now taking it away.

They knew A.I. and technology would eventually replace humans.

And with the unelected Fed in power, there won’t be much any of us can do.

It will become totalitarian – not egalitarian.

Captain Kirk from Star Trek would not be pleased.

Nor will you.

Seek the truth and be prepared,

Carlisle Kane

We’ll be there shortly – FedNow is basically a CBDC system, without calling it a CBDC.

https://www.frbservices.org/financial-services/fednow

It’s merely an extension of the current system, which makes it easy to implement.

there was also a movie describing a society which aloud people to live to a certain age and then report to a recycling center. no more SS, problem solved, but then the movie with Charleston Heston who discovers the gov food people were feed soilent green, which turns out to be the people were recycled. i am an old science fiction buff, so i know how it ends. no more world hunger, problem solved. but gee mom, i’m thirsty!

in the US we have over 42 million who receive food stamps. There is also WIC (many are eligible and take advantage of both “programs”). another popular one is TANF and the list goes on and on and only seems to get a little bigger every year. Self reliance still exists in america but has become the minority over time. Less than 50% of the work force pays federal income tax in many cases because of a large EIC. The only reason our “middle class” isn’t a lot smaller is that many live that lifestyle because the Government subsidizes it! I might add the the quality of the median “middle class lifestyle” ain’t what it used to be. Nice cell phone, flat screen TV, laptop, etc. but you aren’t taking getaways and vacations as often, not going out for steak dinners as often, etc.

Big doom scenario so what should we do to prepare and what should we invest in now ???

Is there anything that can be done to maintain our constitutional liberties? Or are we quickly and quietly heading for complete disaster?