Last week, the Fed released its long-awaited report about a digital dollar.

The officials spun it as a financial disruption that could turn America’s entire monetary system on its head. The report said:

“A CBDC [central bank digital currency] could fundamentally change the structure of the U.S. financial system, altering the roles and responsibilities of the private sector and the central bank.”

(Note the bolded part. This will be the basis for today’s discussion.)

After tossing the idea around for a few years, this report is the first material step toward a digital dollar.

The media has mainly been obsessed with the surveillance aspect.

But the Fed’s access to your grocery list is the least of your worries. A CBDC can, in theory, give the Fed much more than that…

…complete monetary control.

Let me explain.

A CBDC is Not a Cryptocurrency

Before we delve into the nitty-gritty of the digital dollar, we have to make one key distinction.

A CBCD—be it a digital dollar, euro, or yuan—is not a cryptocurrency. Sure, it sounds like one and bears some resemblance. For example, just like a crypto coin, a sovereign digital currency is held in a digital wallet.

But that’s just the user interface.

From a monetary standpoint, a CBDC is the furthest thing from any cryptocurrency.

You see, a cryptocurrency like Bitcoin is built on a decentralized ledger called the blockchain. There’s no central authority that controls it. Instead, the currency is mined (issued), and the blockchain users authorize payments.

Unlike your bank account, crypto uses a wallet address that has no personal information assigned to it. That means you can buy, sell, or otherwise transact in Bitcoin, Ethereum, or another digital asset without a trace to your name.

The CBDC is the polar opposite.

While it’s digital, it’s still backed and controlled by the issuing authority.

The issuer can mint the money, regulate it, and, unlike fiat, even distribute it throughout the economy.

The End of Fractional Reserve Banking?

Let me ask you a question: where do most dollars come from?

Many people would answer “the Fed.” *Bneeep* Not true.

The Fed doesn’t create most of the dollars that circulate in the economy.

It’s the private sector—commercial banks—that do. They use monetary engineering called fractional reserve banking.

We talked about this many times in the past.

But here’s a refresher.

Say you deposit $100 with a bank. The bank isn’t bound to keep that $100 on hand. In most cases, it can lend out up to $90 of it. This means while your balance shows $100, another (nearly) $100 goes into the economy as a result of your deposit.

Then that $90 is deposited with another bank, of which $81 (90%) is, again, loaned out.

And on goes the chain.

Of course, the banks don’t print the bills. They just borrow them and tweak the digits in bank accounts. And while they are obviously liable for them, the borrowed dollars are out there buying houses and cars instead of sitting in deposits.

Central banks play an important role in this chain. They keep tabs on commercial banks, hold their reserve cash, and inject money when liquidity dries up. But it is commercial banks that multiply the dollars and shove them into the economy. Of course, they are often forced to by the Fed, who tells the banks how much money they’re allowed to keep and how much they can lend.

Here’s where it gets interesting.

The Fed Coin?

In a fiatless economy, you wouldn’t need such a depository chain.

In theory, the central bank could simply issue and distribute money directly to citizens. They could even hold and control digital dollars directly—and maintain reserves that back that liability.

So, a digital dollar could, in principle, cut out depository institutions entirely.

In fact, the Fed’s report says a digital dollar would be a “near-perfect” substitute for commercial bank money. And that its implementation could substantially trim the deposits in the banking industry.

This is a communist’s dream.

As economist Thorsten Polleit observed, such centralized monetary oversight is described as one of the building blocks of a communist regime in Karl Marx’s Communist Manifesto:

“As is well known, in their Communist Manifesto (1848) Karl Marx and Friedrich Engels named ten “measures” the implementation of which would lead to communism. The fifth measure reads as follows: “Centralisation of credit in the hands of the state by a national bank with state capital and exclusive monopoly.” The issuance of a digital euro and the resulting consequences are undoubtedly another crucial step in bringing the Marxists’ vision of their desired revolution to fruition.”

The World’s Most Powerful Dealer

As we discussed in “With Great Power Comes Great Responsibility. Unless You’re Part of This Group,” the Fed is the most powerful and by far the least accountable money dealer in the world.

It controls the world’s reserve currency. Yet it’s not elected. And neither does it have to run its policy by Congress. It can print up dollars, fiddle with rates, and now even has a say in politically-sensitive topics.

Remember when I wrote:

“The supposed “politically free” organization extended its duties to partisan waters, such as economic equity and climate change.

In last November’s Financial Stability Report, the Fed spoke about the impact of climate change on financial stability.

And Fed chief Powell hinted it might dictate the Fed’s policy moving forward:

“Incorporating climate change into our thinking about financial regulation is relatively new, as you know. And we are very actively in the early stages of this, getting up to speed, working with our central bank colleagues and other colleagues around the world to try to think about how this can be part of our framework.”

Then, earlier this year, the St. Louis’ Fed launched an Institute for Economic Equity “to support an economy in which everyone can benefit regardless of race, ethnicity, gender, or where they live.”

Still, the Fed doesn’t have much control over circulating fiat dollars. That’s because while it “prints the bills,” it doesn’t have the capability to distribute them throughout the economy.

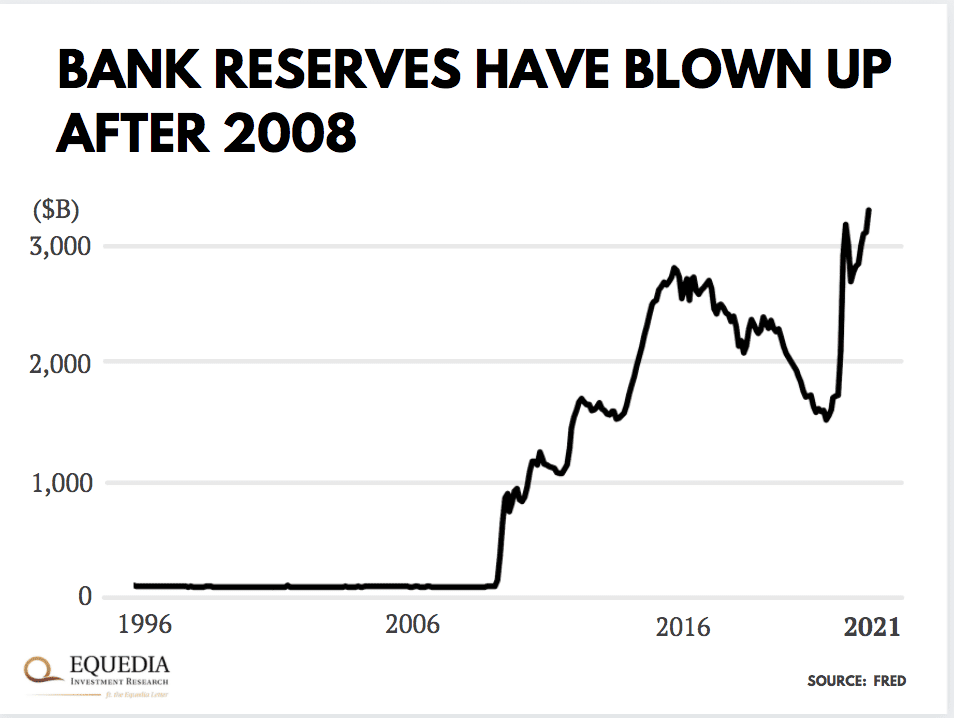

Instead, it uses printed dollars to buy bonds from commercial banks through open market operations. This money goes to their reserves, which they can then lend out—or not. As I showed you before, banks often choose to hold the Fed’s dollars and earn interest.

Take a look at how bank reserves blew up after the Fed printed trillions of dollars after 2008 and the beginning of Covid:

A digital dollar could change that.

Suppose the Fed swapped out fiat dollars for digital tokens that it can issue, hold, and distribute through the economy. In that case, it doesn’t take a conspiracy theorist to see the authoritarian powers it could claim.

For example, it could instantly flood the market with digital tokens and depreciate the currency to monetize its debt. It could even selectively hand it out to certain people and businesses at the expense of others.

Not to mention that each digital dollar would leave a trace and let the Fed surveil every transaction.

In other words, a digital dollar could give the Fed an absolute monopoly over all credit and transactions settled in its tokens. And most worrisome, the Fed could wield these powers without Congress’s backing.

In practice, though, this extreme scenario is unlikely.

Politicians would never pass a bill that would destabilize the banking industry to that extent on their watch. Besides, you can be damn sure lobbyists will work their butts off to talk policymakers out of it*.

(*Ivan here: This assumes the Fed doesn’t bribe the politicians. Just look at current politics, where politicians use their power to become rich.)

I think they’ll probably come up with some middle-ground solution that would work for both sides of the aisle.

But whatever the format, a digital dollar is not going to liberalize or decentralize anything. It’s not going to be a “safer” cryptocurrency successor. If anything, it will further consolidate the control of the financial system into one organization’s hands.

And you don’t have to look far to see this in action.

China Has Already Digitalized Its Fiat

After a six-year-long experiment, China is now rolling out the digital yuan to the broader public.

In April 2020, the People’s Bank of China (PBOC) began demoing its digital yuan app in four cities. This year PBOC expanded to 12 cities and began integrating its digital tokens into China’s biggest e-commerce and payment platforms.

Is the digital yuan anything like the digital dollar we speculated about? It actually is—and in some ways even worse.

China’s central bank didn’t disintermediate commercial banks entirely. It doesn’t issue the tokens directly to citizens. Neither does it operate digital wallets. But it sets the rules, accesses all data, and has its puppet or state-owned banks run them.

Via Law Gazette:

“China’s CBDC features a “centralized management model” (PBOC issuing CBDC and being at the centre of the CBDC operational system). The PBOC manages the whole life cycle of CBDC and is responsible for cross-institutional connectivity, meaning that all cross-institutional transactions need to go through the PBOC for the value transfer to occur. E-CNY wallets are subject to both “centralized management” and “unified cognition.”

CBDC operating agencies “submit transaction data to the central bank via asynchronous transmission on a timely basis,” enabling the central bank to “keep track of necessary data.” E-CNY would “revolutionise” the regulator’s capacity to “scrutinise the nation’s payment and financial system” with additional powers to track how money is used. E-CNY is to provide China visibility into the use of e-CNY and “allow China to use big data generated from” e-CNY transactions. Essentially, the centralised system of E-CNY contrasts with private cryptocurrencies that are “designed to disperse power away from the government.”

So while the central bank doesn’t directly administer wallets, it has full, direct visibility into all transactions settled in digital yuans.

And just as we speculated about a digital dollar, the digital yuan is no longer held with commercial banks. The e-wallets are just the user interface. The actual tokens sit on the central bank’s balance sheet.

Via Law Gazette:

“The balance in a bank deposit account represents a liability of the bank, whereas a DCEP in a digital wallet (both the digital RMB wallet and the sub-wallet) represents a direct liability of the PBOC, and the digital wallet offered by the bank is just an interface to allow users to access their DCEP“

In other words, China’s central bank, and by extension, China’s communist party, controls all circulating digital yuans. And that gives them the surveillance powers that go beyond the imagination of Black Mirror’s scriptwriters.

For example, the digital yuan offers its users only “controllable anonymity.” While its transactions can be anonymous between transacting parties, the issuing authority (PBOC) records all personal data.

There’s speculation that the digital yuan could even be integrated into China’s social credit system to financially cut off “inconvenient” people from the regime. Bloomberg has described potential scenarios:

“The PBOC has also indicated that it could put limits on the sizes of some transactions, or even require an appointment to make large ones. Some observers wonder whether payments could be linked to the emerging social-credit system, wherein citizens with exemplary behavior are ‘whitelisted’ for privileges, while those with criminal and other infractions find themselves left out. China’s goal is not to make payments more convenient but to replace cash, so it can keep closer tabs on people than it already does.”

Monetary Autocracy in a Convenient Wrapper

It’s hard to say when a digital dollar will be introduced, but it’s clear it’s happening one way or another.

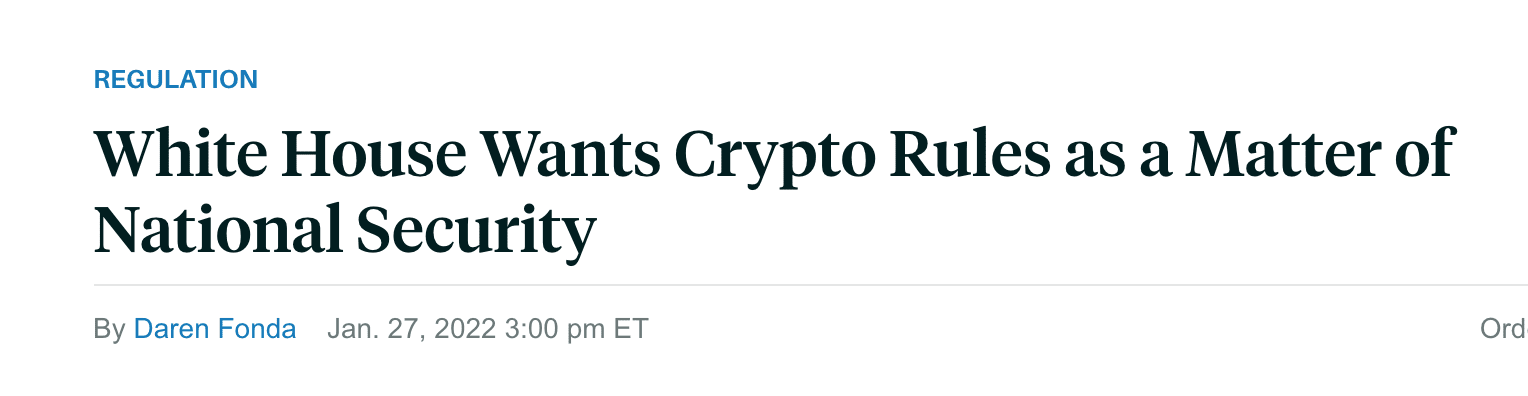

Remember the discussion about the crypto pump and dump? Policymakers are already looking into ways to tame it.

Mark my words. They’ll use speculation frenzy in the crypto market as an excuse to slap a damper on private coins and introduce a “safer” government-backed digital currency in their place.

In fact, Ivan predicted this many years ago when he said that the rise of crypto was the new stimulus, and that it had only been allowed by governments and the Fed because it’s a testing ground for state-owned digital currencies

That’s precisely what China’s leader XI did before rolling out the digital yuan.

The irony is we often look down on autocracies with a patronizing grin. Yet, when our policymakers toss around the same despotic measures, the declared weapon of authoritarians suddenly turns into a “convenient” democratic idea.

I guess we are just better at sugarcoating stuff.

Seek the truth,

Carlisle Kane

A digital currency was actually predicted starting in the book of Daniel and finished in the book of Revelations. And yes, its a communist dream because communism is nothing other than godlessness. The digital currency will be the way to ensure that no one shall be able to buy or sell without the mark of the beast. It proves that the scriptures are true and being fulfilled. Where will you spend eternity?

Carlisle,

Chicken little was right, thanks for your insight.

I appreciate what you’ve told us, but would also appreciate thoughts on how to minimize damage to our financial futures from what I have accepted as inevitably coming.