It’s always a conspiracy theory…until it isn’t.

For example, the creation of the Federal Reserve has always been shrouded in secrecy and conspiracy. Many even believe that those who stood in the way of its creation and eventual power grabs were assassinated – including the likes of Abraham Lincoln and even JFK.

The reality is, we’ll never truly know what happened.

But we do know about the “secret” Wall Street gathering, disguised as a duck hunt, that led to the creation of the Fed.

While it sounds like an outlandish conspiracy theory, this is an indisputable, well-documented fact. (In just a bit, I’ll tell you how it ties back to today.)

Knowing that, have you ever wondered why the Fed’s policies seem so tilted toward the elite?

In a previous letter, I revealed how the Fed set off the biggest asset inflation in history and how it’s quietly pricing the working class out of retirement and homeownership.

Well, it looks like the “official” inflation is quickly picking up, too.

- Used cars up 26%

- Gas up 50%

- Utilities up 26%.

- Meanwhile, alternative data shows rents (which aren’t included in CPI) rose a whopping 10.2%.

All of that in just one year!

So much for transitory inflation.

And yet, the Fed remains idle. It spins the same broken record that its policies are necessary to shore up the economy. But are they?

We’ll “fact-check” that in a moment.

But first, let’s wind back to a century ago to look at the Fed’s evolution. This will help us better understand its role in the economy, governance framework, and most importantly, the underlying conflict of interest.

America Before the Fed

Since America was founded, it has fiddled with the idea of a centralized banking system. However, most attempts throughout were unsuccessful.

As you can imagine, the idea didn’t fly with Americans – Americans who built the United States based on the principle of freedom. They feared that an all-controlling bank would become a powerful entity for the elite, used to separate the rich from everyone else.

In fact, before 1913, America was the only major economy that ran without a central bank.

However, without the ability to create money on demand, America’s fractional reserve banking system was very fragile.

For example, when something bad happened (say, a natural disaster), and people had to withdraw more cash than usual, some banks wouldn’t have enough money on hand. When that happened, those banks failed. We call this a bank run.

Bank runs led to bank failures, which led to more fear. This fear caused the surviving bank customers to take out deposits. In turn, more banks went belly up, and the vicious cycle raged on.

The result was widespread bank failures that led to some of the most destructive depressions in America’s history.

Then came the panic of 1907—America’s last and most severe banking crisis before the Fed.

It all began when Knickerbocker—one of the then-largest banks in America—funded its president’s plot to corner the copper market. When the trade went south, depositors found out and lined up to take their money out.

Knickerbocker collapsed, and people began gobbling up cash all over the nation. Banks even stopped lending to one another, afraid that anyone could be the next Knickerbocker.

It was the Lehman Brothers moment of the past – just a whole lot worse because, unlike 2008, banks couldn’t fall back on the Fed for extra cash.

But this disastrous moment meant opportunity for one of the biggest players in the nation: John Pierpont Morgan.

As the most influential banker at the time, J. P. Morgan convinced New York banks to lend their reserves to the troubled banks to save the banking system.

The bailout worked.

And this convinced America to overhaul its banking system.

How JP Morgan and Friends Created the Fed

Creating a central bank was not so much an economic challenge as it was a political one. People have always distrusted banks—especially a “parent” bank that controls all the banks.

So, Nelson Aldrich, a senator who oversaw the nation’s financial matters, brought some of America’s most influential men in finance into a secret gathering.

The invite-only list included three policymakers and three top Wall Street bankers, including Henry Davison, a former senior partner at JP Morgan.

The meeting was so classified it was right out of a James Bond movie.

It was disguised as a duck hunt at J. P. Morgan’s remote resort on Jekyll Island. The attendees didn’t even use their last names in order to hide their identities from the staff.

They knew if word got out that Wall Street was involved, the plan would never pass Congress.

After nine long days, the secret committee hatched a bill to create the Federal Reserve System as we know it today. And Nelson Aldrich brought it to Congress.

The bill sparked a heated debate, but both sides of the aisle agreed on one thing: America needed some sort of last-resort lender to backstop its banking system.

And so, in 1913, Congress passed the bill and created the Federal Reserve, otherwise known as the Fed.

The Fed’s Role and How it Evolved

The Fed started—at least theoretically—as an independent organization.

Its decisions didn’t have to pass Congress or get the president’s sign-off. Probably because at that time, the Fed had one simple, non-arbitrary job: to act as a lender of last resort.

If another bank run occurred, the Fed could simply step in and temporarily loan the banks money.

With great power comes great responsibility. So, over time, the Fed’s duties expanded.

For example, after the 1970s inflation breakout, the Fed set “price stability” as its #1 mission. Shortly after, Congress gave the goal of “full employment” to the Fed.

The Fed has operated under this dual mandate ever since. Which means…

1) Today, the Fed has two and only two jobs: ensure stable prices (defined as ~2% PCE inflation) and max out employment – over everything else. It does this by controlling long-term interest rates.

2) While its policymakers are politically independent, their powers are somewhat restrained by rule-based governing.

But is that the case today?

The Fed has Already Met Its “Goals”

In the last letter, we discussed how asset inflation has not only led to the rich getting richer and the poor getting poorer, but how it is pricing people out of retirement.

And while this “priced out of retirement” isn’t one of the Fed’s mandates, its policies have undoubtedly created the biggest asset inflation in history.

Meanwhile, things that actually fall under the Fed’s duties are now way above their targets, too.

PCE inflation blew passed 2% this past March and has been climbing since. In September (last reading), it was 4.4%—which is more than double the Fed’s target and the highest level since 1990.

Unemployment has also recovered, although it’s a little more nuanced.

Here’s an excellent analysis from ZeroHedge:

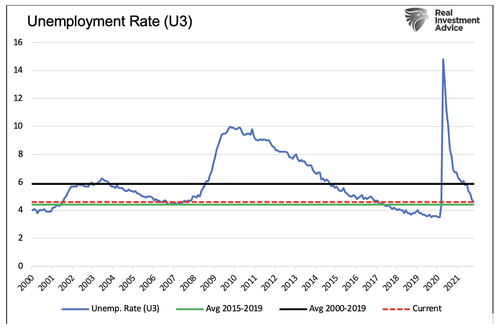

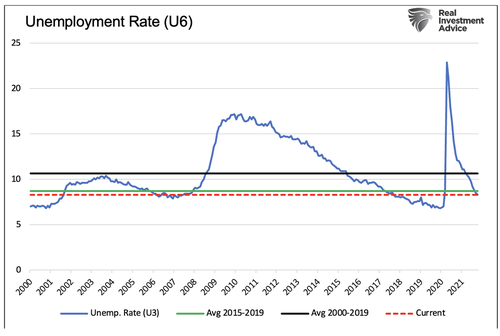

“As shown below, the popular U3 unemployment rate, at 4.6%, is only 0.2% above the average of the five years preceding the pandemic. One can argue that period was abnormal as it posted the lowest level of unemployment since the 1960s.

The U6 unemployment rate is not as well followed as the U3 shown above. U6 includes those unemployed in the U3 number but also those underemployed and discouraged from seeking jobs. Jerome Powell thinks the U6 figure is a more credible indicator given the pandemic-related dislocations. As shown below, the U6 rate is 0.4% below the average of the five years leading to the pandemic.

Both traditional measures show the Fed has met its employment mandate.”

Maybe the Economy is Too Fragile?

You could argue Covid and its economic side effects (i.e., global supply chain disruptions) are uncharted waters that call for more caution. Or maybe the economy is still so fragile that removing a bit of help will cause it to fall apart.

Those are legitimate concerns – so let’s look at that.

Let’s begin with households.

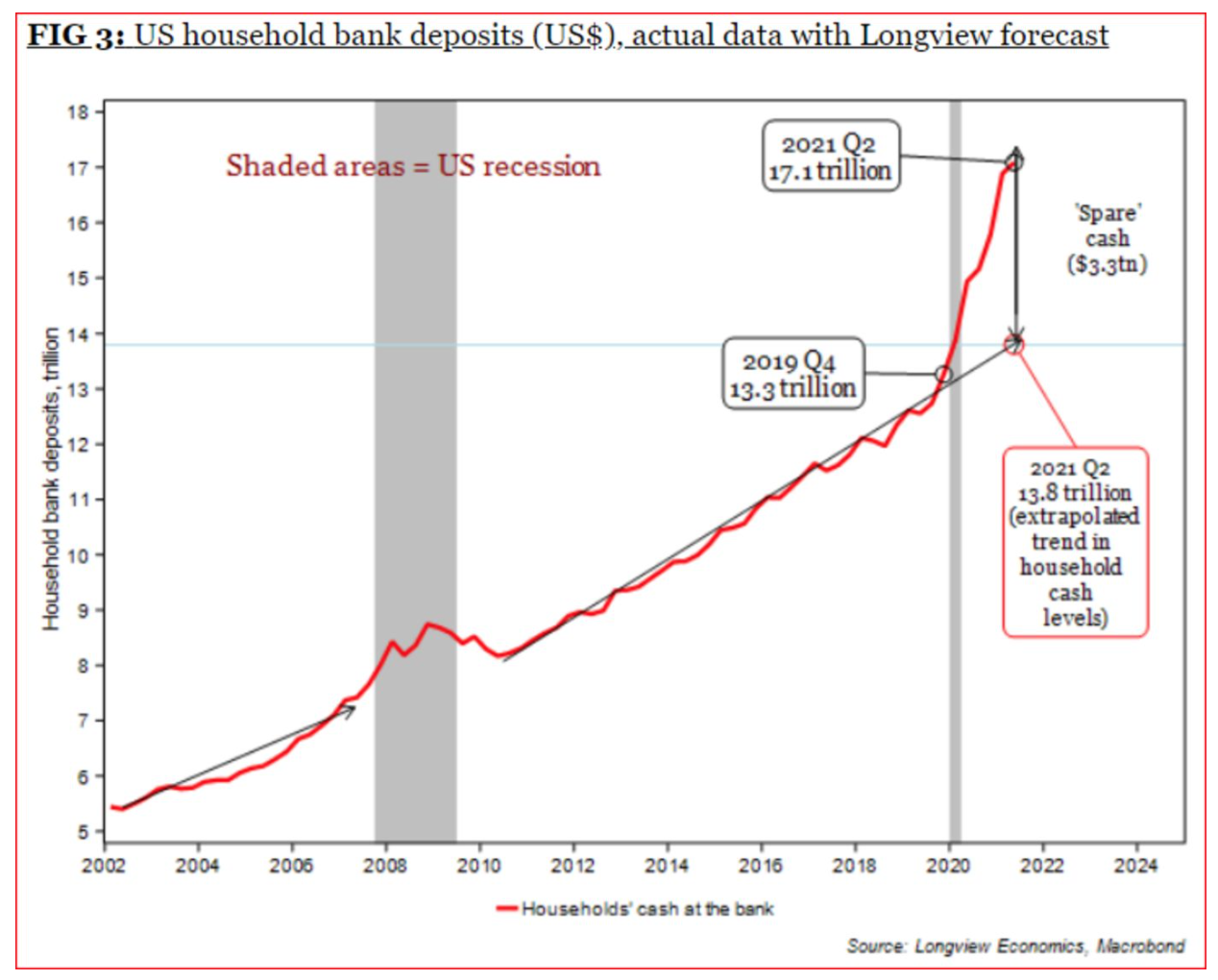

Here’s a chart that shows household deposits at American banks:

This shows Americans have more spare cash than ever – even if this data may be skewed as a result of richer families becoming richer.

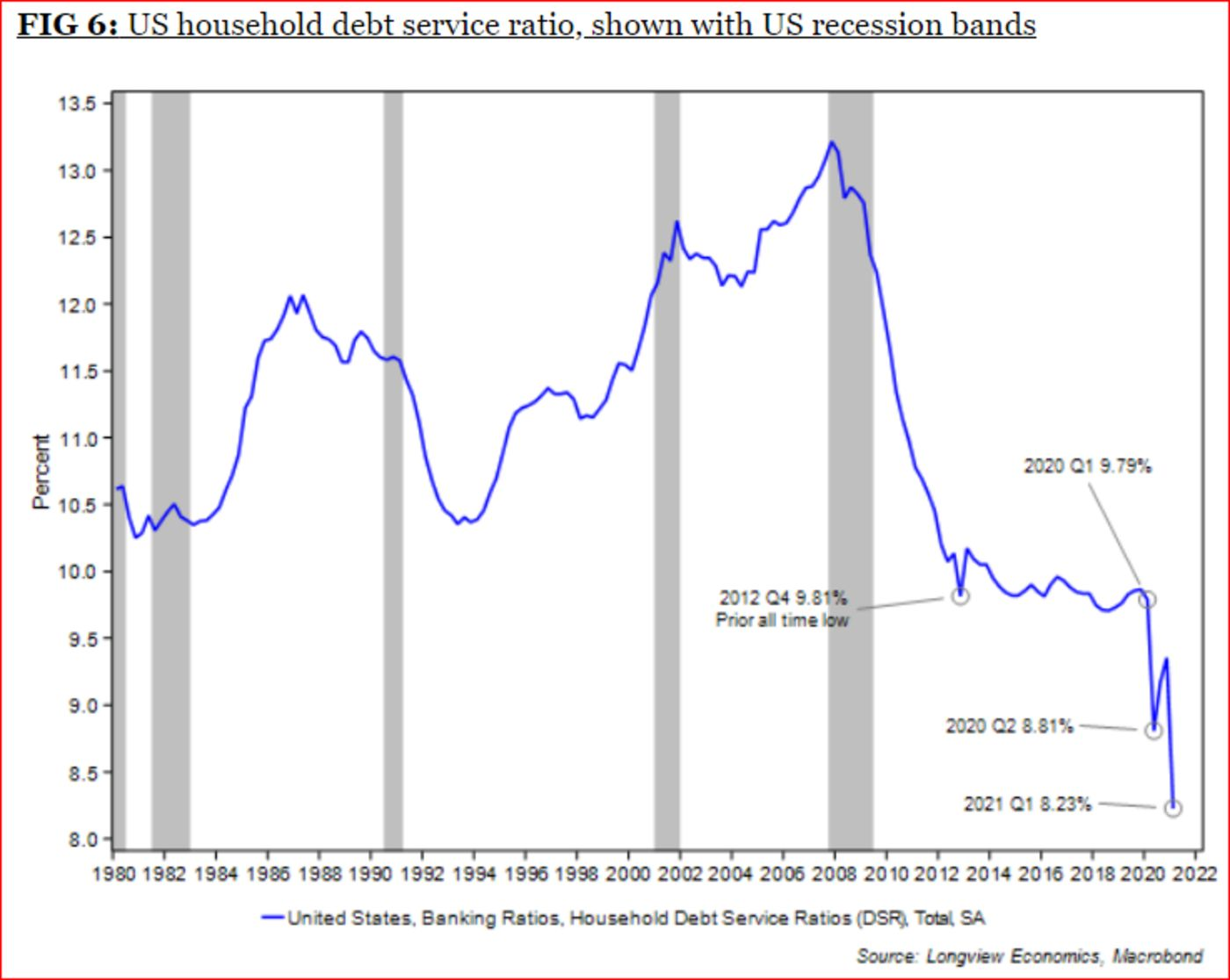

But that’s not all: Americans are now less debt-strained (in aggregate) than they have been in the past 30 years.

The debt service ratio, which shows the share of their income that goes to debt payments, is the lowest since 1980:

Of course, having interest rates at near-zero has significantly contributed to the lower debt to service ratio – when money is free, servicing debt is easy.

But, on the other hand, this shows there might be room to tighten without making things worse than they were pre-Covid.

Businesses aren’t in dire straits either. In fact, they’re crushing it.

After cost-cutting during Covid, S&P 500 companies are raking in more cash than ever. Take a look at their profit margins, which have now soared to the highest levels on record:

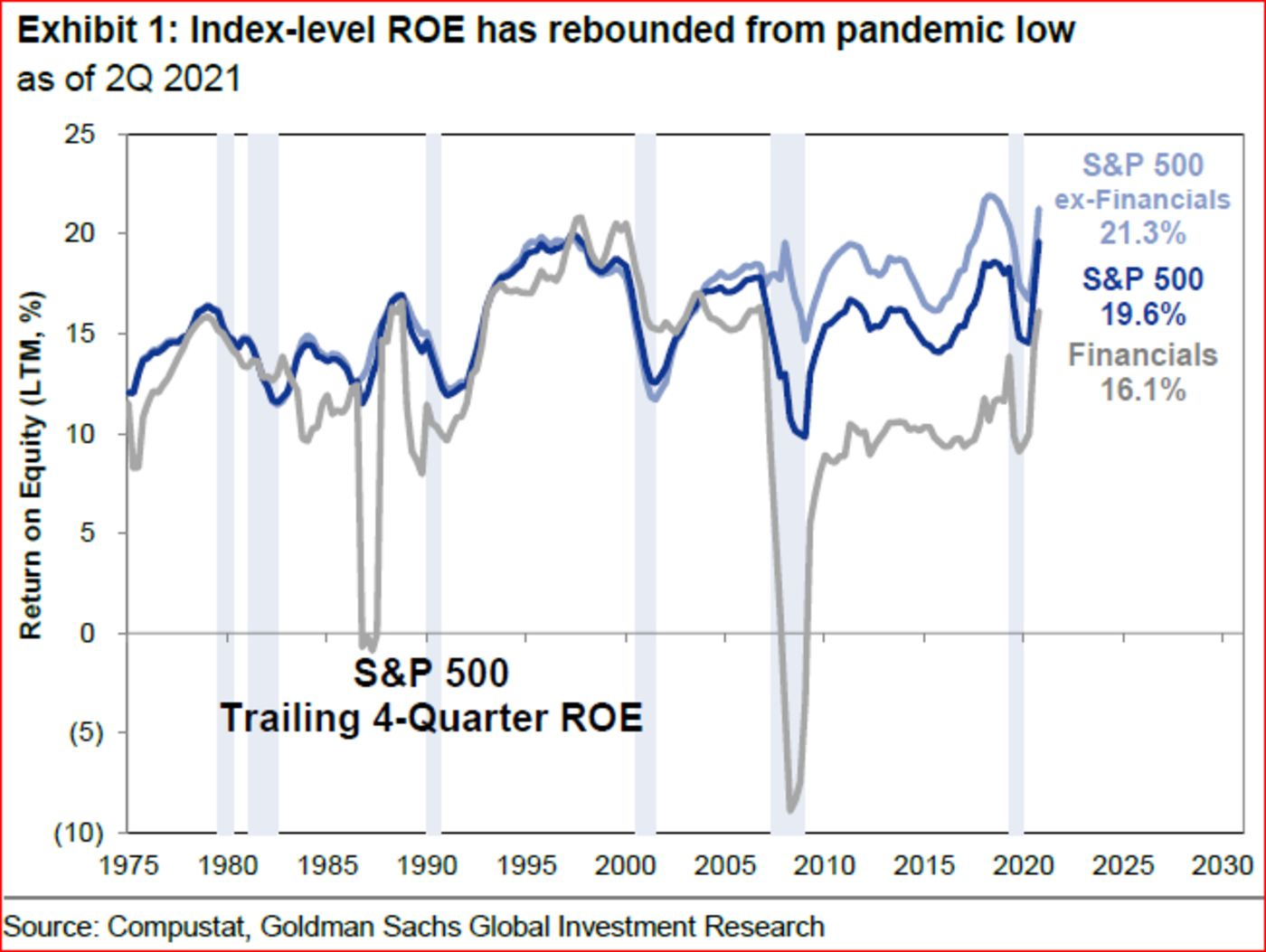

The return of equity (ROE), an even more accurate profitability gauge, hit an all-time high, too.

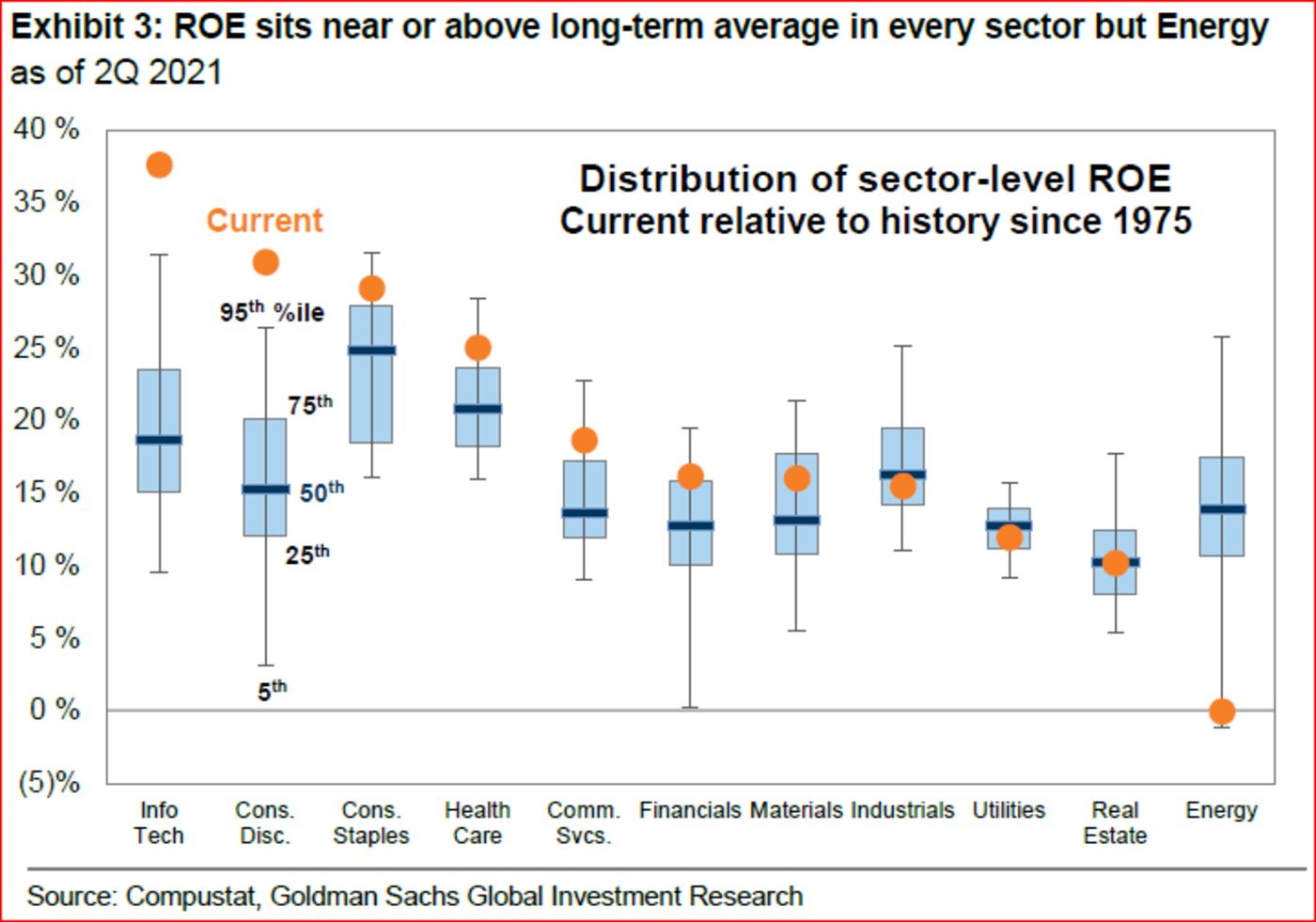

Data skeptics are probably thinking, “Well yeah, but it’s probably skewed by tech giants that made fortunes off Covid.”

But that’s not the case.

Except for energy, all sectors now earn as much or more on each dollar than they did pre-Covid. And the distribution of profits are within historical norms:

Which means this recovery isn’t just a handful of lucky companies or sectors picking up the slack. Instead, it’s an overarching boom that reaches every part of the economy.

So, does that look anything like a fragile economy? On the contrary, to me, it’s as robust as it’s ever been.

And yet, the Fed remains idle.

The Fed’s Identity Crisis

Last year, the Fed made a seemingly semantic update to its mandate that gave it many new excuses powers.

Instead of targeting 2% inflation, the Fed “will likely aim to achieve inflation moderately above 2% for some time” after periods of low inflation.

In simplest terms, the Fed will let inflation go loose to make up for years of little-to-no inflation. The goal is to average out at 2% over the long term.

Of course, the Fed skimped on detail, such as what they define as “long-term,” or how far above 2% they are willing to go.

When asked why, the Fed’s vice chair, Richard Clarida, “Fedsplained” that their formulas are too complex for mere mortals:

“The statement of longer-run goals and monetary strategy within the Fed is thought of as basically a constitutional—quasi-constitutional document, sort of at the 30,000-foot level of the parameters and objectives,” said Clarida in an interview with Peterson Institute for International Economics.

Huh?

Things got even weirder…

The supposed “politically free” organization extended its duties to partisan waters, such as economic equity and climate change.

In last November’s Financial Stability Report, the Fed spoke about the impact of climate change on financial stability. And Fed chief Powell hinted it might dictate the Fed’s policy moving forward:

“Incorporating climate change into our thinking about financial regulation is relatively new, as you know. And we are very actively in the early stages of this, getting up to speed, working with our central bank colleagues and other colleagues around the world to try to think about how this can be part of our framework.”

Then, earlier this year, the St. Louis’ Fed launched an Institute for Economic Equity “to support an economy in which everyone can benefit regardless of race, ethnicity, gender, or where they live.”

That’s right: the Fed is now both a champion of equality and a climate scientist.

Don’t get me wrong: those are important causes.

But the most powerful entity in the world, created to be the lender of last resort, just gave themselves even more power.

Even the Fed’s ex-workers admit the organization has now claimed too many powers:

“They shouldn’t be getting involved in these things even if progressive politicians want to drag them in…. Since 2008, they have capitulated on so many fronts I don’t even recognize the institution anymore. The bank I worked for is gone,” said Christopher Whalen, a former Fed researcher.

“I’m sorry, America.”

The Fed has been spinning its policies as a tool to bring prosperity for all – or so it seems.

But are they really helping the average American, or is this just a Wall Street bailout program in disguise?

If the Fed is so philanthropic, why did they turn a blind eye to record income inequality?

…Or such an uneven wealth accumulation during Covid?

…Or the biggest poverty breakout in American history?

Why is the Fed a constant revolving door between Washington and Wall Street?

For example, Powell’s predecessor, Janet Yellen, made more than $7 million giving speeches to Wall Street banks and Big Corps after stepping down from her post.

I guess her speeches are worth it since she is now also overseeing them as United States Treasury Secretary…

How’s that for a conflict of interest?

It’s no wonder Fed officials have been shrouded in one insider trading conspiracy after another…

But let’s play devil’s advocate.

Maybe the Fed didn’t intend this all along. Maybe it messed around with QE for too long and are now at a point of no return.

There’s no better way to wrap up this letter than this excerpt from a former Fed official who was part of the initial QE experiment:

“I can only say: I’m sorry, America. As a former Federal Reserve official, I was responsible for executing the centerpiece program of the Fed’s first plunge into the bond-buying experiment known as quantitative easing. The central bank continues to spin QE as a tool for helping Main Street. But I’ve come to recognize the program for what it really is: the greatest backdoor Wall Street bailout of all time.“

I’ll leave it at that.

And if you want to know what to do or how to invest from here, just use the advice Ivan has preached all along: Follow the Fed.

Seek the truth,

Carlisle Kane

I found this article to be very interesting. However, as interesting as it is this seems to still only truly help the privileged. I have nothing to invest. But definitely a good read

As you state, the fed has always been the rich and the bank’s friend. In my lifetime, greenspan, especially bernanke (who’d better never cross my path) the worst who really started the too big to fail (rich and banks) to yellen and now powell. We seniors who smelled the disaster coming in 2007 got into complete savings no risk, what is supposed to preserve principal and give a smaller return. Friggin bernanke caused it to be zero and it has basically been that since. Where is our free market? We really don’t have one. The market is run by the jews in the fed and basically the same in government. No, not a knock against the average Jew, just the government makers and billionaires who always come out on top. These jews have cost me and others my age, 72, 10s of thousands of dollars that would have been made were interest rates not artificially lowered to zero when they should have been up around 7-10%. They help who they want. A quick intervention to provide trust and safety if necessary, then get the hell out and let the free markey and real economy who should suffer, the real instigators.

This complete government takeover will never be solved at a ballot box because all in government are greedy incompetents who need a very, very permanent vacation. This will be solved in the streets and it is coming one way or another. Citizen’s waking up, or the total collapse of a $36 trillion debt that can not be sustained.

Ivan! Undoubtedly your best Letter yet. Kudos above all the very best kudos. I LOVED the ‘Maybe’ in front of ‘the Fed didn’t intend this all along. Maybe has messed around with QE for too long and are now at a point of no return.’ So obvious.

Particularly today, the ‘Powell Pivot’ appeared to have given the (WS) Bull(ies) their next rationale for turning the market north yet again. Yet even after their large show of strength late trading today – it was met with a sound doubling of volume in the other direction, much to my relief and delight.

Capitalism in America is well and truly broken (as you evidenced so nicely with this Fed historical). It is going to take a routing in the order of magnitude of the gains the Sentimental Market we’ve been experiencing for at least 5 years has produced to remedy (to whatever extent is available at this point).

Bernanke and Bush started it all with capitulating to the Duck Hunters back in 2009 when QE was implemented… and now he’s sorry? Give us all a DAMN BREAK! It would need to be the grandest Sorry the world has ever seen.

All we can hope for at this point is that fewer innocents are hurt as much as Wall Street should this 65-85% rout transpire… and for good measure – God Help Us All.