Dear Readers,

You’ve heard of Blockchain, Bitcoin and all of the cryptocurrencies and Initial Coin Offerings (ICO) taking the world by storm.

But not everything is as it seems.

In fact, while many of you are piling onto the cryptocurrency bandwagon in hopes for massive returns, a few powerful groups have other things in mind.

Today, I am going to show you the dramatic changes coming that will directly affect you and the entire global financial system.

I’ll tell you why we could witness a potential crash in the world’s most popular cryptocurrency as early as November.

I’ll even tell you why all bitcoin miners could soon become obsolete.

And most importantly, I am going to give you a completely new perspective on the rise of Bitcoin.

I promise you, it’s something that NO ONE has talked about.

Let’s get started.

Complete Control

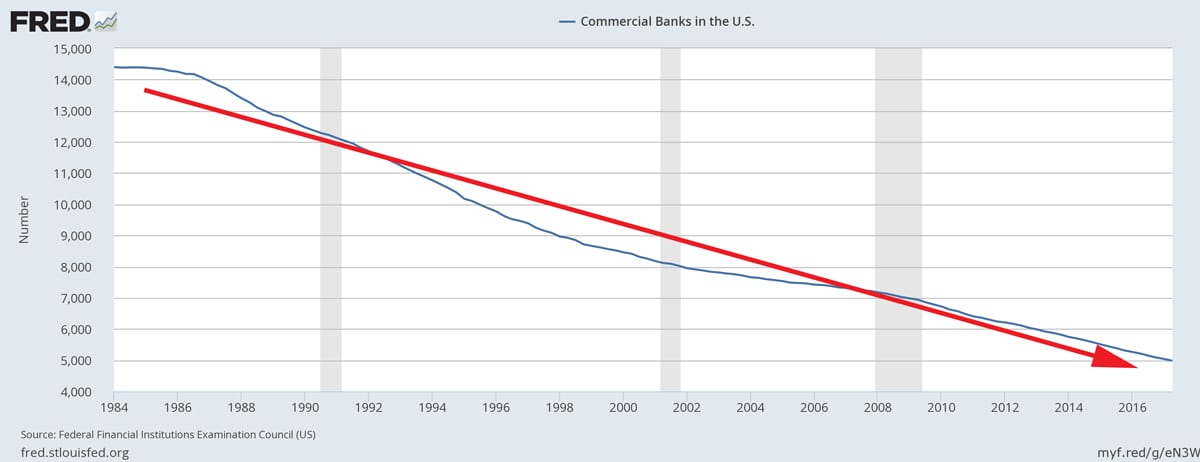

In 2012, there were around 6000 commercial banks in the US.

The top 12 controlled nearly 70% of all the US banking assets.

That means the top 0.2% of commercial US banks controlled nearly US$9 trillion.

Today, only 4,982 of these banks remain.

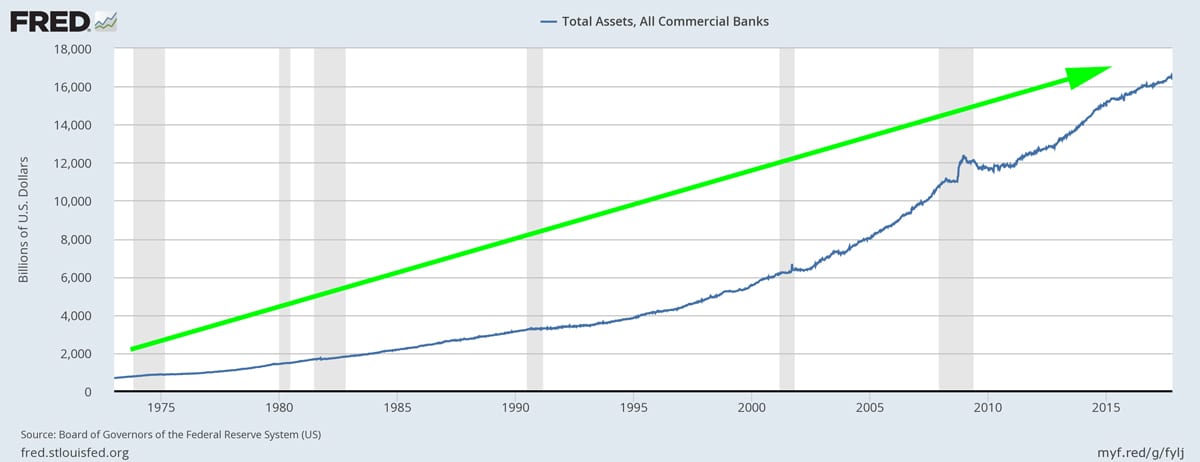

Yet banking assets have grown to nearly $16.5 trillion.

55% of these assets worth over $9 trillion now belong to the top 5 US-chartered banks.

That means the top 0.1% of the banks now control more than 55% of all the banking assets in the US.

In addition to these assets, these banks collect interest, fees, and make a lot of money by risking your savings.

And despite all-time low-interest rates, the banks represent the second-best performing sector in the market since March 2009 with quarterly earnings already beating the record-highs set in 2007.

In fact, many of them had record annual profits last year with 2017 looking to be even brighter.

In other words, the big banks are getting bigger, while making and risking more money than ever before.

But that’s just the tip of the iceberg.

Why?

Because there’s one bank that controls them all…

The Federal Reserve

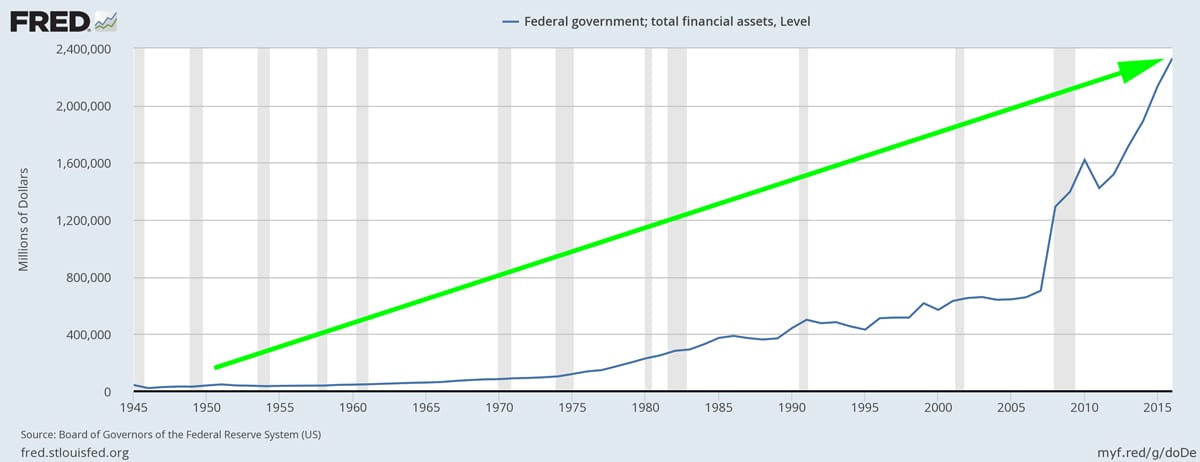

Since 2008, the Federal Reserve has been the single largest buyer of US bonds, swapping out nearly $4 trillion worth of debt and converting it into cash for the banks.

But the Fed isn’t the only central bank injecting record amounts of cash into the system.

Since 2008, central banks around the world have been responsible for more than $12 trillion in money printing and nearly $10 trillion in negative-yielding global bonds, making them the biggest buyers (and eventually sellers) of financial assets.

Take the Bank of Japan, for example, who now owns more than 40% of the Japanese Government Bond market and has already offered to buy an unlimited amount of bonds.

And it’s not only bonds.

At the end of June, the Bank of Japan represented more than 71% of all shares in Japan-listed ETFs and have only added to their position since then.

All of this coming from the world’s third-largest economy. That’s scary.

Why are Central Banks Buying So Much?

From a sinister point of view, it’s so that they can indirectly own everything (see How to Seize Assets Without War).

But from a more public perspective, they are trying to stimulate or sustain the global economy by providing free cash infusions into the system.

That’s because – unlike what you’ve been told – the US and the world’s largest economies have been facing deflationary pressures since the end of the Bretton Woods system (see How Money Works).

By deflationary, I don’t mean the price action of currency. I mean specifically growth itself.

Take a look:

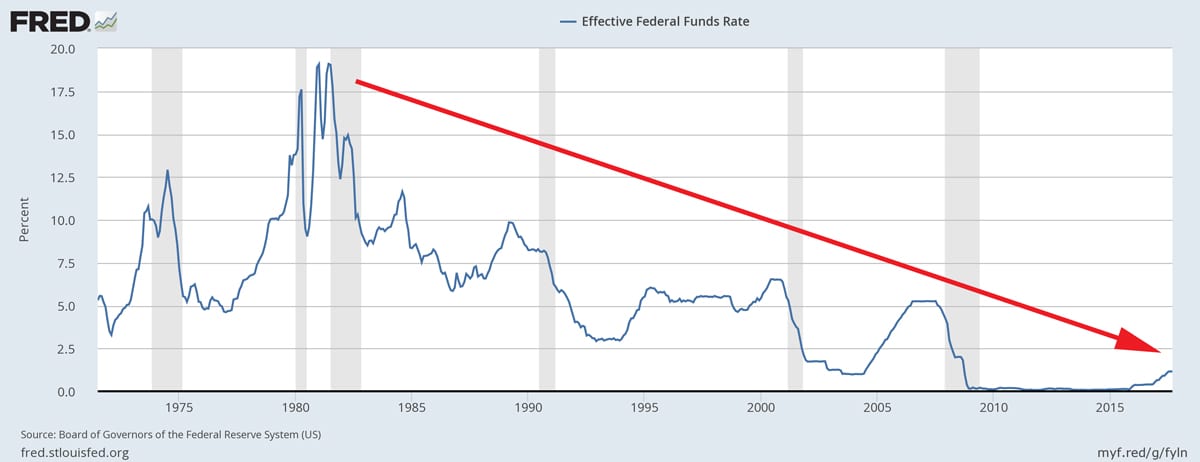

We are taught that the Fed lowers rates to stimulate the economy by creating inflation.

If that’s true, then the chart shows us we have been fighting deflationary forces for over 35 years because interest rates have only gone down.

Yet, housing and almost every consumer good has gone up in price. And every financial assets such as debt, stock markets, currency, and derivatives have all skyrocketed, too.

For example, take the financial assets of US government:

But why?

The logical explanation, but one that’s much more sinister and thus harder to digest, is that this was all done on purpose by the Fed to control the world by injecting “Fed” money across the globe.

Think about it.

The biggest lender to the US is now the Federal Reserve.

As I mentioned in my Letter, The Truth About the Fed:

“The reason experts are wrong in their inflation outlook is because they base their rationale that central banks – in particular, the Fed – want what is best for us.

I have discussed many times about the Fed’s plan to erode capital in order to preserve their system – not our economy – and that, “the Fed works only to pursue its own growth; to engulf more of society into its banking system.”

In other words, no matter how hard we try, the hamster wheel keeps spinning.

And people are finally catching on.

With the advent of the internet and the availability of information, people are finally realizing why the costs of living are so high.

They’re finally realizing why housing has become so expensive.

They’re finally realizing why their dollar simply doesn’t go as far as it used to.

They’re finally realizing that they have little control of their own money.

And they want it back.

The Rise of Bitcoin and Cryptocurrencies

There’s no doubt you have heard of Bitcoin and cryptocurrencies.

There’s no doubt you have heard of Bitcoin and cryptocurrencies.

In short, the idea of Bitcoin is simple: a digital currency with a limited supply.

Think of it as a gold-backed currency without the gold.

Like gold, you have to “mine” the currency by using resources such as computing power.

The biggest difference between Bitcoin (and other cryptocurrencies) and gold is that you can spend Bitcoin using a smartphone instead of having to deliver physical gold.

You can literally send a Bitcoin from the US to Hong Kong in less than a second.

You just couldn’t do that with gold.

In our modern era of globalization, that’s powerful.

You may think, “How is that any different than our dollars?”

Simple.

There is no such thing as a decentralized global banking system.

Do you believe in Bitcoin and Cryptocurrencies?

CLICK HERE to Share Your Thoughts

Decentralization

When you send money from the US to Hong Kong, you must go through banks (centralized), payment systems such as SWIFT, and foreign exchange services, before that payment gets to the other side of the world.

For anyone that has tried to send money overseas, this can take many days and cost a lot of money.

That’s because each gateway in the transaction is required to verify the information against the other parties’ in order to balance out the transfer.

With gold it’s simple. If I gave you my gold coin, I would no longer have it; you would.

But with digital currency, that process is very difficult to replicate because you have to ensure that the digital file was not only unique but could be replicated on the other end.

In 2008, an anonymous person (or group) by the name of Satoshi Nakamoto, created what is called Blockchain technology.

And Blockchain is the single biggest disruption to our world since the creation of the Internet.

What is Blockchain?

First and foremost, Blockchain is not Bitcoin and Bitcoin is not Blockchain – although both are assumed to have been created by the same person.

Bitcoin is simply the digital currency created using the Blockchain platform.

Blockchain is a software protocol that uses math and cryptography (encryption) to create a decentralized system.

This decentralized system distributes a digital ledger that is used to record transactions across many computers so that the record cannot be altered retroactively without the alteration of all subsequent blocks and the collusion of the network.

Let’s simplify this.

Imagine a computing block with a digital ledger.

Every time a transaction occurs, it adds the history of that transaction to the block.

This block is attached to the chain, so every other block on the chain sees it.

In other words, the block itself is managed by the network of all of the blocks and not by one individual system.

A truly decentralized system which, for the most part, doesn’t require a middleman such as a clearinghouse or bank. (More on this topic in a bit).

For example, everyone who owns a Bitcoin effectively has the entire Bitcoin bank and its ledger in their pocket.

The New Internet

Blockchain technology can change everything in the world that needs verification.

This not only includes the entire financial market such as stock trading but also processes like voting.

Imagine buying and selling shares directly with the owner or buyer of those shares in real-time without a clearinghouse (goodbye short sellers).

Imagine no more recounts on Presidential votes.

The power of Blockchain is transparency and that’s why it is the single most important technological development of our era.

I’ve simplified this but to truly understand how Bitcoin and digital currencies work on the Blockchain, I strongly suggest you take the following free online course from Princeton University:

https://www.coursera.org/learn/cryptocurrency

The Potential Problems with Current Blockchains

While Blockchain could revolutionize entire industries, it’s not without its problems.

You see, the more information the “block” stores, the harder it becomes to scale the system.

For example, when Bitcoin was first introduced, it had only one megabyte (MB) blocks.

It takes the Bitcoin protocol around 10 minutes to mine all of the transactions that took place on every block.

But over the past year, the number of transactions occurring in each one of these blocks has grown tremendously.

So much so that the one MB amount of space allocated to each block wasn’t enough to record the many transactions that were taking place.

In other words, there is a serious problem on how to handle the potentially infinite number of transactions that could take place in the future.

The New Middle Man

Many other applications have been created to alleviate the Bitcoin protocol limits, including, for example, the Lighting Network.

The Lightning Network is a potential off-line solution to the bitcoin scalability problem.

In short, the Lightning Network transacts and settles Bitcoin and other cryptocurrencies off the Blockchain by computing the transactions on its own before sending it back to the network.

But when you start adding these types of solutions, the costs associated with transacting in cryptocurrencies also goes up because these networks take a small fee for doing so.

That’s why over the past year, transaction costs for Bitcoin have gone up.

If that is the case, then the idea of Bitcoin itself is no better than the current fiat currency system because the middle man and their fees are back in play.

Now get ready because the scalability problem is one of the reasons why a potential crash in Bitcoin could be coming as early as next week.

Bitcoin to Crash in November?

The Bitcoin community knew long ago that the limitations of the Bitcoin protocol were coming because transactions were already nearing the one-megabyte threshold for the block size for quite some time.

So the “developers,” whoever they are, have already looked at implementing solutions to this bottleneck.

This solution is called Segwit 2X.

Segwit 2X

Segwit 2X is a solution broken down into 2 parts.

- Segregated Witness (Segwit)

- Double the size of the block (2X)

The first part alters how some of the data is stored on the network so that more data can be stored in each block.

In essence, it allows people to do “off-block” transactions and then put them back on the chain after. This is already in play (but still developing) and includes networks like the Lightning Network which was adopted in August.

The second part is simply upgrading the size of the block. This protocol is expected to be triggered three months after the first part was activated, and it is assumed that the second part is to activate in November.

Since the first part of Segwit 2X has thus far been successful, many in the Bitcoin community want to avoid upgrading the Bitcoin protocol in November because the second part of Segwit 2X is much more difficult to implement.

Why?

Because upgrading the Block means having to introduce a new block altogether to replace the old one.

That means we could end up seeing two versions of the Bitcoin on the networks and they might not be compatible with one another.

If that happens, we could end up having two coins trading against each other which could lead to numerous issues.

Do you think Bitcoin will crash?

Click Here to Share Your Thoughts

A similar scenario happened earlier this year to the cryptocurrency Ethereum, which resulted in a major loss of its core value after hackers stole more than $50 million worth of Ether coins due to the split.

Of course, there are all kinds of security systems in place to handle this sort of thing, including what is known as replay protection.

I won’t get into the details of this but what you should know is that the same thing that happened to Ethereum could happen to Bitcoin in November.

If you own Bitcoin, the simplest way to protect against this crash or the potential of a hack on your coins is to take your coins and store them away in a hardware facility off the grid before the fork potentially happens in early November.

Once the Bitcoin community and its developers figure it out, then you can pull them out and put them back on the chain.

I am not here to tell you to invest in Bitcoin, but rather the concept of it. But if you are looking at making the jump, it may be wise to wait and see what happens in November.

Why Bitcoin Miners Could Soon Be Out of Business

Now that you understand Blockchain and Bitcoin a little more, I want to tell you why Bitcoin miners and other cryptocurrency miners could soon be out of business.

Mining Bitcoins takes a lot of computing power. That’s why big computer facilities exist to mine these coins because your computer just isn’t powerful enough.

But what if, using the same decentralized concept as Bitcoin, computing power could be shared across the entire network? What if your computer’s power could be used to help mine these coins?

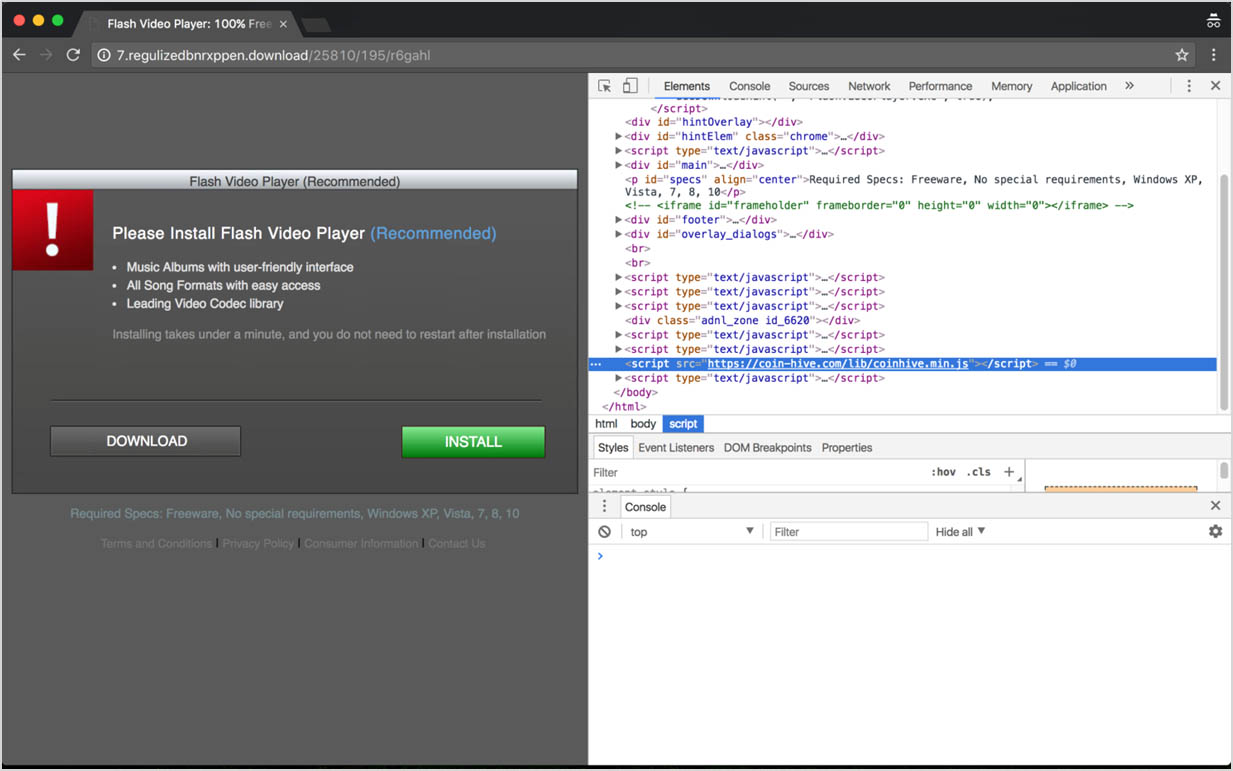

That’s precisely what’s happening now.

In fact, your computer could be helping hackers mine cryptocurrencies as we speak.

Last month, Kaspersky Labs revealed that 1.65 million computers had been infected with mining malware and placed in massive botnets this year.

They do this by installing “cryptocurrency mining malware” onto your computer and then using your computer’s resources to mine cryptocurrencies.

According to Checkpoint, hackers have likely made a lot of money doing it already because an attacker successful enough to average 1,000 concurrent users across all infected sites could generate $2,398 in monthly revenue.

Considering that Kaspersky Labs estimated that 1.65 million computers were infected last month (and likely more now), hackers could be easily raking in $3,956,700 worth of cryptocurrency every month.

Aside from hackers, there are already companies out there that pay a small fee to you if you let them use their mining code on your computer.

I suspect that as cryptocurrencies move forward, we’ll see more implementations of these programs in place whereby anyone can benefit from the mining of cryptocurrencies – especially as computers become faster and more powerful.

There’s going to be a lot of money made in the Blockchain space in the coming years and I am certainly looking at investing in a whole bunch of deals.

However, I warn you to be very careful when investing in the Blockchain space as there are numerous deals being launched to take advantage of this boom. And just like the dotcom bubble, it will likely end tragically for most.

Of course, the ones that succeed could make millionaires out of many and trading in and out of them based purely on market momentum can be very profitable.

Just. Be. Careful.

A New Perspective on Bitcoin

I promised that I was going to give you a completely new perspective on the rise of Bitcoin.

One that NO One has talked about.

Today, Bitcoin is worth is nearly US$6000.

With 21 million Bitcoins, that’s a market cap of US$126 billion.

That value is enough to challenge many world currencies.

And that’s why many argue the price of Bitcoin can go way higher – even if it crashes in November.

But while the world is on this Bitcoin craze, they have forgotten to ask the most important question:

“Who really created Bitcoin?”

The Conspiracy Behind Bitcoin

No one knows who created Bitcoin.

Right now, the creator of Bitcoin has been dubbed Satoshi Nakamoto.

Last year, Australian entrepreneur Craig Wright told the world he’s the inventor of the Bitcoin.

Of course, we already know that’s not true.

So who really created Bitcoin?

More importantly, how did the governments of the world and the powers that be allow it to become so big?

Remember, money/currency is the most highly regulated industry and the creation of digital currency is technically illegal in most parts of the world – especially the United States.

How does a digital currency created by no one grow to achieve a $126 billion in liquid value?

How does the total market cap of all cryptocurrencies grow to be worth over US$166 billion?

I don’t know the answer but I can tell you it’s not what it seems…

Who do you think created Bitcoin?

CLICK HERE to Share Your Thoughts

The Reality of Bitcoin

I’ll be honest, I never believed crypto-digital currencies and ICO’s to be real. Because when you look at it from an honest perspective, it really is creating something out of thin air.

Someone creates a new currency and markets that currency to everyone through an Initial Coin Offering.

Sure, it uses Blockchain technology so it can be tracked, but is it any different than say, Bestbuy Rewards points or points you collect on a Visa? Is it any different than creating baseball cards and saying you’re only creating a limited supply of them?

But when you think about it, cryptocurrencies are no different than our dollars today. The Fed and central banks around the world have already printed money at will and taken over our financial markets.

The only difference between fiat currencies and crypto-digital currencies is that the latter aren’t controlled by government or banks.

Or is that simply what we are led to believe?

Cryptocurrencies: The New QE

My goal of this letter is to have you look at things from different perspectives and not to fall into the habit of believing everything that you’re told.

Question everything.

What I am about to tell you may be true, but it could also be completely wrong. It is up to you to decide what is right and wrong given the information.

Over the past years, I have talked about how to solve the world’s debt problems by moving away from current fiat currencies and how countries around the world are preparing for a major reset.

I have written about these topics as far back as 2009 in my Letter, “A New World Currency: What the Government Doesn’t Want You to Know,” and as recently as last month in my Letter, “How the US Dollar Will Collapse“.

While every economist and market guru questions how the world will move forward without economic stimuli such as QE or helicopter money, they have forgotten to ask the one most important question:

“Is Bitcoin/Cryptocurrencies the new QE?”

Think about it.

The effectiveness of central bank policies is already being questioned. So how can they stimulate the global economy without adding more to the already ballooned balance sheets?

Simple: With new currencies controlled by no one…cryptocurrencies!

Bitcoin itself has already added over $120 billion in free money without affecting a single balance sheet.

Could that be the reason why governments around the world have allowed cryptocurrencies to exist?

Is Bitcoin the new Stimulus?

CLICK HERE to Share Your Thoughts

Just remember, the powers-that-be and the governments of the world would never allow their control to slip…

Big Government Still in Control

Recall my Letter from last year, “Can the Fed Buy Stocks?“:

“Regardless of who is elected to head the US, world economic conditions will continue to deteriorate and we’ll begin to see central banks around the world openly coordinate policy.

And who will likely lead this charge?

The IMF – an organization with no debt, half a trillion dollars of SDRs (worth about $659 billion based on the devaluation of currencies within the basket), and a world of power (see A Simple Solution to the World’s Debt Problem).

As suggested during the Jackson Hole Conference, many central bankers are arguing for “new tools” to fight future fiscal downturns.

And since the idea of negative interest rates was not mentioned by the Fed, we could see them raise the inflation target, or adjust the relative value of currencies through agreements with other countries instead of allowing free markets to determine the value of currency.

…In other words, they could revalue currency and inflation through a single directive.

This strategy becomes even more apparent when you consider the role of the Bank for International Settlements.

The Bank for International Settlements is an international financial institution owned by central banks which “fosters international monetary and financial cooperation and serves as a bank for central banks”.

The reality is that central banks already coordinate policy privately, but it’s preparing to do it publicly – all it needs is that “economic reset.”

They would say, “desperate times call for desperate…”

With that in mind, it’s no surprise that just earlier this month, it was revealed that the IMF is looking into the idea of turning their Special Drawing Rights (SDR) into some form of Blockchain Cryptocurrency.

IMF to Create SDR Cryptocurrency?

“…The head of the International Monetary Fund has been musing about the future of money, and thinks there is a decent chance it will come from the guardian of the world’s monetary system.

IMF managing director Christine Lagarde held up the organisation’s special drawing rights as having a possible digital future at a Bank of England forum last week, and put what she said was a “question mark” over whether SDRs could replace existing international currencies.

“It’s not a far-fetched hypothetical,” she said, and the IMF needed to be ready.”

Furthermore, this could allow a one-central bank global system that could infuse the world directly with free money – a way to solve the world’s debt problem, as I mentioned in my Letter, “How to Solve the World’s Debt Problem“.

WSJ Continued:

“Instead of representing a basket of currencies, the digital SDR would be a currency of its own, albeit one only used for international transactions.

A more limited alternative would try to speed global growth. At the moment, countries hold big piles of US dollars as a form of insurance against a balance of payments crisis, dampening growth and distorting the world economy. If the IMF was empowered to act more like a global central bank, whisking up new SDRs on its own blockchain in a crisis, it would reduce the need for countries to hold reserves.

Jose Antonio Ocampo, a Colombian central bank board member also on the IMF’s expert group considering the future of the SDR, thinks annual SDR issuance could be worth $US200 billion-$US300bn ($256bn-$385bn) a year. “Countries would not have to accumulate reserves, which generate a general contractionary effect on the global economy,” he says.

The prospect of giving the IMF the ability to execute global helicopter drops of money worries believers in strong currencies.”

In other words, there could be a reason why governments around the world are letting cryptocurrencies run rampant:

- To temporarily infuse free money into the system “off-the-books”.

- To implement Cryptocurrencies of their own once the technology is proven and accepted (or once it fails and they step in to save the day).

Even competing world powers such as Russia are getting involved.

The Russian Crypto-Ruble?

Despite Russian President Vladimir Putin calling for improved regulation of bitcoin trading, Russian cryptocurrency projects have been moving forward.

Via Bloomberg:

“…Despite the regulatory questions, some Russian cryptocurrency projects have been moving forward. A company co-owned by the president’s internet ombudsman, Dmitry Marinichev, had raised $43 million in an ICO to fund a domestic digital currency-mining operation.

Sberbank PJSC, Russia’s largest bank, is studying the possibility of opening cryptocurrency accounts at its Swiss unit, Tass reported last month, citing the head of Sberbank CIB Igor Bulantsev.

In June, Putin met with Vitalik Buterin, the founder of the world’s second-largest cryptocurrency after bitcoin, and gave his blessing for Russia to develop blockchain, the technology underlying the instruments.”

In fact, it seems that Putin is already on a path to launch a new crypto of his own.

Via Russia’s Sputnik:

“After months of speculation and conflicting messages, ministers have announced the Russian Federation is to issue its own official cryptocurrency – the CryptoRuble. The landmark development makes Russia the very first government in the world to officially pursue virtual tender.

The Russian Federation is to issue its own official cryptocurrency, the CryptoRuble – the virtual money will be blockchain-based, but regulated and tracked by the government.

… the state-issued CryptoRuble cannot be mined, and will be issued and controlled and maintained only by authorities.

They can be exchanged for regular rubles at any time, though if the holder is unable to explain the source of their CryptoRubles, a 13 percent tax will be levied. The same tax will be applied to any earned difference between the price of the purchase of the token and the price of the sale.

“I confidently declare that we run CryptoRuble for one simple reason: if we do not, then after 2 months our neighbors in the EurAsEC [Eurasian Economic Community] will,” Nikiforov said.

The CryptoRuble does appear to be blockchain-based, however, which ensures a degree of decentralization and could help prevent things like online fraud. The ability to freely exchange the currency for hard tender suggests an official exchange is likely, alongside unofficial markets.

The minister added the CryptoRuble will be based on Russian cryptography and its development is not going to take long.”

If you think Russia is alone, think again.

The New China Crypto-RMB?

Despite banning other ICO’s, the world’s second most powerful country, China, has already been testing its own state-run digital currency.

Via China Daily:

“The People’s Bank of China, China’s central bank, has completed trial runs on the algorithms needed for digital currency supply, taking it a step closer to addressing the technological challenges associated with digital currencies, according to a top official associated with the project.

Yao Qian, director-general of the Institute of Digital Money at the PBOC, said China’s central bank has successfully designed a prototype that can regulate the supply of its future digital fiat currency.

The successful simulation of money supply paves the way for the central bank to become the future sole regulator and policymaker governing the value of digital fiat currency, said Yao.

Digital fiat currencies are the digital forms of a sovereign currency that is backed by the central bank.

Unlike Bitcoin or other digital money issued by the private sector, the digital fiat currency has the same legal status as the Chinese yuan, the only fiat currency issued by the People’s Bank of China.

There is no timetable for the introduction of the currency, but once introduced, China is likely to become the first country that would deploy a digital fiat currency.

China’s central bank has been actively preparing for digital fiat currencies since last year.

Earlier in June, the central bank finished several digital money trials involving fake transactions between it and some of the country’s commercial banks.

“China has been at the forefront of digital payment technology development,” said Di Gang, a senior engineer of the institute.

“However, it would still be some time before the currency goes public,” said Di, adding that, “the central bank is proceeding very cautiously.”

…”The central bank might be able to start trials in some developed regions such as Beijing, Shanghai and Guangdong province, and see how citizens respond to the digital currency,” he said.

The development of a digital currency comes at an opportune time for China, said Yao.

The rapid development of the electronic payment sector and thriving private digital currencies have made it imperative for China’s central bank to move quickly in digital finance.

Looking ahead, deploying the digital fiat currency is expected to be smarter and more intelligent compared to the payment providers using existing currencies, such as Alipay, according to Yao.”

Could it be coincidence that China’s central bank just told the world that the RMB’s reserve currency role will gradually emerge?

Via China Global Television Network:

“The People’s Bank of China (PBOC), China’s central bank, said it will push forward the renminbi internationalization and its function as a reserve currency will gradually emerge, adding that more than 60 countries and regions have included the renminbi in foreign exchange reserves.

…”Looking ahead, the scope of international usage of renminbi will be further expanded in 2017 and usage channels will be further widened,” the central bank said in the report.”

Combine this with China’s new oil benchmark to be launched later this year, and this could be the start of the Crypto-RMB movement.

The move to a cashless society is beginning all over the world (see my Letter, the Cashless Society Revolution).

Bitcoin and other cryptocurrencies are being used as a scapegoat to familiarize society with the concept of a cashless society.

And judging by its acceptance, it’s working.

Get ready.

Do you think governments will create their own cryptocurrency?

CLICK Here to Share Your Thoughts

End of Chapter

Despite the Bitcoin movement being touted as an unstoppable force, governments around the world can at any moment put a ban and implement severe penalties on anyone trading Bitcoin or other digital currencies.

Why are they allowing these currencies to play out?

Could they be creating their own new monetary system as I described?

Could they be allowing everyone to pour money into these currencies, only to crash them so that the people will once again only rely on fiat, or rather digital, currencies controlled by central banks?

Furthermore, since Bitcoin ownership can’t really be traced, could the US, the Fed, or other central banks through private holdings be the biggest holders of Bitcoin?

Could the Fed, the IMF, or another major organization be the true creators of Bitcoin?

When you consider that civilization have always had leadership, whether it’s government or other entities such as banks or secret rulers, the idea of these central banks and their intervention makes sense.

As the population grows and technology allows us to live longer, the world becomes a smaller place and its resources become scarce.

In order to conserve these resources, the price of these resources have to increase; otherwise, we run out of resources rather quickly leading to the end of humanity.

Here’s an easy way to look at it.

If everyone could afford an acre of land, then we would run out of land extremely quickly and we would run out of places to live.

How do we solve that?

By making land more expensive so that not everyone can afford to buy an acre.

And that’s precisely what’s happening around the world; homes are getting smaller and the costs of living are rising.

Jobs are being taken over by robots, and basic income (See These Six Events Will Determine Our Future) is now a very real option for many parts of the world, including here at home.

An easy way to launch basic income is to create a new crypto-digital market whereby the entity controlling it can easily add money to its citizens at will – think IMF and its potential influence on removing the role of reserves.

The problem is that our generation only thinks of today and not tomorrow.

Today, we have Bitcoin and other digital cryptocurrencies.

Tomorrow, we’ll have CryptoRubles, CryptoYuans, and CryptoGovernment currencies.

Tomorrow we’ll have a cashless society.

Seek the Truth,

Ivan Lo

All cryp[to currencies are going to crash sooner or later, They are no different than any other new technology

I am so happy to be in the final quarter of my time here on earth so that I hopefully be able to escape from most of all of the new technology. The concept of even beginning to understand crypto currencies escapes me. I neither want or need to engage in social media where no one minds their own business, bitcoin and soon computers in general as there is no privacy or freedom to do or say what one feels without risking condemnation if someone is offended and we all know you can’t please everyone nor should you try to. When surfing some shopping websites to view some products I might want , they bombard me with the products I researched on other websites I use. I am so sick of being tracked, hacked, and bombarded that i will soon be tossing out all of this useless electronic baggage and withdraw into a remaining life of total privacy and serenity. No wonder people are becoming so impatient , violent and drug induced. So much for being free in a free country.

Compare Bitcoin with any Ponzi scheme and you will not see any difference. Its a fraud like any Ponzi scheme albeit on a greater scale. Instead of supposedly buying into a non-existent investment you are buying into an algorythim. In other words you are buying nothing with real money. Just like a Ponzi. Unforseen market fluctuations that create non-confidence in investors eventually brings a Ponzi crashing down and investors bankrupt. If confidence in Bitcoin diminishes, investors will want to cash in quickly. Do you believe for a minute that there is enough real money at Bitcoin to cover the run? Its a brilliant Ponzi scheme and if it crashes in November as you predict it will make Bernie Madoff look like a piker!

repeating Jamie Dimon of JP Morgan calling bitcoin a ponzi scheme…. two days later JP Morgan buys 2000 Bitcoin. It’s NO ponzi scheme…

“Instead of supposedly buying into a non-existent investment you are buying into an algorythim. In other words you are buying nothing with real money.”

Interesting… Garry, could you please explain to me what Google (or even Facebook/Amazon) is? An algorithm maybe? Could Google possibly be the biggest websearch algorithm? All these huge digital/ no-intrinsic-value companies … just ponzi schemes on the stock market….

Sorry buddy, you need to wake up and educate yourself a little.

jeez another potential nail in the coffin known as western democratic society……pardon me nail in the coffin for any human being who wants to control their own destiny……..yes the the u.s. economic noose is slowly being loosened…..and as a consequence the noose around my neck is slowly being tightened….the top 1% in the east or west will will survive……..chinas setting world trade in terms of their currency and the ability to convert to gold and these crypto currency experiments by nation states eliminates people like me……..from feeling I have planned for the future……thanks but no thanks…..the 1% will get it all.

why do I feel that it is all a Ponzi scheme…….. and I do not know what to do to protect me and mine……yes I have gold, silver,collectables and supposed blue chip dividend paying stocks….FOR WHAT PURPOSE I agree with you garry a grand PONZI SCHEME it is……welcome to the future of unknowns

and mr lo thank you for your arcticles…….love them all

No! cryptos are not the new QE! The total market caps of all the online coins are no enough to stimulate anything.Nor are the central banks or govrnments facile enough to create something like a Bitcoin-but they will catch up using their powers of arrest and jail time threats they maybe able to assemble a golem like coin which will surely be shunned by smart coin users the world over.On the positive side blockchain coins can be used by nations-like the Greeks-to exit the German controled Eurodollar,but only if they put a positive nationalist spin on the purchase if such coins.Cryptos are here to stay with profound changes to be sure,but this is just like the beginings of the aviation industry.Millions will become ‘banked’ without having to leave their remote locations-we cannot even imagine all the changes that this new money will bring.

As a non American with an American invorporsted company can my company purchase cryptic currency stocks? And can I cash in for US$?

you cash in your bitcoin for USD at a Bitcoin exchange FYI all th enew ICO market..to use the Blockchain technology requires a token/coin hence there are over 1200 coins/tokens. Think of them as blockchain apps. Bitcoin is Blockchain genesis..the 1st and most powerful and it’s power grows with every transaction. In 9 yrs Bitcoin/Blockchain has NEVER been hacked and NEVER been taken down.. there is no single point of failure. Bitcoin network is the biggest computer network that has ever existed.

Yes, I definitely agree with you, decentralized money is the way of the future….

And also to invest in these technologies, just the question of which one…??

Peter

Absolutely, that governments will move against private held cryptocurrency’s with there own block chains… The only question is which to invest in to profit from the massacre that will soon start…??

Peter

Of course they will……

Peter

I think that the Bitcoin founders are trying to get the most of their bitcoin and I would not be surprised that teh new gold bitcoin could be corrupted

Thanks for this propaganda…. and long live BTC/ETH!!!

BTW (it’s not a token, it means by the way:-) i your ETH hack means the DAO hack in 2016, ETH was never hack but the DAO site was, not citing you’re source/event is completly dishonest., for a supposedly serious article. All traditional finance people have been saying the same time since 2013 about BTC (read the bitcoin obituaries) so c’mon man. Finally, citing the “realities of bitcoin” just as a title for a paragraphe on ICO’S (Witch every should know they are like penny stock’s: promising ideas, 90% crap) is really showing that you are on the wall street side of the gang….

They are many more things, but i’ll stop there because nobody will read this anyway…..

A more objective and informative article would have been welcomed.

Anyway like it or not welcome to the revolution:-)

Somebody as cynical as I am. If they didnt invent it they can control it by buying up all the bitcoins in existence. Price is no object when you have an infinite ability to create money.

Dear Ivan Lo,

I was given this newsletter as FYI, but I feel that I should respond and in detail as this demands a solid examination.

First of all, I am glad that you have done some homework about Bitcoin and Cryptocurrencies as knowledge is key to understanding. However, when one does their homework, they must take it all the way. Remember the addage ‘a little knowledge is a dangerous thing’, most especially if the study stops halfway and speculation is used to fill in the ‘gaps’, and this is apparently what has happened here. Let me clarify by addressing key points from your newsletter…

——-

>>>First and foremost, Blockchain is not Bitcoin and Bitcoin is not Blockchain<<>>But when you start adding these types of solutions, the costs associated with transacting in cryptocurrencies also goes up because these networks take a small fee for doing so. That’s why over the past year, transaction costs for Bitcoin have gone up.<<>>So the “developers,” whoever they are, have already looked at implementing solutions to this bottleneck.<<>>Once the Bitcoin community and its developers figure it out, then you can pull them out and put them back on the chain.<>>Miners Could Soon Be Out of Business<<>>And just like the dotcom bubble, it will likely end tragically for most.<<>>Right now, the creator of Bitcoin has been dubbed Satoshi Nakamoto<<>>Powers that be allow it to become so big?<<>>How does a digital currency created by no one grow to achieve a $126 billion in liquid value?<<>>I’ll be honest, I never believed crypto-digital currencies and ICO’s to be real. Because when you look at it from an honest perspective, it really is creating something out of thin air.<<>>So how can they stimulate the global economy without adding more to the already ballooned balance sheets?<<>>Bitcoin itself has already added over $120 billion in free money without affecting a single balance sheet.<<>>IMF to Create SDR Cryptocurrency?

Could replace existing international currencies.

Yes, I’ve been following all of that. SDR’s is your actual attempt by the system to reboot their failed fiat ponzi scheme. Not bitcoin. They are now in fear for that system with bitcoin on the doorstep threatening their new house of cards that they have worked on for decades. Hehe, not sorry for that kick in their teeth.

—

>>>In other words, there could be a reason why governments around the world are letting cryptocurrencies run rampant:

1. To temporarily infuse free money into the system “off-the-books”.

2. To implement Cryptocurrencies on their own once the technology is proven and accepted (or once it fails and they step in to save the day).<<>>Despite the Bitcoin movement being touted as an unstoppable force, governments around the world can at any moment put a ban and implement severe penalties on anyone trading Bitcoin or other digital currencies.

Why are they allowing these currencies to play out?<<>>Could the Fed, the IMF, or another major organization be the true creators of Bitcoin?<<>>When you consider that civilization have always had leadership, whether it’s government or other entities such as banks or secret rulers, the idea of these central banks and their intervention makes sense.<<<

No, it doesn't make sense for the specific reasons laid out above, but additionally, we have not always had leaders. This will take some history reading and a much longer talk (more than happy to go into full detail but if I get into that, you're buying the beer) but we have not always had leaders. We are just taught we have because the system does not want you to realize that we simply do not need them, and now that bitcoin is solving the debt-based money problem, this dependency on leaders are the next problem to solve.

———–

Hope all this helps to clarify, contact me anytime,

Cheers,

Don Herres

So sorry, reposting this as the previous post missed half of my responses…ignore the last version…

———————

Dear Ivan Lo,

I was given this newsletter as FYI, but I feel that I should respond and in detail as this demands a solid examination.

First of all, I am glad that you have done some homework about Bitcoin and Cryptocurrencies as knowledge is key to understanding. However, when one does their homework, they must take it all the way. Remember the adage ‘a little knowledge is a dangerous thing’, most especially if the study stops halfway and speculation is used to fill in the ‘gaps’, and this is apparently what has happened here. Let me clarify by addressing key points from your newsletter…

IvanL: First and foremost, Blockchain is not Bitcoin and Bitcoin is not Blockchain

Not quite true. Blockchain can be simplified by recognizing it as a database. A unique form of a database but really, just a distributed database with clever characteristics.

A database is a collection of organized data. A contact list is a database. A telephone book (remember those?) is a form of database. Ledgers – databases. If I point to a contact list and say “that’s my database” I would be correct just as I could say “Bitcoin is my blockchain.” Therefore, bitcoin is a form of blockchain. All over the news, governments, banks and corporations are trying to separate bitcoin from blockchain because they want you to ignore bitcoin and just talk about blockchain because bitcoin is the threat to their established hegemony. Why assist them with that false perception?

IvanL: But when you start adding these types of solutions, the costs associated with transacting in cryptocurrencies also goes up because these networks take a small fee for doing so. That’s why over the past year, transaction costs for Bitcoin have gone up.

Segwit (proper designation BIP148, a core dev initiative soft fork) was only implemented in September/October, higher fees have been rising for the past 2 years. Segwit is not causing higher fees, it is striving to diminish them, and it will, same with the lightning network yet to be implemented. Segwit 2X is a contentious hard fork being pushed buy an alternative group and certain miners/companies who have since pulled their support. A smaller rouge group is still trying to push it but it is very unlikely to have much of an effect. The attempt basically failed as it had questionable implementation problems so supporters started pulling their support. Finally, Segwit 2x initiators themselves pulled out saying ‘they did not want to cause rifts in the community.’ I have not seen a single bitcoin developer with a ‘rule the world’ mentality, these are hard working and brilliant people, many with an anarchist/libertarian bent, not global domination types.

IvanL: So the “developers,” whoever they are, have already looked at implementing solutions to this bottleneck.

The ‘Core Devs’ are developers who contribute to bitcoin code, patches, upgrades and the like. Their names and contacts are fully transparent and they are some of the best computer engineers/developers in the world. You don’t have to care, but brushing them off as ‘whoever they are’ is counterproductive at best. Listen to some of them speak, it is well worth your time and you will learn a lot.

IvanL: Once the Bitcoin community and its developers figure it out, then you can pull them out and put them back on the chain.

Bitcoin never leaves the blockchain as all bitcoin is recorded on the ledger that is the blockchain. Thought I would clear that up. What you are suggestion is ‘cold storage’ or even a hot-wallet but not initiating a transaction during the problematic period shortly after Segwit 2x implementation. The important part is to have control of your private keys and not trust them to a third party. A wise stance but it is unlikely that Segwit 2x will be causing problems now that the support has melted.

IvanL: Miners Could Soon Be Out of Business

This is a big misunderstanding. Yes, instances occurred where unscrupulous actors were/are embedding code in their webpages to mine cryptocurrencies unannounced to the webpage visitor. It is a form of Malware. Already, most antiviruses and ant-malware programs are putting in detectors and eliminators into their packages which will minimize this problem. All the versions I’ve seen to date mine altcoins, not bitcoin as bitcoin mining requires intensive processing power that cpu’s, even distributed ones, simply cannot compete with dedicated ASIC machines which is what Miners invest heavily in to mine BTC. Miners do not see this as a threat. Best to check into these things more deeply before conjecturing.

IvanL: And just like the dotcom bubble, it will likely end tragically for most.

The DotCom bubble became that because unrealistic claims were being made about what the internet was and what it could do, ie: everyone could simply put any napkin designed business online and succeed, 90% was starry eyed silliness and many of us realized that while it was happening and saw the crash coming.

Bitcoin is not a company, it is not a business, a stock, a conglomerate, a ponzi scheme or any of the long list of dream creations that people sink money into to get rich quick.

Bitcoin is a protocol, a collection of code which simulates a ledger so that people can store and transfer value. That’s it, the whole nutshell.

Investing in a business runs numerous risks because you have to trust so many players: The management, the staff, the workers, the accountants, the lawyers, the competition, the government, etc, etc. Endless points of failure. A company can have the best ideas, the best implementation, the best marketing, the works, and it can all be brought down by one key embezzler, mouthy CEO, disgruntled employee, etc. That is risk.

Bitcoin doesn’t have to do anything to be a global success but keep the trustless, un-counterfeitable, psuedonoymous, transparent transactions going. Just like email doesn’t have to do anything but route messages back and forth.

No marketers, CEO’s, embezzlers to fail.

With Bitcoin, we are not seeing a rush to a dreammaker, we are seeing a running away from a corrupt banking system. Sure, some are riding this train for the gains but it doesn’t matter. If gains are luring people, that’s fine, it is still getting people in so that we can ultimately take down the banks. That’s what bitcoin is for. That is not a dream (well, it is my dream), rather, it is an essential accomplishment for humanity.

IvanL: Right now, the creator of Bitcoin has been dubbed Satoshi Nakamoto

Huh?? Not right now. Satoshi was a handle the creator used on the cryptography/developer chat boards. He/she/they called themselves that, no one else ‘dubbed’ that.

Watch ‘The Bitcoin Phenomenon’ to get the full background story, it really is worth getting the full story.

https://www.youtube.com/watch?v=6pWblf8COH4&t=434s

IvanL: Powers that be allow it to become so big?

Another big misnomer. The PTB are not allowing it, they simply CANNOT stop it. Most of them considered bitcoin a doomed joke and now that they are realizing its power, they are scared sh**tless. It’s becoming big because they just have no ability to stop it.

IvanL: How does a digital currency created by no one grow to achieve a $126 billion in liquid value?

No one? Satoshi was someone, a person or group that had real dialogues with the initial core developers.

How it grows? Simple, people see it as better than that crappy fake fiat we have been controlled with. Bitcoin will have Trillions in value when billions of people start using it and leave banks to wither.

IvanL: I’ll be honest, I never believed crypto-digital currencies and ICO’s to be real. Because when you look at it from an honest perspective, it really is creating something out of thin air.<<<

You do not believe it to be real because you do not understand it. It is a common misunderstanding. Let's clear it up…

Do you believe math to be real? Of course, it is a tool we use to quantify the world around us and communicate that understanding.

Do you believe email to be real? Of course, it is a tool we use to communicate thoughts and ideas around the world in seconds (so we can add chat, skype etc).

Bitcoin is a tool for communicating value. I reiterate: Bitcoin is a protocol, a collection of code which simulates a ledger so that people can store and transfer value.

That is a real thing. It is not physically tangible but it is nevertheless, quite real and has real impact on people's lives.

Computer programs are created out of thin air and do amazing things that people and companies pay real money for to get things done and there is value in that.

Music, art, writing, philosophy, speeches etc. All out of thin air. Still all useful and valuable. Mmmm, thin air is not looking so thin. 😉

IvanL: So how can they stimulate the global economy without adding more to the already ballooned balance sheets?

So banks are not altruistic entities who want the economy stimulated for yours, mine or the masses benefit. They want the economy stimulated using their fool's paper (fiat) so they can keep control of everything. Again, it is not about running 'to' bitcoin, it is about running away from the corrupt banking system. This is why they fear bitcoin, why bank CEO's around the world decry bitcoin as fraud/ponzi/tulip-bulbs/bubble/failure because they fear it. They would be most happy if not one other person entered bitcoin. Kind of self-defeating if you want people to run to it. If at this point a reverse psychology argument is raised, you will lose all credibility.

IvanL: Bitcoin itself has already added over $120 billion in free money without affecting a single balance sheet.

Actually, not. Bitcoin is purchased with fiat,which was bought by people who have generated that money with their labour. Bitcoin's market cap valuation is a transfer of wealth not a magical creation of wealth. It shows as a real entry on my balance sheet.

IvanL: IMF to Create SDR Cryptocurrency? Could replace existing international currencies.

Yes, I've been following all of that. SDR's is your actual attempt by the system to reboot their failed fiat ponzi scheme. Not bitcoin. They are now in fear for that system with bitcoin on the doorstep threatening their new house of cards that they have worked on for decades. Hehe, not sorry for that kick in their teeth.

IvanL: In other words, there could be a reason why governments around the world are letting cryptocurrencies run rampant:

1. To temporarily infuse free money into the system "off-the-books".

2. To implement Cryptocurrencies on their own once the technology is proven and accepted (or once it fails and they step in to save the day).

Mmm…

1. Answered the 'off the books' claim above.

2. Why would gov/banks need to implement a 'dangerous to themselves' system to get people used to cryptocurrencies? Why not just implement it on their own and not give people an idea that they can control their own money themselves and leave gov/banks out of the whole mix? That's like saying the post office created email to get people to become used to electronic communications so that they can implement their own version of email and trap everybody on their walled garden system. Ooops, that didn't work so well.

I'll let Andreas Antonopolous (a core developer of bitcoin) explain it better…Love the clapping scene…

https://www.youtube.com/watch?v=ncPyMUfNyVM

Actually, watch anything by Andreas to get a clear perspective on what bitcoin is and is not, and why it is the probably the most brilliant human invention since fire, I kid you not.

https://www.youtube.com/user/aantonop/videos

IvanL: Despite the Bitcoin movement being touted as an unstoppable force, governments around the world can at any moment put a ban and implement severe penalties on anyone trading Bitcoin or other digital currencies.

Why are they allowing these currencies to play out?

From the top — They CANNOT stop it. Banning it and severe penalties will not stop bitcoin and cryptocurrencies. Prohibition did not stop drinking, the war on drugs did not stop drugs, laws do not stop crime, shall I go on? Governments can only curtail but they cannot stop, and often they fail to curtail. And when they try and fail to stop, they look impotent so they ultimately stop trying and make it 'legal' but it still goes on no matter what. This is an old and failed argument and just let it die here and now.

https://www.youtube.com/watch?v=LIQkuF_I5Xo

https://www.youtube.com/watch?v=AecPrwqjbGw&t=146s

Could the Fed, the IMF, or another major organization be the true creators of Bitcoin?

Conceivably, to the drug/alcohol soaked mind. But seriously, I've heard the speculation many times, and even studied the possibility for my own clarification. The result, it just makes no sense at all and even if they did, as silly as it would be for shooting themselves in the foot, it just doesn't matter. What is unmentioned or forgotten when this speculation is brought up, is that the bitcoin protocol is 'open-source'. The code is fully transparent to anyone who wants to look at it. There is no back door, trip wire, malware, trojan, booby trap. There just isn't. And this gets back to my previous statement about the post office creating email. It just doesn't make the slightest bit of logical sense. Prove me wrong, I will listen to ANY argument, but bring out the solid proof because speculation doesn't cut it.

IvanL: When you consider that civilization have always had leadership, whether it's government or other entities such as banks or secret rulers, the idea of these central banks and their intervention makes sense.

No, it doesn't make sense for the specific reasons laid out above, but additionally, we have not always had leaders. This will take some history reading and a much longer talk (more than happy to go into full detail but if I get into that, you're buying the beer) but we have not always had leaders. We are just taught we have because the system does not want you to realize that we simply do not need them, and now that bitcoin is solving the debt-based money problem, this dependency on leaders are the next problem to solve.

———–

Hope all this helps to clarify, contact me anytime,

Cheers,

Don Herres

I guess, the initial intention of crytocurrency is probably good. The first reason is they evade paying tax and fees to the so called “not so deservings”. The second reason is people in the loop transact unnoticed, anonymously. There is no secrete how many transactions are done without the knowledge of the governments or the public. The advance underground technologies are way beyond the ability to catch up by modern world known to the public. But the key focus here when it first started was probably: it was a focus group, small-specific group of people are included in the loop, not everyone. Therefore, every transaction can be monitored easily because they are related, with no secrete. It’s probably like a private bank minus the fees and tax, for a few friends and families. Operation based on trust and righteousness.

The opening to the public created problems. The big data base and number of unselective inclusions created unforeseeable hurdles in data handling and monitoring. Re-categorization is probably necessary to make transaction and monitoring easier. Because there is no physical property to be owned, there is a risk……….. How long can the trust hold before problems occur or things change hands and problems occur, is an unknown. Top personnel are the lucky ones, regardlessly.

Instead of chasing over things that way beyond catch up and causing the trusting public to probably fall prey at the end, why not refurbishing the tax and fees systems? The creation of cryptocurrencies aims to evade payment of tax and fees, or is it not?? Why are people so reluctant to pay? Imagine a farmer working his ass off from morning till evening. After he gains his harvest, one third or half of those have to be forced to be delivered to some one or a group of people who are there because they are rich and have more manpower to beat him up when he does not comply?? For good service rendered, people are willing to pay. But not by forced, without justifiable reason. Therefore, give people a reason not to evade paying is the best solution by far?? Cryptocurrencies offering to the public must be monitored because people’s hard earn money are there based on TRUST. Something that is intangible and delicate. Valuable to many, especially the underground world; but not by some….. When things are delivered as promised, it’s a win win situation that makes everyone happy. On the other hand, what could be done when things are not delivered?? Why are we encouraging a crowd change now?? And who or what is there to safeguard the functionality and sustainability of it?? A few questions to ponder, before we jump into the conclusion to have paper backed or cashless society based on TRUST……….

GField,

You’re post must have gone through a few renditions of Google Translate, it is barely understandable. I’ll take a shot at a couple of points though.

GF: The first reason is they evade paying tax and fees to the so called “not so deservings”.

DH: Kind of like dollars. There are those that keep cash so as to avoid being tracked. Crypto was not designed to evade taxes, but it does allow one to keep full control over their money. Taxes should be voluntary. If a government uses taxes for the benefit of the people, then the people are more willing to give government taxes to ‘do the job.’ Government forces taxation on threat of kidnapping and theft of property and because of this, wastes vast amounts of what it collects. Government doesn’t care how much it wastes as it can just milk more from the people. If taxes were voluntary, government would HAVE to be far more responsible with what it gets. Crypto cannot be ‘confiscated’ like gold/silver/dollars because it cannot be physically found. This helps to make taxation more accountable, government has to make taxation ‘appealing.’ But as I said, it is similar to cash in this regard.

GF: The second reason is people in the loop transact unnoticed, anonymously. There is no secrete how many transactions are done without the knowledge of the governments or the public.

DH: Yup, kind of like dollars. So what has changed?

GF: The creation of cryptocurrencies aims to evade payment of tax and fees, or is it not??

DH: No, it aims to give people control over their money so it cannot be arbitrarily confiscated. Most of us work very hard for our money and we do not want a bank, a government, a police agency or a criminal to just take our money. Look at Asset Forfeiture for instance. Only a tiny proportion of the public are drug runners. Yet some states are financing up to 60% of their budgets using trumped up Asset Forfeiture legislation and raids, the vast majority of which are set upon innocent people, and with no recourse to recover their assets. If government didn’t act like mafia gangs, we wouldn’t need to go to the measures that cryptocurrencies give us to protect our hard earned money. But they do and we need to.

GF: Why are people so reluctant to pay?

DH: Taxes? Have you seen the obscene level of waste by government? Truth is, most do pay tax. But by giving individuals protection from arbitrary confiscation means government has to be more accountable.

GF: Valuable to many, especially the underground world;

DH: Criminal use of cryptocurrencies is actually minimal and minute. News stories tell you otherwise(without proof) but do the research. Criminals love dollars. Harder to track. Yet we are not berating dollars for their use by criminals. The biggest money laundering tool by criminals is VISA and MASTERCARD prepaid cards. Completely un-trackable, can be brought across boarders without being checked, pretty much as good as cash, etc, etc. It is the tool of choice by drug runners and the underground. Yet do we hear a SINGLE word about how they are being used to launder money? Absolutely not. Why not? Because VISA and MASTERCARD take a solid cut at the point of sale and they do not want their apple cart upset. Crypto is picked on because it is a threat to the banks, it takes away their reason to exist, that is why the banks attack crytpo.

Additionally, bitcoin is not good for laundering as all transactions are registered on the blockchain and visible for ALL to see. What idiot criminal (though there are many) would post large transaction on the blockchain where it is instantly visible to authorities to focus on and investigating to attach the transactions to individuals? Better to use VISA/MC prepaid cards, nothing to connect.

GF: And who or what is there to safeguard the functionality and sustainability of it??

DH: The Users and the Miners. It is a trustless system(trust not required), run by mathematics with built in incentives to keep it going on in perpetuity. That is the brilliance of it. Watch this documentary to get a proper idea of how it works before disparaging it…

https://www.youtube.com/watch?v=6pWblf8COH4&t=434s

Fear comes from lack of understanding. Learn about bitcoin to understand how it works and why it is so brilliant and why it will free humanity from the enslaving bonds of the banks.

Cheers,

Don

To the moderator: Please replace the previous response to Ivan with this response. In the previous response, your system deleted half of the text. This response has the full text. Thanks.

————————-

Dear Ivan Lo,

I was given this newsletter as an FYI, but I feel that I should respond and in detail as this demands a solid examination.

First of all, I am glad that you have done some homework about Bitcoin and Cryptocurrencies as knowledge is key to understanding. However, when one does their homework, they must take it all the way. Remember the adage ‘a little knowledge is a dangerous thing’, most especially if the study stops halfway and speculation is used to fill in the ‘gaps’, and this is apparently what has happened here. Let me clarify by addressing key points from your newsletter…

IvanL: First and foremost, Blockchain is not Bitcoin and Bitcoin is not Blockchain

DH: Not quite true. Blockchain can be simplified by recognizing it as a database. A unique form of a database but really, just a distributed database with clever characteristics.

A database is a collection of organized data. A contact list is a database. A telephone book (remember those?) is a form of database. Ledgers – databases. If I point to a contact list and say “that’s my database” I would be correct just as I could say “Bitcoin is my blockchain.” Therefore, bitcoin is a form of blockchain. All over the news, governments, banks and corporations are trying to separate bitcoin from blockchain because they want you to ignore bitcoin and just talk about blockchain because bitcoin is the threat to their established hegemony. Why assist them with that false perception?

IvanL: But when you start adding these types of solutions, the costs associated with transacting in cryptocurrencies also goes up because these networks take a small fee for doing so. That’s why over the past year, transaction costs for Bitcoin have gone up.

DH: Segwit (proper designation BIP148, a core dev initiative soft fork) was only implemented in September/October, higher fees have been rising for the past 2 years. Segwit is not causing higher fees, it is striving to diminish them, and it will, same with the lightning network yet to be implemented. Segwit 2X is a contentious hard fork being pushed buy an alternative group and certain miners/companies who have since pulled their support. A smaller rouge group is still trying to push it but it is very unlikely to have much of an effect. The attempt basically failed as it had questionable implementation problems so supporters started pulling their support. Finally, Segwit 2x initiators themselves pulled out saying ‘they did not want to cause rifts in the community.’ I have not seen a single bitcoin developer with a ‘rule the world’ mentality, these are hard working and brilliant people, many with an anarchist/libertarian bent, not global domination types.

IvanL: So the “developers,” whoever they are, have already looked at implementing solutions to this bottleneck.

DH: The ‘Core Devs’ are developers who contribute to bitcoin code, patches, upgrades and the like. Their names and contacts are fully transparent and they are some of the best computer engineers/developers in the world. You don’t have to care, but brushing them off as ‘whoever they are’ is counterproductive at best. Listen to some of them speak, it is well worth your time and you will learn a lot.

IvanL: Once the Bitcoin community and its developers figure it out, then you can pull them out and put them back on the chain.

DH: Bitcoin never leaves the blockchain as all bitcoin is recorded on the ledger that is the blockchain. Thought I would clear that up. What you are suggestion is ‘cold storage’ or even a hot-wallet but not initiating a transaction during the problematic period shortly after Segwit 2x implementation. The important part is to have control of your private keys and not trust them to a third party. A wise stance but it is unlikely that Segwit 2x will be causing problems now that the support has melted.

IvanL: Miners Could Soon Be Out of Business (referencing malicious webpage mining)

DH: This is a big misunderstanding. Yes, instances occurred where unscrupulous actors were/are embedding code in their webpages to mine cryptocurrencies unannounced to the webpage visitor. It is a form of Malware. Already, most antiviruses and ant-malware programs are putting in detectors and eliminators into their packages which will minimize this problem. All the versions I’ve seen to date mine altcoins, not bitcoin as bitcoin mining requires intensive processing power that cpu’s, even distributed ones, simply cannot compete with dedicated ASIC machines which is what Miners invest heavily in to mine BTC. Miners do not see this as a threat. Best to check into these things more deeply before conjecturing.

IvanL: And just like the dotcom bubble, it will likely end tragically for most.

DH: The DotCom bubble became that because unrealistic claims were being made about what the internet was and what it could do, ie: everyone could simply put any napkin designed business online and succeed, 90% was starry eyed silliness and many of us realized that while it was happening and saw the crash coming.

Bitcoin is not a company, it is not a business, a stock, a conglomerate, a ponzi scheme or any of the long list of dream creations that people sink money into to get rich quick.

Bitcoin is a protocol, a collection of code which simulates a ledger so that people can store and transfer value. That’s it, the whole nutshell.

Investing in a business runs numerous risks because you have to trust so many players: The management, the staff, the workers, the accountants, the lawyers, the competition, the government, etc, etc. Endless points of failure. A company can have the best ideas, the best implementation, the best marketing, the works, and it can all be brought down by one key embezzler, mouthy CEO, disgruntled employee, mis-visioned executive, etc. That is risk.

Bitcoin doesn’t have to do anything to be a global success but keep the trustless, un-counterfeitable, psuedonoymous, transparent transactions going. Just like email doesn’t have to do anything but route messages back and forth.

No marketers, CEO’s, embezzlers to fail.

With Bitcoin, we are not seeing a rush to a dreammaker, we are seeing a running away from a corrupt banking system. Sure, some are riding this train for the gains but it doesn’t matter. If gains are luring people, that’s fine, it is still getting people in so that we can ultimately take down the banks. That’s what bitcoin is for. That is not a dream (well, it is my dream), rather, it is an essential accomplishment for humanity.

IvanL: Right now, the creator of Bitcoin has been dubbed Satoshi Nakamoto

DH: Huh?? Not right now. Satoshi was a handle the creator used on the cryptography/developer chat boards. He/she/they called themselves that, no one else ‘dubbed’ that.

Watch ‘The Bitcoin Phenomenon’ to get the full background story, it really is worth getting the full story.

https://www.youtube.com/watch?v=6pWblf8COH4&t=434s

IvanL: Powers that be allow it to become so big?

DH: Another big misnomer. The PTB are not allowing it, they simply CANNOT stop it. Most of them considered bitcoin a doomed joke and now that they are realizing its power, they are scared sh**tless. It’s becoming big because they just have no ability to stop it.

IvanL: How does a digital currency created by no one grow to achieve a $126 billion in liquid value?

DH: No one? Satoshi was someone, a person or group that had real dialogues with the initial core developers.

How it grows? Simple, people see it as better than that crappy fake fiat we have been controlled with. Bitcoin will have Trillions in value when billions of people start using it and leave banks to wither.

IvanL: I’ll be honest, I never believed crypto-digital currencies and ICO’s to be real. Because when you look at it from an honest perspective, it really is creating something out of thin air.<<<

DH: You do not believe it to be real because you do not understand it. It is a common misunderstanding. Let's clear it up…

Do you believe math to be real? Of course, it is a tool we use to quantify the world around us and communicate that understanding.

Do you believe email to be real? Of course, it is a tool we use to communicate thoughts and ideas around the world in seconds (so we can add chat, skype etc).

Bitcoin is a tool for communicating value. I reiterate: Bitcoin is a protocol, a collection of code which simulates a ledger so that people can store and transfer value.

That is a real thing. It is not physically tangible but it is nevertheless, quite real and has real impact on people's lives.

Computer programs are created out of thin air and do amazing things that people and companies pay real money for to get things done and there is value in that.

Music, art, writing, philosophy, speeches etc. All out of thin air. Still all useful and valuable. Mmmm, thin air is not looking so thin. 😉

IvanL: So how can they stimulate the global economy without adding more to the already ballooned balance sheets?

DH: So banks are not altruistic entities who want the economy stimulated for yours, mine or the masses benefit. They want the economy stimulated using their fool's paper (fiat) so they can keep control of everything. Again, it is not about running 'to' bitcoin, it is about running away from the corrupt banking system. This is why they fear bitcoin, why bank CEO's around the world decry bitcoin as fraud/ponzi/tulip-bulbs/bubble/failure because they fear it. They would be most happy if not one other person entered bitcoin. Kind of self-defeating if you want people to run to it. If at this point a reverse psychology argument is raised, you will lose all credibility.

IvanL: Bitcoin itself has already added over $120 billion in free money without affecting a single balance sheet.

DH: Actually, not. Bitcoin is purchased with fiat,which was bought by people who have generated that money with their labour. Bitcoin's market cap valuation is a transfer of wealth not a magical creation of wealth. It shows as a real entry on my balance sheet.

IvanL: IMF to Create SDR Cryptocurrency? Could replace existing international currencies.

DH: Yes, I've been following all of that. SDR's is your actual attempt by the system to reboot their failed fiat ponzi scheme. Not bitcoin. They are now in fear for that system with bitcoin on the doorstep threatening their new house of cards that they have worked on for decades. Hehe, not sorry for that kick in their teeth.

IvanL: In other words, there could be a reason why governments around the world are letting cryptocurrencies run rampant:

1. To temporarily infuse free money into the system "off-the-books".

2. To implement Cryptocurrencies on their own once the technology is proven and accepted (or once it fails and they step in to save the day).

DH: Mmm…

1. Answered the 'off the books' claim above.

2. Why would gov/banks need to implement a 'dangerous to themselves' system to get people used to cryptocurrencies? Why not just implement it on their own and not give people an idea that they can control their own money themselves and leave gov/banks out of the whole mix? That's like saying the post office created email to get people to become used to electronic communications so that they can implement their own version of email and trap everybody on their walled garden system. Ooops, that didn't work so well.

I'll let Andreas Antonopolous (a core developer of bitcoin) explain it better…Love the clapping scene…

https://www.youtube.com/watch?v=ncPyMUfNyVM

Actually, watch anything by Andreas to get a clear perspective on what bitcoin is and is not, and why it is the probably the most brilliant human invention since fire, I kid you not.

https://www.youtube.com/user/aantonop/videos

IvanL: Despite the Bitcoin movement being touted as an unstoppable force, governments around the world can at any moment put a ban and implement severe penalties on anyone trading Bitcoin or other digital currencies.

Why are they allowing these currencies to play out?

DH: From the top — They CANNOT stop it. Banning it and severe penalties will not stop bitcoin and cryptocurrencies. Prohibition did not stop drinking, the war on drugs did not stop drugs, laws do not stop crime, shall I go on? Governments can only curtail but they cannot stop, and often they fail to curtail. And when they try and fail to stop, they look impotent so they ultimately stop trying and make it 'legal' but it still goes on no matter what. This is an old and failed argument and just let it die here and now.

https://www.youtube.com/watch?v=LIQkuF_I5Xo

https://www.youtube.com/watch?v=AecPrwqjbGw&t=146s

Could the Fed, the IMF, or another major organization be the true creators of Bitcoin?