Dear Readers,

There is something big in the works and nations all around the world are participating in it.

Yet, this something is completely hidden from us – and every time it surfaces, it is quietly swept under the rug.

Over the past few years, I have written about many events that suggest we are coming closer to the end of a financial era. Something big is about to change, and it will alter the course of history in ways we may not yet be able to comprehend.

Central banks around the world, led by the Fed, have unleashed a record amount of money into the market – almost all of it at zero borrowing cost. This makes the money “free” in the short term – short being the operative word.

But I don’t need to go over how much central banks have printed in the last decade – that story is far from new. I do, however, want you to look at Fed policy from a different angle – a view very far from what is mentioned publicly. Once you read this Letter, you may never look at things the same way again.

Free Money – But Not For Long

Global recovery has been extremely slow, growing at less than 4 percent a year between 2012-14 – that’s 3 percent below the pre-crisis average annual growth.

Even after nearly a decade of recovery, things do not appear to be getting better.

Soft commodity and resource prices are hurting economies and world trade is very weak. Meanwhile, low interest rates continue to be the standard but risks are further intensified through increasingly divergent monetary policies across major economies.

In other words, while the world is more connected than ever, it is economically and politically drifting further apart.

Financial market volatility, compounded by the risk of a sudden deterioration in liquidity conditions, could sharply raise developing countries’ borrowing costs. After several years of heavy capital market issuance in developing countries, this one event could turn the world upside down.

Why?

Central Bank Lending

To prevent an outright economic collapse after 2008, many emerging markets have had to borrow money – lots of it. But where did the money come from?

Nations from around the world borrowed money from their central banks. The Fed led the way here, printing trillions of dollars over the last decade.

In many past letters, I explained that as the Fed prints, other developed nations must also print in order to maintain balance with exchange rates. Fro example, if the Fed prints and devalues its currency, China must also do the same or suffer lower exports as a result of a higher valued yuan.

The problem, however, is that other central banks aren’t the Fed – a central bank that controls and prints the world’s reserve currency.

Herein lies the beauty of the Fed’s plan.

Much of the money the Fed has unleashed have been streamed to investments outside of the US, fueling nations all around the world with cheap money. The combination of money flowing into emerging markets and near-zero interest rates has turned many emerging nations hostage to the US through debt.

Just how much, you ask?

Via WSJ:

“…the amount of dollar-denominated loans to borrowers in emerging markets, excluding banks, has nearly doubled since 2009 to more than $3 trillion.“

Via the Telegraph:

“The Swiss-based BIS said total debt ratios are now significantly higher than they were at the peak of the last credit cycle in 2007, just before the onset of global financial crisis.”

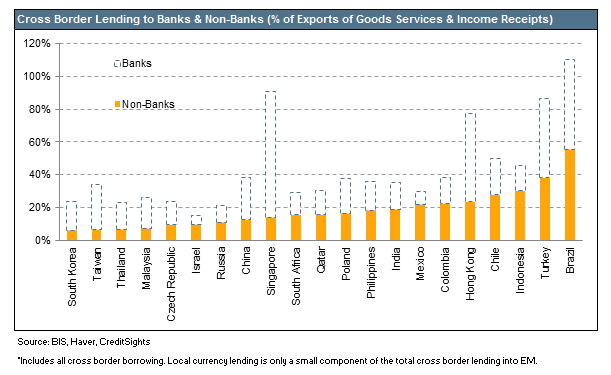

When you include dollar-denominated loans through banks, the scenario becomes even scarier. Take a look

Via Bloomberg:

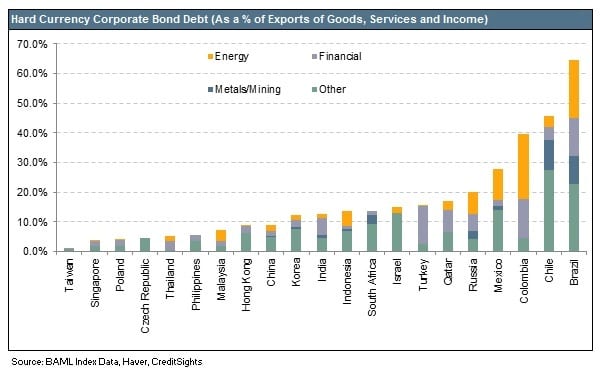

Next up are corporate bonds, via BofAML’s hard-currency, emerging-market corporate bond index, as a percent of foreign-currency revenue. Brazil dominates again, with a big chunk of its foreign FX bonds having been sold by energy companies.Combine cross-border lending, plus foreign FX corporate bonds, then add a smattering of government debt, and you get the CreditSights chart below, showing total hard-currency borrowing by country.Brazil is the standout, followed by Turkey and Colombia.It’s not a pretty chart, and unfortunately, as the CreditSights analysts note, the real picture of emerging markets’ foreign-currency borrowing is probably even uglier. (When it comes to corporate bonds, for instance, the BofAML index excludes dollar or euro-denominated debt that exceeds certain thresholds.)We have tried to capture as much of the hard currency debt as we can reliably get for a cross country comparison using BIS and the bond index data but the actual total will almost certainly be higher given that only BIS reporting banks are included and the bond debt only includes the index eligible deals.”

In short, the amount of dollar-denominated debt owed by emerging markets could be – and likely is – astronomical.

Via the Telegraph:

“Adding to the toxic mix, off-shore borrowing in US dollars has reached a record $9.6 trillion, chiefly due to leakage effects of zero interest rates and quantitative easing (QE) in the US. This has set the stage for a worldwide dollar squeeze as the Fed reverses course and starts to drain dollar liquidity from global markets.”

In other words, if the Fed raises interest rates, many emerging market economies will suffer the consequence of debt defaults. Which, historically means that asset fire sales – often commodity-based assets such as oil and gas – are next.

Coming to Take Your Land

Historically, if you wanted to seize the assets of another country, you would have to go to war and fight for territory. But today, there are other less bloody ways to do that.

Take, for example, Petrobras – a semi-public Brazilian multinational energy corporation. As seen by the above charts, Brazil is in one of the worst debt positions in the world with much of its debt denominated in US dollars.

Earlier this year, Petrobras announced that it is attempting to sell $58 billion of assets – an unprecedented number in the oil industry.

Guess who will likely be leading the sale of Petrobras assets? Yup, American banks.

Via Reuters:

“…JPMorgan would be tasked with wooing the largest number of bidders possible for the assets and then structure the sales.”

As history has shown, emerging market fire sales due to debt defaults are often won by the US or its allies. Thus far, it appears the Petrobras fire sale may be headed that way.

Via WSJ:

“Brazilian state-run oil company Petróleo Brasileiro SA said Tuesday (September 22, 2015) it is closing a deal to sell natural-gas distribution assets to a local subsidiary of Japan’s Mitsui & Co.”

The combination of monetary policy and commodities manipulation allows Western banks and allies to accumulate hard assets at the expense of emerging markets. And this has been exactly the plan since day one.

As the Fed hints of raising rates, financial risks among emerging markets will continue to build. This will trigger a reappraisal of sovereign and corporate risks leading to big swings in capital flows.

There are many corporate, banks, and even sovereigns in a number of major oil producing nations, such as Russia and Nigeria, which have borrowed vast sums of US-denominated loans. Many of them may turn to China (Venezuela has and continues to), but even China has issues of its own (we’ll discuss more of this next week).

Fed Policy: The Other Perspective

While it may appear that the Fed’s rate policy is dictated by the performance of the American economy, I believe it is more heavily dictated by global political influence.

Knowing that a small rise in interest rates could drastically affect a number of emerging market nations, the Fed could use monetary policy as a means to influence global and corporate profit politics. If emerging markets don’t budge or bend to the will of the US and instead continue to shift East toward China’s global aspirations, then I suggest we will certainly see a rise in rates.

Furthermore, much of the debt taken on by emerging markets were taken on with short-term maturities. That means many countries are now being forced to repay some of their dollar-denominated debt. And since the US dollar has risen in value against many emerging market currencies, these debts have become increasingly difficult to repay. If interest rates were to rise, it would cause a whirlwind of financial troubles for emerging markets.

Remember, unlike what people tell you about currency wars, the US is not trying to repeatedly devalue its currency – it only devalues to make it easier for other nations to borrow US dollar. Then, when its time to pay the piper, the dollar rises – just as it is happening now.

Via my Letter, “The Truth About Currency Wars“:

“…those who follow the currency war meme often take the idea of competitive devaluation too far by believing that the winner of a currency war is the first nation who devalues their currency the fastest.This, in fact, is completely wrong.Yes, Japan has significantly devalued their currency against other world currencies hoping to artificially create inflation. Yes, the United States – for a brief period – did the same.…If you think that winning a currency war means being the first to devalue your currency, then the US is clearly losing. This is obviously not the case – not yet, anyway.Over the last year, the US dollar index has climbed nearly 20%, while the US saw its strongest economic growth since the 2008 recession.If the currency war meme is correct – that the winner in a currency war is the one who devalues the fastest – how has the US managed to achieve such growth?”

If you look at the fire sales over the last year from emerging market nations, you will see many of them. As we move closer to a potential rate hike, we’re going to see even more.

I hope what I have written today has given you a simplified look at what’s really happening around the world – and more importantly, why it is happening.

This also leads me to believe that it may not be a bad time to look at a select number of gold stocks. There are many reasons why central banks have continued to be net buyers of gold – it’s their only long term protection from outside influences of monetary policies.

The Best Performing Gold Stock. Period.

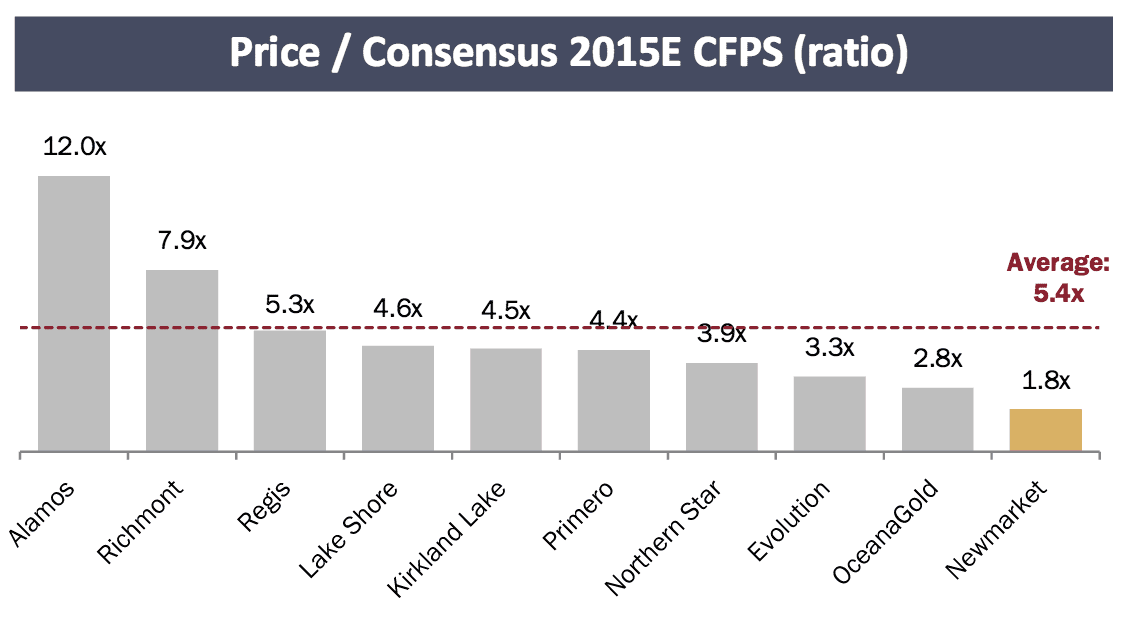

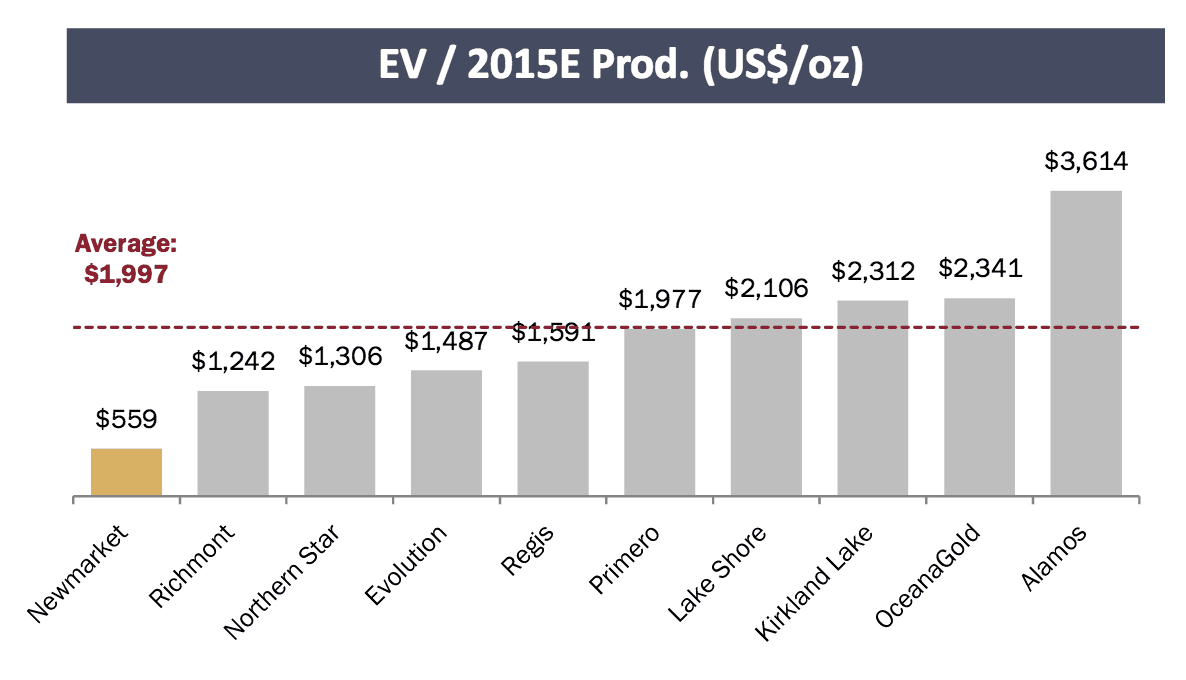

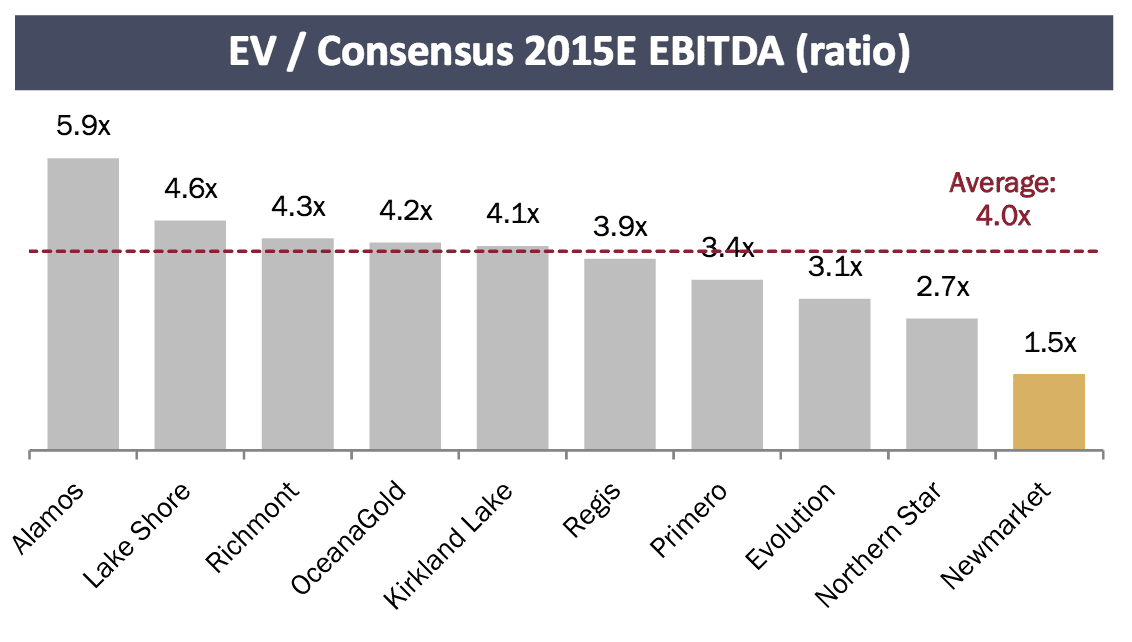

Earlier this summer, I introduced you to Newmarket Gold (TSX: NMI) (OTCQX: NMKTF), a new gold producer that I felt was extremely undervalued – especially when compared to its peers.

Since the introduction, NMI shares are now up nearly 83% – making it the best performing gold producer stock on the market today.

But despite the astonishing run in a tough market, I believe it’s just the beginning. I am not the only one who feels this way.

Analysts are now covering the story (and I expect more to jump on board) and have put out recommendations and target prices that are much higher than where the Company trades today.

And with good reasons.

NMI is still significantly undervalued when compared to its peers and is run by a management team and a BOD comprised of some of the best in the business.

If you haven’t read my original report, you can catch up by CLICKING HERE.

You can also find a follow-up report by CLICKING HERE.

Before I continue, I want to go back to why I introduced the Company in the first place.

Via “One of the Most Undervalued Producers You Never Heard Of“:

“Commodities, resources, and precious metals have continued their slide, crippling the majority of the Canadian market.

That’s why over the past year, I have told my readers to stay away from the Canadian market while looking to the US market that was, and still is, hot.

This week was one of the worst weeks for gold, as a bear raid forced its price down to the lowest level in five years. It sent the benchmark Philadelphia Stock Exchange Gold and Silver Index of the largest producers to its lowest since 2001.

But shortly after the last time we witnessed panic selling like this, the leading gold-stock index more than quadrupled in value, and many of the smaller gold miners with strong fundamentals climbed even higher.

Gold stocks are now trading at fundamentally ridiculous price levels today and have never been cheaper relative to the gold price itself. This is an anomaly that simply isn’t sustainable.

Which is why I believe that gold’s actions this week may have just set us up for an incredible opportunity.”

A week ago, the Fed left interest rate unchanged, which told us that the US economy is nowhere near where it needs to be. And with global economic and financial conditions deteriorating, the fear gauge is back with the VIX (the fear index) doubling since the start of August – just after I wrote the Letter.

(it is interesting to note that in the weeks after my Letter, gold stocks did, in fact, go for a nice run, before once again being hammered back down).

While most gold stocks have been relatively flat over the past few months, there does appear to be lots of buy side volume brewing – especially over the last week.

That means funds and institutions are once again looking at gold stocks – not because they like gold, but because they are looking for value.

And since value is what they are looking for, it only makes sense that they look at:

Why?

I could go on about the Company’s management, which includes some of the best in the industry.

I could go on about the Company’s strong balance sheet – a rare occurrence in today’s gold market.

I could on about the Company’s continued growing Free Cash Flow that – according to one

analyst – may be on the verge of significant Free Cash Flow generation in 2015/16E, even at current depressed metal prices.

But quite simply, Newmarket Gold is still one of the most undervalued gold producers on the market.

|

Source: Newmarket Gold Investor Presentation, September 24, 2015: FactSet, Bloomberg, company disclosure, available equity research. Averages exclude Newmarket

|

When compared to its peers, Newmarket is still way undervalued.

But that’s not all.

The Company continues to make organic new growth discoveries with continued high-grade drill results.

Here are just some of the drill results released over the last few weeks alone, all outside of the Company’s current mineral and resources report from December 2014:

- High-grade visible gold drill intercepts associated with the Eagle Fault including 16.38 g/t Au(1) over 18.0 m (ETW 16.56 m) in hole UDH1364 (Including 145.3 g/t Au(1) over 0.95 m).

- East Dipping Faults returned high-grade results including 141.1 g/t Au (1) over 5.8 m (ETW 4.59 m) in hole UDH1321 (Including 1908 g/t Au(1) over 0.4 m).

- Development of the Sliver Lode at the Cosmo Mine with additional high grade results including: 14.79 g/t Au over 11.4 m (ETW 11.4 m) in hole CE67518 and 14.07g/t Au over 6.0 m (ETW 5.83 m) in hole CE67522.

- At Stawell, a second phase of drilling in the Aurora B discovery target returned high-grade gold intercepts containing visible gold of 8.03 g/t Au (1) over 8.80 m (ETW 5.0 m) including 51.80 g/t Au (1) over 0.80 m (ETW 0.45 m) in hole MD6347.

The Opportunity

Even at current gold prices, NMI is making money and generating free cash flow. That not only puts the Company in a position for growth through organic exploration – which the Company continues to knock out of the ballpark – but also strength through M&A.

If gold prices increase even slightly, the opportunity becomes exponentially greater as every increase in the price of gold leverages the upside.

And with India having just approved gold to pay dividends via gold-backed bonds, well that’s a story for another time…

Seek the truth,

Ivan Lo

The Equedia Letter

www.equedia.com

We’re biased towards Newmarket Gold Inc. because they are an advertiser. We also own shares in Newmarket Gold, which were purchased after our initial report dated July 26, 2015. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions, including Newmarket Gold Inc. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence. Remember, past performance is not indicative of future performance. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. Furthermore, Newmarket Gold Inc. and its management have no control over our editorial content and any opinions expressed are those of our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us.

Thanks for the update on Newmarket. Glad to see more analyst jumping on board. Volume has picked up and I have yet to see any other gold producers match the performance of NMI. Looking to buy more, and I believe with the warrants may be able to get some at these prices before the next shoot up.

Canadian Gold miner Claude Resources (CLGRF) is my pick as best gold miner to invest in. As of 10:35am Monday 9/28/15 it is up 75.42% YTD and up 141.77% in the last 52 weeks. They have very low outstanding debt and good management team, check them out.