Dear Readers,

I am about to introduce you to one of the best and most undervalued opportunities that you never heard of. While its peers are having their worst quarters, it may be about to have its best one yet.

In just a moment, I’ll tell you why.

But there’s more: next week, the Company is expected to make a very special announcement that could propel its value much higher than where it is today.

I want to emphasize one important thing: this is the FIRST company I have introduced in over a year.

That means it has seriously caught my attention.

Over the past years, I have been privileged to introduce many winners to our readers. And despite market downturns or sector woes, many of the ideas introduced have significantly outperformed their peers during our coverage.

You may recall some of these ideas:

- A small junior gold explorer in Canada, which climbed over 200%, became of the most heavily traded stocks on the TSX Venture, and was named Quebec’s top prospectors two years in a row.

- A world class silver company with one of the highest grade undeveloped silver assets in the world, which nearly tripled its market cap during our coverage, while shares of its peers slumped.

- A Mexican gold producer that doubled its share price in a few short months, significantly outperforming its peers whose shares lagged behind

- A world-class gold asset owner whose shares nearly doubled on three occasions during our coverage.

I take a lot of pride in the companies I choose to introduce.

And, as you can imagine, I am swamped with hundreds of new ideas – if not thousands – throughout the year.

With so many to choose from, why haven’t I introduced a new idea in over a year?

The answer is simple: nothing made sense. Until now…

A Diamond in the Rough

Commodities, resources, and precious metals have continued their slide, crippling the majority of the Canadian market.

That’s why over the past year, I have told my readers to stay away from the Canadian market while looking to the US market that was, and still is, hot.

This week was one of the worst weeks for gold, as a bear raid forced its price down to the lowest level in five years. It sent the benchmark Philadelphia Stock Exchange Gold and Silver Index of the largest producers to its lowest since 2001.

But shortly after the last time we witnessed panic selling like this, the leading gold-stock index more than quadrupled in value, and many of the smaller gold miners with strong fundamentals climbed even higher.

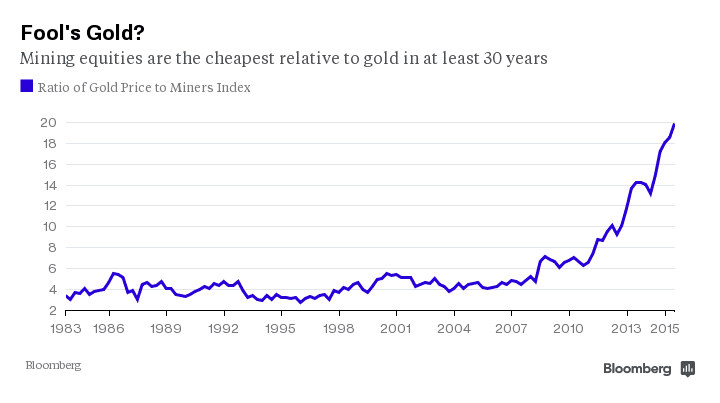

Gold stocks are now trading at fundamentally ridiculous price levels today and have never been cheaper relative to the gold price itself. This is an anomaly that simply isn’t sustainable.

Which is why I believe that gold’s actions this week may have just set us up for an incredible opportunity. It couldn’t have been timed better.

Let me explain.

A Unique and Special Situation

A few months ago, a file came across my desk that immediately got my attention.

It detailed an unusually special situation on how one Company may not only have the firepower to outperform its peers in this down market, but also take advantage of a unique opportunity that many of its peers can’t touch.

As a matter of fact, the recent flash crash in gold and gold producer stocks may actually prove beneficial to this Company.

This deal is the most promising one I have seen in a long time. It was so good, in fact, that I knew there had to be a catch.

And there was: It wasn’t a done deal.

For the deal to go through, the Company would need to raise C$25 million – not exactly an easy thing to do in this capital-constrained environment.

But that wasn’t the hard part.

The hard part was convincing the owners of a basket of cash flow producing assets with more than 7 billion dollars* worth of gold in the ground, to merge their assets into a shell company that didn’t even have the C$25 million yet!

(*based on the total combination of inferred, measured and indicated, and proven and probable gold resources, at today’s gold prices

Now this may seem like a tall order: why would anyone want to merge assets at such a discounted price? Why would anyone want to merge $7 billion worth of gold in the ground and free cash flow, into a shell with nothing more than the anticipation of a C$25 million bank roll?

I thought exactly the same thing…that is until I saw who was involved in this deal.

And that’s where the story begins.

From Humble Beginnings

Great investors and dealmakers know that history repeats itself.

In 2000, gold closed out the year at $272.65, down 30% over the previous five years.

No one in the investment industry could remember investor sentiment being so universally negative.

Against all the negativity, two of the most successful people in the business today — both of who need little introduction — sensed the urgency that gold was about to rebound.

These two men were Ian Telfer and Frank Giustra, and they were worried they weren’t going to have enough great assets to take advantage of a potential gold run.

So they got together and raised money to acquire a shell company called Wheaton River – which at the time had around $20 million in cash but nothing else – to form a new gold company that would go and acquire discounted gold mines.

At the time, their biggest advantage was that no one was paying attention. But that was also their biggest challenge: convincing investors that they weren’t overpaying for gold assets during a time where gold was expected to go lower.

But being two of the best dealmakers in the history of the mining business, Telfer and Giustra used their connections to raise the capital to buy into the Wheaton River during an extremely capital-constrained market – very similar to the market we face today.

In 2001, Telfer became Wheaton River’s CEO, a junior company with a dormant mine, and $20 million in its treasury. And that was it – no producing mines and no producing assets.

But through Telfer’s amazing deal-making tenacity and negotiation skills, he acquired one of the first big projects for Wheaton: the purchase of the Luisman mine in Mexico. The project was worth ten times Wheaton’s market value at the time.

More transactions followed, and Wheaton eventually merged with Goldcorp to form the gold-mining giant it is today.

Telfer’s success was contagious leading him to numerous success stories that have made billions for investors, including: Uranium One, TVX Gold, Peak Gold, Primero Mining, Tahoe Resources, Terrane Metals, and Silver Wheaton.

Why the Wheaton River Story?

Much like the story of Wheaton River, gold is down more than 30% over the last five years, and investor sentiment is extremely negative.

Gold stocks are trading at their lows for the year, and virtually the same conditions exist today as they did in 2001 when Wheaton River was formed – except for some very important things:

- The world has accumulated more debt than it ever has in the history of mankind.

- More money has been created than ever before – by an astronomical amount.

- Total Fed assets to GDP have nearly tripled since that time, while the total Fed balance sheet has increased more than five-fold.

- Since 2010, central banks have been net buyers of gold, and their demand has expanded rapidly, growing from less than two per cent of total world demand in 2010 to 14 per cent in 2014.

- Global central banks are forecasted to continue to be net buyers of gold in 2015.

But that’s not all.

One look at Bloomberg’s chart shows us that gold stocks are now the cheapest they have been in over 30 years relative to the price of gold:

But why would I tell you about the Wheaton River Story?

What does that have to do with the Company I am introducing today?

The Dream Team

Because just like in 2001, some of the biggest names in the business believe it’s the perfect time to create another Wheaton River roll up. And they have banded together to form the Company I am about to introduce.

The coincidences between Wheaton River and the Company I am about to introduce are so vivid, it’s scary. Both companies were a shell company with $20-25 million. Both began by acquiring a producing asset valued at many times more than the shell company was worth. And both have very strong dealmakers.

They have the resources, they have the cash, they have the expertise, and they are all extremely connected.

Some of the people involved were even introduced through Ian Telfer, who is now an advisor to this Company.

I present you one of the most undervalued producers you never heard of…

Newmarket Gold Inc. (TSX: NMI)

The best time to buy assets is when they’re the least expensive. And just from the chart I just showed you, we haven’t seen such low valuations for gold producers in decades.

But not just anyone can acquire great quality assets for discounted prices; these types of assets are sought by some of the best and most connected people with the ability to do these types of deals.

Acquiring quality assets, while simultaneously trying to raise funds for the assets you are acquiring, is one of the trickiest things in the business. It takes a team of seasoned individuals to do that – a team with a lot of know-how, and more importantly, trust in the industry.

That is exactly what Newmarket Gold Inc. (TSX: NMI) has: a dream team comprised of the best in the business. Here are just some of the names involved:

- Doug Forster: A man involved with numerous successes including Terrane Metals which was acquired by Thompson Creek in 2010 for $750 million and Potash One which was acquired by K+S in 2011 for $434 million.

- Lukas Lundin: A billionaire whose sold billions of dollars worth of assets to major gold producers, including the $7.1 billion sale of Red Back Mining in 2010.

- Randall Oliphant: Current chairman of the World Gold Council, past President and Chief Executive Officer of Barrick Gold

- Raymond Threlkeld: A man that has been responsible for putting more than 60 million ounces of gold into production

- Blayne Johnson: A man involved in the acquisitions and buyouts of over a billion dollars, and helped his firm transact over $5 billion of equity financings

- Doug Hurst: A founding executive of International Royalty Corporation from 2003 to 2006 and a director of the company until 2010 when the company was purchased by Royal Gold for $700 million.

Together, the principals of Newmarket Gold Inc. (Newmarket) have founded, managed, and sold mining companies with a combined value of nearly $30 billion!

Take a look:

What if I told you that there was an opportunity to participate right alongside this super successful team?

What if I told you that you could participate at the same price levels – even cheaper in some cases – than the dream team involved in Newmarket Gold (TSX: NMI)?

Well, you can.

Put Your Money Where Your Mouth Is

Founders, management, board of directors, and advisors, have invested $9.4 million into the recent C$25 million financing. And they put money in at $1.25 per share.

That same group has a total investment to date of approximately $12 million, with an average cost base (ACB) between C$0.80-C$1.00 per person.

Newmarket Gold Inc. (TSX: NMI) currently trades at only C$0.82.

The Newmarket (TSX: NMI) Story

Earlier this month, Newmarket Gold completed a transformational merger with Crocodile Gold (Crocodile) to form a new top 20 Canadian-listed gold mining company with three 100% owned operating mines across Australia producing more than 200,000 ounces annually.

Just five years ago, Crocodile Gold’s assets and mines were considered to be some of the best in the business with a lot of potential. At the time, I invested in Crocodile Gold as a result of the recommendations I received from many geologists in my network regarding the strength of their assets and production potential.

Crocodile quickly ramped up production and shares of the Company soared. But soon after production began, operations began to falter.

Crocodile’s assets were outstanding, but a bad barber with the sharpest scissors still won’t give you a good haircut. Such was the case with Crocodile’s management.

Sensing that operations weren’t being properly executed, I sold my shares in Crocodile for a decent profit.

I made the right decision: I later found out that Crocodile’s management wasn’t even keeping track of which employees already had their vacation!

Crocodile began losing money every month. So much that, around 20 months ago, they brought in Rodney Lamond in hopes of turning the mines around.

Many of the geologists I consulted with knew the assets weren’t the problem – the people were. And Rodney Lamond recognized this immediately.

He asked for six months.

Six months later, that is exactly what he did. Rodney had turned the money-losing mines into ones that were profitable.

And they’re getting better.

An Incredible Land Package

Newmarket Gold’s (TSX: NMI) assets and three mines are located in Australia – one of the best and most stable mining jurisdictions in the world, and home to 11% of the world’s economic demonstrated resources of gold.

Within Australia, Newmarket owns a large gold inventory of nearly 7 million ounces consisting of 935,000 ounces of proven and probable (2P) reserves, more than 3.8 million ounces of Measured and Indicated resources (M&I), and over 2 million ounces of inferred resources*.

Together, the Company controls over 4,000 km2 of highly prospective landholdings (that’s about the size of Rhode Island, USA).

*I won’t breakdown each and every asset, but you can find more details in their news release from March 2015, by CLICKING HERE.

You can further access their technical reports by CLICKING HERE.

Delivering Results

The Company is currently on pace to produce 220,000/oz of gold this year through its three mines: Fosterville, Cosmo, and Stawell.

Not only are the three mines anticipated to be at the top end of production guidance for the upcoming quarter, production numbers are getting better at all three of the mines.

This was clearly evident in their Q1 performance where consolidated average grade at the three mines rose to 3.58 g/t – a 22.6% increase year-over-year.

At Fosterville, they’ve intersected a new geologic event that is wider in width and contains free gold. That means both grades and recoveries are going up.

At Cosmo, the grades have gone up almost a gram over the last year, and recoveries have climbed from 80 percent to over 90 percent – clearly adding to the bottom line.

Stawell continues to deliver value by maintaining consistent production levels from its underground operations and successfully produced 9,929 ounces of gold in the first quarter of 2015. Q1 also marked Stawell’s seventh consecutive quarter of gold production above 9,500 ounces – not bad considering that the mine was previously expected to end operations just two years ago.

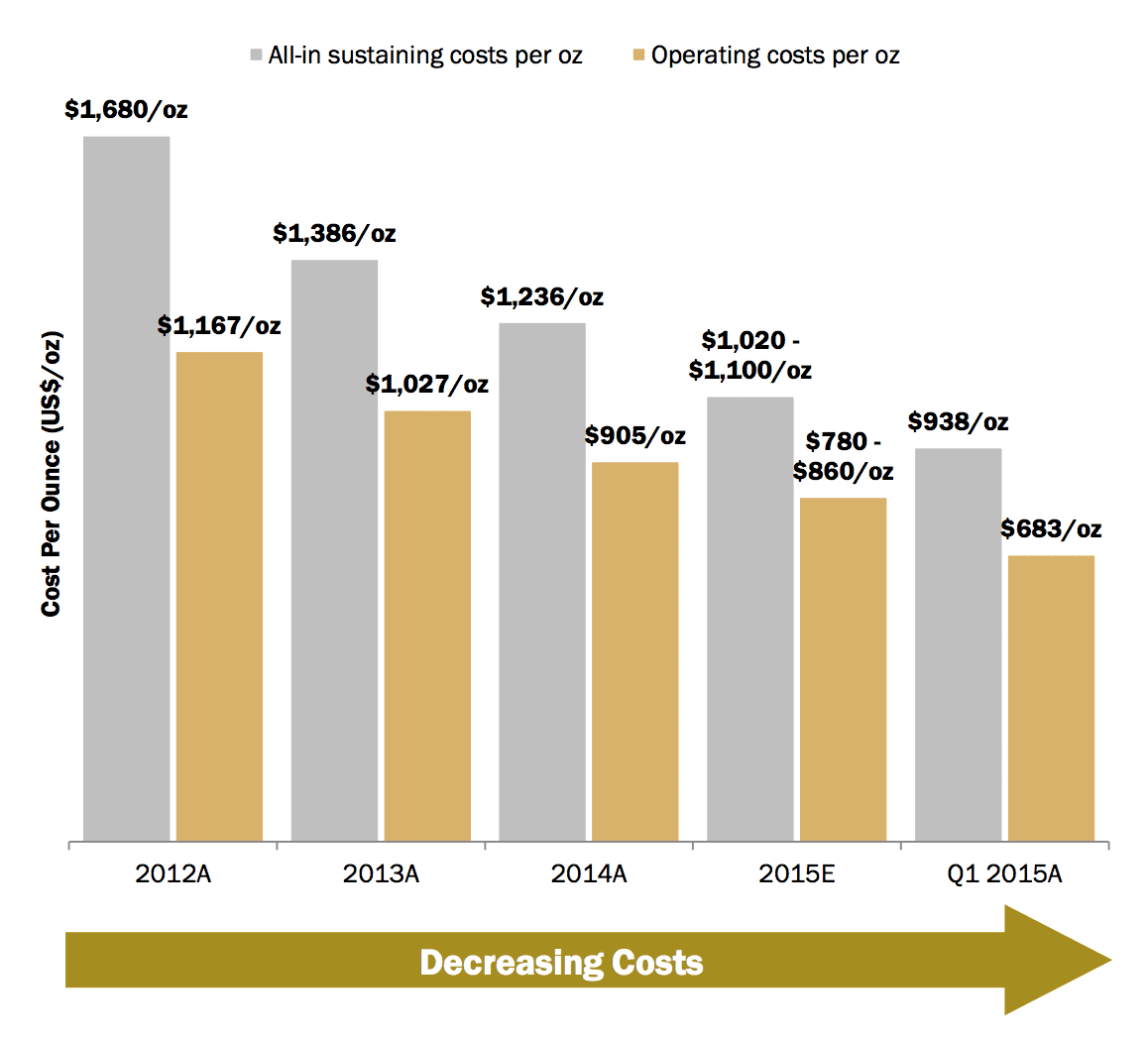

Not only are production numbers getting better, but the costs of production are dropping fast:

- Consistent decrease in operating costs and All In Sustaining Costs (AISC)

- Operating cash costs have decreased 41% since 2012

- All-in sustaining costs have decreased 44% since 2012

- Further cost reductions expected in 2015 and beyond

- Q1 cash costs of US$683/oz and AISC of US$938/oz, significantly below guidance

- Management expects continued optimization efforts to lead to further declines in operating costs and AISC

Which, of course, leads to a better bottom line: Newmarket has more than doubled its free cash flow over the last quarter.

But there’s more to Newmarket than its existing resource.

New Discoveries

Just last week, Newmarket announced significant drill results from their growth projects at Cosmo and Stawell.

At the Stawell mine, they made a significant discovery at the Aurora B East Flank target and intersected 7.06 g/t Au over 17.8 metres with the interval including visible gold.

At Stawell, the West Flank has already produced 2.3 million ozs of gold but the East Flank where the Aurora B discovery has been made has no recorded production. Even after so many years, Newmarket is proving that it can still make significant new gold discoveries.

At the Cosmo Mine, high-Grade drill results for the Cosmo Western Lodes Target, which is outside the current mine plan, included 7.42 g/t Au over 4.3 m and 6.59 g/t Au over 6.4 m.

Newmarket is currently providing mill feed from the Eastern Lodes, but the Western Lodes have the potential to develop additional resources in the future, and this is clearly being demonstrated by the recent high-grade drill results.

Why Now? Why Newmarket Gold?

With so many battered and beaten gold stocks, why now? And why Newmarket?

First of all, putting all gold producers in the same basket is as ridiculous as saying all technology stocks are the same. They’re not.

Yes, many gold producers have AISC above $1200. Yes, many have gone bankrupt or are about to. And yes, many are in serious trouble at today’s gold price.

But not Newmarket Gold (TSX: NMI).

While practically every producer is on track to have their worst quarter, Newmarket Gold may be on track to have its best one yet.

In just a few days, July 30, 2015, Newmarket Gold is set to announce their full Q2 financials. Given the production results already released last week, I am fully expecting Newmarket Gold to have its best quarter yet.

But that’s not all.

Consider the following.

Better than Their Peers: A Comparison

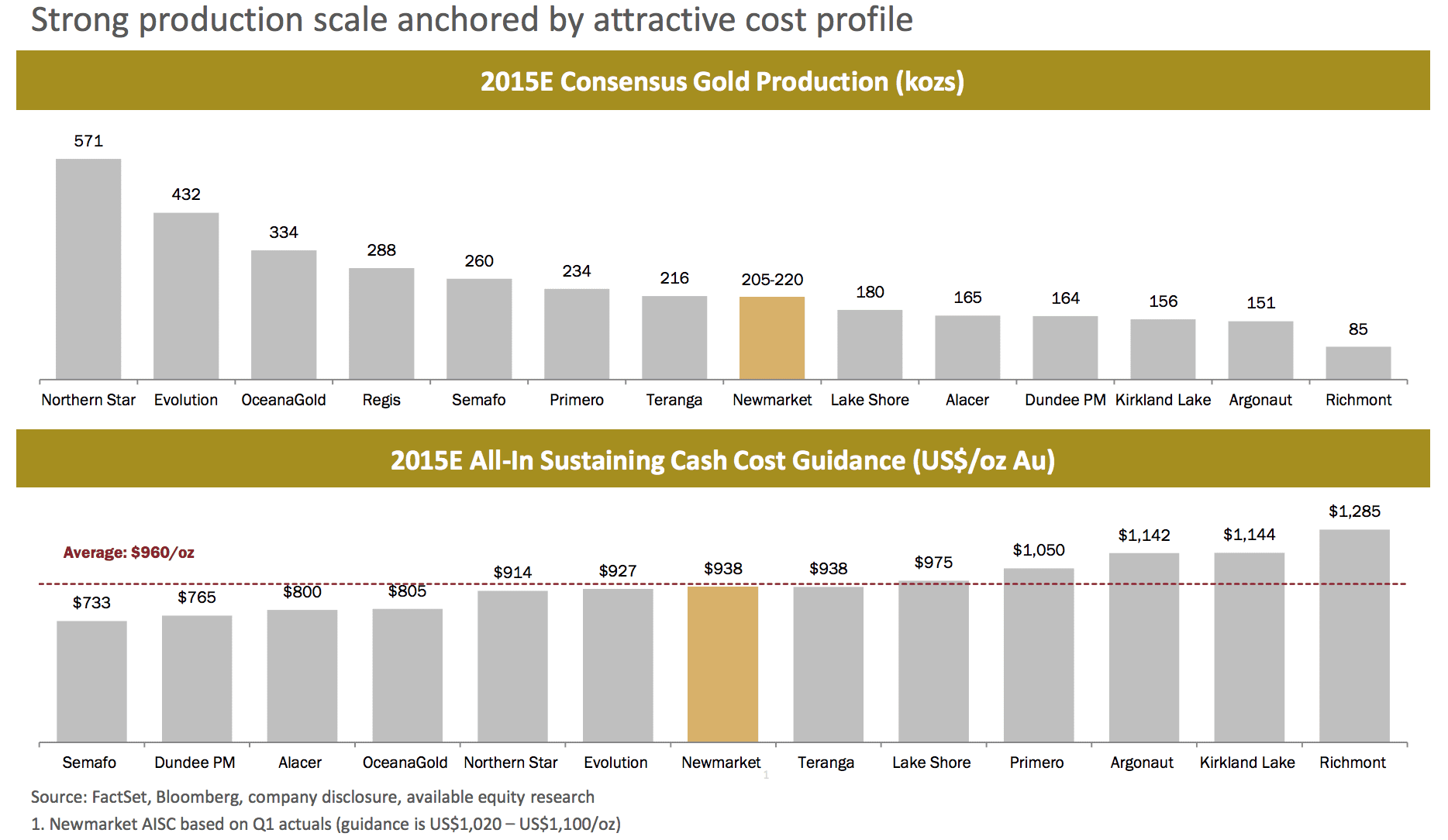

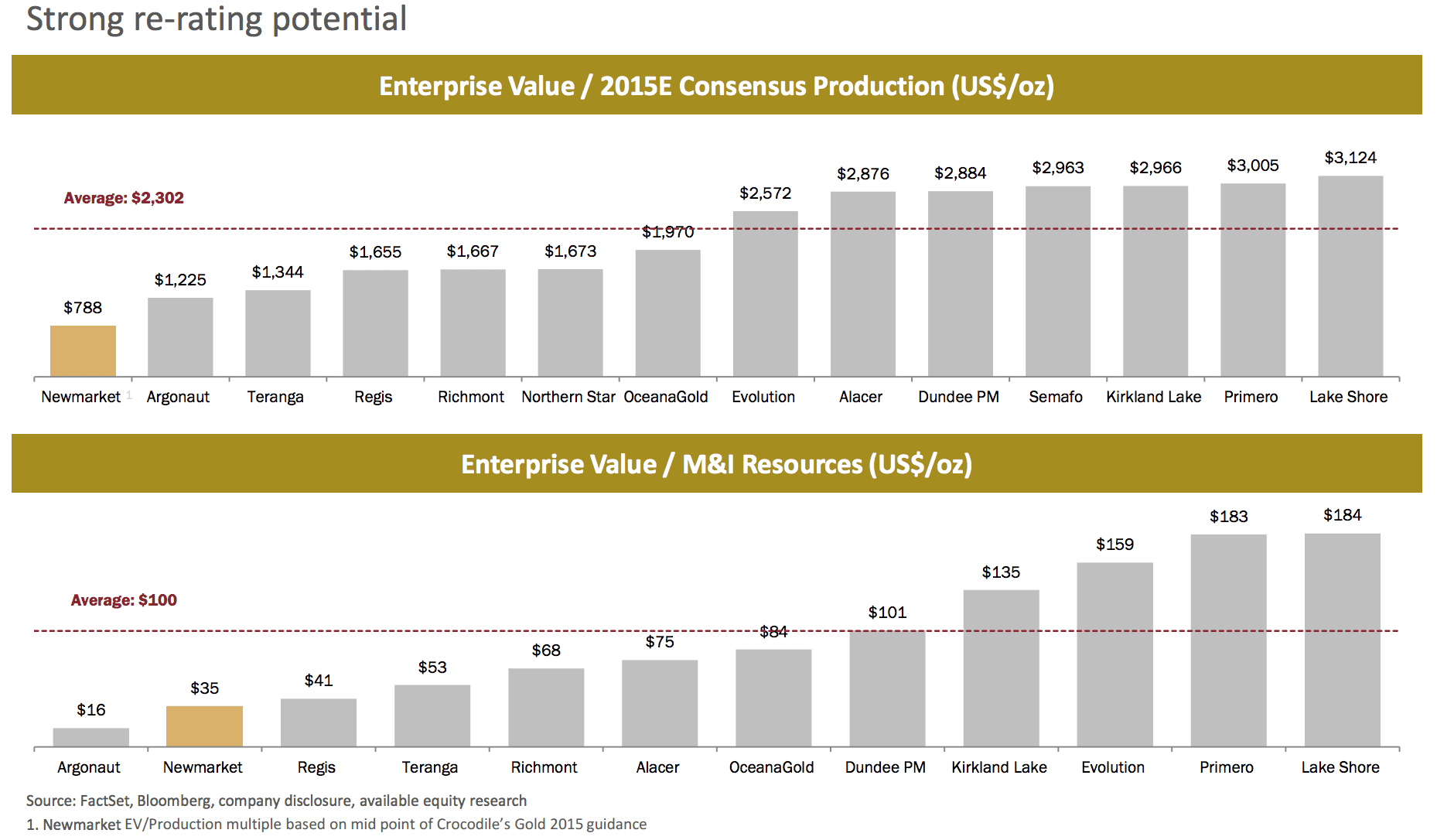

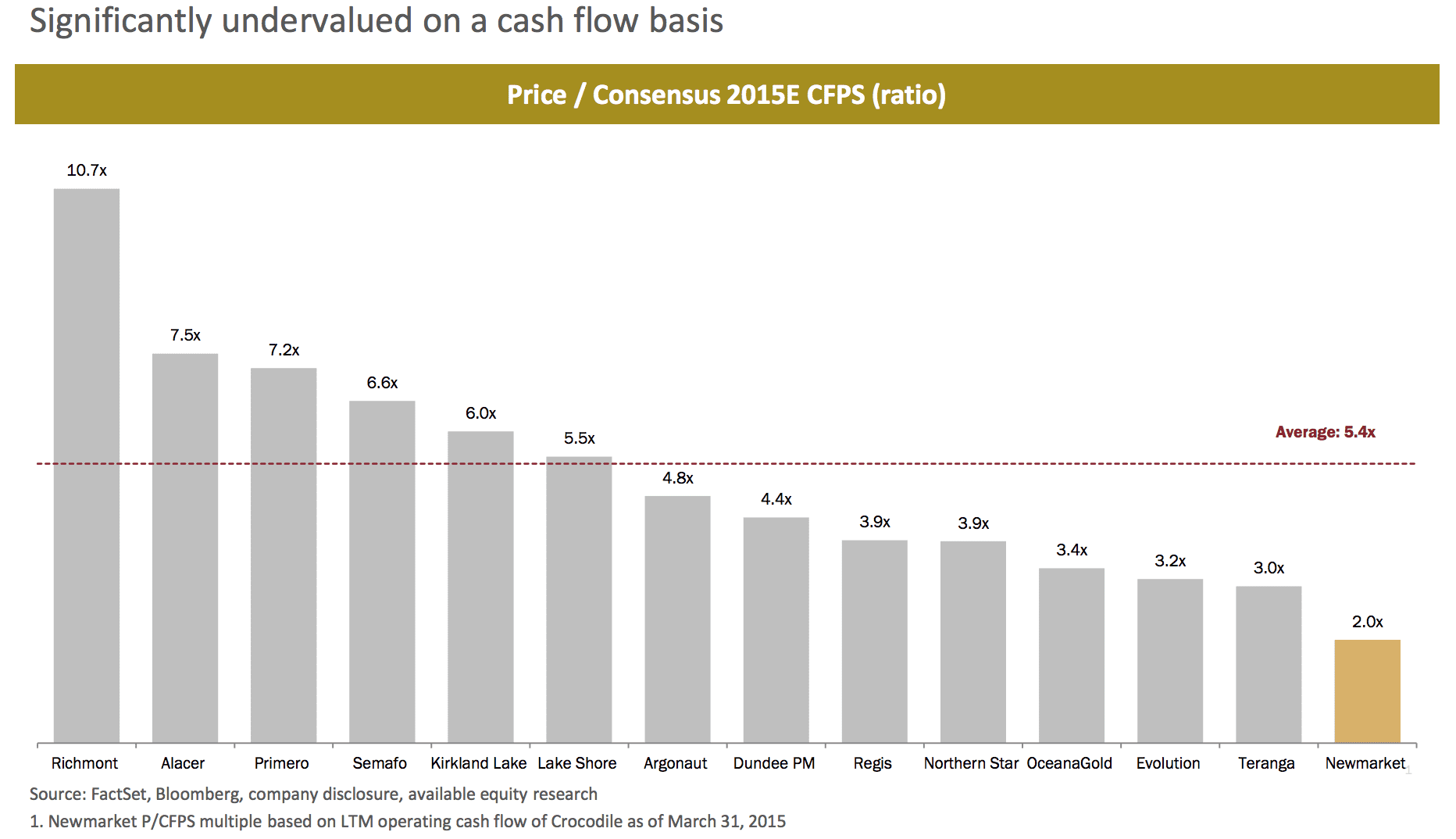

When you compare Newmarket to its peers, that’s when it truly shines:

- One of the lowest Market Caps

- One of the lowest Enterprise Values based on 2015 estimated production

- One of the lowest Enterprise Values based on Measured and Indicated resources

- One of the lowest valuation based on Cash Flow Per Share

Take a look:

Newmarket Mines vs. Abitibi Mines

For those who are paying a significant premium for mines in the Abitibi, consider the following back-of-the-napkin calculations:

Mines in Abitibi, Canada (Kirkland, Lake Shore, Richmont, and Black Fox)

- Old Underground Mines

- All in Sustaining Cash Costs: US$1,120/oz

- Cash Costs: US$770/oz

- G&A Costs: US$85/oz

- P/CF (LTM): 6.0x

- EV/2015E Production:$2,400/oz

- Tax Rates: 26.5% – 30% + mining tax

Newmarket Gold Mines, Australia (Fosterville, Cosmo, Stawell)

- Young Underground Mines

- All in Sustaining Cash Costs: US$938/oz

- Cash Costs: US$683/oz

- G&A Costs: US$25/oz

- P/CF (LTM): 1.4x

- EV/2015E Production:$610/oz

- Tax Rates: 0% due to existing tax shields

There’s no doubt that there is a big value discrepancy between Newmarket Gold and its peers – especially when compared to its peers in the Abitibi.

And what do funds do when they see such big value discrepancies?

Asset Reallocation: Precious Metals Funds Shift

There are numerous precious metals funds in Canada, the U.S. and around the world. The managers of these funds have one goal: to make money for their clients.

In the current weak gold environment, their jobs are proving very difficult.

For these managers to perform, they have to rebalance and reallocate their holdings by removing the poor performers and adding stronger ones. But it’s not easy finding the strong ones, especially when some of the best producers are failing.

Many of the current producers need US$1200 gold to break even, which means many of them are already highly leveraged and in a world of hurt.

But Newmarket is in a unique situation: its costs are low, grades are getting higher, and it continues to outperform quarter after quarter.

Fund managers looking to rebalance their portfolio will soon be looking at new opportunities, and I can’t think of a better place to look than a Company whose balance sheet is getting better, while everyone’s is getting worse.

But there’s yet another reason Newmarket could soon surpass its peers…

Another Unique Opportunity

Gold producers in the Abitibi have always traded at a premium to those in Australia. No one is sure why, since much of their geology is very similar. As a matter of fact, Australia has much younger mines.

But that valuation gap may be about to change.

As gold prices have sunk to the lowest level since 2010, smart investors are now seeking refuge in Australian gold mining stocks.

As Bloomberg just noted this week:

“The key is the plunging Australia currency that’s helping local producers boost margins even as the U.S.-dollar denominated metal slides. While spot gold tumbled 16 percent in the past year, the metal’s price in Australian-dollar terms has risen about 8 percent.

… That’s helped the S&P/ASX All Ordinaries Gold Index of 21 Australian miners gain 12 percent this year as of Thursday, as the benchmark Philadelphia Stock Exchange Gold and Silver Index slumped 31 percent.”

As I mentioned earlier, fund managers need to get rid of the poor performers and add the strong ones. Clearly, the Australian miners are doing better – 43 percent better!

Best of all, no one knows about Newmarket Gold because its so new. Its had no marketing, no road shows, no analyst coverage, no fund coverage, and not one newsletter has covered them.

Most of the institutional funds have no idea they even exist.

But they will soon.

Newmarket has already had multiple analysts at their site, and I assume more on the way. Management will also soon – for the first time – be promoting the story to the capital market. And with their deep connections and relationships, I am sure they will do that very well.

For now, the quiet summer is our opportunity.

I believe that once analysts begin covering the Newmarket story, there’s great potential for a strong re-rate in the share price.

A Winner Amongst Losers

While everyone is losing in the gold market, Newmarket is winning. It has:

- growing cash flows

- great discovery potential

- a massive land package backed by a significant resource base

- improving production numbers, including higher grades and recoveries

- a ridiculously cheap valuation when compared to its peers on multiple metrics

- no analyst coverage yet (which means we’re in at the beginning)

- an incredible team with very deep connections

Furthermore, even at current gold prices, all of their mines are profitable, and the team continues to embark on new acquisitions.

The recent tumble in gold prices may actually help Newmarket’s team as they look to purchase more great producing assets – many of which are now likely even more discounted than before.

This fits perfectly with the Company’s plan to leverage the free cash flow from their mines, using their equity as currency to roll up additional production – much like Wheaton River in the early days.

The Company is already halfway to achieving their goal of becoming a mid-tier gold producer of 400-500k ounces per year – and they just started.

Imagine what these guys could achieve in a few short years…

Risks

Like every deal, there are risks. And the most obvious one for Newmarket Gold is the price of gold.

However, the Company is sheltered by the Aussie Dollar, has a low all-in sustaining cash cost guidance, and production numbers are improving. Back that up with the nearly C$40 million it has in the bank and management’s ability to raise money in tough environments, and Newmarket should be able to weather even lower gold prices.

The second risk is debt. Newmarket has convertible unsecured debentures of C$34.5M with an 8% yield. After the merger with Crocodile, the converts are now convertible at $1.02/share (33.8M shares) and there is a forced convert at 20 day VWAP at $1.52. The upside is that the notes aren’t due until April, 2018 – if cash flows continue to meet expectations, those notes will be of little concern as the market should be able to absorb the convert if exercised. Even with a slight headwind at $1.52, it still represents an 85% return from today’s price.

One more risk that we should look at is its Proven and Probable (2P) reserve of just under a million ounces. 2P reserves is what we know to be economic and is generally pulled out for production first.

However, the Company has a very large resource base of nearly 7 million ounces in both the inferred and measured and indicated categories.

Historically, it has cost the Company about $35/oz to convert M&I to 2P, and ~$45/oz from Inferred to M&I. Of course, mother nature still has to play fair, but after so many years of production and drill work, the geology is very well-known.

To add to the backstop, Newmarket continues to make new discoveries. This is backed up by the recently released high grade drill results from their Cosmo and Stawell growth targets. Management is also currently pursuing a Preliminary Economic Assessment for their Maud Creek asset scheduled for completion by next year.

That means there’s lots of news flow ahead.

Potential Bull Market Ahead?

I could give you hundreds of reasons on why gold should be higher. But I have always said that predicting the price of gold is near impossible when so much of it is controlled/manipulated by powers beyond our control.

But the foundations for gold remain strong and central banks continue to be net buyers of the metal. So regardless of what the media may tell you, if central banks – the ones who control the amount of currency in our financial markets – believe it to be a safe haven, it surely has to be.

I am not saying gold is about to skyrocket, but I do believe that the recent beating in gold stocks is setting up for a potential potential opportunity that may allow us to make some great returns.

“The ratio of gold prices divided by the Philadelphia Gold and Silver Index has spiked above 20.

That level is “by far the highest extreme in history,” according to Warwick Valley Financial’s Ford.

To put that into context, he said that since 1974, the gold/XAU ratio has been greater than 5.0 only about 15% of the time.

The high ratio “does not guarantee near-term gains in gold-mining stocks, but looking out a year or more, an elevated gold/XAU ratio has been a strong indicator of bull markets in gold,” said Ford.”

Barron’s – one of the few publications I respect – also published an article citing that it may be time to sell risk assets, and perhaps buy a little gold:

“Writing on his Felder Report blog, Jesse Felder argues that gold looks like a buy now, particularly among the mining stocks which have fallen harder than the metal itself.

“They say the best time to buy is when there’s blood in the streets,” writes Felder. “At minus 22%, the 5-year average annual return for the Philadelphia Gold/Silver index has never been so poor. This is exactly what ‘blood in the streets’ looks like.”

While the financials of other gold miners continue to get worse, Newmarket has only been getting better – its not bleeding, its making money. And it will make a lot more if gold does rebound even slightly.

Not only that, I don’t know of one gold producer that is as undervalued when compared to its peers than Newmarket Gold. If gold does rebound, it will make Newmarket even more attractive.

The bottom line is this: Newmarket is currently trading at around a C$110 million market cap, with around C$40 million in the bank. It generated free cash flow of over C$17 million in the first quarter alone. That means investors investing in Newmarket at the current share price is not only getting an extreme discount for the near 7 million ounces of gold resources (combination of inferred, M&I, and 2P) Newmarket owns, but an insane discount on future anticipated cash flows!

That’s why gold’s recent drop may have presented us with an incredible opportunity – valuations as low as this is extremely rare to find and absolutely absurd.

In just a few days, Newmarket will release its Q2 financials. If it’s anywhere near as strong as its Q1, we have a lot to be excited about. If its better, then surely Newmarket will get noticed.

I suggest all other gold producers take note: Newmarket is one of the best gold stories around, and it’s certainly outperforming its peers.

It’s only a matter of time before its shares catch up.

Disclaimer and Disclosure

Equedia Network Corporation is also a distributor (and not a publisher) of content supplied by third parties and Subscribers. Accordingly, Equedia Network Corporation has no more editorial control over such content than does a public library, bookstore, or newsstand. Any opinions, advice, statements, services, offers, or other information or content expressed or made available by third parties, including information providers, Subscribers or any other user of the Equedia Network Corporation Network of Sites, are those of the respective author(s) or distributor(s) and not of Equedia Network Corporation. Neither Equedia Network Corporation nor any third-party provider of information guarantees the accuracy, completeness, or usefulness of any content, nor its merchantability or fitness for any particular purpose.

Thanks for another great report. I participated in many of the stocks you had recommended and saw strong profits almost every time – the time I lost was purely bad timing on my part (getting overly greedy and not selling when the stock was over 100%!). Glad to see another new idea after so long – sounds like my patience may be well rewarded with this one!

Nice to see that the old CRK assets are now run by competent people. Gold may or may not be at the bottom, but this deal should do well in the long term. Hopefully liquidity issues won’t be a problem and I can get stock for these prices

Wow. Just read somewhere that the P/E on this thing is at 3, and that’s not even factoring what may be a great Q2 or the recent Bonanza grade drill results.

Seriously undervalued and can’t believe that it will stay at these prices for long once every one wakes up from their summer sleep.

This thing is the only gold stock that has climbed like this since summer. another great idea that has made me nearly 100% in very short, but steady time. Thanks Mr. Lo!

This is a great recommendation. Another gold stock I am accumulating is GORO. I bought when the yield was over 5%. Pays div monthy in FRN or you can take it in phys! Imagine that.