Dear Readers,

What I tell you today could change the way you view many things in life.

Over the past years, I have written about the Real Reason for War in Syria, the Truth About the Currency Wars, and the foundations on how to Solve the World’s Debt Problem.

All of the Letters are interconnected and together they form an important guide to our economy, the stock market, and our very livelihood – an educational non-fiction story of how the world really works.

Today’s Letter marks a very important chapter in this ongoing story.

I am warning you this is not a quick read, but it is an extremely important one.

Take the time to read this Letter in its entirety.

Let’s start with a Letter I wrote back in July 2014.

“When Nations Unite Against the West”

“Emerging economies have had enough of being slaves to a currency that has unlimited production, controlled by one organization.

This control has turned rivals into allies with a common goal of diversification away from the dollar.

It may be hard to grasp the concept of a world not ruled by the dollar, but what we are witnessing in the form of civil wars in the Middle East, to Ukraine and Syria, is a fight for exactly that: de-dollarization.

The dollar currently represents more than 60% of the world’s foreign reserve holdings. Its distribution has allowed the U.S. to enjoy a substantial advantage over every nation in the world.

American lenders have been able to use the dollar’s strength to control emerging markets by making loans with strong contingencies to nations who simply can’t afford to ever pay those loans back.

As I mentioned in my Letter, “The Real Reason for War in Syria“:

“Currency manipulation allows developed countries to print and lend to other developing countries at will.

A rich nation might go into a developing nation and lend them millions of dollars to build bridges, schools, housing, and expand their military efforts. The rich nation convinces the developing nation that by borrowing money, their nation will grow and prosper.

However, these deals are often negotiated at a very specific and hefty cost; the lending nation might demand resources or military and political access. Of course, developing nations often take the loans, but never really have the chance to pay it back.

When the developing nations realize they can’t pay back the loans, they’re at the mercy of the lending nations.

The trick here is that the lending nations can print as much money as they want, and in turn, control the resources of developing nations. In other words, the loans come at a hefty cost to the borrower, but at no cost to the lender.

That is why energy is much more valuable than currency in a fiat system.

That’s why many wars have been fought over the control of energy.”

There’s no doubt that much of this would have never happened if the dollar didn’t rule. And because of its status, the dollar enables the Fed to limit the growth of emerging markets by contracting the money supply at will.

But that’s rapidly changing.

The dollar in foreign holdings has been on a steady decline over the last decade, and a substantial decline will likely take place in the very near future; thus, affecting everything from our investments and our wealth, to our social well-being.

Countries Fight Back

For many years, the dollar has enjoyed its power.

But with power comes greed, and with greed comes suffering.

And some of the world’s largest economies have suffered enough.

World Bank and IMF – We’re Coming for You

Just last week (July 2014), five of the biggest major emerging national economies, Brazil, Russia, India, China, and South Africa (BRICS) signed a long-anticipated document to create a $100 billion BRICS Development Bank (now called New Development Bank (NDB), with headquarters in Shanghai.

The institution will counter the influence of Western lending firms as well as the dollar, and give way for developing economies to grow without being forced into unfair terms from Western lending firms.

The creation of this bank is not only a direct threat to the dollar but also a direct threat to the United States and its control over emerging economies.

Recall the Bretton Woods summit in 1944 that became the basis for the modern system of central banking and foreign exchange as well as the creation of both the World Bank and the IMF.

Their creation gave Western powers control of the world through loans to nations that simply could not afford to pay them. In the end, many of these nations are forced to privatize state-owned assets in order to fulfill their debt obligations.

In other words, it’s a politically correct way to seize the assets of a country and hand them over to corporations and bankers for profit.

Just ask Argentina.

With the creation of the BRICS development bank, emerging nations now have a choice outside of Western policies.

China’s official Xinhua news agency said in an editorial that the agreement ushers in a long-awaited alternative to the “Western-dominated institutes in global finance.”

…The development of the BRICS Development Bank gives poor developing nations (may I add resource-rich) the option to potentially receive better lending terms. In addition, these nations no longer have to rely on the harsh lending terms from Western banks.”

In other words, the BRICS are telling the world that it no longer has to rely on the dollar and Western banks to grow.

And they are all unilaterally engaging other economies to do the same.

Putin’s Roadshow

Putin just kicked off his Latin America trip (July 2014) to gain further support around the world.

But he’s not only gaining allies, he is pursuing those who have a bone to pick with the West.

Take Cuba.

Putin has agreed to write off 90% of Cuba’s debt to Russia, which is equal to $32 billion.

In exchange, Russia gets to reopen an electronic eavesdropping post in Cuba that closed more than a decade ago.

Earlier, I mentioned Argentina. Argentina has already privatized much of its public infrastructure, such as its water services, to the West in order to meet loan obligations.

It’s no wonder that Putin has made it very clear that Argentina would be one of major focus in Latin America.

Clearly, Russia and the BRICS nations are on a worldwide hunt for allies…and they’re succeeding. (I have written many Letters on how they’re succeeding since 2014, such as this one.)

This is a direct threat to the dollar’s value.

But it doesn’t stop there.

Shoot Me

For the past few years, I have given you many examples of how nations are beginning to move away from the dollar in international trade.

…the dollar enjoys its power because of the liquidity it provides to foreign nations when buying or selling goods.

But being the world’s reserve currency also has other benefits. It has the ability to impede the growth of other nations – in particular, the rise of Eastern nations.

Attack Through Sanctions

This week (July 2014), the U.S. issued another round of sanctions against Russia for its continued role in Ukraine.

These sanctions pose a direct threat to Russia and are an international symbol of “don’t f%# with us” by the U.S.

It also means the U.S. is growing increasingly worried about Russia’s forward progress.

Again, recall that Ukraine is a primary energy corridor of significant importance. I strongly suggest you go back and read my letters to get a better understanding of what the real battle in Ukraine and Syria is all about.

You can do so by clicking the following links:

The Real Reason for War in Syria

The Real Reason for War in Ukraine

In American media, the sanctions are about Russia and its “unlawful” stance in Ukraine.

In Russian media, the sanctions are simply about competing gas sales between Russia and the U.S.

Via RT:

“…The connection between the civil war in Ukraine and gas deliveries is far too weak, and the US simply wants Europe to stop buying Russian gas and start buying US gas.”

The above represents the basis for this Letter.

To summarize, nations around the world – led by China and Russia – are on a path to remove the US dollar as the primary world reserve currency.

I have talked about this specifically in many letters, for example, The Truth About the Currency Wars, where I talk about the many currency swaps amongst nations that have been directly implemented to circumvent the US dollar.

This is no secret.

It’s also no secret that countries around the world have been net importers of gold and many of them – Venezuela and Germany included – have repatriated their gold from abroad.

The reason isn’t simply that they believe gold is valuable. There is a very specific reason for this.

And I am about to tell you why. Stay with me.

Do you think the US dollar will collapse?

CLICK HERE to Share Your Thoughts

Still at the Top

While every media outlet wants you to believe that electric cars will remove our dependence from oil, that couldn’t be further from the truth – at least not for another few decades.

I’ll tell you why specifically in just a bit.

Right now, oil and gas remains the most important resource in the world. Every nation needs it, which means every nation needs to buy it.

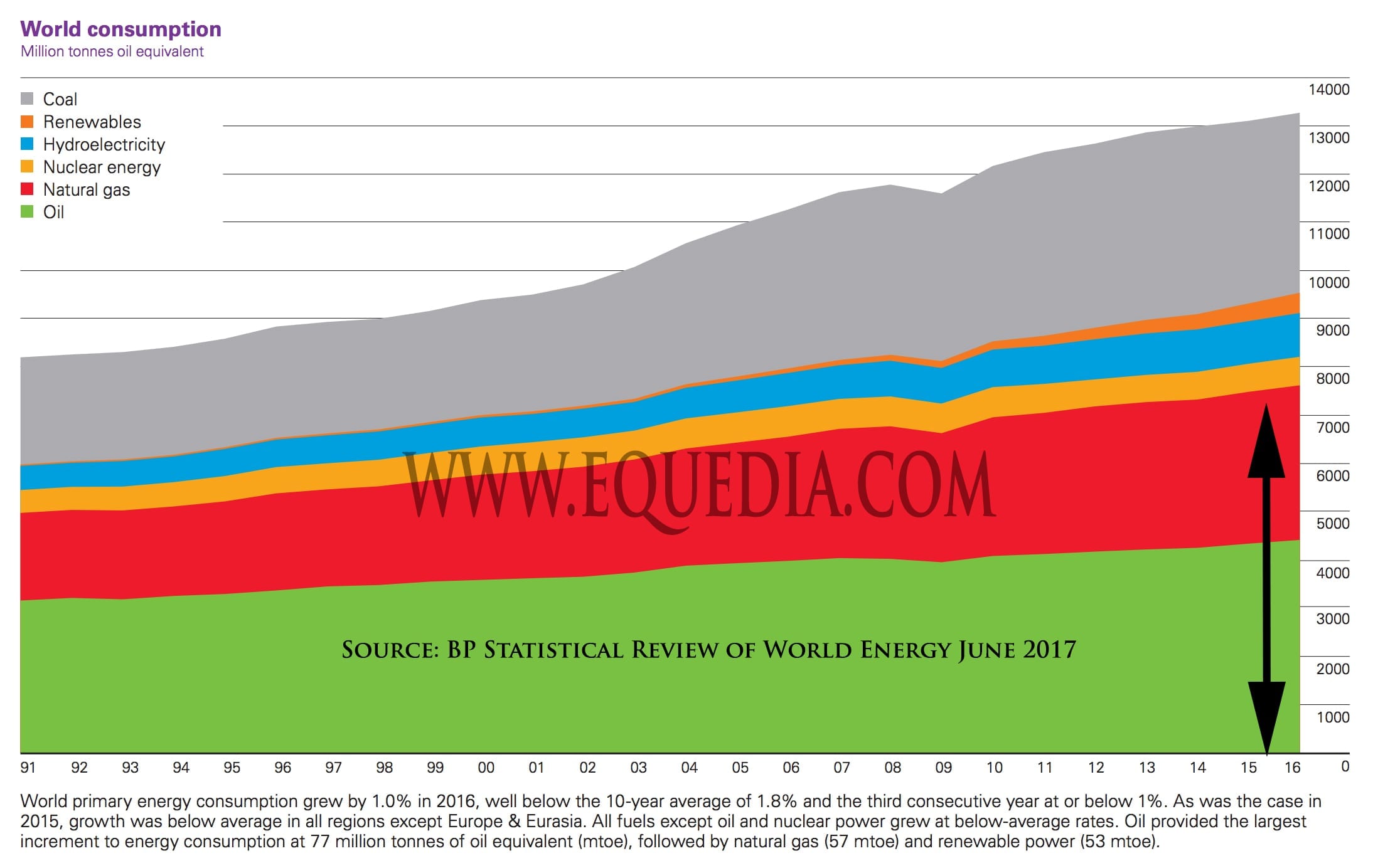

In fact, contrary to what the media tells you, not only do oil and gas still represent more than 50% of the world’s primary energy supply, oil and gas were the top two largest increments in energy consumption last year:

As you already know, the US has been the ultimate consumer and importer of oil for the last few decades. This is one of the primary reasons why the US dollar is the most used currency in the world today.

As you already know, the US has been the ultimate consumer and importer of oil for the last few decades. This is one of the primary reasons why the US dollar is the most used currency in the world today.

Even if you can’t fathom real-life statistics about our growing oil and gas consumption, you can’t deny that oil represents a tangible conduit for the exchange of world currencies.

So while you turn the TV on and see racism, inequality, N. Korea, and Donald Trump, something of the utmost global importance happened this year.

Something that no one has even talked about.

The Silent Takeover

During the first half of 2017, China became the number one crude oil importer in the world – overtaking the United States.

During the first half of 2017, China became the number one crude oil importer in the world – overtaking the United States.

In fact, crude oil flows in China have increased by a whopping 80 percent since 2010 and hit 8.6 million barrels per day (bpd) just last year.

However, the recent increase in consumption wasn’t driven only by a massive increase in Chinese fuel consumption.

In the first half of 2017, “510,000 bpd more was flowing into storage in the first half of 2017 compared to the same period last year.”

That means China’s oil demand wasn’t driven only by consumption, it was driven by strategic and commercial inventory volumes.

But why?

China has publicly made the world aware that they plan to challenge the strength of the U.S. dollar. This includes garnering international legitimacy by making efforts through bilateral trade/swap agreements and inclusion into the IMF’s Special Drawing Rights (SDR).

(*the SDR is an international reserve asset created by the IMF in 1969 to supplement its member countries’ official reserves. Its value is based on a basket of four key international currencies (currently the U.S. dollar, Euro, Japanese Yen, and the British pound), and SDRs can be exchanged for freely usable currencies. See https://www.equedia.com/real-reason-behind-asian-infrastructure-investment-bank/)

Despite the increase in the yuan’s international recognition, it will take much more for nations around the world to accept the yuan as they accept dollars.

For that to happen, nations around the world will not only have to include yuan in their foreign reserves, but they will have to include it in large enough amounts for it to matter.

But how can China’s yuan infiltrate global foreign reserves?

Just ask the United States.

If it Ain’t Broke…

After World War 2, the United States became a global economic powerhouse. They traded with nations all around the world and were the ultimate consumer.

It wasn’t only the economic power of the US that made foreign nations trust its currency; it was the ability for holders to convert their US dollars into gold at any time.

However, all growing economies eventually reach a tipping point before taking a step back.

The U.S. economy after WWII was no different.

Via How Money Works:

“As US government spending continued to rise along with the uncertainty of government policies, foreign nations holding US dollars began converting their dollars into gold.

As a result, the US lost half of its gold reserves in the sixties and by 1971, there were four times the amount of dollars overseas than the US had gold for conversion.

So in that same year, President Nixon told the world they would no longer be able to convert their dollars into gold.

By 1971, there was no longer any backing for gold internationally.”

What followed is extremely important.

“The world was in shock and the global monetary system collapsed.

Under the Bretton Woods system, currencies were all pegged at a fixed exchange rate and trade, for the most part, was in balance.

But as soon Nixon removed gold backing internationally, along with record government spending, the system collapsed.

Inflation also took over and commodity prices skyrocketed. Oil, for example, went from $3.60 to over $35 in 10 years, climbing nearly 900%.

Fixed exchange rates became floating exchange rates and trade imbalances began to blow up.

“Beginning in the early 1980s, annual U.S. trade deficits reached unprecedented levels. After decades of postwar surpluses, the U.S. trade deficit topped $100 billion in 1984 and peaked at a record $153 billion in fiscal year 1987.”

Most of this deficit was with Japan. And that meant a boatload of dollars went into Japan.”

Not only did the global financial and currency market go into disarray, but the United States was beginning to lose its standing as the international economic powerhouse.

It had to do something and it had to do it fast…

The Rise of a New Currency

Oil and gas were the lifeblood of the world economy and one nation was at the epicenter of it all: Saudi Arabia.

If a nation could control the price of oil globally, or at least the majority of it, then its currency could become the most widely used currency.

So the U.S. struck a deal with Saudi Arabia to price Saudi oil in US dollars. But why would Saudi Arabia agree to such terms when they were the biggest exporter of oil?

Because the United States had what no one else in the world had: the strongest and most advanced military weapons.

Via Bloomberg:

“…The basic framework was strikingly simple. The U.S. would buy oil from Saudi Arabia and provide the kingdom military aid and equipment. In return, the Saudis would plow billions of their petrodollar revenue back into Treasuries and finance America’s spending.”

The plan was genius. In return for pricing oil in US dollars, Saudi Arabia would not only get weapons to defend its oil, but it would gain US military support to control the Middle East and the surrounding oil reserves.

Anyone who challenged their plans, such as suggesting alternative currency payments outside of the US dollar, fell to their knees.

Think Muammar Gaddafi (Libyan Oil)* and Saddam Hussein (Iraqi Oil).

(*recall that Muammar Gaddafi proposed to create a unified African currency backed by gold, which could be used to buy and sell African oil and circumvent the US dollar. Hilary Clinton’s leaked emails showed that one of the main reasons Gaddafi was overthrown was to prevent Gaddafi’s plans for a gold-backed currency and prevent oil from being priced outside of the US dollar.)

Since many of the world’s biggest economies, such as the U.K., France, and Japan, were heavily dependent on Saudi Oil, they had no choice but to buy US dollar.

It also made sense for these nations because many of them had massive amounts of US dollar and debt that could no longer be converted into gold. Think Japan (as I mentioned earlier, who had boatloads of US dollars).

In other words, oil became the foundation that paved the way for the US dollar to become the world’s most widely used currency.

So just a few years after the Nixon Shock, the Petro/US dollar was born.

And for decades, the United States maintained control of this energy-currency stranglehold.

But over the past years, this stranglehold has loosened its grip.

And it’s all because of another emerging power.

China: The Next United States?

After WWII, the US experienced tremendous economic growth and was the number one driver of economic activity in the world.

Over the last decade, China has become what the US was post-WWII – growing at more than 6% every year since 1991 and averaging nearly 10% a year since that time.

If China were to solidify its spot as the top global oil importer, it would give China’s currency, the yuan, true international status.

In fact, natural resource purchases, including oil, have already assisted in increasing the yuan’s international position.

For example, back in 2011, Nigeria, one of the largest producers of sweet oil, agreed to sell oil to China in exchange for yuan and thus, began holding yuan in reserves.

A year later, Iran sold oil and gas to China and accepted yuan as payment. This allowed Iran to bypass the dollar-delineated sanctions imposed by the US.

The same thing happened just a few years ago in 2015 when Russia began accepting yuan as payment for oil and gas to combat sanctions from the West.

In fact, as I mentioned in Death of an Oil Giant in 2014, China already has bilateral currency swap lines with more than 20 countries and regions since 2009.

As of 2015, via CFR.org:

“Since 2009, China has signed bilateral currency swap agreements with thirty-two counterparties.”

As a result of the increasing role of the yuan in international trade, the yuan has officially been included into the IMF’s SDR, despite certain convertibility and capital control issues.

And just as the currency swaps haven’t slowed, neither has yuan-for-oil…

The Global Chess Match

There is a serious global chess match right now for the global oil/dollar trade and China is infiltrating nations all around the world.

Earlier this month, a little-known Chinese exploration and production company, CEFC China Energy, announced it would buy a massive stake in Russia’s state-owned oil and gas giant Rosneft:

Via Bloomberg:

“A closely-held Chinese oil company agreed to buy a minority stake in Rosneft PJSC for about $9 billion, deepening energy and political ties with Russia amid increasing tensions with the U.S.

… CEFC will buy a 14.16 percent stake in Rosneft from a joint venture between Glencore and the Qatar Investment Authority for about $9 billion.”

While this stuff doesn’t reach our Trudeau-funded CBC or other American news outlets, the historic deal is the first major Chinese investment into Russia’s oil and gas sector.

And that represents an absolute contender to the US stranglehold on oil pricing.

To make matters worse for the US, this relationship between China and Russia has long been in the works.

Last year, both Rosneft and CEFC signed a deal for the long-term supply of Russian crude into China. Then in July, they signed a cooperation agreement that included an option for CEFC China to buy into the Russian company’s retail business.

But there’s more:

“The Chinese company (CEFC) isn’t only establishing a presence in Russia. Abu Dhabi National Oil Co. in February awarded CEFC a 4 percent stake in an onshore venture that includes China National Petrol Corp., the Asian nation’s biggest producer, as well as BP Plc and Total SA, Japan’s Inpex Corp. and South Korea’s GS Energy. In March, it agreed to buy a stake in the U.S. broker Cowen Group Inc.”

Of course, the big news is China’s ownership in Rosneft.

But why?

Because it allows China a backdoor to markets it could never access on its own.

Back-Door Access to India

China and India have always had a tough relationship. Heck, India just approved to spend $750 billion to protect its borders against a China invasion, despite China announcing the two nations should work together on “common challenges such as ‘anti-globalisation’ and trade protectionism.”

While it’s been mostly peaceful, there’s no doubt that with a disputed border of over 4,000 km tensions will arise.

But India represents one of the biggest emerging oil and gas markets in the world – a market China wants a piece of but never made any real strides.

So how does China infiltrate India?

Just last month, Russia’s Rosneft finally closed a deal to buy a 49% stake in India’s Essar Oil, one of India’s prominent oil and gas firms.

That means China, who owns a piece of Russia’s largest oil and gas company, now also indirectly owns a stake in India’s emerging oil and gas market.

But that’s not all.

Rosneft currently has operations in many places around the world including nations on the completely opposite end, such as Brazil and Venezuela.

Venezuela Attacks

Venezuela is home to the largest oil reserves in the world, according to OPEC data.

Unfortunately, much of Venezuela’s massive oil reserves are located either offshore or deep underground, and consist of heavy oil, making it very expensive to extract.

In other words, the price of oil needs to be much higher for the country to succeed – especially since oil represents 95% of Venezuela’s export earnings. Venezuela President Nicolas Maduro has already suggested that $70 per barrel would be a balanced price and help the global financial situation.

As I mentioned in my Letter, oil prices have been manipulated downward (see my newsletter Why Oil Prices are So Low) and as a result, Venezuela has suffered.

Call it conspiracy but there’s a reason why Venezuelan President Maduro told the world earlier this month that it would remove its dependence on US dollars – and it’s not just because of potential US sanction threats.

“Venezuelan President Nicolas Maduro said on Thursday his cash-strapped country would seek to “free” itself from the U.S. dollar next week, using the weakest of two official foreign exchange regimes and a basket of currencies.”

That’s why Venezuela has been working closely with China and Russia over the past years.

“From 2007 to 2014, China lent Venezuela $63 billion – 53 percent of all its lending to Latin America during this time.

There was an important catch to this largesse; to guarantee repayment, Beijing insisted on being repaid in oil.

With most lending agreed to when oil hovered at more than $100 a barrel, as it did for most of 2007-2014, it seemed a good deal for both sides.

However, when oil dropped to close to $30 a barrel in January 2016, this caused Venezuela’s price tag for serving its debt to explode. To repay Beijing today, Venezuela must now ship two barrels of oil for every one it originally agreed to.”

And guess what?

Just last week, Venezuela launched its attack on the US dollar by using China as its anchor.

“Venezuela published the price of its oil and fuel in Chinese currency on Friday in what it called an effort to free the socialist-run country from the “tyranny of the dollar,” echoing a plan recently announced by President Nicolas Maduro.

Maduro last week said his government would shun the dollar after the United States announced sanctions that blocked certain financial dealings with Venezuela on accusations that the ruling Socialist Party is undermining democracy.

The global oil industry overwhelmingly uses the dollar for pricing of products.

A weekly Oil Ministry bulletin published on Friday listed September prices in yuan, while including prices from previous weeks and months in dollars.”

Do you think it’s a coincidence that all of a sudden, the CIA tells us that it intends to exact a change in the Venezuelan government?

Is it a coincidence that Trump just threatened Venezuela with military intervention?

It’s because Venezuela is directly attacking the dollar.

What do YOU think?

CLICK HERE TO Share Your Thoughts

The current climate in Venezuela and the costs for extracting oil there means the country will have to take a backseat role in China’s yuan infiltration in the near-term.

But what happens when China infiltrates the world’s number one oil producer, who just happens to be under the complete control of the US?

The Big Threat: Saudi Arabia

Nothing could threaten the US dollar reign more than if Saudi Arabia began to accept yuan as payment for oil – Saudi Arabia is the birthplace for the petrodollar after all.

However, this likely won’t happen given the US would most certainly no longer supply the Saudi nations with advanced military weapons nor back them up in a fight, which means the Saudi’s could lose its reign in the Middle East.

But as I mentioned before, this is a global chess match at its finest.

Just a few weeks ago, Saudi Arabia’s Vice Minister of economy said that their government is now considering the possibility of a yuan-denominated bond.

“Saudi Arabia is willing to consider funding itself partly in Chinese yuan, a senior Saudi official said on Thursday, raising the possibility of closer financial ties between the two countries.

The Saudi government has started borrowing tens of billions of dollars abroad in the past year to cover a big budget deficit caused by low oil prices, but its foreign bond issues and loans have been denominated entirely in U.S. currency.

Obtaining some funds in yuan could give Riyadh more financial flexibility and would mark a success for China, the biggest market for Saudi oil, in its drive to make the yuan a top international currency.

… Tuwaijri added, “We will be very willing to consider funding in renminbi and other Chinese products, and Industrial and Commercial Bank of China and other divisions have shown interest for us to do that.”

Furthermore, the two nations agreed on establishing a $20 billion joint investment fund.

“Saudi Arabia and China plan to establish a $20 billion investment fund as the Kingdom deepens ties with its biggest Asian oil customer.

King Salman met Chinese Vice Premier Zhang Gaoli in Jeddah on Thursday amid a flurry of deal-making between the countries, which are both pursuing economic transformation plans through Saudi Arabia’s Vision 2030 and China’s Belt and Road Initiative.

The pair plan to jointly operate the investment fund, sharing costs and profits on a 50:50 basis, Saudi Energy Minister Khalid Al-Falih told Reuters on Thursday.”

Adding more fuel to the fire, the Saudi-Chinese relationship has already been set in motion and the two nations are closer than ever.

In fact, Saudi Aramco is already in talks to buy a 30 percent stake in a refinery owned by China National Petroleum Corporation.

“State-owned oil giant Saudi Arabian Oil Co. is in talks to invest billions of dollars in a Chinese state-owned oil refinery, according to people familiar with the matter.

The deal-which could be valued at up to $2 billion-would give Saudi Aramco, as it is known, a more-than 30% stake in a 260,000-barrels-a-day plant owned by PetroChina Co. in China’s Yunnan province, the people said. PetroChina is a unit of state-owned China National Petroleum Corp.”

Of course, this is all gearing up for the potential significant investment from China into the world’s largest oil producer, Saudi Arabia’s Saudi Aramco.

Saudi Aramco just announced that they intend to go public in what would be the world’s largest-ever IPO.

Talks are already swirling regarding the valuation and legitimacy of the Aramco IPO with many experts stating that it may not happen due to numerous reasons including a lack of transparency and potential oil and gas reserve issues.

However, one might suggest that it’s the US not allowing it to happen because if it does, it could not only open up historical trade secrets between the US and Saudi Arabia, but it could be the end of the US-dollar priced Saudi oil.

We’re already witnessing the groundwork that Saudi Arabia and China are paving to price/trade oil in yuan. But if China ends up buying a stake in Aramco, the pricing of Saudi oil could include yuan, and even shift from dollars to yuan.

If this happens, China would influence nearly 40% of the global oil and gas production through its interests in Russia, Iran, and Saudi Arabia – maybe more when you consider Venezuela.

But will the Saudis allow China to own a stake in Aramco and risk losing US military support?

I think so, but only if it has access to other military support – say, from China.

In March, Saudi Arabia and China struck a massive $65 billion investment cooperation deal. Within that deal was an agreement to set up the first factory for Chinese hunter-killer aerial drones in the Middle East.

“Saudi Arabia’s key science and technology organization has confirmed that one of the deals sealed during Saudi King Salman’s visit to China this month was an agreement to set up the first factory for Chinese hunter-killer aerial drones in the Middle East.”

Furthermore, via Defense News:

“Security ties between the two have also grown significantly, with the Royal Saudi Air Force deploying Chinese unmanned attack drones and the two militaries holding joint counter-terrorism exercises in western China. Chinese naval defense vessels have also visited the Saudi port of Jeddah as part of increasingly active maneuvers in the Gulf of Aden.”

I expect we will soon see a massive arms deal between China and Saudi Arabia to cement their relations. Or we will see the US block it.

Do you think Saudi will ever price its oil in yuan?

CLICK HERE to Share Your Comments

It’s clear that China has done almost everything to increase the use of its yuan through the oil trade.

But there is one last roadblock.

Controlling and influencing oil and gas supplies is one thing, but having the world accept a new unit of pricing for oil is another. If China wants people to accept yuan, it needs its own benchmark.

And that, too, is in the works.

A New Oil Benchmark

Crude exports are primarily priced through the Brent, WTI or Dubai benchmarks – all of which are priced in US dollar.

If China solidifies its rank as the number one importer of oil in the world, it would still be at the mercy of benchmarks priced in US dollar.

In other words, if China truly wants to compete with the US dollar, it must begin pricing oil in its own currency. It must have its own benchmark or marker to serve as a reference price for buyers and sellers of crude oil.

And that’s why it has been working on launching its own crude oil futures on the Shanghai International Energy Exchange.

But there’s a problem.

Why would foreign exporters want to remove themselves from the trusted and easily convertible US dollar?

Simple. Back it up with something tangible.

“…China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry.

The contract could become the most important Asia-based crude oil benchmark, given that China is the world’s biggest oil importer. Crude oil is usually priced in relation to Brent or West Texas Intermediate (WTI) futures, both denominated in U.S. dollars.

China’s move will allow exporters such as Russia and Iran to circumvent U.S. sanctions by trading in yuan. To further entice trade, China says the yuan will be fully convertible into gold on exchanges in Shanghai and Hong Kong.”

Not only will China’s oil benchmark be priced in yuan, but those still wary of the yuan could convert their holdings into gold.

And yes, that means we’ll likely see higher gold prices in the coming months and years.

It’s no wonder China – and Russia – have been serious net importers of gold in the past decade, with record net inflows of gold. Many argue that China is now the biggest holder of gold.

If China is successful, the rules of the global oil game will change enormously. And that means the rules of the global currency game will change as well.

It’s no wonder oil-producing nations around the world have been hoarding their gold.

Including, of course, Venezuela.

Hoard Your Gold: Venezuela Nationalizes Gold Sector

Earlier in the week (August 2011), Venezuelan President Hugo Chavez said that he plans to nationalize the gold sector, including extraction and processing, and use the production to boost the country’s international reserves:

“I have here the laws allowing the state to exploit gold and all related activities. That is to say, we’re going to nationalize the gold and we’re going to convert it, among other things, into international reserves because gold continues to increase in value” – Hugo Chavez

He’s also ordered the repatriation of 90 percent of Venezuela’s gold reserves held abroad, returning the country’s gold reserves back to Caracas.”

All of this coincides with talks that Russia and China – and many other emerging markets such as Venezuela – are setting up for a day where a gold-backed currency, likely led by the yuan, comes to the world.

The Reality of Moving Away from Oil

While countries such as Russia and China and the likes grow in their share of oil and gas ownership, globalists and other Western-style nations are attempting to abandon (or at least paint the picture) vehicles which use these as a resource. China has stated the same, but their actions on oil trade say otherwise.

The truth is, while the world goes crazy on the electric car boom fueled by government subsidies, we’ve forgotten to ask one simple question:

“Where will these cars get their power?”

First of all, the majority of power still comes from oil and gas.

Electric vehicles (EV) still need to be plugged into an outlet and in many places, that outlet likely comes from a grid that is powered by oil and gas.

That means even if all cars are powered by electricity, that electricity still has to come from somewhere.

Now think about this.

There were over 263 million vehicles registered alone in the US in 2015.

What would happen if all of these vehicles needed to charge up at the same time?

Could our current grid even handle that?

Not a chance.

Let’s just do some simple math.

On average, it takes around 20 kWh (half-way point between Chevy Bolt and Tesla) for an EV to go 100km.

According to the US Federal Highway Administration, the average driver drives 13,476 miles/year.

In 2015, there were around 218 million drivers holding a valid license in the U.S.

That means a potential of 2,937,768,000,000 – or nearly 3 trillion miles are driven annually in the US alone.

Converting miles to kilometres and we get 4,727,879,304,192 km. That’s nearly 5 trillion kilometres that are driven annually in the US.

Convert that again to the power required to fuel those kilometres and we would need more than 945,575 GW of power!

4727879304192/100km = 47,278,793,041.92 X 20 kWh = 945,575.86 GW

The total summer capacity in 2015 in the United States was just under 1200 GW – nowhere near enough to fuel all of those cars.

Total yearly electric energy produced in the US, including renewables, solar, everything, was 4,079 Twh.

To power and charge all of the cars on the road in the US for one year, we would require nearly 25% of all the energy produced in the US!

I am not an engineer or an electrician so my math could be off, but no matter how you spin it, it will take an insane amount of energy to power an America of electric cars.

I suspect that nuclear power plants, and thus uranium, will be making a huge comeback if this shift to electric is real. And grid infrastructure will need to be improved big time. If you’re looking for an alternative play to the EV boom, those are two places to start.

Look, I am not saying that electric vehicles don’t make sense, I am just saying we’re not as close as the media tells us in replacing oil and gas vehicles.

What do you think?

CLICK HERE to Share Your Thoughts

End of Chapter

Earlier this week, the United States announced that the national debt had finally breached the $20 trillion mark.

The rise of the US post-WWII encouraged nations around the world to hold US dollars. But when they began to sense the US economy slowing, political uncertainties brewing, and US debt rising, they began to convert these dollars to gold .

Today, many would argue that US economic growth is slowing and may be headed towards another recession – especially if interest rates rise and the Fed decreases the money supply.

Today, political uncertainties are extremely high with a divided Trump government.

Today, US debt is higher than ever.

All of this could lead to a new era of foreign entities who want something that’s backed by gold – especially if the US no longer has control of the oil supplies and its pricing benchmark.

With the rise of one power comes the weakening of another.

In this case, the rise of China and its yuan means the weakening of the US and its dollar.

The only thing standing in the way of US dollar dominance is the might of the United States’ military power – not just at home, but overseas where it has nearly 800 military bases in more than 70 countries and territories.

If China continues to increase its power, then the US may have to resort to military might to prevent its decline.

And that is a scary thought.

*A note to loyal readers. The Equedia Letter is now a monthly edition. As you’ve seen if you’ve read up to this point, it takes a lot of research and time to write a Letter. In order to continue with the quality of work, you’ll now receive monthly editions of the Equedia Letter. But don’t worry, there will be a lot of new weekly content on www.equedia.com full of economic research, technological trends, and most importantly investment trends to help grow your portfolio. Thanks so much for being a loyal follower of our Letter.

All you’re doing is the same as every other Newsletter – fear Yes China will/is going to be the next superpower it’s part of the cycle. USD will not collapse, it will just change as everything else and as to those who listen to Richard Russel he’s been wrong for way to long and the same as those gold bugs too. China giving money to Venezuela will come with a big and painful cost too and will be no difference then US giving them cash either. As Trump said this past week, “America comes first” and what you think China is saying?? I bet the same “China comes first” Also it doesn’t matter where the oil contracts end up “China is expected shortly to launch a crude oil futures contract priced in yuan” because end of days get converted again into USD because money is flowing out of China.

Well put. Thanx for saving me the effort of a lengthy reply to this ‘bad news’ hype letter.

If you are right Eric, I can sigh with relief and go spend my inflation proof gold. If you are incorrect, you may have a hard time of it I’m afraid. Don’t be sure sure that you don’t hedge against this possibility.

ERICVORG….. Did you even read the article ?

Would investing in the Yuan be a smart thing to do ?

Perhaps it would. At least, investing in the better Chinese companies stocks would be an alternative.

Great article! It must be the reason our Treasury Secretary made an unexpected visit to Fort Knox.

This is a great read and your references appreciated, if this doesn’t make people think and start researching nothing will. –Thanks — JS.

Your comment regarding EV is now outdated. The latest development in China is that they will use Hydrogen Fuel Cell vehicle.(HV) The biggest problem of using Hydrogen as a source of energy is the storage of Hydrogen. For example the Toyota Mirai Hydrogen fuel cell car uses a very strong and thick tank to store Hydrogen in liquid form.( Keep Hydrogen in a high pressure chamber). In a few months, this will become obsolete. China now invents a new material to storage Hydrogen without the need of high pressure nor very low temperature. The storage can work in normal room temperature and pressure. This substantially lower the costs to make a Hydrogen vehicle and substantially safer. Hydrogen is much more environment friendly than EV. Lithium battery used in EV requires another source to manufacture the electricity, and the making and disposal of lithium batteries represent environment risks too. You can research on this issue. Once HV becomes popular, EV will be obsolete. SAIC Motor in Shanghai has announced that it will manufacture cars run on Hydrogen Fell Cell, and will give up EV. Other China car factories will follow. So EV will probably be obsolete in a few years. Refuelling Hydrogen is as easy as refuelling gasoline and existing gas stations can just easily add Hydrogen pumps, and refuelling takes only 3 minutes. China has set up some “mini nuclear power plants” to extract Hydrogen from water. The Hydrogen (in liquid form) will be trucked to pump stations for vehicle refuelling. Hydrogen is much cleaner and cheaper than gasoline or electricity. And the source and is water. Now the storage issue is solved. There is no reason that HV be not popular as it’s apparent benefits are so clear; cheaper, cleaner, unlimited supply, no big technical changes on a vehicle.

Very soon petroleum corporations and Tesla will become broke.

The good part of this hype letter is reading thoughtful replies like yours.

While you may be correct that HV could be tbe next thing, it would take at least a decade for them to be commercially viable. People have been talking about electric cars for decades – technology on a massive scale takes time.

I disagree that hydrogen will be the next big thing. The problem is you have to generate the hydrogen in the first place, i.e. separate it from water or some other similar process. The energy used to free the hydrogen from this would be more efficiently used if it was put straight into our cars… And while the same logic may be used against electric cars, EV’s require electricity which is much easier to generate than liquid chemical fuels and can come from a wide variety of places, some renewable and some not. The other major problem with hydrogen is that the cheapest and easiest source to make hydrogen is to strip it from natural gas. It then turns out it is more energy efficient to just burn that natural gas straight in an internal combustion engine… plus you don’t have all the problems with storing hydrogen at high pressure; natural gas is easier to store. Any way you look at it, hydrogen fuel cells make zero sense.

I’d also like to address your comment in the article about the rise of EV’s requiring a bunch of new electrical generation infrastructure. Your calculation looks good and the conculsion is accurate — that switching the entire fleet of passenger vehicles to electric would require 25% more electricity generation. However, the point you are overlooking is that by far the majority of people will charge their cars overnight when demand otherwise goes down. The bottom line is that no new electrical generation infrastructure would be required for this transition, it would just continue running on high overnight. Of course we would need more fuel to run the electricity generation if it comes from fossil fuels like gas or coal, but no new generation infrastructure would be required. It isn’t a perfect solution but one of the required steps in the process. Perhaps the next step would be to then transition to generate the electricity cleanly. Look at this website for charts of how much electricity demand otherwise goes down at night. Also search out the “smart grid” where your car would talk with the grid and only charge when demand is low and electricity is cheap. It could even sell power back into the grid when demand and price are high, so you can make profit off your car acting as a buffer storage device.

https://energymag.net/daily-energy-demand-curve/

I wouldn’t bet money on that last statement.

It is inevitable that the Chinese will eventually be in a position to dictate world’s economy. This is actually a blessing in disguise for the USA in that it will have 50% less to worry about world domination and hence the spending. If the USA can maintain the reliancees with her close allies without being imposing, I believe it can maintain it’s superiority and hence progressiveness with the shared resources for half of the globe.

Not in our lifetime I think.

American politicians are too impatient to be so progressive, since they work on two, four or six year election cycles. They always have to be cognizant of the next election in whatever they do. Solution? Limit them to one term.

The US citizen will be much better off when the dollar is not the reserve currency. There seem to be some bankers (who can print money) who feel otherwise but speaking for myself they are they only ones who see an advantage unless there is some sort of pride that has no cash value included. If the dollar is not a reserve currency then there does not have to be so many of them and that helps the citizen.

China is already part of the IMF so the dollar is nothing to them.

Most money trades freely on the Forex so what is all the theoretical discussion about except hot air.

A most intuitive prospect for discussion here. I had no idea about the development of HVs and it’s solution to our dependency of oil and gas.

On a second note about the proposed weakening of the US hold of world commerce, I don’t believe that this will be the case, as the US is based on economically driven colonial ideals which, unfortunately for the lower class, will surely maintain its power hold on the western civilization monetary system in place no matter the consequences which it will bring upon the unprivileged majority population. Too bad that it seems like an ugly human trait at this time of human development.

Hopefully, through my own ” Rose coloured glasses”, the future generations will rebound and change this global mess that we are in right now.

Optimism is necessary to survive.

I don’t see a serious threat to US$ remaining the world’s reserve currency so long as there is no other SAFE place to park big money. Currency transactions dwarf the world’s equities markets… and US debt is where they park. Would anyone park money in Chinese or Russian debt when the rule of law is questionable there? Would you park money in European debt, while Europe is arguably the most stagnant major ecomony in the world, taxation levels obscene, and negative deposit yields a serious policy tool?

And absent these, who else has a large enough debt market to park $? Only Japan, where debt to GDP is in the stratosphere and yields miniscule. Nope, don’t see US$ being dethroned anytime soon…. especially with US debt yields heading up.

This is a great big heap of nonsense. Russia and China in particular are fundamentally corrupt dictatorships. Do you want to put your trust in their management of a global currency . People put their money into dollars because they can trust the institutions supporting it , courts , banks, law enforcement etc. Russia and China can never give the world that.

It’s interesting to see the comments posted – especially the replies that don’t agree with the opinion in this Letter.

Perhaps it’s best I clarify.

I am not saying China will overtake the US dollar – I am simply writing facts on how China is making efforts to, or at least compete with it.

The key word is facts. The facts are clearly stated with supporting links. The premise of this Letter is to let people see things from many perspectives.

It certainly would be very difficult for China to overtake the US dollar, but not as difficult as you may think if they simply want to compete. Ten years ago, people said there would be no way the yuan makes it into the SDR, yet here we are and the yuan makes a large component of it despite capital controls and convertibility issues.

I highly encourage everyone to share their thoughts, but I do think it’s wrong to say “I am wrong” when I simply stated facts, and did not say that China will overtake the USD.

If you disagree with certain facts, please state which facts are wrong and we can clarify. The idea of the Equedia Letter (Equal Media) is to write about all sides of the story.

If you think the USD will prevail, please share why.

If you think the yuan will overtake the USD, please share why.

If you think the yuan will eventually compete with the USD, please share why.

Thanks again to all who have made comments thus far!

One word why the Yuan will gain and surpass the USD…….. US debt.

Thats 3 words

I thank you for your news letters from the past and glad that you are continuing on the monthly schedule. You inspired me to “seek the truth ” and I have subscibed to China daily and sputnick news. I get another Viewpoint and I’ve become very impressed with the brilliance of Xi Jinping and th belt and road and BRIKS initiatives. I believe that the U.S. in particular will work very deviously to delay the inevitable loss of world domination to the point even of war. Interesting but frightening situations in play.

On the bright side, i have used several of your investment recommendation s and usually made some money on your recommendations. Hope to see more in the future.

Thanks again, Edward adolph

Should a person acquire Real gold not certificates or IOUs but real gold

China’s offering of oil futures contracts designated in Yuan, and convertible to gold could be a backdoor way of linking the Yuan to gold. This would ultimately destroy the Dollar, unless we would do the same thing. However, re-linking the Dollar to gold would also destroy the Dollar’s value against the Yuan, because it would require a value of tens of thousands of Dollars per ounce to account for all the $Trillions printed by the Fed since 1971, and Nixon’s de-linking. This would make the Yuan preeminent among currencies. American politicians look for immediate payoffs, even if they weaken us. Chinese politicians respect the value of patience in affairs of state.

Ivan,

Sorry for the delayed reply.

You did not end this excellent and comprehensive analysis with what I thought would be the biggest point – that Trump would announce that we are now going to back the dollar again with gold, and soon.

Seems likely. Any reason you can think of that we wouldn’t – or couldn’t?

John Musial

What you all need to realize is that the US is not the only player in the game. Yiu also have to realize by now that the US government is not always telling you the truth. It’s a false economy. Hell your still looking for weapons of mass destruction hmmm! War feeds the US economy. How many countries has the US invaded in the last 15 years. Why do worried about what’s going on in countries around the world! Or is it just for financial gain, and securing resources.

With China owning 40% Russian oil, if it starts to deal with Saudi Arabia, this would allow Saudi to increase the price of oil and therefore Saudi revenue. Venezuela could then extract its oil as it would become financially feasible to do so and Venezuela’s decision to price oil in Yuan would increase the pressure on the USD and Western currencies further.

The increase in price of oil would not put pressure in China as the deficit would be supplemented by its holdings in Russian oil.

Everyone’s a winner except for the US and whoever carries on dealing solely in USD.

The UK, which has the largest Stock Exchange market is already making advances to China and India. That is what Obama was afraid of with Brexit.

The US might have to re-consider aligning the USD to gold again however that will also put pressure on all Countries (especially US, UK, Europe) who have printed large amounts of currency without improvement in productivity. China not transparent enough to allow a fair realignment.

A big reset is about to happen. The question is when and who long it will last.

Of course the U.S. will eventually be supplanted as THE world power. When and by whom are the real questions.

Argentina has had a history of defaulting on every penny they have borrowed long before the IMF existed.

China is doing exactly what the west did in the previous couple of centuries. And what they are accusing the IMF of doing, just slightly more subtly.

I am a new subscriber, and I must admit, this site is wonderful, insightful, and democratic ( in that everybody is entitled to their own opinion in the face of unbiased facts and research.) This site doesn’t seem to have its hand out for my hard earned dollars, unlike many media outlets that contest to be unbiased only to parrot the mass media remarks.

Thank you Equedia for sharing!

yes

Trulife Distribution – Nutrition Distribution helps our clients achieve success in a complex, competitive retail environment. Our team of nutrition industry experts takes care of everything from importation compliance to marketing, sales and distribution at the ground level. There is no need to navigate the complicated intricacies of the American market when we have already done the work. Let us use our experience to expand your brand and put your product into the hands of American consumers. https://trulifedist.com/

Trulife Distribution – Nutrition Distribution helps our clients achieve success in a complex, competitive retail environment. Our team of nutrition industry experts takes care of everything from importation compliance to marketing, sales and distribution at the ground level. There is no need to navigate the complicated intricacies of the American market when we have already done the work. Let us use our experience to expand your brand and put your product into the hands of American consumers. https://trulifedist.com/

Trulife Distribution – Nutrition Distribution helps our clients achieve success in a complex, competitive retail environment. Our team of nutrition industry experts takes care of everything from importation compliance to marketing, sales and distribution at the ground level. There is no need to navigate the complicated intricacies of the American market when we have already done the work. Let us use our experience to expand your brand and put your product into the hands of American consumers. https://trulifedist.com/

Trulife Distribution – Nutrition Distribution helps our clients achieve success in a complex, competitive retail environment. Our team of nutrition industry experts takes care of everything from importation compliance to marketing, sales and distribution at the ground level. There is no need to navigate the complicated intricacies of the American market when we have already done the work. Let us use our experience to expand your brand and put your product into the hands of American consumers. https://trulifedist.com/