The Truth About the Currency Wars

Preparation is the key to progress and victory.

While the Fed and other Western central banks have pushed countless amounts of currency into the world’s financial system, emerging market nations are preparing themselves for the day when the world’s currency system is reset.

Over the past few years, I have logged and reported on the world’s geopolitical and financial activities: how nations are removing themselves from a Western-controlled world; the real reason for some of the wars overseas; the fight between Russia and the US for pipeline and energy control; how our financial markets are rigged; and how global politics are intertwined to reveal the outcomes of the global financial market.

Ultimately, all of what I have written about boils down to one thing: currency.

The reason for this is simple: the more nations willing to accept your currency for the purchase of goods and services, the more you can outsource your expansion by infiltrating foreign economies. This is why the US has become the dominant world power – every one can transact in their currency.

The term “currency war” has been used many times and has been described as competitive devaluation where countries compete against each other to achieve a relatively low exchange rate for their own currency.

I have talked about how countries, at times, do engage in competitive devaluation. However, those who follow the currency war meme often take the idea of competitive devaluation too far by believing that the winner of a currency war is the first nation who devalues their currency the fastest.

This, in fact, is completely wrong.

Yes, Japan has significantly devalued their currency against other world currencies hoping to artificially create inflation. Yes, the United States – for a brief period – did the same.

But not one nation in the world wants to devalue their currency to the point where they are the least valued currency. Just ask Iran.

Unleash the Dollar

If devaluation was the only concern in a currency war, then perhaps you should tell that to China and Russia.

China, which faces shrinking trade surpluses and growing capital outflows, has been selling its foreign reserves of US dollar at a rapid pace to prop up the value of its own currency.

Russia, Saudi Arabia, Nigeria and Malaysia have been forced to do the same as a result of reduced revenues from commodity exports leading to steep reserve losses.

As a matter of fact, to keep their currency afloat, central banks in emerging markets have been running down their foreign-currency reserves at the fastest pace since the financial crisis.

Via Marketwatch:

“Total foreign-exchange reserves in emerging countries are estimated to have dropped $222 billion to $7.5 trillion during the first quarter, according to a Wall Street Journal analysis of International Monetary Fund data. The 3% decline in reserves would be the biggest percentage loss for a quarter since the first quarter of 2009

…A surging dollar leads to lower values for reserves held by emerging countries in euro, yen, and other hard currencies. Morgan Stanley Investment Management estimated that about 40% of the reserve drop was due to currency valuation changes.

The decline represents a reversal from a decade-long trend of rapid reserve accumulation in developing countries amid strong capital inflows and trade surpluses. According to the IMF, total emerging-market foreign reserves had risen from $610.6 billion in 1999 to peak at $8.1 trillion last June.”

Foreign nations are now selling their massive holdings of US Dollar (USD) to prop up the value of their own currency. They do this by flooding the market with USD so that the immediate supply of USD increases in the market. The more we have of something, the less that something is worth.

The selling of USD reserves from foreign emerging markets is why the recent 9-month rally that the USD enjoyed from last July finally stopped this April.

Could it be possible that emerging markets are selling USD to fight back? There have been many theories as to what happens if these foreign nations, in particular, Russia and China, decide to completely sell off their USD reserves to attack the Dollar. These theories all conclude with the destruction of the USD and the fall of today’s greatest empire.

However, if attacking the US were that simple, it would have already been done.

First, USD represents too large of a portion of these foreign nation reserves; rapidly selling them off would hurt the sellers’ financial system. Second, the US is still the world’s number one consumer by far, representing more than a quarter of the world’s consumer consumption. This means many countries, especially China, rely on the purchasing power of the US via the US Dollar to grow their own economy.

Preparing for a Financial Reset

If you want to maintain purchasing power, your currency has to be strong against other world currencies. And while the Fed has unleashed record amounts of new currency into the financial system, it has been able to maintain the purchasing power that the USD enjoys as the world’s reserve currency.

If you think that winning a currency war means being the first to devalue your currency, then the US is clearly losing. This is obviously not the case – not yet, anyway.

Over the last year, the US dollar index has climbed nearly 20%, while the US saw its strongest economic growth since the 2008 recession. If the currency war meme is correct – that the winner in a currency war is the one who devalues the fastest – how has the US managed to achieve such growth?

CLICK HERE to Share Your Thoughts

With the greenback’s 12-year high against the euro, US GDP for Q1 this year has been dismal. The dollar’s strong run is now causing headwinds for growth, with manufacturing taking a beating as a result.

However, talks of a strong rebound are already back as retail sales, new employee hires, and homes sales, have all climbed in May. When the US dollar is strong, it hurts manufacturing exports, but it does allow American companies to buy things for cheaper and resell at a cheaper price, à la Walmart Rollbacks.

Americans are now buying oil, cars, machinery, and lumber from Canadians and Mexicans for more than 20% less than they did just a year ago; imports from these two countries alone amount to over $650 billion dollars.

Imports from Europe, which amounted to nearly $420 billion dollars last year, is now 30% cheaper than it was a year ago for Americans.

And when Americans see a good deal, they spend.

The Power of the Dollar

The world reserve currency status has propelled the US into the top political, economic, and military power in the world.

But what if foreign nations such as Russia and China were preparing for a day where they would unleash their USD onto the world? What if they could convince other emerging markets to join in?

In order to do that, they would have to make some major preparations.

And that is exactly what they have been doing.

China Continues Currency Push

China’s yuan has made leaps and bounds in preparing for the day it may become one of the world’s primary currencies. I have written about their progress many times, and you can find some of them by CLICKING HERE.

While the US is still by far the dominant global currency reserve, this number has been falling.

In 2001, 72 percent of global currency reserves were in USD; today, its 62 percent.

As the percentage of USD in global currency reserves is shrinking, China’s yuan is growing.

Via Bloomberg:

“The yuan will make up an estimated 2.9 percent of foreign-exchange stockpiles by the end of this year, based on the Central Banking Publications survey sponsored by HSBC Holdings Plc.”

While that number is nothing compared to the USD, it does show China’s progress for the international recognition of its currency.

By the end of this year, it is expected that China’s yuan will not only be fully convertible, but will also receive international recognition by Western nations with a hopeful inclusion into the Special Drawing Rights (SDR) of the IMF.

As I mentioned before, the SDR is an international reserve asset created by the IMF in 1969 to supplement its member countries’ official reserves. Its value is based on a basket of four key international currencies (currently the U.S. dollar, Euro, Japanese Yen, and the British pound), and SDRs can be exchanged for freely usable currencies.

Will the Yuan Make it into the Special Drawing Rights?

Sometime in the near future, likely next week, the IMF is expected to reveal provisional results on whether or not the yuan will be included in the SDR:

Via China Topix:

“Since the beginning of the month, a team of experts from the International Monetary Fund (IMF) have been in China to assess whether the yuan should finally be added to the organization’s basket of currencies with Special Drawing Rights (SDR).

…The inclusion of the yuan into the SDR basket is not only going to make it easier for Chinese investors to do business abroad and vice versa, it will also encourage more nations to include the yuan in their foreign reserve.

Although the IMF will formally announce the result of their review later in the year, Zhu Min, IMF Deputy Managing Director, has revealed that the provisional results of the review will be available by next month, according to China.org.cn.

If the IMF decides to add the yuan to its SDR basket, it would cement the place of China’s economy in the world today. However, should the organization decide to refuse the yuan for a second time, it would play into the hands of the US and other opponents of the yuan’s inclusion in the SDR basket. Many experts agree that it is not a matter of whether it will happen, but when the IMF will agree to include the yuan into its SDR basket.”

While most expect the yuan to be officially voted into the SDR later this year, we certainly shouldn’t jump the gun on expectations.

A while ago, I wrote how the majority of the members of the IMF have already agreed and voted on China’s inclusion into the SDR as part of the wide-ranging governance reforms to reflect the increasing importance of emerging market countries back in 2010. However, nearly five years later, nothing has happened as a result of the US’ voting power:

“… As of March 4, 2015, 163 members having 80.17 percent of total quota had consented.

That means that the majority of nations approve the new quota increase.

Yet, the quota hasn’t changed. Why?

Because, as mentioned above, the quota increase is still dependent on the approval to reform the Executive Board.

In order for the proposed amendment on reform of the Executive Board to enter into force, acceptance by three-fifths of the Fund’s 188 members (or 113 members) having 85 percent of the Fund’s total voting power is required.

As of January 27, 2015, 146 members having 77.07 percent of total voting power had accepted the amendment.

There’s only one country that can change that: the United States of America.

As I mentioned earlier, the US has just over 16% of the voting power at the IMF. If the remaining 7% of the votes accept the amendment, it still leaves us with only 84% – 1% shy of the required 85%.”

In other words, until the US gives the OK, the yuan won’t make it into the SDR.

Of course, it would be hard for the US to provide valid reasons as to why the yuan should not be included, especially given that the use of the yuan has grown internationally at an astonishing pace over the past few years.

The Yuan’s Rapid International Growth

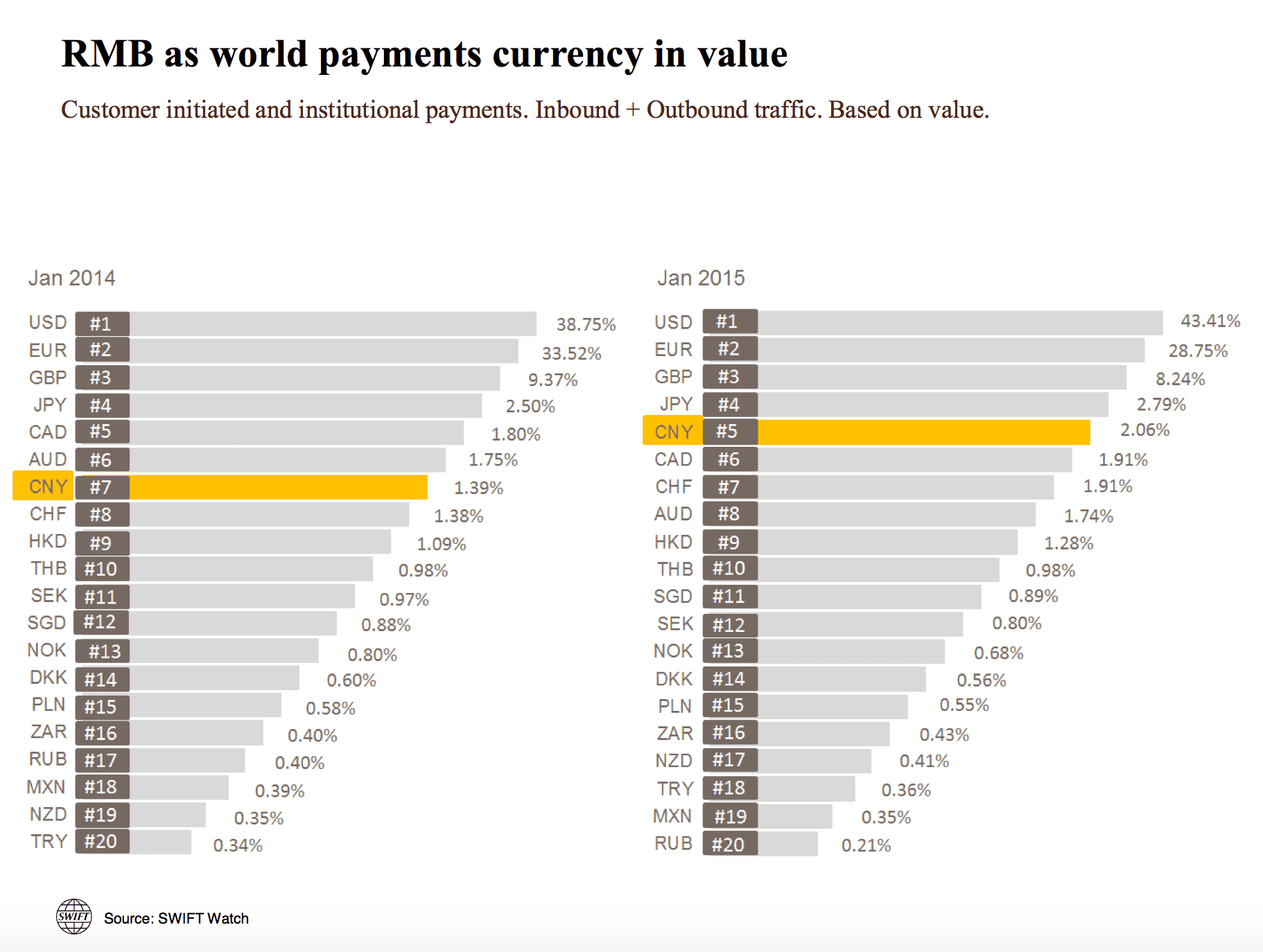

The use of the Chinese Yuan in international transactions has moved from 7th place at the start of last year, to fifth place as of January 2015:

If we take this data back just a couple of years, the yuan’s amazing rise is even more evident: in January 2012, the yuan ranked 20th as the most-used currency.

That means the yuan has climbed 15 spots in less than three years as the most used currency in the world. Just two years ago, the yuan overtook the euro to rank second in global trade finance.

And it’s not just Russia and Eastern nations supporting the yuan.

In London, Renminbi trading and influence is not only booming, but expected to grow – despite US concerns. According to the Telegraph:

“Forex trading in the Asian currency has grown six-fold in just four years, while total deposits have jumped by more than a third in the past 12 months alone.

This growth will be supported by China’s long-awaited international payments system to process cross-border yuan transactions, which could be launched as soon as September. The move should greatly increase global usage of the Chinese currency by cutting transaction costs and processing times.

The International Monetary Fund is also considering adding the yuan to its basket of currencies, which would raise the country’s standing in the global financial system.

Britain has agreed to become a founding member of the China-backed Asian Infrastructure Investment Bank, despite America’s concerns.

The $50bn AIIB has been feted by Beijing as a way of financing regional development, and is seen as a potential rival to US-based institutions such as the World Bank.

“There will be times when we take a different approach (to the United States),” a spokesman for David Cameron said, referring to the decision to join the bank. “We think that it’s in the UK’s national interest.”

Chancellor George Osborne echoed the Prime Minister’s view. “Forging links between the UK and Asian economies to give our companies the best opportunity to work and invest in the world’s fastest growing markets is a key part of our long-term economic plan,” he said.

“Joining the AIIB at the founding stage will create an unrivaled opportunity for the UK and Asia to invest and grow together.”

The AIIB also has support from India, Singapore, Malaysia, Cambodia, Pakistan, the Philippines, Uzbekistan and Vietnam.”

I suspect the yuan will soon surpass the Japanese Yen in international transactions by the end of this year.

China’s Continued Progress

It’s clear that China is pushing very hard to make its yuan an international currency by cementing strategic agreements with other nations, while creating many allies along the way.

Earlier this month, China struck a new oil payment plan with Iran.

According to Breaking Energy:

“Last week, several news agencies in the region, including the Iran Daily and Trend News Agency said that Iran and China have agreed that China would pay in cash for the oil and gas it buys from Iran.

China is currently the biggest buyer of Iranian crude oil, purchasing more than 440,000 barrels per day (b/d), but Tehran imports goods instead of receiving cash from these sales.”

So what? What if China is going to be paying cash instead of goods to Iran?

Remember when I wrote how China and Russia – and other nations – are now bypassing the USD altogether in energy trade? It may be that China has just struck a deal with Iran to do the same.

Continued via Breaking Energy:

“…He added that there is no problem for payment of the oil earnings by the Chinese, without specifying the currency in which the two countries are trading. Crude oil is priced in US dollars, however, China has stated on several occasions that it would like to see the Chinese Yuan, as part of a basket of global currencies, used as the world’s reserve currency to offset a global financial system dominated by the dollar and Western governments. Iran, for its part, has also advocated using a different currency for oil payments, in efforts to distance itself from Washington’s influence.”

It doesn’t take a scholar to read between the lines: Iran continues to be threatened with US sanctions which would prevent them from transacting in US dollar (which is why they have been receiving goods from China instead of cash) and China wants to trade in their own currency. Don’t be surprised if Iran sells oil to China in Yuan, bypassing the Dollar altogether and further removing the dominance of the US petrodollar.

China is well on its way to buying oil in its own currency from energy producing nations such as Russia and Iran. This means it will soon have the same luxuries that the US has enjoyed for so many years.

But if China wants its yuan to become a real competitor to the US dollar from an international standpoint, it will have to do much more; it will have to significantly differentiate itself.

How?

Make people trust it. Back it up with more than just promises.

Backed By Gold?

I’ve talked about many energy deals with China that bypass the dollar, but what about gold? What’s been happening with China’s gold progress?

China hasn’t stopped there either.

Last month, according to Xinhua News:

“China National Gold Group Corporation announced on Monday it has signed an agreement with Russian gold miner Polyus Gold to deepen ties in gold exploration.

The companies will cooperate in mineral resource exploration, technical exchanges and materials supply, the largest gold producer of China said.

Polyus Gold is the largest gold producer in Russia and one of the world’s top 10 gold miners.

The agreement between the two gold miners is one of many deals signed between China and Russia in energy, transportation, space, finance and media exchanges during President Xi Jinping’s visit to Russia from May 8 to May 10.

“China’s Belt and Road Initiative brings unprecedented opportunities for the gold industry. There is ample room for cooperation with neighboring countries, and we have advantages in technique, facilities, cash, and talents,” said Song Xin, general manager of China National Gold Group Corporation.”

But that’s not all.

Xinhua news also reported that 60 countries have now invested in a new $16 billion Chinese fund that will facilitate gold purchase for the central banks of member states to increase their holdings of the precious metal:

“A gold sector fund involving countries along the ancient Silk Road has been set up in northwest China’s Xi’an City during an ongoing forum on investment and trade this weekend.

The fund, led by Shanghai Gold Exchange (SGE), is expected to raise an estimated 100 billion yuan (16.1 billion U.S. Dollars) in three phases.

China is the world’s largest gold producer, and also a major importer and consumer of gold. Among the 65 countries along the routes of the Silk Road Economic Belt and the 21st-Century Maritime Silk Road, there are numerous Asian countries identified as important reserve bases and consumers of gold.

About 60 countries have invested in the fund, which will in turn facilitate gold purchase for the central banks of member states to increase their holdings of the precious metal, according to the SGE.”

All of this coincides with talks that Russia and China – and many other emerging markets such as Venezuela – are setting up for a day where a gold-backed currency, likely led by the yuan, comes to the world.

Combined with the continued physical gold repatriation from Germany, Belgium, Holland, Austria, and even individual states such as Texas, these talks may be more than just talks.

Will you trust the Yuan if its backed by gold?

We’re nowhere near the end of the US Dollar, as some may tell you. But we are near a time where the Yuan will soon become an international, fully convertible currency.

And that is certainly a threat.

Preparation is the key to progress and victory. And China has been making lots of preparations.

Ivan Lo

I have a question what would happen if the US who purchases 25% of the worlds goods suddenly stopped purchasing China’s goods and started purchasing only from Canada and Mexico would the Chinese still have a strong Yen could the Russians step in and purchase as many goods from the Chinese to help them out ? if not then would the Chinese still need all that Gas and oil from Russia

China has been going for the end game for a long time. They are very patient and are able to adapt to changing political and economic conditions. They are allowing a sort of perverted capitalism to forward their goals. Their appetite for expansion is awesome. As long as the US continues on its destructive spending the Chi Coms have a good chance of ultimate success. Gold is just one more brick they are using to build their Kingdom.

solutions:

taking the highest fifty percent of the wolrds countries GDP and averaging it out to create a norm or curve and using this measurement of economics to stabilize all currencies.. Fluctuations allowed to plus or minus ten percent..

No one economy should ever be allowed to control the manipulation of currency value.. The above will give more strength to smaller economies thus reducing the need for a US dollar only..

Folks who are interested in the “currency war” aspects of the geo-political game might be interested in reading a book by James Rickards calleed “Currency Wars”. It covers many of the features mentioned in this article plus points out how sundry comparisons and ratios (GDP calculations , costs of living calculations , interest rate determinations etc) are manipulated to deceive the general public.

I have no idea but what I would like to know is what YOU THINK