A Critical Shift: How the Swiss Just Screwed the ECB

We have just witnessed a very significant event; one that suggests our world is about to rapidly change. This change will bring a lot of grief and a lot of destruction.

But it may be the necessary evil first step to bring order back to the world’s financial system. If we are lucky.

In my last letter, I said, “the next five years will be of great change: from global politics to a complete change in the global financial system.”

Russia, China, and other nations have already been laying the foundation to combat the U.S. dollar, and the Fed’s control of other world currencies.

This week, one of the world’s top central banks finally decided to fight back.

The Swiss Fights Back

It was only a matter of time before one of the world’s most stable currencies decided it had enough of tying itself down to Fed dollars.

Last week, Switzerland and its central bank decided to end its three-year currency peg to the weakening euro. The result was nothing short of stunning: the franc appreciated a whopping 21 percent against the euro this week in New York, jumping as high as 41 percent – the strongest jump since the euro’s debut in 1999.

This marks the first major economy to leave the battle of our current international currency war.

For those in the dark, the Swiss National Bank (SNB) decided to peg its currency to the euro in 2011, in order to avoid being too overvalued against the euro. At the time, it seemed the logical choice: the Eurozone was experiencing a financial meltdown, so investors rushed into Switzerland; thus, sending the franc significantly higher (nearly 50% in a year) against the euro.

Three years later, the obvious result was a franc that not only declined with the euro, but also inflated the SNB’s once impeccable balance sheet.

If the Swiss were to continue its peg to the euro, its balance sheet would have likely gone passed the point of no return.

But why? Why would the Swiss all of a sudden decide now was the time to remove the peg?

Last week, I talked about the massive new stimulus bailout package that’s anticipated to be announced by the ECB later this month. If the SNB continued with its peg against the euro – provided that the ECB goes ahead with its new stimulus package – it would have to add a massive amount of new euros to an already ballooned balance sheet.

The decision to remove its peg against the euro is a direct counter-attack by the SNB in the currency war against the monetary policies of the big three: the dollar, the euro, and the yen. Together, they combine for more than US$7 trillion of new money since 2008.

Without the help of the Swiss, it may be even more difficult to unleash a full-blown European QE.

According to RBS, the ECB will be forced to boost its balance sheet to an insane €4.5 trillion – beating the Fed’s current balance sheet of US$4.5 trillion.

Via Telegraph:

“The European Central Bank will be forced to boost its balance sheet to €4.5 trillion in a colossal monetary blitz to prevent deflation engulfing the Eurozone, economists at RBS have warned.

The figure is the most aggressive forecast issued so far by any major bank and implies quantitative easing (QE) of at least €2.3 trillion, two or even three times the level suggested so far by ECB officials.”

Wealth Destruction

The franc peg removal has already sent a shockwave of disaster to forex trading outlets across the world.

Retail broker Alpari UK just filed for insolvency on Friday, and New York-listed FXCM Inc, one of the biggest platforms catering to online and retail currency traders, just got a $300 million bailout in order to meet regulatory capital requirements, after its clients suffered $225 million of losses.

I began writing this piece earlier in the week and had written about the financial contagion that would occur as a result of the Swiss’ move against the euro. I suggested that we may soon see hedge funds and others begin to collapse as a result of this enormous overnight jump in currency exchange rates.

A few days since I began this Letter, Everest Capital’s Global Fund – with $830 million in assets – has now lost all of that money.

Via Reuters:

“Hedge fund manager Marko Dimitrijevic is closing his largest hedge fund, having lost almost all its money after the Swiss National Bank (SNB) scrapped its three-year-old cap on the franc against the euro, Bloomberg news reported on Saturday.

Citing a person familiar with the firm, Bloomberg said the fund had been betting that the Swiss franc would decline. The fund had about $830 million in assets at the end of 2014, according to a client report cited by Bloomberg.”

This is just one of many hedge funds that likely had significant exposure to the franc. In the coming days and weeks, be prepared to hear more stories about failing funds.

But these failures are peanuts compared to what all of this might mean for the future of the global monetary system.

Next Thursday, the ECB will hold its first policy meeting of the year. Along with the discussions of the Swiss exit, the members will have to face yet another rising/recurring issue: Greece.

CLICK HERE to Share Your Thoughts

The Greece Bank Run

Back in 2011, during the midst of the Eurozone crisis, Greece was imploding and its central bank had to withdraw money from the Emergency Liquidity Assistance (ELA) program created by the ECB.

This past Thursday, two of Greece’s four main banks are now once again seeking access to the ELA.

Via NYTimes:

“In a sign that political uncertainty in Greece has shaken the country’s fragile economy, two of Greece’s four main banks are seeking access to emergency funds from the European Central Bank, a Greek official said on Friday.

Executives at Eurobank and Alpha Bank, the country’s third- and fourth-largest banks, confirmed they were the ones making the request, citing “preventive” reasons. Those acknowledgments followed a report in the daily newspaper Kathimerini that said the lenders had sought 5 billion euros, or $5.8 billion, between them and that other banks were expected to make requests in the coming days.

…The banks’ requests comes before Greek elections set for Jan. 25, when a change of government could cast new uncertainty on the country’s ability to meet the terms of its international bailout program.

Some €3 billion has been withdrawn from Greek banks in the last two months. Speculation in the Greek news media about a potential bank run prompted the country’s central bank to say last week that the situation was under control.”

In other words, the Greeks are once again running to the bank machines and withdrawing their cash. This is more infamously known as a bank run.

Correct me if I am wrong, but drawing on emergency funds doesn’t exactly spell “under control” to me – especially when its your own citizens running away with the cash.

Here we are three years later and we’re once again witnessing the same Greek crisis as before. Only this time, its even more leveraged.

A Sign of Things to Come

What hasn’t been talked about in all of these franc discussions is inflation.

While deflationary forces are most certainly at work – especially in Europe – the amount of money being printed (monetary inflation) will likely begin showing up around the world in the form of higher prices.

What do I mean?

This week, the US dollar fell nearly 20% against the franc – overnight!

That beautiful Swiss watch you wanted to buy just got a lot more expensive.

This should send a message to everyone about just how fragile our global financial system is.

The franc’s rise last week is one of the biggest currency moves by a major economy since the collapse of the Bretton Woods system in 1971, when countries removed themselves from the gold standard.

What do you think would happen if China, or another major world currency, also decided to completely remove its peg against the dollar?

It may seem far-fetched, but the wheels are already in motion.

Is China Preparing to Leave the Dollar Peg?

Over the past few years, we have witnessed China slowly removing its peg to the dollar. This year was no different.

Via Bloomberg:

“China’s holdings of U.S. Treasuries fell to a 20-month low in October, as yuan appreciation indicated less of an impetus to buy the government securities.”

Of course, China hasn’t completely removed itself; a direct removal – for now – would mean an absolute collapse of its export market.

Over the past few years, I have talked about all of the different currency swaps that China has initiated with other nations that directly bypass the U.S. dollar. That’s because in order for China to completely remove the yuan-dollar peg, it would have to make the yuan fully convertible.

And that is exactly what China has been secretly working on.

CLICK HERE to Share Your Thoughts

Backed By More than Promises

China has been secretly buying gold (who knows how much) for years, but hasn’t revealed how much it has accumulated since 2009, when it announced that it has increased its reported holdings by a stunning 75%, to 1,054 tonnes.

What we do know is that China’s gold imports has been growing for years, and in November, exports from Hong Kong rose to their highest level since February.

The recent decline in treasury holdings by China, in conjunction with record inflows of gold from Hong Kong, could suggest it has been using the funds to buy gold (or transferred to Russia for future purchases of oil?).

There’s no doubt that China has a plan, and likely won’t announce its holdings until it gains the support of other nations for its yuan. But you can quote me on this: “When China finally announces its gold holdings, it will shock the world.”

And – unlike the Fed – I bet China won’t have a problem showing its gold to the world*.

(*Here’s something to think about: Since the Fed won’t let anyone – not even its own officials – see the gold in its vaults, what would happen if China does? Will “trust” eventually shift from the U.S. to China?

Furthermore, we know that Germany was unable to repatriate its gold from the Fed, and eventually decided not to bother with it. Could the Fed have promised Germany, head of the Eurozone, that it will help with the euro-debacle in exchange for leaving its gold at the New York Fed? We’ll soon find out…)

The Biggest Public Buyer of Gold: Russia

It’s no secret that Russia has been the biggest buyer of gold in 2014 – at least via publicly available knowledge.

Russia continues to soak up whatever gold it can. By Q4 of 2014, Russia purchased a whopping 55 tons – that’s more than all the central banks combined in Q3 (according to official data).

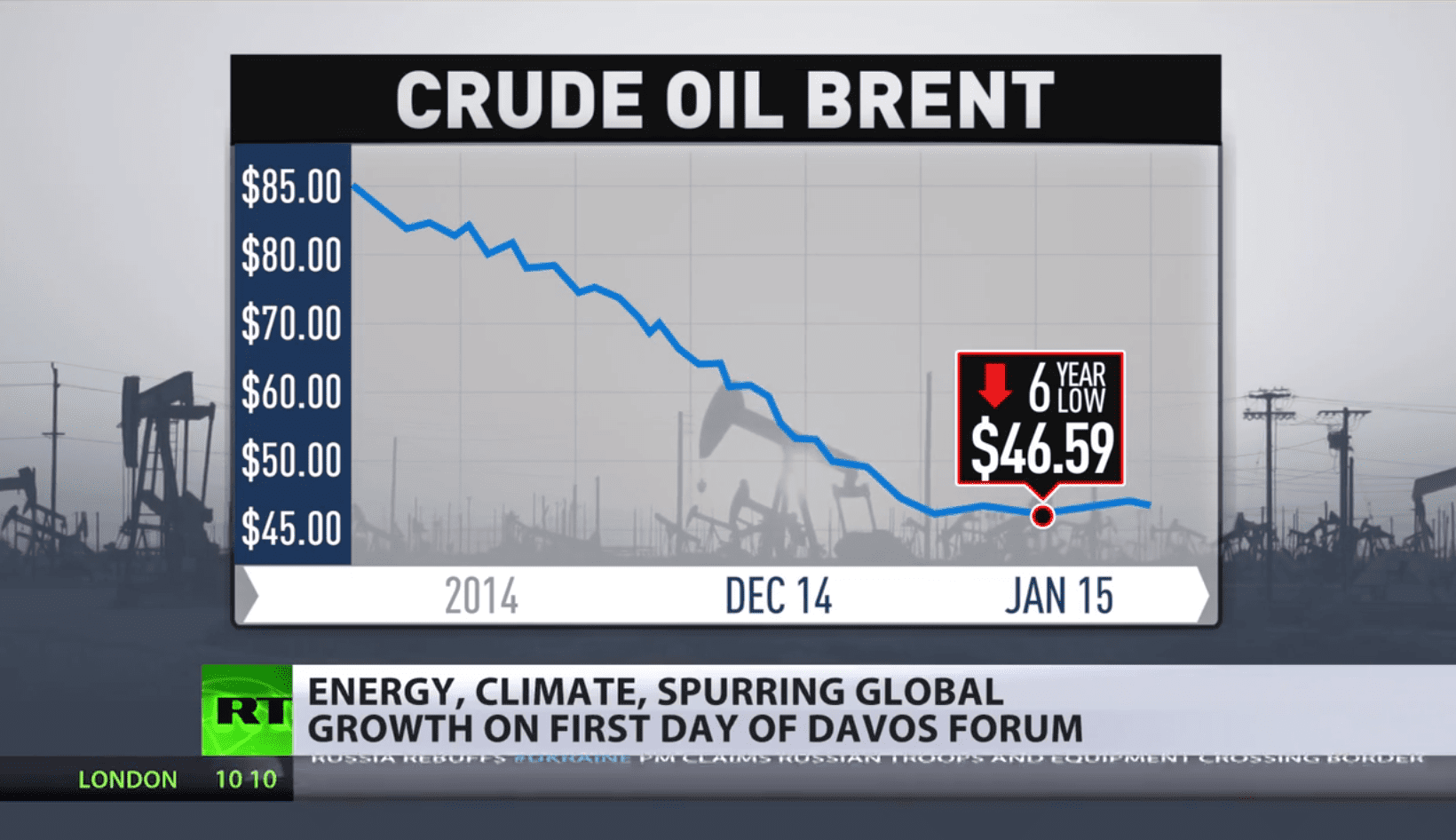

While Russia’s economy is being destroyed by lower oil prices, it still is the leader in energy supplies to Europe. With that being said, what if Russia begins to demand gold for its oil supplies?

Russia’s President, Vladimir Putin, is not a dumb person. Why would he continue to buy so much gold during a time when his country is suffering from lower oil prices? Remember, Russia has already been testing its own clearing system to bypass the West’s SWIFT system.

I am sure the answer will be revealed soon.

Countries all around the world are now asking for their gold back, including Germany, Belgium, Holland, and Austria. Here’s some food for thought: These four nations represent a massive core of the European Union – a union whose central bank is likely about to embark on another round of money printing.

Could these countries be preparing for a Russia-China gold-backed currency swap?

Perhaps it is already happening.

“The new Universal Credit Rating Group (UCRG) is being set up to rival the existing agencies Moody’s, S&P and Fitch, and its first rating will be issued this year.The setting up of UCRG is in its final stages, ready to challenge the ‘Big Three’ that currently dominate the industry, the Managing Director of RusRating, Aleksandr Ovchinnikov told Sputnik News Agency on Tuesday.

“In our opinion, the first ratings [will] appear … during the current year,” Ovchinnikov said, adding that accreditation with the local regulator is already underway.”

It seems to me that China and Russia are well on their way to removing their dependance from a Western-controlled financial system.

Gold: The Final Frontier?

After two straight years of losses, gold is off to its best start to a year since 2008; when, of course, we witnessed gold climb to record highs.

No matter how anti-gold you are, the fact is: gold remains a safe-haven hedge against global financial calamity.

Gold has been on a bearish-to-bullish reversal against the dollar since early November.

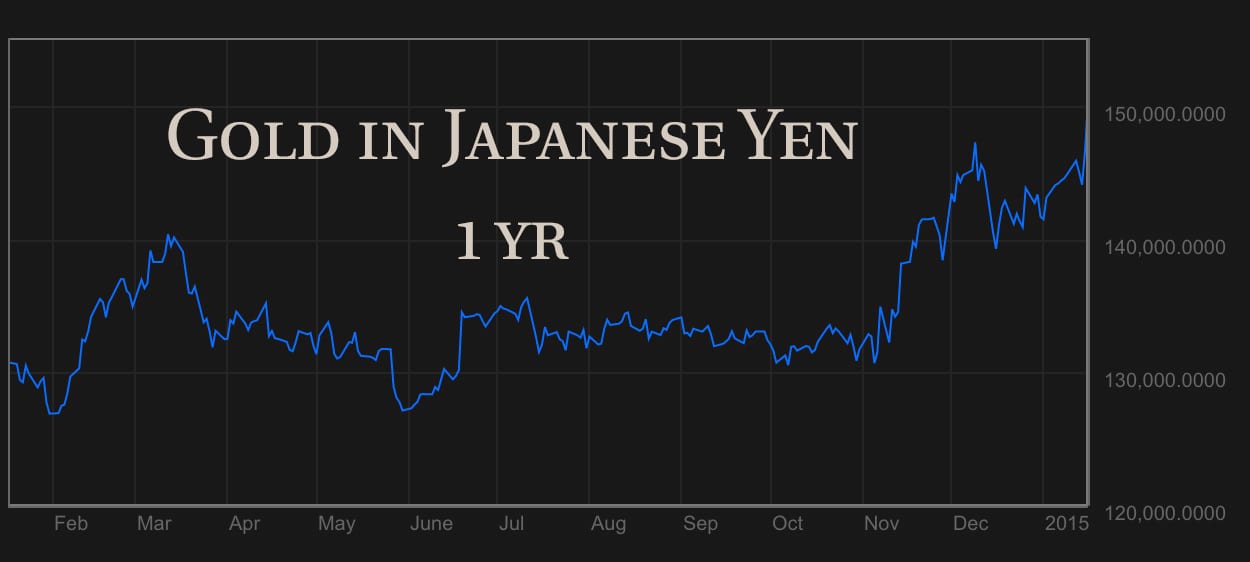

While it doesn’t seem like much, take a look at gold against the other two most traded currencies in the world:

The Unwinding of Rehypothecation

Remember, physical gold has been sold and leveraged so many times over since the 1950’s, through what we call “rehypothecation”

I talked about rehypothecation before:

“In short, banks and brokers lend money to their clients using assets that have been posted as collateral. These assets can be anything from currency to hard assets such as gold or other base metals.

The banks/brokers can then take these assets and use them for their own purposes to create other financial instruments; metal-backed currency, so to speak.

This is called rehypothecation. And yes, it sounds almost like a Ponzi scheme.

Many times, these assets are “supposed” to be sitting in a vault or storage facility somewhere but because the “rehypothecation” process is often repeated many times over, no one really knows where the assets/metals/commodities are – if they exist at all.”

For years I have warned about the problem with the rehypothecation of commodities and metals; that we could see a major break in this system if strong evidence were presented that many of these collateralized assets may not actually exist.

It’s no secret that the amount of gold that’s suppose to exist, likely doesn’t. We already witnessed massive withdrawals of gold from the vaults of major banks, such as JP Morgan – all in conjunction with the repatriation of gold by nations around the world.

While gold has been boring when viewed from American soil, it has continued to protect the wealth of many other nations (as seen in the above charts).

Which brings us to gold mining stocks…

There are now a staggering number of gold companies experiencing a bearish-to-bullish reversal in their charts. While the last few years have been dead for the gold mining sector, it may be about to change.

Let’s see how much more gold can be manipulated…

The Equedia Letter

THE E-LETTER IS ALWAYS A GREAT READ. PERHAPS IF THE DOLLAR IS GIVEN COMPETITION OUR LEADERS WILL STOP PLAYING EMPIRE AND RETURN HOME. WE HAVE NOTHING TO FEAR REALLY, GLOBALISM NEEDS AMERICA BUT AMERICA DOESN’T NEED GLOBALISM.GREECE SHOULD LEAVE THE EURO/EU AND REORGANIZE THEIR ENTIRE ECONOMY TO FIT THE REALITY OF THEIR NATION.PER THE E-LETTER,GREECE IS MOSTLY A FARMING COUNTY. WELL THEN THEY NEED SHRINK THEMSELVES DOWN AND PREPARE FOR A BRIGHT FUTURE IN THE AG REVOLUTION.THEY WILL HAVE TO SUFFER BUT IN THE END THEY CAN WIN BIG.ONE DAY RUSSIA WILL ASSUME LEADERSHIP OF EUROPE AND EVERYONE CAN RELAX.THE EUROPEANS CAN SELL GOODS INTO RUSSIA,AND RUSSIA CAN FEEL SAFE AT LAST.LASTLY ALL NATIONAL DEBTS CAN BE SET ASIDE OR FORGIVEN ESPECIALLY TO PREVENT A WAR.WE CANNOT LET INVESTORS AT ANY LEVEL ENDANGER THE WHOLE WORD MERELY BECAUSE OF MONEY…

Equedia Letters are always great piece of reading which we do not get to read elsewhere. Keep the good work going and keep enlightening us. Thanks Equedia. Regards

Fantastic letter this week. When will this all implode? Things are getting scary

It appears as though ,the SNB, has defied reptilian banking cabal. I wonder! The cabal is the most deceitful,amoral bunch of con artists since,the beginning of the 20th century. What will be their next dose of treachery?

What if Fort Knox is empty? Do the Russians and China anticipate a world currency collapse? They could of course, cause one, hmmm!…Pass the Brandy please.

Letter always a nice read Is there any other method besides gold to safeguard your money in the coming crisis.

I think the Swiss was doing what’s best for their situation. The unintended consequences on their decision impacted Countries worldwide.

Of course, all of the Central Bankers knew this could happen but chose instead to keep their heads buried in the sand.

It is my opinion that this is the first shot in the currency wars and it won’t be the last.

The only Countries that should be worried are those with fiat currencies that have chosen to spend themselves out of debt (QE).

We all (except for the politicians & bankers) know where this will end. It won’t be pretty but inevitable.

When all the dust settles do you think the citizens of these fiat Countries are still going to have a “love-fest” for Central Bankers, and in the USA, the Federal Reserve?