Dear Readers,

There’s been a lot of unnecessary political drama over the past few weeks, notably the big issues with the debt ceiling and government shutdown. This put many investors – including technical traders and analysts – on edge and on the sidelines.

But as I clearly stated in my last few letters – unless you’re an American government employee – none of this should’ve worried you; the markets would likely move higher:

“With the amount of money in deposits growing at the banks and being used as collateral for big stock market bets, the markets could continue to move higher this year.”

Of course, a U.S. default would’ve been disastrous; more so for what America represents, rather than the actual outcome of a short-term default. One default in a set of bonds doesn’t directly affect other bonds, but would cause lending rates to skyrocket. The domino effect of this would’ve been very bad.

Now despite everything that is happening around the world, including recent record-breaking bad loans across Spanish banks, the European recession, Japanese turbulence, and Brazilian inflation, stock markets continue to move higher.

Over the past few weeks, I explained exactly why and how the stock market is moving higher – and why it will continue to move higher – despite all economic worries:

- Why Banks are Being Forced to Create a Stock Market Bubble

- The Fed’s Grand Illusion: Why the Fed Didn’t Taper

- The Subprime Crisis Obama is Allowing, But Doesn’t Want You to Know

And if you go back a little further to my Letter, “The Story of the Year“:

“Never make short term bets against an entity that can print unlimited amounts of money.”

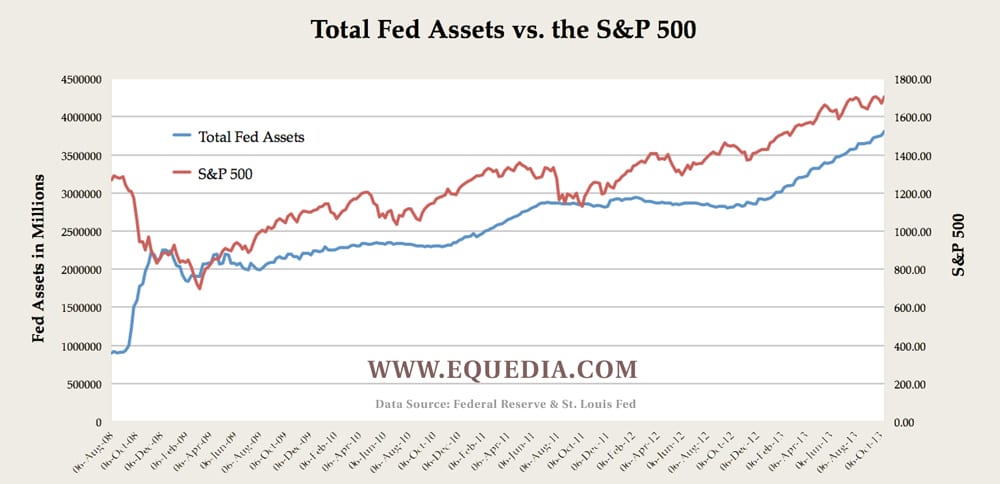

Now take a look this chart:

This is a chart comparing the Fed’s total balance sheet starting August 2008 (now over a record-high of $3.81 trillion and growing) to the S&P 500 (which has now reached a record high close of 1744.50 this Friday).

While many of you understand the situation (as I can see in the comments and emails), there are some that still have yet to grasp why and how QE has flowed into the stock market.

So this week, I am going to start with the most basic concept: how money/currency works.

How Money Works

Let’s use the United States as an example.

The United States is a world power and a first world nation. It has to spend money to maintain this status by building roads, providing healthcare and public services, and funding wars.

But all of this money has to come from somewhere.

Historically, most of this money came from taxes and government-owned corporations.

But as the world power grew – through wars and economic activity – so did its spending habits.

Taxes were no longer enough to cover all of the bills.

So – like every one else – when you don’t have enough money, you borrow it.

When the government spends more than it brings in, it’s called deficit spending.

How the Government Borrows Money

The U.S. treasury, the department of the U.S. government that manages all of the Federal finances, borrows money by issuing a bond.

A bond is simply a piece of paper – a promissory note – that says if you give me money now, I will pay you back in X amount years, with interest.

These pieces of paper are then sold through a bond auction where the world’s largest banks participate in buying part of this national debt.

The banks then sell these bonds to other investors, such as investment funds and countries like China and Japan.

(China owns more than $1.28 trillion in U.S. Treasuries, according to the July 2013 figures released by the U.S. Treasury. This is equal to nearly a quarter of the U.S. debt held overseas and nearly 8% of the United States’ total debt load of more than $17 trillion. Since China owns all of this debt and since the government generates income through taxation, your kids will be taxed in the future just to pay China back.)

Since America is the world’s largest economy, among other things, the demand for their promissory notes has never been an issue.

But over the past years, record amounts of these bonds have been issued; so much that the banks had to turn to someone else to buy them.

But who?

Who is the Largest Single Buyer of America’s Federal Debt (aside from the government itself*)?

(*The U.S. Social Security Trust Fund is the largest single holder of America’s national debt, but they’re part of the government. Yes, the government can sell debt to itself but it will have to pay it back by issuing more bonds borrowing more money.)

Welcome the Fed, America’s central bank – a private bank controlled by bankers, and not the U.S. government.

The Banks – who purchase these bonds from the Treasury – sell Treasury-issued bonds to the Fed, who in turn gives these banks yet another piece of paper in exchange.

This piece of paper is essentially another IOU from the Fed to the Banks, just like the IOU from the Treasury to the banks.

Its like when you or I write a check, we’re giving someone an IOU that they can redeem at a bank.

The only difference between our IOU and the Fed’s IOU to the banks, is that we have to have that amount available in our bank account for someone to cash that IOU – otherwise, that check bounces.

When the Fed writes an IOU to the banks, it doesn’t have to have anything:

“When you or I write a check there must be sufficient funds in our account to cover the check, but when the Federal Reserve writes a check there is no bank deposit on which that check is drawn. When the Federal Reserve writes a check, it is creating money.” – Federal Reserve Bank of Boston, Putting It Simply (1984)

If there are no deposits at the Fed, how does the Fed give cash to the banks?

Easy. It writes another IOU to the banks. And since the Fed is neither audited, nor are there are any real bank deposits taking place, it’s literally creating free money.

Now here’s where it gets fun.

When the government spends money building roads, providing social aid, or funding wars, they are essentially funding more workers and soldiers who then take their hard-earned money and deposit it back at the banks.

But when you deposit your money at the bank, the money doesn’t just sit there for safekeeping.

In fact, once your money is there, the bank can use it to make more money by lending it back out to you, or make big bets on the stock market by using YOUR money as collateral (see Why Banks are Being Forced to Create a Stock Market Bubble).

Furthermore, it can do this with insane leverage because a bank is only required to have a certain percentage of your money available at any given time. The remainder of your money is used to fund investments or loans that the bank makes to other customers, including you.

This is called fractional reserve lending.

Currently, banks in the U.S. are required to have a certain amount of money in their system, known as reserves. These required reserves are normally in the form of cash stored physically in a bank vault (vault cash) or deposits made with the Fed.

In the U.S., the average fractional reserve-lending ratio is 3%* – meaning that if you deposited $100 at the bank, the bank can take $97 of it to make loans or gamble on the stock market.

(*This number can be as low as 0% – depending on the amount and on different classifications. We can save this for another story next time.)

Not only are banks able to use most of your money to make big bets, they now have a record amount of money in deposits from selling bonds to the Fed.

And, as I mentioned last week, with so much money sitting in the banks, the banks are practically forced to invest and make even bigger bets on the stock market.

One look at the chart above and you can see how the Fed’s asset purchases have fueled the stock market.

How Big Can the Bubble Get?

If you remember in my Letter “A Shocking 2011 Cover-Up,” I showed you that the Fed purchased an astounding 61% of the total net Treasury issuance in 2011.

According to Bloomberg, the Fed bought 90% of new bonds in 2012.

While the ultimate stock market bubble is being created, there is so much more room to grow in terms of paper asset appreciation. The amount of leverage now in the system is beyond anything you could imagine.

While I believe things are most certainly not what they appear, I am not one to say the world is about to end, nor will I scream doom and gloom…yet.

Those who protest that the Dollar and other currencies will collapse soon because of this paper asset bubble should ask themselves one thing:

“Do you see paper currency EVER not being used?”

The world is so intertwined in central bank currency that it would take an absolute world war conflict to change that.

This is not to say the markets are safe, but reality is that money continues to enter our system – and much of it has barely even been used…

Where is the Market Headed?

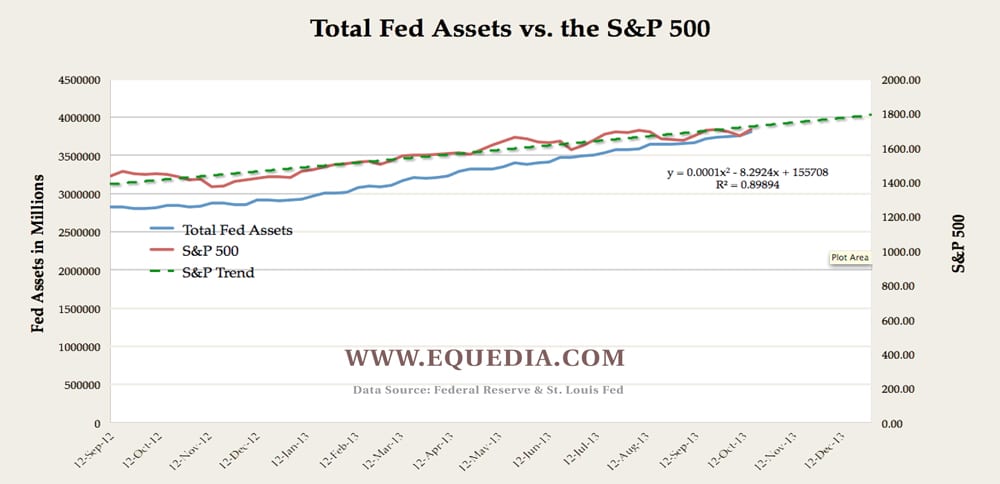

Let’s take a look at the data from September 13, 2012, since the Fed’s asset purchases have been more steady over the this time with QE3:

Why Gold Price Has Not Spiked

It’s hard to talk about currency without talking about gold.

I received a lot of questions regarding gold prices and it’s becoming more tedious to find specific answers for every day price actions.

So to really make it simple, my answer to all gold price questions is this:

Gold, like the financial system, is now traded as an IOU – just like currency.

As such, it can be manipulated by the banks and other institutions the same way currency has been (you’re seeing this everywhere, with the UK’s Financial Conduct Authority now joining the probe on currency manipulation.)

If a $5.3 trillion-a-day foreign currency market can be manipulated, then manipulating the gold market – of which the total value of all gold ever mined is around $7 trillion at current prices – seems like a walk in the park.

The fundamentals for higher gold prices are all there, but there are obviously occurrences that suggest gold price manipulation. It’s going to take a serious probe by world organizations on gold price manipulation to truly send gold to the levels that people like Peter Schiff predict in the near term.

And since all buyers of gold would rather pay a cheaper price anyway, whose going to lead the way in a global investigation?

The Equedia Letter

A wise man once said,” If you can’t solve the problem, then you don’t have all the answers”.

my dream is that each country’s own government has its own creating money machine. This would solve most of the debt problems and slavery of the natural beings on the planet earth. No, FED needed as we would be our own/government FED bank.(that is why the now a days queen’s & Kings of this world hide behind the scenes (little public exposure)) We would be paying interest to ourselves as a country thus reducing leveraging big time. Each citizen can establish their own line of credit at 1% and pay back their own debt to the benefit of all.

Another ideia : if you buy home $500,000.00

put down 50K of real money. Now you have an asset or credit. You, could sell this credit back to the central bank $450K and receive an allowance to utilize your debit rights for same, now the leverage of monopoly money is 900k this is what,s being done. Banks buying US Treasuries /bonds and turning around and selling the same to the fed central bank in order to keep the leverage multiplying : so why have a middle man collecting on your sweat.

Very, confusing isn’t it .that is why there is no real money involved thus the snow ball affect of debits and credits is non-stop and keeps growing till the value of a currency expires (devaluation 100%) at which time the Fed orders any physical currency left be burned to the stick.(just like gold 1930 depression bankruptcy of all nations, a new currency status quo had to be created for the same monopoly to continue and starts allover again. ( cycle for this period is in the Fibonocci number series..

Its all, Fiction. The only non-fiction is the fact that each natural being has to sweat out their own efforts in order to establish the difference of the MEANING or status between Commoner and elite. What a waste of non- evolution for the human species.

From a quantum mechanics point of view. the Energy source is all the same within all that exists in the Universe.

Second Dream: One page tax return. you make 100K you contribute 5%. simple and applies to all corporations. no wonder they keep improving the complexxxx – ity of the form for the addition of confusion as they know that the habits of a human lost at sea are, that we do not take the time or bother to question and rather prefer to accept it as is and have a beer instead. etc.

We all need to contribute to the overall society required social programs : roads ; education ; health system and the looking of the elderly and the very young etc. Have you wonder why we have to pay for education(debits on our side become creidt-s on the other side, credits become debits and keeps repeating ) Its a way of controlling how much we need not to know .

How, confused we have become on the priorities

P.S. the way to control world population is to educate them in having 1-2 kids and learn and expand the knowledge so that we evolve in all fronts. No wars please. let all Souls experience the pleasures on Mother Earth.

The best way for free-trade is no free-trade and allow each nation evolve at its own pace. (look what happen to majority of European nations). Free-trade has never worked long term in the past (look at history & the empires) as it is a wealth wrecker just like the FED> and for our life time look at the inflation inflicted upon us by depreciation of assets and currency since 1930 monopoly.( Inflation on the other side is depreciation ) + & -, yin & yen….white & black…

It seems like we are being manupilated , by a different intelligence etc.

God help us all.

Thanks to Equedia inv. as this gives a source of awakening to all of us reading the contents and also the emails.

TODAYS GENERATION KNOWS HOW TO FIX THE ISSUES WITHOUT MUCH SUFFERING TO HUMANITY OVERALL on a non-violent fahsion..as we are overcoming the power of the word……I will not take it Anymore. Enough…

so then lets begin… and evolve.. starts by knowing and teaching others of our findings.

THANKS TO YOU ALL…

A wiser man said: “Insanity, is doing the same thing over and over again and expecting different results.”

For whatever reason your “Leave a comment” bar does not work for me. IVAN: I know you have taken a lot of criticism lately for a previous essay you wrote and most of the criticism was garbage, (I read you all the time and mostly agree) however I must take issue with a statement you make this time that is inaccurate at best, and banker propaganda at worst.

You said and I quote: “In the U.S., the average fractional reserve-lending ratio is 3%* – meaning that if you deposited $100 at the bank, the bank can take $97 of it to make loans or gamble on the stock market.” That is indeed what the bankers want the public to believe, (not the gambling in the stock market part) but it is NOT TRUE! At least not if you believe the sworn testimony of Graham Towers former Governor of the Bank of Canada in 1939 before a Parliamentary Finance Committee. He stated the REAL TRUTH, “every bank loan is a new creation of money, and when it is paid back it ceases to exist” Now do some out of the box thinking to the mathematical outcome!

1) How can you loan out a liability? i.e. When you make a bank deposit (for safekeeping) the money is still yours, not the banks, (though since the Cyprus debacle even that has come into question) so the theory is the bank’s must have enough “reserves” to pay you back if you decide to withdraw your money. Towers statement however means that the level of reserves, (in actuality a LIABILITY of the Bank) ALLOWS the banks to create NEW MONEY at a ratio of at least 20 X actual reserves, literally out of thin air, backed by nothing but the hot air of politicians as in “full faith and credit of the government” which to-day is literally ZERO given the U.S. governments debts and promises that total at least $100 TRILLION when you include entitlements in addition to bonds that are never paid, just rolled over.

But here is the part that very few people have ever considered. ONLY the PRINCIPAL of a loan is ever created, so how can INTEREST ever be paid UNLESS there is an exponential growth in NEW LOANS that cover not only the principal being paid back, but also the INTEREST, which can only ACCUMULATE as a pyramid of debt!? READ Graham Towers statement again and again, until you get it, INTEREST long term is mathematically IMPOSSIBLE, it is a cleverly designed PONZI SCHEME enacted as the Federal Reserve Act of 1913 that via the U.S. privileged position of being the worlds “reserve currency” is another interesting story in itself. This CURSE of Central Banking has now spread to the whole world enslaving virtually the whole of humanity as perpetual debt slaves.

Bottom line, banks do not loan out their depositors money, on the strength of their “reserves” they are allowed to CREATE “out of thin air” 20 X their reserves in loans on which they can collect interest an incredible monopoly and legalized form of counterfeiting at the expense of all borrowers. There is no logical or logistical need for our currency to be BORROWED into existent as debt on which interest has to be paid, a CREDIT system of currency creation for all the infrastructure society needs would be more equitable and fair and cut out the middle man. The same thing that makes a bond good would also make a dollar bill good, and remember, the establishment mantra, of the “Magic of Compounding” also works in reverse, i.e. DEBT compounds faster than interest, bottom line, not everybody can be a NET recipient of compound interest, otherwise WHO would be paying it?

Actually Myron, I think you have mistaken Ivans comment. He IS indeed saying what you’re saying, that every bank loan is an ponzi IOU – hence the picture of Madoff. As far as the 3% rule, he IS actually stating that for every $100 deposited, another $97 of money is created because it is now available for loan. So if you deposited a $100, the bank lends out $97, that doesn’t mean $97 is gone…its still there and if the original depositor asks for the $100 back, the bank still has $97 lent out…but from where? Oh that’s right, they’ll charge the borrower interest who then has to work hard to pay that interest off to give money to the bank that the bank never really had in the first place.

Thanks for your input Mr. Thompson, but with respect you apparently like IVAN still don’t get it. On a deposit of $!00. the bank CAN lend out $2000. in NEW MONEY created out of thin air, not the $97. Ivan presents! The problem is far worse than what Ivan’s false parameters make it out to be. Not only that, at least SOME of that newly created money ends up as a deposit in some other banks reserves thus compounding the new money that can be created by the fractional reserve banking system. The fundamental point being that the interest that needs to be paid on that newly created currency can only accumulate as an exponentially growing DEBT PYRAMID that can never be repaid, except with depreciated currency that buys less and less of real goods. It makes us all perpetual debt slaves and is not resolved by the FED’s pumping more currency into the system to keep it liquid. All that “quantitative easing”does is ADD more debt, its like trying to pull yourself up by your own boot straps. can’t be done. The benefit (if any) is solely to the banks unholy alliance with the politicians by keeping the Ponzi scheme alive a little longer, but eventually it has to crash like any other financial pyramid when no new players can be induced to support it.

Hi Myron, Ivan here. You are correct the number can become much higher. But please keep in mind that I am starting from the root of the issue, and trying to keep this as simple of a concept as possible.

The fractional model begins when an initial $100 deposit of central bank money is made into Bank A. If we use a 3% ratio, that means:

Bank A takes 3 percent of $100, or $3, and sets it aside as reserves, and then loans out the remaining 97 percent, or $97.

That means the money supply actually totals $197 – not $100 – because the bank has loaned out $97 of the central bank money, kept $3 of central bank money in reserve (not part of the money supply), and substituted a newly created $100 “IOU” claim for the depositor that acts equivalently to and can be implicitly redeemed for central bank money (the depositor can transfer it to another account, write a check on it, demand his cash back, etc.).

When this process goes on, the multiplier becomes bigger and bigger – and yes, can continue to reach the number you mentioned, depending on the ratio.

At this point in this model, Bank A now only has $3 of central bank money on its books. The loan recipient is holding $97 in central bank money, but he soon spends the $97.

The receiver of that $97 then deposits it into Bank B.

Bank B is now in the same situation as Bank A started with, except it has a deposit of $97 of central bank money instead of $100.

Similar to Bank A, Bank B sets aside 3 percent of that $97, or $2.91, as reserves and lends out the remaining $94.09, increasing the money supply by $94.09. As the process continues, more commercial bank money is created.

This continues and continues, until that $100 has been exhausted.

So yes, the situation is much worse.

Thanks for your comments Myron, they’re a great inspiration.

Thanks for the reply Ivan (my late father’s name by the way) but unfortunately you are sill buying into banker propaganda and DENYING the testimony of Graham Towers who as a Central Banker should KNOW the reality of the situation. Respectfully you are NOT starting from “the root of the issue” because your thesis is banker propaganda. What you are stating is what they WANT YOU to believe. In fact they take it a step further by stating that “they make their money on the “SPREAD on the interest they pay on DEPOSITS and the higher interest they charge when loaning the money back out!

That is a complete and utterly deceptive fiction. Under your thesis “every bank loan is NOT a new creation of money” you are saying in effect that the ORIGINAL money deposited gets loaned out “serially” while only maintaining a MINOR reserve! Our former Central Banker is saying the ENTIRE amount deposited is counted as “RESERVES” which become the foundation for new money creation via loans that can be 20X the base on which it is calculated.

Under your thesis you are saying there is only $3. in reserve to pay back a possible $100. in withdrawals, the theory being that not everyone will call in their money at the same time, and that is sound as far as it goes. Where the banks get into trouble is when there is a sustained bank run, the problem is not a lack of $100. bills to pay out withdrawals, they can get those from the Federal Reserve or equivalent such as the Bank of Canada, problem is that, (to keep it simple), should 50% of total deposits be withdrawn, the individual bank now has twice as much money out on loans as the “Bank Act Ratio” allows, meaning they either have to call in loans to get into compliance, OR, they have to somehow shore up their deposits to replace the withdrawals, which is why banking is such a risky business on a fractional reserve basis. I have seen reports where some banks have a leveraged position of as much as 30 to 50 X in loans to one of actual base capital, which means it only takes a small percentage of non – performing loans to wipe out their capital.

Take Graham Towers statement seriously and think it through, INTEREST as a concept is mathematically impossible long term for the simple reason that as money is paid back it “ceases to exist” as Towers states and therefore to maintain LIQUIDITY to allow an economy to function, not only must the paid back loans be reactivated with new ones, they grow exponentially to also cover the interest, which was never created in the first place, so the only possible outcome is the exponential growth of a DEBT PYRAMID that like any Ponzi scheme eventually collapses.

If you still think your thesis is sound, then I respectfully submit you are “mathematically challenged” again think it through. If the bankers propaganda were correct and their “SPREAD” was say at the most 5%, how could they possibly set aside MILLIONS for non performing loan right offs and still pay out the dividends and show the profits that they do?

Your thesis is not only badly flawed, but mathematically impossible. We have just about reached the “end of the line” where the accumulated DEBT, (read interest) can no longer be serviced as indicated by the financial conditions extant in the world at large. Can Greece “pull itself up by its own bootstraps” and get out of the hole they have dug for themselves by “borrowing their way out of debt” can anybody? How can BORROWING MORE no matter how low the interest help to retire already overwhelming DEBT?

Answer me this, by what logic or economic theory is it necessary for our currency to be “borrowed into existence” to produce a monopoly where a privileged group of self appointed bankers are allowed to earn a percentage on every wage earner and businessman’s wages or profit?

Just for clarification, I have a library of dozens of books I have accumulated over 60 years of STUDYING the issue and particularly the Federal Reserve Act of 1913 and if anybody reading this wants a source to PROVE what I am asserting I suggest you “GOOGLE” the book “The Creature From Jekyll Island” to get a good foundational understanding.

Great letter, Ivan, especially the comments about the mysterious price of gold. What about oil? Why hasn’t the price collapsed as new supply emerged in the U.S., the way the price of gas did? Is it being manipulated also?

YES Syd, everything is manipulated by bankers and the government to suit their own ends. From slanted/planted stories in the establishment media that is on side with the economic direction decided by politicians to preserve their own jobs, to the suppression of gold and silver prices, where if demand was not checked by selling more bullion than actually exists, the exploding demand and therefore price, would expose the mathematical unsoundness of the present system. Politicians only get elected by promising more than they can deliver by reasonable taxation. While it is popular to say that you can tell whether politicians are LYING by whether their “lips are moving” the absolute truth is when they say they will NOT raise taxes. They are LYING because taxes ultimately MUST increase to cover new programs and expenditures plus interest on the National Debt! Further proof comes from the fact that INFLATION (read interest payments) is eroding our purchasing power by our wages not keeping pace with the rise in prices. This is disguised by manipulated statistics and prices being kept the same by reduction in portion sizes and many other tricks employed by Corps. and government to try and bamboozle the tax paying consumer.

Psychologically both of you are correct. I have learnt that if there is nothing I can do about the problem than dont sweat it. Living today is not in the 1700’s. Living today is only for the future as one can only make the same mistakes until they die.

Which is why governments will continue making the same mistake until the value of something worthless is recreated by a Central Bank to be honoured simply as an exchange of value for production.

There is a short time frame of 40 years that the purchasing power will deflate a currency to nil. Any one that put a $1.00 bill in a can 40 years ago could buy about 6 quarts of milk. Or buy a gram of gold for about $0.032 cents. Today that bill will not buy you a package of bubble gum. But a gram of gold is worth $40US today. I can buy about 40 Litres or 10 qts of milk.

To understand the “present value of money”, one has to live in the present and forget the past including the shoulder chips. If one can’t forgive, that person will live in negativism for a live time only to be clutching worthless paper to the grave. The achilles heel of Humans is GREED. Had that person put 1 oz of gold in a can, it would be worth $1450 US today. Granted the dollar value is not equal but the lesson is the same.

Buy gold, don’t worry about the value until you need to spend it in 10 or 30 years. All commodities will keep up with the excess of devaluation of currencies. A friend had one wish before he died. To be worth a Million dollars. I promised him I would throw into his coffin a check made out to him drawn on my bank account for $1,000,000.

Third world country citizens are purchasing gold at a record pace. China incourages its citizens to purchase 1 gram of gold annually. China and India have been the biggest buyers of gold the past several years. Which may explain why gold price is flat when the Comex is closed. India has a premium on gold purchases as the weight of gold purchases, is collapsing there currency production value.

One only has to wake up to the fact, commodities are dug up with an effort of production. That production is paid for, with soon to be devaluing currencies, from the sale of the commodity extracted from the ground. As the money supply increases, prices rise (cost of production). The price of production increases at an unsustainable rate. The current supply of commodity in the warehouses now represents the total value of the money supply,

at that moment. The real purchasing value in the warehouse will continue to increase with the rate of increase of the money supply.

The problem is how does a society of greedy citizens secure more present value dollars. In comes the stock exchange, commodities markets, etc.

Anyone not working at a mine, needs to exchange their efforts, (production) for currencies to exchange for a basket of goods.

As long as they are working (producing), there is not a problem with the currency. The problem comes evident, when there are more people on earth. They need currency to exchange for their production.

Thus the increase in the money supply.

The problem is the money supply will rise faster if the profits of corporations are fatter, including the funds required for non-productive persons working. IE:priest, floor trader, government employees etc. When currencies come out of the cycle as savings, there is less money to use to keep the production going. So the government issues in example, welfare, to non-productive skilled workers and increased funds to Corporations for increased sales and profits which, example, goes into savings and the stock market. This is why floor traders wait bit in mouth for the quarterly unemployment rate or some Monetary Banker in control of the money supply to prophesize. Those persons churning money over every day need a ring leader.

The only way the government can withdraw the savings (excess printed funds) is by creating a Bull market. Inflated values of stock and bonds have a way of depreciating like rust before your eye. The stock markets on average are up over 25% in the past year. Getting real value next year will represent 1929 memories if anyone can remember that far back.

The market is in the mood of dividends. Many companies will increase there dividends over the next year. But stock values will likely fall as profits will not be keeping in line with a PE 24 multiple far out of line with the historical average.

I remember the collapse of the Dow and Nasdaq only 13 years ago.

Including Black Friday during the 1980’s.

This market is nothing more than another “BUBBLE”. During the past 100 years or so, There have been several Mania’s worth mentioning. The Tulip Bubble, The Flordia Land Bubble, The Chicago Land Bubble, The Dow Jones Collapse of 1929. (In part of the collapse of manipulated wheat prices by the than US Government. It was only because of Keynesian Economic Theory “Keynesian Cross”, that the than government learnt they could effectually cause production to go up by the creation of money without value). The list goes on because there’re thousands of citizens not actually producing anything except they need funds for an exchange of goods. Like Robin Hood. Only the King and his Merry men didn’t produce either but taxed the “production” of its citzens so they could also, eat.

Derivative’s increase the velocity of money with more worthless paper. Speeding up the “K” factor. Banks make tools for its customers to access funds they don’t have to spend on goods and services of other workers with the promise to pay from future production.

This cycle could sustain itself indefinetly if, a. all were producing something, b. there was no mechanism to withdraw funds from the cycle without production. c. there were no savings. Like some CEO’s and Board directors being paid outragous amounts of money for the value of their efforts, (production). This money has to come from the sale of stock certificates (worth less paper) in the stock market and savings of the company in the bank. Should there be insufficient funds, the Government will be backing those Certificates for more Certificates they can sell to investors, (pension funds) thru the Stock Exchange for a fee/service at a later date.

Now we have a virtual money supply. Bitcoin. It won’t be long when the Banks learn how to extract more fees for this “pyramid”, gambling with your lack of savings, and zero interest rate loans from the Federal Reserve.

You were given one life. Avoid loud and aggressive persons as they are vexations of your imagination.

I for one prefer an open and Democratic Society than a Hammer and Sickle. Society has never had a meeting of minds. There will always be persons, Government, Corporations with the mind set to extract as much denominated currencies from your production.

Support your mines, as they are the real producers of value.

Well alright, “here comes your 19th nervous manipulation breakdowm”.

Coming to a market near you very soon!

Thanks for this recent Equedia Letter on “How the Government Borrows Money’.I found it very informative. Look forward to your next e-mails.

This is true that Government borrow money from us. But that money is paid back to the people in other forms such as roads. This is a good post and everything explained well.