If this law passes, we could face an inflation spike that could dwarf what we’ve seen in the past two years – or even the past century.

Last month, I revealed how Wall Street is pushing for more inflation-inducing stimulus to monopolize the world’s most lucrative resource: energy.

We called it “The Green QE,” and it’s full effects have yet to be felt.

But there is a new and shockingly overlooked development that targets more than just energy. And if it goes through, it will force prices even higher.

Combine this new development with the Green QE and we have a recipe for hyperinflation.

To understand how dangerous this is, let’s first look at how we got here.

Why Inflation Was Low

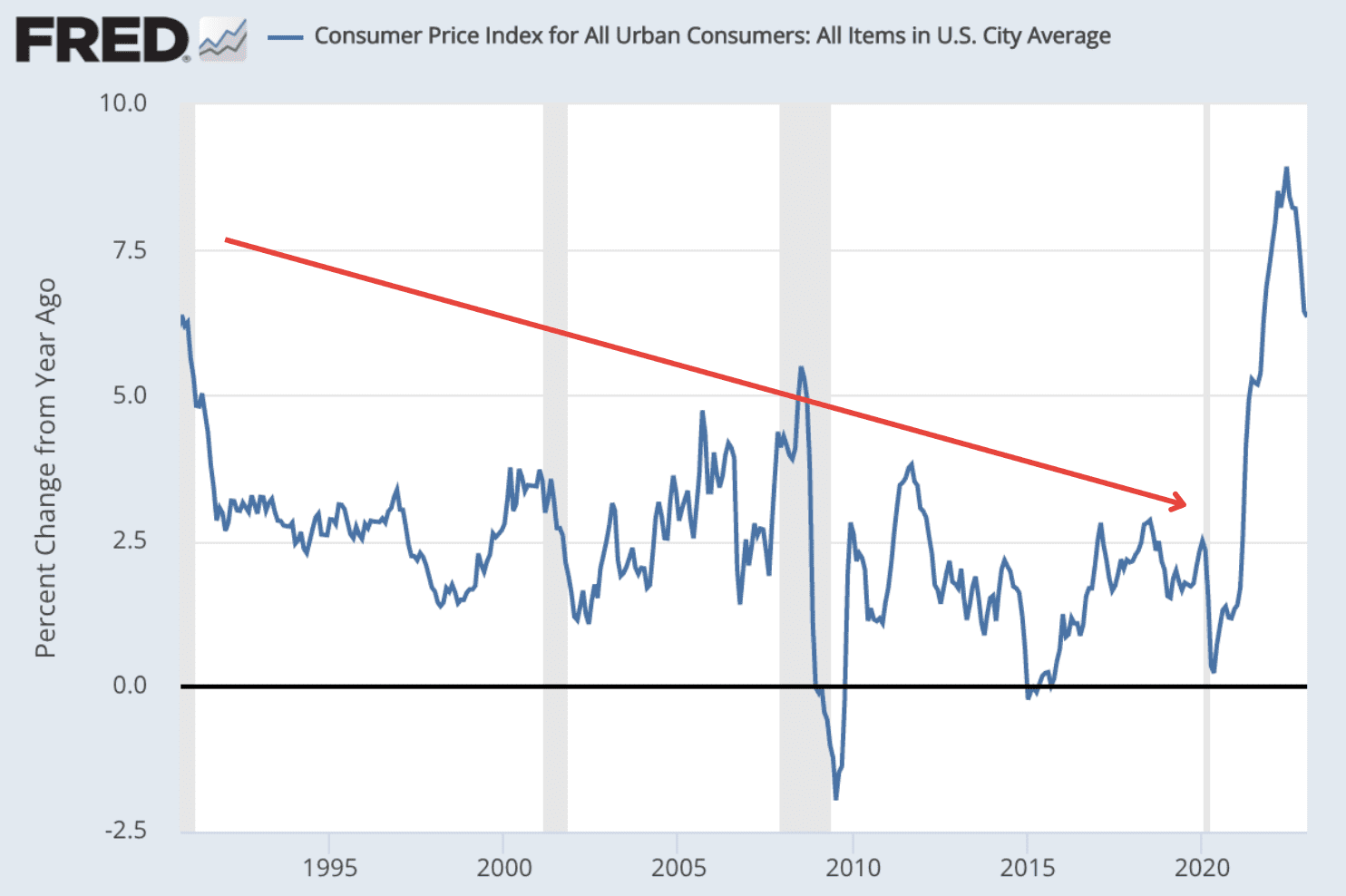

Look at U.S. consumer price index (CPI) over the past 30 years:

Barring a few upticks, inflation has been consistently falling since the 1990s. In the last decade, inflation was so low that policymakers were more worried about a deflationary spiral.

It is even more surprising considering that the decade was not characterized by austerity measures in which the Fed restricted the money supply.

It was quite the opposite: the Fed used every tool in its toolbox to flood the economy with money. They kept interest rates at zero and printed trillions of dollars.

Why, then, for all that monetary stimulus, did inflation not budge but instead fall?

The answer: globalization.

In the late 1990s, major emerging countries—primarily China and India—began rapid industrialization of their economies. And over the next decade, they became major manufacturing powerhouses.

The globalization boom had begun.

Exploiting the cost arbitrage, the developed world offshored the lion’s share of its manufacturing. And emerging markets, in turn, flooded the world with cheap goods.

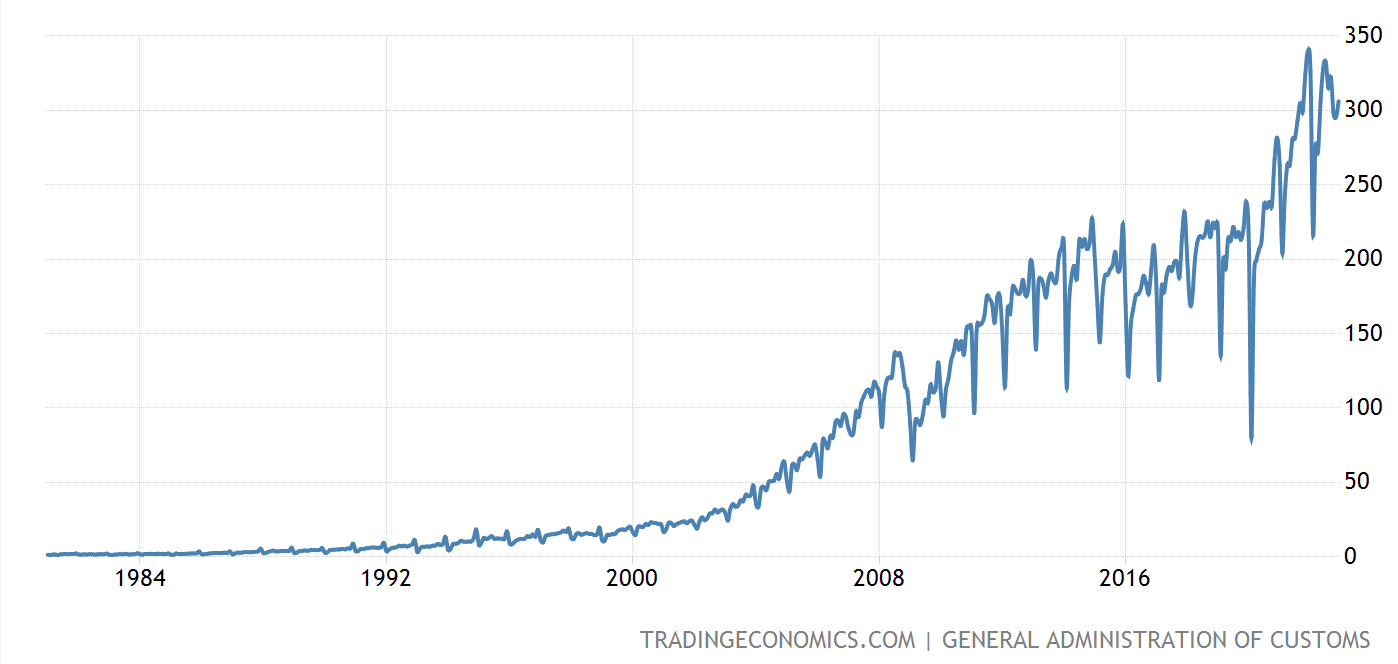

Here’s a chart that shows China’s exploding export growth:

At the turn of the century, China barely mustered $25 billion in exports; by 2022, it shipped over $3.5 trillion worth of goods. That’s a 140x increase!

That’s just China.

Factor in India, Russia, Brazil, and South Africa, and you’ve got the supply of cheap labor weighing down costs across the developed world by trillions of dollars.

This cost-cutting has been one of the most deflationary forces of our era and one that offset the Fed’s mishaps.

But the era of globalization and cheap goods could be coming to an end.

Peak Globalization

In 2016, globalization peaked and has been on a downward trend since.

The tipping point was the China-U.S. trade war.

Trump blamed China for decades of IP breaches (and righteously so). In response, China accused America of imperialism. Both slapped each other with tariffs.

This was the initial blow to the downfall of globalization.

And there’s no turning back.

As I wrote in “The Battlefront for the New World Order,” many resources like chips have become a matter of national security. And major powers are now insistent on securing their direct supply no matter the price:

“Taiwan is home to the Taiwan Semiconductor Manufacturing Company (TSMC). It is the world’s largest chipmaker, cranking out more than half of all made-to-order chips on the planet. And when it comes to the most advanced chips, it holds more than 90% of the market.

Now, imagine what would happen if a company like TSMC went offline or were nationalized? The global supply of products with at least one chip inside—from a kettle to modern artillery—would grind to a halt.

That explains why Xi is so protective of Taiwan. He doesn’t want to give up control over the supply of this vital resource to China’s fiercest enemy.”

The relocation of manufacturing processes to domestic markets means production costs will unavoidably rise, potentially for several years.

But this may just be the beginning.

Carbon Leakage

In 2020, the European Commission passed what is known as the European “Green Deal.”

In short, it’s a super aggressive green bill that aims to cut the EU’s emissions in half by 2030—and eventually, make it the first carbon-neutral continent in the world.

The actual ramifications of this are mindboggling.

You see, to become “carbon neutral,” it’s not enough to simply change the source of energy.

You also have to overhaul the entire infrastructure—from vehicles to machinery and buildings—which were all primarily built on fossil fuel energy.

In other words, you have to:

- Replace all gas-guzzling industrial machinery with green alternatives and revamp industrial processes to emit less carbon—e.g., set up very expensive carbon trapping systems.

- Swap out entire fleets of internal combustion engine vehicles with electric alternatives and build out new infrastructures of recharging or hydrogen fueling stations.

- Renovate millions of square feet of buildings—which, as I revealed in “The $131 Trillion ‘Green Gold Rush’ Has Begun,” are one of the most significant carbon footprints. That means insulation do-overs, green heating systems (such as solar thermal panels or heat pumps), efficient cooling systems, etc.

Not to mention the surcharge the onshored EU manufacturers will have to pay for “cleaner,” greener energy.

So, to pass blame, EU lawmakers created another “emergency” to compel the rest of the world to follow suit.

They call it the risk of “carbon leakage.”

Via the European Commission (emphasis mine):

“There is a strong risk of so-called ‘carbon leakage’ – i.e. companies based in the EU could move carbon-intensive production abroad to take advantage of lax standards, or EU products could be replaced by more carbon-intensive imports. Such carbon leakage can shift emissions outside of Europe and therefore seriously undermine EU and global climate efforts.”

To address that, they’ve engineered a legal framework that will empower—or rather force—European businesses to impose these green policies throughout their entire supply chain…all the way to Asia.

Here’s how.

Carbon Border Adjustment Mechanism (CBAM)

A year into the “Green Deal,” the European Commission introduced a proposal for a so-called “Carbon Border Adjustment Mechanisms” (CBAM).

The rationale behind this idea is that if the EU only imposes environmental taxes on domestic firms, these firms will move their production to other regions, and then import the final product to Europe without incurring any carbon taxes.

To avoid this loophole, the Carbon Border Adjustment Mechanism (CBAM) applies the same environmental, social, and governance (ESG) regulations to the EU’s trading partners.

Here’s the scheme in a nutshell.

From the Europe Commission’s CBAM press release:

“Designed in compliance with World Trade Organization (WTO) rules and other international obligations of the EU, the CBAM system will work as follows: EU importers will buy carbon certificates corresponding to the carbon price that would have been paid, had the goods been produced under the EU’s carbon pricing rules. Conversely, once a non-EU producer can show that they have already paid a price for the carbon used in the production of the imported goods in a third country, the corresponding cost can be fully deducted for the EU importer. The CBAM will help reduce the risk of carbon leakage by encouraging producers in non-EU countries to green their production processes.”

This isn’t just some virtue-signaling law about climate change.

It’s an overarching tariff.

The list of affected goods includes key imports such as aluminum, steel, and even electricity. And the list will only grow.

Via Deloitte:

“Currently the following goods have been proposed to be in scope of the CBAM: iron and steel, cement, fertilisers, aluminium, electricity, and hydrogen. Scope will additionally include certain precursors, and a limited number of downstream products (however currently not chemicals and polymers as was previously proposed by the EU Parliament);

Further scope extensions to include additional products (such as chemicals and polymers) are to be determined by 2026, and the full inclusion of all EU ETS products is planned by 2030.”

If all goes according to plan, starting this October, all EU-based businesses will subject their import partners to ESG reporting and corresponding carbon taxes.

Code Red Alert

Asian suppliers have already issued a code-red alert.

According to South China Morning Post, the CBAM will affect some 50,000 manufacturers across Asia, mostly in China.

And most of them are nowhere near ready for that kind of scrutiny.

Via SCMP:

“Ultimately, if some suppliers fail to show that they are fulfilling those expectations, at some point, companies sourcing from them will tell them that they are a risk to their reputation and therefore not eligible for the business relationships,” she said.

The Corporate Sustainability Reporting Directive, due to be rolled out next year, will require companies to disclose how sustainability issues, such as climate change, impact their business and how their operations in turn affect people and the planet.”

This will deal yet another blow to cheap offshoring – and the costs will undoubtedly be passed onto consumers.

This could be as inflationary—or even more so—than our current energy crisis.

Case in point…

As reported on Zerohedge, Hong Kong will pay 30% more for ESG jobs because companies fight for talent to meet those ESG targets.

Now, why would the EU enforce something like that in the heat of one the biggest inflation routs of the past century? Moreover, why would it implement such an idea while the central bank is raising rates?

First of all, those in power don’t really care about inflation. As we wrote in, “How to Survive the Biggest Wealth Transfer”, inflation only hurts the poor and middle class, while it actually benefits the ultra-wealthy.

Furthermore, the objective of achieving domestic manufacturing targets can only be justified if the final product’s cost is equal to, or lower than, the cost of importing it from abroad. By implementing new tariffs, domestic manufacturing and technology discovery becomes more economical.

Secondly, and ultimately the most important for the EU, is energy independence.

By implementing these new ESG tariffs, the EU can kill two birds with one stone: make onshore manufacturing more cost competitive while increasing investments in green energy technology.

Either way, it’s inflationary. Prepare for further – albeit slower – rate hikes.

This combination of inflation and slower rate hikes should bode well for gold and gold stocks.

Seek the truth and be prepared,

Carlise Kane

This may very well border on fear mongering .why would hydrogen be on the list for CBAM. If only the rich profit, then where is the divide between rich and poor, soon the filthy rich aren’t rich enough to be part of the exclusive club. Soon there is no one left to provide for the parasites to maintain their status, what value does that bring to the table. Seems like there could be a few flies in the ointment.