The writing is on the wall.

A new stimulus is coming – only this time, there won’t be any checks or unemployment benefits. Instead, the money will flow straight into Wall Street.

And they’ll use it to quietly corner —then monopolize— today’s most profitable resource.

Let me explain.

What Rate Hike?

If you take the Fed’s word for it, you’ll think Powell is determined to bring inflation back to 2%.

In his Feb 1 press conference, he pledged:

But as history has shown, Powell is great at bluffing.

Remember when he swore inflation was transitory and the Fed wouldn’t hike rates until 2023?

Well, you know how that panned out.

And while he’s once again promising to tame inflation with further rate hikes, his actions tell a whole ‘nother story.

We’ve gone from 0.75% to 0.5% and now to a quarter-point hike.

And that’s exactly what Wall Street wanted.

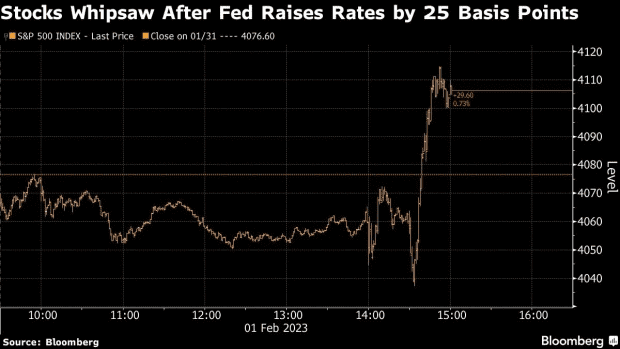

As soon as Powell’s quarter-point hike announcement hit, the S&P 500 soared:

As Win Thin, global head of currency strategy at Brown Brothers Harriman & Co, wrote to clients:

“The Fed lost a chance to really reset market expectations and instead, markets are doubling down. US financial conditions continue to loosen.”

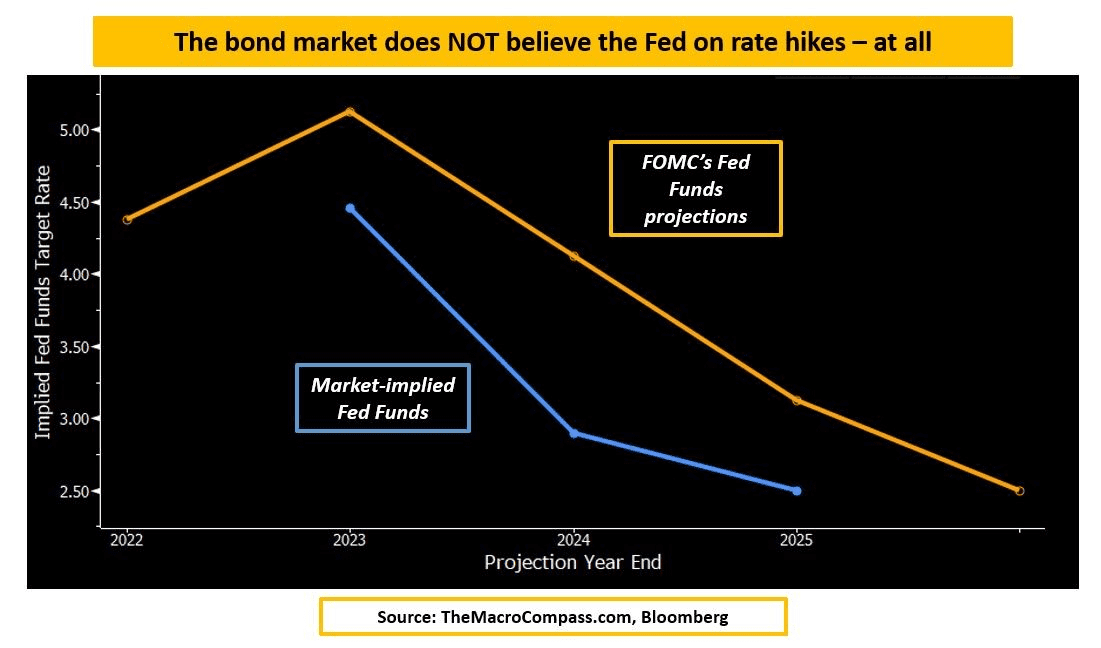

The bond markets called Powell’s bluff, too.

See the divergence between Fed’s projections (yellow line) vs. what the bond market implies (blue line):

And finally, the dollar is weakening—another clear sign that the world doesn’t buy Powell’s “tough talk.”

Meanwhile, the Bank of England just signaled a pause on further rate hikes.

Via Phill’s Stock World:

“The Bank of England signaled Thursday that it might soon pause increases as the UK economy falters. The BOE said further rate rises are possible, but only if inflation threatens to be high for longer than it currently expects it to be.”

And Europe’s central bank is shelving planned hikes after this quarter.

Via CNBC:

“ECB Executive Board Member Fabio Panetta reportedly said earlier this week that the central bank should not pre-commit to any specific rate moves beyond its March meeting.”

Why are central banks backing off while inflation is still so high?

The clue lies in a western central bank’s new-found mission.

2% Inflation or 2°C Target?

A few years ago, the ECB became the first central bank to add a “climate stability” goal to its official mandates.

That means, from now on, its policy could be dictated by environmental goals instead of consumer prices.

The ECB’s logic behind it is that climate change supposedly exposes us to what they call “climateflation.”

No, seriously.

Via ECB:

“Unless greenhouse gas emissions are cut rapidly, our economies will remain exposed to the risks of “climateflation” and “fossilflation” – that is, persistent inflationary pressures associated with more frequent natural disasters and a continued dependency on gas, oil, and coal.”

And they “must therefore ensure that all of the ECB’s policies are aligned with the objectives of the Paris Agreement to limit global warming to well below 2 degrees Celsius.”

This self-assigned climate mission is now in conflict with the ECB’s original mandate.

Via ECB:

“These [green] developments now risk being reversed by the marked rise in global interest rates over the past year. Since fossil fuel-based power plants have comparably low upfront costs, a persistent rise in the cost of capital may discourage efforts to decarbonise our economies rapidly.”

So, they’ve pushed inflation targets to the side and launched a new stimulus that serves its new-found mission.

Known as the “Green QE,” the ECB’s new program has mandated the central bank to buy nothing but green bonds:

Via Reuters:

“In a bid to decarbonise its assets, the ECB said it will stop buying new bonds issued by private sector entities by March, except where corporate issuers have a strong track environmental track record. It will also continue buying their green bonds, which fund environmentally-friendly projects, in the primary market.”

And it’s not just corporates the ECB is arm-twisting – they’re influencing policymakers, too.

It even released a paper titled “Climate change mitigation: how effective is green quantitative easing?“ that calls for central banks’ intervention in the case of a lack of government response:

“We conclude that green quantitative easing may be an effective complementary policy instrument, in particular if governments around the world fail to coordinate on introducing a sizeable carbon tax or equivalent carbon pricing through other fiscal policies.”

Is there any doubt about who’s in control here? Clearly, it’s not the government you think you elected.

The Green QE in disguise

On this side of the world, the “Green QE” isn’t as straightforward as it is in Europe.

Back in 2021, Powell tossed around the same idea of incorporating climate goals into the Fed’s decision-making:

“Incorporating climate change into our thinking about financial regulation is relatively new, as you know. And we are very actively in the early stages of this, getting up to speed, working with our central bank colleagues and other colleagues around the world to try to think about how this can be part of our framework.”

To that end, he even introduced two separate committees.

But last month, Powell got cold feet and backed off. He announced that the Fed would leave climate policy to policymakers after all.

Perhaps Powell is conscious that this inflation bout could lose the public’s trust in the Fed.

…perhaps this was just a tactic to let the Europeans spend first.

…perhaps Powell is just bluffing, as he always does.

Or perhaps enough is being done by politicians on this side of the world.

REMEMBER, last year, the Biden administration passed the largest climate spending bill disguised as an “inflation reduction act.” Under this bill, the government will spend well over $700 billion…

….half of which will go to fight “climate emergency.”

Meanwhile, Trudeau has already pledged billions to meet its climate target by 2030.

Anyone with a shred of logic could tell you that spending more money to fight inflation caused by climate policies makes zero sense.

(Read my letter “The Green Economy Is Gasping for Dirty Fuels” on how the ESG movement robbed the fossil fuel industries of institutional capital, and how it set the stage for this energy crisis.)

While world leaders may sometimes appear to make illogical decisions, they (or their handlers) aren’t as dumb as you think.

There has to be something more to this stupidity, right?

There is… and the answer won’t surprise long-time Equedia readers.

A Blackrock Coincidence?

Just before Covid hit, Blackrock, the world’s largest asset manager overseeing $10 trillion in assets, issued a dire warning to Wall Street.

Its CEO, Larry Fink, alerted his clients that capital markets would undergo a sweeping flight of capital because “money would go green.”

From his alarming note:

“In the near future – and sooner than most anticipate – there will be a significant re-allocation of capital…Climate risk is investment risk. Every government, company, and shareholder must confront climate change.”

Not long after, Fink declared war on legacy energy industries—and urged clients to follow his lead.

Via Black Rock:

“Given how central the energy transition will be to every company’s growth prospects, we are asking companies to disclose a plan for how their business model will be compatible with a net zero economy.”

And so began the ESG craze.

Fink’s forewarning urged over $1.2 trillion of capital to flow from “unsustainable” legacy businesses into ESG assets like EV companies and solar panel makers in the next two years.

And guess who oversaw and earned a fat commission on this capital flight?

That’s right, Blackrock.

At the end of 2021—the record year for ESG—Blackrock became the leading asset manager of ESG funds.

“Our flows continue to grow and dominate,” he said during a conference call with clients, then added: “BlackRock is a leader in this, and we are seeing the flows, and I continue to see this big shift in investor portfolios.”

On top of that, Blackrock used Aladdin* to quietly channel clients’ funds into its ESG funds without their knowledge. Via Bloomberg:

“What Fink did not say is that BlackRock, along with another asset manager, drove a significant part of that shift by inserting its primary ESG fund into popular and influential model portfolios offered to investment advisers, who use them with clients across North America. The huge flows from such models mean many investors got into an ESG vehicle without necessarily choosing one as a specific investment strategy, or even knowing that their money has gone into one.”

(*Aladdin is BlackRock’s flagship asset management software. Think of it as a “dashboard” for some of the biggest institutional investors in the world, who collectively oversee nearly $22 trillion through Alladin. That’s roughly 7% of all assets in the world.)

Imagine earning 1-2% in management fees from that $1.2 trillion invested in ESG funds…

But Larry Fink is not the only one.

As I revealed in “The Master Puppeteer,” Bill Gates is another powerful yet largely disguised asset manager overseeing capital flows into this greenwashing craze.

Gates is running a secretive fund called Breakthrough Energy that’s been granted authorization to distribute both private and federal capital to green companies of his choice.

That means he has the power to potentially distribute and earn a slice of trillions of dollars in fiscal money to fight the “climate emergency.”

But make no mistake; these guys are not in it just for the money; they have plenty to last many, many lifetimes.

As always, it’s about control.

The “Morganization” of America

Remember how John Piermont Morgan used his power to create the Fed and take over entire industries in the early 20th century?

Larry Fink and Gates are the J.P. Morgan-like industrialists of the 21st century.

Just as Morgan monopolized steel and railroad industries, Fink and Gates are now gobbling up today’s most precious resource: energy.

They use their influence in capital markets to gain control over budding energy giants while choking off competition.

…in this case, legacy fossil fuel companies.

(Read “They Own Everything: Part 1” to find out how this scheme works.)

Meanwhile, the rest of us are paying the price for their power games: a significant rise in energy costs which have lead to the highest inflation in 50 years.

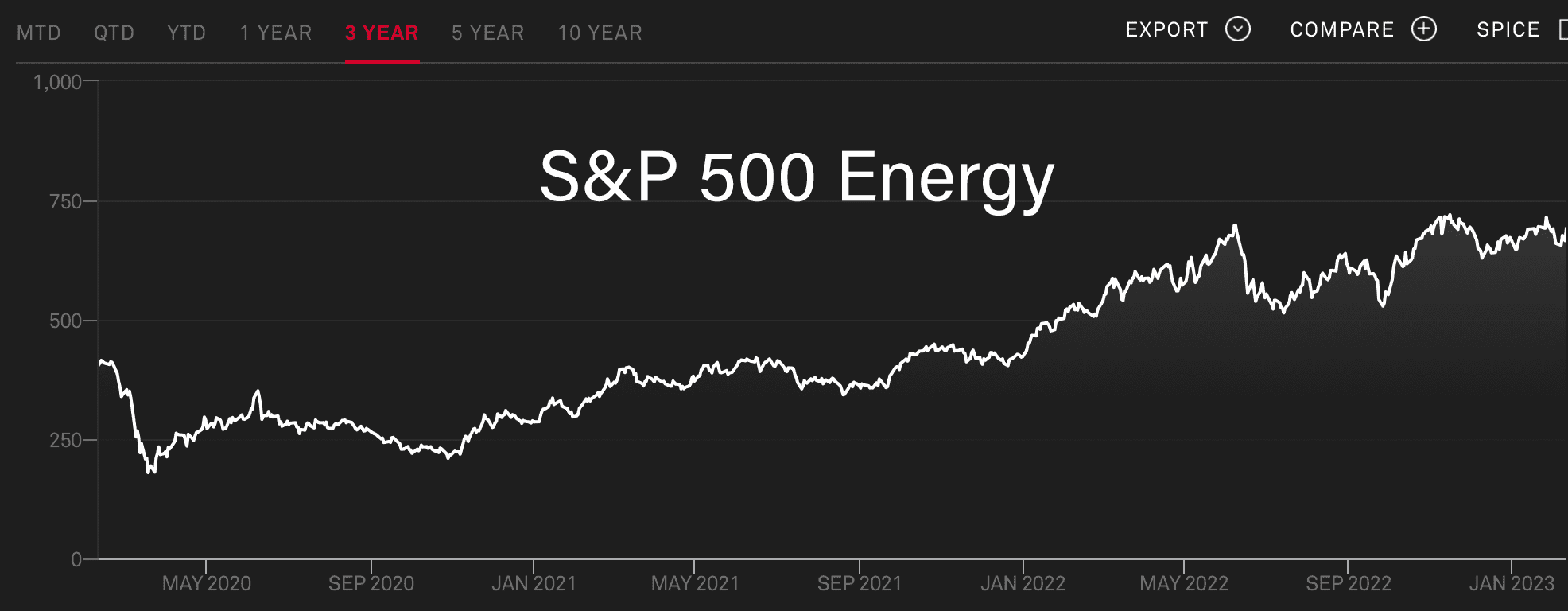

Just take a look at the energy sector setting record highs since politicians announced their climate bills and goals.

Now consider this: natural gas is still considered a green energy – at least according to the EU.

Via The Conversation:

“The European Commission has decided that power plants burning natural gas can be considered generators of green energy. This means they can count as sustainable investments along with nuclear power. The commission’s technical rules on sustainable finance classify a list of sustainable economic activities in the EU. Under these guidelines, economic activities that may help EU countries meet their energy needs while shifting from coal power can be considered sustainable.”

In other words, don’t think of green energy as your only investment alternative. Natural gas players, such as those in the Marcellus Shale, and LNG will continue to boom in the next leg of the green energy transition.

There’s a reason why the biggest asset managers, such as Vanguard and Blackrock, are heavily invested in them.

So if you want to keep up with inflation, follow the money.

Do as they do, not as they say.

Seek the truth and be prepared,

Carlisle Kane

An article with tremendous insight into the Global Elites coordinated objectives for energy control and domination. Some of these elites are Richard Brandon, Jack Ma, Jeff Bezos, Michael Bloomberg etc. Queen once sang “I want it all” , well these elites think the same THEY WANT IT ALL.

Well said John. And to think of how much more power they grabbed during COVID…

The whole push to green is ill-conceived as thousands of products we use in every day life owe their origin to either oil or gas yet all is silent from the green crowd how these items will be replaced. I agree with follow the money. I found this article to be very interesting – https://www.mining.com/web/the-fossil-fuel-elephant-in-the-electrification-room/? and fully supports the fact that the green agenda is misguided, at best.

Do as they do and not as they say. Best line ever.

You dont get it do you??? The Fed is defunked and everything that is taking place is mere optics !!!! There will be no more Fed in a very very short while!! You people are in the DARK!! The fiat dollar will no longer exist WE are returning to Precious Metals VERY VERY VERY shortly!!!!

There is no doubt that ‘somethings up’ and we’re at the tail end of it. When the Prime Minister of Canada says we will be a green country by the end of 2030 and the rest of the world knows he’s full of shit, us Canadians know somethings up. In my 67 years, I have never seen such a useless tit running my country and being the puppet for those in high places. Hopefully, in the next election, the yes voters see the evil in his ways.

All of the comment offered above are interesting. The question I have is this: How do I make some of the money that the elite are continually scooping into their possession? Thanks?

They laid it out…Nat gas plays in Marcellus Shale – there’s a few companies there like RICE Energy, Range Resources, EQT, Consol…all are good stocks that have been performing well and look to continue.

What I love about this newsletter is that it often guides you in the right direction.

I tried to read and understand this. I am not a lawyer or educated in the translation of BS, so I can only ask for an explanation in plain English, if that is even possible.