The world is on the brink of a blackout…

China is almost out of coal – its #1 power source. The reserves are so low the government is rationing power for millions of homes and shutting plants.

With no wind in sight, Britain will soon exhaust its gas stock. It’s now firing up emergency coal-burning plants to keep the lights on.

Meanwhile, Europe warns it may close factories to heat homes for the upcoming colder months.

In fact, Lebanon just plunged into a total blackout.

Via France24:

“Lebanon was plunged into a total blackout Saturday after two main power stations went offline because they ran out of fuel, the state electricity corporation said.

The Mediterranean country is battling one of the planet’s worst economic crises since the 1850s, and has in recent months struggled to import enough fuel oil for its power plants.

State electricity in most places is barely available for an hour a day amid rolling power cuts, while the fuel needed to power private back-up generators is also in short supply.”

And it isn’t even winter yet…

In other words, we are grappling with one of the biggest energy crises in history. It’s setting off a dangerous domino chain that will affect everyone. But if you place your bets right, you can turn it in your favor.

I’ll tell you how we’ll play it in a moment. But before that, let’s quickly break down what’s going on here.

The Economic Boom Caught Energy Producers Off Guard

This year, the global economy staged the comeback of the century.

Lockdowns were lifted. People rushed out to the stores, bars, and restaurants to splash saved-up cash. And businesses gobbled up stuff in bulk to restock their depleted inventories.

All of a sudden, the sluggish economy went into hyperdrive.

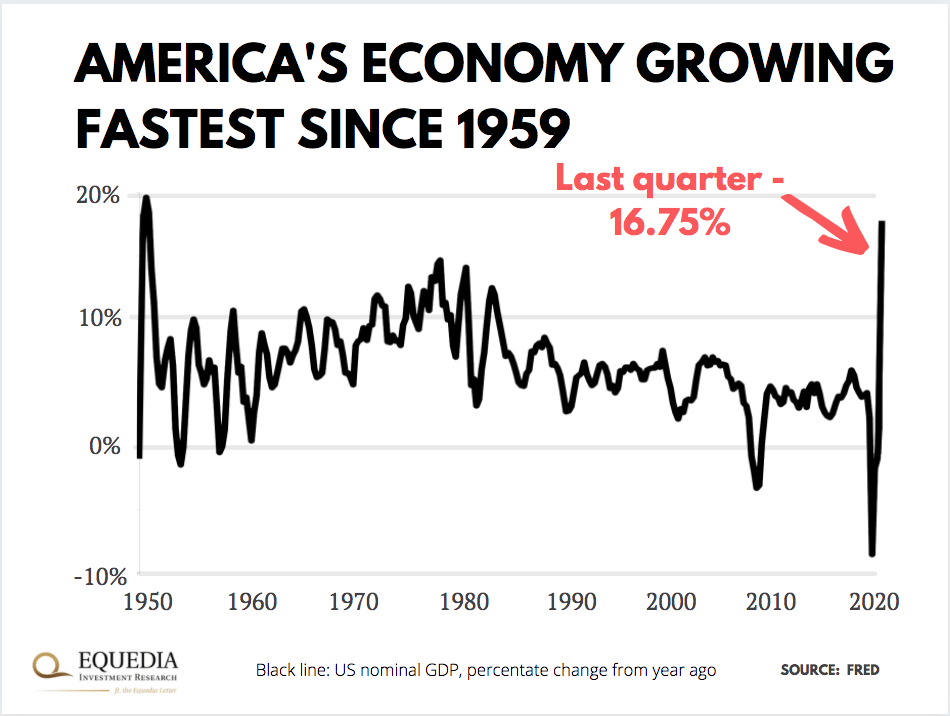

Take a look at the impressive growth of America’s economy this year. Last quarter, its GDP jumped the most since 1959:

The rest of the world didn’t fall behind.

China’s economy grew 21% and 13% in Q1 and Q2 this year, the highest growth since 2008. Britain soared 17% last quarter compared to a year ago. And the EU—15%.

This is the fastest growth on record, and it took a lot of energy. In fact, more energy than the world was ready to produce.

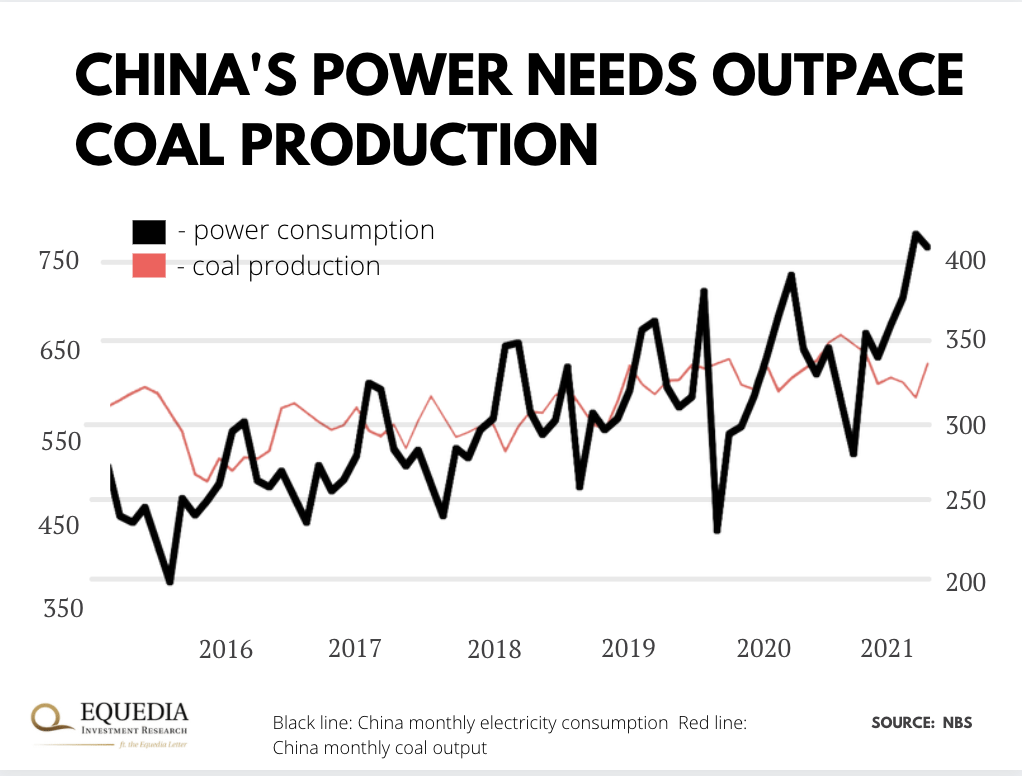

Take China, the world’s biggest manufacturer and energy consumer.

In 2021, the nation used more thermal power than in any other year since 2000. The demand was so high that it outpaced coal production needed to produce that power, as you can see here:

What gives?

Investors Left Energy Companies to Their Fate

When Covid hit, energy stocks were the worst place to be.

As you can imagine, these companies have humongous fixed costs. Think mining operations, plants, and oil wells. But, most important, they are very reactive to the economy (in financial terms, cyclical).

See, the more the economy produces, the more energy it needs. Demand for fuels—such as oil, coal, or gas—goes up, and energy producers can sell more, often at a higher price.

But when the economy cracks, the sector goes into a tailspin.

So when the pandemic swept up the world, investors knew the economy would grind to a halt. And what they naturally did was sell out energy stocks en masse.

According to the International Energy Agency (IEA), $300 billion fled energy companies last year. That’s the largest money outflow from this sector on record. And the IEA has been warning this wouldn’t end well since last May.

Via the IEA:

“The historic plunge in global energy investment is deeply troubling for many reasons… It means lost jobs and economic opportunities today, as well as lost energy supply that we might well need tomorrow once the economy recovers,” said Dr. Fatih Birol, the IEA’s Executive Director

But who wants to invest in something governments want so badly to kill?

Governments Fend Investors Off Old Energy Companies

Last year, the world’s leaders pledged to spend tens of trillions of dollars to phase out fossil fuels.

Joe Biden won the election with a historic climate plan. He’s now pushing a bill to spend $352 billion, the biggest amount ever, to shift America away from fossil fuels and generate 80% of power from green sources by 2030.

Overseas, China’s leader, Xi Jinping, set out to revamp its coal-based energy infrastructure and go 100% green by 2060. For the world’s biggest polluter, that’s a big about-face and undertaking estimated to cost $15.5 trillion.

Europe has introduced its own “green deal,” too. Last year, Brussels signed off on a plan to spend at least a trillion dollars by 2030 to turn its block members onto green energy.

Now, throw in Musk’s PR stunts and the whole ESG movement where fund managers are barred from investing in “dirty” energy companies…and you’ve got a perfect storm that’s sucked billions out of this sector.

Meanwhile, underfunded drillers idled production.

And there you have it.

Dude, where’s my coal?

I get it.

The world is shifting from a fossil-fuel economy to a green economy. And dirty fuels are the past. Fine.

The problem is, renewables barely cover 30% of the world’s energy needs. And we need the other two-thirds today – not 10, 20, or 30 years from now.

Yet, the companies that supply that energy are starving.

As a Goldman analyst summed up on Bloomberg the other day, “The new economy [green energy] is overinvested. Gas, coal, oil, metals, mining — you pick — the old economy is severely underinvested.”

In other words, investors got so caught up in the green future they forgot we still need dirty fuels to make it to 2030, 2040, or whatever carbon neutral target we raise.

And just like that, the world is suddenly out of energy.

Winter is coming

And the world is dangerously drawing down its reserves.

In Europe, natural gas stock is at the lowest seasonal level in a decade. If they keep dipping in reserves at this rate, the block may not make it through the cold season.

After shutting its biggest storage facility in 2017, the UK has barely any space to stockpile gas.

And get this, China has just enough coal to power the country for about two weeks.

Yes, we are talking weeks!

To restock, major nations are now gobbling up fuel leftovers at any cost. For example, China ordered its state-owned energy companies to “do whatever it takes” to secure fuel.

This panic buying is sending energy prices through the roof.

This year, European and British gas jumped 452% and 400% to record levels. Coal is at all-time highs, too—up 286% this year. And energy prices keep hitting fresh records every day.

Who knows how far this can go, especially when temperatures drop.

Inflation is here to stay

Yes, expect higher bills, but that’s the least of your worries.

Because energy prices don’t just affect figures on your bills. They dictate the price of everything.

Think about it.

Energy is one of the first inputs that go into the production of any product. If it runs out, the entire supply chain halts. Supply falls, prices go up.

That’s already happening.

For example, Europe is already in a food crisis. Its fertilizer companies can’t produce enough chemicals. Now, farmers are in a sudden shortage of carbon dioxide gas, a byproduct of fertilizers.

That shortage is causing disruptions for the livestock sector, which uses the gas during the slaughter process. And food prices are going up.

This is just one example, but there are many others.

What happens when China shuts factories down to keep the lights on? There goes the global supply chain…

Here’s how to play it

Look, I’m all for clean oceans, smog-free air, and all that.

But the cold hard reality is the world still needs dirty fuels – especially when it has to power up the biggest economic restart in history.

For this reason, betting on under-owned fossil-fuel stocks could net a healthy return in the near term. And there are a couple of ways to invest in them.

The easiest, set-it-and-forget-it way is to buy an ETF that holds a broad basket of energy stocks – take Vanguard Energy ETF (VDE), for example. It’s the second-largest energy ETF that covers a whole range of fossil-fuel stocks in the US—from small to large caps.

You could also pick your own roster of stocks, of course.

Inflation ain’t going anywhere anytime soon. You better be on the right side of it.

Seek the truth,

Carlise Kane

Disclosure: We own energy stocks and are looking at buying more.

I agree with your comments, but think they would have been more timely last June. The oil & gas stocks have already had a good run – they can run further, but are vulnerable to any cracks in OPEC+ supply constraints and/or new supplies (shale etc) coming on stream in the coming months.

TIME TO INVEST IN SOME US STUCKS LIKE – CHEVRON

What about uranium? Nuclear power has been gaining favour amongst the carbon neutral crowd in recent months. UK, USA, China all committing t o this clean source of energy.