The world’s central banks are turning off the money taps.

The banks of England and Canada have been scaling back printing (QE) since summer. The Fed’s chief said it would join in as soon as next month.

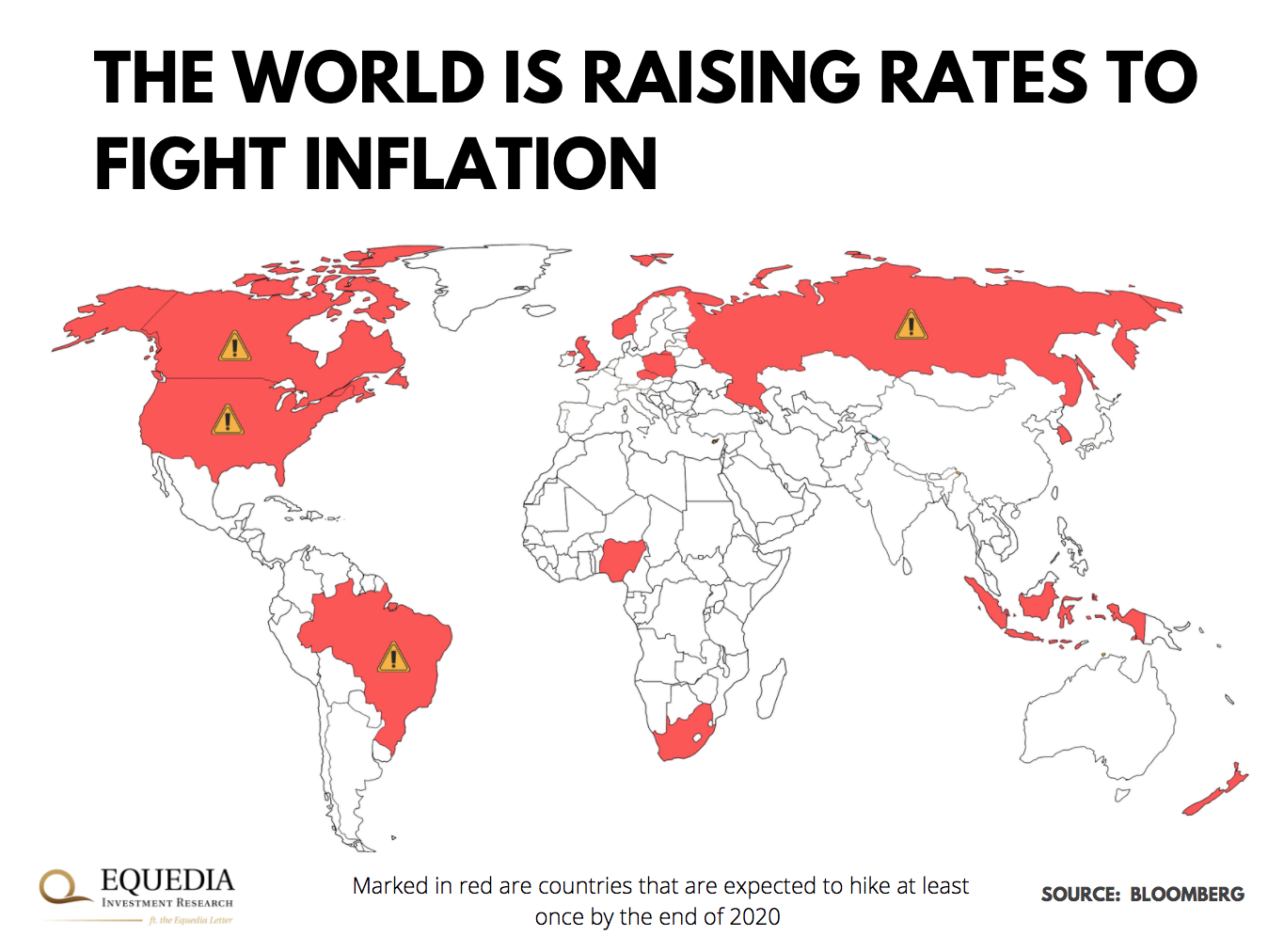

Most of them are seriously considering raising interest rates, too. Here’s a map of countries that are expected to hike by the end of next year:

Meanwhile, rates in Norway, Brazil, Mexico, South Korea, and New Zealand have already increased.

Is this the end of the free money era?

If rates rise, the cost of money is going to shake up an economy that’s piled up a Mount Logan of debt to fight Covid.

Luckily, there are a few market corners that thrive when this happens.

More on that in just a bit…

First, let me show how the world mortgaged this economic boom.

Money goes on sale

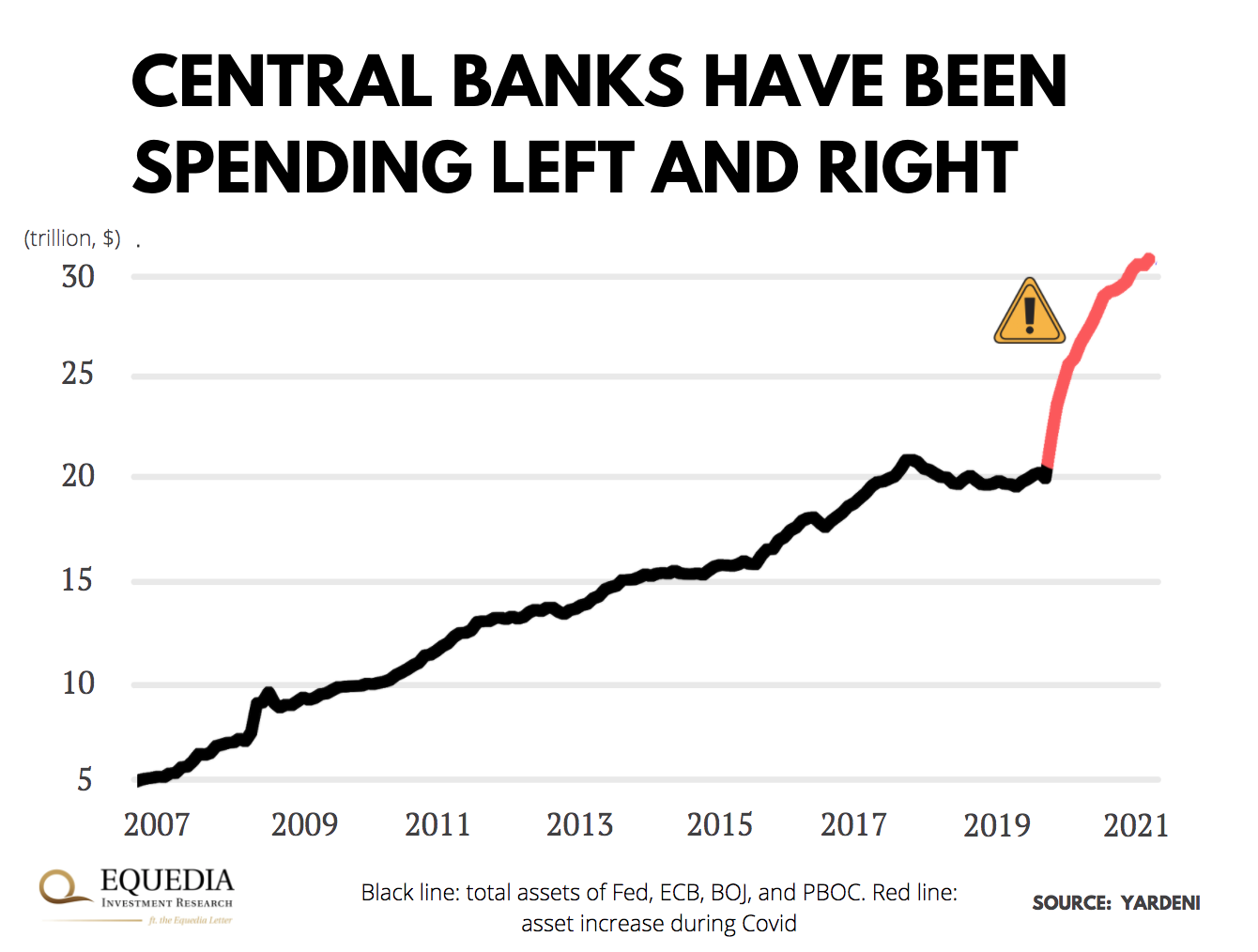

Since 2020, central banks have printed over $11 trillion dollars. The Fed alone cranked out around $4.5 trillion…

…which is about one-fifth of all US dollars in existence!

To illustrate the scale of this madness, look at how the balance sheets of central banks have swelled during Covid:

In less than two years, central banks have stacked up nearly as much money as they did during the past 14 years. Keep in mind that includes shoring up the economy after the housing collapse in 2008.

And they practically handed this money out for free.

Most of the developed world slashed interest rates to near zero. And in countries like Switzerland, Japan, and Denmark, rates have been negative for a while now – which essentially means you get paid for borrowing money.

So, like always, the world snatched up the opportunity and borrowed truckloads of free money. The psychology of free is a powerful thing.

The Mortgaged Boom

As we discussed last week, the world is going through the economic restart of the century.

Last quarter, America’s GDP jumped 16.75% – the biggest growth since 1959.

Meanwhile, the GDP of most other major economies, including Britain and China, grew in the high teens.

But the world’s economy didn’t spring up on its own. Instead, its recovery has been engineered with this free printed money.

And this increase wasn’t earned because of hard work – heck, the US labor participation rate last year fell to a level not seen in over 40 years! It was simply because Uncle Sam gave it away in the form of generous benefits and stimulus checks.

In fact, the National Bureau of Economic Research estimated that two-thirds of unemployed Americans got benefits greater than their lost earnings.

And 1 in 5 were earning at least 2X their previous pay!

And it’s all thanks to borrowed money from Uncle Sam.

The same goes for businesses.

Despite one of the biggest economic shocks in history, there were relatively few defaults – even in the most beaten-down industries such as airlines, cruise lines, and resorts.

That’s because central banks assured investors they’d do “whatever it takes,” including buying all the junk, to bail out the economy.

So, investors threw caution to the wind and lent trillions of dollars to “zombie” companies that were (and a lot of them still are) supposed to go bust.

In fact, a record $421 billion in junk debt was issued in America last year—2X more than a year ago. This year, it’s 50% higher than in 2020. Such growth is unheard of, especially during a pandemic.

Compare that to 2008 when investors ran for the hills, and junk debt issuance crashed 70%.

In other words, the government has mortgaged this boom.

It has borrowed trillions of dollars to fill the void in the stalled economy. And that tide lifted all boats, including ones that weren’t supposed to float.

Time to Pay the Piper

Many “boats” are loaded with debt.

Take airlines, for example.

Since the beginning of Covid, the world’s carriers have borrowed an extra $140 billion. Now they’re sitting on a record $340 billion pile of debt—80% more than pre-Covid.

This extra debt is a big deal for such a razor-thin margin industry – especially when airlines are still burning through millions every day because flyers haven’t been coming back.

The same goes for other beaten-down industries like resorts, hotels, and cruise lines – all of which took on loads of debt to stay afloat.

What will happen when airlines and other “zombie” companies already up to their teeth in debt have to borrow more or refinance at higher interest rates?

At best, this debt will eat away earnings (and, in turn, investor returns) in the coming years. At worst, there could be, well, an economic epidemic of defaults.

And I haven’t even begun to talk about what happens to our countries who have borrowed more money than ever in history. If you’ve read any of our letters on the Great Reset in the past, this is precisely how the elite ensure the majority never get ahead.

Its actually brilliant:

- Sink everyone into debt

- Lend money at no cost, while looking like heroes for helping in time of need

- Raise the cost of that borrowed money

It’s the never-ending mortgage.

Mark my words: taxes are going up.

Stock Valuations At-Risk

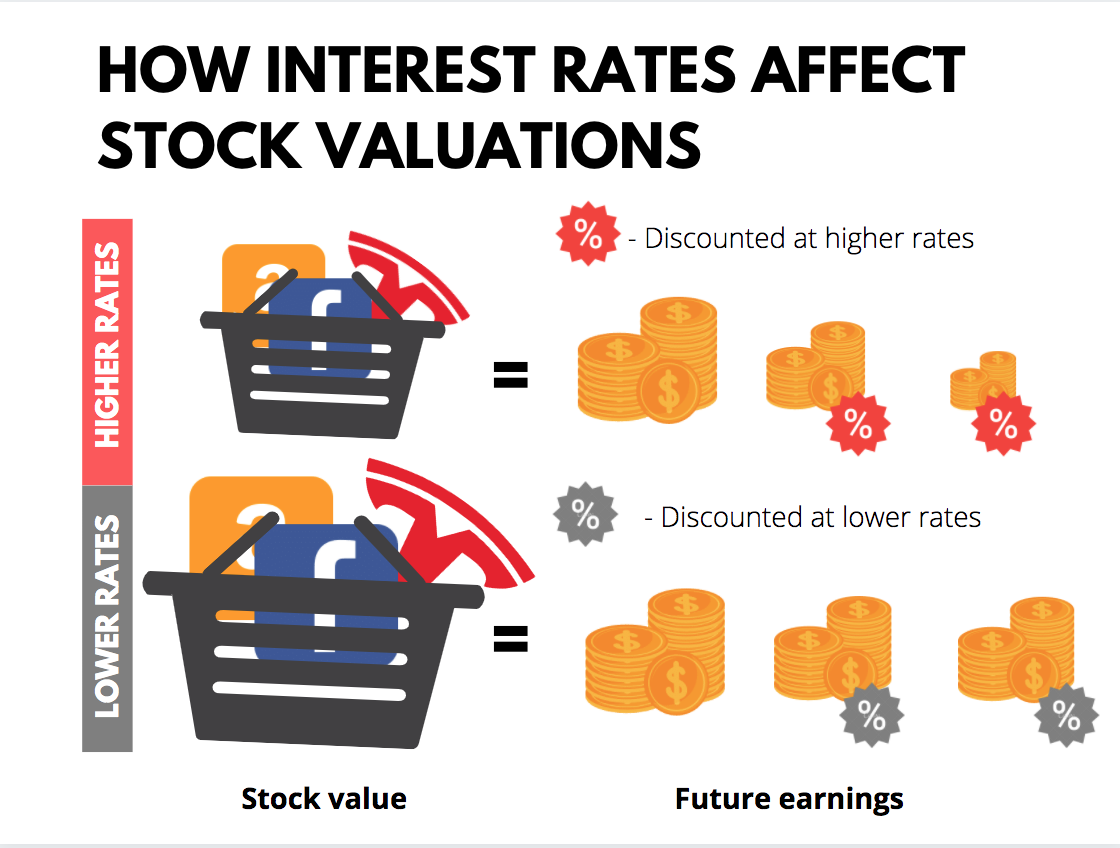

Another—and lesser-known—effect of rising rates is that they weigh down the theoretical value of stocks.

There are many ways to assess a stock’s worth. But at the most basic level, it’s today’s value of all the money this company will make in its life.

But here’s the catch.

The company will make most of that money in the future. And as you know, a dollar today is worth more than a dollar tomorrow.

So when investors assess stocks, they discount their future earnings based on when the company expects to make that money.

The discount rate is another topic. But what you need to know today is that the thing affecting it most is – you’ve guessed it –

interest rates.

The higher the rates, the more discounted—or less valuable—is the money that the company will make in the future.

That means when central banks raise rates, they indirectly trim stock valuations—all things being equal. Here’s what that looks like:

Time to Get Picky

The mortgaged boom is almost over, and the easy money has already been made.

While we remain mostly optimistic, now is the time to get more cautious and more selective. And there are three types of stocks we are betting on today.

Companies That Can Outgrow Rising Rates

Companies that are light on debt and can grow fast in the coming years could weather the storm.

As rates rise and weigh down the “theoretical” value of stocks, you want to hold companies whose growth is not only offset but will outgrow its negative effect.

A good example is a “live commerce” pioneer that we introduced to our readers a few weeks ago.

It’s a hyper-growth company led by an elite tech team that’s set to disrupt how we shop online for good. Here’s our recent special report about this disruptor.

Another is a novel wearable tech company that we’re heavily invested in. Over the past few months, it’s bolstered its management team with heavy hitters and signed deals with big names. And despite its recent share performance, we believe this company is on the verge of stepping into the limelight. Find out more about this company by CLICKING HERE.

Value Stocks

Value stocks are typically well-established companies that are trading at lower valuations.

Think giants like Proctor & Gamble (P&G) or Coca Cola (KO).

These companies generate lots of cash. But due to their size, their growth is limited. And so, investors naturally expect less of them than other stocks in the future.

That means the discount rate, which we discussed in the previous section, affects them less.

In fact, JPMorgan’s data going back 50 years showed that value stocks consistently outpaced the market when interest rates rose.

Stocks Tied to Raw Materials

The last group of stocks include companies that extract raw materials – and past readers have made a lot of money from this sector.

As discussed last week, the material shortage is driving inflation in energy, food, and other products, which is spooking central banks into raising rates.

So, investing in stocks that cash in on inflation is another way to offset the negative effect of the measures trying to tame it.

For example, a gold producer that we first featured nearly two years ago, and one that has already made our readers a lot of money, is looking extremely strong. It recently reported Q3 financials, showing a cash position of US$72.9 million, no debt, and remains completely unhedged. Best of all, despite a strong Q3, management has told investors that Q4 will be even better.

The risk from rising rates is nearing. It’s not a bad idea to cull your portfolio before it’s too late.

– Carlisle Kane

Even when they raise rates, they will still at all-time lows.