We warned you it was coming.

In 2021, we told you that the Covid-driven economic boom was just an illusion built on free debt.

And as soon as central banks began charging for it, the economy would implode.

Fast forward to today, the Fed has brought interest rates to 4.5%—and the markets are barely holding up.

Tech is nearly back to pre-Covid levels—but with hundreds of thousands of layoffs.

Meanwhile, crypto has wiped out over $2 trillion of investor wealth.

But the real threat goes beyond crypto and tech.

This rapid flip from extreme monetary loosening to even more extreme tightening has put millions into a debt trap.

A debt trap that’s bound to culminate in a major wealth transfer.

The good news is that if you act wisely, you still have time to be on the right side.

Listen via podcast instead

Unaffordable Debt

All the money printing during Covid brought two dire consequences.

First and most obvious, it sank the world into more debt than ever while fostering a false sense of security.

It fooled people into thinking that, somehow, money was free – that we could collectively print our way out of any crisis.

It worked in 2008, so it must continue to work, right?

As a result of being accustomed to low rates and free money, people took every windfall and splashed it around with reckless abandon.

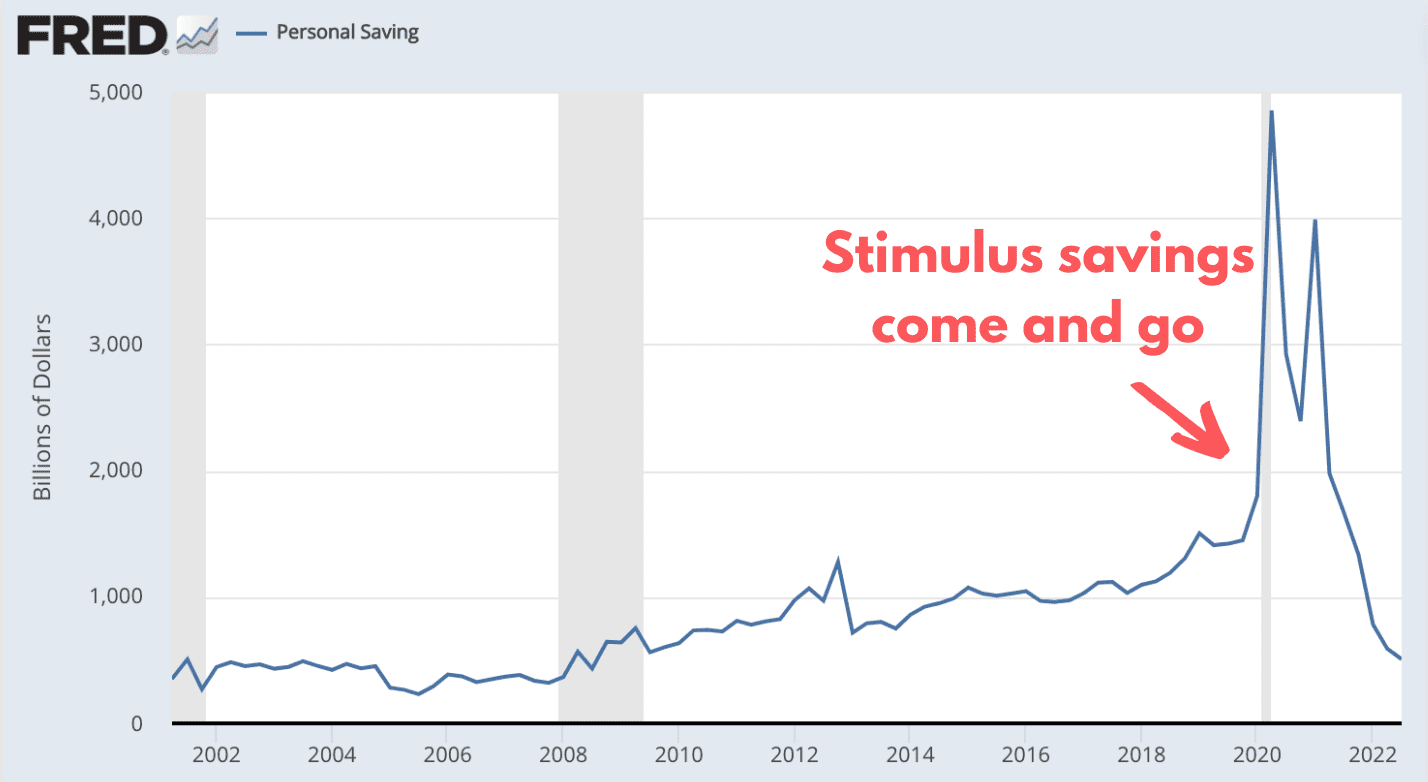

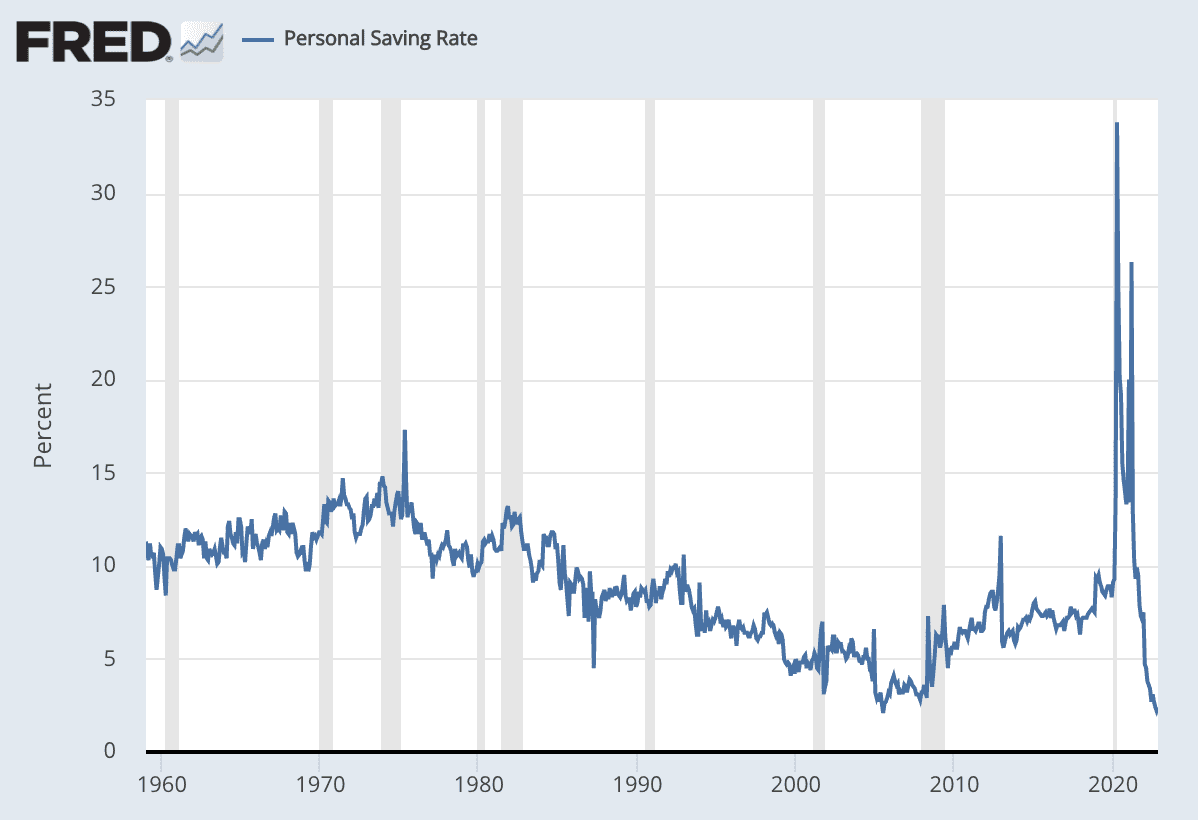

Take a look at how the leap in savings from stimulus quickly melted away throughout the last two years:

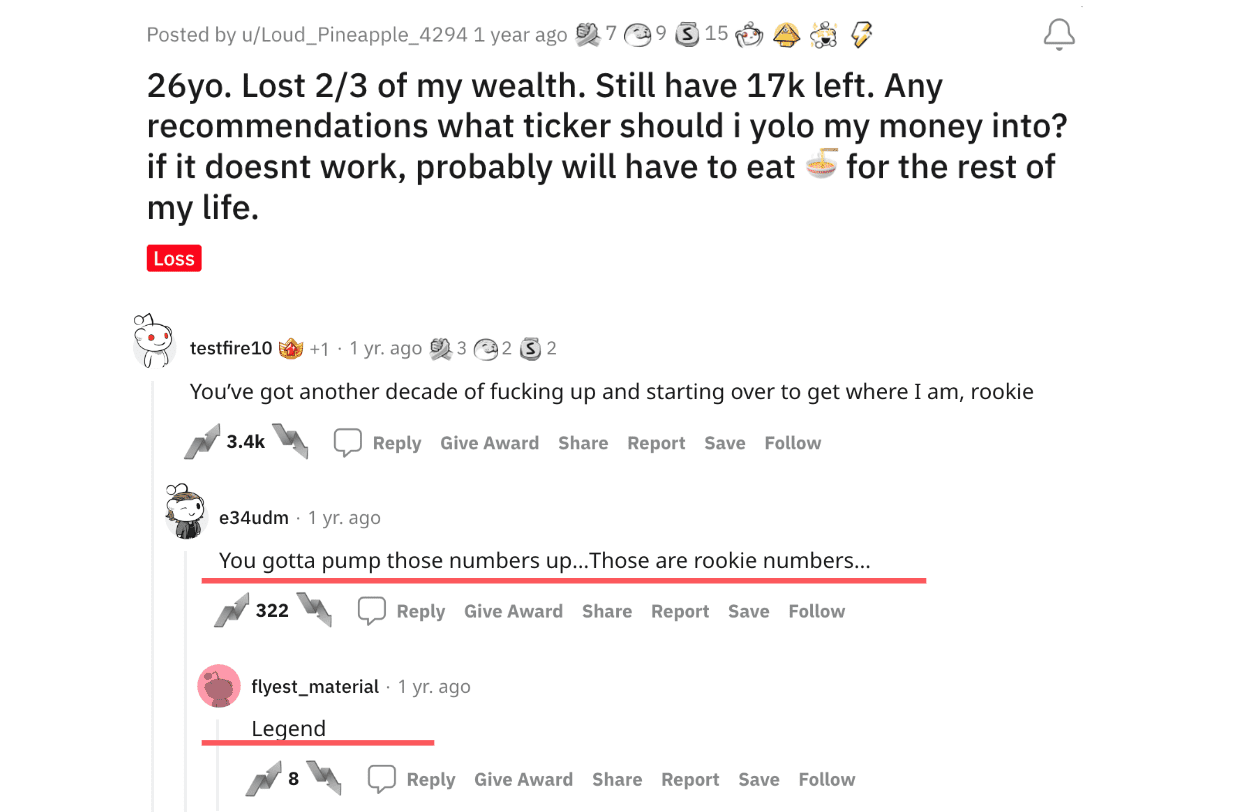

All this money was “YOLOed” (You Only Live Once) away on crypto, meme stocks, and other frivolous stuff.

The free money turned the younger generation into gamblers who would risk it all at a shot of wealth without much care for losing it:

And why should they care? The youth should take risks – especially when most of that money came from the Treasury with no strings attached.

At least that’s what they were led to believe.

But little did they know the free money would be due much sooner than expected.

After a few years of multi-trillion dollar money printing, the world is experiencing the highest inflation in 50 years.

Prices for essential stuff like housing, gas, used cars, and food has increased by double digits.

Imagine the pinch of raising kids when a meal at school costs 305% more than it did a year ago, according to the latest data.

Not only have most stimulus dollars been spent, but the remainder won’t go nearly as far anymore.

So how do people make ends meet?

They borrow more.

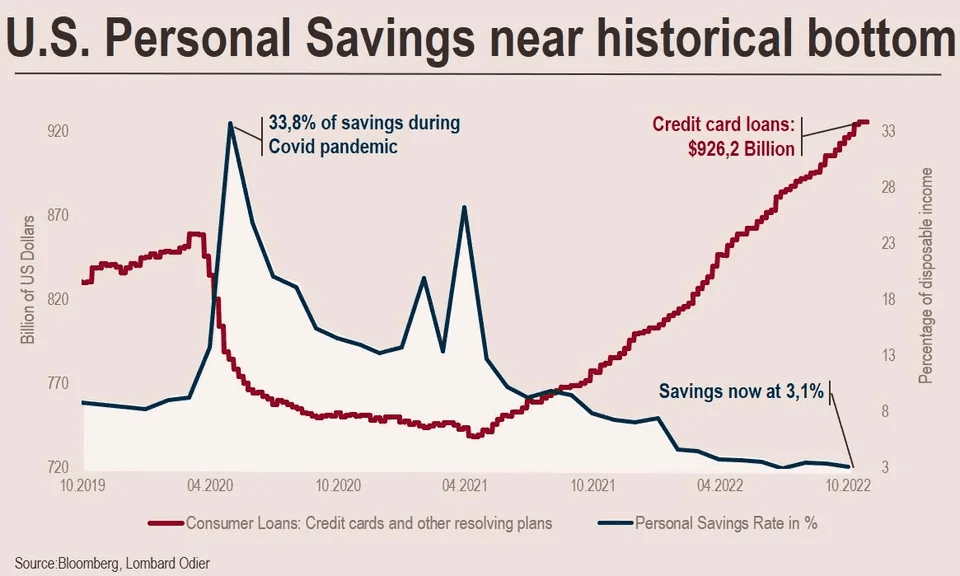

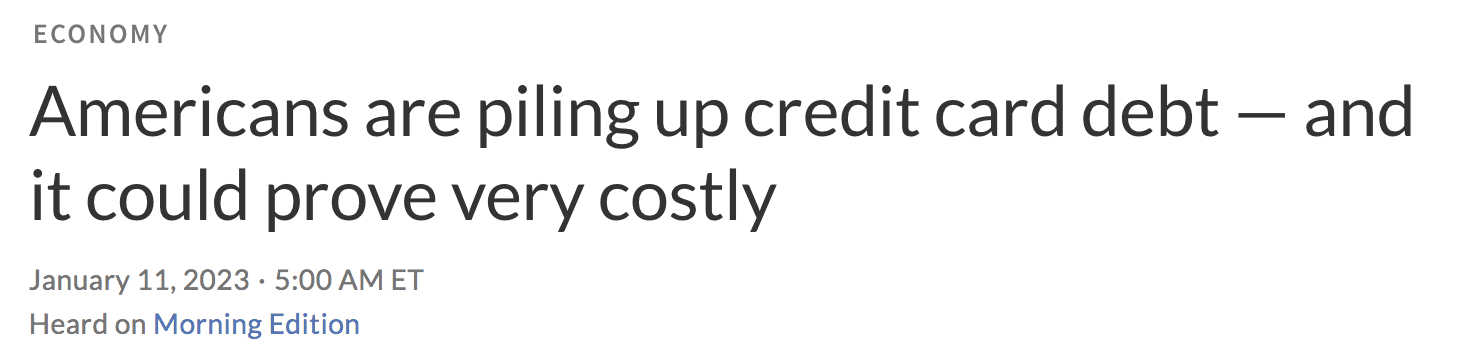

Take a look at how credit card debt is blowing through the roof as savings fizzle out:

And that money is no longer free.

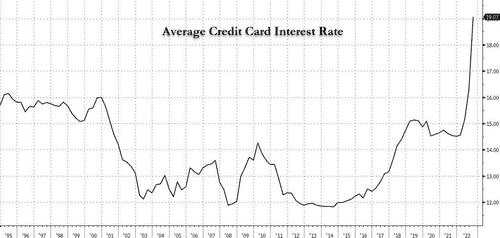

In fact, it’s costing more than it has in three decades. Take a look at average credit card interest rates:

According to Bankrate, credit cards now charge the highest interest on record:

“The average credit card APR has hit a new record high of 19.04 percent, according to our Bankrate.com database which goes back to 1985. The previous record was 19.00 percent in July of 1991. The national average started this year at 16.30 percent, so it has increased by 274 basis points so far in 2022.”

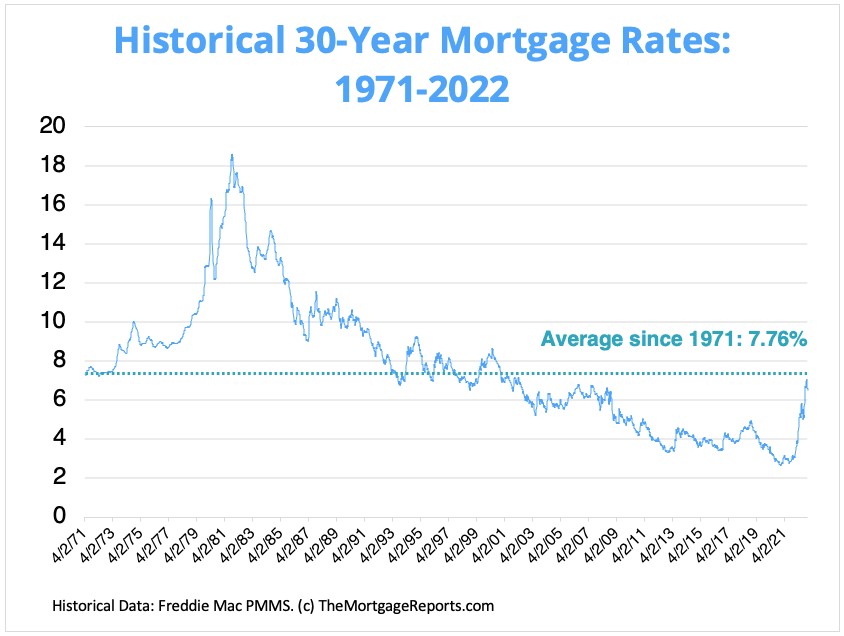

Meanwhile, in just a year, mortgage rates have increased to the highest in the last two decades.

That’s an insane increase in debt services costs.

A few years back, a $500,000 house would have cost you $2,000/month on a 30-year fixed mortgage.

That same house will now set you back $3,200/month.

It’s no wonder people have burned through savings and now have the smallest cash cushion since 1960:

Tsunami of Defaults Not Here. Yet.

According to a 2009 study published in the European Journal of Social Psychology, it takes 18 to 254 days for a person to form a new habit.

So it should come as no surprise that we’ve grown accustomed to next-to-zero interest rates – we’ve had over ten years of it.

So far, delinquency rates are what many pundits call “normalizing.”

For example, credit card defaults across major banks have jumped, on average, 30% this year.

Yet they are still low compared to pre-pandemic levels.

That’s because people can still borrow to cover debt.

Despite the predatory rates, Americans are still taking on more credit card debt than ever.

Perhaps they believe things will indeed “normalize.”

But what will happen when layoffs expand from relatively small tech to sectors that actually affect the average American?

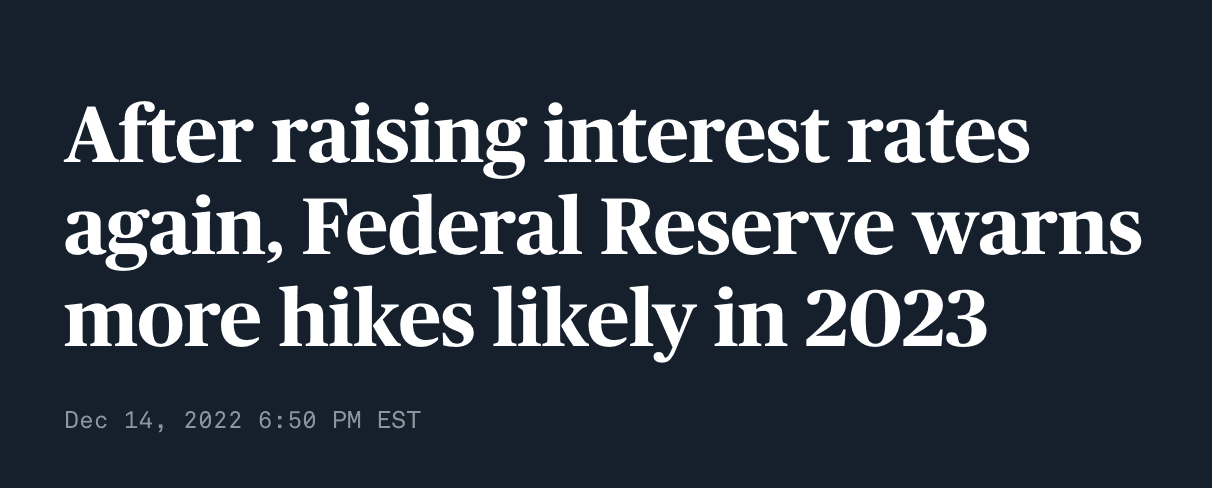

What will happen when central banks raise rates even more?

People won’t be able to take out more debt, and this vicious cycle will hit a dead end.

That’s when a tsunami of defaults, from credit cards to cars and mortgages, will come thundering.

This brings me to the central thesis of this letter…

The Biggest Wealth Transfer in History

If you are trapped in 20% APR debt and know that if you don’t pay it back soon enough, it will grow like mold, what do you do?

Assuming you’re financially literate, you do everything possible to eliminate that debt.

You might auction off your car. Or list your house and downsize to a smaller condo or rental. You could cash out your 401ks/IRAs.

Just as people piled into stocks when money was free, they may have to sell them now that everything’s becoming unbearably expensive.

If this happens, the stock market will sell off further. In fact, it’s already happening.

Just look at Tesla and Meta, two of the biggest companies in the world, which are down around 60% from their peak in late 2021.

But guess who will be there to snap up the bargains?

That right, the elites.

Have you seen how much money is sitting on the sidelines on Wall Street?

A little short of $5 trillion—an all-time record!

Via CNBC:

“Total net assets in money market funds rose to $4.814 trillion in the week ended Jan. 4, according to the Investment Company Institute. That eclipses the prior peak of $4.79 trillion during May 2020, back in the earlier months of Covid-19. “It’s a mountain of money!” wrote Bank of America technical research strategist Stephen Suttmeier.”

Wall Street knows a breaking point in this debt cycle is near – as do Big Tech (hence the layoffs).

And they are diligently accumulating cash to take advantage of this coming onslaught of bargains. Just ask Berkshire’s Charlie Munger. Meanwhile, they’re buying up real assets and dividend-paying instruments such as REITS (backed by real assets).

They know that the have-nots who are strapped for cash will soon flood the market with sell orders to cover their debt.

But contrary to what many expect, the Fed won’t reach out a helping hand this time.

Why Rates Need to Remain Higher

Many believe that interest rates will tumble as soon as we enter a recession.

The logic is that the government won’t be able to service its debt at these rates, and the Fed will feel political pressure to cut them.

What they are missing is that the government isn’t a household, nor is it running its books like one.

For example, unlike you and me, the government doesn’t rely only on what it brings in to pay its debt. That wouldn’t be possible, considering the US national budget has been in deficit for more than two decades.

So how do they get around it?

They borrow more to cover the interest on that debt, then settle the principal by debasing the currency.

Think of it as “credit card churning” only on a federal level.

That’s why, as we revealed in “The Government’s Big Plan,” the government doesn’t intend to stop inflation at all.

In fact, if there’s no inflation, there’s no way to debase the principal on federal debt.

That explains why the Fed has unofficially increased its inflation target from 2% to 4%+.

To better understand this, please read our previous letter here.

Now, what happens when inflation becomes permanently higher?

The Fed will have to keep raising rates to sell Treasury debt.

Otherwise, Treasuries will yield less than they lose to currency depreciation, which will turn off investors. And the Treasury won’t be able to borrow more.

But wait, isn’t there a debt ceiling to prevent such “debt churning”?

In theory, there’s a legislated limit, but as we all know, it’s just a formality.

In fact, Congress has raised it 78 times already—from ~300 billion to $31.4 trillion. And they are planning to do it again.

Meanwhile, they can always cut back on Social Security for retirees and the disabled…

Via CNN:

“In a letter to House Speaker Kevin McCarthy on Thursday, Treasury Secretary Janet Yellen announced that the agency will start taking “extraordinary measures” now that the US has reached its $31.4 trillion debt limit.

This time around, Yellen anticipates selling existing investments and suspending reinvestments of the Civil Service Retirement and Disability Fund and the Postal Service Retiree Health Benefits Fund. Also, she is suspending the reinvestment of a government securities fund of the Federal Employees Retirement System Thrift Savings Plan.”

The Invisible Tax

I’ve said it many times, and I’ll say it again: Inflation is a tax in disguise.

It’s a tax for the government’s reckless spending, paid for by those who least benefit from it.

Those who’ve got the cash on hand collect that tax. And those who are strapped are destined to pay it.

This is why inflation has caused the biggest wealth disparities throughout history. And it will again.

I hope you followed my advice throughout the last decade and made enough cash in the stock market.

If not, start saving now and pay off debt as immediately as you can. It’s not too late yet.

Because cash is getting pretty darn expensive.

And if you deploy it wisely, this decade will bring investment opportunities that can set you up for life.

More on that in future letters.

Seek the truth and be prepared,

Carlisle Kane

Another fantastic article. Most people don’t get it, we are headed into dangerous territory, not only here in the US, but other countries in the World are in the same condition as we are.

“Gold is the money of Kings,

Silver is the money of Gentlemen,

Barter is the money of Peons,

Debt is the money of Slaves.”

Just a question. Have you tried to put your wisdom on money and finance into junior high, senior high and college classes? Young people need to get the basics of money. Private schools might be an easier avenue right now.

I don’t think Democrats,who own public schools,want a literate electorate.They would soon be out of jobs.

Have you been watching the news of late from FLorida.. You mentioned Democrats own public schools.. That is such a stupid and funny comment.

Its the democrats that have done the best for the country…they did not overturn Roe V Wade, or wage war with LGBTQ+, or ban books that talke about race or CRT as they like to call it..

Clinton was able to balance the budget, Obama inherited a horrible economy much like Joe Biden and both were able to turn it around. The amount of jobs created, and average GPD is highest of any president thus far.. Clinton was 4%, Bush 43 was 1.5%, Obama 2.2%, Trump 1.8%, and Biden for the first 2 yrs so far 3.3%.. So you can see from the past the DNC in whitehouse is better for the country in many ways..

I bet you think trump was a good president and he won the 2020 election.. It’s the republicans that don’t want a literate electorate as they are now seeing how bat $hit crazy they/you are..

My only comment would be that there may still be jobs as the 40% increase in all cause mortality probably due to the jab will leave vacancies. Healthcare will be a disaster. Interested to know your take on the impact on the economy of workers dropping like flies.

Will they ever reduce the average American”s Social Security benefits???

They already are.The benefits are in Dollars,which are devaluing faster than the increases in SS payments.They have no choice.Govt is bankrupt and can’t give real increases.