They’ll Own Everything

Part II

I am about to reveal the next 4000 trillion dollar idea.

It’s not crypto. It’s not AI. And it isn’t a drug.

In fact, it’s much bigger than all of those things – combined!

It’s so big that it will put EVERY financial instrument that ever existed to shame.

Let’s get started.

Earlier this year, I revealed how a small organization is quietly the biggest shareholder in 96% of American companies. And how they use their voting power to dictate corporate policy that puts billions into their pockets.

If you missed that letter, I highly recommend reading it before today’s issue.

In this Letter, I’ll expose a much, much grander scheme of asset accumulation.

A 4000 trillion dollars multilateral operation meant to financialize all of the world’s natural resources…

…down to the last breath of fresh air.

And no, $4000 trillion isn’t a typo.

Warning: At first, this will sound like just another conspiracy theory.

But don’t let the unthinkable scale of this operation fool you into thinking this can’t be true.

Because it’s ALREADY HAPPENING.

In fact, a special investment vehicle that lets Wall Street do this has already been green-lit.

Listen to this via podcast

The Gates’s “Farmland Grab” is Peanuts

You’ve all probably heard about Bill Gates and his “farmland grab.”

For the past decade, the tech billionaire has been gobbling up hundreds of thousands of acres of farmland.

He’s accumulated so much land that last year, he owned a mind-boggling 242,000+ acres—making him America’s largest individual farmland owner.

But as big a landowner owner as he is, Gates is just a poster child for a much bigger land grab.

As I exposed in “Food Wars: The Next Pandemic,” behind the scenes, there’s a massive transfer of farmland from individual farmers to asset managers.

For example, The Teachers Insurance and Annuity Association of America (TIAA)—one of the largest pension funds in America— has acquired more than two million acres of farmland since 2010.

That’s 10X more than Gates.

Why is so much institutional money suddenly flocking into a historically ignored and low-returning asset class?

Many analysts think Wall Street is pursuing this land grab for the sheer economic value of that land.

But there’s much more to it.

Economic Value vs. Nature Value

Let me ask you what seems like a simple question: How much is a piece of land worth?

If you were a realtor, you would probably think through the property’s economics—what structures you could build on it and how you could farm or otherwise utilize it.

Then you’d take that information to project cash flows and tally up a rough estimate.

But the land’s utilitarian value is just part of what it’s actually worth to society.

The land itself and its role in nature’s ecosystem has intrinsic value, too.

For example, a plot in the forest may have vegetation that supplies fresh air and water. It may provide a home to wildlife, trap carbon, and carry out other “services” that underpin life.

These natural processes are not factored into the land’s sale price because they don’t have a monetary value. Nor has there been a legal framework to commercialize them.

Until now.

Natural Asset Companies

Last April, the NYSE and the Intrinsic Exchange Group (IEG) introduced a new kind of securities and accounting standards designed to financialize these very natural processes.

This asset class is called a Natural Asset Company (NAC).

And what it will essentially do is allow landowners to IPO their properties with the natural resources that inherently come with them.

“NACs will attempt to assign value to services – such as carbon retention, freshwater generation, pest control, groundwater storage and erosion prevention – intrinsically provided by natural resources. To account for the ecological value of the NACs, IEG has developed an accounting methodology that will supplement GAAP financial statements. NYSE plans to file the listing standards and accounting information for NACs with the US Securities and Exchange Commission (SEC) in fourth quarter 2021, setting the stage for the vehicle, if approved by the SEC, to become available as soon as next year.”

The owner will get capital to reinvest into that land or buy more. And investors, in return, will get a share of the rights to its “natural services” and any profits that may come from them.

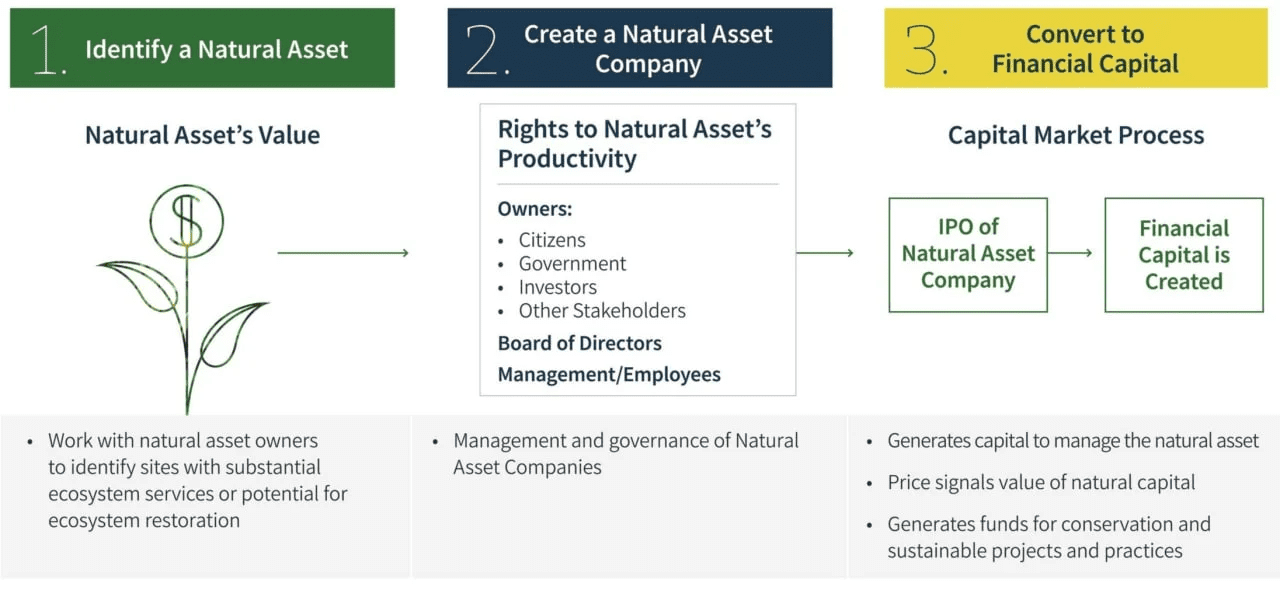

Here’s the scheme in a nutshell:

In other words, Wall Street will take all of nature’s natural processes—things that have always been your inherent right by nature—and turn them into financial capital.

The wonders of mother earth will become a “service” that Wall Street will earn royalties from.

Proceeds from a NAC initial public offering (IPO) will be used to manage the specific natural asset and potentially acquire additional natural assets or return value to the owners.

And oh boy, is there a ton of money to loot from nature.

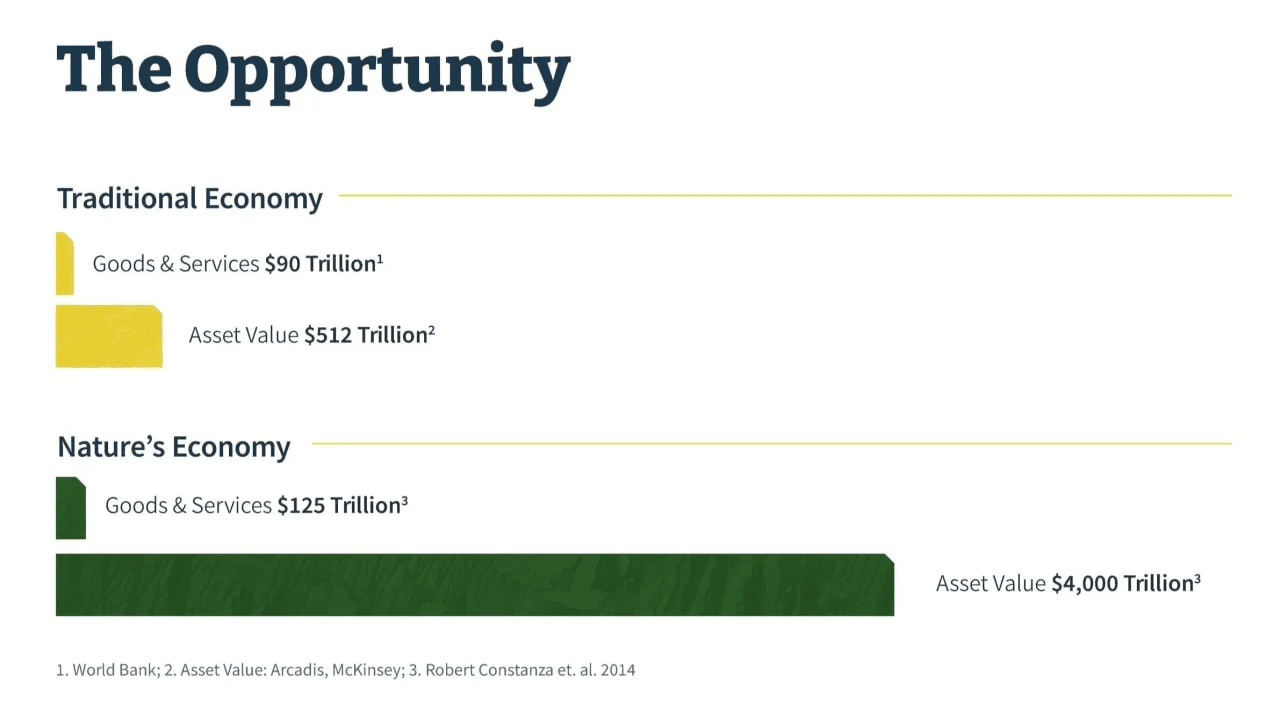

According to the IEG, nature’s assets are estimated to be worth over $4 quadrillion globally. That’s $4,000 trillion—with 15 zeroes: $4,000,000,000,000,000.

That’s 8x more than all the world’s economic assets combined:

Nature’s Raid in a “Sustainability” Wrapper

You may be asking: how on earth will they make this fly with the public?

It’s simple. They’ll use “climate change” fear-mongering the same way they have successfully used it to push ESG (environmental, social, and governance).

And they’ll use this time-tested narrative to make you believe it is for your own good.

Look at all the lofty promises of this asset class from the IEG’s now-removed presentation. (full retrieved copy here):

“IEG works in consultation with the owners of natural assets to create a Natural Asset Company which manages a parcel(s) of land or marine area(s). These companies are typically characterized in the following general categories:

Natural Areas, protecting and expanding existing conservation areas and intact landscapes, including restoration of degraded lands, to protect biodiversity and ecosystem services production

Working Areas, converting existing conventional agricultural practices towards regenerative practices, which increase the health of the land and the surrounding air and water, provide room for nature to expand, increase farm incomes and improve the nutritive value of food.”

NACs are advertised as a creative way to capture a non-utilitarian, intrinsic value of nature. But how do you derive value from something that’s universally owned by everyone?

Well, you don’t.

If you dig deeper, the IEG’s accounting principles for investors state profitability/cash flows from natural assets as the main gauge of NAC valuations:

“As the natural asset prospers, providing a steady or increasing flow of ecosystem services, the company’s equity should appreciate accordingly providing investment returns. Shareholders and investors in the company through secondary offerings, can take profits by selling shares. These sales can be gauged to reflect the increase in capital value of the stock, roughly in-line with its profitability, creating cashflow based on the health of the company and its assets.”

This is obviously in direct conflict with nature’s conservation.

IF you invest in nature’s conservation, you won’t be able to extract as much from it. Or if you do, you’ll have to do it more sustainably, which means your margins will take a hit.

And vice versa.

If you seek to maximize cash flow from a piece of land, you’ll have to extract as many resources from it as possible. And that will obviously come at the expense of conservation.

Then again, I don’t have all the answers to climate change and how it should be addressed—if at all.

But I can bet my life on one thing: whatever Wall Street is up to, they’re definitely not doing it for the environment, nor are they doing it for the people.

Their one and only motive is to make as much money as possible.

It’s always been that way. And all the sustainability efforts that Wall Street has pushed thus far haven’t proved otherwise.

Remember the ESG craze over the pandemic?

Turns out it all was just one big greenwashing campaign to attract capital for its investment banking clients.

Via the New York Times:

“Contrary to the spirit of ESG investing (and likely unknown to most investors), the leading rating agencies are not scoring companies on their degree of environmental or social responsibility. Instead, they are measuring how much potential harm ESG factors like carbon emissions have on companies’ financial performance.

Corporate responsibility and financial risk, however, are not the same thing. Indeed, they can be diametrically opposed.

McDonald’s, for instance, was given an upgrade of its ESG rating last year by MSCI… But greenhouse gas emissions from the operations and supply chain of McDonald’s, which is one of the world’s largest buyers of beef, grew by 16 percent from 2015 to 2020.

This is hardly an isolated case. According to a recent Bloomberg analysis of 155 rating upgrades, only one cited a cut in emissions as a factor.”

And while these companies enjoy billions of extra dollars in capital, it’s the people who have to pay for the consequences. (I wrote about how it all started in “Green Economy is Gasping for Dirty Fuels.”)

Will the NACs be any different?

Is Wall Street doing this out of sheer goodwill?

You tell me.

They’ll Own Everything. Literally.

If you’ve been following this Letter, you’ll notice a strikingly obvious pattern.

First, Wall Street quietly took over corporate America—that is, goods and services that we buy every day.

Then they financialized housing with REITs and utilities that power them.

And now they’ve found their next feeding ground…

… MOTHER NATURE.

Soon enough, Wall Street will literally own everything that you depend on for life.

Meanwhile, you’ll own nothing and be happy – just as the World Economic Forum has told you.

Be aware and share this with your friends and colleagues who are open-minded enough…otherwise, your next camping trip may come with an extra charge for that fresh mountain air.

Invoiced by Blackrock.

Seek the truth and be prepared,

Carlisle Kane

NONE OF THIS MATTERS IF GO BRANDON GETS HIS DIGITAL DOLLAR, IF THAT HAPPENS AMERICA AS WE KNOW IT WILL DISAPPEAR ALONG WITH THE CONSTITUTION AND BILL OF RIGHTS !!

There’s only one way to correct these evils. But there’s two effects that need to be corrected.

The first effect is the primary reason corruption gets a pass. And that is due to the mass on population being asleep. I prefer to label them Stoopid. Because they repeatedly do Stoopid with astonishing dire consequences. (Think vote Democrat) so fixing Stoopid is one thing. Second is corruption. Judges are corrupt. No one speaks or writes a damn word of this yet it’s occurrences are obvious and plentiful and worse, cause irreversible damage. (Election fraud, Gay marriage, Trans rights, killing babies and more)

So there’s only ONE way to fix the mess.

Someone like DeSantis becomes President (or someone else with a pair and courage) and declare Martial Law.

The reality is we need to rid the world of the evil by killing the perpetrators. Liberalism has quite literally ruined societies which has softened men, corrupted institutions and affected science. People have suffered. So kill the insane liberal minds that cause all the ills. Next are the greedy evils just as described in this and other pieces. Bill Gates, Klaus Shwab, George Soros, Larry Fink, Mike Bloomberg will have their entire assets seized and captured and I mean ALL OF THEIR ASSETS. Then kill these people and their associates so they’ll never attempt another evil.

With judges, power elite, minions of indisputable moral corruption who are none the less dangerous killed, we can fix things. Money seized used to pay down the national debt in no time and then a restart of common sense and normalcy. Liberalism will not be tolerated in any form. The FCC is controlled and this rids us of MSM lies and so much more good comes out of this. To those who think this too much, you’re soft. And there is simply no room to acquiesce. Real men don’t act like men anymore and women are uneducated and full of opinions that don’t relate to common sense. All of that has hurt the entire world. We are off balance and there’s only one way to fix it.

What is the Ticker Symbol for this Financial Instrument?

Will the Public ever be able to buy shares?

Any great ideas on how to stop this……or at least have our Share in it?

Very tired of only reading about more things to Fear; with No ideas of what to do about them!!!

I have Replied!!! Now it is Your Turn to Reply back……. to all of your readers!!!

Crying to Government Leaders is Not an answer!!!

First, I want to say I’m a long time reader of this newsletter. I am aware of most topics, but value the insight on the reasons that things happen.

I have followed the NAC from the beginning. I knew this would happen decades ago. How did I know? It was told by the Elders, my Ojibwe ancestors, in the seven fires prophecy. The Ojibwe people lived on the east coast of Turtle Island (North America). The first fire foretold of the arrival of newcomers from across the sea, and that the people must leave and move inland. All seven of the prophecies have come true. They include that some newcomers will come with a smile on their face while holding a knife behind their back. They foretold of the residential schools. You can find limited info online about this. It is unfortunate that our written history doesn’t go back 500 years.

For all of my life, we have been in the 8th fire. This is the final prophecy. This the point where mankind must make a decision; To pursue a life of materialism, at the cost of giving up spiritualism, or giving up materialism, and pursuing a spiritual life, in harmony with Mother Earth. The prophecy doesn’t tell us what the people will choose, but it does state that if the people choose materialism, all will perish.

This knowledge has been carried by the Ojibwe and Algonquin people for centuries. I’m sharing it with you because I believe the time to make this decision is upon us. I have seen in my lifetime, from Love Canal to Grassy Narrows, how corporations have treated Mother Earth in the name of shareholder ROI. This NAC vehicle is very dangerous. Please ponder what you want to leave to future generations before you make your decision.

Sounds like they finally found a way to fast forward & support climate change, carbon sequestration & preserve our global ecosystem services while making a $ or two. Of course the rich will prosper the most, so why not ride their coattails with stocks like: LAND, DX, GMRE, FPI, UHT, UBP, UBA, STAR, CLDT, TRTX, and ACRE .

Hello

Interesting Article, is there investment info to be had on this new emerging market, or is this more of a warning to be concerned about? I do not see an investment tab to focus specifically on the potential opportunity?? Just curious.

Thanks

This is insane. Nature is for everyone. It is part of the natural law. Something we enjoy as human beings. If this scheme is true, and I don’t doubt that there are people in this crazy world that would do it, that will make all of us less than human. Bottom line? GREED.