After years of talks, the world’s leaders have finally taken action. Last year, they budgeted trillions of dollars to shift away from fossil fuels for good. This sent green energy companies soaring.

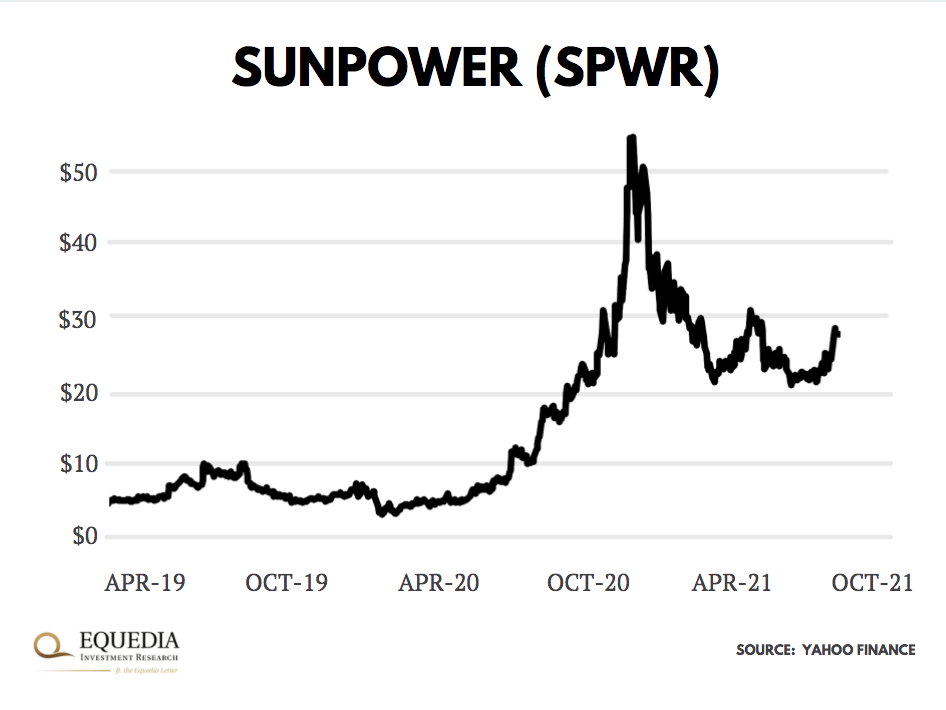

Here’s SunPower, one of America’s biggest solar panel makers:

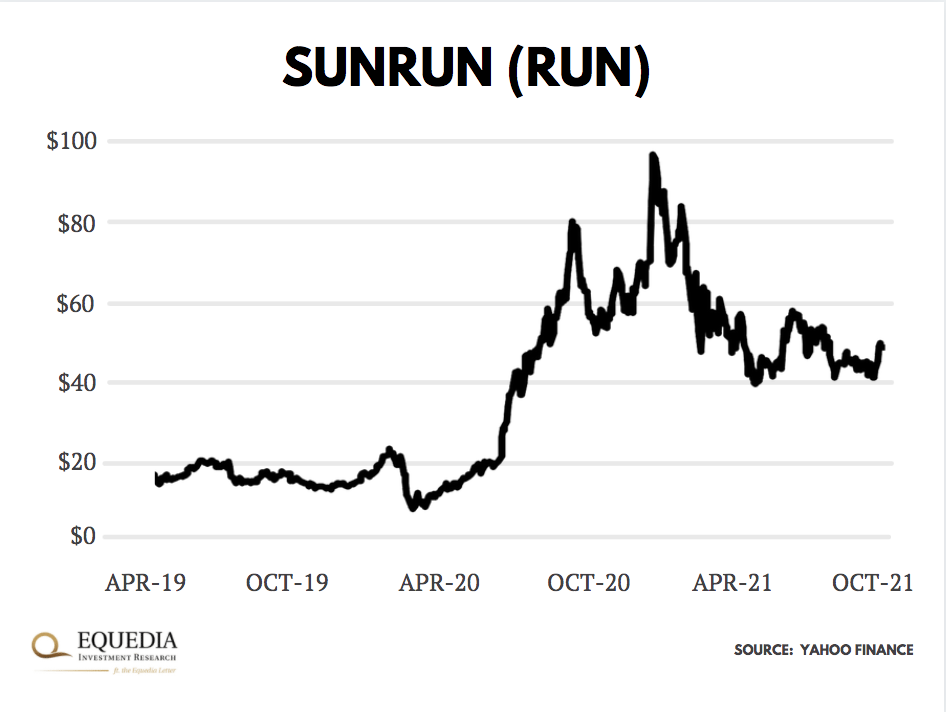

Or SunRun, another solar panel and battery maker:

Or SunRun, another solar panel and battery maker:

But while these stocks are commanding attention, they will claim just a mere fraction of the coming “green gold rush.”

But while these stocks are commanding attention, they will claim just a mere fraction of the coming “green gold rush.”

That’s because the world will have to remold its entire infrastructure to harness green energy. This redo will cost over a hundred trillion dollars—and bring multi-fold bigger investment opportunities.

The green revolution is here. But…

Green is More Than Energy

Think the Internet.

For the internet to work, we first had to lay down millions of miles of telephone lines and fiber optic cable. (Fun fact: even today, transatlantic underwater cables carry most of the data on the internet.)

Then we built out a network of cell towers and data centers to transmit and store data online. And finally, we had to buy all sorts of new equipment – from modems to a multitude of ever-changing WIFI routers—to access that data.

And the buildout isn’t even close to being done.

5G towers are now springing up on every corner. And folks are replacing “offline” appliances with things like smart TVs and fridges, which they can control over the Internet.

In other words, most of our new technology doesn’t work on its own. It has an infrastructure that supports it. And that infrastructure takes years to build and costs way more than the technology itself.

Energy is no different.

The world as it is today wasn’t built with green energy in mind. Most of its infrastructures, such as buildings, energy grids, and industrial operations, run entirely off fossil fuels.

So, this transition is not just about tearing down oil wells and putting up a bunch of solar panels and wind turbines. It’s about making over the world’s entire infrastructure to distribute, store, and use that green energy.

And this buildout is going to be bigger than you can even imagine.

The Biggest Buildout in History

There are five key areas in the world’s infrastructure that very much rely on fossil fuels. And as governments begin to clamp down on CO2 emitters, these areas will have to invest trillions to “greenify” their operations.

Let’s begin with the most obvious.

Power Generation

Burning oil, gas, and coal is by far the #1 source of energy.

US Energy Information Administration (EIA) estimated that around 60% of electricity in the U.S. comes from fossil fuels. And most vehicles and industrial machinery still run on gas or diesel.

So, when combustion engines go into metal scrap yards, we’ll have to generate way more electricity to power their electric alternatives. According to the International Energy Agency (IEA), electricity demand will triple by 2050.

In other words, green plants won’t just be filling in for dirty electricity – they’ll have to generate 3X more electricity than fossil fuels do today.

And to meet this demand, they will have to quadruple their capacity from today’s levels—which will cost around $40 trillion, according to UBS’s calculations.

Legacy energy companies will also plow billions of dollars into overhauling their old infrastructure.

For example, Chevron, America’s oil giant, set out to spend a billion a year minimizing its operations’ carbon footprint and moving into green energy sources, such as hydrogen and solar.

Energy Infrastructure

Now, power generation from green sources is just one piece of the puzzle.

The world will also need to modernize its energy infrastructure. It will have to expand its power networks and build out storage systems and smart grids that can distribute largely intermittent green power consistently and efficiently.

Think smart sensors, meters, and systems with advanced forecasting capabilities. It’s like installing a smart thermostat in your home – but for the entire world.

Buildings

Buildings have a massive carbon footprint, too.

According to the IEA, space heating/cooling, water heating, and home appliances that use energy from fossil fuels emit nearly one-third of all the CO2 in the air.

As part of the world’s greenification, we will see massive investments in building renovations…green heating systems, such as solar thermal panels or heat pumps…smarter, more efficient appliances, lighting, and cooling systems.

Industrial Infrastructure

And don’t forget about heavy industries.

Think of all the trucks, power tools, and giant SciFi-like mining excavators – most of which run on gas or diesel. And it’s not just the machinery.

The production of industrial materials emits loads of CO2 through chemical reactions as well.

For example, cement is responsible for 8% of all CO2 in the air. If cement were a country, it would be the third-largest CO2 polluter in the world.

That means industrial businesses will have to restock their fleets with electric machinery—and invest in technologies that can capture more CO2 during industrial processes.

Transportation

The last but not least polluter: transportation.

Passenger and freight vehicles, ships, and planes account for 24% of CO2 emissions. And to reach climate goals, IEA estimates that CO2 from all vehicles has to go down 90% by 2050.

Put another way, combustion engines are going extinct.

Their fleets will be swapped out with green alternatives like electric cars and hydrogen trucks, and ships. And gas stations will turn into recharging and hydrogen fueling stations.

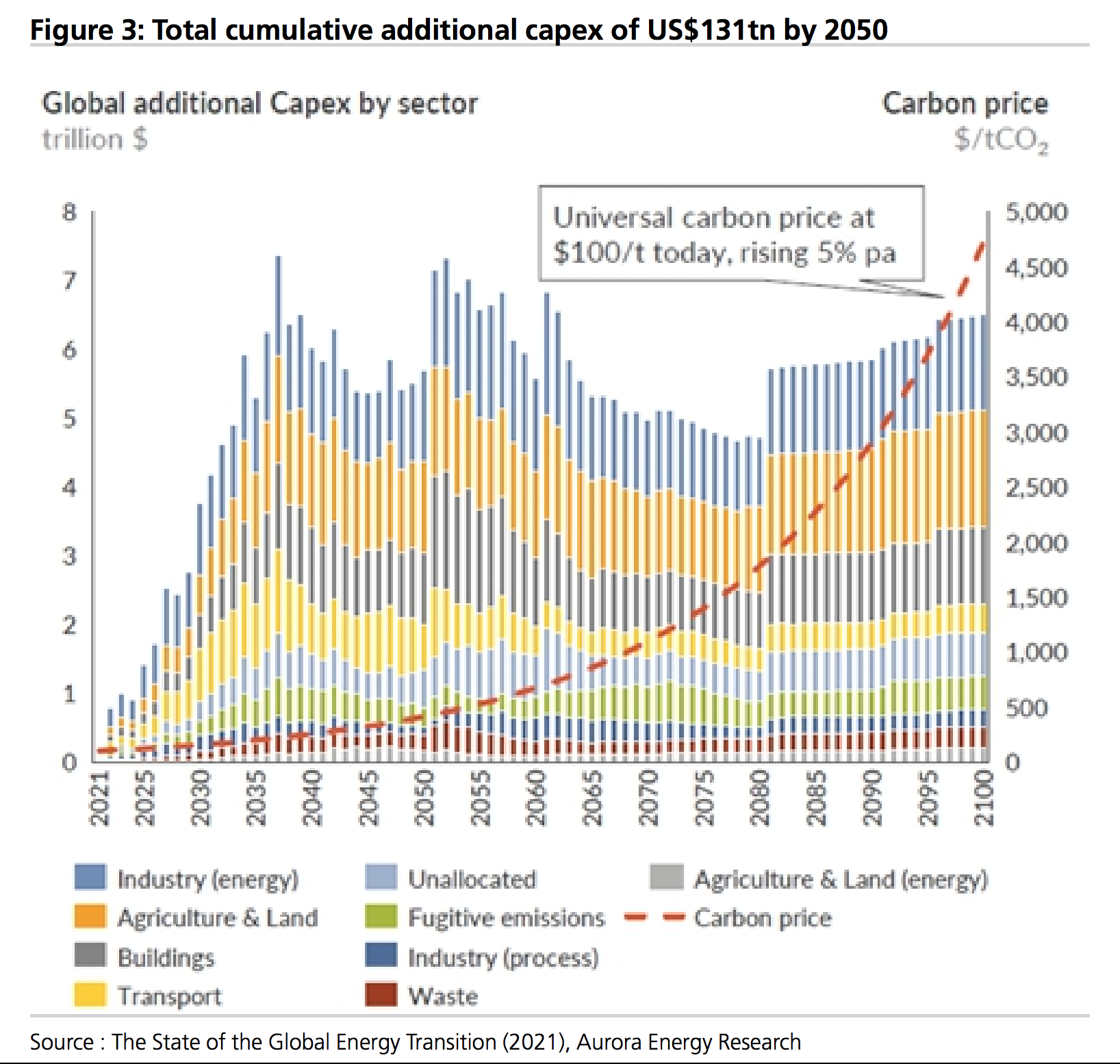

This buildout will cost $131 trillion—and energy will claim just a fraction of it.

The scale of this buildout is mind-boggling.

An internal UBS report estimated that we’ll spend $131 trillion by 2050 to adapt infrastructure for green energy. And the spending will start to pick up steam very soon:

Yet, most of the money will go into infrastructure: green vehicle fleets, building renovations, sustainable agriculture/industry, and everything else in between.

Now for the multi-trillion dollar question: How do you invest in such massive spending?

The Californian Gold Rush Millionaires

In 1848, rumors spread about heaps of gold nuggets in the American River.

Before long, 300,000 Americans rushed to California, hoping to fill their pockets with gold. But most of them came home empty-handed.

Meanwhile, those who actually did make millions didn’t even get their feet wet.

Samuel Brannan was one of the first Gold Rush millionaires. He famously earned his fortune by selling picks, shovels, and pans to migrant miners.

Levi Strauss and Jacob Davis were another success story.

The entrepreneur duo made a killing selling miners rugged work pants made from blue denim. Later, they patented them as “the blue jean” we know and still wear today and became the billion-dollar fashion empire: Levis & Co.

This story has inspired a popular investment strategy called “pick and shovel investing.”

Imagine you’ve got a huge trend like, say, electric cars.

These mammoth trends are easy to spot and predict because they are inevitable. They attract truckloads of money and span decades.

The problem is, picking a stock that will make the most money in the end is like digging up a gold nugget in the American River. It’s an outright gamble.

So instead of betting all-in on stocks like Tesla (TSLA), you invest in established companies that supply tools and materials to the likes of Tesla.

If Tesla flops, there will be another Tesla because electric cars aren’t going anywhere. But the world will still need the “picks and shovels” to manufacture electric – or even hydrogen – vehicles.

And just like the Gold Rush millionaires, their suppliers will keep raking in money.

The Picks and Shovels of This Green Gold Rush

The “picks and shovels” of this green gold rush are so-called capital goods companies.

In short, they make stuff that other companies use to produce finished goods and services. It could be industrial machineries such as forklifts or metal presses… equipment such as high-pressure washers… tools, such as power screwdrivers… or simple materials such as steel and cement.

As a starting point for your research, here’s a few examples of stocks that supply capital goods for this multi-trillion dollar buildout:

Energy Generation

Companies that make and install wind turbines, solar panels, or hydro equipment, such as GE (GE) or SunRun (RUN)

Energy infrastructure

Companies that provide battery storage, grid infrastructure products and services, such as Siemens Energy (ENR)

Transport

Companies that provide automotive/rail/marine equipment and green solutions like Alstom (ALO) or TE Connectivity (TEL)—as well as battery makers, such as Panasonic (TYO:6752)

Buildings

Companies that provide energy-efficient heating, ventilation, and air-conditioning systems, such as Schneider Electric (SE)

Industrial infrastructure

Companies that make electric equipment, power tools, and machineries used in industrial operations, such as ABB (ABB) or Siemens (SIE)

And lastly, of course, the raw materials producers that will supply all of these industries. So if you think mining stocks are expensive, wait another few years – they’ll seem out of this world to you.

We are still in the first inning of this green gold rush. And I’m convinced these “picks and shovels” will cash in big time.

Remember, it’s better to be early than late.

– Carlisle Kane

subscribed to comments

My pick…….. FuelPositive Corporation (“FuelPositive” or the “Company”) (TSX.V: NHHH) (OTCQB: NHHHF) is

This is the first time in 10 years I have ever posted a comment about a newsletter. When I look at this I see oil is here for a long long time, you are talking more like MSM is your source versus real world actualities.

Consider India, Africa and China. The worlds largest populations of low income earners. They will not be seeing electric cars or bikes or infrastructure projects to go green, hell, many still use rudimentary water supply and toilets!(I’ve seen so many rural people use bushy fields as outdoor toilets as I rode miles and miles on a train there!)

Norway just made news again saying they are ramping up exploration? You can bet Russian millionaires due too and any North American ones have got one hands in the global oil money bag scooping billions as they donate 100 million towards a go green company. You see other examples like carbon offsets, what a joke as a polluting company buys “green credits” instead of spending on greener initiatives for a wholesale internal change.

Look at the recent emerging news how US oil interests gave hundreds of millions to Canadian charities to lobby against oil sands and pipelines while American oil flowed freely and so did the rest of the worlds oil producing countries!

And speaking of green, what about the greater problem I believe, the mass pollution created by consumer, industrial, and commercial wastes? Water contamination, methane gas growth, carbon into the atmosphere, decreasing of water bound life populations that comes from all this.

Nope, while your article looks nice in a wedding dress of optimism, underneath its rotten and you missed all that. Does Ivan Lo not sound in on these articles anymore? He often raised the uglier side of things, life isn’t all about making money.

Won’t internal combustion engines be modified to run on hydrogen and /or ammonia? We should be able to capture and store CO2 to help in growing food? Photosynthesis might even give us a little oxygen for our trouble. It’s pretty basic, I know…pretty difficult too…

The whole green world is a fairy tale. There are a number of practical issues that have to be addressed. I will indicate a few:

1) Garbage. The turbines for power generation have a useful life. Nothing in the turbines is recycleable. Where is the graveyard for these turbines? A similar situation exists for solar panels. These cannot be recycled. Where is the graveyard?

2) Society Acceptance. How many turbines will have to be built? Where will they be located? What is the

impact on birds/people living in the general area/impact on farm and forest areas. These a practical issues that are not even talked about.

3) Plastic impact. Much of our society depends on plastics. Not only on a personal basis but also on a business basis. Turbines are bascially plastic. Many medical applications are dependant on plastics.

Plastics are primarily made from oil/natural gas. We have a “pollution problem” by dumping used plastics into the ocean. This issue needs a solution.

The above are some of the practical things that need addressing. The UN love-in in Glasgow will not even talk about the above problems, but need serious attention before we come up with targets that have no real meaning unless the practical side of the issue are included.

Calibre Mining is mostly in central America. A VERY unstable area. You never tell us when you are selling anything! I lost my investment twice following your buy advice. No Thanks.

Sorry to hear your response. However, jurisdiction is also where we find opportunity. No risk, no reward. For example, K92 is in PNG – even more unstable. We introduced them around $1, and they hit over $9 a few years later. As far as Calibre, we introduced them at $0.75 – they hit a high of nearly $3 a couple of years later, and despite gold stocks dropping, they are still nearly double our introduction price today.

Hope that clarifies – best of luck on your investments.

was rather disappointed in the stocks you were pushing, the OOOO Entertainment Commerce Ltd is another unregulated piece of nonsense, if people are that stupid to buy there wares from an unreliable source then it’s their own fault and I hope no one gets sick or poisoned. I cant believe you are pushing this website, maybe the Chinese buy their food and wares from these places but to think buying food from the likes of OOOO is unsafe. Sorry state of the world if the general public in the free world must to be entertained buying clothes and food while the rest of the world is under siege or starving.

Perhaps you may have misunderstood/ OOOO is a UK-based company, selling UK brands.

B

Won’t people wake up and do a quick analysis of the false reasoning that reducing hydropogenic CO2 is behind the “green” energy transition because of the huge cost, and realize that hydropogenic CO2 makes up only 1.6% of atmosphereic CO2 and is actually insignificant to climate changes that are natural and within all normal parameters and not caused by man!

Fossil fuels be around for our lifetimes. World’s best energy storage devices still ton of coal, and barrels of oil with NG sideline. climate change will always occur and therevis very little we can do about it. The MSM is full of BS as usual.

You missed the most promising new energy. Look up Lightbridge (LTBR). The new Modulated Nuclear Energy.