The Great Reset Is Playing Out Right Before Our Eyes

I learned my most profound economic lesson in the most random place on earth.

Many of you don’t know this, but I’m* originally from Lithuania.

(*It’s Carlisle here.)

Lithuania is a small Baltic country to the northeast of Europe—which was part of the Soviet Union (USSR) for much of the last century.

In 1991, just before the USSR’s collapse, Lithuania escaped the Soviets’ clutches. It declared independence, privatized the state-owned economy, and reintroduced its old currency, the litas.

Thirteen years later, the country joined the EU and replaced its litas with euros. The currency was converted at the rate of ~3.5 litai to one euro.

That means three and a half litai bought one euro.

Although the litas was pegged to the euro for years in advance, and its replacement had no direct effect on the economy, the switch drastically changed spending behaviors.

People across every income bracket started spending more. Tips at restaurants doubled.

Meanwhile, workers became more discontent with wages and asked for raises.

They subconsciously thought the money was worth less.

And yet, nothing really changed, apart from the denomination of that money.

The “Money Illusion”

There’s a theory in behavioral economics called the “money illusion.”

It says that people tend to measure their wealth in nominal terms. They don’t take into account inflation and other economic facts (such as the currency change in my story) that affect their real purchasing power.

In the end, this psychological quirk often makes it seem we are richer than we really are. (My example is a rare case with the opposite effect.)

Just think about it.

After 50 years, making a million nominal dollars is still largely a symbol of the rich.

That’s despite the fact the dollar lost 85% of its value over that time. And a million nominal dollars will buy you just a shack on the outskirts of San Francisco or a townhouse in Vancouver, BC.

If anything, to be an “inflation-adjusted millionaire” today, you would have to have at least $6.5 million.

Likewise, no family gathering is complete without an uncle boasting about his nominal home value.

But guess what, it’s not just your home that’s appreciated. So when you sell that property for a nominally handsome sum, the windfall won’t buy you much more in real terms.

Scholars also argue modest inflation helps the corporate world get away without raising real wages.

For example, let’s say there’s 2% inflation. The company has strong demand, and it can pass the cost of inflation to the consumer by jacking up its prices. At the same time, it raises its wages by 2%.

In a pragmatic, logical sense, it’s a zero-sum game. The employer just matches its workers’ pay to inflation.

But on an emotional level, employees feel richer despite the fact they aren’t even a bit better off in real terms. And so they are less likely to come banging on your door asking for another raise.

My fianceé fell into this trap lately. She got a modest raise before the inflation breakout. And now, she must wait for another year or so to ask for more. Because that’s “company policy.”

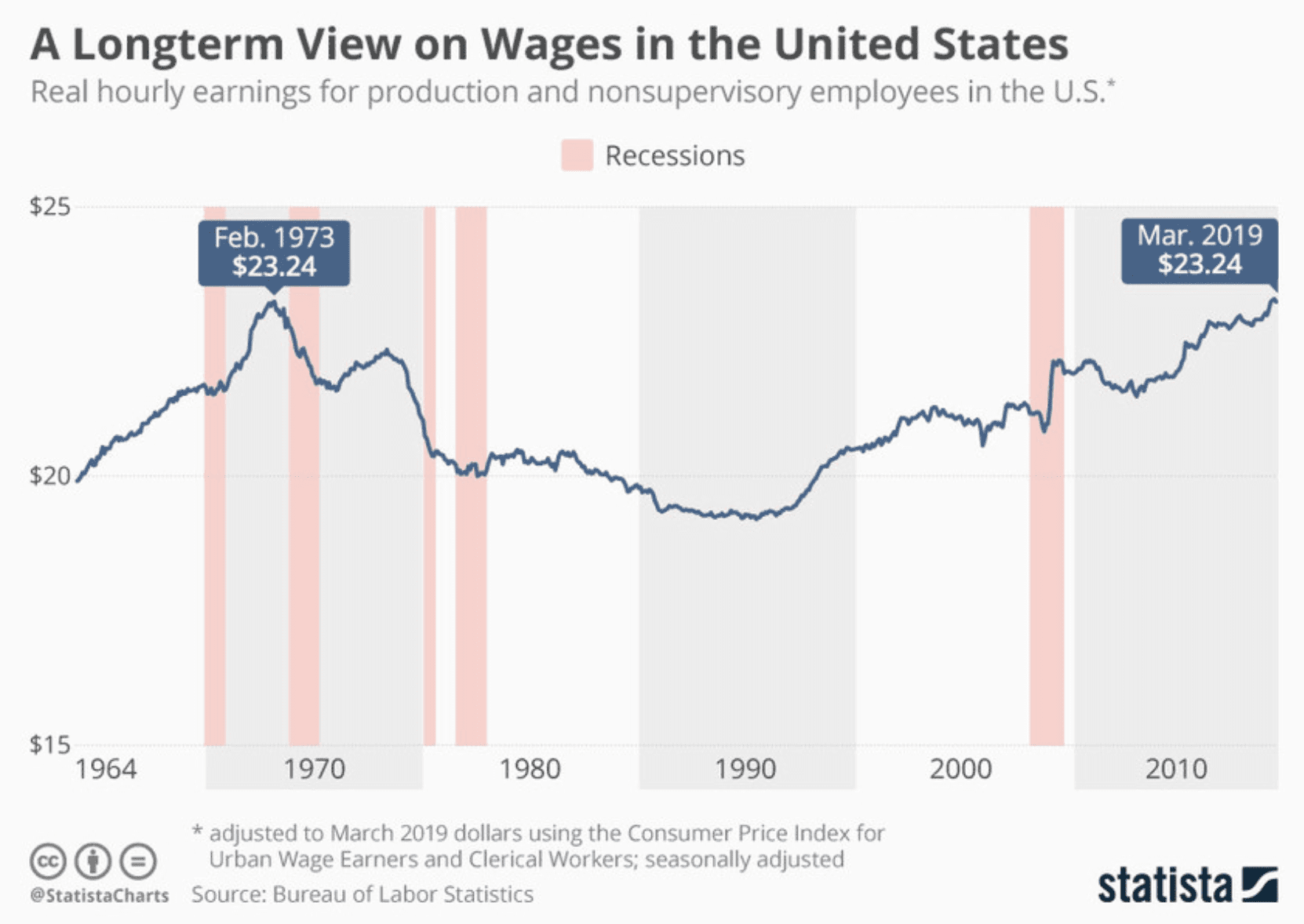

This is why real wages have gone nowhere since the 1970s:

But it’s not the corporate world that uses this trick to manipulate people…

How Nixon used “Money Illusion” to Win the Presidency

In the 1970s, America was grappling with the highest inflation since WWII.

For half a decade, inflation lingered at double digits. And by 1979, the dollar had lost nearly half its value.

Later, Volcker picked up the Fed’s reins, took a tough hawkish stance, and brought inflation to heel.

Why did policymakers wait so long?

After the 1970 recession, the economy was in bad shape. Unemployment was high.

Meanwhile, Nixon’s first term was coming to an end.

He didn’t want to fight inflation at the expense of throwing more of his voters out onto the streets. So instead, Nixon imposed price controls as a temporary measure, like slapping a Band-Aid on a gunshot wound.

Meanwhile, he pressured his old buddy at the Fed’s wheel to pump more money into the economy and give it a “cocaine hit” before the election.

Here’s an excerpt from the book (which I highly recommend) “Secrets of the Temple: How the Federal Reserve Runs the Country”:

“No one, of course, could definitely settle questions of motivation, but politicians could interpret the evidence for themselves: When Arthur Burns erred, his errors were all tipped in the same direction—providing a prosperous climate for Richard Nixon’s re-election company…

Early in 1971, concerned that the new Fed chairman was behaving as independently as the old one, two White House staff members called on Burns separately and told him what the President wanted—money expansion that would allow the economy to reach full employment by 1972. Burns protested that their behavior was improper, and he complained to the President.

That summer, the White House managers fired another “shot across the Fed Chairman’s bow,” as one presidential aide put it. A fictitious story was planted in the press that Burns asked for a $20,000 pay rise at the same time he was urging wage and price controls for the rest of the nation. The story also claimed the President was considering a proposal to double the size of the Federal Reserve Board—a not-very-subtle threat to dilute the chairman’s power…

…The Federal Reserve came, though. Money growth, which averaged only 3.2% a month in the last quarter of 1971, jumped to a monthly average of 11% in the first quarter of the election year. Overall, the Fed permitted money expansion throughout 1972 that was about 25% faster than the year before.

A determined minority [in the Federal Open Market Committee] warned him that a new breakout of inflation was ahead in 1973 if the Federal Reserve did not apply restraints now. The White House, they pointed out, was already hinting that price controls would be lifted early the next year.

Once the regulatory lid was taken off prices, an inflationary burst would surely follow—fueled by the generous money policy that preceded it. Their warnings, expressed in minutes of the FOMC meeting through 1972, proved to be an accurate forecast of what did occur after Nixon’s electoral victory.”

It’s clear Nixon deliberately flooded the economy with cheap money. Then he used the resulting economic high to win a second term with no regard for what would surely come after his tenure (very much like our leaders today).

As an excuse, his policy patrons used a theory called the Phillips Curve.

The theory claims inflation and unemployment have a stable inverse relationship. That’s because inflation often comes from economic growth, which in turn leads to more and better-paying jobs.

But the 1970s shred this theory to bits.

Over that decade, inflation destroyed half of America’s savings. Unemployment more than doubled compared to pre-1970 levels. And while nominal wages doubled, the real pay for those lucky enough to get a job considerably shrank.

The Fed’s Breach of Duty

The Fed is a relatively new organization that’s evolved a lot since its founding in 1913.

(If you want to explore it further, I wrote a deep dive about the Fed’s history and evolution here.)

But since the 1970s, the Fed has operated under a clear mandate meant to keep the economy in check. In short, the Fed has to watch two metrics and keep them within relatively well-defined ranges:

- Inflation (benchmark is ~2% PCE inflation)

- Unemployment (benchmarked using historical averages)

So while the Fed is free of political pressure, its powers are theoretically restrained by rule-based governing.

But is it? Apparently, not…

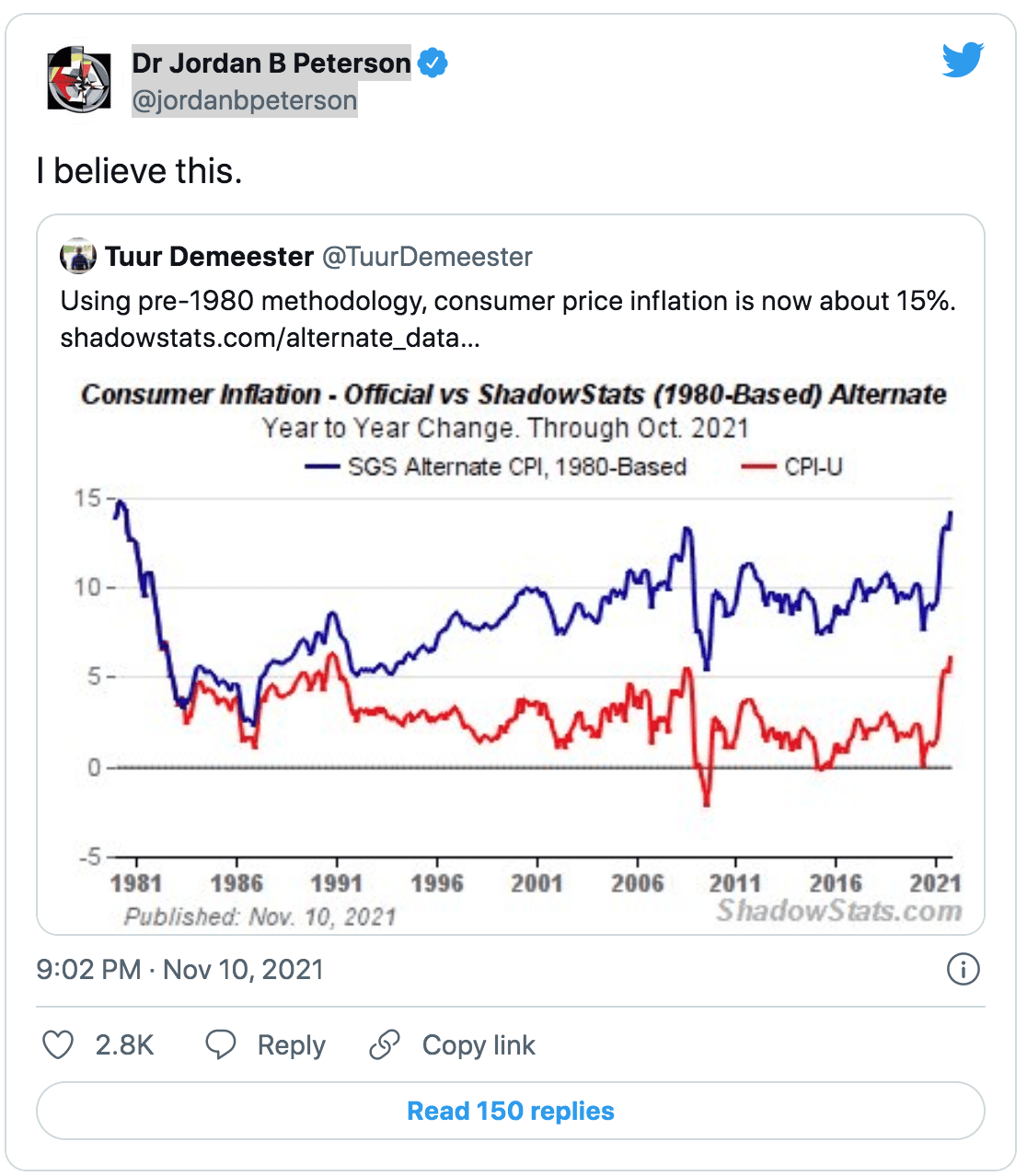

Last month, inflation jumped to just short of 8%. Keep in mind that the CPI is a heavily manipulated metric with little transparency. The real inflation could be much higher. (You can learn more from Ivan’s past letter here, which also explains how prices have actually increased even prior to COVID.)

In fact, by some unofficial measures, at the end of 2021, prices grew as much as 15%:

Meanwhile, unemployment is at a level we’ve only seen this low during just two quarters since the 1960s.

And while the economy is overheating like my old Mac with 25 Chrome tabs open, the Fed is barely tinkering at the edges.

Last month, the Fed raised rates by 0.25% – a mere quarter hike after two years of sitting on their hands. We are still eight hikes away from pre-Covid levels when deflation was our biggest worry – let alone the kinds of hikes we need to tame today’s inflation.

Meanwhile, money printing is slowing, but the Fed hasn’t stopped shoving greenbacks into the economy. Since the beginning of this year, its balance sheet has plumped up by $200 billion.

The K-shaped Recovery

The result is the K-shaped recovery that I predicted last year.

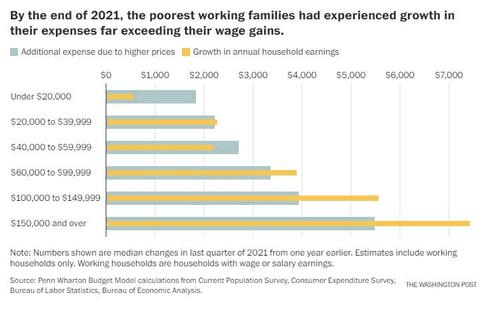

The asset inflation driven by loose monetary policy is building fortunes for the rich. Meanwhile, the working class is paying for it with real expenses that are growing out of proportion to their wages.

According to the Washington Post, in 2021, the working class’s expenses exceeded all wage gains. The opposite was true for households with higher incomes.

Here’s a telling graphic that shows the inflation-adjusted increases in spending vs. earnings broken down by income bracket:

Keep in mind that’s a conservative estimate that assumes the CPI represents true inflation. The real picture is likely far worse.

The biggest problem is that the average citizen will blame the rich for this – and while that may be true to some extent for the billionaires and the true elite, the reality is that this has all been brought on by politicians – the same politicians who implemented these inflationary policies.

And by simply taxing higher income earners – who are not part of the elite class with offshore accounts and never pay taxes – the politicians will continue to get away with this: making themselves and their rich friends richer, while the working class suffers, all the while blaming high income earners who pay the majority of taxes already.

The Great Reset

History doesn’t repeat itself, but it does rhyme.

In the 1970s, the Fed let inflation destroy half of Americans’ purchasing power in pursuit of its political agenda. Today, once again, it’s deliberately holding off the response when inflation is clearly hurting common people.

They are using excuses like the Philips curve or a “fragile economy.”

But the facts are loud and clear.

Back then, inflation didn’t make people better off. Nor does it today. If anything, it just pumps up the value of paper assets and makes the rich richer at the expense of everyone else.

That shouldn’t be much news for Equedia’s old-time readers. Ivan has predicted this exact chain of events for years – only now there’s an official term for this: the Great Reset.

In short, this was the chain of events he first predicted in 2017, and then reiterated in his Letter, “Reality Exposed“:

“1. Inflate: Make people feel good by giving them cheap money through Quantitative Easing (QE) and low-interest rates – increase the money supply.

2. Deflate: Take the good feeling away by taking away cheap money through Quantitative Tightening (QT) and higher rates – decrease the money supply.

3. Control: Subdue the population by taking their focus away from the real situation. Think media control; think the increase of opioid usage and the legalization of marijuana; think President Trump; think billionaire-funded protests.

4. Divide: Segregate society by inducing riots and hate crimes (*even moreso now with COVID; think anti-vaccine, masks, etc).

5. War: Mask the international financial and economic crisis through the rhetoric of war, or even war itself.

6. Reset: Global economic reset will be blamed on war, not the monetary actions of the powerful elite.”

Given that we’re already heavily into stage 4, the inevitable path to stage 5 is near: war.

Could Russia or China be the tipping point? Is the Russian-Ukraine war going to be the cause of food shortages and energy crises worldwide?

We’re already seeing global tensions rise – not just with countries but with global organizations such as the United Nations and even the World Health Organization.

In fact, in just a few short years, in May 2024, the International Treaty on Pandemic Prevention, Preparedness, and Response – otherwise known as the WHO Pandemic Treaty, is due to be signed.

The scary part about this Treaty?

If a pandemic is declared, the WHO takes over the global health management of all 194 member states, including the US and Canada. This includes everything from what treatment you can receive to what vaccines you MUST take. We’d go so far as to say that the idea of digital travel microchips could very well be next.

One look at China’s fear-mongering response to yet another recent “outbreak” of COVID, and you can see why this is a horrible idea.

One look at how many times the WHO has been wrong and you can see why this is a horrible idea.

It looks like things are shaping up exactly as Ivan predicted. In fact, if you go back to his past letters, you’ll see just how accurate he has been with his “COVID” predictions. See for yourself:

March 2020: The Conspiracies Behind COVID and How it Will Change Your Future

How to Invest in the Coronavirus Pandemic

April 2020: Is the Worst Over?

June 2020: Reality Exposed: Blue or Red Pill?

July 2020: How to Invest in the New Covid World

November 2020: The Boldest Prediction of 2020

We’re now nearing the last stage of Ivan’s prediction. It could happen tomorrow, next year, or in 2024.

Remember, inflation puts you under a nominal illusion of wealth. It lets the government fool you into believing you are richer than you actually are. And that the economy is more inclusive than it really is.

So ask yourself: does your nominal “raise” buy more today than it did yesterday?

Stop believing in right vs. left, and look at how things have fared in both the US and Canada since Biden and Trudeau took over. Blaming COVID for government policies is silly.

It’s time to blame Big Government.

Seek the truth and be prepared,

Carlise Kane

Remember, Janet Yellen added a third goal to the Fed: support stock prices. They will fail, big-time, at that, too.

Even if we say “The problem is Big Government” no one can do anything about it except, you guessed it, Big Government. What can the poor worker, who was barely getting by in the first place, do when inflation is at 15% and gas is at $6.00+ /gallon here in California? If a million dollars needs to be comparable

today to $6 million dollars then I am never going to be a millionaire!! What is the point where the people rise up and take these great countries back? We are treading water; with someone pulling our foot all the while…glub, glub, glub…

you can also see the reason for the push for gun control. gun control is a means to get guns out of patriots hands to leave us defenseless against a tyrannical government. .