Dear Readers,

They’ve done it.

THIS company just made a game-changing announcement.

One that should value the company far higher than where it trades today.

In just a bit, we’ll explain what this announcement means and why it likely won’t stay under the radar for much longer.

But first…

You’ve seen the news.

Earlier this month, three geologists published research revealing what could be the biggest discovery of lithium resources…EVER.

This discovery could significantly alter the global landscape for lithium, from pricing, supply stability, and even geopolitics.

It was so significant that almost every lithium stock fell following the news due to the sheer size of the potential influx of supply in the future.

More importantly, some believe it could potentially remove the United States’ dependence on China’s lithium supply.

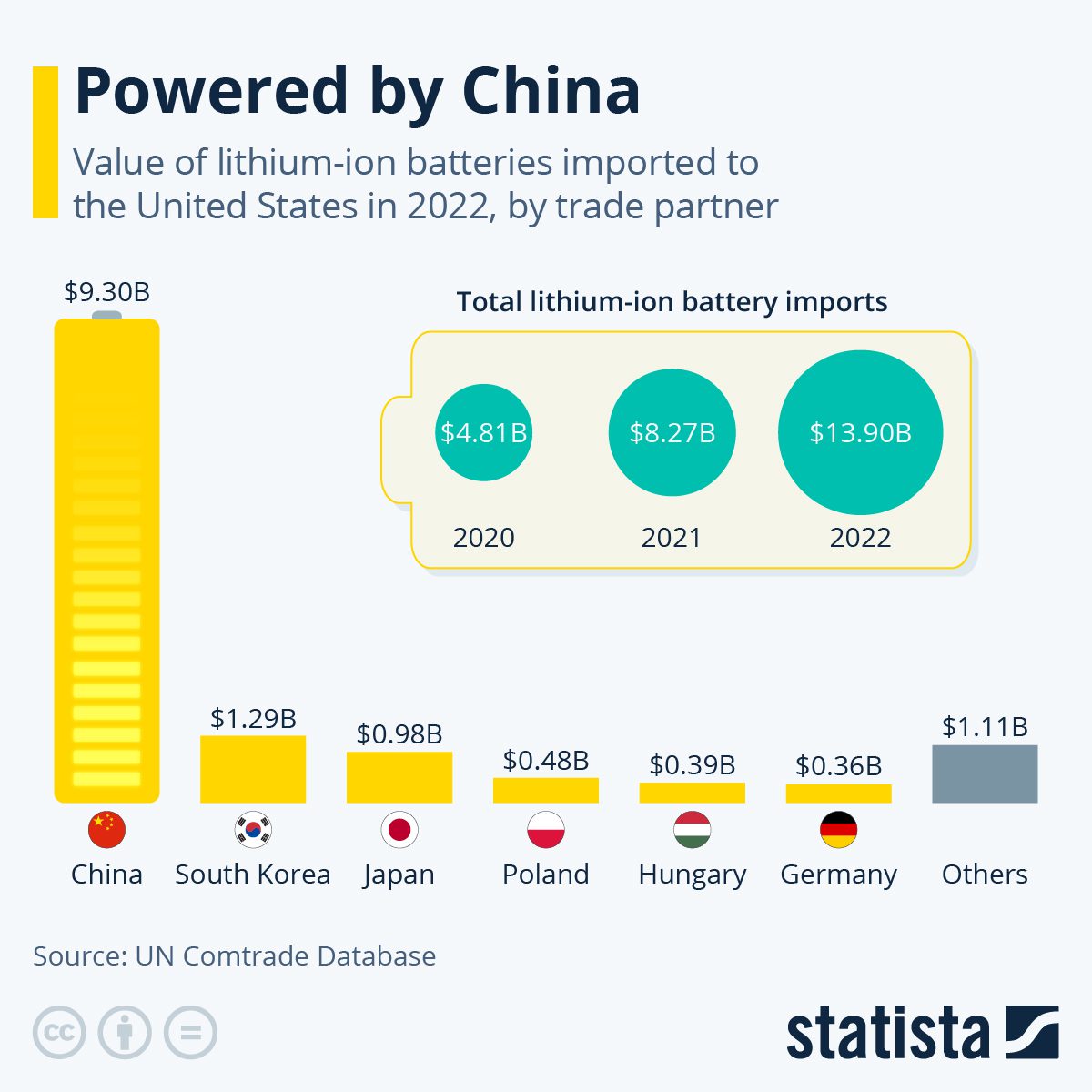

Powered by China

According to a 2022 report by the U.S. Geological Survey, the United States’ only lithium production came from a single brine operation in Nevada.

It’s no wonder American imports of lithium-ion batteries jumped by 99% from 2021-2022, according to data from Panjiva. This marks the third consecutive year in which U.S. battery imports almost doubled.

Of these imports, it’s estimated that over 65% came from China.

So, it should come as no surprise that such a massive discovery in the United States could influence the entire lithium supply chain.

But before we celebrate the thoughts of cheaper EVs and batteries, there are many issues that need to be solved.

In fact, despite such a potentially large discovery, the actual ramifications on supply may not actually be as significant as people believe.

Let me explain.

Not So Fast

This massive discovery was found in the McDermitt Caldera, a geological feature located along the border of Oregon and Nevada in the United States. It was formed through a series of volcanic eruptions and geological processes over millions of years.

This region is of great importance for indigenous communities and is a site of a violent confrontation between U.S. soldiers and the Paiute people during the 1860s.

Ranchers have also voiced apprehensions that lithium production in this area may adversely impact groundwater levels, potentially resulting in land desiccation and posing a threat to both domesticated animals and endangered species.

Despite these adversaries, the economic value of this discovery may be too large to ignore.

In fact, one company has already begun construction.

This company is Lithium Americas – the same company that purchased one of our past featured lithium companies, Millennial Lithium, for US$400 million.

Lithium Americas has outlined plans to begin production at its Thacker Pass project in McDermitt Caldera by 2026.

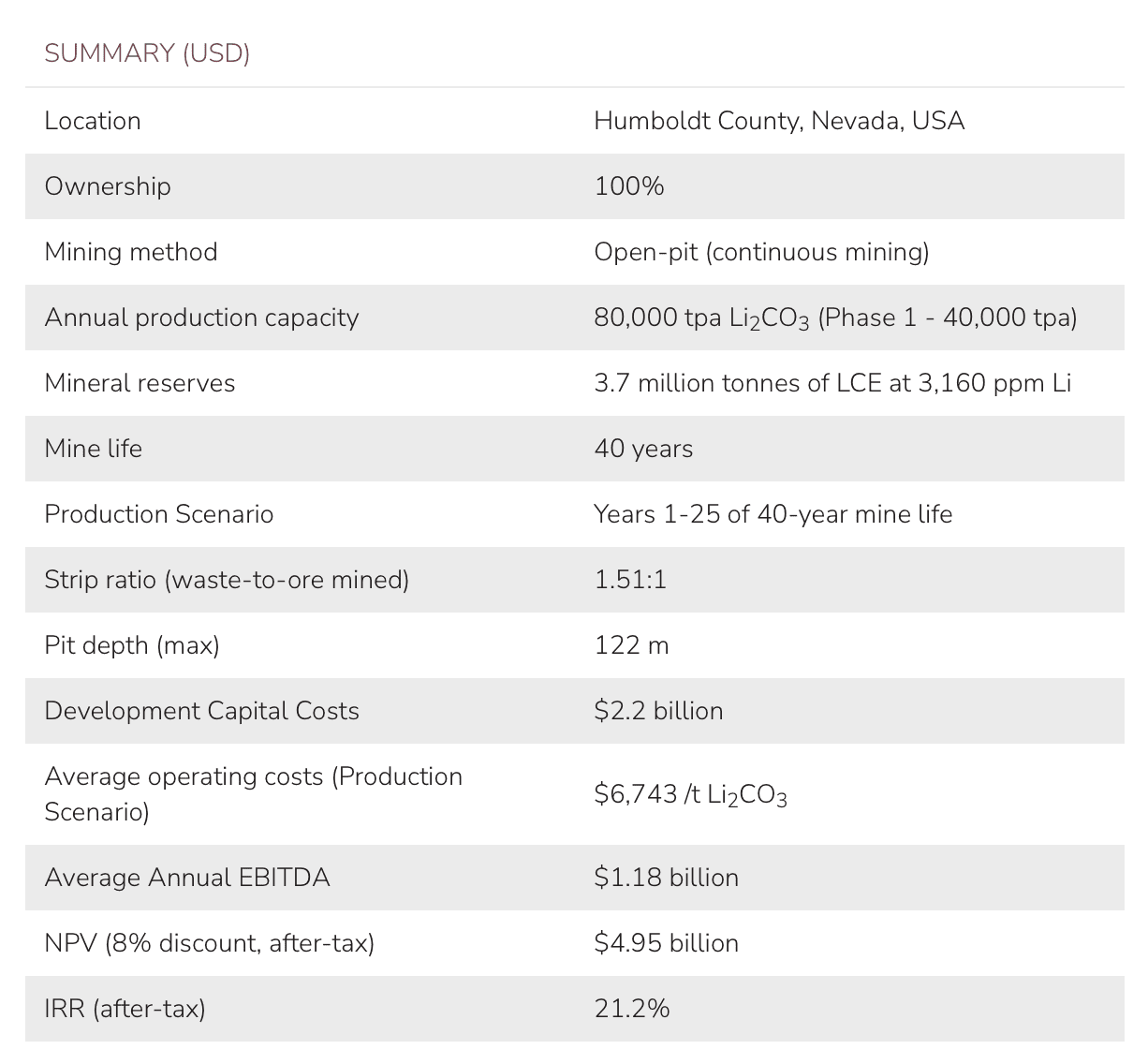

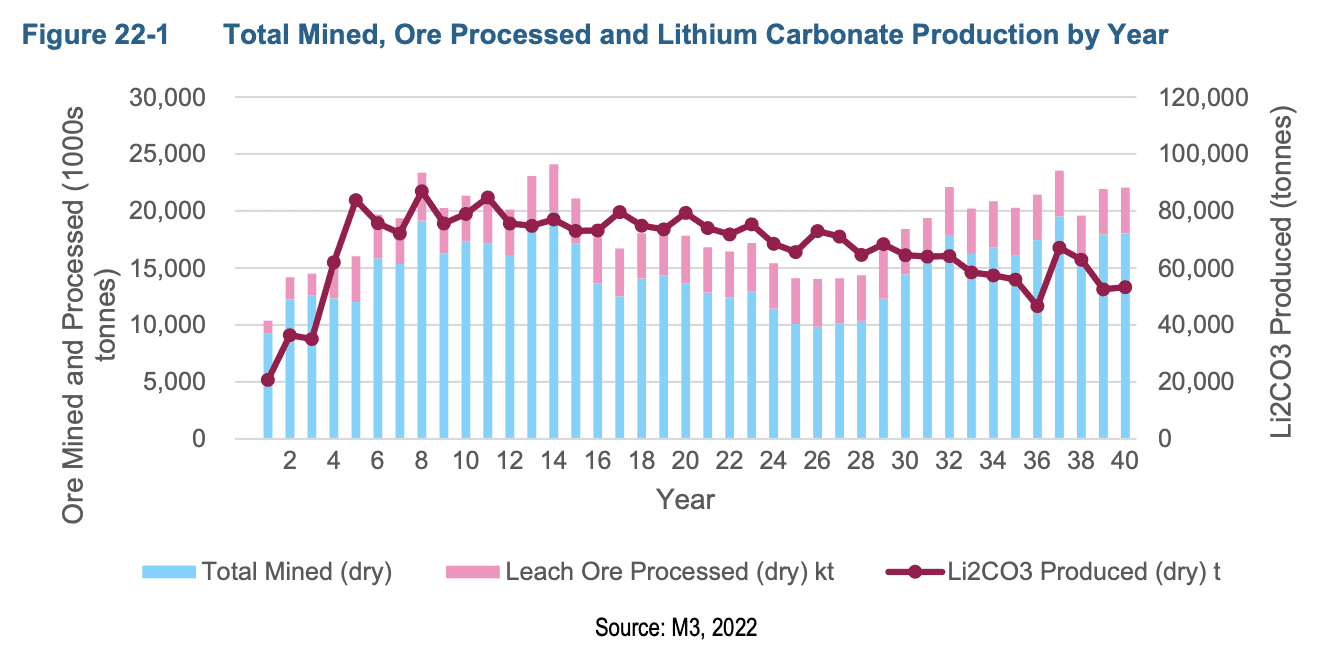

The project’s capital cost is estimated at $2.2 billion, with a 21.2% IRR and a payback period of 5.4 years.

This is all based on a lithium carbonate price of $24,000 US$/t.

In other words, to achieve the above numbers, lithium prices must be $24,000 US$/t or higher.

And that means there’s little room for lithium prices to fall – not if the US wants access to this new supply.

So, if you think cheap lithium is coming simply because of the potential of a such a massive discovery, think again.

That’s not the only issue.

Currently, lithium is mainly extracted from ore and brine.

But this massive lithium discovery is found inside the caldera of an extinct volcano, where the lithium is trapped in clay.

Why is this important?

Because there isn’t one single lithium clay deposit or oil-field brine in commercial production yet.

As of right now, there are two leading companies in McDermitt Caldera: LAC and Jindalee.

Jindalee is working with POSCO on multiple metallurgical processes to see how they can extract the lithium out of the clay. The outcome is unknown.

LAC, on the other hand, is already building out its project and has completed a feasibility study that suggests it can achieve commercial production.

If everything goes according to LAC’s feasibility estimates, the price of lithium carbonate still has to be at least $24,000 US$/t to make its financial model work – and that’s if it can extract the lithium out of the clay based on current cost estimates.

Provided all goes to plan, LAC is expected to begin production in the second half of 2026, and reach 40,000tpa 3-4 years after that. This remains a challenging feat considering not one sedimentary lithium deposit has been put into commercial production.

So while most pundits are now thinking that lithium prices could fall further due to this discovery, the reality is that the price of lithium still needs to remain at today’s levels or higher to achieve any sort of supply and demand balance.

Furthermore, while many projects have come to the forefront as a result of Direct Lithium Extraction (DLE) technologies, just like extracting lithium from clay, these projects haven’t been commercially proven yet.

Via Skarn Associates:

“Doubtful and delayed were adjectives murmured by delegates at the 15th Fastmarkets Lithium Supply and Battery Raw Materials conference in Henderson, Nevada, in June, rather than direct when referring to the direct lithium extraction (DLE) technologies touted as the means to deliver the lithium the world needs for lithium-ion batteries for electric vehicles and energy storage systems.

The conference came a week after Australia’s Lake Resources tempered its decision to jump straight to a 50,000tpa development at its Kachi lithium brine project in Argentina. The developer said production at Kachi, using a Lilac Solutions technology, would see significant delays and cost much more to achieve. First production is now slated for 2030, a six-year delay from the original 2024 guidance.

Around the conference, the chatter was that operating costs would be much higher than project promoters state, no matter the DLE route taken. The principal of a leading engineering firm told Skarn Bulletin that project developments will take longer and cost more because of the impossibility of standardising the equipment. “There is a reason DLE has not been commercially proven yet. You have to create a bespoke solution for each deposit,” they said.”

While people are giddy at the possibility of more lithium supply, a lot of this new supply might end up being more expensive to produce, which could drive lithium prices even higher – or, at least, prevent it from falling further.

And this means companies with lithium brine projects via evaporation will be highly sought after.

As we mentioned in our last letter, evaporation has a long-established history as a reliable and quantifiable method of lithium extraction. Its capital costs are well-documented, and once the brine resource is assessed and the operational plan is in place, the operating expenses are generally predictable and stable.

And we know one company with a lithium brine project that checks many boxes.

In fact, this company just made a massive company-changing announcement.

This company is…

Lithium South Development Corporation

US Trading Symbol: LISMF | Canadian Trading Symbol: LIS | German Trading Symbol: OGPQ

Lithium South is developing its 100%-owned flagship lithium brine project, the Hombre Muerto North Lithium Project (HMN Li Project) in the Salta province of Argentina.

The project sits right in the middle of two of the biggest lithium producers: Korean giant POSCO and Livent/Allkem.

If you haven’t read the full report on this company, we urge you to learn why we believe it is one of the most undervalued lithium juniors by CLICKING HERE.

Last week, Lithium South announced a new lithium resource of 1,583,100 tonnes of Lithium Carbonate Equivalent (LCE).

That’s a 175% increase from its original resource.

Even more significant is that 90% of this resource is in the measured category – a rare occurrence in the lithium industry, let alone mining as a whole.

In the context of mining, “measured,” “indicated,” and “inferred” are categories used to classify the level of confidence in estimating the quantity and quality of mineral resources within a given deposit.

These categories are defined by industry standards to communicate the reliability and certainty of the estimates to investors, regulators, and stakeholders.

Here’s an explanation of each category:

- Measured Resources: These are the highest-confidence estimates of mineral resources. Measured resources have a high degree of certainty because the data is closely spaced and well-defined, often with multiple drill holes and detailed geological information. The estimation of measured resources is considered highly reliable.

- Indicated Resources: Indicated resources are estimates of mineral resources with a lower level of confidence compared to measured resources but are still considered reasonably reliable. They are based on geological evidence and sampling data that is less comprehensive than that used for measured resources. However, there is still enough information to support the reasonable assumption that the minerals exist in economically exploitable quantities.

- Inferred Resources: Inferred resources are the lowest-confidence estimates of mineral resources. These estimates are made with a much lower level of data confidence and are often based on limited information, such as widely spaced drill holes or geological observations. Inferred resources are considered speculative and have a higher degree of uncertainty. They are typically used to suggest the potential presence of mineralization but require further exploration and data collection to upgrade them to higher-confidence categories.

If you’d like to learn more about these categories, CLICK HERE.

In short, measured resources is the most reliable category for defining a resource prior to completing a pre-feasibility or feasibility study.

Despite a big jump in lithium resources, Lithium South’s resource grade remains high, with an average grade of 736 mg/L Li – making it one of the highest grade brine resources around. Chemistry also remains good, with a low magnesium to lithium ratio of 3.27.

With this increase in resources, the potential for Lithium South to become a 15,000tpa+ producer grows stronger. And if you’re someone looking to secure lithium supply, wouldn’t you want a tried, tested, and true method of production?

Perspective

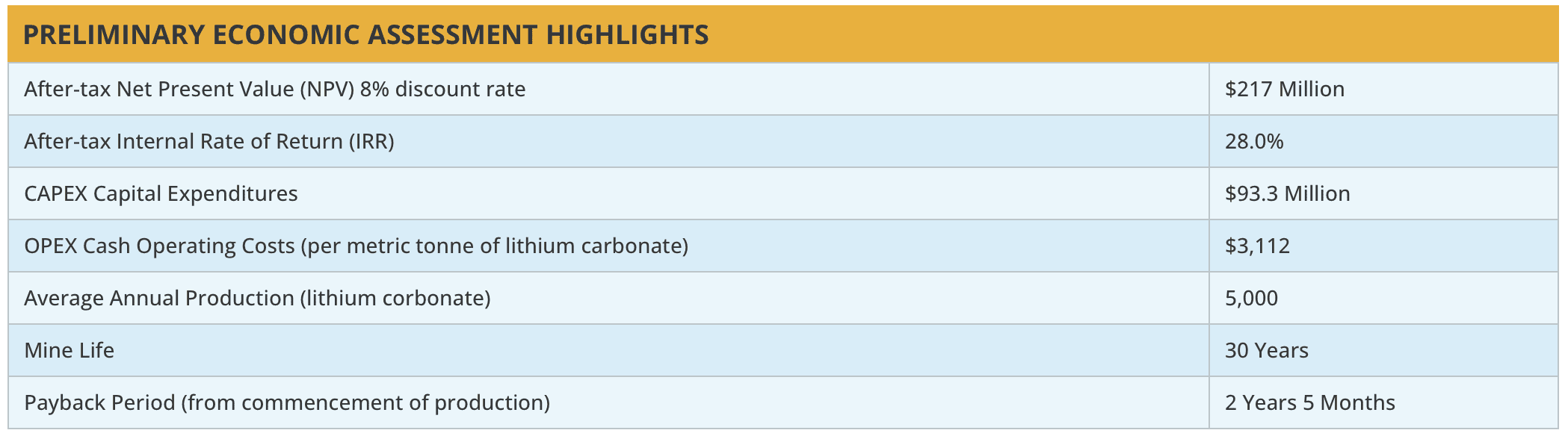

In 2019, with a small resource of just 571,000 tonnes of LCE, Lithium South was able to show just how economic its project could be.

Initial CapEx was estimated at US$93.3m and OpEx at US$3,112/t lithium carbonate. The PEA was based on a project price assumption of just US$12,420/t.

Today, lithium prices are well above US$12,420/t.

If we were to use the same price that LAC used for its Thacker Pass feasibility study of US$24,000/t, things could be dramatically better for Lithium South.

In addition, with OpEx prices estimated at less than half of LAC’s Thacker Pass’s OpEX cost of $6,743, you can see just how profitable Lithium South’s brine operation could become.

The next step for Lithium South is to revise its PEA with this new resource to show potential buyers how profitable its resource could be with current lithium prices.

Conclusion

The price of Lithium South shares reached a high of $0.56 in the US and $0.74 in Canada last year – and one could argue, at that price, it was still undervalued when compared to its peers.

Today, Lithium South trades at a low of just US$0.31 in the US under the symbol LISMF, and CAD$0.42 in Canada under the symbol LIS.

That gives it a tiny market cap of just over US$30 million and CAD $40 million, respectively.

Take a look at what some of it’s peers have been bought out for:

With a 175% increase in resources, as well as continued positive progress, the company is more undervalued than it has ever been.

We believe the recent downturn in lithium stocks has created yet another opportunity for investors to get back on the lithium train.

And that’s why we like Lithium South.

If you haven’t read the original report, you can do so by CLICKING HERE.

Lithium South Development Corp

Canadian Stock Symbol: LIS

US Stock Symbol: LISMF

Germany Stock Symbol: OGPQ

The information contained herein is provided solely for the reader’s general knowledge. The information is not intended to be a comprehensive review of all matters and developments concerning Lithium South Development Corporation (LIS). All information is offered on a “best intentions” basis. No securities commission or other regulatory authority in Canada or any other country or jurisdiction has in any way passed upon this information and no representation or warranty is made by LIS and Equedia to that effect.

This presentation may include “forward looking statements.” All statements, other than statements of historical fact, included herein, including without limitation, statements regarding exploration results, future plans, or objectives of LIS.

Some of the statements herein are forward looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. LIS and Equedia do not make any representations, warranties or guarantees, express or implied, regarding the accuracy, completeness, timeliness, noninfringement, or merchantability or fitness for a particular purpose or use of any information contained in presentation.

Furthermore, the information in no way should be construed or interpreted as, or as a part of, an offering or solicitation of securities. Investors are advised to discuss all of their stock purchases with a registered securities broker or personal finance professional prior to investing. No obligation, responsibility or liability shall be incurred by LIS and Equedia or any of its officers, directors, employees or agents for any loss or damage whatsoever, whether incidental, special, indirect, consequential, punitive, exemplary, or for lost profits in connection with, caused by or arising from any delays, inaccuracies, errors or omissions in or infringement by, or from any use of, or reliance on such information contained in this presentation.

THE FINANCIAL PROJECTIONS PERTAINING TO THE HOMBRE MUERTO LITHIUM PROJECT ARE BASED UPON ASSUMPTIONS, EXPERIENCE AND PROPRIETARY KNOWLEDGE OF KEY LITHIUM MANAGEMENT. FURTHER EXPLORATION OF THE HOMBRE MUERTO NORTH LITHIUM PROJECT IS REQUIRED TO CONFIRM THE ASSUMPTIONS CONTAINED WITHIN THIS LETTER AND TO VERIFY AND CONFIRM THE POTENTIAL OF THE FINANCIAL MODEL.

THIS PRESENTATION IS FOR DISCUSSION PURPOSES ONLY.

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. We are biased towards Lithium South Development Corp (LIS) because the Company is an advertiser on www.equedia.com. We currently own shares of LIS. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in LIS or trading in LIS securities. LIS and its management have no control over our editorial content and any opinions expressed in this article are our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us. For a complete disclosure of the compensation received by us from LIS, please review our Terms of Service and full disclaimer www.equedia.com/terms-of-use/.

Thanks for highlighting how relatively expensive lithium south is.

1.5mt lce for 30m usd? I will go long Lithium Energy on the ASX on a 40m usd valuation for 90% of a 3.3mt lce resource and pair it with a Lithium South short.

That’s funny. Lithium energy is nearly twice the market cap of LIS, with a 3.3mm LCE resource vs. nearly 2mm for LIS but with less than half the grade at 310 mg/l vs. Lithium South’s 725 mg/l.

Also, Lithium Energy’s resource is all inferred – the least reliable of the mineral categories vs Lithium South’s 90% Measured – the most reliable prior to pre-feasibility/feasibility.

You’re welcome.

I forgot to mention, with such low lithium grades, Lithium Energy will have to use DLE – an unproven resource. Lithium Energy also doesn’t mention their Mg to Li ratio – just that it’s low. Why won’t they publish that data? No pump ability test, low grades, no published mg to li ratio, all inferred resource…and twice the market cap of LIS.

Thanks for highlighting how undervalued Lithium South really is!