We have been telling you for years EXACTLY why stocks would continue to climb.

We have also been telling you for years EXACTLY how the stock market will fall.

Now take a look at the following headline from Business Insider:

Via Business Insider:

“…Since March 2020, Treasury bonds with maturities of 10 years or more have plummeted 46%, Bloomberg says.

…That’s just under losses seen in the stock market when the dot-com bubble burst.

…The bond rout is worse than the one seen in 1981 when the 10-year yield neared 16%.”

If you’re an investor, those are some pretty scary headlines.

But why should you be worried about stocks if bonds are falling?

Today, we’ll explain why this exact scenario has been the elites’ plan all along.

When There is More of Something, It is Worth Less

In order to see where we are headed, we first have to know where we’ve been.

So let’s go back to our Letter from 2015, “Why Every Expert Has it Wrong: The Truth About the Fed”:

“Since 2008, the Fed, and other central banks, have slapped bandages on the world’s economy via long-term paper digital claims, otherwise known as bonds. Their trillions of dollars of newly created digital currency have been used to buy trillions of dollars worth of bonds – or, in Layman terms, debt.

As central bankers focus on preventing deflation (which attacks the power of the central banks), they have chosen the path of least resistance: focusing on short-term results via currency debasement.

Their unlimited purchasing power of debt has forced bonds to reach all-time highs, resulting in record-low yields. This has created a market where investors are rewarded while savers – generally the low-to-middle class – are penalized.

Eventually, however, some very logical and disturbing consequences will ensue as a result of their strategy.

The Macro Outlook

First, we know that inflation (created by central banks) erodes the value of capital over time.

And with current extreme low yields, capital invested in long term bonds are sure to lose value – unless inflation remains subdued for the next decade.”

As you’re well aware, inflation is no longer subdued – nor do extreme low yields exist anymore.

“The only reason the bond market has been hot in this climate is that bond traders have been able to front-run the central banks for the last seven years.

This will change.

It’s changing now.

While the financial market is complicated, the end game remains the same for everyone: to make a return on capital invested.

A bond is a debt that has been sold to an investor with the promise that the monies are to be repaid in the distant future, with small interest payments along the way to compensate the lender. This interest compensation is generally calculated based on risk of default and inflation.

In most developed nations, where the risk of default is presumed to be minimal, current prevailing interest rates are so low that investors who buy or hold bonds at current prices and rates will literally lose money if there is any inflation over the next 10 to 30 years (the maturity of long term bonds).

If inflation rises, anyone invested in the bonds of the developed world today will lose much of the value of their capital invested.”

And inflation has risen, hitting over 8% last year in both the US and Canada.

As a result, since March 2020, Treasury bonds with maturities of 10 years or more have plummeted 46%.

“Yet, the bond market continues its march: German 30-year bond yield fell to under 0.5% just a month ago, and currently sits barely above 1%; U.S. 10-year yield is barely over 2%; Japan’s 10-year yield is not even 0.5%, while its 30-year is under 1.5%.

Why? How can the bond market be so hot with such low yields?

First and foremost, as I mentioned before in many past letters, most government bonds have been soaked up the central banks.

As a matter of fact, according to the bank of Bank of America in a 128-page report released this February (2015):

“Since Lehman (2008):

…global central banks have cut rates 550 times, that’s a rate cut once every 3 trading days…

…global central bank assets now total $22.5 trillion, a sum larger than the GDP of the US & Japan…

…52% of all government bonds in the world currently yield 1% or less…

…outstanding amount of global government debt currently yielding 0% or less: $4.2 trillion.”

Aside from the ease in which a central bank can intervene through debt monetization, perhaps the central banks do have a plan.

The Fed Isn’t Stupid, Just Selfish

While it appears central banks are reckless, they certainly aren’t stupid – even if they may often act the part.

Perhaps they know something we don’t?

Could it simply be that central banks predict little to no growth over the next ten years?

Has the Fed effectively turned the U.S. into the next Japan – a country battling debt and deflation?

In practice, inflation rises relative to the increase in money supply. But this hasn’t happened, despite record amounts of central bank monetary injections. That is why experts claim that we are on the brink of major inflation.

However, what the central bank gives, it can also take.

In other words, if inflation begins to steer out of control, the central bank can immediately monetize their debt by removing money from the system; thus, leading to an immediate halt in our economy as lending and capital investment stalls.

Perhaps that is what ex-Fed Chair Ben Bernanke meant when he said they could stop any dangers of inflation rather quickly.

The reason experts are wrong in their inflation outlook is because they base their rationale that central banks – in particular, the Fed, want what is best for us.

I have discussed many times about the Fed’s plan to erode capital in order to preserve their system – not our economy – and that, “the Fed works only to pursue its own growth; to engulf more of society into its banking system.”

In other words, the Fed could care less about our economy: If inflation rises, it just gives the Fed a reason to sell back the bonds they purchased at a better price.

What to Expect

As I mentioned in my Letter from January 2015, “The Fed’s True Plan”:

“Eventually, the Fed will have to begin winding down its assets, which means there will be a lot of bonds to soak up.

Foreign liquidity won’t be able to soak up all that has been printed. That means money will have to come from somewhere else. And that somewhere – I believe – is from the stock market.

If the stock market continues to climb, it will create more liquidity for bonds. Why? Because the stock market will eventually correct at some point, and when it does, investors will seek the safety of bonds; thus, soaking up much of the bonds held by the Fed.

The higher the stock market climbs, the more money is available for bonds on the way down.”

So my prediction is simple: yields will rise, transferring equity-side investments over to bonds to soak up the piles of debt in the market.

Meanwhile, we have a long ten years of little to no growth coming our way, with a stock market crash headed our way in the near future as the system rebalances liquidity.”

And that’s what Barclay’s Ajay Rajadhyaksha, global chariman of research, believes now.

Via Business Insider:

“In a note titled “The beatings shall continue,” Ajay Rajadhyaksha, global chariman of research, said the stock market has to get a lot worse before investors begin piling up on bonds, bringing yields down.

… So, according to Rajadhyaksha, something in equities has got to give before we see yields lower.

“Stocks are still up very comfortably for the year,” he said. “And the magnitude of the bond sell-off has been so stunning that stocks are arguably more expensive than a month ago, from a valuation standpoint.”

“The magnitude of the bond selloff has been so stunning that stocks are arguably more expensive than a month ago, from a valuation standpoint,” they wrote.

…“We believe that the eventual path to bonds’ stabilizing lies through a further re-pricing lower of risk assets.”

What exactly does that mean? Why would people sell stocks to buy bonds if bonds are crashing?

Let’s go back to our Letter from 2013, How the Government Borrows Money, to better understand how this phenomenon works.

“The United States is a world power and a first world nation. It has to spend money to maintain this status by building roads, providing healthcare and public services, and funding wars.

But all of this money has to come from somewhere.

Historically, most of this money came from taxes and government-owned corporations.

But as the world power grew – through wars and economic activity – so did its spending habits.

Taxes were no longer enough to cover all of the bills.

So – like every one else – when you don’t have enough money, you borrow it.

When the government spends more than it brings in, it’s called deficit spending.

How the Government Borrows Money

The U.S. treasury, the department of the U.S. government that manages all of the Federal finances, borrows money by issuing a bond.

A bond is simply a piece of paper – a promissory note – that says if you give me money now, I will pay you back in X amount years, with interest.

These pieces of paper are then sold through a bond auction where the world’s largest banks participate in buying part of this national debt.

The banks then sell these bonds to other investors, such as investment funds and countries like China and Japan.

…Since America is the world’s largest economy, among other things, the demand for their promissory notes has never been an issue.

But over the past years, record amounts of these bonds have been issued; so much that the banks had to turn to someone else to buy them.

But who?

Who is the Largest Single Buyer of America’s Federal Debt (aside from the government itself*)?

(*The U.S. Social Security Trust Fund is the largest single holder of America’s national debt, but they’re part of the government. Yes, the government can sell debt to itself but it will have to pay it back by issuing more bonds borrowing more money.)

Welcome the Fed, America’s central bank – a private bank controlled by bankers, and not the U.S. government.

The Banks – who purchase these bonds from the Treasury – sell Treasury-issued bonds to the Fed, who in turn gives these banks yet another piece of paper in exchange.

This piece of paper is essentially another IOU from the Fed to the Banks, just like the IOU from the Treasury to the banks.

Its like when you or I write a check, we’re giving someone an IOU that they can redeem at a bank.

The only difference between our IOU and the Fed’s IOU to the banks, is that we have to have that amount available in our bank account for someone to cash that IOU – otherwise, that check bounces.

When the Fed writes an IOU to the banks, it doesn’t have to have anything:

“When you or I write a check there must be sufficient funds in our account to cover the check, but when the Federal Reserve writes a check there is no bank deposit on which that check is drawn. When the Federal Reserve writes a check, it is creating money.” – Federal Reserve Bank of Boston, Putting It Simply (1984)

If there are no deposits at the Fed, how does the Fed give cash to the banks?

Easy. It writes another IOU to the banks. And since the Fed is neither truly audited, nor are there are any real bank deposits taking place, it’s literally creating free money.

Now here’s where it gets fun.

When the government spends money building roads, providing social aid, or funding wars, they are essentially funding more workers and soldiers who then take their hard-earned money and deposit it back at the banks.

But when you deposit your money at the bank, the money doesn’t just sit there for safekeeping.

In fact, once your money is there, the bank can use it to make more money by lending it back out to you, or make big bets on the stock market by using YOUR money as collateral (see Why Banks are Being Forced to Create a Stock Market Bubble).

Furthermore, it can do this with insane leverage because a bank is only required to have a certain percentage of your money available at any given time. The remainder of your money is used to fund investments or loans that the bank makes to other customers, including you.

This is called fractional reserve lending.

Currently, banks in the U.S. are required to have a certain amount of money in their system, known as reserves. These required reserves are normally in the form of cash stored physically in a bank vault (vault cash) or deposits made with the Fed.

In the U.S., the average fractional reserve-lending ratio is 3%* – meaning that if you deposited $100 at the bank, the bank can take $97 of it to make loans or gamble on the stock market.”

Before we continue, it’s important to note that as of March 23, 2020, the Fed’s Board reduced reserve requirement ratios to zero percent. This action eliminated reserve requirements for all depository institutions. See our Letter, The Banking Failures Were Planned, to learn more.

Continued from How the Government Borrows Money:

“..Not only are banks able to use most of your money to make big bets, they now have a record amount of money in deposits from selling bonds to the Fed.

And, as I mentioned last week, with so much money sitting in the banks, the banks are practically forced to invest and make even bigger bets in the market.

Especially given that the reserve requirement ratios for banks went to zero percent.

How Big Can the Bubble Get?

If you remember in my Letter “A Shocking 2011 Cover-Up,” I showed you that the Fed purchased an astounding 61% of the total net Treasury issuance in 2011.

According to Bloomberg, the Fed bought 90% of new bonds in 2012.

While the ultimate stock market bubble is being created, there is so much more room to grow in terms of paper asset appreciation. The amount of leverage now in the system is beyond anything you could imagine.

While I believe things are most certainly not what they appear, I am not one to say the world is about to end, nor will I scream doom and gloom…yet.

Those who protest that the Dollar and other currencies will collapse soon because of this paper asset bubble should ask themselves one thing:

“Do you see (Fed) currency EVER not being used?”

The world is so intertwined in central bank currency that it would take an absolute world war conflict to change that.

This is not to say the markets are safe, but reality is that money continues to enter our system – and much of it has barely even been used…

Where is the Market Headed?

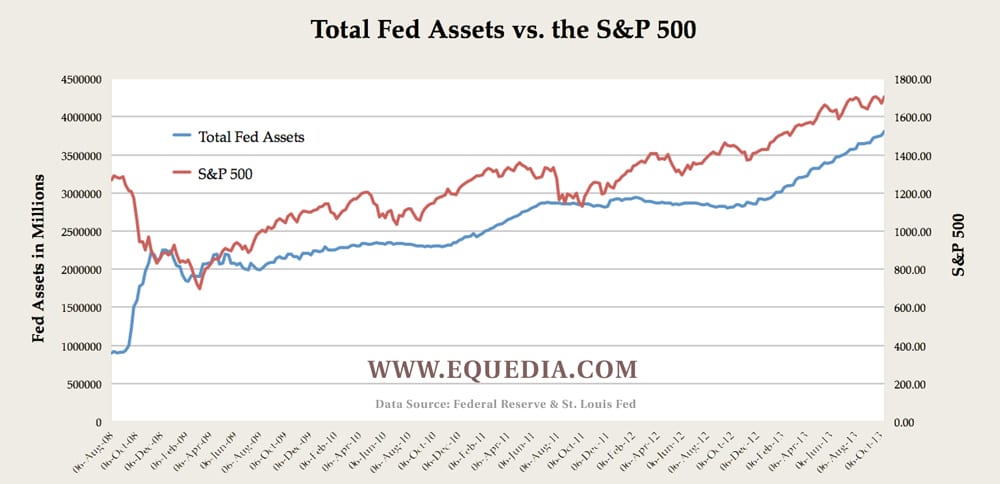

Let’s take a look at the data from September 13, 2012, since the Fed’s asset purchases have been more steady over the this time with QE3:

If record asset purchases – QE – continue over the next few weeks and months (and all signs point to this being the case), then the chart’s outlook is very simple: We should see the S&P move to a smashing new record of 1800 before the end of the year – that’s a gain of more than 23% for 2013.”

And the S&P 500 did exactly just that in 2013, smashing through 1800 before the year was over.

In short, the Fed’s policies have almost a direct correlation with how the stock market performs.

Just take a look at the following chart:

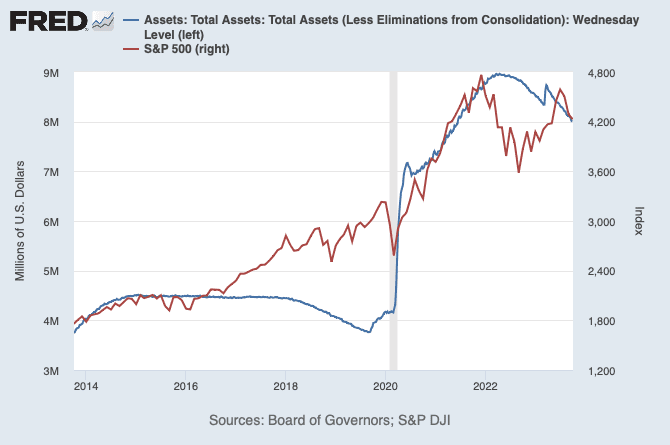

So while, for the most part, there appears to be a rather strong correlation between the S&P 500 and total Fed assets, just because the Fed reduces its balance sheet, it doesn’t mean the stock market can’t keep climbing – especially since we have record cash sitting on the sidelines.

This can be seen between 2016-2020.

The primary difference today is that interest rates are now higher than in the last 20 years, the economy is slowing, and corporate earnings are slowing (although still very high). Meanwhile, Trump’s tax cuts are expected to end in 2025.

However, despite those negative scenarios, we are now at a new record level of cash sitting on the sidelines, with over US$5.6 trillion in money market funds.

The S&P 500 is currently valued at just under $38 trillion.

In other words, should we experience a market crash, that market crash could be short-lived (just as it was in 2022) based on the amount of cash sitting on the sidelines ready to deploy.

So forget the noise of bonds crashing, yields rising, and stocks dropping.

The true indicator of where the market is headed will be based on what the Fed does next.

If the Fed decides to continue with the rate hikes, the stock market will likely decline. But the moment it reverses course, it will climb.

Everything else is just noise.

Seek the truth and be prepared,

Carlisle Kane

I do not understand this statement:

” If inflation rises, it just gives the Fed a reason to sell back the bonds they purchased at a better price.”

With increased inflation, wouldn’t the price of the bond go down ?

he’s referring to the backend assuming interest rates rise, economy pulls back big time, stocks fall, interest rates go back down dramatically to stimulate the economy; the unattractive although “safe” 5% yield today have the potential to be very attractive a couple years from now. I recently went into some Fortis and Emera preferred stocks (essential bonds) that are priced at a discount (they yield ~ 8% at the discounted price) because the markets are expecting higher rates. To me 8% for the next 5 years is fine, and if the bonds are called I’ll have some nice capital gains, so although everything has some risk I’m good with it. These are both rate-reset every 5 years dependent on the 5 yr Canadian bond; in the big scheme of things not very glamorous but in all honesty in over the past 30 years I have never lost a dime on a preferred stock. Pembina (which I also bought last month) has a rate-reset at the end of november which should result in an 8-9% yield for the next 5 years with an upside to sell if interest rates pull back in a couple years. I am a US citizen who owns common stock in many Canadian companies also (AG growth, Premium Brands, Wajax, Mcan, parkland, BNS, SLF, extendicare, Superior Plus, and more)

Where do you see gold in the short, medium & long term in the scenario you’re outlining