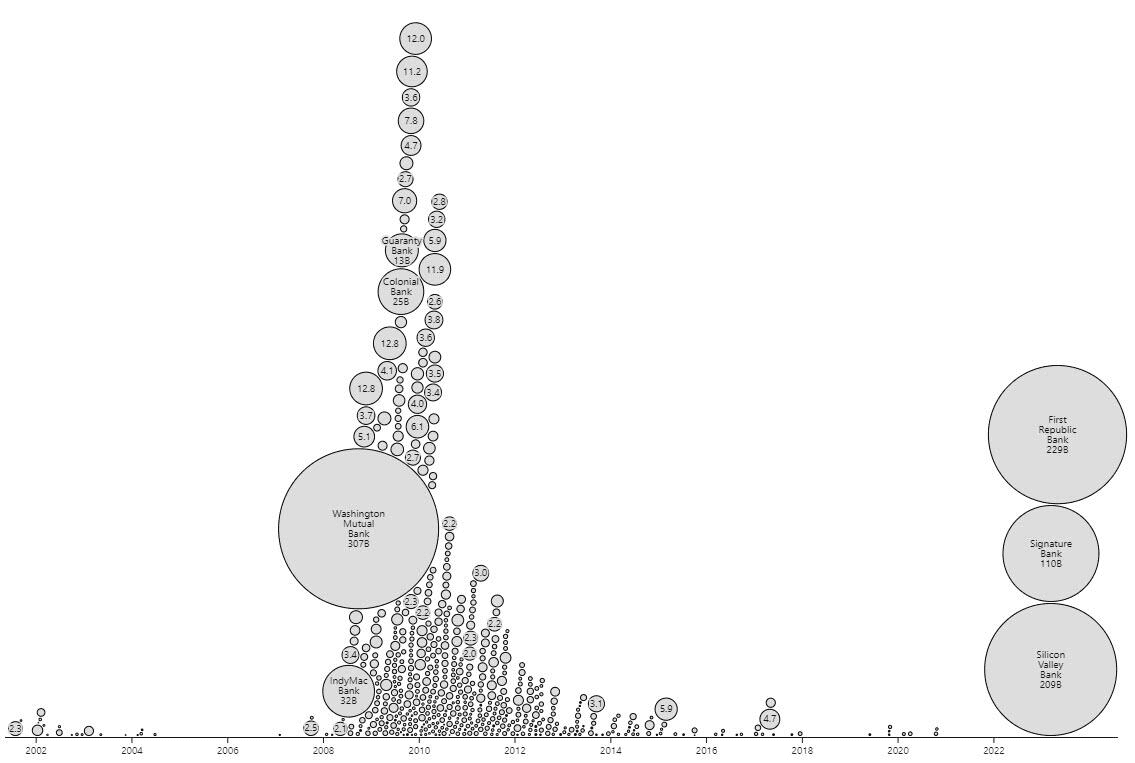

It all started with Silicon Valley Bank (SVB).

Soon after, Signature Bank went under.

And then, First Republic.

These three banks wiped out almost half a trillion dollars in deposits. And if that figure doesn’t quite resonate, let me put it in perspective:

In a matter of months, a few regional banks lost more than the entire banking industry did in 2008:

And we aren’t even out of the woods yet.

In fact, new research shows there are 2,000+ banks that could soon fail.

But for all the danger this situation presents, this letter isn’t about the banking crisis or what it means for our financial system. It’s about the extraordinary investment opportunity it brings.

But to seize it, we have to think two steps ahead.

The Core of the Banking Crisis

Before diving into the opportunity, let’s take a moment to break down what’s happening.

Technically, all three banks fell due to a textbook bank run.

For example, SVB clients tried to take out nearly $142 billion in just two days—a whopping 81% of the bank’s deposits. SVB obviously couldn’t fulfill those requests and, as such, was seized by regulators.

That shouldn’t come as much of a shocker. Any bank would break if most of its depositors asked for their money all at once.

The same goes for Signature Bank and First Republic.

But those bank runs weren’t so much an illness as they were a symptom of a larger problem.

You see, the three banks in question had one thing in common that made their clients nervous. They were overleveraged on long-term debt as both creditors and debtors.

For example, SVB invested most of its deposits in long-term Treasuries and mortgage-backed securities under the assumption of persistent low interest rates. As a result, they neglected to establish sufficient hedges for those investments.

The situation took an unexpected turn when the Federal Reserve abruptly reversed its stance and initiated the fastest rate hikes not seen in 50 years.

In turn, the market value of that long-term debt—which backed the lion’s share of SVB depositors—crashed.

First Republic, on the other hand, had borrowed so much that in the first quarter of 2023, interest expenses surged 2040% year-over-year and 153% from the previous quarter.

That’s a 20x increase in debt servicing costs!

No wonder their clients stormed in bunches to get their money out.

The Contagion

While the Fed’s intervention may have thus far contained further panic runs, the root cause of the banking issue remains.

There are simply too many overleveraged banks.

And they’re now quietly crying for help.

Take PacWest. The $41 billion California bank is reportedly exploring its “options” for a potential sale. Its management revealed that they are in talks with “several potential partners and investors.”

Meanwhile, according to a controversial FT report, Phoenix-based Western Alliance is also seeking help.

But that’s not all.

Experts are now suggesting that half of the US banking system is in danger of becoming insolvent.

Via ZeroHedge:

“[Amit Seru], a professor of finance at the Stanford Graduate School of Business, presented a grim warning that the regional banking dominos are falling. In an interview with The Guardian, Seru was more precise about just how many banks were burning through their capital buffers and were underwater. The estimate is shocking: Almost half of America’s 4,800 banks. “It’s spooky. Thousands of banks are underwater. Let’s not pretend that this is just about Silicon Valley Bank and First Republic. A lot of the US banking system is potentially insolvent.”

And the domino reaction could start anytime.

As another trigger, Seru points out real estate loans that will have to be refinanced at multi-fold higher rates in the next few years.

From Seru’s NYTimes op-ed:

“Commercial real estate loans, worth $2.7 trillion in the United States, make up around a quarter of an average bank’s assets. Many of these loans are coming due in the next few years, and refinancing them at higher rates naturally increases the risk of default.

Rising interest rates also depress the value of commercial properties, especially those with long-term leases and limited rent escalation clauses, which also increases the likelihood of owner default.

In the Great Recession, for example, default rates rose to about 9 percent, up from around 1 percent, as interest rates rose.”

Keep in mind the impact of interest rate hikes doesn’t occur immediately. The higher costs take time to reflect on the bank’s balance sheet.

Moreover, it’s worth remembering that all these rate hikes just occurred last year. And that means the full extent of this crisis has yet to be felt.

Fed to the Rescue?

It’s too early to speculate what will come from this.

There are too many unknowns and little transparency into how each bank is intertwined.

Moreover, banks tend to maintain the appearance of financial health until the very last moment to avoid triggering early bank runs.

Remember, just this past January, First Republic reported “extraordinary” earnings results, and its stock surged 20%.

Fast forward a few months, and the stock has lost over 99% of its value.

And there could be dozens or hundreds of banks like First Republic keeping the bad news under wraps until it’s too late.

The question now is: will the Fed continue bailing out the banks?

It appears so.

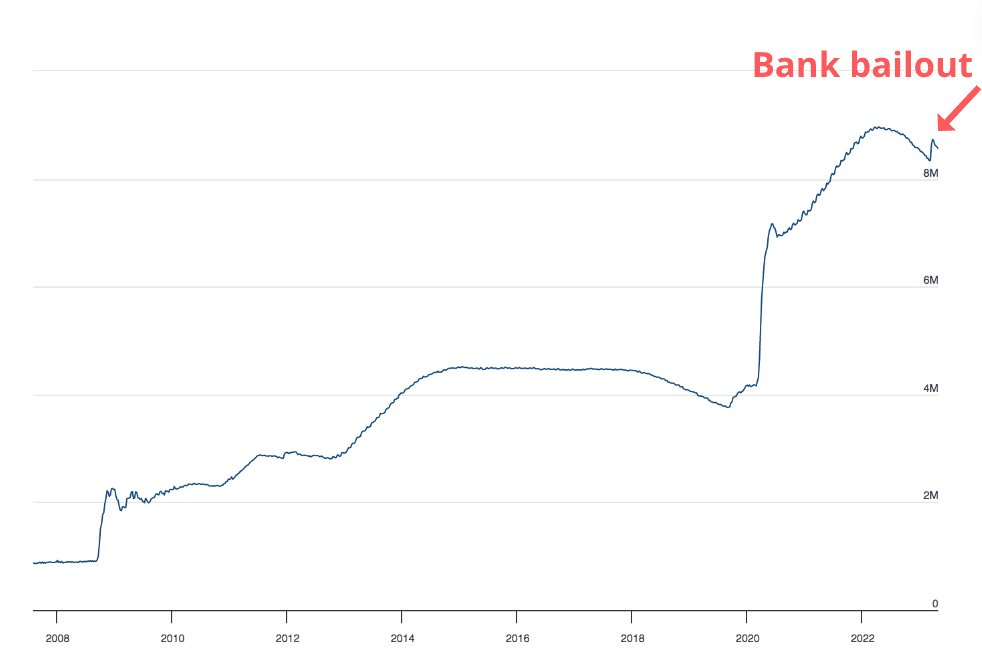

When Silicon Valley Bank went bust, the Fed launched an emergency lending facility without hesitation. And within a month, it stuffed bank reserves with $4oo billion to backstop the contagion.

In one quick swoop, the Fed reversed over six months’ worth of balance sheet reduction:

So it appears that Fed Chair Jerome Powell is committed to bailing out banks—even if it comes at the expense of more inflation.

But here’s what’s even more worrying.

This banking crisis isn’t a result of some speculation as it was in 2008. Instead, the banks are crumbling because the Fed is removing the Covid stimulus and slowly returning its policy to normalcy.

(Note the emphasis on slowly.)

The fact that even the slightest tightening is enough to break the banking system shows that this economy can’t function without the Fed’s “life support” anymore.

And we believe that was the plan all along.

As we tweeted before, the Fed reduced reserve requirement ratios to zero percent in March 2020. This action eliminated reserve requirements for ALL depository institutions.

U.S. average fractional reserve-lending ratio was 3% – meaning that if you deposited $100 at the bank, the bank can take $97 of it to make loans or gamble on the stock market.

This was reduced to ZERO effective March 26, 2020. pic.twitter.com/5E47tR3UrR

— The Equedia Letter (@equedia) March 13, 2023

The reserve requirement ratio is the percentage of deposits that banks are legally required to hold as reserves, which cannot be lent out. It is set by the Fed to ensure that banks maintain a certain level of liquidity and stability.

So, obviously, removing the reserve requirement means banks no longer need to have any level of liquidity or stability. It could have none.

Do you honestly believe that the Fed didn’t know what would happen when it dropped the reserve requirement ratio – the very thing that is supposed to ensure the stability of banks – to zero?

For more info on this fractional reserve banking system, read our letter from 2013: How the Government Borrows Money.

But that’s not all.

If a bank holds more reserves than required, it earns a much lower interest rate from the Fed on those reserves. This is how the Fed encourages banks, or rather forces them, to lend.

So when the reserve requirement ratio is ZERO, banks holding ANY reserves will likely be losing money on those deposits. That’s why so many banks had to continue making bets.

Any “expert” or “talking head” that thinks the Fed doesn’t know what it’s doing is either naive or just plain stupid.

The Fed is the most powerful institution in the world; it didn’t become that because it doesn’t know what it’s doing.

In other words, the Fed has likely done all of this on purpose; it removed the reserve requirement for banks, thus “forcing” them to lend and invest, and then hiked interest rates.

But why?

As we told you many times before, “the Fed works only to pursue its own growth; to engulf more of society into its banking system.”

And we believe its goal is to consolidate all of the smaller banks to pursue its goal of direct monetary influence.

Your money is much safer with us…in the form of CBDC, central bank digital currency – Federal Reserve, in the not-too-distant future$SIVB $SBNY $PACW $FRC $ZION $KEY $WAL

Follow us @equedia

— The Equedia Letter (@equedia) March 13, 2023

And that likely means more banks will collapse, and the lender of last resort will be there to step in.

$SIVB is not a true bailout – only depositors get their money back.

We will see other banks collapse and be swallowed up by bigger players soon, at pennies on the dollar.

— The Equedia Letter (@equedia) March 13, 2023

And that’s precisely what happened. Just ask Credit Suisse. Or JP Morgan who was given First Republic Bank.

So what do we do from here?

The Opportunity

Remember the three “counterforces” holding up the dollar from the last letter?

A major factor that has strengthened the dollar lately is the Fed’s lead over other central banks in terms of interest rates.

But today, not only are major central banks catching up to the Fed, the Fed is now taking a step back.

And that creates a trifecta of tailwinds for gold.

As we discussed in “The Gold and Inflation Peg Is Wrong,” gold is mostly connected to real interest rates, not CPI. That is, an inflation-adjusted interest you earn from risk-free government bonds.

When bond earnings rise, gold demand falls. And vice versa, when yields go down, gold becomes more attractive.

So where are real interest rates headed?

There’s a strong argument that the Federal Reserve will need to initiate additional quantitative easing (QE) measures before effectively addressing inflation.

This could potentially diminish the attractiveness of Treasuries, leading to increased demand for gold as an alternative investment.

After all, why invest in something guaranteed to lose money?

Couple that with a weaker dollar and a coming recession that is already overdue (or arguably already here), which are the other two biggest drivers for gold, and we potentially have a perfect storm for gold to keep going higher.

And given that gold hit $2,000 under the combination of two historically unfavorable conditions — inflation subduing and real rates rising — the price of gold may just be getting warmed up.

Seek the truth and be prepared,

Carlisle Kane

Your analysis is correct. Your “solution”, buying gold, is wrong. The correct solution is to short Regional Banks via ETFs while staying long in high quality growth stocks, earning 5% in interest on cash, and buying high ROI vacation rental condos in strong growth places like Tulum, Mexico.

You wrote “In other words, the Fed has likely done all of this on purpose; it removed the reserve requirement for banks, thus “forcing” them to lend and invest, and then hiked interest rates.

But why?

As we told you many times before, “the Fed works only to pursue its own growth; to engulf more of society into its banking system.”

And we believe its goal is now to consolidate all of the smaller banks to pursue its goal of direct monetary influence. ”

Those are some very strong statements. Your last two sentences leave the reader hanging because you didn’t explain them. Without some evidence to explain “to engulf more of society into its banking system” and “And we believe its goal is now to consolidate all of the smaller banks to pursue its goal of direct monetary influence. ” these statements look like simple conjecture on your part. Explaining what the Fed is doing and more importantly, why, would add some credibility to your opinion. Without credibility and evidence we have no reason to believe what you say.

What you have written is important enough to justify a thorough explanation. One would hope this stream of thought would be considered important enough by you to spend the necessary time to finish and not leave the reader to jump to their own conclusions which may support your thesis or not.

Your call.

What IF the CDBC currency. Becomes the Feds?

I see this being their ultimate goal, to have full control

Government will be left no choice than to comply as they will own the government!

All banks who fail you will first see a surge in so called earnings, but is nothing more than a few short selling to make a quick profit before sending them to their grave

All Feds tactics are clear for those who see