What to Expect for Stocks in 2014

2013 has been a year filled with many ups-and-downs; ups for American equities, and many downs for the resource-laden Canadian market.

Early in the year, I decided to feature one – and only one – precious metals stock to see if the tides would turn for the sector; it didn’t. As a result, I took my very first loss on a silver investment.

But that experiment saved my portfolio this year. Aside from the precious metals trading opportunity I told you to take advantage of at the end of June, I mainly stayed away from precious metals altogether.

(Luckily, some of my tech stocks paid off in big ways – one climbing over 650%)

There’s no doubt that many respected “fight-the-fed” gurus have been slammed in 2013. Big precious metal funds have been destroyed, including the flagship fund of prominent Canadian hedge fund manager Eric Sprott, which has dropped more than 50% this year.

Were these precious metals experts wrong in their fundamental analysis?

Were they wrong in their bearishness towards the global economy?

I don’t think so. In fact, I’d say they were dead right.

The problem, however, is forgetting whose in control: the Fed.

If there was one lesson that echoed in the majority of my letters this year, it’s “never bet against an entity that can print a limitless amount of money.”

Here’s a look at the markets over the last two years of the two biggest initiators of the printing press, Japan and the United States:

By no means do I agree with what the Fed is doing, nor do I support it. Frankly, as you may have noticed in the almost “conspiracy-like” tone in my letters, the Fed works only to pursue its own growth; to engulf more of society into its banking system.

But the chart speaks for itself.

The Fed’s Hand

If you simply look at what happened leading up to 2008, it’s really easy to see the Fed’s hand in action.

Low interest rates and monetary incentives resulted in the creation of copious and dubious financial instruments that led to the housing bubble. This forced the American government into borrowing an insurmountable amount of money to save the economy. And since countries around the world suffered from the shock waves, the US government turned to the lender of last resort: the Fed – who essentially created the problem in the first place.

So while I commend precious metal gurus for not only boldly unraveling the fundamental truths of the Fed while supporting gold, I believe that fundamentals (temporarily) play a backseat role in investing – especially in this modern era of manipulation, regulatory policies, and robot trading.

There is a stark difference between beliefs and investing. This is where I believe many precious metal gurus failed this year: they got emotional with their trades.

In time, the gurus will prove to be right. Their fundamental analysis will finally show in the market place. We’ll get back to this in a bit.

The American economy is in a state of change; shifting from an era of manufacturing, to an era of financial instruments. This is a major problem because it increases the disparity between the poor and the wealthy, leading to a decline in America’s middle class. The results are already showing up everywhere. Median wages have fallen to lows not seen in 15 years, while top earners are making more money than ever.

For now – as unsettling as it sounds – if you want to survive and prosper, follow the Fed.

The Tipping Point

Many great New York Times Best Sellers, such as Jonah Berger’s Contagious, or Malcolm Gladwell’s, “The Tipping Point,” talk about why things catch on.

With many new phenomenons around the world catching on – Bitcoins, Twitter, Facebook, Instagram, stock market rallies, and global monetary stimulus – I thought it would be interesting to look at these author’s theories as it relates to us now.

In Malcom Gladwell’s, “The Tipping Point,” he begins with a look at the dramatic drop in New York City’s crime rate in the early nineties.

In 1992, he explains, there were 2144 murders in New York City and 626,182 serious crimes. But all of a sudden, things changed. Within five years, murders had dropped 64.3% to 770, and serious crimes fell by nearly one-half to 355,893.

How could this have happened in such a short period of time?

The police officers in the City would tell you that it was a result of their dramatically improving policing strategies. Criminologists said it was a result of the declining crack trade and an aging population. Economists, meanwhile, say the gradual improvement of economic activity in the city over the course of the 1990’s had the effect of employing those who might have otherwise become criminals.

These are the conventional explanations for the rise and fall of social problems.

Malcolm notes that the declining crack trade, the aging population, and improving economic activity were all long-term trends happening all over the country. So why did crime plunge so much more in New York City, than in other parts of the country in such an extraordinarily short time?

How can a change in social and economic indices cause murder rates to fall by 2/3 in five years?

Gladwell writes that to truly understand these types of phenomenon, we have to view them as epidemics; ideas, products, messages, and behaviours can spread just like viruses do.

The fall in New York crime rate is textbook example of an epidemic. It wasn’t that some huge percentage of would-be murderers suddenly sat up in 1993 and decided not to commit any more crimes. Nor was it that the police managed to magically intervene on situations that would’ve otherwise turned deadly.

What happened was that a small number of people, in a small number of situations, which the police and the new social forces had some impact, started behaving very differently and that behaviour somehow spread through other criminals in similar situations.

Whatever the cause, however, if things can change for the better in such a short amount of time, could it easily reverse and go the opposite way?

A Growing Epidemic

While we see New York as the world’s center of financial trade, filled with millionaires and rich extravagant stores, an epidemic is quietly emerging within the city: The disparity between the rich and the poor.

In a sad but eye-opening article in New York Times’ “Invisible Child,” we’re told that there are more than 22,000 homeless children in New York, the highest number since the Great Depression, in the most unequal metropolis in America.

This epidemic has very quickly spread throughout the nation.

According to CNN, there were 1.2 million homeless students during the 2011-12 academic year, from preschool all the way through high school. That’s up 10% from last year and 72% from the start of the recession, according to the most recent data available from the National Center for Homeless Education, which is funded by the Department of Education.

%CODE82%

This is a perfect example of an epidemic.

Despite all the negativity happening in North America, and around the world, the stock market is at an all-time high. If the stock market is a forward-looking indicator of our economy, why are companies not hiring? Why are there more homeless people in America than before?

Because according to the “experts,” corporations are doing great. They tell us that P/E ratios are still within normal ranges and there’s plenty of room to grow. But have they told us why?

As I mentioned in my Letter from 2012, higher earnings have been the results of inflation, and more importantly – major cost-savings at the expense of jobs.

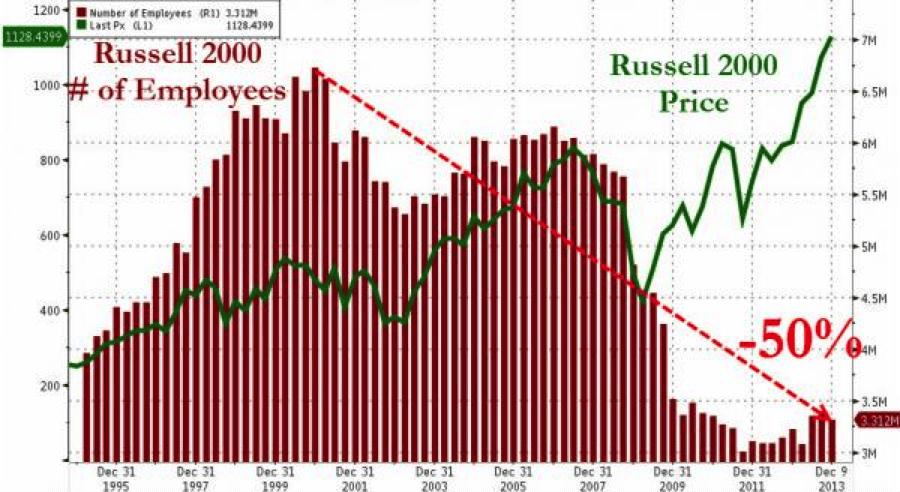

Here’s a chart with data from Bloomberg, via Zerohedge:

The chart shows the major disconnect between jobs across the firms of the Russell 2000 equity index and the Russell 2000.

Generally, when corporations do well, they hire more people because they need more manpower to sustain their growth.

But since 2008, this trend has dramatically reversed.

Corporations in America are no longer doing well because they’re selling more goods – they’re doing well because they are becoming more efficient. In other words, they’re shipping jobs overseas, or handing them over to robots.

The discrepancy between the wealthy and the “not-so-wealthy” continues to grow.

The question is, at what point does this discrepancy become so big in America that it forces the nation into a revolution.

At what point do fundamentals in the stock market take over? At what point does the stock market fall from its meteoric rise?

Interest Rate Shocker

Over this year, I have talked about everything from the Federal Reserve’s power, to Russia’s ambitions.

If you’re new, I strongly suggest you take the holiday to review the Letters from this year, as it will give you a much clearer picture of what’s happening and why.

The rise of the stock market is an epidemic created by the central banks of the world.

They have injected so much money into the financial system that removing any of it will cause an immediate collapse.

So just how easily is this system toppled?

Last week, Bernanke announced tapering. In many letters before, I suggested that his tapering would not only be minimal, but it would have no affect on the market because of its size.

The market rose on its announcement.

What’s more important – as I have stressed – is the continued aggressive stance on low interest rates.

Ultimately, interest rates dictate the pace of the financial system everything.

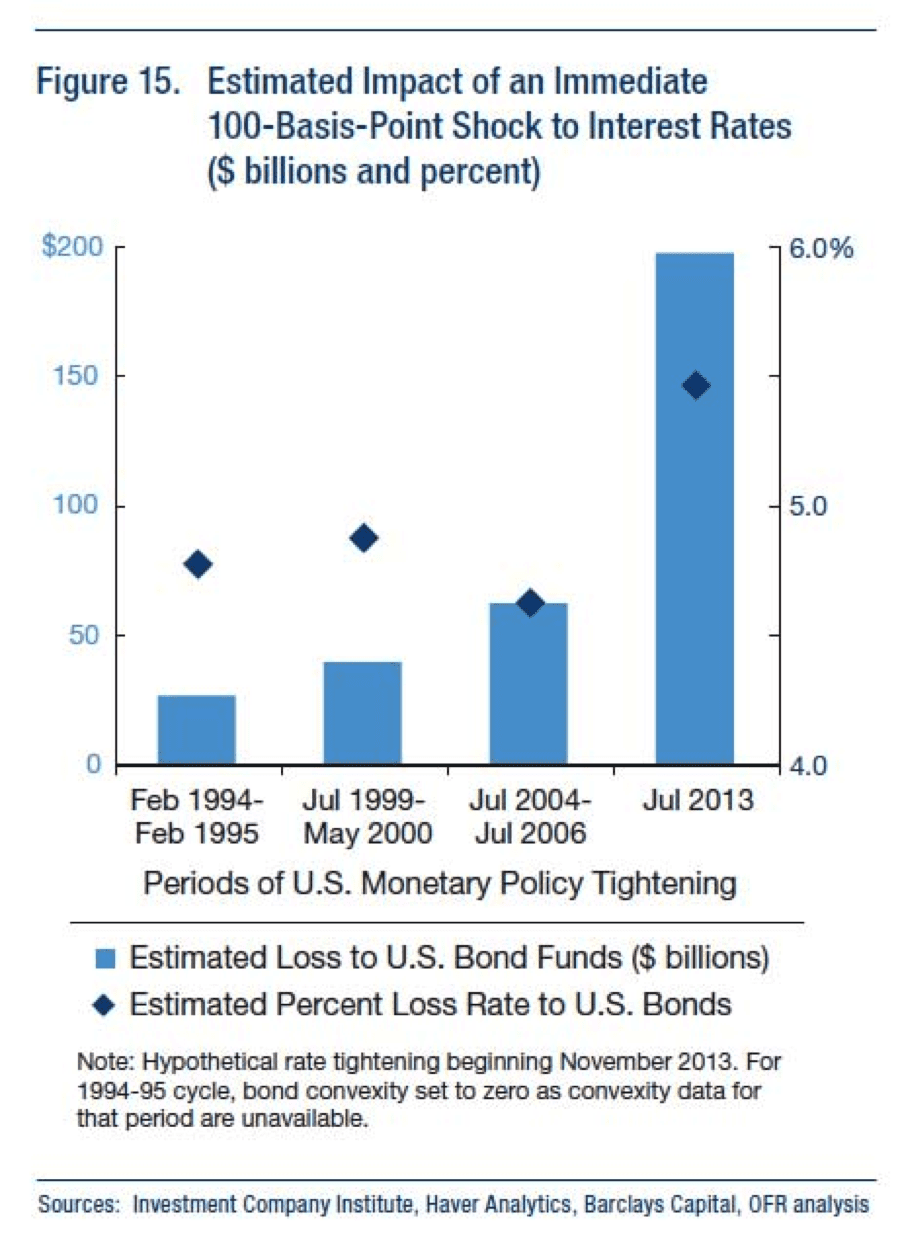

Take a look at this:

This chart represents an estimation of the impact on bond losses if the interest rate were to rise 1%. If the interest rate spiked 1%, bond funds would lose $200 billion.

That is exactly why Bernanke announced that low interest rates would remain for an even longer period of time than previously announced.

Bernanke says the federal fund rate isn’t expected to rise until 2015, and will remain at current record-low levels even after the unemployment rate falls below 6.5 per cent.

When the price appreciation of assets is the result of a low interest rate environment (cheap money) rather than real economic drivers, there is no turning back.

This Letter isn’t a book review, nor is it about how bad the economy really is. It’s a Letter about changing the way you view the stock market.

And the stock market, too, has its “tipping point.”

But will the markets “tip” in 2014?

Ultimately, the same people who control our money and the media (the Fed), dictate the pace of our markets. They are the puppet masters, and sadly, we are the puppets.

Whatever actions they choose, we have to pay attention.

Fastest Rise in History

It’s easy for every one to predict that 2014 will fall because of the dramatic rise in nominal values over the past few years.

However, analysts and experts have been telling me that the stock market would crash every year since 2008. They told me the same this year – despite my arguments for the contrary.

Since 2008, I have told my readers to buy American equities, essentially following the wisdom of Warrant Buffet that the lowering of interest rates create secular bull markets.

On Friday, the Dow Jones Industrial Average achieved something it hadn’t managed in nearly 14 years: it closed at a new record inflation-adjusted high.

What’s more significant is that this is the fastest return to an inflation-adjusted record in American stock market history.

After past bear markets, it has generally taken as much as 30 years for the Dow to return to an inflation-adjusted record: from 1906 to the mid twenties; from the late 1920’s to the late fifties; and from the late sixties to the early nineties.

Does that mean the secular bear market is over?

I believe it could be, especially if you look at it from a historical perspective – although I know I will get a lot of heat for saying this.

If you tune out all of the noise, the chart’s direction tells us its over. We’ve broken to new inflation-adjusted highs and there are compelling reasons to say the market could go higher in 2014 – continued low interest rates, intervention by the Fed, and Obama spending.

Is there a possibility that stocks will fall in 2014? Yes, of course. And if it does, it could be the worst financial disaster in the history of mankind.

But I don’t see that happening unless there is a revolution of some sort, or the central banks decide it’s someone else’s turn (Russia? China?) for prosperity.

Furthermore, since Obama bends to the will of the Federal Reserve, and will remain in power until 2016, it would be a risky bet to expect a market crash – even if fundamentals point to that being the case.

However, leading to the end of Obama’s reign, the disparity between the rich and poor may force the American people to vote for someone who will attempt to fight the Fed.

At which point, if this “fight-the-Fed” candidate wins, the Fed will likely contract the money supply (as they have done in the past), and America could fall into a great depression.

Will the American people be willing to fall in order to rise?

Growth and Trends in 2014

There are 2 billion people who aspire for the lifestyles of the West.

While the middle class shrinks in America, it will grow in other parts of the world.

According to the OECD, by 2030, the middle class is expected to rise from 2 billion to 5 billion, and their spending expected to grow to $35 trillion.

Many corporations in America distribute products and services to this growing market, so focusing on companies with international sales will be a priority.

Technology is another area of growth because it will always change society. We’re currently on the cusp of many breakthroughs in tech including 3D printing, faster computer chips, nanotechnology, and quantum computing. If there is one sector that can save America, its tech.

Since the manufacturing era has moved away from America, new job creation will require a higher level of education. For 2014, the education sector may be one of the hidden areas of growth. As technology changes, America’s declining middle class will need to evolve to survive. Jobs in America will require a higher level of training, and a higher level of education. This, along with government policy, will lead education stocks higher.

Healthcare is important because it involves government policy and gains political votes from a growing lower class in America. Look for many ways to play Obamacare and the growing healthcare requirements of baby boomers.

For those who don’t want to bet on the overall direction of the market, I suggest looking at individual stocks or sectors; for example healthcare stocks and uranium plays.

Of course, I can’t finish this section without discussing the prospects of gold and silver. I have, on too many occasions, written about the supply and demand of fundamentals within the space. I note that since gold and silver are traded via financial instruments with currency, they too can be manipulated as easily as anything else on a trading platform.

Gold is clearly shifting from the West to the East. The People’s Bank of China hasn’t provided an update on its bullion reserves since 2009, but some estimate that the country has quietly accumulated over 300 tonnes this year alone.

If China decides to use 2014 as the year it unleashes its numbers, it could provide a strong pop to the gold market. But keep in mind, as I have mentioned in past letters, accumulators prefer a lower price; there is no rush for China to drive up the price of gold.

Physical demand fundamentals for both gold and silver remain strong and growing. I will maintain a portion of my portfolio into select gold and silver stocks for 2014 – but will wait for much bigger cues before diving in deeper.

Bitcoin Epidemic

How can I talk about gold without talking about Bitcoins and virtual currencies? The creation and the epidemic nature of these things clearly show that society wants to fight the Fed.

However, virtual currencies are, in essence, another Fed-like regime: a digital currency created from thin air without any real monetary “value.”

“Bitcoiners” forget to realize that, despite gaining mass momentum, they are still extremely small. And small means easily manipulated.

Bitcoin took a massive drop of over 50% in just a few days earlier this month when China decided to ban Bitcoin transactions. The coins traded below $500, falling from highs of $1200.

Like gold, I ask the same questions about Bitcoin: Could it be that the rise in the value of Bitcoin was orchestrated by bankers to control the Bitcoin supply? Could it be that they drove up the price of the virtual coins, just so they could slam it and scare investors away?

After all, no matter how many Bitcoins you buy, they’re purchased with currency created by central banks.

This will be the last Letter I write this month. Thanks for all your support this year and I look forward to bringing you more ideas and insights in 2014.

I wish you a happy holiday and wonderful New Year.

great insight!!

all the best in 2014

-eugene

Another great piece. Thanks for your insights this year – truly an eye opener.

Look forward to your thoughts in 2014!

SF

Focus on creating work for homeless and criminals. Organic farming, manufacturing things people need for survival, any hands-on skills like the schools that teach the trades. sincerely,Art

The Capitalist system is a FED preten-ced notion of creation of wealth for the multitude .Yes we all got a taste of it but for those who read between the lines Fed policies is intended for a small group , has been and will continue to be so.This is what we come to understands how economics work, However there are enough educated folks now a days to know the difference and HOW TO IMPLEMENT THE CHANGE quite smoothly.Its simple.

The banking system stays operating as the net-work middle-man as they are but the MONEY MACHINE out of thin air is created by each government responsible for the economics of their own country. Countries and populations grow at their own pace based on its natural rhythm of personal evolution. All that is needed is an outside body with no conflict of interest to maintain rules and regulations on how each country prints money out of thin air. THE SOLUTION IS SIMPLE AND AFFEECTIVE. Currencies would hold their values accordingly, goverment debts would disappear as all citizens contribute to the system, unlike taxation, where we are penalized and controlled. THE ONLY ASSET IS LABOR..

and we all produce this asset. The FED capitalizes on this ASSET the day we all obtain our BIRTH CERTIFICATES.as per the New York-Stock- Exchange registration of your stock birth certificate.THIS IS A TRUST THAT BELONGS TO EACH ONE OF US AS THE BENFICIARY, yet we are not able to redeem part of it for the well being of our own financial life. Each individual life production is more or less established at the day of birth. CAN WE EDUCATED FOLKS BE CAPABLE OF DREAMING UP A WORLD WITH NO SLAVERY OF THE REAL ASSET (LABOR)and levy this asset for what it really is .Its one people one nation , one earth working together for the same goal,FOR THE EASEMENT OF OUR DAILY FINANCIAL LIFES AND FOR THOSE OF FUTURE GENERATIONS.HAVE WE COME TO OUR SENSES THAT WE THE MAJORITY 90% HOLD THE VOTE TO CHANGE THE FUTURE OR ARE WE GONNA CONTINUE TO BE GOVERNED, MANIPULATED BY POLICIES THAT ONLY INTEREST A FEW. CHANGE IS EVIDENT, SILENCE AND PEACEFULL WHETHER THEY LIKE OR NOT.IT IS TIME IN THE COSMOLOGY FACTORS THAT SO INFLUENCE THE NATURAL BEHAVIOUR OF OUR HUMAN SPECIES.

The FED is a very predictable institution and we all must learn and anticipate their thinking and for those so called intelligence money managers, guru’s etc,for most just create noise. Why don’t they tell it like it is..I been able to see in plenty of time thus far the major turn arounds, the manipulation of human emotions for personal gains. Oh Yes the FED knows more about us the commoners than we think we know about them. More SO PAINFULL ARE THE POLITICIANS IN PLACE who have fallen into their ideology navigating a current against main stream of the river. And for those in the past who have initiated some kind of ideas of change have fallen under. YET we all hold the vote. OR DO WE EVEN KNOW THAT WE HOLD THE VOTE. IS THIS DEMOCRACY Of WHAT OUR FOREFATHERS FOUGHT AND BELEIVED WERE BETTER WAYS FOR THE GOOD OF ALL INVOLVED. Someone left a common and it went like this. POORER COUNTRIES FIGHT KILLING EACH OTHER SO THAT MORE ADVANCED COUNTRIES CAN KEEP THE BEER COLD IN OUR FRidge.

If we are so advanced, how can we allow the FED. now take the charge again in the implementation of the pretense-idea of financial freedom by financing their way into the smaller economies (countries) to only later devaluate their currencies and seize their own survival assets of natural resources along with the only ASSET-LABOR…

20014 is 100 year cycle since first world war, and the only thing that is stopping another one is Divine intervention and the vibratory thought process of humanity coming into common sense that we don’t need wars to solve issues.(The Budha Awakening)That the survival of a society is interdependent on another and in all.

AS I mentioned before, rates to stay low for long time and in between is just manipulation. We will see the same in 2014. Economics are not as good as the media advises. Just ask your self the question. Has my income gone up or has my LABOR ASSET been asked to improve its production to the limit.? Metals to have its usual seasonal run Jan-May..HISTORY IN THE MARKETS KEEP REAPING ITSELF. ITS THE PROGRAM.IF THE FED MOVES ITS RATE 1% IN A S-HORT tiME (30 TO 60 DAYS ) THEN YOU KNOW THINGS ARE CHANGING. So what is it that takes Guru’s to figure things out. Have you ever seen a CEO of a company says things are BAD. the word does not exist. Main time the FED will continue to guide us economically for mutual interests, however their policy is to make sure that some type of inflation factor, small as it may be, it must be there in all economies for this is the survival mechanism of its internal organism.

I PRAY THAT THE GOD SOURCE IN EACH OF US GUIDE US ALL PEACEFULLY AND WITHOUT PREJUSTICE.

HAVE A HAPPY HOLIDAY..

The trouble with the gold bugs /gurus or whatever you wish to call them is that they all run gold related businesses so try to talk the market up . Buy the dips has been their cry all the way down to where we are. For me the red signal was when Sprott threw in the towel on silver a number of months ago . He said he had trust obligations ,but was it inside information? The following day silver tanked . Jamie Diamond visited the White House and the market tanked further. Was he told to hammer the gold market to protect the dollar?

JPM are now long the gold market yet the price is going down , how can that not be manipulation?

Finally the LBMA chairman openly stated a few days ago that they would knock the price $400 to $800 in 2014 . Expect the investigation into them in London and Germany to go nowhere just like the CTFC investigation into silver went.

All these people do the Feds bidding.

Prosperous New Year , I doubt it ,unless we have a black swan event

Its all manipulation. Its as Ivan said in this letter, anything traded on a financial platform can basically be manipulated by the Fed – they have all the money in the world.

So,you’re saying,you knew gold and silver were not the place to invest,because the Fed was creating lots of fiat and keeping interest rates,artificially low?I don’t get the logic.I think precious metals prices went up too fast/far and got ahead of actual inflation(which is about 2 1/2 to 3 times govt figures or 6-8% per year) and has to rest,letting prices catch up.Eventually,when currency holders,foreign and domestic,figure out they have been conned,by what the Fed has done and is doing,it will result in a declining currency and rising precious metals.Stocks are the trendy investment,today,because they have been rising.Same as gold was,a couple years ago.Everyone gets a turn,eventually.

Blah blah blah…..Russia is going to nuke US, inflation will go through the roof, world will end, get guns, buy silver and gold and put under your beds,..etc etc

These are just some samples of your dire predictions and suggestions in 2013.. Not to mention the brilliant stock picks..:) LOL

Why do people come here and make statements that aren’t true? I don’t think I have ever read the Equedia Letter mention that Russia will nuke the US, or inflation will go through the roof.

As a matter of fact, I’ve read great reasons in this letter on why inflation has been tame and why it will remain subdued because of unemployment, spending, and money velocity.

Shame on you for defamation.

Must be from the people who have bought his stock picks,… He is a paid stock promoter and people should realize this when investing based on these kind of newsletters. Almost in all cases the authors of these newsletters are here to make money for themselves and not the readers. And people should not believe everything they read and do their own research. If they buy into anything they read then they have only themselves to blame..

this may be the most insightful information on the web – or not!

One thing is for sure, the author does not value my time adequately.

Articles here are far too long winded!

K.I.S.S.