“How did you go bankrupt?”

“Two ways…gradually and then suddenly.”

Over 300 million people will be reciting these Hemingway lines sooner than you think.

Especially if the projections about AI’s impact comes true.

Yet, very few realize the danger they’re in. That’s because we are still in the “gradually” phase.

But the tipping point is near.

Entering AI 2.0

While the subject of AI is all over the media, most analyses fail to explain the true magnitude of the coming disruption.

Let’s begin with the term and what it really means.

Nowadays, when people talk about AI, they often refer to ChatGPT.

Yet, ChatGPT is just the most recent iteration of publicly available AI technology.

But in reality, AI has an extensive history.

One way to better understand this is to break down the rise of AI into two eras: backend analytical AI and generative AI.

In the early days, AI was designed for analytics. It crunched through petabytes of data to pick up patterns, and then used them to make sense of future data sets to make predictions.

This all happened in the backend “circuitry” of software.

Analytical AI is now deployed in software across every domain: from trading and advertising to healthcare.

For example, the world’s best quant trader, Jim Simon, used AI to predict the future moves of commodity prices based on historical records. His fund averaged a 71.8% annual return. And he did this in the 90s.

Nowadays, most digital advertising is also built on machine learning.

For example Facebook and Google use machine learning algorithms to spot user preferences, and then use those insights to put highly personalized ads in front of them at scale.

Such AI-based advertising became so efficient that it effectively phased out TV and billboards over the past decade.

In healthcare, machine learning models lend a hand to radiologists by decoding X-ray and MRI scans. Similarly, in the manufacturing sector, AI engines diligently monitor real-time data acquired from sensors to detect anomalies and perform other essential functions.

But while analytics AI has disrupted many industries, its overall impact on the economy was relatively small for two reasons: it was limited to analytics and off limits to the general public.

But we are now entering AI 2.0.

With the rise of tools like ChatGPT and Midjourney, anyone can use AI to create just about anything: from writing a killer short story to creating unique digital artwork.

That means AI’s capacity has expanded from analytics to creation. And it’s coming out of the “backend” into graphic user interfaces, bringing the technology to the broader public.

Think of it as the equivalent of switching from command-line operating systems like DOS to Windows.

White Collars at Risk

While analytical AI was more of a “feature” for automation systems, allowing them automatically adjust their algorithms based on new information, generative AI is a whole new beast.

That’s because it taps into what has always been considered “human territory.”

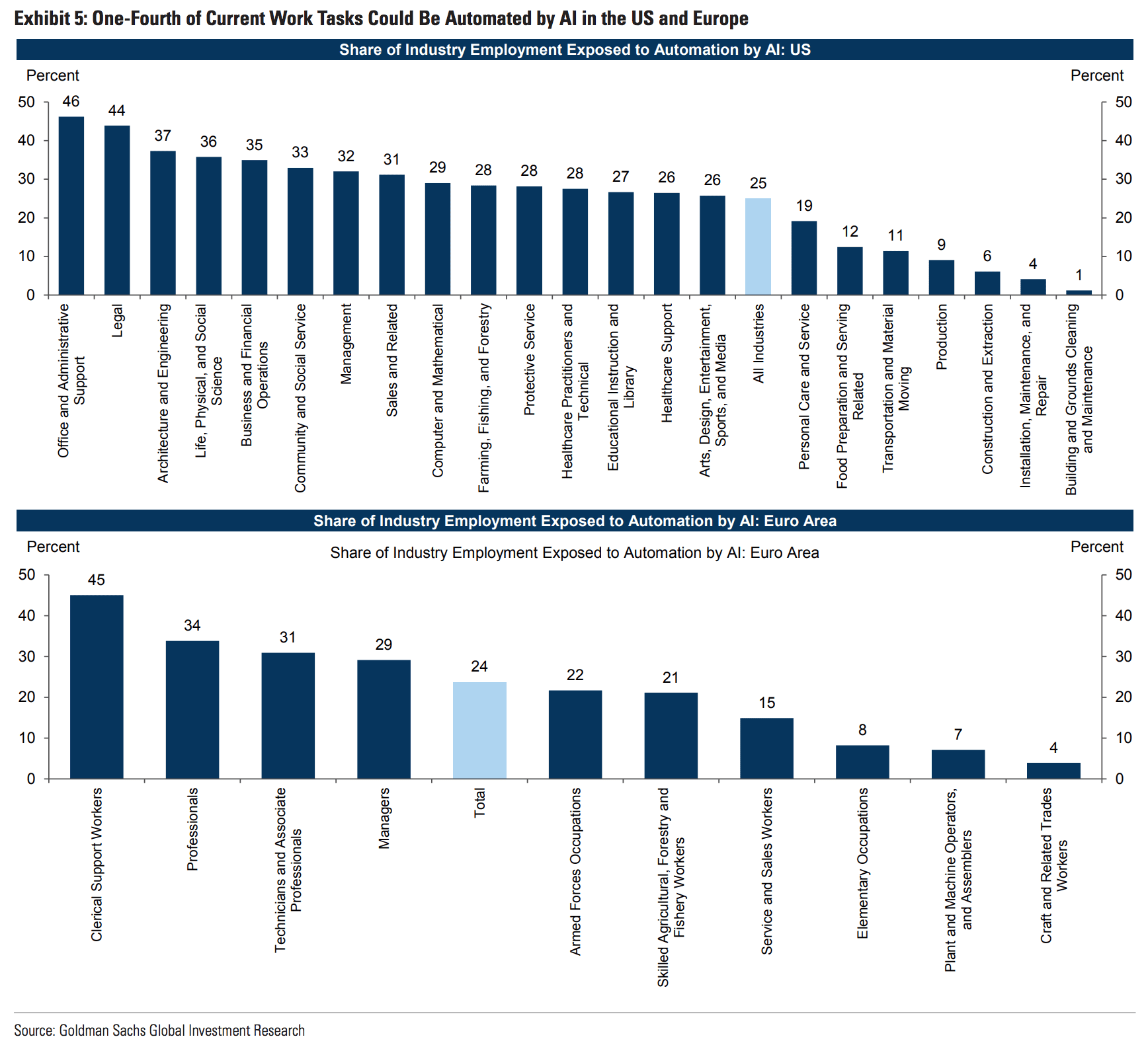

In its recent report, Goldman Sachs found that generative AI can already replace 1 out of 4 white collar workers in almost every occupation.

Take a look:

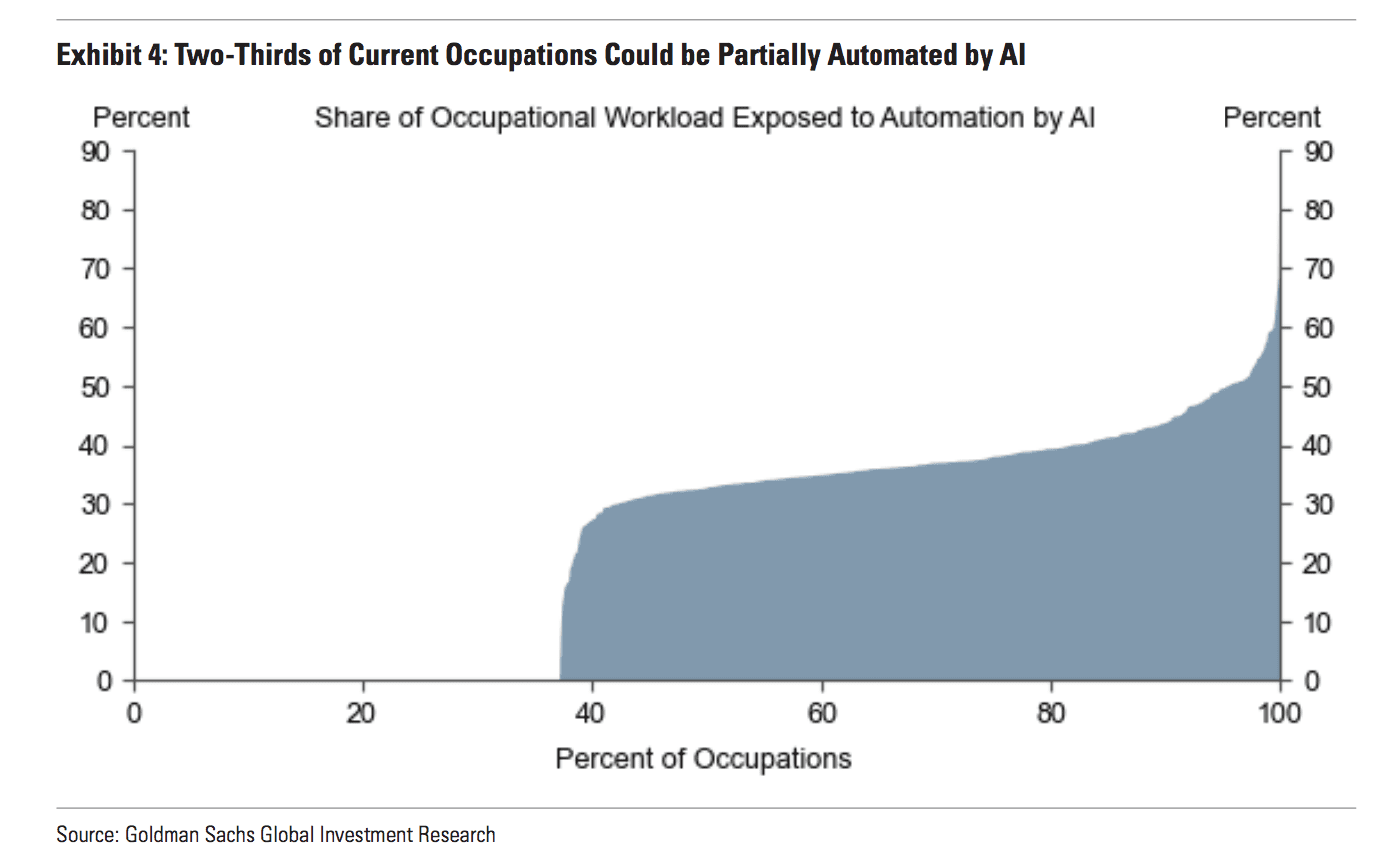

They estimate that AI (in its current form) will eventually replace two-thirds of occupations – an assumption that doesn’t even factor in the exponential growth of AI capabilities.

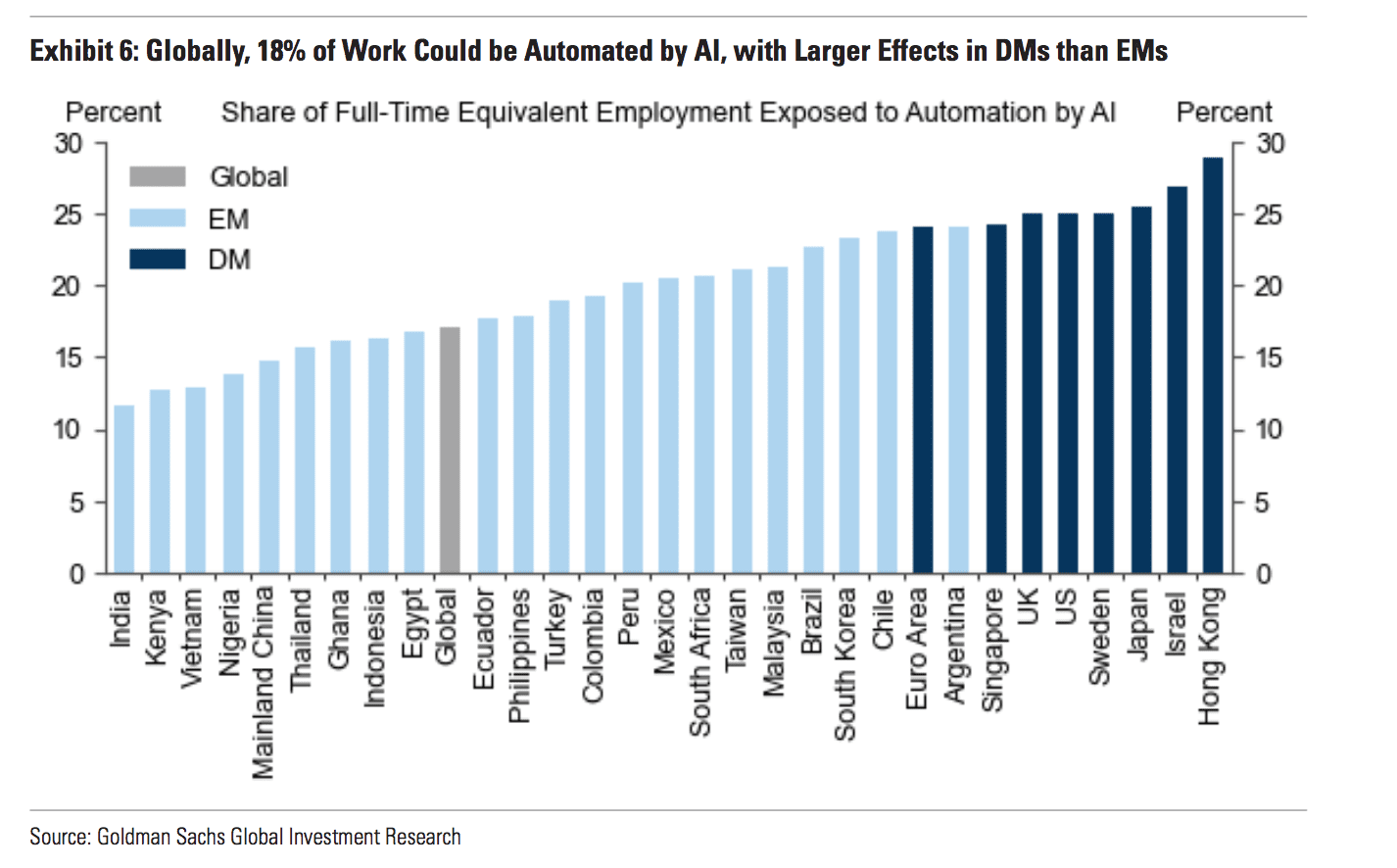

Even more worrying, this disruption will mainly affect the developed world, where most white-collar jobs are concentrated.

In all, Goldman Sachs projects that AI will hit 300 million workers globally.

That doesn’t necessarily mean that those hundreds of millions of people will instantly lose their jobs. More likely, they will gradually face more competition until they are eventually priced out.

Just think of how Uber drivers have overtaken taxis.

In the past, having the ability to know every address on a given block was considered a valuable skill. However, with the emergence of GPS and ride-hailing apps, this knowledge has transformed into a commodity easily replaced by anyone with a smartphone.

Likewise, the skills of 300 million workers, from engineers to office clerks, will become “commoditized” by AI—or low-skill professionals using AI.

This will inevitably bring everyone’s wages down.

And this is not some distant future doom and gloom scenario.

Big corp is already budgeting for human resources with the AI disruption in mind.

Hiring Spree Turned Layoffs

The last time I wrote about AI, there was just one big company that made actual staff changes due to AI. It was media giant Buzzfeed—which let go of 12% of its workers and replaced them with OpenAI tools.

Today many big corporations are following Buzzfeed’s lead.

Take IBM, for example. Its CEO, Arvind Krishna, recently announced that he would stop hiring for roles that can be replaced by AI. He believes this will affect over one-third of IBM’s back-office employees.

“I could easily see 30 percent of that getting replaced by AI and automation over a five-year period,” Krishna said in a Bloomberg interview.

IBM isn’t alone.

In San Francisco, one of the biggest cloud companies, Dropbox, just announced laying off 16% of its workforce. Apparently, the company is restructuring itself as an “AI-forward” company.

“Our next stage of growth requires a different mix of skill sets, particularly in AI and early-stage product development,” CEO Drew Houston said.

Meanwhile, a fresh survey from Sortlist Data Hub shows that one-fourth of European tech and 22% of financial companies will downsize because of AI chatbots like ChatGPT.

And it’s not just the back offices.

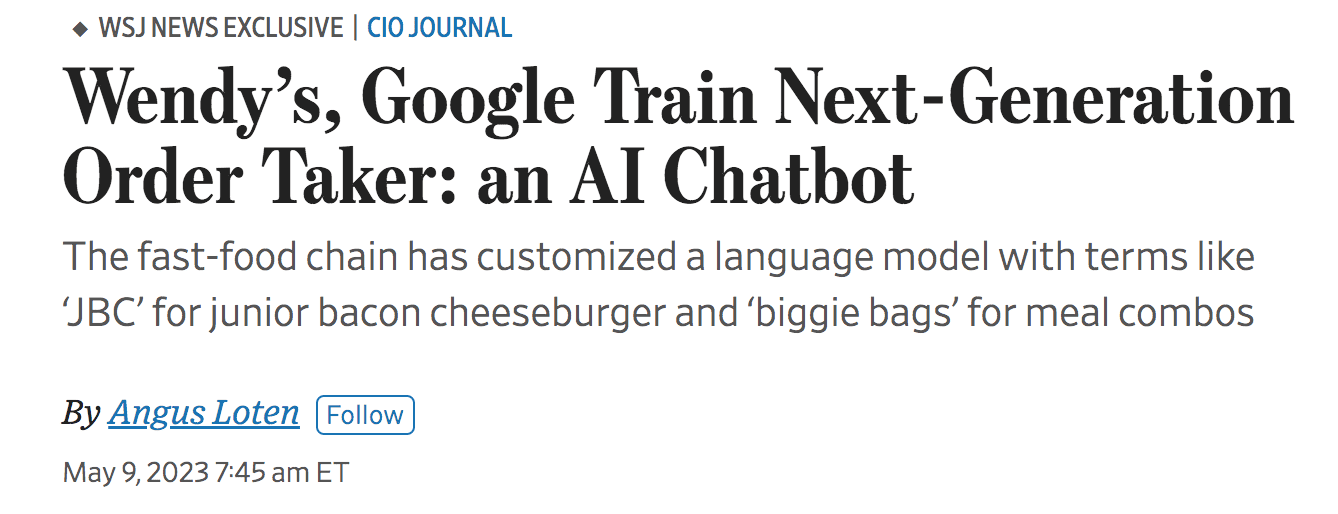

Customer-facing service workers are also at risk as AI enters the food industry. For example, Wendy’s will roll out a chatbot that can take orders at drive-thrus as early as June.

Via WSJ:

“It will be very conversational,” Mr. Penegor said about the new artificial intelligence-powered chatbots. “You won’t know you’re talking to anybody but an employee,” he said.”

And those are just a couple of anecdotal cases.

There are many, many more companies that are quietly automating their processes with AI.

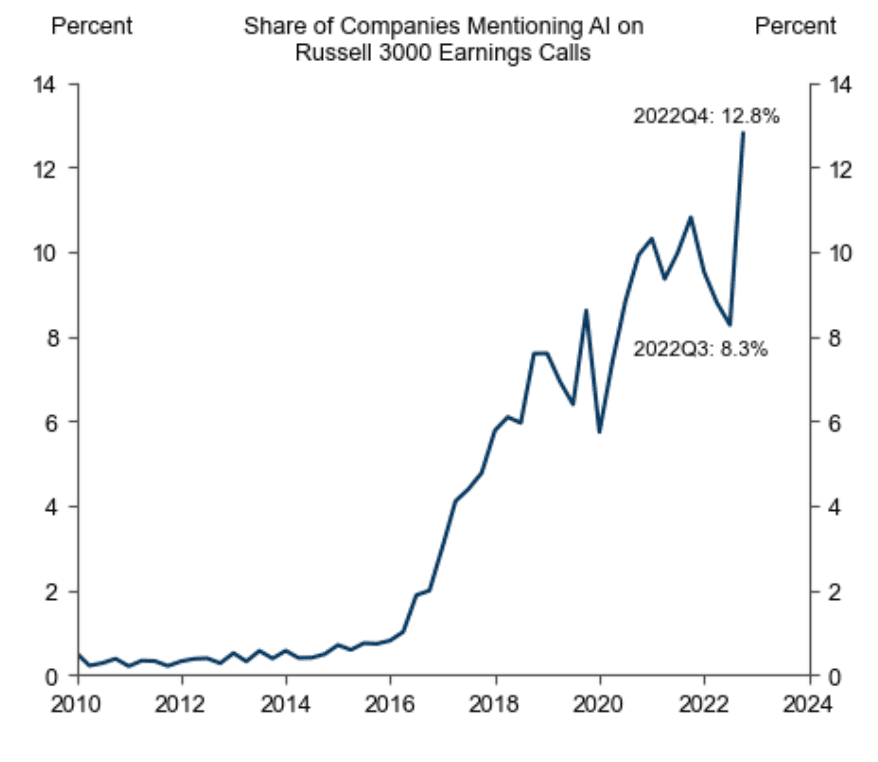

Take a look at the explosion of AI talks during earnings calls:

In just a few years, these companies will upgrade their internal processes with AI solutions that will render many desk jobs obsolete.

What happens, then?

More Centralization

Let me show you a set of two charts that explain what’s coming up better than anything.

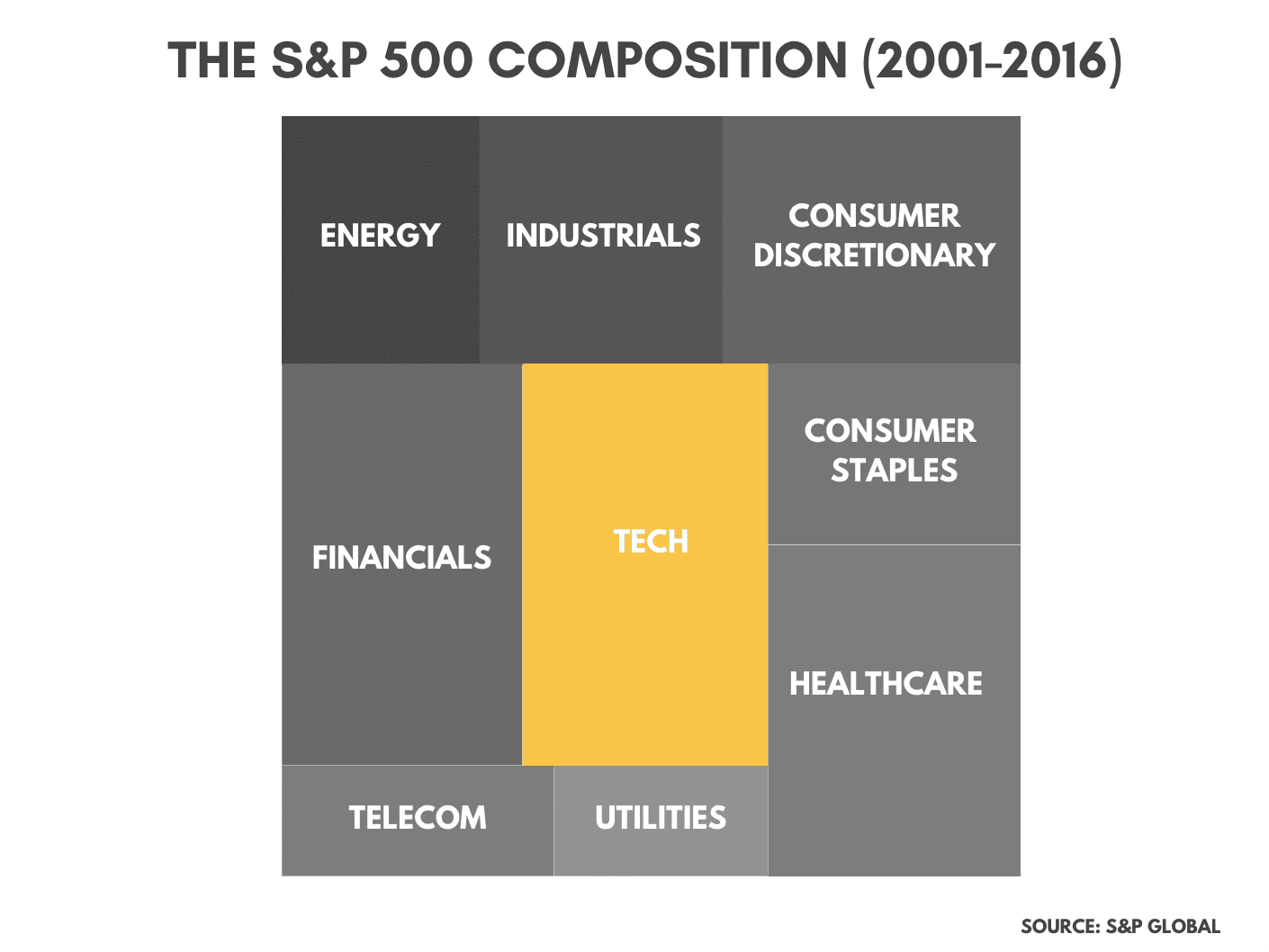

In Chart 1 below, you see the average composition of the S&P 500 between 2000-2016:

For most of this century, America’s biggest companies were more or less evenly spread across these key sectors.

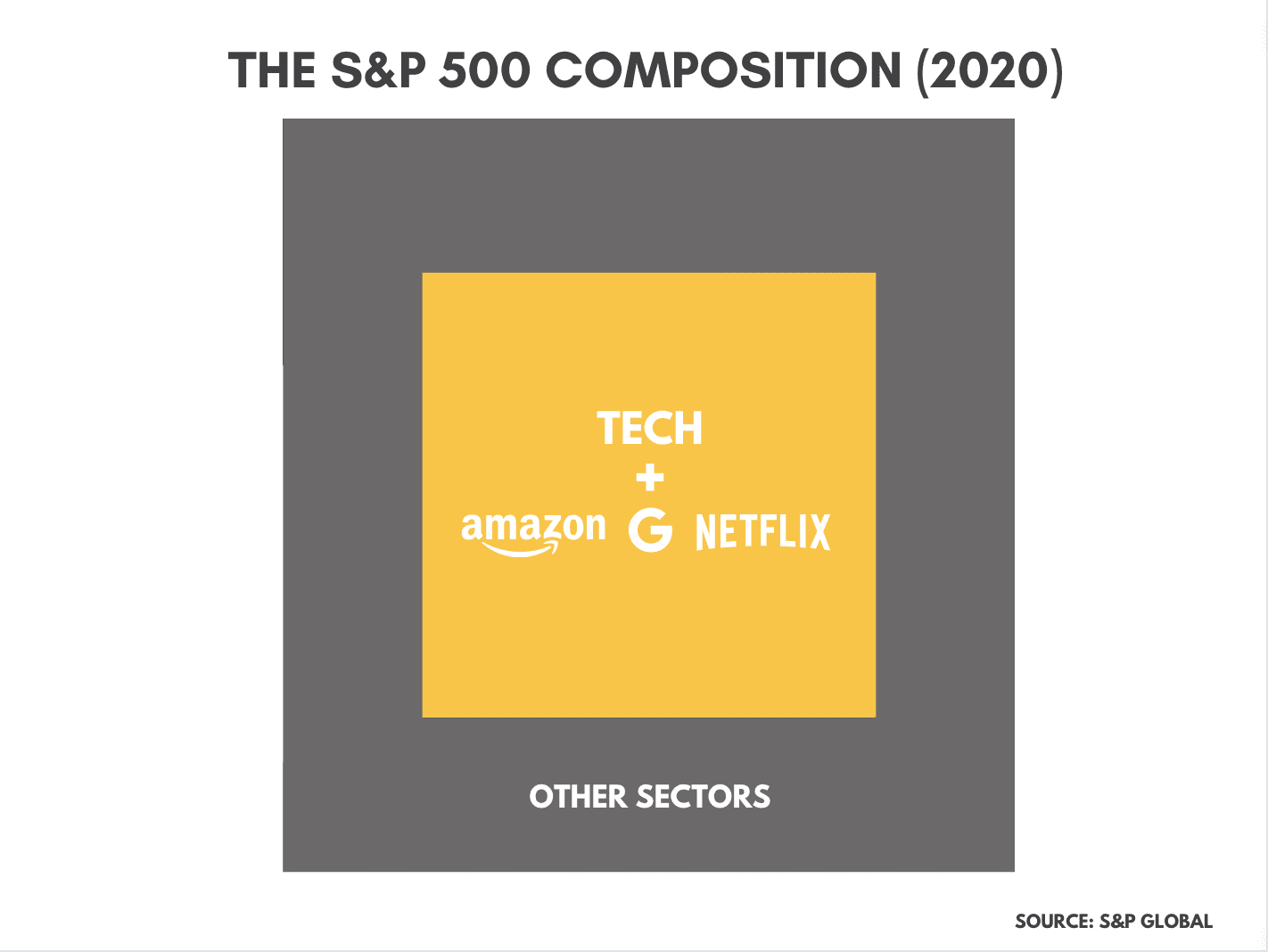

But look what happened recently.

In Chart 2, tech has completely taken over the S&P 500. And it all happened in just the past couple of years.

In other words, most of America’s profits are now clustered in a select few tech companies.

In fact, as we head into a recession, tech companies are driving 86% of market returns.

Via Marketwatch:

“Big Tech stocks have driven 86% of the S&P 500’s performance so far this year, according to the note, citing seven stocks including Apple Inc., Microsoft Corp. Google parent Alphabet Inc., Amazon.com Inc., Nvidia Corp. Facebook parent Meta Platforms Inc. and Tesla Inc.”

And all of this is thanks to AI 1.0.

Technology has become so advanced and rooted in our economy that no business can get by without it. And you don’t have to be a big corporation to fall into this category.

Take any mom-and-pop store.

If they have a basic website and run ads online, they are effectively relying on AI 1.0.

Let that sink in for a moment.

If AI 1.0 had such an impact on the “composition” of our economy, imagine what AI 2.0 will do. That capitalization chart will be glowing yellow from top to bottom.

Meanwhile, millions of workers will pour out of cubicles and into the street clutching cardboard boxes.

Historians Don’t See the Future

When people express concerns about technology’s impact on jobs, historians often shrug them off with a thesis that goes something like this:

“While technology destroys jobs in the short term, eventually, the new industries it brings create more jobs.”

They are right; every technology breakthrough, from the Industrial Revolution to the Internet, has ultimately created more—and more fulfilling—jobs. And I don’t think AI will be an exception.

But there’s one big “but.”

The job destruction happens here and now while the job creation part lags. And that lag can sometimes last more than a person’s entire working lifespan.

In other words, there’s a long period of painful adjustment.

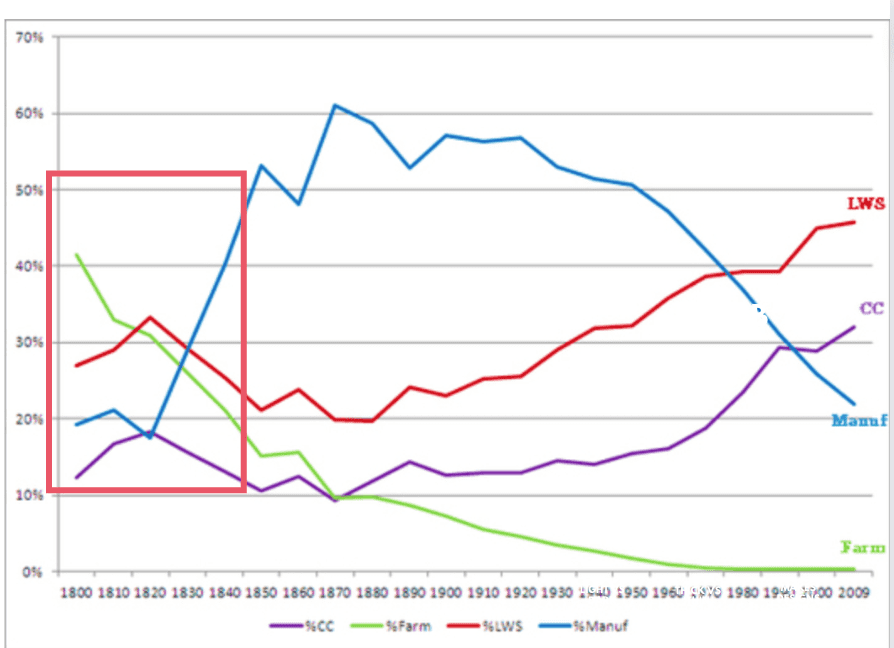

Take a look at the drastic drop in farming jobs (green line) during the Industrial Revolution. And how many decades it took for manufacturing jobs (blue line) to catch up:

Note that this chart doesn’t quite do what happened justice. The 200-year timeframe may fool you into thinking it happened instantly, but the adjustment took more than 30 years.

That’s almost three-fourths of the average worker’s productive lifespan.

That means you are more likely to retire or kick the bucket before you can take advantage of those “more jobs.”

The Window of Opportunity for CBDCs

What will happen when 300 million workers lose their jobs or are “quietly displaced” through lower wages due to AI?

Policymakers will have no choice but to implement some sort of Universal Basic Income (UBI).

Otherwise, they risk nation-wide unrest or, hell, even a civil war.

Of course, UBI is nothing to cheer for. That money obviously won’t be enough to make ends meet. Based on recent proposals, it will barely reach four figures a month.

Nor will it be handed out without strings attached.

Considering the timing of Central Bank Digital Currency (CBDC) and AI, I’m convinced UBI will eventually be distributed in some form of CBDC.

And guess what happens when the public adopts this deep state enforcement tool?

Just read our past letter, “CBDC China: Authoritarian Experiment Goes Mainstream,” to find out.

Seek the truth and be prepared,

Carlisle Kane

I wonder, and this is an assumption, how the companies will generate profits if there is no one who buys the product, if there is no income you cannot spend, that is why I have seen the new homeless are no longer just drug addicts or disabled people asking for money in the streets, now They are the ones who decide to change a life of work and the comfort of having a home, for living without responsibility for anything and you get that by living as a homeless.

In the final graphic for this article, the lines on the chart for Farm and Manuf were discussed. Please identify CC and LWS (the purple and red lines). Thanks!

The AI genre is about to be turned upside down. I would suggest reading “The Spatial Web” and then looking at the company which will dominate the AI space by the name of VERSES AI

The authors of that book and also founders of VERSES AI are light years ahead of all the AI plays including Chat, Baird etc…