A year ago, I exposed how crypto was effectively one high-profile shill campaign.

M0re importantly, I told you that almost all crypto was about to crash.

And crash they did.

But I have to admit; although I was dead on the money about 99.9% of the cryptocurrencies out there, one completely bucked the trend: Bitcoin.

I highly encourage you to read this with an open mind because, in a moment, I’ll show you some data that will surprise you.

But before we get into technicalities, let’s answer the most important question in this debate.

What’s a Store of Value?

Or better, what is NOT a store of value?

For one, it’s not an active component of the financial regime—e.g., shares on a brokerage account or bank deposit. And contrary to popular belief, it can’t be a medium of exchange.

Why?

Because any monetary element of the regime functions as long as it remains in power, but once it fails—and all regimes eventually do— so do its components.

Think of every hyperinflation case that followed fallen regimes like Weimar Germany.

A REAL store of value is a layer above this.

Unlike traditional assets, a store of value is not directly tied to the monetary system, enabling it to retain purchasing power even in the event of its failure. Think of it as a “meta” asset class that transcends the regime itself.

As of today, there is just one asset that has managed to do that.

Gold

Gold went through the bimetallic era of the 19th century…the Civil War and national bank currencies…the Fed’s inception and currency centralization…and even the creation and abandonment of the gold standard.

Regime after regime, the price of gold has steadily climbed. And not just in modern times.

Consider how gold’s purchasing power has endured throughout the centuries…

Via Bullionvault:

“Time of Christ: Under the Roman Empire, an ounce of gold purchased a Roman citizen his toga (suit), a leather belt, and a pair of sandals. Today, one ounce of gold will still buy a man a suit, a leather belt, and a pair of shoes.

400 BC: Some scholars report that during the reign of King Nebuchadnezzar, an ounce of gold bought 350 loaves of bread. Today, an ounce of gold still buys about 350 loaves ($950 divided by 350 = $2.73/loaf).

1000 BC: King Solomon was known to have purchased many horses for his army. Historical records show he bought them in Egypt for 150 shekels of silver each. 150 shekels was about 55 troy ounces of silver. Today, you can still buy a riding horse for 55 troy ounces of silver ($800).”

In other words, gold (and silver) has outlived all the currencies and financial systems ever created.

That’s the reason precious metals have been in demand for as long as civilization has existed.

Even in today’s digital world, central banks hold 34,000 tons of this supposedly “archaic” asset. And their stockpiles keep growing, as we recently discussed.

Why?

Ironic as it is, policymakers need a hedge against the regime they are running.

A Digital Precious Metal?

At first glance, Bitcoin comes across as the furthest thing from gold.

But as asset classes, the two are surprisingly alike.

For example, like gold, Bitcoin has little utility in the economy. It’s also scarce – not by nature but by blockchain. And its value purely depends on supply and demand rather than a centralized monetary policy.

From a technical standpoint, it’s the most democratic form of currency there is. But as is always the case, what looks good on paper doesn’t necessarily translate to the real world.

For most of its lifetime, Bitcoin was a highly speculative asset adopted by nerds and would-be teenage millionaires. Here’s what an archetypal Bitcoin holder looked like just a little while ago:

That’s not the image of the store of value you want see. You don’t want it to be exciting. You want it steady and boring.

Bitcoin didn’t fit that bill by any stretch. It’s been on a hell of a rollercoaster ride 90% of the time. It’s had regulators at its throat. And all that with a mere track record of 13 years and one recession.

But Bitcoin has come a long way since then.

Bitcoin Goes Institutional

Not long ago, Warren Buffet called bitcoin “rat poison squared,” and Wall Street laughed at it as “nerds’ money.”

Bitcoin was too niche for institutional investors.

Consider this: In 2016, the market cap of all Bitcoins in circulation averaged a mere $5 billion. That’s less than 0.3% of Apple’s market cap and about the same percentage share of gold’s overall market.

But look where it is now.

At the peak of its last rally, one in 10 Americans were invested in Bitcoin. And its market cap hit a mind-boggling $1.3 trillion! That’s half of all private gold holdings—including institutional investors.

Think about it.

In a few short years, Bitcoin claimed half of the store of value’s market. And it managed to do so in a “guerrilla” way— without the help of institutional flows such as ETFs, 401(k)s, and IRAs.

But now it’s getting there.

Here are a couple of big developments:

- Last April, Fidelity became the first manager to add Bitcoin to 401(k)s, and it is now weighing adding the crypto to its 34 million brokerage accounts. Considering that Fidelity is the world’s third-largest asset manager with $4+ trillion in AUM, that’s nothing to sneeze at.

- A few months later, Blackrock partnered with Coinbase to bring Bitcoin to its flagship asset manager software, “Alladin.” Few people understand this, but that’s just massive. Think of “Alladin” as the “dashboard” for some of the world’s biggest fund managers that administer a crazy $20+ trillion in assets.

As an institution, you might buy a few bitcoins for PR, as many celebrities and companies did in the midst of the frenzy. But you don’t incorporate it into the core of your business if you don’t mean business.

That’s’ why I believe Bitcoin’s institutionalization isn’t just talk. In fact, I give it a few years at most before Bitcoin is as accessible and liquid as any stock or ETF in your brokerage account.

But that was still NOT what tipped the scales for me.

The regional banking collapse

Remember the series of banking collapses that rocked the U.S. a few months ago?

Here’s a brief refresher from our recent letter, “The Banking Failures Were Planned“:

“It all started with Silicon Valley Bank (SVB). Soon after, Signature Bank went under. And then, First Republic. These three banks wiped out almost half a trillion dollars in deposits. And if that figure doesn’t quite resonate, let me put it in perspective: In a matter of months, a few regional banks lost more than the entire banking industry did in 2008.”

Having half a trillion dollars in deposits wiped out in a few months is not to be taken lightly.

If it weren’t for the Fed, we would be dealing with something much worse than the Great Recession of 2008. And naturally, the risk of a magnified 2008 repeat roiled risk assets.

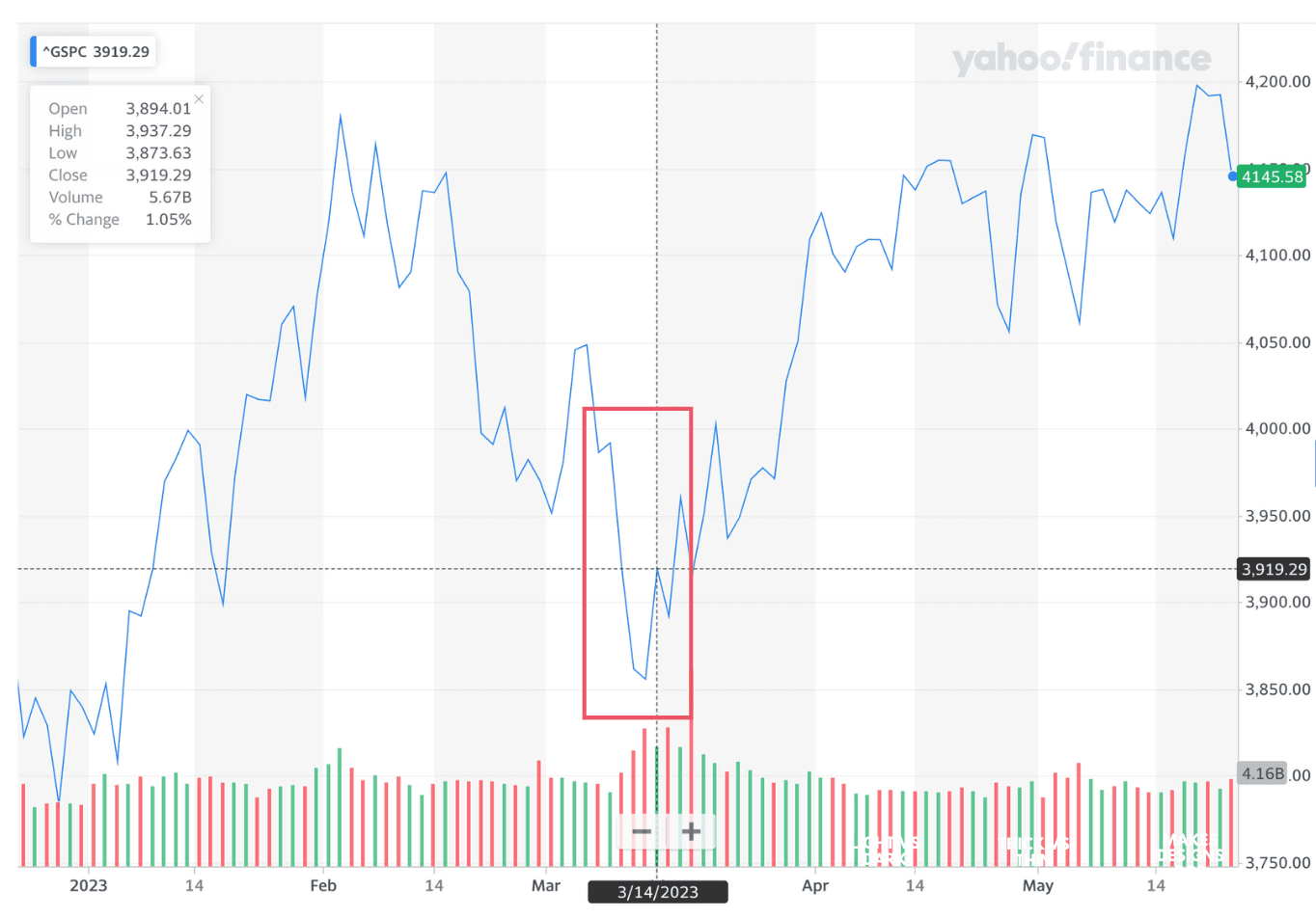

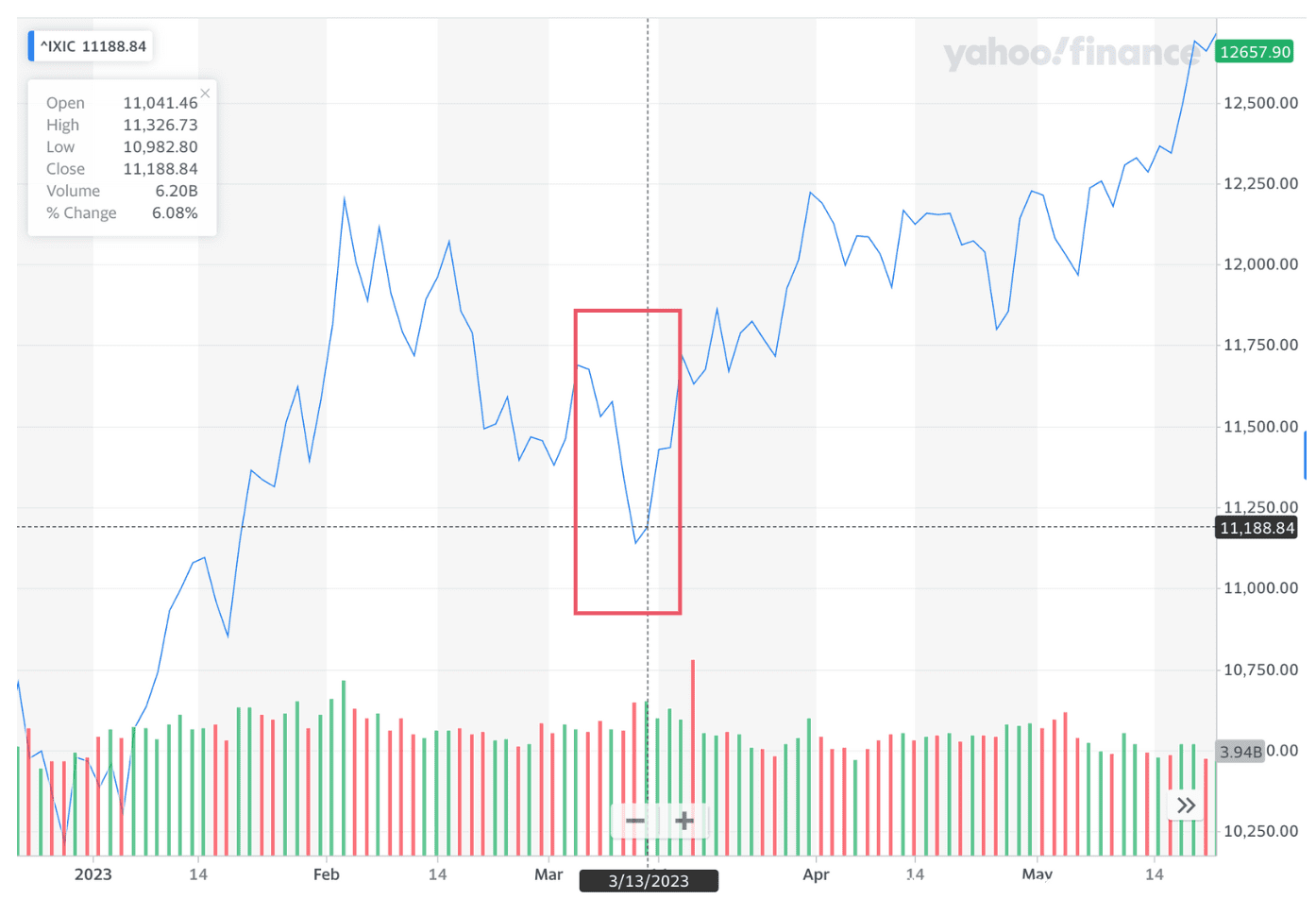

Look at how stocks behaved BETWEEN Silvergate Capital’s liquidation on March 8—which led to the SVB collapse—AND the Fed’s bailout announcement on March 14.

The S&P 500 fell 4%:

Same with tech stocks in the Nasdaq:

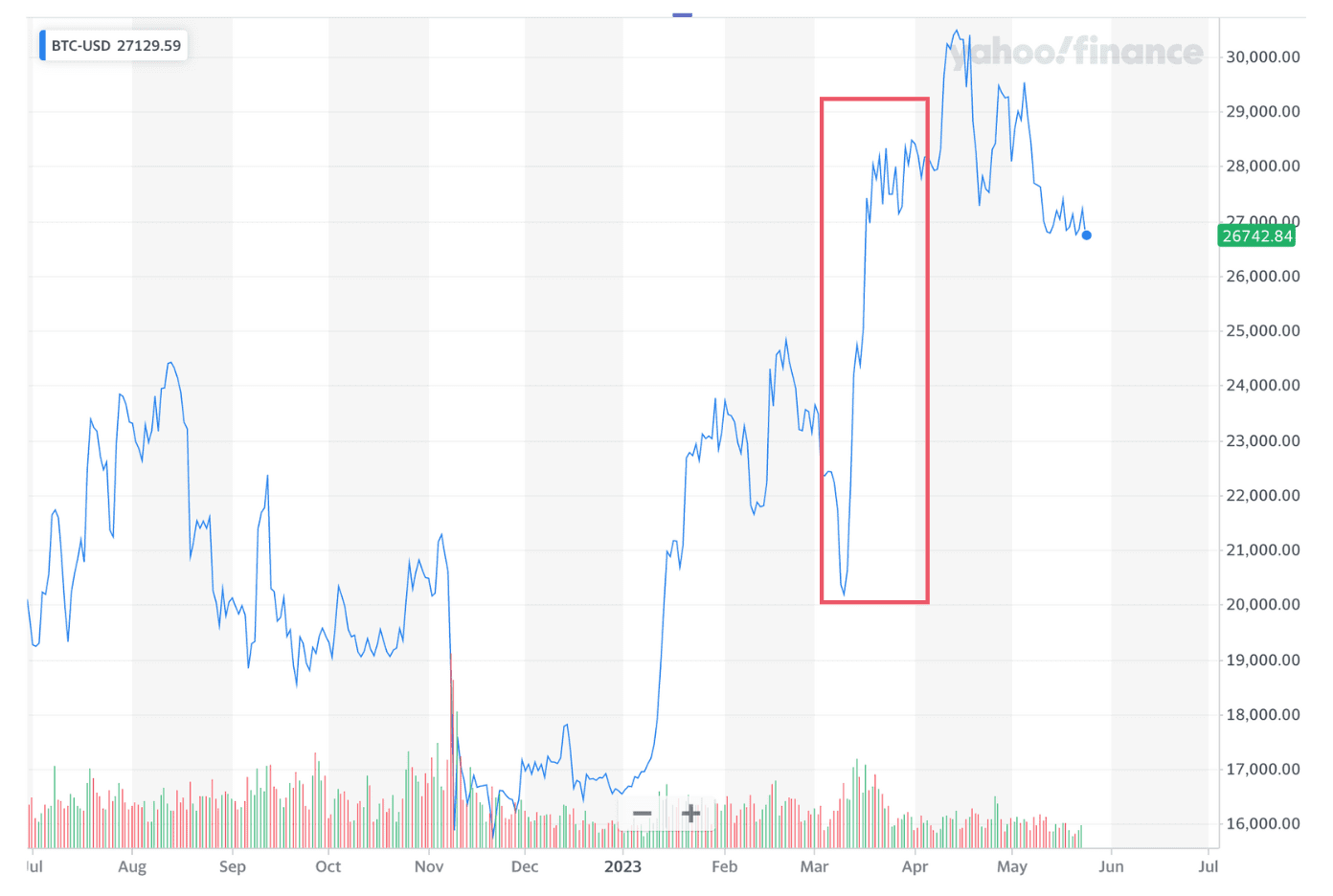

Meanwhile, the only two asset classes that rose as the news broke were – you guessed it — Gold and Bitcoin!

And not by 4% or 10% but by 25%!

That’s a big deal, and not just for those big percentages.

While Bitcoin went mainstream during the pandemic, it still traded like a speculative asset. And its price pretty much behaved like a high beta (riskier) version of the Nasdaq.

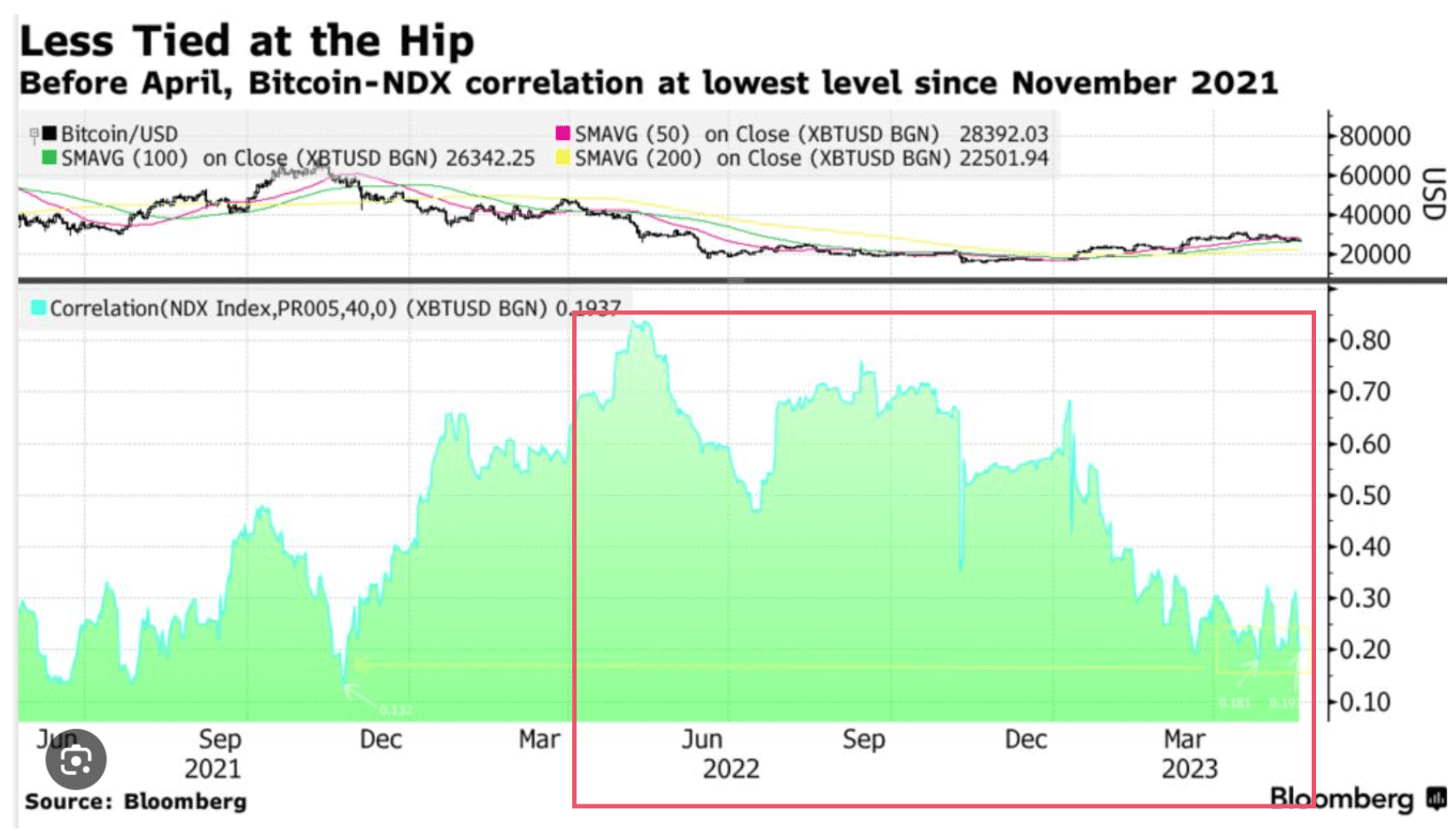

But over time, Bitcoin began to “decorrelate” from tech stocks, as you can see here:

This means it started to behave less like a risk asset and more like a hedge.

This banking crisis was the first real-life test to see if Bitcoin could live up to that expectation. And it aced it with flying colours.

For the first time since its inception, Bitcoin acted like a real hedge instead of a risk asset. And combined with the developments we just covered, there’s a very real chance that Bitcoin will successfully cement itself as an alternative store of value.

Bitcoin in Portfolio

Do I believe that Bitcoin can decentralize the monetary system and become legal tender?

No.

If you have any hope in that pipe dream, think back to Franklin Roosevelt’s “Great Confiscation” and what happened to gold when it threatened to disrupt the Fed’s system.

And do I believe that there is still a chance that the Fed, or whatever ruling elite is out there, are allowing institutions to play the Bitcoin game, just to crash it so people favour CBDCs?

Yes.

But, I do believe that Bitcoin can become a modern “meta” asset, just like gold.

Of course, that’s not to say that Bitcoin should take the place of gold in your portfolio.

But in the same way you diversify across asset classes, it may be smart also to mix up your “stores of value.”

Because these asset classes are not an investment, they are insurance.

And as is true with all insurance, I hope we never have to use it.

Equedia writes great articles, but u have readers from beginners to advanced, and as bad as the worlds fiat currencies are approaching their end cycles, time to CLEARLY explain the definition of Money, ie durable, portable, limited. etc. Bitcoin will never be money, by definition but like a lot of investments, where one invests , one can make the most “earnings” by playing “Fad” stock. But like u explained, the buying power gold, silver remained about the same, did not “make” any money. so just like casinos people play where they can make ” earnings”. Maybe time to explain the fiat dollar world buying power history before BRICS gets recognized for what it will do to the corrupt world fiat game.

I am a regular reader of your newsletter and find it generally educational and informative.

I have never been an investor in bitcoins and don’t intend to start now.

Your discussion about gold cause me to lose considerable confidence in you!! Gold has been in a $1800 to $2100 channel for years!!

Also gold was pegged at $32 for many years until gold coins were recalled.

Then you use a $950 figure for comparison !

SHAME ON YOU !!

Come on, there are enough bitcoin pimps without Equedia jumping on board! Bitcoin, an imaginary computer currency of nothingness ledger system, is in no way a store of value! It is a store of imaginary nothingness, that requires the pimps to sucker in evermore gullible gambling Muppets, or it fails, and the last ones in are the bag holders. To hold bitcoin, is to be a pimp, or you lose! Congratulations Equedia, you made bitcoin pimp extraordinaire status! The problem with pyramid scheme bitcoin, is that there is nothing to redeem (it is imaginary nothingness) which precludes the possibility of anonymity, supply doesn’t expand to mitigate inherent deflation, and it is inherently too volatile (a feature, not a bug) to serve in finance as money. Returning to gold corrects these flaws! Investment institutions see this huge amount of gambling fool Muppet money ignorantly piling into it (due to effective pimping), and they want a piece of the gambling action, and they will abandon the space when pimps run out of gullible gambling Muppets, that can be suckered in and keep it propped up. Also, it is no surprise the government sees dollar signs too and is desperately going after the gullible Muppet tax money!

Even tulips had a modicum of real tangible value, because beautiful flowers are a real something. Bitcoin is absolutely imaginary nothingness, the liability of pimp ability! It isn’t even in the same ballpark as gold, when it comes to a store of value.

Good luck pimps, try not to end up bag holders!

A good read….however, what is “CBDC”?? Why writers use acronyms, I’ll never know.

As for Bitcoin, why do they have photos of a gold coin with a “B” on it when it doesn’t exist??

Yes Bitcoin quantity for customers is protected in blockchain. However, the dollars paid for bitcoins are in Exchanges that are NOT protected by blockchain. As many fake coin exchanges have been hacked for millions of dollars. So much for protection.

I have a friend who had a few bitcoins and when he wanted to sell, he could NOT sell them.

And he was NOT told why………..can you say scam!!!