If everything we say about the new world order is true, why is the dollar still holding strong?

That’s a question we have been asked many times.

And it’s a fair one.

For all the doom and gloom, the greenback has appreciated more than 25%* against other currencies since the beginning of Covid.

(*Measured by the DXY Dollar Currency Index.)

And while it might have dipped recently, it’s still at levels not seen since the early 2000s.

So what’s holding up the dollar?

Today, I will explain the three counterforces masking the dollar’s real dilution. And more importantly, why these forces will soon be out of the picture.

You better be ready.

The End of “Exorbitant Privilege”

The dollar faces two terminal threats—the first being the fate of its reserve currency status.

For the past 70 years, the dollar has been the reserve currency of the most globalized world in history. That status gave it what economists call “exorbitant privilege.”

Because 90%+ of trade is settled in dollars, trading nations are forced to hold the currency in their reserves, thus, creating a nearly insatiable demand for the greenback.

But this “unconditional” buying is coming to an end.

As I exposed in “A New Powerful Global Coalition Is Coming” and recently confirmed by the ECB, the world is switching to a multipolar financial system:

“She [the ECB’s chief Christine Lagarde] also affirmed that the world is moving away from a unipolar trade system. And that free trade will soon fragment around two trade blocs: the West and China’s led BRICS.

“We are witnessing a fragmentation of the global economy into competing blocs, with each bloc trying to pull as much of the rest of the world closer to its respective strategic interests and shared values. And this fragmentation may well coalesce around two blocs led respectively by the two largest economies in the world.”

Not only are these coalitions building out independent monetary systems with their own reserve currencies, but they’re also breaking up global trade by reshoring entire supply chains.

In such a fragmented trade system, the dollar’s hegemony will no longer be the same.

In addition, the dollar’s position in the global economy no longer corresponds to the economic power of its backing nation.

When the Bretton Woods agreement was signed, the US was a beast of an economy that had no match.

In 1944, the US accounted for 50%+ of global GDP. And having dominated key industries, American companies produced over half of the world’s goods.

Furthermore, the Treasury held 80% of global gold reserves—which was, and still is, a de facto reserve asset.

But the US is no longer the sole economic driver of the world.

In 1945, US GDP was 10X bigger than China.

But last year, China’s GDP reached an impressive 18 trillion dollars in nominal terms, positioning it not far behind the United States’ 25.5 trillion dollars.

Not only that, if you adjust for purchasing power parity, China has been crushing the US since 2013 in terms of economic output.

And the US doesn’t even come close to matching China’s growth.

Since the Great Recession, Beijing has accounted for one-third of the world’s GDP growth. And over the past decade, China’s contribution was twice the size of the United States’.

Meanwhile, China is now the #1 manufacturing country in the world and may even hold the largest stockpile of gold.

In other words, the speculation about the decline of the dollar’s dominance is not far-fetched but rather a matter of common sense.

The Allure of US Debt is Fading

Another knock-on effect of the dollar’s “exorbitant privilege” is explosive demand for its denominated debt.

Because most nations hold their reserves in dollars, they face the necessity of finding suitable destinations to safeguard their cash. And obviously it can’t just sit there depreciating in value because of inflation.

So, most of it ends up in what is considered a risk-free safe haven: Treasuries.

This creates a virtuous cycle for the greenback.

The logic is simple.

With an increasing number of dollars circulating worldwide, there is a growing desire among individuals to invest in Treasuries. As a result, the US government can borrow money at lower costs, enabling the economy to continue expanding.

That, in turn, reinforces the dollar’s status as a safe haven asset —which further drives demand for the currency.

Rinse and repeat.

But there’s a catch.

This cycle works only if new investors (also known as the marginal buyer in finance talk) keep wanting to invest in US debt.

But that might not be the case anymore.

Via Bloomberg:

“Everywhere you turn, the biggest players in the $23.7 trillion US Treasuries market are in retreat.

From Japanese pensions and life insurers to foreign governments and US commercial banks, where once they were lining up to get their hands on US government debt, most have now stepped away. And then there’s the Federal Reserve, which a few weeks ago upped the pace that it plans to offload Treasuries from its balance sheet to $60 billion a month.”

Since the dawn of this century, the Fed has been the biggest buyer of Treasuries. And in times of lower demand, the central bank simply printed money and bought Treasuries to fill the shortfall.

But, as we’ll soon discuss, the Fed’s hands are now tied. And this means the Treasury will need the private sector and foreign investors to pick up the slack.

The challenge lies in the diminishing allure for those buyers.

According to a Bloomberg analysis, most foreign buyers are trimming off their Treasury reserves. That includes the historically biggest buyers, such as China and Japan.

Emerging market nations are selling off, too.

Via Bloomberg:

“Countries around the world have been running down their foreign-exchange reserves to defend their currencies against the surging dollar in recent months.

Emerging-market central banks have trimmed their stockpiles by $300 billion this year, International Monetary Fund data show.”

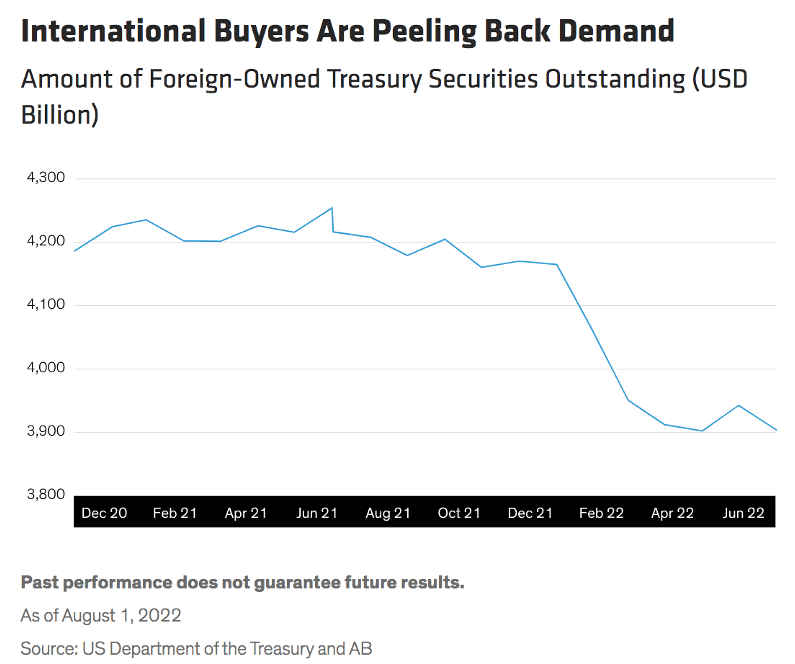

In the past year alone, foreign holders sold off roughly 10% of their Treasuries:

And this doesn’t appear to be a passing trend.

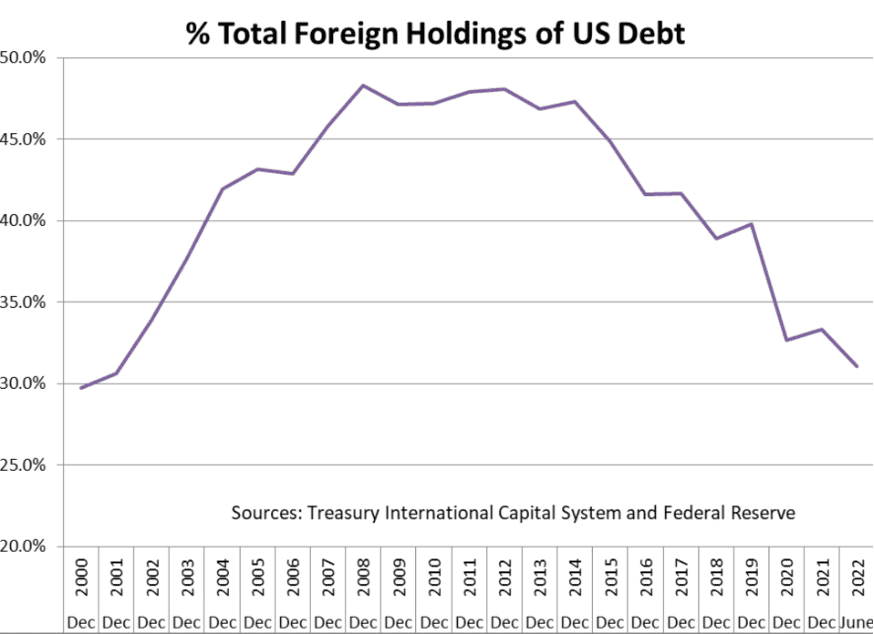

If you zoom out, you’ll see that foreigners have been shunning Treasuries for nearly a decade. Since 2008, their holdings have fallen from 50% to just over 30%.

That’s why Peter Boockvar, a well-respected fund manager, recently warned that the Treasury may not “find buyers to take the place of the Fed, foreigners, and the banks.”

What will happen when Uncle Sam can’t fund its deficits with Treasury debt?

Simple: the Fed will have to either print more and devalue the dollar to prevent default, or it will have to make the terms of that debt more attractive – such as a much higher interest rate.

Despite all these systemic risks, the dollar is still hovering at multi-decade highs. Why?

Masking the Dollar’s Weakness

The answer lies in three “counterforces” that have temporarily propped up the dollar.

Firstly, the Federal Reserve took the lead among major central banks in raising interest rates post-Covid. And due to the attractive rates offered by the Fed, a significant influx of capital gravitated towards Treasuries as a secure and high-yielding safe haven, which in turn exploded demand for dollars.

But now that most central banks have caught up with the Fed, the sugar rush is wearing off.

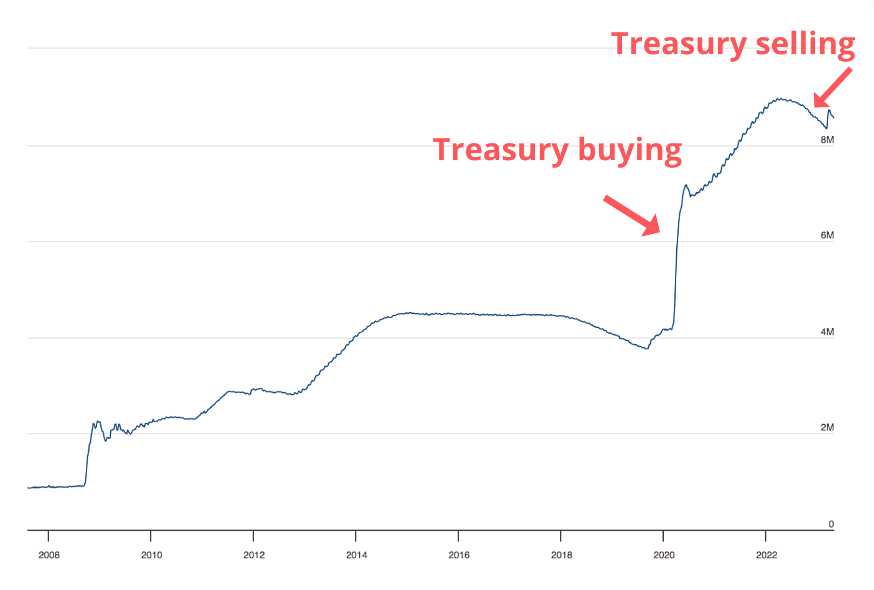

Secondly, the Fed was by far the biggest Treasury buyer of the pandemic. To revive the Covid-struck economy, it more than doubled its balance sheet from $4 trillion to $8 trillion – effectively compensating for the diminishing demand from traditional buyers.

But the monetary expansion is over, and the Fed is now looking to unwind its balance sheet.

In other words, if Fed Chair Jerome Powell actually intends to prevent an uncontrolled surge in inflation, the Fed will no longer be capable of bridging the gap in demand for Treasuries.

Thirdly, major powers, including China, have primarily held dollars in their foreign exchange reserves to stabilize their own currencies. Paradoxically, as the dollar strengthened throughout the pandemic, these nations had to acquire even more dollars to support their respective currencies (as evidenced by Sri Lanka’s near bankruptcy and subsequent 65%+ inflation surge when it lacked dollar reserves).

However, with the introduction of BRICS’ own reserve currency and the global shift towards a multipolar monetary system, these nations will no longer require as many dollars in their reserves.

Debasement Has Begun

I hope that this letter gave you more clarity on why our thesis runs counter to the dollar’s price trends. We’re not trying to tell you what is happening today – the talking heads can do that.

We’re trying to tell you what will happen in the coming years.

The dollar’s current rally is just the calm before the REAL DEBASEMENT.

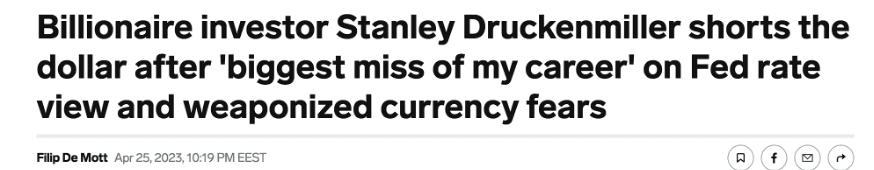

And the Big Money is already making moves.

At an event hosted by Norway’s sovereign wealth fund, Stanley Druckenmiller—Soros’s right-hand man who helped him break the Bank of England—revealed his fund’s big bet against the dollar.

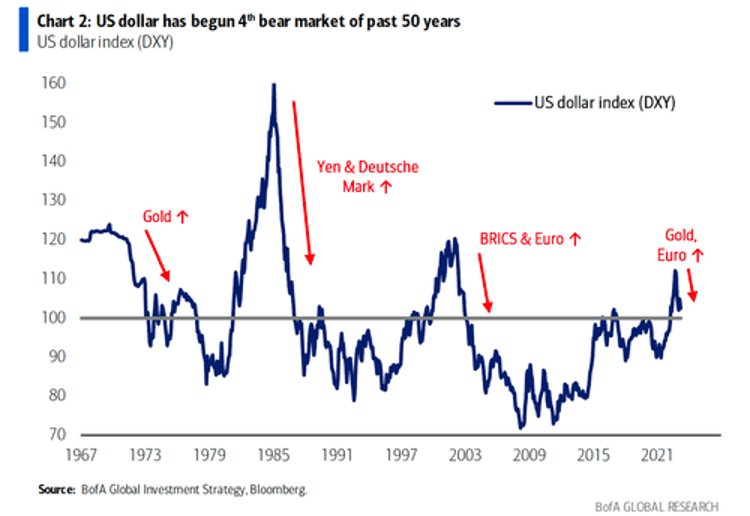

Meanwhile, there’s word on Wall Street that the dollar is in the fourth structural bear market, and banks are urging their clients to get out:

In fact, Bank of America predicts that the dollar will debase by at least 20% from here.

So, if you haven’t yet, it might be a good time to give your portfolio another look. Pay special attention to how much of your capital is tied to hard assets vs. dollar-denominated paper.

Because, like a company running out of money, the dollar will eventually become a victim to dilution.

Seek the truth and be prepared,

Carlisle Kane

Your column omits consideration of the effects of the many problems China faces. Enormous debt, a shrinking and aging population, and the departure of possibly thousands of employers which could lead to millions of unemployed Chinese. Leading a successful effort to create a second reserve currency could be difficult.

Everyone is aware that all government are are increasing their debt rapidly. Where do they get the money? The printing press will be very busy. The search for alternative ways to protect the value of currency is finding limited options.

Although gold has always been the last resort of value, not all countries accept this premise at present. However as the weeks and months go bye, more and more people and governments will start to realize that the old relic of value called gold is starting to make more and more sense. As you cannot “print” gold, you need to either bid to get it from someone who has gold, or you need to find “new” gold via exploration and mining. A dilemma for many countries.

The U.S. has been in decline,since at least 1970.The decline is accelerating.China has the opportunity to be the #1 country,if it’s govt stays out of the way.

Very good issue. Worth noting in the chart of foreign holdings of US debt the market weakness began around the 2013/14 period — which is when Obama administration began using sanctions against Russia and Russian citizens. That is when Russia China and any other nation paying attention began to look for backup alternatives to the Dollar and to the SWIFT system. It is why Russia was relatively well prepared to deal with sanctions from Biden and company. Sanctions accelerating the de-dollarization process.