Something BIG is happening behind closed doors.

And by the time you hear about it on the news, it’ll be too late.

That’s why it’s important for you to read what we are about to share.

Last week, we talked about the mysterious coincidental deaths of those in the crypto space.

And just days after that Letter, another one bit the dust.

Via Coin Telegraph:

“Russian billionaire Vyacheslav Taran, president of Libertex Group and founder of Forex Club, died Nov. 25 in a helicopter crash in France while en route from Lausanne, Switzerland to Monaco. He was 53. The helicopter pilot, the only other person aboard the craft, also died.”

This marks the third death of a major crypto player in just the last few weeks.

Could these deaths, the timing of the FTX scandal, and the fall of crypto, all be a coincidence?

Perhaps.

But as our saying goes, coincidences are only coincidences if you can’t connect the dots.

So let’s see if there are more dots to connect.

A Secret Buyer

While everyone is rushing to sell crypto, a MASSIVE player is quietly buying something else.

That’s right: gold.

Yet, here’s what the mainstream media is telling you about gold:

Here’s what it’s not telling you…

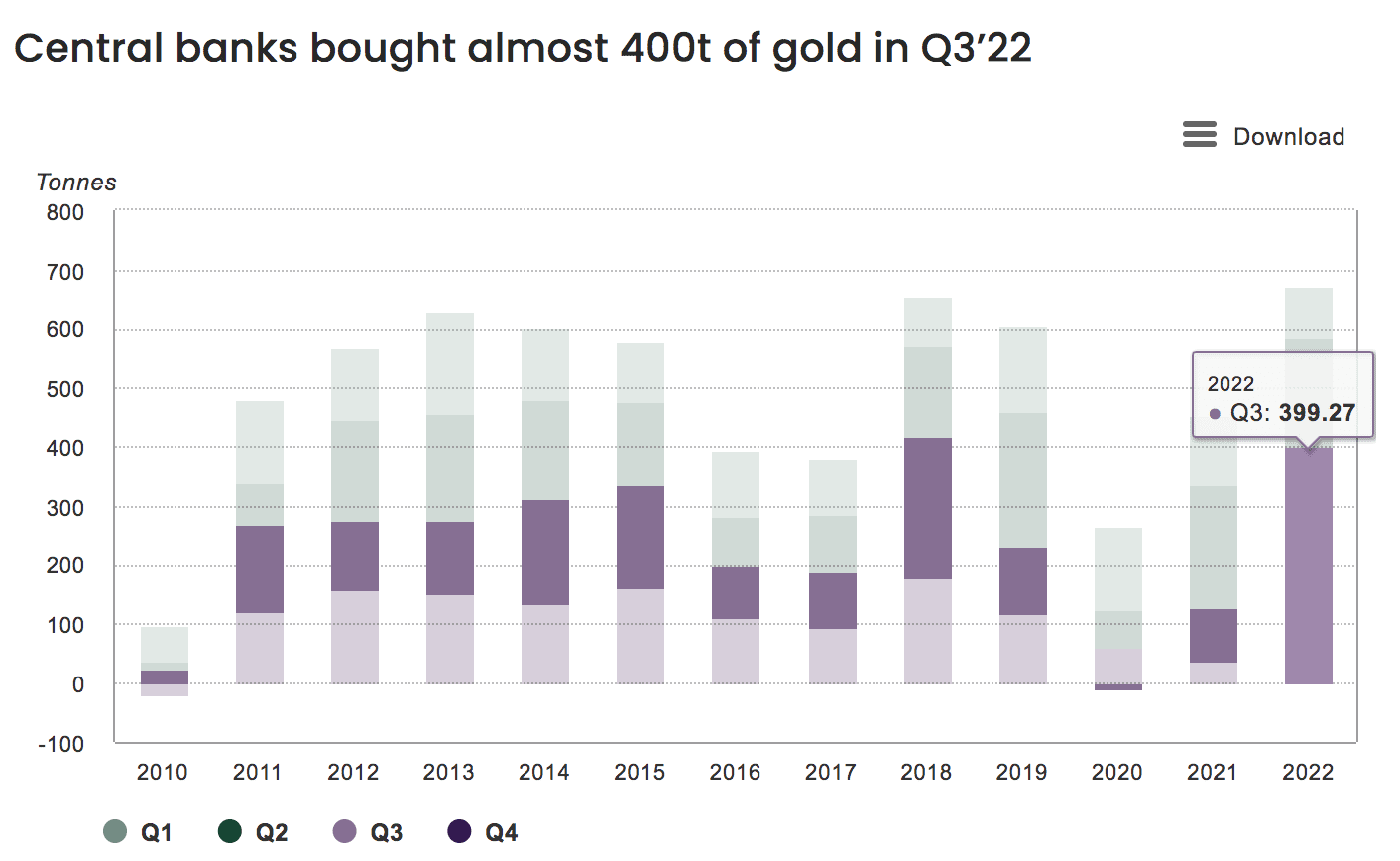

Central banks are buying more gold than they did during the last leg of the gold standard buying frenzy.

According to a fresh report from the World Gold Council, central banks added 673 metric tons of gold to their reserves this year. That’s more than 4x the amount last year. Get this:

… higher than in any year since 1967.

Some countries, like Uzbekistan, have brought their gold stack to two-thirds of all their reserves.

And while its normal for central banks to buy and sell gold, this is much different.

Trust me.

You see, there’s no official record of who bought most of this gold.

In fact, 87% of the purchases went to an undisclosed buyer – most of which was bought just prior to the recent crypto deaths, scandals, and fallout.

Today I’ll show you who that buyer is and why its sudden gold hoarding forewarns the beginning of a massive shift in the perception of money.

The Western Gold Exodus

Consider for a moment how seemingly out of place this gold buying frenzy is.

In the first three quarters of 2022, the global investment demand for gold fell off a cliff. With investors redeeming 227 tons of gold, ETFs saw the biggest outflows since 2013.

But while private investors are offloading gold, central banks are doing exactly the opposite.

In the same period, central banks stocked up 673 tons of gold—more than any full year since 1967.

And the buying frenzy has just begun.

Almost two-thirds of this year’s gold purchases took place in Q3—a whopping 115% jump compared to the quarter before:

It’s not hard to explain the lost allure of gold on the investment side.

The Fed’s U-turn on policy has brought interest rates and the dollar to multi-year highs. And when that happens, investors tend to switch from gold to bonds. (Read full explanation here.) Why would you hold onto an asset that doesn’t pay a dividend when you can get over 5% interest in a bond?

So why, then, are central banks buying?

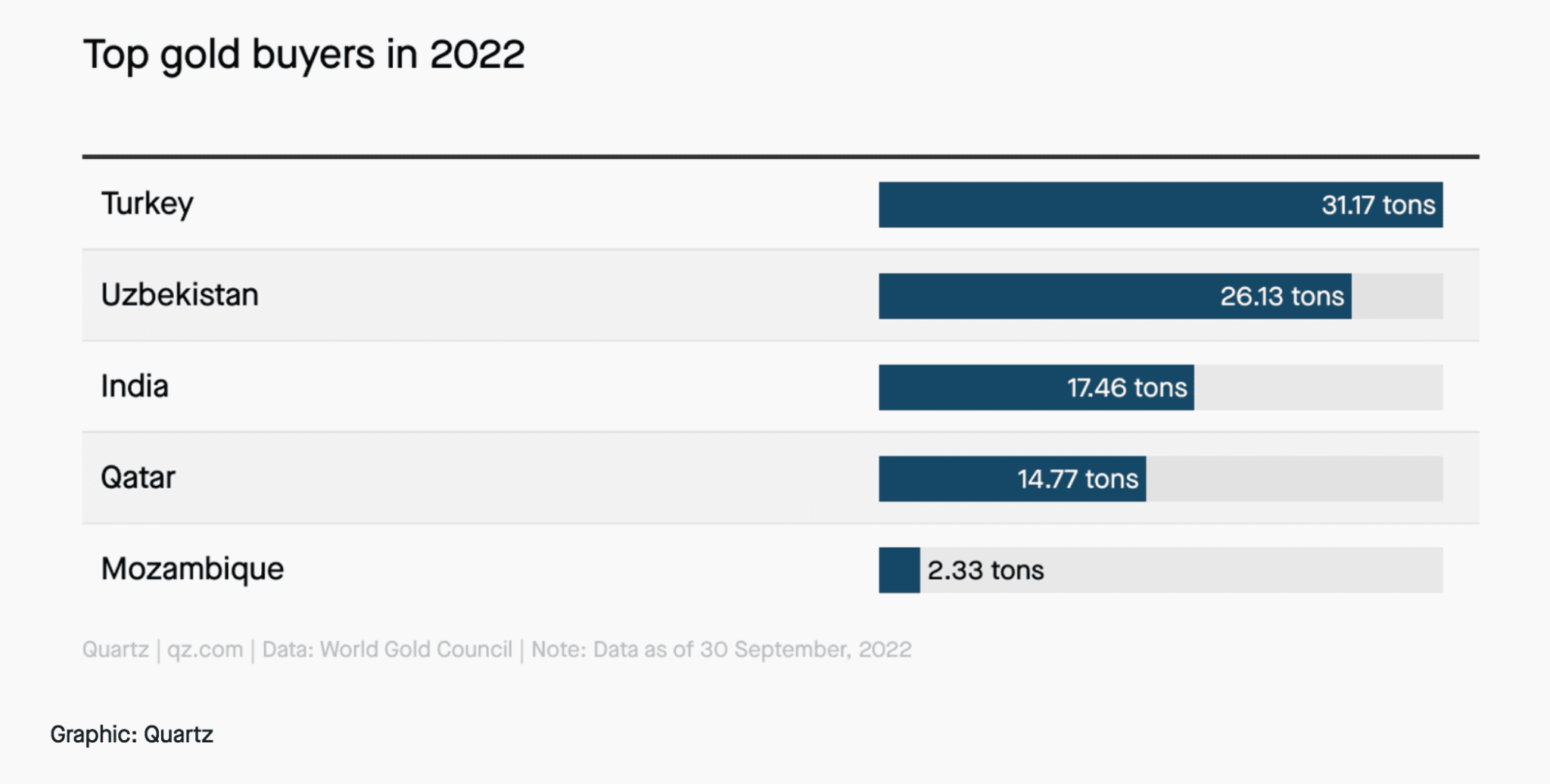

For the first clue, take a look at which central banks officially bought the most gold:

Of those, Turkey is leading the pack, with Uzbekistan right behind.

(Interestingly, until very recently, Uzbekistan planned to replace its gold reserves with Treasuries. But after Russia invaded Ukraine, it suddenly backed off and loaded up on more gold.)

But take a closer look at that chart.

Notice that the five biggest official buyers purchased just 91 tons of gold, making up only 13% of all gold purchased in that period.

Where did the rest of the gold go?

There’s no way to account for every ounce of gold in reserves because many central banks keep that confidential. But a few clues reveal where that 87% of gold went.

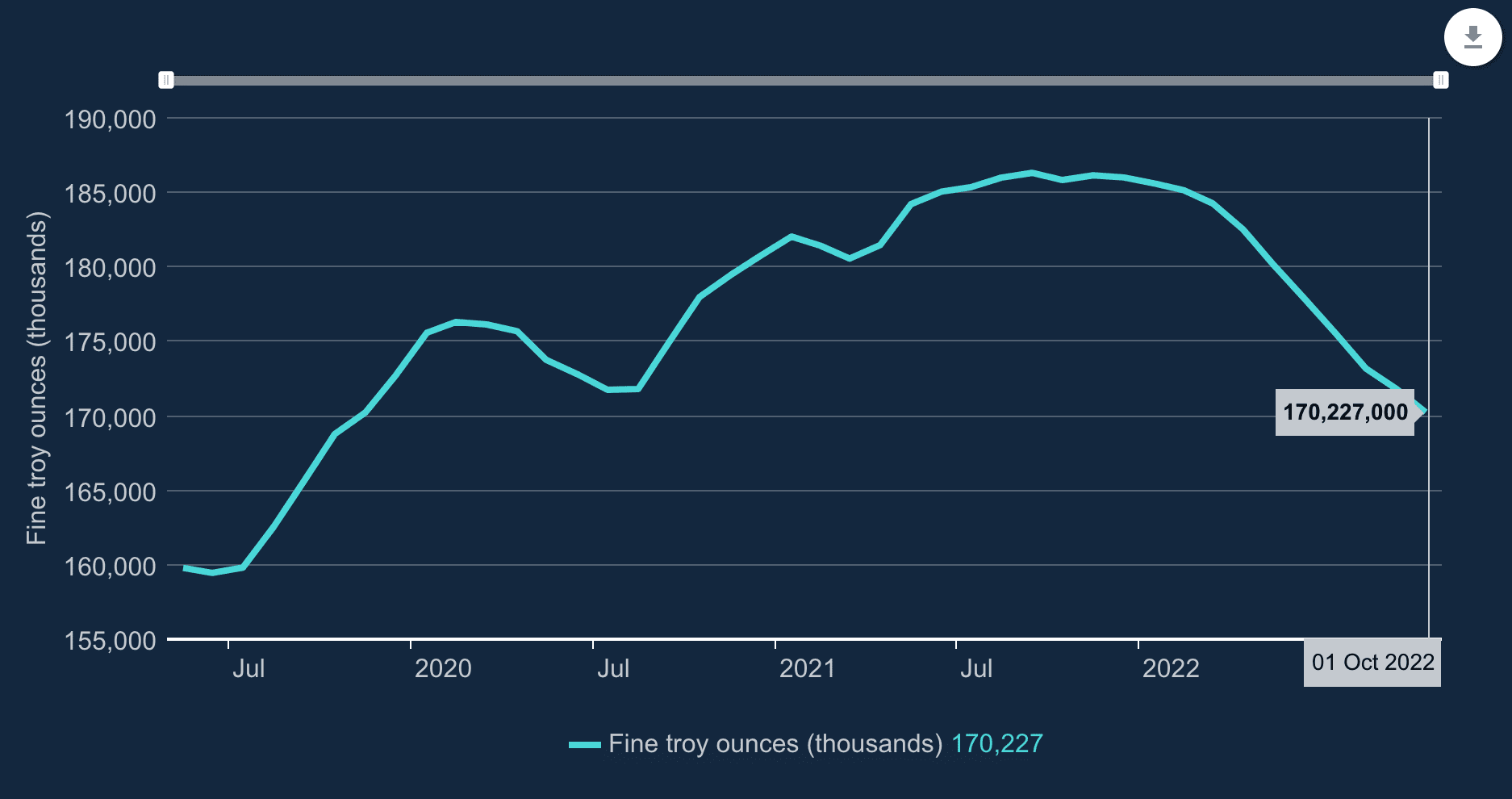

For starters, let’s rule out Western central banks that haven’t been into gold for a while.

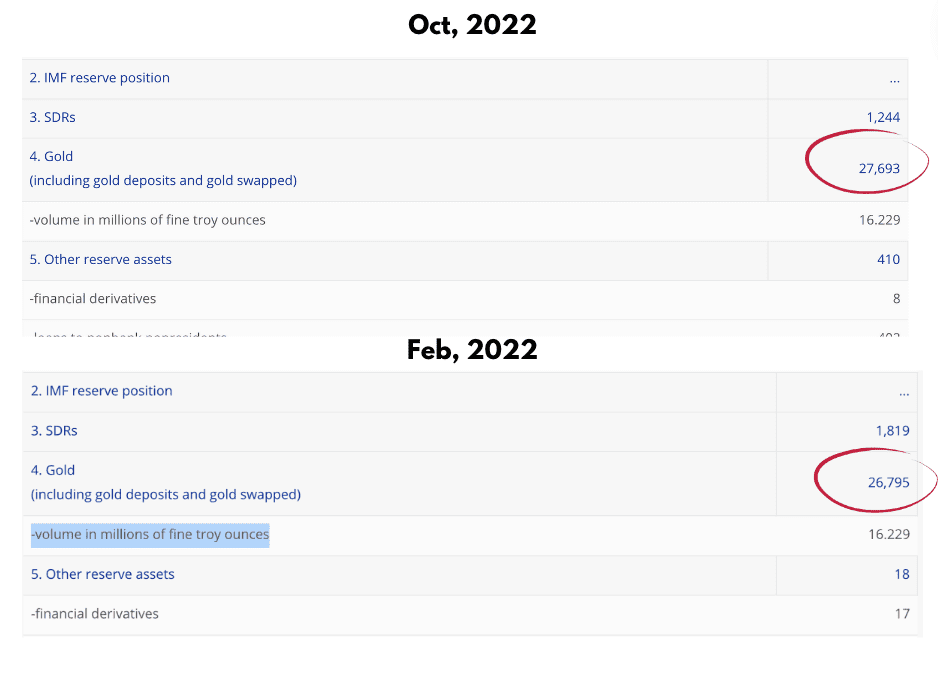

Here’s the Bank of England:

And since this past February, the ECB added just $100 million worth of gold— a mere 0.3% of central bank purchases this year.

What about the Fed?

The U.S. gold reserves held with the Treasury officially remained unchanged since 2008. And by all measures, it’s plausible there is a net exodus of gold from the country.

The Fed’s goal is to maintain the status quo, that is, keep the dollar as the global reserve currency. And an increase of gold presence in central bank reserves works contrary to its intent.

But that’s not the case with China.

Although China officially hasn’t added an ounce of gold to its reserves since 2020, global gold flows paint a completely different picture.

This year, China’s gold imports have reached the highest level since 2018.

Via Schiffgold:

“New York and London vaults have reported an exodus of more than 527 tons of gold since the end of April, according to data from the CME Group and the London Bullion Market Association. At the same time, gold imports into China hit a four-year high in August.

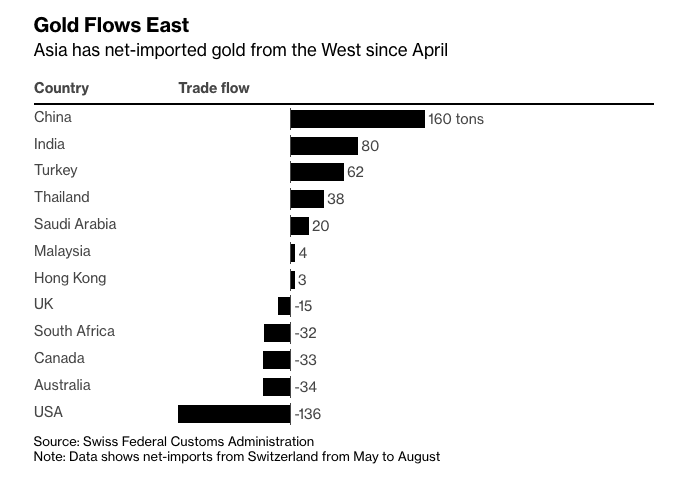

India, Turkey, Thailand, and Saudi Arabia have also reported increased imports of gold.”

In fact, demand for gold imports in China is so high that gold premiums in China are at a 6-year high:

“Asian suppliers are having a difficult time getting enough bullion into Asian markets. As a result, there has been a significant increase in premiums in many Asian countries. For example, September’s average premium in China reached the highest monthly level for nearly six years.”

China also imported (net) over 160 tons of gold from Switzerland during the May-August period alone:

That’s just three months from one gold market. Imagine the figure if you extrapolate that to all wholesale gold markets, including the London bullion market, and extend the timeframe.

Keep in mind that China doesn’t just import gold – it’s also the world’s biggest producer of it. Last year, it mined 370 tons of gold, and there’s no chance that gold left the country because gold exports are banned in China.

But there’s more.

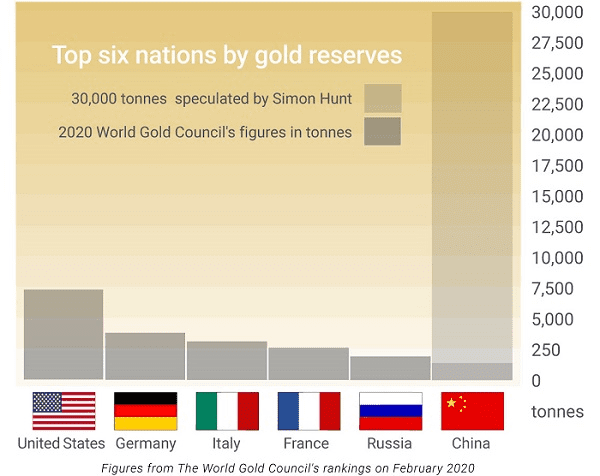

According to unofficial sources, China bought part of Russia’s gold reserves when the West froze its foreign reserves. Itsuo Toshima, former Japan director for the World Gold Council, thinks China could have added over 2,000 tons to its gold stock.

Think about it.

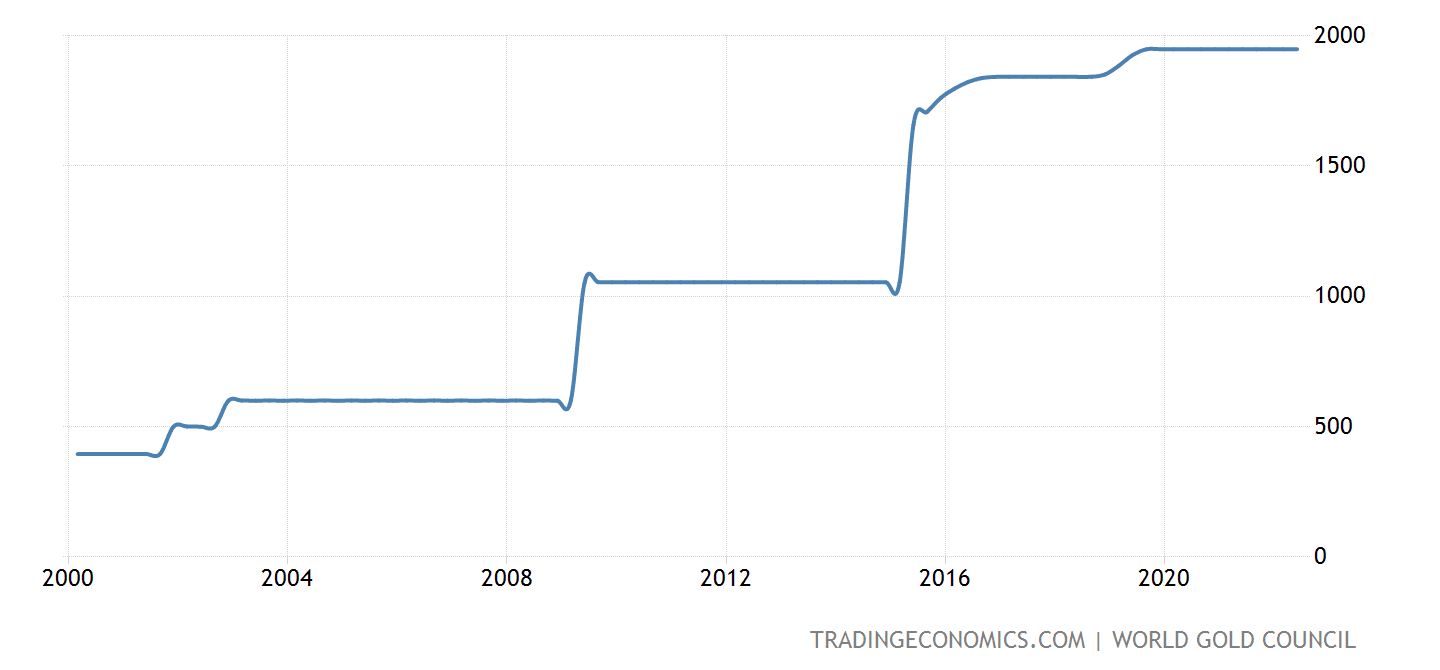

China imported 160 tons from Switzerland this spring alone; it produced hundreds of tons, then bought 2,000 tons of Russia’s reserves. And yet, China’s official reserves have barely budged since 2016:

Does that make sense to you? Could the people of China be buying all of this gold to protect themselves from their government?

Possibly.

But regular Chinese citizens don’t exactly have the power to broker a 2000-ton deal with Russia.

China is clearly stocking up a massive stash of gold in secret – as they have been doing for many years.

Via our Letter from from 2015, “China’s Next Move in Becoming a World Power“:

“We already know that China, and other central banks such as Russia, are continuing to increase their gold positions. We also know that China is likely hiding the full truth when it comes to how much gold it actually owns. I suspect that the primary reason for this is that it wants to accumulate as much gold as it can at low prices, and exchange much of its foreign reserves for gold.”

In fact, by the calculations of Simon Hunt, a well-regarded gold analyst, China today is holding 15x more gold than officially reported:

And China’s biggest anti-Western allies are following its lead.

But why the sudden rush?

A New Global Reserve Currency?

As I revealed a few weeks ago, China took advantage of the West’s war with Russia to “de-dollarize” its trading partners.

Edited excerpt from “A New Global Currency is Live”:

“After the West isolated Russia, China came to its rescue by buying up its embargoed energy. But China’s seemingly “altruistic” gesture was more of a Trojan Horse for the yuan than genuine political support because China forced Russia to ditch the dollar and trade oil and coal in their own currencies.

Meanwhile, Russian companies began issuing hundreds of millions of dollars in yuan-denominated bonds.

And now, the yuan is moving along the global supply chain. For example, UltraTech Cement, India’s largest cement company, reportedly paid for a shipment of coal from Russia in yuan, according to Reuters.”

Soon after, China began testing the digital yuan for international transactions through a CBDC equivalent of SWIFT—which eliminates the need for dollar-dominated correspondent banking:

“Last week, China successfully completed a 40-day trial using its digital currency to settle cross-border transactions with Hong Kong, Thailand, and the United Arab Emirates. The trial processed over 160 payments worth $22 million – all in real-time. Those transactions came through the so-called “mCBDC bridge. “—which was designed to settle real-time payments in CBDCs without using correspondent banks.”

But here’s the thing many overlooked.

If China wants to control the next reserve currency, it can’t push a fiat yuan. Just as countries hate to depend on the easily manipulated dollar, they’d hate to adopt a new fiat reserve currency only to subject themselves to the same deceit.

In fact, at the last BRICS summit, Russia hinted that emerging economies want a reserve currency built on a basket of export-driven currencies that would all be backed by gold and other commodities.

Unlike the post-Bretton Woods fiat system, the next monetary regime won’t be built on a currency with the most notes circulating worldwide. Instead, it will likely be built on one backed by the largest stash of gold.

China knows that and has been diligently preparing for this moment.

The Crypto Coincidence?

Knowing all of this, could China have also orchestrated the recent downfall of crypto?

You see, China has been seizing billions of dollars worth cryptocurrencies from its citizens for years.

In 2019 alone, China seized 194,775 BTC, 833,083 ETH, 487 million XRP, 79,581 BCH, 1.4 million LTC, 27.6 million EOS, 74,167 DASH, 6 billion DOGE and 213,724 USDT, worth over $4 billion.

And guess where that crypto went?

And guess where that crypto went?

Right into China’s national treasury.

And China hasn’t stopped its crackdown.

Earlier this September, it arrested another 93 people for what it called crypto-related money laundering.

In other words, China has a massive stash of cryptocurrencies it never paid for.

A massive stash it can dump at anytime.

It’s no wonder rumours keep popping up about China’s crypto manipulation.

Via Cryptoslate.com in May 2021:

“An anonymous user apparently not only predicted yesterday’s massive sell-off on the crypto market but also claimed that it was an organized China-related campaign aimed at a single “stakeholder”—half a day before the trading carnage actually began.”

Now get this.

On November 5, China-owned Forbes released this headline:

The next day, on November 6 (as mentioned in our Letter last week), CZ of Binance, the largest crypto exchange originally created in China, said Binance would release all of its FTX tokens from its books – all $2.1 billion worth.

Via our Letter, “The Biggest Scam in History”:

“

A few days before the bang, FTX’s biggest competitor, Binance’s CZ, announced the liquidation of $2.1 billion from FTX’s token FTT.

The announcement immediately sowed panic in the market. Within 72 hours, FTX clients lined up to withdraw $6 billion.

$6 billion that FTX didn’t have.

And so it filed for bankruptcy.”

Could Binance be a double agent for China?

Could the clients who lined up to withdraw $6 billion also be from China?

China does, after all, have $6 billion in cryptocurrencies, as Forbes suggested just the day before CZ’s tweet on November 6.

Was this all just a coincidence?

One could even argue that the number 6 is of significance. But we won’t go there.

The Mother of All Trade Wars

Is the timing of the crypto crash and the large purchases of gold by China a coincidence? Or is it all part of a bigger plan to introduce the world to a new CBDC (central bank digital currency) monetary regime?

Regardless of whether the Fed, China, or a higher power orchestrated the crypto crash, we are entering one of the most turbulent times in modern history.

It is likely that China will soon propose the digital yuan as the new reserve currency backed by real assets. BRICS countries will adopt it according to the plan, but the U.S. will push back.

Next, we’ll see the world breaking into two opposing monetary poles; on one side, you’ll have the U.S.-led fiat system. On the other, there will be the China-led gold standard.

No one can say who will come out on top in such an interconnected world.

But one thing is certain: There’s always a number one.

And we know the current champ won’t go down without a fight.

Prepare for a major trade war to sort out this new arrangement—and its scale could be unlike anything we’ve ever seen.

Get ready.

Seek the truth and be prepared,

Carlise Kane

What you are writing sounds quite reasonable. The question however is, as an international investor, what would you invest in. Alibaba, Tencent, …? Or gold, silver and other asset mining companies?

Frank

Very good article as usual. China always is doing things with underlying intentions. Gold is but another topic with underlying meaning. Keep up your good work EQUEDIA.

An excellent analysis of the gold/cripco situation. I admire your thoughtful analysis of the gold situation. Gold has always been the last resort for value when paper money is overprinted.

Was ist endlich und bedingt verfügbar: Gold. Als der erste globale Datenverlust, Daten die Weltwirtschaft in die Knie zwang, Erhebt sich genau das die alten Werte zu einem globalen Kampf um die Macht des Glitzerns . Bis die Sinnlosigkeit darin zu erkennen dass die Menschen die wir sind und dann waren, auf der Strecke geblieben sind. Schildbürger Global !

Orakel-Records

This NEEDS explicit things to do to keep us SAFER ……in Direct regards to your analysis and warnings!

Gosh… you didn’t even mention Sam and his bimbo CEO or his parents or the “democrats” and the clinton foundatation? Another coincidence or just more missing dots?

If governments bought 400 tons of gold why hasn’t gold prices gone up?