We warned you it was coming.

People are mysteriously dying and billions are missing.

In 2018, the CEO of Canada’s largest crypto exchange, Quadriga, died suddenly – locking away hundreds of millions of other people’s money.

Earlier this month, crypto king Nikolai Mushegian was found dead just days after the following tweet:

CIA and Mossad and pedo elite are running some kind of sex trafficking entrapment blackmail ring out of Puerto Rico and caribbean islands. They are going to frame me with a laptop planted by my ex gf who was a spy. They will torture me to death.

— ☀️☀️☀️☀️☀️☀️☀️☀️☀️☀️☀️☀️☀️☀️☀️☀️☀️☀️☀️☀️☀️☀️☀️☀️ (@delete_shitcoin) October 28, 2022

And just this past week, Tiantian Kullander, the co-founder of the $3 billion cryptocurrency firm Amber Group, died suddenly in his sleep.

Meanwhile, multi-billion dollar crypto operations are now imploding one after another.

In May, one of the largest stablecoins, Terra’s Luna, crashed to zero, and wiped out $60 billion of value.

Then in June, Celsius, a supposed crypto bank with $25 billion in Assets Under Management (AUM), faced a liquidity crisis and shut its doors.

And now comes the failure of one of the biggest crypto exchanges in the world: FTX.

As you’ve probably heard, the $25 billion exchange recently froze its clients’ assets and filed for bankruptcy.

The mainstream media is now totally focused on the criminal aspect of the story and the losses. And as well, they should be.

BUT this story goes much, much deeper than that.

While different from a technical standpoint, these crypto bankruptcies share one key characteristic: they were all staged bank runs engineered by people very high up on the food chain.

That’s right: none of these crypto failures were an accident.

As I’ll explain in a moment, they’re all part of a plan to introduce a new monetary order—or what we call the “ultimate enforcement system”—that Ivan first predicted more than nine years ago.

In fact, Ivan has warned you for years that – despite the rise of Bitcoin – cryptocurrency would be used as a scapegoat to usher in a central bank-controlled digital currency.

But before we get there, let me break down the FTX fraud to show you how the higher powers will use it as a scapegoat.

The Biggest Fraud in Modern History

In just a few short years, FTX grew to a $32 billion company and became the world’s second-largest crypto exchange. Every day, it processed over $10 billion in transactions from over a million customers.

FTX sponsored F1 races, bought naming rights for Berkley’s football stadium, and signed a 20-year advertising contract with Golden State Warriors. It was backed by big names like Steph Curry, Tom Brady, and Larry David.

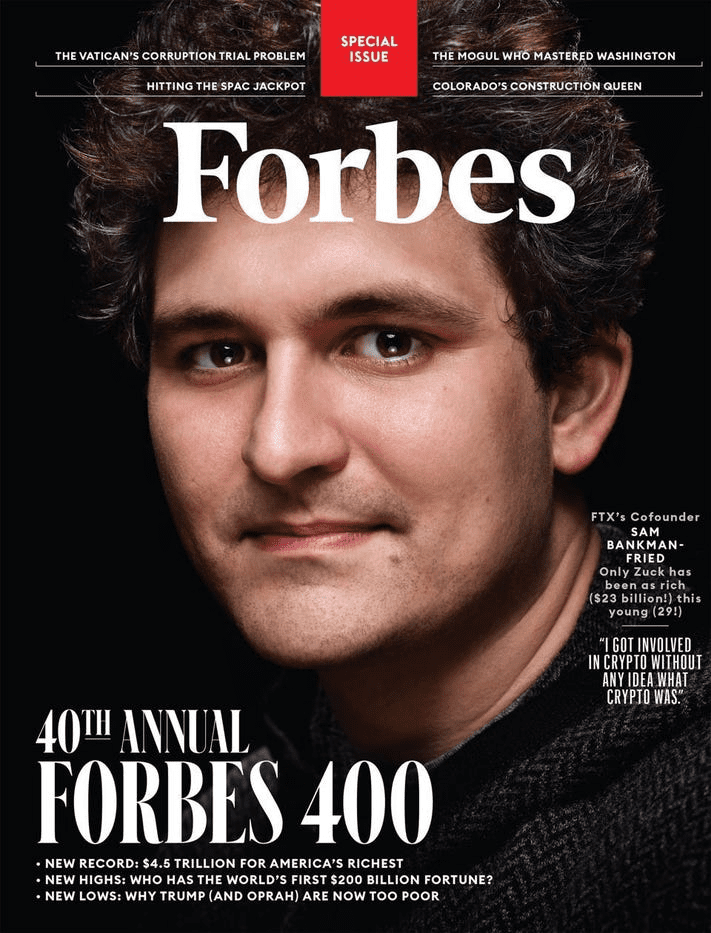

Meanwhile, its founder, Sam Bankman-Fried, earned himself the tag of “wonder crypto child” and gained tremendous influence.

Meanwhile, its founder, Sam Bankman-Fried, earned himself the tag of “wonder crypto child” and gained tremendous influence.

He was on magazine covers.

He had dinners with the power elite, including Jeff Bezos.

And in just a few years, the 30-year-old accumulated more than $26 billion in net worth.

But FTX didn’t get there by just tricking unsuspecting individual investors. It raised more than $2 billion from hedge funds and investment banks—including the world’s biggest, BlackRock.

And that’s where things get suspicious.

How on earth did this guy convince the smartest financial experts to bet billions of their clients’ money on a “pinky swear?”

The Rules Don’t Apply

A typical regulated stock brokerage like Fidelity has to comply with two strict SEC rules explicitly designed to prevent FTX-like insolvency and protect investor money.

Rule #1: All brokerage firms must hold a mandatory minimum of liquid capital against liabilities as a reserve.

Rule #2 (which goes above all else!): They must keep client assets (both cash and securities) in a separate account from the firm’s assets.

If a brokerage becomes insolvent, creditors can’t touch investor money. Even in the case of fraud—like FTX—there’s an FDIC-like protection in place that insures investors’ assets held with a brokerage.

None, and I repeat, none of these safeguards applied to FTX.

This means money managers poured billions of dollars into an operation, knowing it didn’t answer to any regulatory agency.

But it gets even worse.

Balance Sheet From Hell

Not only wasn’t FTX regulated, but it was also a complete black box.

FTX was run by a bunch of friends in the Bahamas who openly called themselves “degenerates.” They didn’t have a board, and no one from outside was allowed to come aboard.

Nobody knew what they were up to.

Until now…

As part of bankruptcy procedures, FTX had to open up its books. And oh boy, did it unleash shrieking monsters from financial hell.

Bloomberg’s Matt Levin conducted a great analysis of FTX’s finances leaked by Financial Times (FT). If you want to delve into the weeds, I highly recommend his op-ed “FTX’s Balance Sheet Was Bad.”

Here are a few gems to give you a taste of how far things have come.

For one, the company didn’t hold nearly enough liquid capital to cover its liabilities. According to FT numbers, FTX had just $900 million in easily marketable securities against a jaw-dropping $9 billion in liabilities – the day before it filed bankruptcy,

The remainder of its assets were locked up in highly speculative cryptos—which weren’t properly marked down—or illiquid venture capital.

The biggest asset on FTX’s balance sheet was a crypto called Serum. The exchange held a staggering $2.2 billion position in this crypto. Yet, as of November 14, its entire market cap was worth $88 million, according to data provider CryptoCompare.

That’s right.

FTX had gambled away a $2.2 billion position that’s now worth less than $88 million.

But that’s not all.

FTX’s absurdity of a balance sheet also contains a negative $8 billion entry called, get this, “hidden, poorly internally labeled ‘fiat@’ account.”

A hidden eight billion? How does anyone overlook eight billion on a balance sheet?

That’s the question that will likely never get a real answer.

What we can answer, though, is where that money actually went…

Over $10 billion of client money was siphoned off to Alameda – an FTX subsidiary crypto hedge fund run by Sam’s ex Caroline who had no trading experience but apparently did have a drug addiction.

Her fund took that money and used extreme leverage to gamble it away on speculative crypto coins without FTX’s clients’ consent or knowledge.

In other words, Sam’s FTX didn’t directly invest its clients’ money in speculative cryptos; it lent it out. To another company. That he owns. Which used it to invest in cryptos.

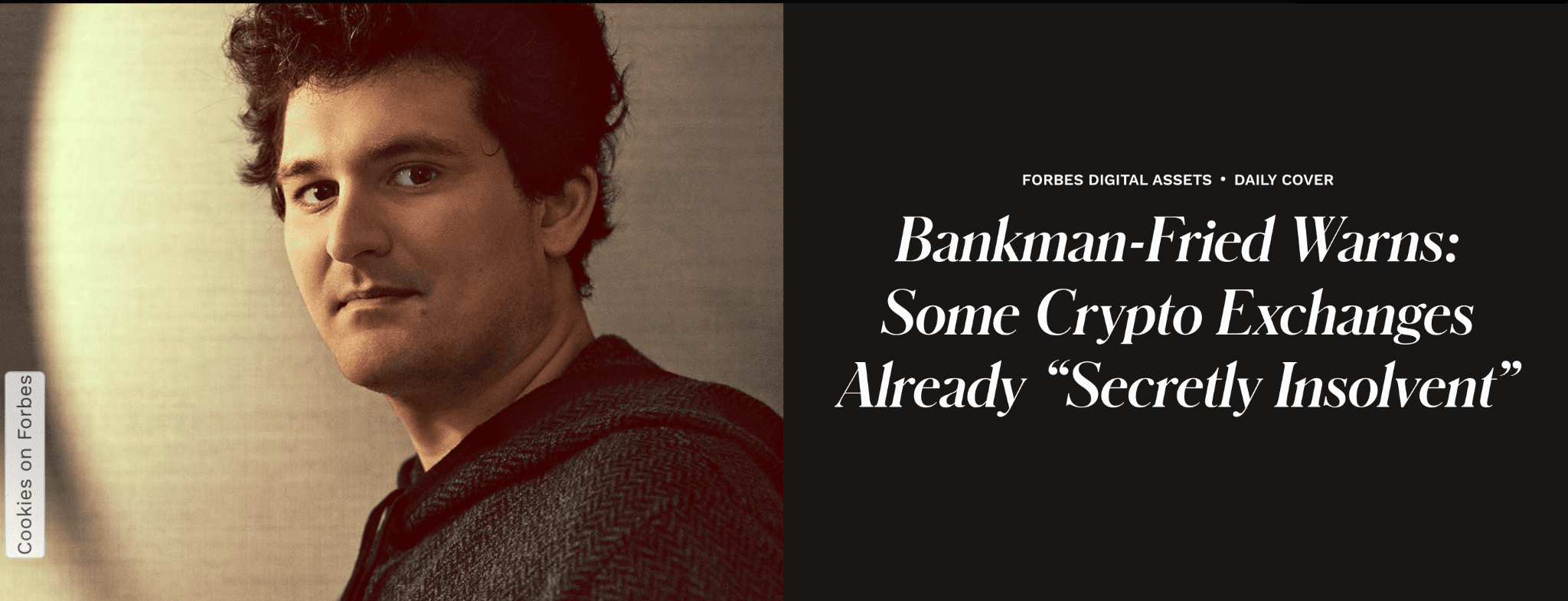

And as if all that wasn’t enough of a sign that FTX was up to no good, on one podcast, Sam explicitly admitted that crypto was just one big Ponzi scheme.

And that many crypto exchanges were “secretly insolvent.”

Did Government Allow the Crypto Crash?

The number of red flags could bury an entire nation.

But the biggest question is: How did the SEC allow this to happen?

Considering that what we know is based only on publicly available information, how much more did they know that hasn’t yet surfaced—and maybe never will?

And yet, the legislation that could have reined in these fraudulent schemes is now gridlocked for years:

If FTX were a Wall Street operation, Sam would have been in handcuffs ages ago.

Instead, they waited until this crypto house of cards grew so big that one nudge could cause max collateral damage.

And soon enough came the nudge:

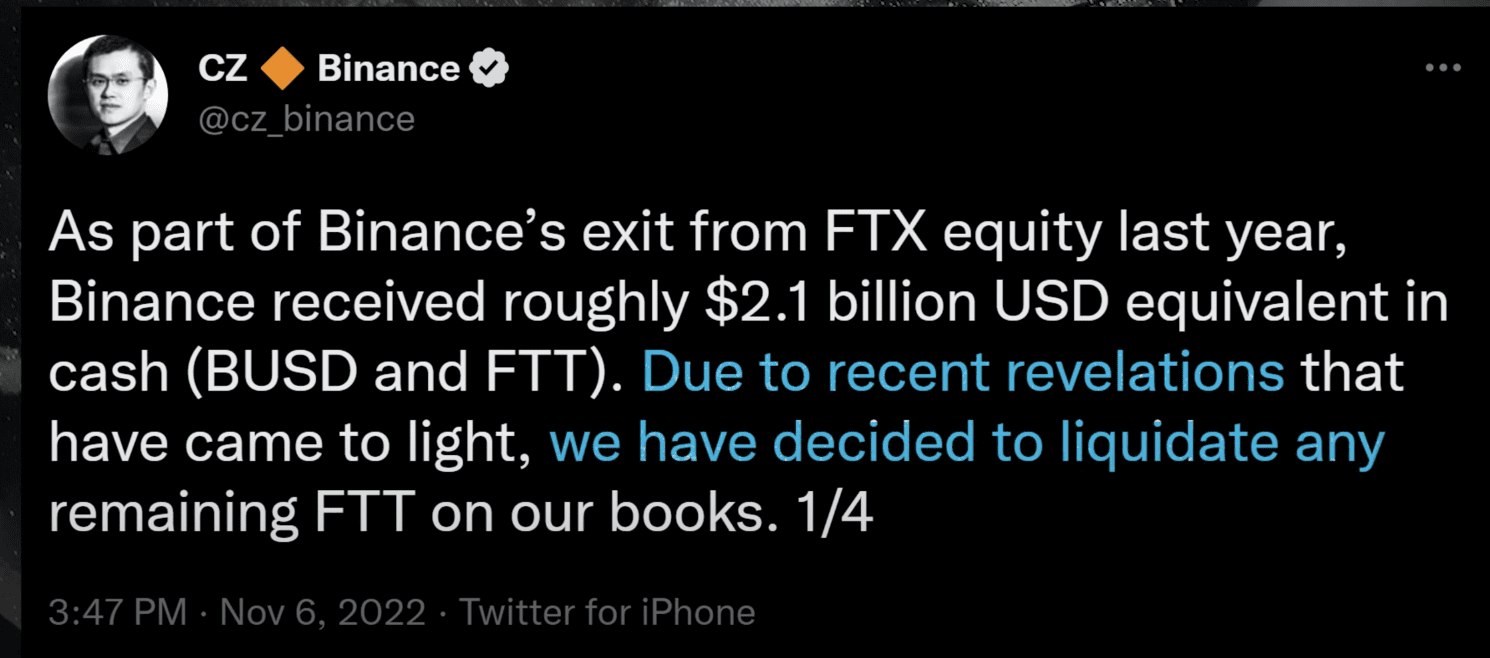

A few days before the bang, FTX’s biggest competitor, Binance’s CZ, announced the liquidation of $2.1 billion from FTX’s token FTT.

The announcement immediately sowed panic in the market. Within 72 hours, FTX clients lined up to withdraw $6 billion.

$6 billion that FTX didn’t have.

And so it filed for bankruptcy.

Although there’s no direct proof that CZ took orders from high up, is it a coincidence that he’s publicly praised the White House’s efforts to clamp down on crypto before the liquidation?

Is it a coincidence this is all happening as China ramps up its digital yuan efforts, as we told you earlier this month in “A New Global Currency is Live?”

If that were the case, FTX leader’s name alone would be an insult: (Uncle) Sam’s Bank Man has been Fried.

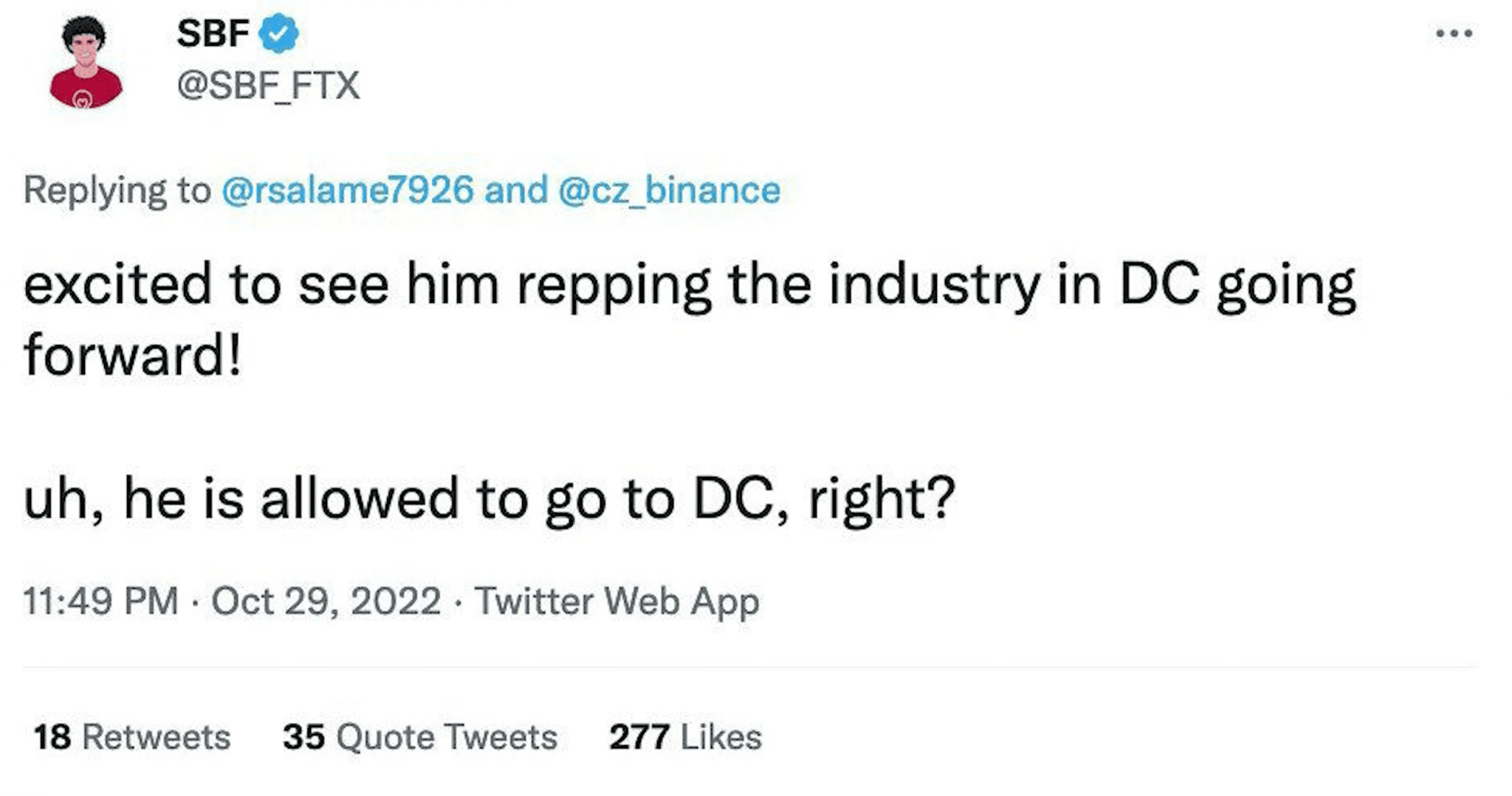

Perhaps Sam’s now-deleted tweet from October implied that CZ’s reach on Capitol Hill was deeper than anyone knew:

Doesn’t this whole setup sound strikingly familiar?

Let’s wind back to May when the first crypto domino fell—Terra. As I wrote in “Why Did Crypto Crash?“:

“As you probably witnessed, two of the largest cryptos, TerraUSD and Luna, blew up in smoke—wiping out over $40 billion of capital.

Ivan and I aren’t fanboys of these cryptocurrencies, and I predicted something like that would happen sooner or later. But, however useless, these cryptos didn’t die from “natural causes.”

The liquidity dry-up was so fierce and fast that only a coordinated attack could have caused such a blowup. In fact, there’s talk of an undisclosed wallet that raked in over $815 million from this implosion.

The heist began on May 8 when the attacker offloaded one-third of its UST position, which created a liquidity shock. UST couldn’t absorb it and slightly drifted from its peg to 99 cents.

The trader then doubled down and offloaded the rest of $650 million in UST. UST fully de-pegged to ~$0.6. And, over a week-long “bank run,” the cryptocurrency lost nearly all its value.”

Terra’s crash was an identical bank run engineered by someone who can move billions of dollars—that is, someone who is very high up on the food chain.

But who benefits from such a sheer infliction of pain and losses on people at such scale?

The answer?

Those who want to ingrain a specific narrative into the public’s psyche.

The Digital Dollar

If you have been reading Equedia long enough, you know that the Fed is following in China’s footsteps to introduce its own CBDC.

Known as the digital dollar, it is designed to give the Fed absolute control over the entire depository chain. It will be able to “print,” selectively distribute, lend, and even take away your money without notice.

Most worrisome, the Fed will hold this immense power without Congress’s backing.

But, unlike China, the U.S. is a de jure democracy. And in a democracy, introducing such a centralized monetary system is no small political feat, which requires a lot of public priming.

So how exactly is destroying crypto helping the Fed to condition the masses?

It’s all about optics.

If the government banned crypto from the get-go, it would have started a “guerilla war” and incited even more pushback against centralized control.

But instead, it played along. It let private cryptos grow big, unregulated, and then, with some help on their part, fall under their own weight.

In other words, they fooled the masses into believing that a decentralized model would never work. I can’t put it any better than I did back in May:

“Maybe that was the plan all along: gaslight the masses by letting them believe in something so badly, then deliberately destroy it to raise a generation of hopeless conformists.”

Boy was Ivan right.

He first warned of this in 2013 when bitcoin started taking off!

From the Dec 2013 Equedia edition:

“Could it be that the rise in the value of Bitcoin was orchestrated by bankers to control the Bitcoin supply? Could it be that they drove up the price of the virtual coins, just so they could slam it and scare investors away?

After all, no matter how many Bitcoins you buy, they’re purchased with currency created by central banks.”

In fact, as Ivan often stated, one of the main principles of Bitcoin – anonymity – is the same reason it can be so easily manipulated. What if the Fed or central bank entities controlled 50, 70, or even 80% of the Bitcoin supply? It could easily send the price skyrocketing at any time.

It could also crash it.

Then in 2017, he warned and predicted the creation of the digital dollar:

“Could they be creating their own new monetary system as I described?

Could they be allowing everyone to pour money into these currencies, only to crash them so that the people will once again only rely on fiat, or rather digital, currencies controlled by central banks?

…In other words, there could be a reason why governments around the world are letting cryptocurrencies run rampant:

-

-

- To temporarily infuse free money into the system “off-the-books.”

- To implement Cryptocurrencies of their own once the technology is proven and accepted (or once it fails and they step in to save the day).”

-

Seems like we are inches away from an inflection point.

Could more deaths in the crypto world follow?

One thing is for certain: there will be more crypto implosions.

Regulators will suddenly call to end this.

And it will be just in time for a digital dollar you can trust…

Seek the truth and be prepared,

Carlisle Kane

Don’t forget to subscribe for our free weekly newsletter to see what the mainstream media won’t expose!

My theory has been Cryptos are a deflationary strategy by the Fed . In the zero interest years fiat poured into Cryptos . Now as inflation returns all the fiat that poured into Cryptos will be destroyed as Cryptos collapse reducing the amount of fiat in circulation.

I have always thought that cryptos were nothing more than “Pump and dump” vehicles started out of thin air. Biggest mistake we ever made was taking the dollar off the gold standard. When that happened we should have replaced it with Silver or land backups. Something anyway…maybe not the fore mentioned. Maybe someone has a better idea. All I can say is let china do a pump and dump digital coin. They will eventually suffer like Bitcoin and other cryptos investors are doing. Biden and his handlers including Obama just want complete control of your money and your whereabouts and what you are spending it on along with the ability to take it away from you without a moments notice.

I don’t get it. Why are you so worried about a digital dollar? Effectively, we already have one.

Almost all of the dollars in circulation in modern times are digital dollars that will never turn into cash.

They start as computer entries and never turn into anything other than computer entries.

You don’t call that digital money?

Moreover, almost all dollars currently in circulation are borrowed money.

They are not actual cash to begin with. As in money just simply handed to someone.

The process by which most new money gets into the system is the following.

Someone borrows money from a bank.

The bank deposits the borrowed money in the borrower’s bank account.

This is nothing more than a digital entry increasing the balance in the borrower’s bank account.

The borrower then starts spending the money and that is how the money gets into circulation.

Monetary velocity then determines how things go from there.

But in almost all cases, the money is not eventually spent by first going to a cash machine and turning the bank entry into cash.

It is an electronic transfer of money in one form or another, say, debit or credit card or bank wire.

And that just continues that way from then on. The money never turns into cash.

It remains electronic money. Fully monitorable by the banking system.

The proposal by the Federal Reserve is just simply to convert what remains of cash currency in the system into electronic money.

That is a very small step from what is already going on.

Part of my point here is that what you are talking about in terms of what you think the Fed and the government plan to do, they could in reality have long since already done.

Because almost all the money in modern times is already a digital currency to begin with.

Think about it.

Whenever you see a number with a dollar sign in front of it, in other words, a dollar balance somewhere, is that balance likely ever going to turn into cash, in other words, appear in the system eventually as cash? No. The answer is no.

You confusing credit with a digital dollar. Hit the nearest ATM pull out $200, or cash a check for the same amount. Now go buy whatever you want, sex, drugs, gold, lunch, etc. Who knows where that money was spent and who was there to stop you?

Now enter the new world of digital, and understand just as the gold, and silver certificate were replaced with the Federal Reserve Note so will be all paper money. Each dollar you earn will be. digital so as will be every dollar you spend. All dollars will be controlled by a central authority, no hiding cash in the mattress or storing in gold. One day you’ll say something on social media or be in the vicinity of a person who is not following the plan (terrorist). Instantly all your dollars will be locked up, you’ll be an outcast from the financial system.

Welcome to the WeChat app and China.

What an interesting way to destroy inflation by destroying the fake currency that accelerated inflation. The perception of eliminating somthing that was never there, the magicians best kept secret, until now

All offshore. In fact US entity appears to be sound and has processed withdrawals. What is your agenda? Anyone who invests in crypto should know it is risky in the first place and in this case didn’t do due diligence on the custody of their assets. Of course, as usual, when right wing trash lose or get fleeced the first thing they do is run crying to the government who they don’t want to fund and swear shouldn’t interfere in their lives. Oh now it’s a conspiracy. Shut the F up.

You always know someone is a Leftist because they just want people who disagree with them to shut up.

Why are you so angry Steven?

And why is this a Left or Right thing?

My question is of what value would it be to own sold, silver or other precious metals in such a digital system? Seems like ownership would profit zilch!

there is a lot of money that changes hands in the USA that is under the table. I know several people who work under the table (obviously manual labor type jobs), and of course do you think that bartender or waitress will accurately report all those cash tips? If your boss can no longer hand you $100 for your 1/2 day of labor but instead has to digitally transfer it to your account then the government doesn’t have to guess what you did with that hundred they know exactly where it went (and you certainly can’t deny it). A lot of unpaid payroll and income taxes that Uncle Sam wants from You! + the fact that that unreported income would make some people ineligible for food stamps and other government programs.

And no one could buy or sell unless he had the mark of the Beast

NEVER BOUGHT INTO IT (NO PUN INTENDED). COULDN’T SEE THE LOGIC. CALL IT AN INABILITY TO SEE BEYOND THE DOLLAR OR, CALL IT GENIUS TO SEE THE LACK OF SENSIBILITY IN THIS. I BELIEVE THAT MORE POWER HOUSE WILL FALL BUT, WHAT DO I KNOW?

While we all greatly appreciate your honesty about how (and by whom) we are all being scammed psychologically by all the really big players; including the different world governments…… this certainly causes me ANXIETY!! I just wish that there were long articles like this, coming out from Equedia Highlighting Plans being worked on to STOP all this totally Centralized Thievery!! Otherwise, we all just get to sit here and wait to be CRUSHED!