Last month, China made the world’s first cross-border transaction in a digital currency.

But it wasn’t just some sort of crypto/Bitcoin retail transaction. It was part of the digital yuan test simulating direct transactions between China and its partners without dollar-dominated correspondent banking.

And that’s a BIG deal.

In fact, after China’s successful test, Russia announced it would begin tests using the digital ruble and yuan to settle transactions with China.

Is this the beginning of a new commodity-backed reserve currency that the largest non-western countries have already pledged to launch this year?

I’ll tell you in just a moment.

But first, let’s look at how far the digital yuan has come and how China plans to use it against the dollar.

The Digital Yuan

In 2020, China became the first country to roll out the central bank digital currency (CBDC) domestically.

In April, the People’s Bank of China (PBOC) launched a beta test for the digital yuan app in four small cities. Later, the beta app was officially launched for iOS and Android in Chinese app stores.

Today the e-yuan trial program covers 23 cities, including Beijing, Shanghai, and Tianjin. And last month, the PBOC pledged to expand it to Guangdong, Sichuan, Hebei, and Jiangsu provinces.

These aren’t just small random cities. They are four whole provinces that make up 350 million people – one-fourth of China’s population.

After extensive testing, the PBOC also released the full-fledged digital yuan app, letting millions of residents sign up for digital wallets through multiple state-owned or controlled commercial banks.

But by far the most important push comes from the no-so-private* private sector.

Shortly after the news broke, Tencent-owned WeChat, China’s biggest messaging and payment platform, announced it was rolling out the digital yuan as a payment option.

WeChat has a mind-boggling 1.2 billion users, of which 750 million are active daily, which means coming on WeChat will expose China’s CBDC to half of its population and bring it closer to mainstream adoption.

(*It’s obvious Tencent didn’t adopt the e-yuan voluntarily because it directly competes with Alibaba-owned Alipay and Tencent’s WeChat Pay, which control 94% of mobile payments in China. It can be easily assumed that the Chinese Communist Party (CCP) forced it to, which, if anything, signals that China is rushing to roll it out nationwide. If you think that’s far-fetched, remember that Alibaba’s founder Jack Ma disappeared for three months after he pledged to revolutionize China’s financial system.)

But the digital yuan’s utility goes way beyond its domestic use.

Never Let a Crisis Go to Waste

Xi has long plotted ways to throw over the petrodollar.

And the Russia-Ukraine war offered him a once-in-a-lifetime chance to “de-dollarize” its key trading partner and Europe’s fourth-largest economy.

After the West isolated Russia, China came to its rescue by buying up its embargoed energy. In the first eight months of 2022, Russia and China traded $117 billion worth of goods, which is 30% more than a year ago.

But China’s seemingly “altruistic” gesture was more of a Trojan Horse for the yuan than genuine political support.

For one, China’s been buying Russian energy at heavily discounted prices because Russia didn’t have much choice. And then, China forced Russia to ditch the dollar and trade oil and coal in their own currencies.

Via Bloomberg:

“Russian coal and oil paid for in yuan is about to start flowing into China as the two countries try to maintain their energy trade in the face of growing international outrage over the invasion of Ukraine.

Several Chinese firms used local currency to buy Russian coal in March, and the first cargoes will arrive this month, Chinese consultancy Fenwei Energy Information Service Co. said. These will be the first commodity shipments paid for in yuan since the US and Europe penalized Russia and cut several of its banks off from the international financial system, according to traders.”

Then in September, China and Russia signed an agreement to trade gas in the yuan and the ruble on a 50-50 split. The deal came shortly after Finance Minister Alexey Moiseev concluded that “Russia no longer needs the US dollar as a reserve currency.”

The result is that, for the first time in history, the yuan dethroned the dollar in Russia. Moreover, since October 8, the yuan/ruble pair has been the most traded currency on the Moscow Exchange.

Meanwhile, Russian companies began issuing hundreds of millions of dollars in yuan-denominated bonds.

Via Global Times:

“Less than one month earlier, Russian aluminum company Rusal issued 4 billion yuan-denominated bonds in the Russian market. According to a Reuters report on Thursday, Rusal’s director of corporate financing, Alexey Grenkov, told a finance conference that 20 percent of the company’s loans were already in yuan.”

And now, the yuan is moving along the global supply chain.

For example, UltraTech Cement, India’s largest cement company, reportedly paid for a shipment of coal from Russia in yuan, according to Reuters.

Is this the true beginning of the de-dollarization we predicted nearly ten years ago?

The Digital Yuan Bridge

China’s next step in dedollarizing its trading partners is having a first-mover advantage in CBDCs.

Last week, China successfully completed a 40-day trial using its digital currency to settle cross-border transactions with Hong Kong, Thailand, and the United Arab Emirates. The trial processed over 160 payments worth $22 million – all in real-time.

That’s right – no more waiting days to clear through SWIFT.

Those transactions came through the so-called “mCBDC bridge.“

This system was initiated by the same countries that participated in the e-yuan trial and was designed to settle real-time payments in CBDCs without using correspondent banks.

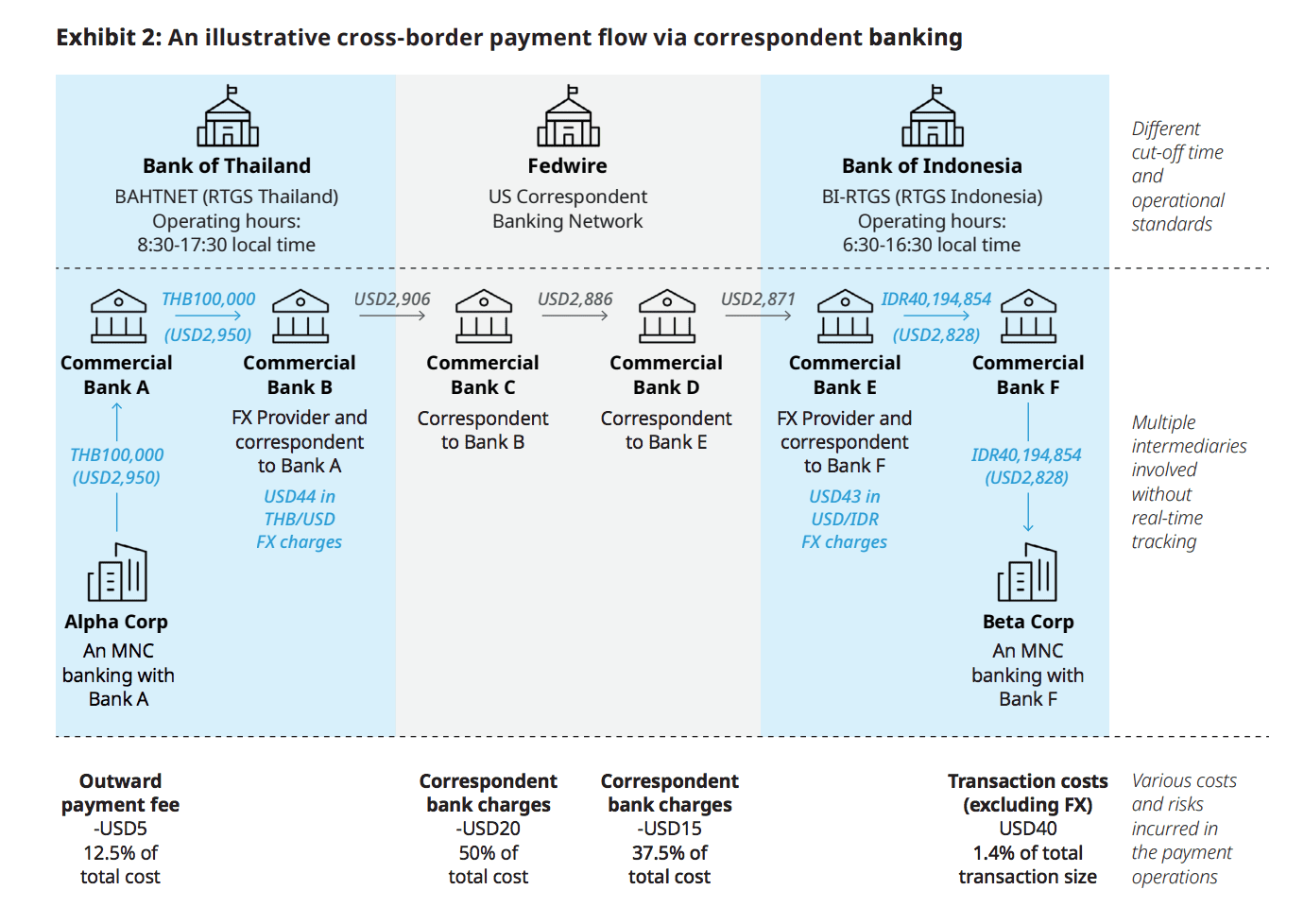

To better understand what correspondent banking is, here’s a good graph from JPMorgan’s paper that shows the complexity of it:

For countries like China and the United Arab Emirates, the benefit of mCBDC bridge is twofold: It can reduce costs and expedite cross-border transactions; but even more important, it can undercut the dollar in correspondent banking.

China has also launched a liquidity mechanism that would make the yuan even more attractive against the dollar for its trading partners.

Via Carnegie Endowment for International Peace:

“In late June, the People’s Bank of China (PBOC)—China’s central bank—announced the launch of a new emergency liquidity arrangement that can be funded using renminbi and tapped by participating central banks during times of market stress.

Three of the five participating central banks are Singapore’s, Malaysia’s, and Indonesia’s, which each recently renewed agreements with the PBOC implicitly aimed at reducing dollar usage in cross-border payments. This follows policymakers in Thailand, Laos, Cambodia, and Myanmar all announcing efforts to reduce dollar usage, as well as comments by Indonesia’s central bank head that consumers across five of Southeast Asia’s largest economies will soon be able to make intra-regional cross-border payments via linkages that avoid using the dollar as an intermediary, as is currently often the case.”

A New Era

We often take the dollar’s reserve status for granted simply because we’ve grown up under this system.

But the truth is, reserve currencies come and go every 100 years or so.

And considering how the balance of power has shifted since Bretton Woods, the dollar’s 75-year reign as the global reserve currency could be coming to a bitter end – especially if history repeats itself.

The dollar was the only choice when the world moved to a fiat system.

Because of Bretton Woods, trillions of dollars had already been circulating globally. And at that time, no country could even attempt to match the might of the US economy.

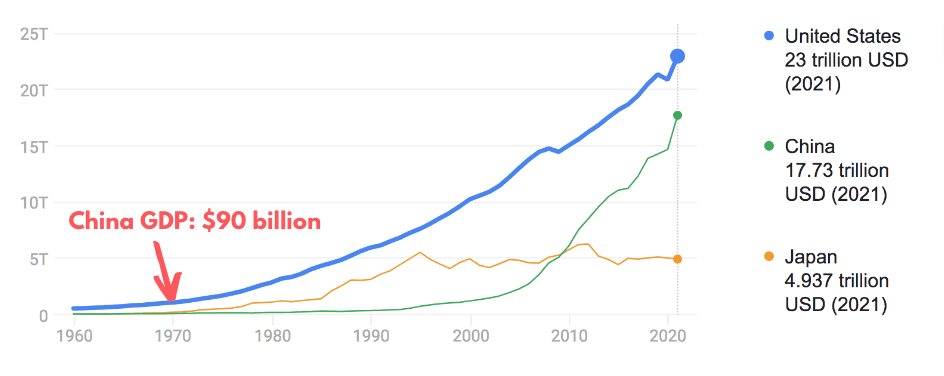

But look where China was versus where it is now:

When Bretton Woods ended in 1971, China barely mustered $90 billion in GDP—which amounted to just less than one-tenth of the US output.

But in the past 50 years, China pulled off what many call an economic “miracle economic growth.” Its economy grew at four times the rate of the US and soared 200x. And now, not only has it caught up with the US, but by some measures, it’s beating it.

In nominal dollar terms, China had $18 trillion in GDP last year vs. US’ $23 trillion.

BUT… if you measure both economies in terms of purchasing power parity,* China’s economy already overtook the US back in 2013 and now accounts for one-fifth of the world’s output, according to the World Bank data.

(*In short, purchasing power parity takes into account the absolute purchasing power of the currency rather than the somewhat manipulated exchange rate.)

But it’s not just the economic output.

Consider the following:

- China has become the #1 manufacturing country in the world and has stolen the US’ role as the key trading partner with most nations in the world

- China has established itself as one of the most critical pieces of the puzzle in global supply chains

- China has displaced the US as the “locomotive” of global economic growth. Since the Great Recession, it has accounted for one-third of the world’s GDP growth. And between 2013 and 2018, its contribution was twice the size of the US’

- In 2020, China overtook the US as the leading destination for foreign direct investments

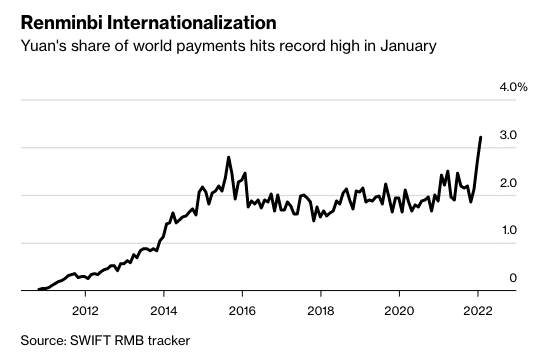

The result is that the yuan is slowly, yet consistently, chipping away at the dollar’s monopoly in international transactions:

The Dollar Dilution

That, my friends, is the beginning of the new bipolar global order, or what I call Breton Woods III.

We don’t know when it will happen or what form it will take.

But all signs show that the dollar will be diluted by a China-led coalition of export-driven currencies backed by gold and other commodities like uranium and nickel.

In fact, at the last BRICS Summit, Russia let slip that Brazil, Russia, India, China, and South Africa are going to issue a “new global reserve currency.” And it will likely be based on a basket of participating countries with the yuan at the forefront.

Egypt, Turkey, and Saudi Arabia are considering joining in too.

China’s digital move could very well be the initiation of this new currency. The CCP has taken lead to expand China’s digital currency footprint and will use it to showcase that its currency is safe and efficient.

Surely the West can’t allow this to happen if it wants to remain world leader. And that means the real trade war is only getting started.

My advice?

Be conscious of how many of your eggs are put in a dollar-denominated basket because, mark my words, the dollar is getting diluted.

Seek the truth and be prepared,

Carlisle Kane

China is clearly aiming for the Russian play in energy. That communist regime being able to squeeze the money spigot at will once established through their Yuan scheme, to advance its political, power and monopolistic agendas on the world. Can we let communists autocrats put us under this yoke? Hell no. Hopefully western leaders have their eyes wide open and see this play for what it is, another power grab for communist world domination, and will take action to avert this.

I HATED PRTES NIXON FOR TWO REASONS AND I AMA CONSERVATIVE !! ONE FOR OPENING TRADE WITH CHINA AND THE OTHER , TAKING US OFF THE GOLD STANDARD !! LOOK WHAT THAT HAS DONE TO AMERICA AND NOW WE HAVE THE NEW COMMUNIOST PARTY RUN BY GO BRANDON !! VIETNAM VET 67-68

Don’t hold your breath. The fascist scheme is like cancer. It started 50 years ago, and due to fiat money has slowly grown to cause pain and suffering to all but the elite.

The jump in the gold price was inevitable. It confirms my opinion that a new bull market is underway that will take out the all-time high.

US debt is now 130% of GDP. FED is locked in. The treasury cannot afford higher rates. Inflation is the only opinion to get rid of Gov’t debt.

I FEEL CHINA WILL OVERCOME ITS ECONOMY AND WILL SIMPLY COLLASPE ROGER PAUL …704 957 2609…

In terms of domestic business, how does all this change what happens in the USA? Will it mostly effect pitching foreign goods? How will turning on drilling in the USA stop this anti-dollar progression?

That’s purchasing not pitching in above message

Didn’t we give up one-third of our physical gold to settle our ” balance of payment” trade ? What else could Nixon have done???