They said the market would crash. They said a recession is coming. They said to sell everything.

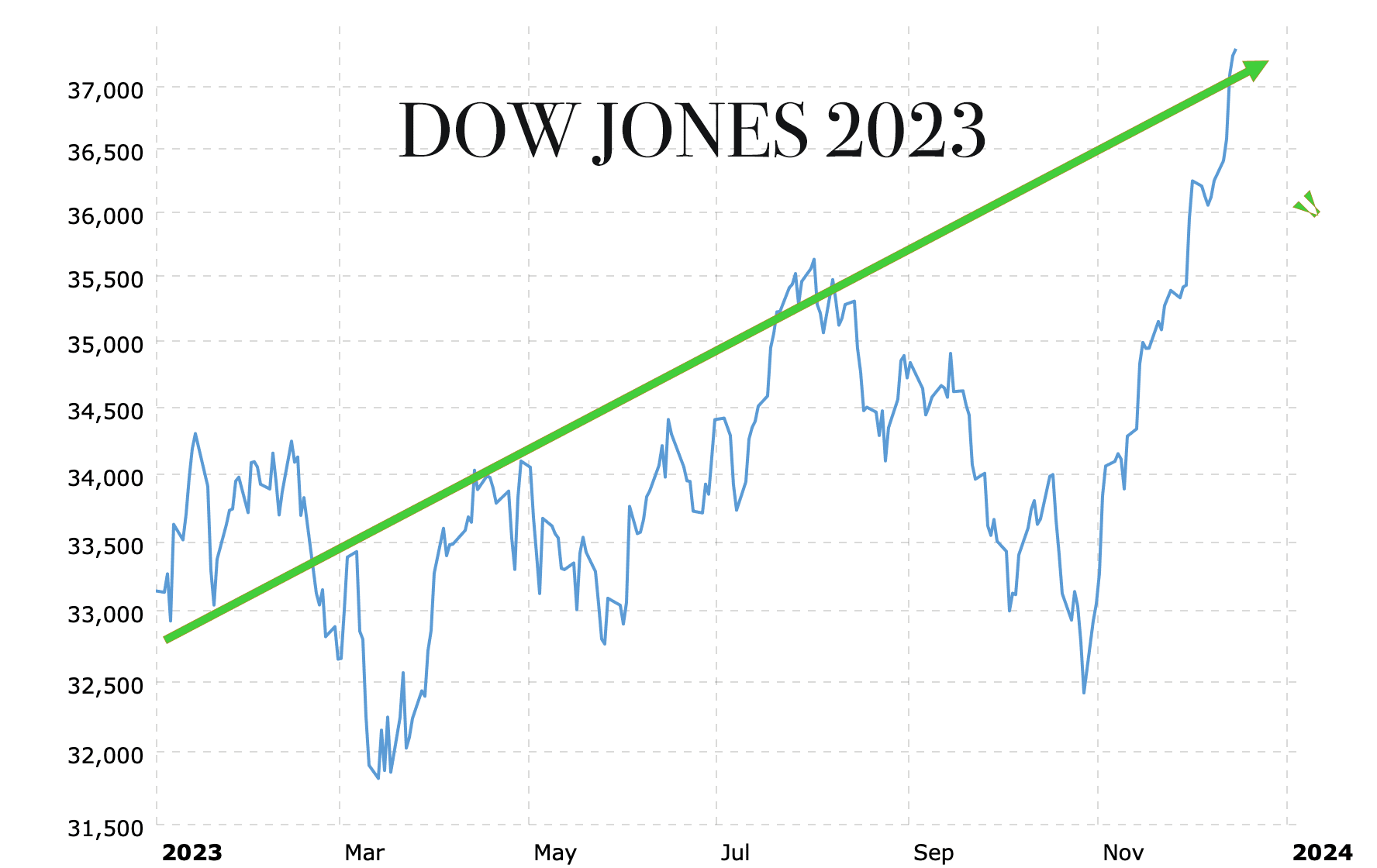

And if you listened to them, you would have missed out on this.

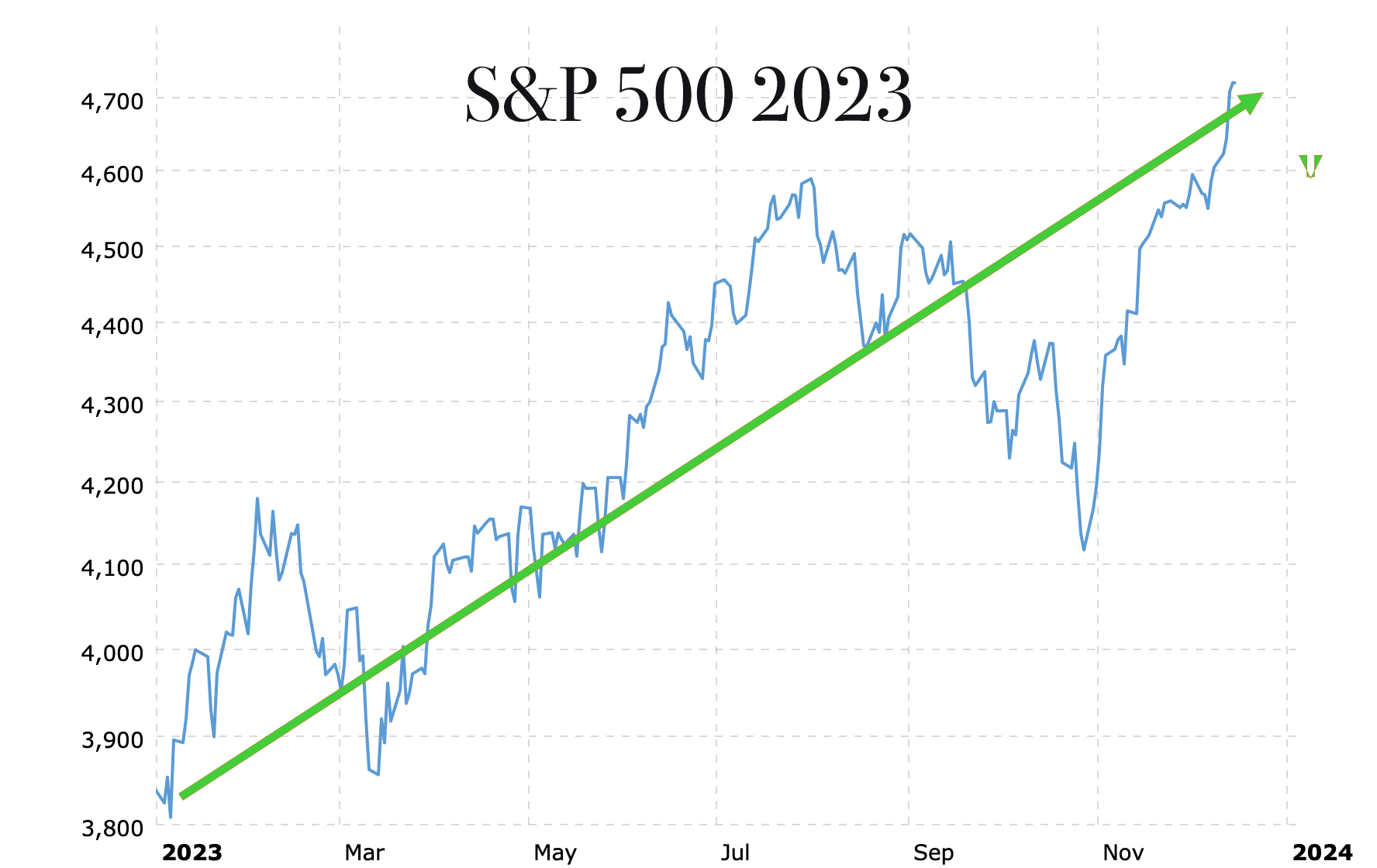

And this:

Despite one of the fastest rate hikes in modern history, an event that should have sent stocks tumbling, stocks are on track for yet another strong performing year.

The Dow is up over 12%. Gold is up 11.5%. The S&P 500 is up over 23%. And Bitcoin is up 154%.

Almost everything is up. Including interest rates.

But why? How can this be?

The answer lies in the Letter we wrote in January 2021, “What Will Stocks Do in 2021.“

What Will Stocks Do in 2021?

…it’s important to know where and how money will continue to fuel the market.

The first and most obvious are institutions.

“Experts” keep telling me that equity outflows were high last year and that it’s a sign of a bubble popping as institutions leave the market.

Well, it certainly didn’t end that way.

Inflows into stock funds hit a 20-year high in November 2020.

Via Financial Times on Nov 14, 2020:

“Funds that buy stocks counted $44.5bn of inflows in the week to Wednesday, including more than $32bn that was invested in U.S. stock funds, according to the data provider EPFR Global. It was the largest weekly haul by equity funds since EPFR has been collecting the data, as well as the second-biggest intake by U.S. stock funds since 2000.”

That trend continued in December:

Via Reuters:

“Global equity funds saw massive inflows in the week ending Dec. 2, Refinitiv Lipper data showed, while investors pulled out of money market funds to seek higher risks.”

Overall, ETFs – a strong component of the new retail investor – posted a calendar-year record inflow of $502 billion.

“Experts” were right, however. U.S. equity funds experienced $241 billion of outflows for the year – four times the previous record of $58 billion set in 2015.

But that’s not all; large-growth equity funds had $66 billion of outflows in 2020, marking their 17th consecutive year of outflows.

Now, one could assume that this is the result of money being pulled away from equities because investors expected the market to fall. And some of it was, as witnessed by the growth of money market funds.

Via CNBC:

“The coronavirus sell-off sent investors fleeing into money market funds, which ballooned well above $4 trillion, surpassing the peak of the financial crisis, according to research by LPL Financial. The flood into money markets pushed the sector’s assets to the highest on record, peaking at $4.672 trillion during the week of May 13, according to Refinitiv Lipper, and even recent net outflows have left more than 90% of that increase intact.”

But merely looking at equity fund flows to gauge future stock market performance and sentiment is like investing without level 2 market depth – you just don’t have a clear picture.

So let’s dig a little deeper.

U.S. Equities Liquidity

In 2019, 1.77 trillion shares traded hands via 9 billion trades. Those trades were worth $81 trillion.

- The S&P 500 was up 28%.

- The NASDAQ composite was up 35%.

- The DOW was up 22.3%.

In 2020, 2.76 trillion shares traded hands via 14.8 billion trades. Those trades were worth $121 trillion.

- The S&P 500 was up over 16%.

- The NASDAQ composite was up a staggering 43.6%.

- The DOW was up only 9.7% (including dividends).

Despite the COVID pandemic, stock market participation and liquidity grew significantly – and most importantly, to the upside.

Therein lies the reality of the fund outflows.

Safe is Boring

The DOW, if you take away dividends, mustered up only a 7% gain on the year.

Comprised of 30 large blue-chip companies, the DOW is home to companies that have been around for a very long time – Nike, Disney, McDonald’s, Apple, Microsoft…

Because of their historical strength, these blue-chip companies are a staple in many large equity funds. They are what most people consider “safe” stocks.

But safe has significantly underperformed.

Just ask anyone putting money into GIC’s or the hilariously misnamed “high-interest” savings accounts.

Not only that, blue chips are boring.

Why is that important?

First, while institutions make up the majority of the market, they still need retail investor participation to fuel excitement and liquidity.

The more retail investors participate, the easier it is for institutions to make money.

And retail investors are back in a big way.

Retail Boom Continues

In 2020, retail investors made up nearly 20% of the market.

And if the first few weeks of 2021 are an indication of what’s to come, then the first half of 2021 could be just as big.

Via Reuters:

“Retail broker eToro told Reuters it registered more than 380,000 new users in the first 11 days of 2021, adding to the five million who used it to trade last year. It says a third of its base joined in 2020 when trading on its platform surged five-fold from 2019 to $1.5 trillion.”

As I mentioned last October, via my Letter “Rise of the Retail Investor“, this trend is only growing – and institutions are betting on it:

“…if the actions of the big institutions are any indication, then my prediction of a continued bull market could prove true once again.

Via CNBC:

“Fidelity just announced it plans to hire 4,000 people in the next six months, plus is recruiting 1,500 college students for internships and full-time work.

Morgan Stanley is buying Eaton Vance after snapping up E-Trade earlier this year, as it continues to pivot from Wall Street to Main Street.

BlackRock–a major institutional player–said it’s been capturing more retail money, too.”

When big firms switch strategies from Wall Street to Main Street, you know they expect big things from the retail investor.”

This trend hasn’t stopped.

Earlier this week, I.G. Group Holdings Plc agreed to buy American online brokerage platform Tastytrade Inc. for $1 billion, adding 105,000 active retail accounts.

That’s a massive bet on a small number of investors. Nonetheless, it’s a bet to tap into the rapidly growing retail market – one that I.G. clearly believes will continue to boom.

And I bet they’re right.

The New Generation

Three years ago, in my letter “Top Sectors to Invest in 2018,” I wrote:

“The torch is being passed from the Baby Boomers to the Millennials.

Millennials will become the decisive force driving our economy through interaction across economic, technological, social, and political realms. As digital natives who are global and interconnected, they have different views and approaches to banking and investing, different views of energy, and different expectations and priorities both from a social and political perspective.

They will soon become the dominant generation of active workers, and as such, will be the focus of politicians and corporations moving forward.

If it weren’t for the politically correct and liberal nature of millennials, Trudeau might have never been voted in as Canada’s PM.

If it weren’t for Millennials, Amazon might not have become one of the biggest retailers in the world.

From corporate buy-outs that cater to Millennial consumer startups to the new era of clean energy brought on by Millennials who demand it, the shift in corporate focus is targeted directly at the Next Generation.

That means the biggest growth sectors and developments will be aimed at Millennials and their plans for an on-demand, connected, and automated future.

They will be the drivers of new investment trends and ideas.

They are the ones who will drive share prices higher.”

And boy, did those statements prove true.

The share prices of companies within the clean energy space (think Tesla and Nio) and on-demand platforms (think Doordash, Netflix, and Amazon) have skyrocketed to incredible valuations.

When I wrote the above, Tesla was trading at $62; today, it’s at $846 – a gain of nearly 1300%.

This isn’t going to change for the foreseeable future.

But that’s not all.

Just over a year ago, millennials had an abundance of debt and little-to-no net worth.

In fact, a study by Deloitte in 2019 showed that the average net worth of an American millennial was only $8,000.

Via Washington Post:

“Post Millennials are doing far worse financially than generations before them, with student loans, rising rents and higher health-care costs pushing the average net worth below $8,000, a new study shows.

The net worth of Americans aged 18 to 35 has dropped 34 percent since 1996, according to research released Thursday by Deloitte, the accounting and professional services giant. This demographic is paying more for education and such basics as food and transportation while incomes have largely flatlined.”

But in just a year’s time, and incredibly through a politically-induced shutdown of the world’s economy, things appear to be changing.

Via Bloomberg:

“…millennials are enjoying rapid gains in net worth. Between 2019 and the third quarter of 2020, the aggregate net worth of those Americans increased by 21%, while the net worth of Generation X (between ages 40 and 55) rose 8.5% and baby boomers — born between 1946 and 1964 — saw a 4.3% wealth gain.

Members of Generation X hold about $6 trillion in liabilities against $37 trillion in assets, while baby boomers have $4.7 trillion in debts and $66.6 trillion in assets. Moreover, baby boomers hold just $958 billion in consumer debt compared with the $1.6 trillion held by millennials.

…Stock market gains pushed millennial wealth to the highest share of their overall assets in six years, surpassing $5.4 trillion. Real estate and consumer durables in the third quarter also reached record levels. Over the last five years, millennial holdings of corporate equities rose by $394 billion. Meanwhile, private-business equity doubled in the last three years to $800 billion, reflecting an entrepreneurial surge among younger Americans.”

As I explained before, the majority of millennial investors have missed most of the last decade’s historic bull market run.

But they’re rapidly jumping back in now.

Via CNN:

“Schwab said in an email to CNN Business that more than half of its new clients since the start of 2019 are households under the age of 40, and that these younger customers are investing “at higher asset levels than normal, so they appear to be very engaged.

…(Robinhood co-founder and co-CEO Vladimir Tenev) added that the firm’s customers, whose median age is 31, are specifically scooping up shares of airlines, videoconferencing and streaming media companies as well as biotechs.”

Even new investors are piling in.

Via Robinhood:

“Half of Robinhood’s new accounts in the first half of 2020 were from first-time investors.”

There’s no doubt that the advent of commission-free trading has propped up the market. It has paved the way for the creation of a new economy by millennials and Gen-Xers: the financial economy.

And that means the biggest economy in the world just got bigger.

The New Normal

The new normal isn’t about wearing masks or social distancing.

The new normal is a shift from a labour-driven economy to a financial economy.

We already know that robots, A.I., and more efficient platforms such as driverless cars, will take over many of the jobs that exist today.

This will force governments to provide a basic income – just as they have through last year’s pandemic.

We now know what happens when millennials and Gen-Xers lose their jobs: governments give them a check, which they, in turn, invest and day trade to make more money.

And while they may not be playing with much, they are playing together.

A single termite can’t build even a small hill, but a collective can build a kingdom.

The Climb Continues

While many invested in stocks during the onset of the pandemic, many more saved their money – including the free money they received from the government.

In fact, millennials’ cash and bank-deposit holdings rose by more than 80% last year, from $100 billion in 2019 to $216 billion last year.

In other words, the consumer is flush with cash and wants to spend it – especially if COVID dies down in the summer (which I believe it will), and the economy opens back up.

What happens when consumers spend?

It all goes back to the corporations.

Mark my words: there will be record corporate profits this year.

The Fed’s Ingenuity

While many argue the Fed and other central banks have printed too much, they forget to argue the other side: that is, where there are liabilities, there are also assets.

The key is translating those liabilities into growth.

And that’s exactly what the Fed has done.

Five years ago, the money went to corporations – and thus, the stock market.

Recall my Letter from July 2014, “How the Fed Influences the Stock Market“:

“Since Fed policy dictates that it cannot directly buy stocks, the Fed has found other ways to encourage people to take risks.

I have talked about these strategies many times before.

One of these strategies is to force banks to lend.

The problem, however, is that it’s difficult for banks to lend to unqualified borrowers. And since the majority of Americans have been terribly affected by the economic crisis, many of them don’t meet the requirements for borrowing.

With so much stimulus, where has all the money gone?

To the people who meet the requirements: big corporations with cash.

Remember a while back when I talked about the record amount of cash hoarding by big corporations and how they weren’t using it for capital investments (hiring, infrastructure, etc.) because the economy didn’t warrant such actions?

So what do you do when you have so much cash but nowhere to deploy it?

Invest in the stock market…simple!

Since spending didn’t make sense for these corporations, as the economy truly didn’t warrant further hiring or sales, these companies decided to buy a record amount of their own stock with their cash pile.

When a company issues a share buyback, the amount of outstanding shares in a company decreases. This leads to a higher Earnings Per Share (EPS), which makes the stock look much more attractive. This, of course, leads to higher share prices.

While this is great for shareholders, it’s bad for the economy as the cash is no longer put to use to hire new employees or grow the company.

Share buybacks continue at a record pace, and I expect billions of dollars in transactions over the next few months alone.

But there’s even more to this story than what the face value suggests.

While the headlines tell us of record cash holdings at corporations (giving the illusion sales are great), what they don’t tell us is that U.S. corporate cash holdings are at the lowest level relative to corporate debt.

That’s because banks – as I just mentioned – have had to lend record amounts of money out.

And since many consumers no longer qualify to buy houses or take out other loans, the majority of this lending has gone to big corporations.”

The Fed had to rely on banks to drizzle the printed money into the economy. As we witnessed over the last decade, that is a long and lengthy process.

But that was then.

Today, we have governments around the world directly giving money to their citizens. We have governments paying the wages for corporations – leading to record profits that will continue to balloon when consumers spend the money that the very same government has given them.

All central banks have to do now is inject money. The governments hand it out, and the stock market goes up. In turn, investors make money.

And it happens all over again.

Now imagine that.

No jobs? No problem. Just invest.

It’s the new financial economy.

If you’re scratching your head wondering why the stock market continues to climb, there’s your answer: the new financial economy.

“The new normal is a shift from a labour-driven economy to a financial economy.”

The value of the stock market in the US is already 160% of its GDP; in Canada, it’s over 141%.

In other words, if you’re one of those who tells everyone to stay out of the stock market and relies on the idiom “an honest day’s work,” you’re going to be left behind in the new financial economy. Those “honest day’s work” jobs won’t be around for much longer.

This isn’t to say that stocks can’t and won’t crash. But the future will absolutely be dominated by AI and robots, and us mere mortals simply cannot compete. The only way to compete is to let our money work for us by investing in the right sectors and stocks, at the right time.

Heading into 2024, we will most certainly see volatility. In Canada, a lot of mortgages are up for renewal which could put a serious strain on the housing market.

In the US, not only is it an election year, but the events created by our world elites are a direct attempt to disrupt the world and shape its future.

For example, while lithium and lithium stocks have dropped recently, the “green” future the elites have planned are still a go. Nuclear will continue to dominate.

Healthcare is another sector that will continue to see advancements. New forms of diagnostics and therapies are emerging, and AI/machine learning models will speed up advancements in all of these areas. In addition, cancer rates and other ailments are once again seeing an increase after many years of decline – this will put a strain on the healthcare system forcing governments to act quickly. For example, the American Cancer Society just changed lung cancer screening guidelines last month, making way for another 5 million Americans to receive annual screenings – this is in addition to the 15 million who already qualify. In turn, more funds will be allocated to this sector.

And yes, AI and machine learning will most definitely remain a focus in almost every industry. However, your best bet isn’t simply to bet on AI via “AI” stocks, but bet on those companies who can effectively use AI/machine learning to make advancements within their key sectors.

In other words, a wise and patient investor should not let volatility be their guide. Let it be an opportunity.

Until next year, seek the truth and be prepared.

Carlisle Kane

Fabulous writeup and so true. Throw a trillion plus dollars at the people, watch the S&P gain a trillion plus. Thanks for the read.