Global digital currencies are coming. They haven’t made prime time, but that’s exactly how they will roll out—quietly but violently.

If you missed our Letter this week, be sure to go back and read it – we laid out many of the events that have happened in the past few months.

Knowing this, is it a surprise that central banks have been the biggest buyers of gold in recent years?

In fact, central banks have consistently been net buyers of gold since 2010. Over this time, they have accumulated more than 7,800 tonnes of gold and over a quarter of this was purchased in the last two years alone.

And, of course, just like CBDCs, guess who has been leading the charge?

Follow the Leader

The People’s Bank of China reclaimed its position as the largest single gold buyer.

In 2023, it reported an increase of 225 tonnes in its gold reserves, marking the country’s highest single year of reported additions since at least 1977.

But it’s not just China.

Central bank buying reached record highs in 2022 and has shown no signs of slowing.

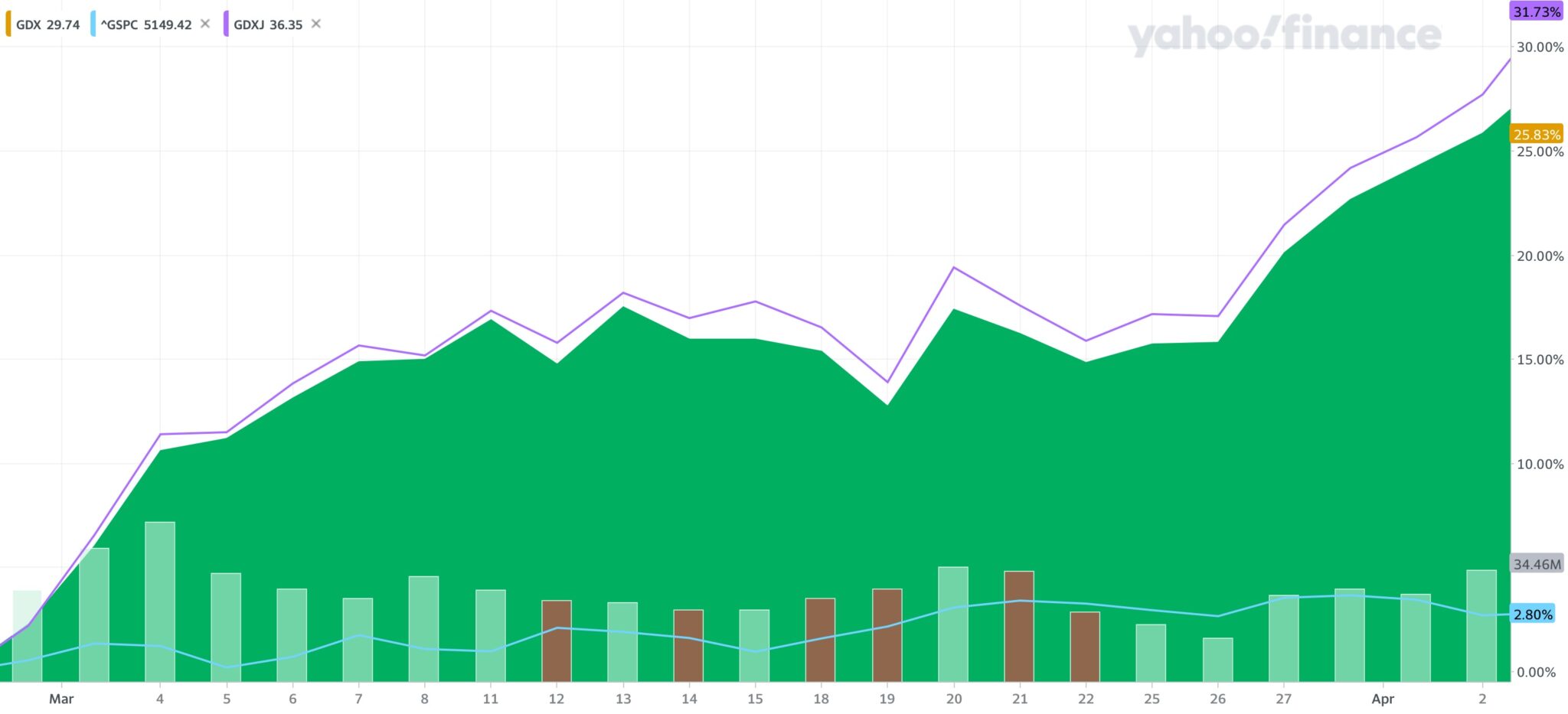

And mining stocks are starting to follow.

Since February 28, the price of gold has climbed 12%.

Meanwhile, the VanEck Gold Miners ETF (GDX) has climbed nearly 26%.

During that same time, the VanEck Junior Gold Miners ETF (GDXJ) has climbed over 31%.

The S&P 500? Less than 3%.

As we have told you many times before, the miners represent one of the best levers for gold’s climbing price action – especially the juniors.

When metal prices are higher, it leads to higher profit margins and higher share prices for the bigger players.

When both of these scenarios play out together, the big boys go shopping.

Time to Go Shopping

Big mining companies don’t often focus on making discoveries – it’s too time-consuming and too risky. They let the little guys do it.

But if the little guys show promising results, the big boys will gladly pay up – especially during times of rising prices and profit margins.

Last year, we got a perfect example of this.

Mining discoveries are the stuff dreams are made of for investors – especially Canadian investors.

These discoveries have turned average Joes into multi-millionaires and have created some of the world’s most prominent billionaires.

However, as more discoveries are made, the fewer there are to find.

In fact, most of the significant discoveries have already been found.

But that’s exactly why the mining world goes berserk when a new discovery is made.

And that’s exactly what happened last October.

A Major New Discovery

Last October, a small junior exploration company in Idaho, Hercules Silver (Hercules), announced it had discovered the first significant porphyry copper system in the state of Idaho.

Copper porphyry deposits are the most significant copper deposits in the world, representing more than 60% of all copper mined.

While their grade is relatively low, they are often massive, ranging from 100 million tonnes to 10 billion tonnes of ore.

That’s because, in these systems, copper mineralization can vertically extend for several kilometers beyond the primary open pit base. This expansive vertical scale generally results in mine lives spanning decades.

In addition, the metallurgical characteristics of copper porphyry orebodies make them tailored for cost-effective, large-scale resource extraction.

The metallurgical characteristics, high tonnage of mineralized rock, and mine life that often spans decades, make copper porphyries extremely appealing to the big players.

So it should come as no surprise that less than a month after Hercules made the discovery, Barrick Gold, one of the world’s largest gold producers, bought nearly C$23.5 million worth of Hercules stock at C$1.32 per share.

Less than two years ago, you could have bought shares in Hercules for under $0.06 per share.

Last year, after announcing the discovery and Barrick’s investment, Hercules shares soared to as high as $1.62 – a potential gain of over 2845%!

Now, I am not here to tell you about something that has already happened, nor am I here to rub it in for those who might have missed the boat.

I am here to tell you another way to potentially capitalize on this same discovery.

How?

Porphyry Clusters

One of the most important rules with copper porphyries is that where there is one, there are others.

Copper porphyry systems are often found in clusters or groups within specific geological regions. These clusters can contain multiple individual orebodies or deposits of copper porphyry, often within relatively close proximity to each other.

This clustering highlights how exceptional geologic processes affected localized regions of the lithosphere during mineralization, leading to the formation of discrete geographic clusters that are regularly spaced and aligned within orogen-parallel belts.

For example, the central Andes is known for the occurrence of giant porphyry copper deposits of similar ages that group into these clusters within orogen-parallel belts.

It’s no wonder the world’s biggest mining companies, such as Glencore and Freeport-McMoRan, are there.

As a result, exploration efforts often focus on known copper porphyry clusters or districts where the likelihood of discovering additional deposits is higher.

Now, not only does the Hercules copper porphyry discovery appear to be the first large-scale copper porphyry found in Idaho, but it occurs within the same Cordilleran orogenic belt as the porphyries of the central Andes.

In other words, just like the copper porphyries in the Andes, one discovery means there could be many more!

Of course, you can bet that mining companies have been rushing to stake ground within the same area of Hercules.

Most have yet to be successful.

But there is one company—one that many of you may already know through our newsletter—that has been actively working in Idaho.

In fact, along with Hercules, THIS company was one of the only other operators in Washington County, Idaho, during the time of discovery.

As a result, their technical team already had a solid understanding of the regional geology.

They knew its potential, and we were a first mover in making key strategic claims while consolidating some of the most strategic ground in this emerging copper belt.

This Company is…

Nevgold Corp.

(TSX-V: NAU) (OTC: NAUFF) (FRANKFURT: 5E50)

If you haven’t read our last report on this company, you can do so HERE.

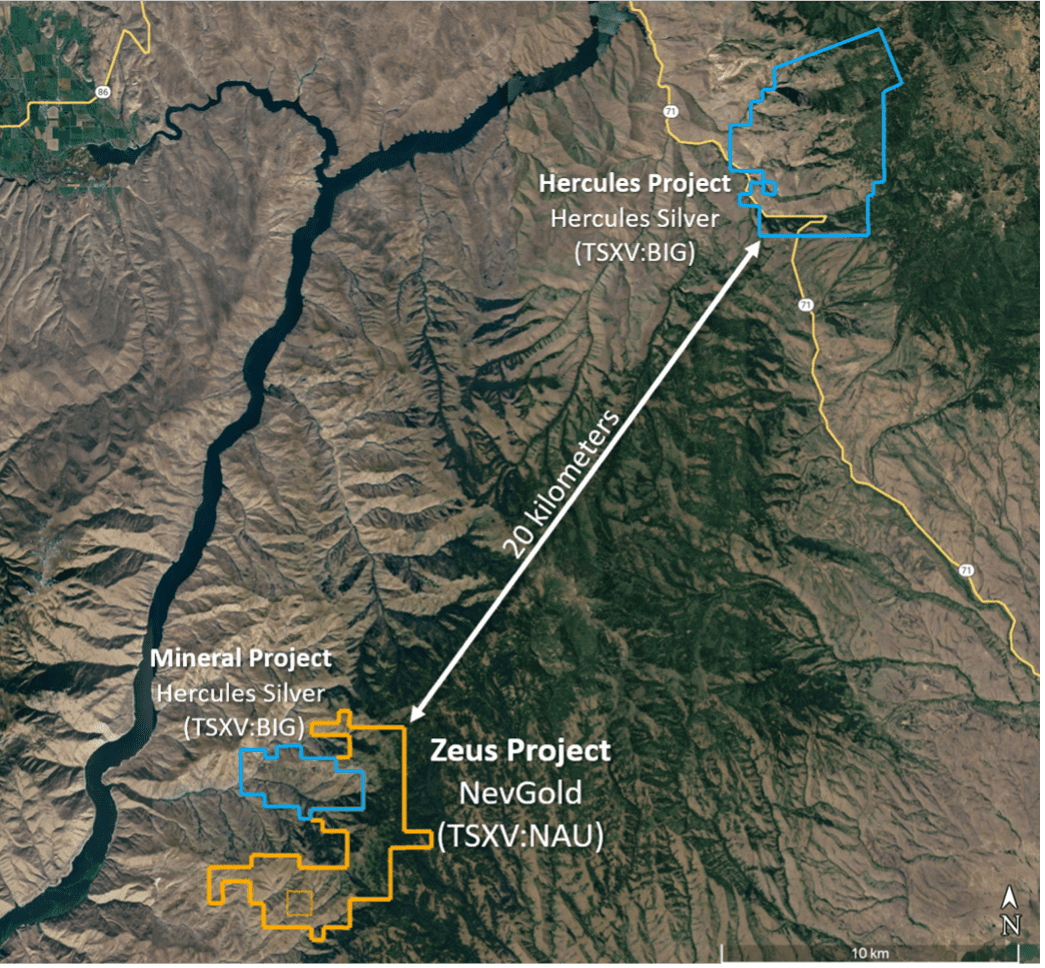

NevGold Corp. (“NevGold” or the “Company”) (TSXV:NAU) (OTCQX:NAUFF) (Frankfurt:5E50) just announced it had staked approximately 20 square kilometers contiguous to mineral claims held by Hercules Silver Corp., the owners of the Hercules copper porphyry discovery.

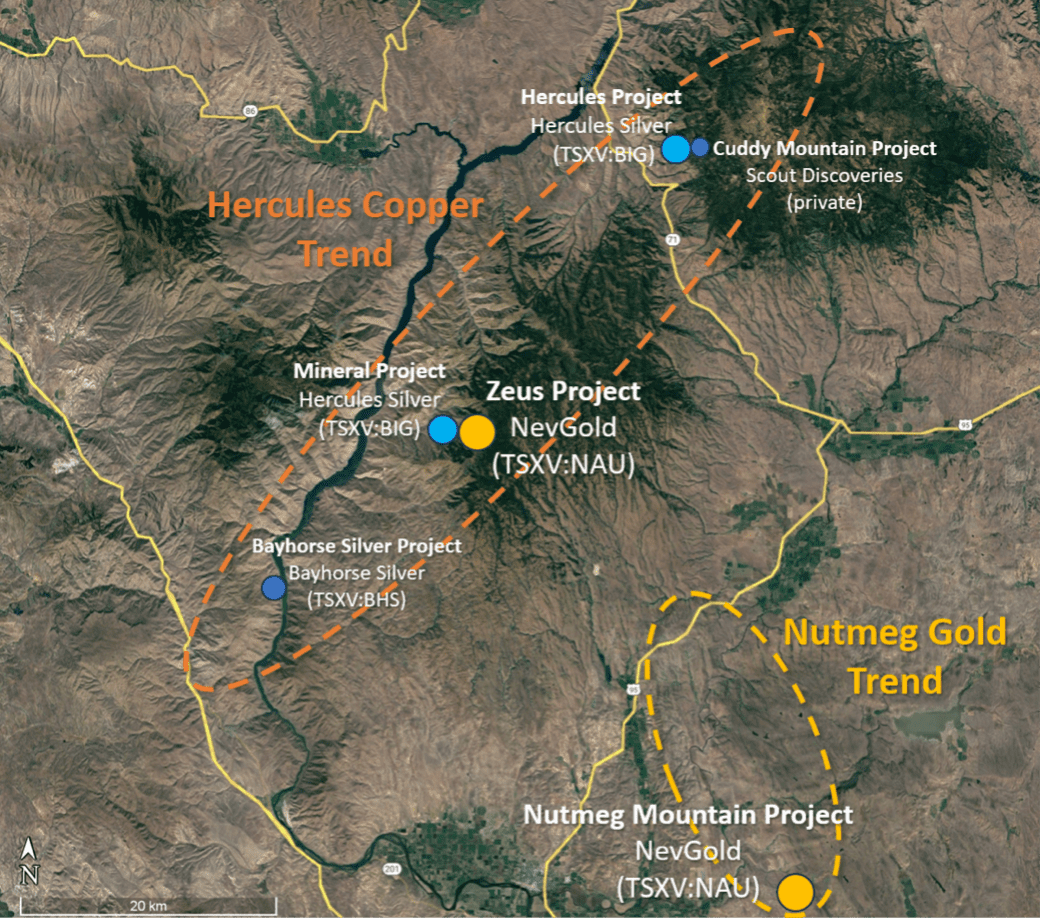

Nevgold calls it the Zeus Copper Project (“Zeus” or the “Project”) – a fitting name.

Zeus is 120 km northwest of Boise, Idaho, 40 km northwest of NevGold’s Nutmeg Mountain gold project (learn more here), and approximately 20 kilometres southwest of Hercules’s copper porphyry discovery.

The area has strong road, water, and power infrastructure, with numerous nearby sources of power and water and a large network of access roads leading to the Project.

The recent staking covers some of the most prospective ground in the Hercules Copper Trend.

Just how prospective?

Just ask Hercules.

On October 2, 2023, Hercules entered into a lease option agreement to acquire the Mineral Project, which is just 14 miles southwest of their flagship property.

Via Hercules Silver:

“Chris Paul, CEO and Director of the Company, noted: “We’ve entered into a lease option agreement to secure another key piece of ground in the Hercules mining district, which the Company believes shows strong potential to emerge into a significant copper porphyry belt. The Hercules Copper Belt, as it’s referred to internally, represents a trend of underexplored copper porphyry targets with excellent discovery potential. Relative to Hercules, the Mineral Project appears to be the next best developed prospect in the district and adds another compelling copper-gold porphyry target to the portfolio. We are highly encouraged by Mineral’s historical drilling, strong soil geochemistry and similar geological setting to the Hercules project.”

Now take a look at what Nevgold was able to stake, represented by the yellow outline:

The geological mapping compiled by the United States Geological Survey indicates that the Zeus Project is underlain by the same geology encountered at the Hercules Project.

In fact, during the recent staking campaign, Nevgold’s geologists encountered numerous examples of copper mineralization and copper porphyry alteration signatures.

As NevGold VP Exploration, Derick Unger put it:

“The Hercules copper porphyry discovery is one of the most exciting recent discoveries in the Western USA. Along with Hercules, NevGold was one of the only other operators in Washington County, Idaho.

Since acquiring Nutmeg Mountain two years ago, we have established strong infrastructure and local relationships while building a very good understanding of the local geology. This allowed us to move quickly to secure some of the most prospective ground on the entire Hercules Copper Trend, which saw a significant increase in land acquisition and exploration activity after the Hercules discovery was announced last October.

We have spent significant time in the field completing the staking process, and our team has been encouraged by the numerous indications of a large copper porphyry system at Zeus. The work now begins to target the best part of the system while we also continue to systematically advance Nutmeg Mountain and Limousine Butte.”

If Hercules is going after the Mineral Project (represented by the blue lines), you can bet they see potential there. And Nevgold now surrounds it.

A Good Time for Juniors

We haven’t seen junior mining stocks perform this well in a very long time. With the miners making more money from record gold prices, we have no doubt this will translate into further acquisitions and investments by the big players.

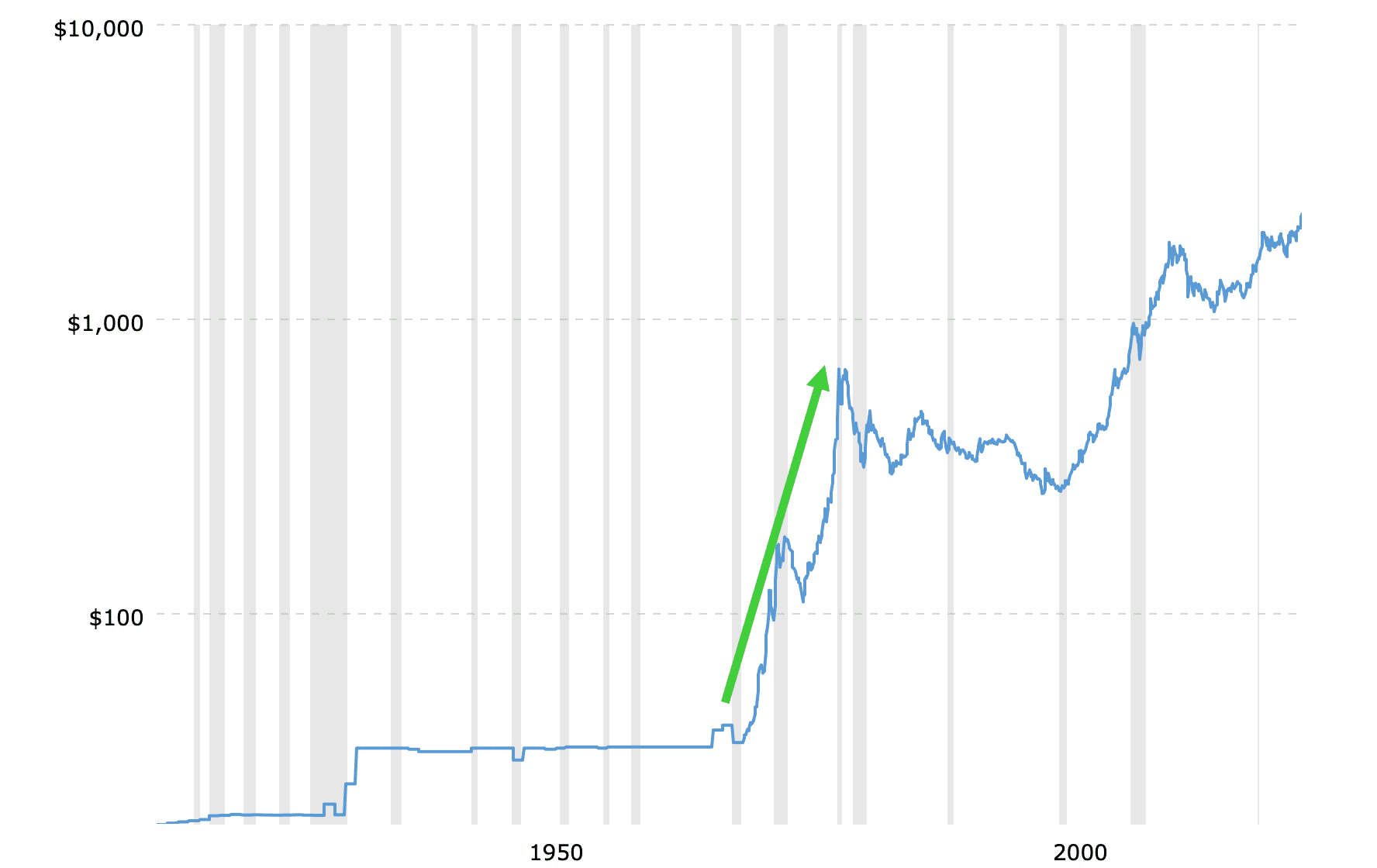

And from both a macroeconomic and geopolitical perspective, there is no reason to believe that the price of gold won’t see higher prices.

When the world went from a gold-backed system to a complete fiat system, the price of gold soared from $35/oz to nearly $650/oz (non-inflation adjusted) in less than ten years.

That’s a gain of over 1740%.

The past month has already shown us that junior gold stocks significantly outperform the price of gold.

What will happen when the world goes from fiat to CBDCs?

Nevgold Corp.

Canadian Trading Symbol: NAU

US Trading Symbol: NAUFF

German Trading Symbol: 5E50

Disclaimer:

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. We are biased towards Nevgold (NAU) because the Company is an advertiser on www.equedia.com. We currently own shares of NAU. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in NAU or trading in NAU securities. NAU and its management have no control over our editorial content and any opinions expressed in this article are our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us. For a complete disclosure of the compensation received by us from NAU, please review our Terms of Service and full disclaimer at www.equedia.com/terms-of-use/.

Why do you insist on pushing these junior minors- all they do is inflat the facts and underdeliver. Most juniors never make it, hugely disappointing when they go down -off the rails as in delisted or they split and share dilution usually means bye bye to your investment and the rats at the top make out like bandits!! Why don’t you focus on stuff that actually has a meaningful valuation and not gold digger plays that are 10 years out before a mine is built if ever. Tiresome none sense reading the hype.