Something BIG is happening in the gold sector.

Yet, the media has been extremely quiet about this. But those who are “in-the-know” are quietly making moves before things get out of hand.

And that means time is running out.

Today, I am going to introduce you to a company primed to take advantage of this situation.

In fact, this company just made a massive announcement – one that could send THIS company’s shares up 800% by the end of this year.

More on this in a bit.

Gold Ripping

Gold just blew past US$2,000/oz and is now hovering near the record price set on the first day Russia invaded Ukraine.

And while analysts believe it might just be a temporary rally triggered by the SVB collapse, they’re missing something much bigger.

In fact, if you look closely, the price of gold has been completely detached from the market for the past five months.

In other words, this gold breakout points to a MUCH bigger story.

Broken Century-Long Gold Correlations

Many believe that the recent rise in gold has to do with inflation.

But for the most part, gold has little to do with inflation – especially in the shorter term.

In fact, most of the time, it doesn’t move in tandem with inflation at all. Just look at how gold tumbled in most inflationary periods after 1980.

In other words, investing in gold based on inflation has largely been a money-losing strategy.

Had you been trading gold since 1980 based on this inflation theory, you’d have blown most of your money.

Instead, what gold is most connected to is real interest rates. Ever since the end of Bretton Woods, its prices have moved counter to these rates like clockwork.

From “The Gold and Inflation Peg is Wrong”:

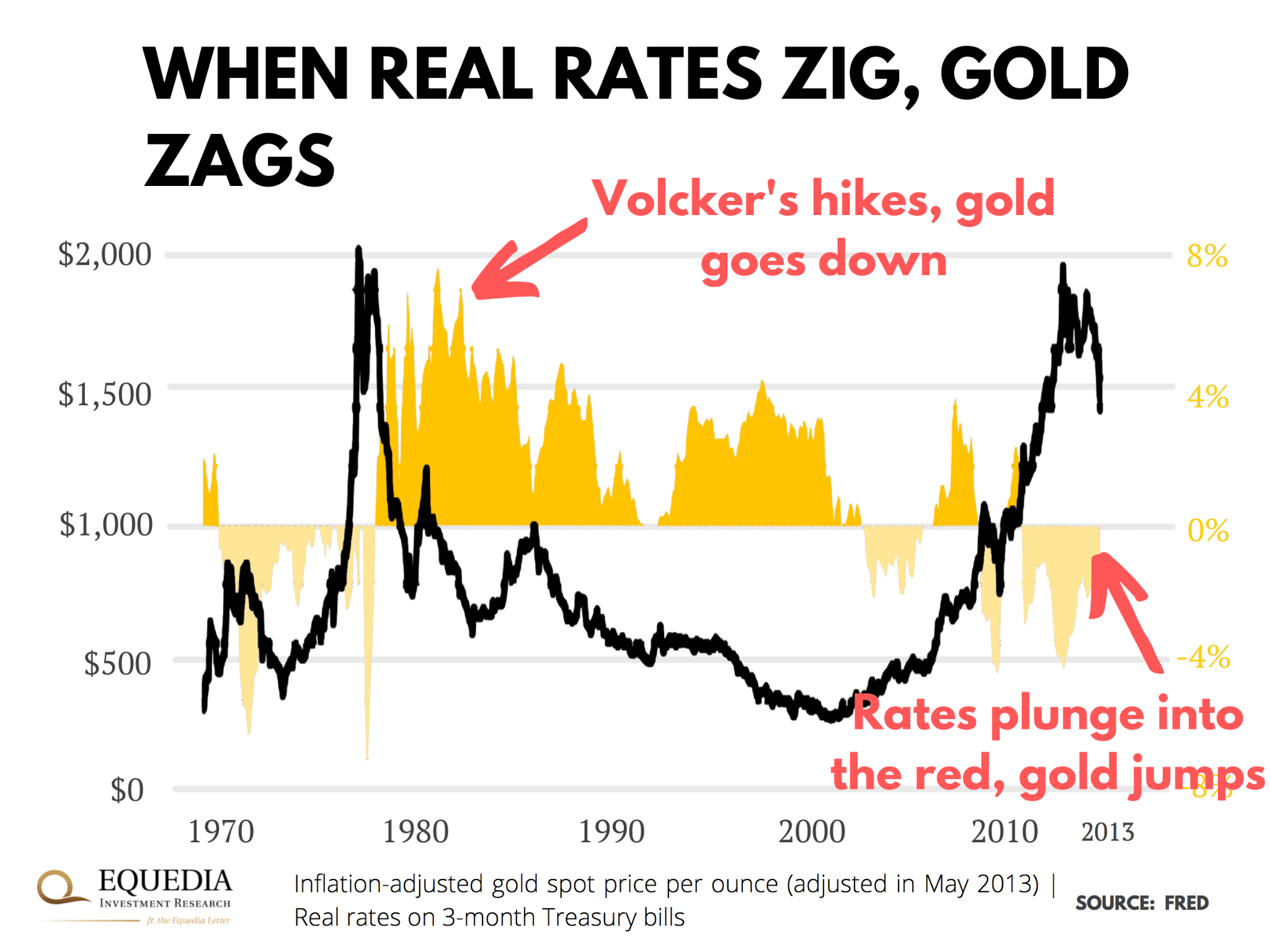

“Take a look at this chart which shows gold’s near-perfect inverse relationship with real rates on 3-month Treasuries (common benchmark):

See where Volcker’s hikes brought the rates out of the red and how gold crashed soon after? Or how negative rates after 2000 launched gold into the biggest rally since the ’70s?”

The logic behind it is that real interest rates, in effect, show your inflation-adjusted earnings from the safest government bonds—such as Treasuries.

So, naturally, the more income you can earn “risk-free,” the bigger the allure to invest in bonds rather than “incomeless” gold.

But five months ago, this century-long peg broke.

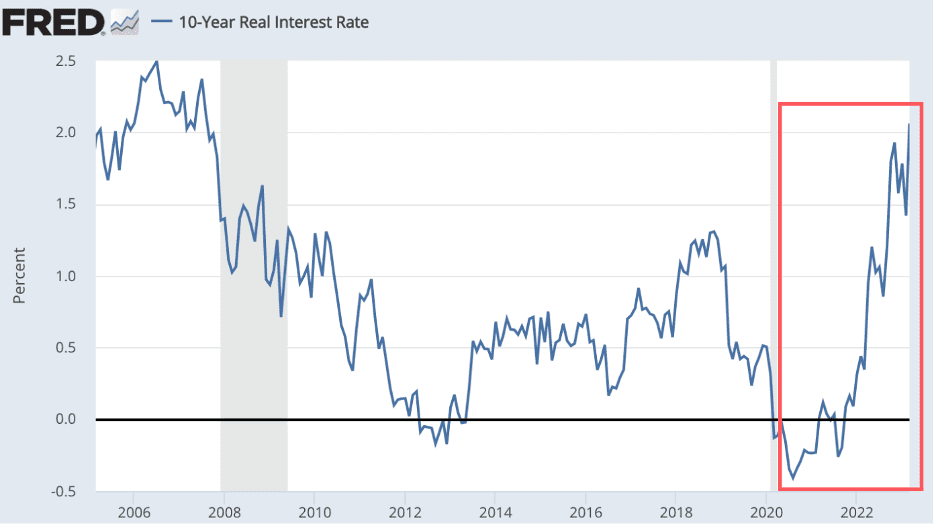

Take a look at how real interest rates have soared since mid-2021:

By the logic of that peg, gold was supposed to crash. Yet, despite its “unattractiveness” relative to bonds, the yellow metal is nearing its all-time high.

And it’s not just this correlation.

Throughout history, gold has served as a remarkably sensitive barometer of risk. (That’s why Wall Street calls it a “fear trade.”)

It means if there’s more risk in the markets, demand for gold jumps, and so does its price. And vice versa.

But look at what’s happening now.

Inflation is tamed—or at the very least, has slowed- and the Fed has backstopped the banking crisis.

In other words, the scary stuff that had the markets roiling over the past five months isn’t as bad now.

And yet, gold is climbing.

In other words, something else is causing the price of gold to rise.

And that something is so monumental that it overrides everything that has determined gold prices since the beginning of the fiat money era…

BRICS’s New Reserve Currency

This gold rally could be a sign that the new BRICS reserve currency is not just a concept but could be imminent.

Let’s connect the dots real quick.

In “A New Powerful Coalition Is Coming,” I exposed how Xi Jinping spent most of the past decade laying the groundwork to dethrone the dollar.

First, when the West slapped Russia with sanctions over Crimea, he convinced BRICS to launch a replacement for the West-dominated International Monetary Fund (IMF) and World Bank.

Then, last year, Xi talked Russia, Iran, and Venezuela into ditching the petrodollar and settling some of their trade in the yuan instead.

After that, he launched a pilot for the e-yuan—a CBDC edition of its currency— for cross-border transactions using a SWIFT-like banking system.

And it looks as if he’s successfully gotten his BRICS allies on board.

At the last summit, BRICS announced it would launch a reserve currency built on the basket of its member currencies, likely led by the Chinese yuan.

A new Cambridge paper studying Xi’s master plan even states that BRICS now has everything it needs to replace the dollar, except the scale:

“The emerging BRICS de-dollarization infrastructure does not yet allow the BRICS members to make a complete break from the existing US dollar-based financial system. BRICS de-dollarization initiatives are predominantly happening at the sub-BRICS level and have not achieved the necessary economies of scale to de-dollarize the existing global financial system.”

But don’t think the BRICS nations haven’t begun preparations for the block’s expansion.

Last month, the BRICS nations announced they would entertain including other countries in their coalition.

And immediately, a dozen oil nations lined up—including oil producers Argentina, Egypt, and Algeria, and even bigger players, such as the UAE, Iran, and Saudi Arabia.

In fact, Saudi Arabia’s de facto ruler, Mohammed bin Salman, has been busy building relations with Russia, China, and even Iran, while distancing himself from Biden and the US.

If the world’s largest oil producers outside of the US decide to start trading oil in another currency, it would be a major blow to the might of the US dollar.

The Central Bank Gold Rush Has Begun

Now here is where it gets crazy for gold.

Rumour has it that the BRICS’s reserve currency won’t be fiat.

Instead, as Pavel Knyazev, deputy director of the Russian Foreign Ministry, hinted at during the last BRICS summit, it will be backed by the commodity reserves of its members— predominantly gold.

But you don’t have to take his word for it.

The evidence is out there in plain sight.

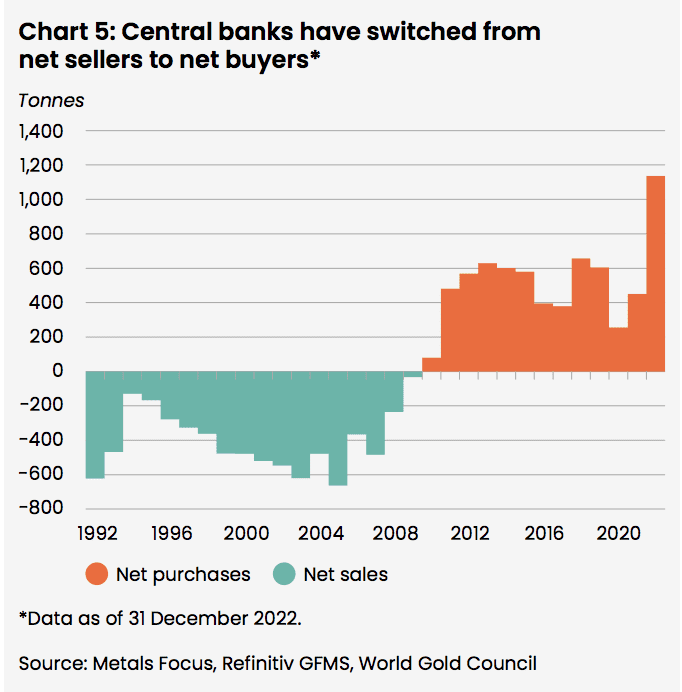

As I revealed before the new year, central banks are quietly bulking up on gold at a rate not seen in over 50 years. Last year, they added over 1,100 tons of the metal to their reserves.

That’s ~2x the average over the past decade:

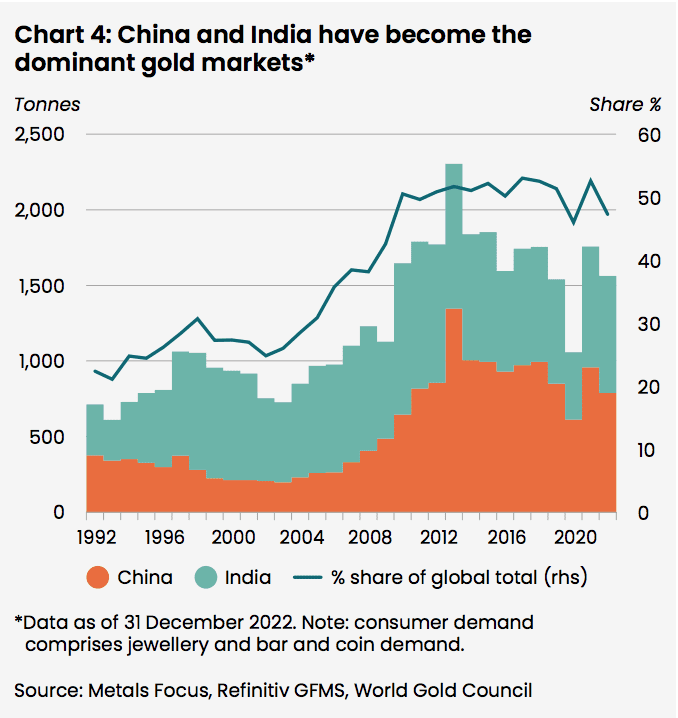

And surprise, surprise, China and India, the core of BRICS, are the principal buyers fueling this frenzy.

And those are just the official figures.

You see, central banks aren’t obligated to disclose their gold purchases.

In fact, that would be counter-intuitive to their goal. If everyone knew what they were up to, the price of gold would surely climb; why force yourself to buy at higher prices?

It’s no wonder that over 87% of gold purchases were unaccounted for last year – equal to more than 500 tons of gold.

For some perspective, that’s equal to 5% of America’s entire gold reserves and one-fourth of China’s official gold stock.

So who’s the mystery buyer(s)?

A few months ago, we could only speculate. But now the cat is out of the bag.

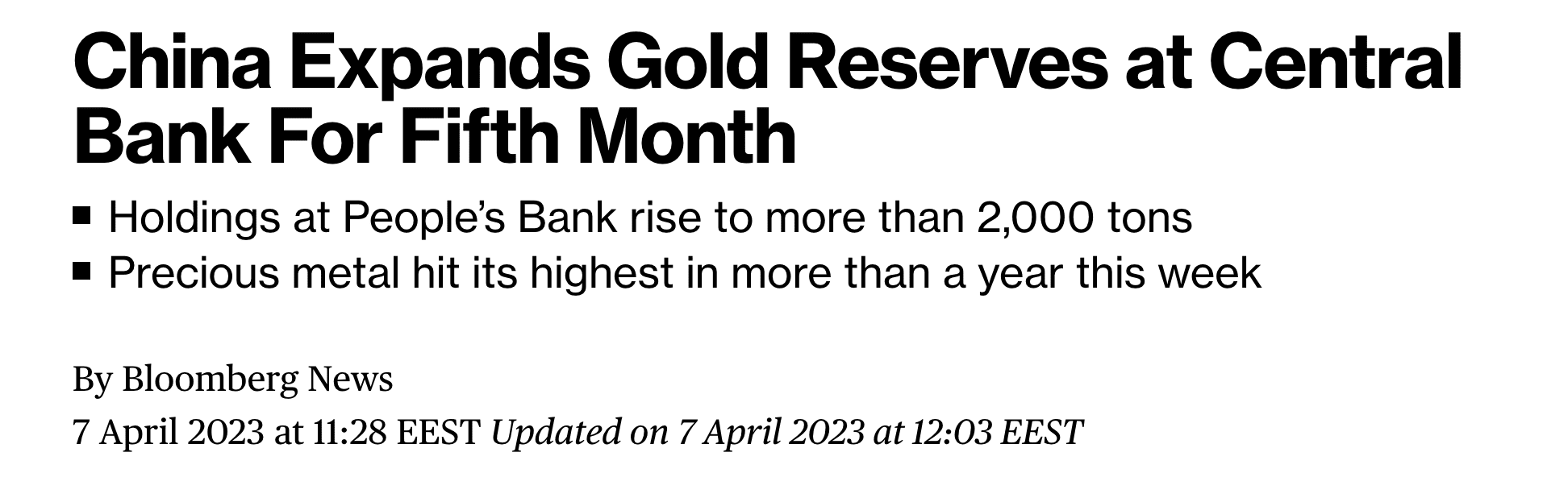

Last November, China reported an increase in its gold reserves for the first time in four years. And its official stock has grown for five consecutive months now:

Why now?

The timing suggests they are building a backing for the launch of the new BRICS currency and showing other nations that they are indeed building up gold stock.

It’s just a matter of time before China reveals the REAL magnitude of its gold holdings.

What happens when the US dollar loses dominance and fiat currency is no longer trusted in international trade?

What happens if gold becomes the end reserve asset?

Simple: its price will explode.

This is why I am once again excited about the prospects of gold stocks, and looking forward to introducing our readers to these opportunities.

Starting with a junior gold stock whose recent announcement could prove very rewarding for its shareholders…

NevGold: A Potential for 800% Gains

(TSX-V: NAU) (OTC: NAUFF) (FRANKFURT: 5E50)

NevGold is a budding Canadian gold junior with rare upside potential.

It owns the Limousine Butte and Cedar Wash gold projects in Nevada, the Ptarmigan silver-polymetallic project in Southeast BC, and has an option to acquire 100% of the Nutmeg Mountain gold project in Idaho.

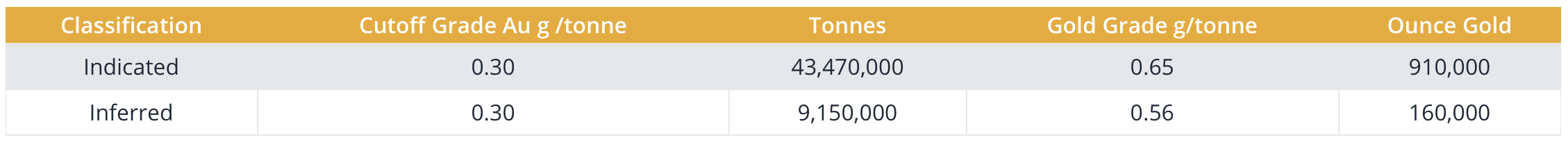

While the projects all have potential, let’s focus on their most advanced project: Nutmeg Mountain.

Nutmeg Mountain

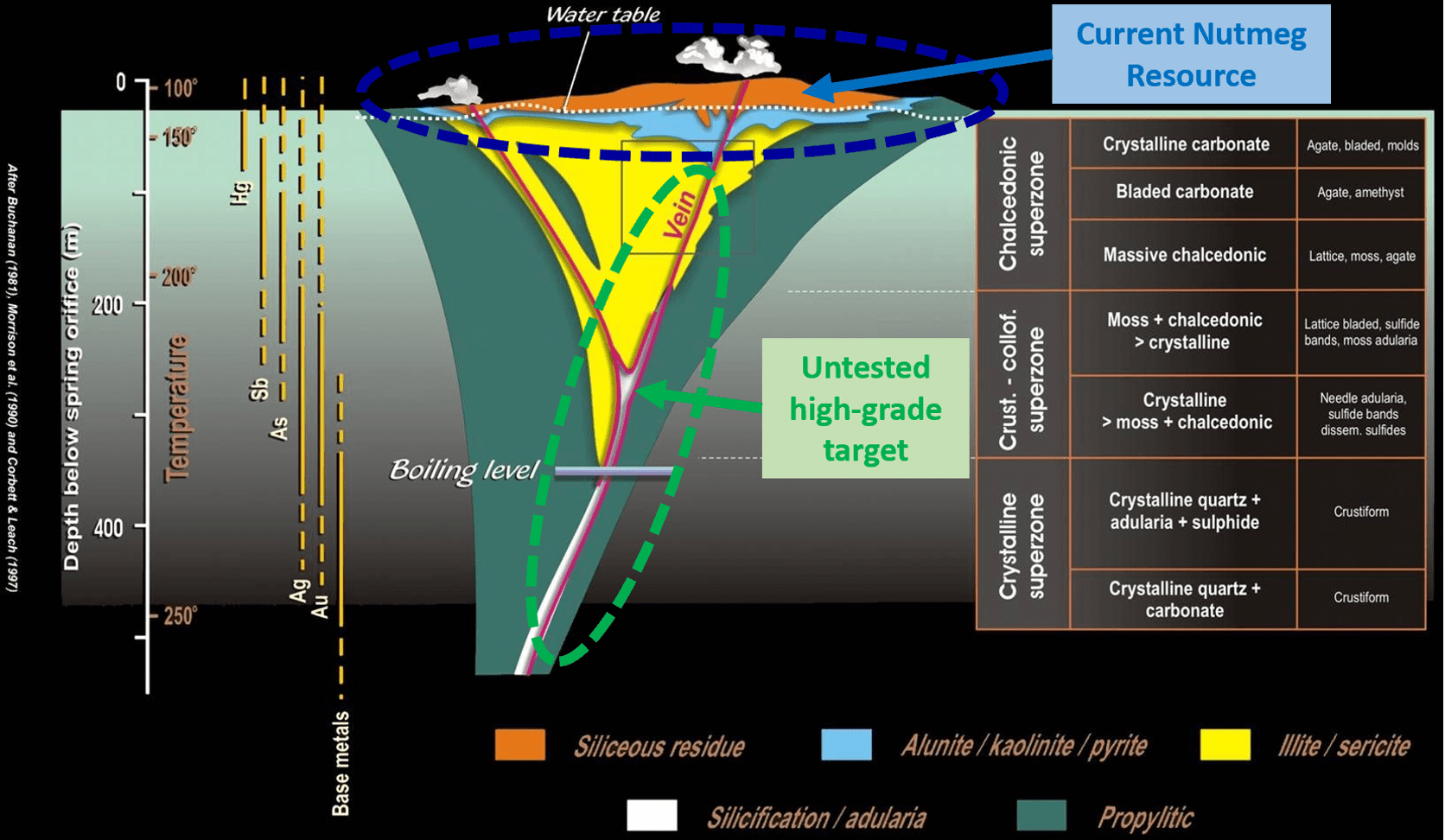

The Nutmeg Mountain (Nutmeg) project is a low-sulphidation epithermal gold-silver deposit with over 70,000 meters of historical drilling.

The geology of this deposit is comparable to several other epithermal deposits found in the Western USA, home to some of the world’s largest gold producers in history.

In fact, some of the most profitable mines in the Western USA and globally have been low-sulphidation epithermal (LSE) systems.

The attractive characteristics of LSEs are simple: they have the potential for large, open-pit, heap-leach tonnage at or near surface and the potential for large high-grade feeder structures at depths that can have bonanza-grade material.

This gives you the best of both worlds as the near-surface, heap-leach ore can provide immediate cash flow while the bonanza grade system at depth is being advanced.

Think of an LSE having two distinct parts of the system:

- The disseminated, consistent, near-surface heap-leach part of the system, which is amenable to heap-leaching

- The high-grade feeder structure, which is the pathway where the gold at surface came from.

In short, they’re cheap to mine, make money in most gold-price environments, and have a minimal environmental footprint.

Nutmeg currently hosts an LSE resource of just over 1 million ounces of gold.

But this resource could get much, much bigger.

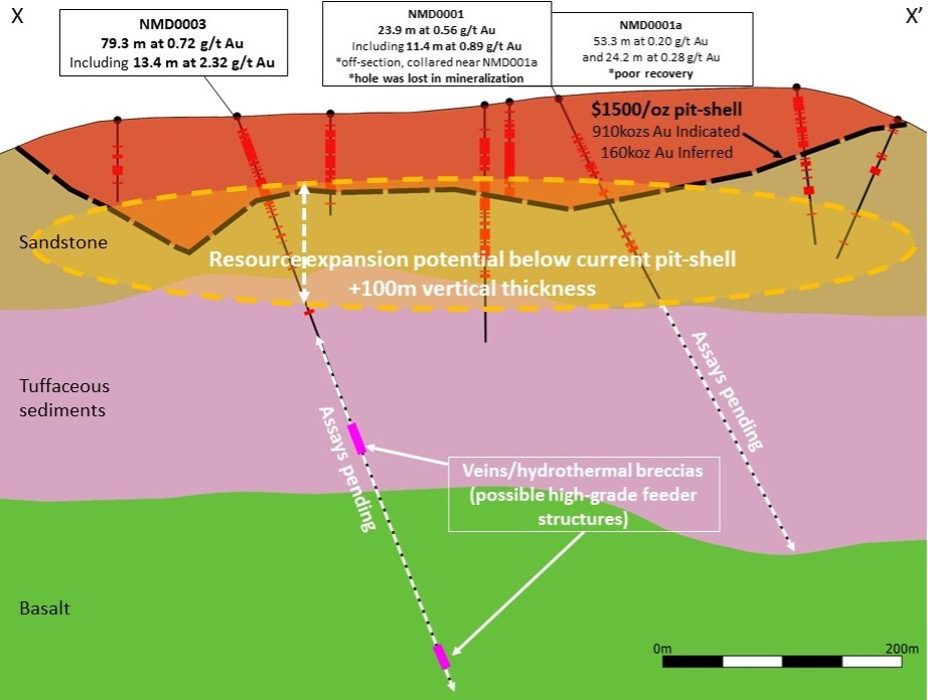

You see, NevGold just announced an extremely important news release regarding the inaugural drill results from its Nutmeg Mountain project.

Here are the highlights:

- High-Grade, Heap-Leachable Gold Intercepted from Surface: 0.72 g/t Au over 79.3 meters from 10.4 meters depth (heap-leachable), including 2.32 g/t Au over 13.4 meters from 25.6 meters depth (heap-leachable) (Hole NMD003), and 0.56 g/t Au over 23.9 meters from 24.1 meters depth, including 0.89 g/t Au over 11.4 meters from 25.6 meters depth with 4.33 g/t Au intercepted near the bottom of the hole (Hole NMD001, hole was lost in mineralization). The mineralization starts at surface with minimal stripping required, and exhibits positive, heap-leach characteristics with both free gold and oxidized material.

- High-Grade Potential at Depth: Hole NMD003 intercepted multiple, large, vein/breccia zones at 251 meters and 469 meters depth, with assays pending, in an entirely untested area of the project. (Figure 1, Figure 4, Figure 5) The average historical hole depth at the project is only 75 meters, and the company sees significant resource expansion potential at depth. Hole NMD003 intercepted a material structure that will require follow up drilling as the quartz textures seen in the core indicate a potential high-grade feeder structure is present at depth.

- Open, Near-Surface Mineralization Along Strike: a large step-out 140 meters from the nearest drill collar intercepted significant anomalous mineralization starting at 4.6 meters depth and extending to 93.6 meters depth with grades up to 0.43 g/t Au. (Hole NMD002) Mineralization is open in all directions and further drillholes are planned in this area to test additional targets identified by geochemical and geophysical data previously collected at the project.

For geologists, these results are very promising. But what do they really mean for investors?

Let’s break it down.

First of all, this release not only confirms that Nutmeg has a large, heap-leach gold system sitting at surface but also has massive high-grade potential at depth.

What’s exciting is that Nutmeg has historically only been drilled at surface, and the deeper part of the system was not properly tested.

In fact, the project’s historical average hole depth is only 75 meters, as noted by the news release.

It’s no wonder the guys at Nevgold are excited. Not only do these drill results show significant potential for expanding the open-pit near-surface resource, but there is also the prize at depth which has remained elusive to date because no one has drilled that far down.

And based on the recent drill results, Nevgold now believes that the near-surface resource could double while still having the large, high-grade target at depth.

Take a look:

And in just a few short weeks, we should have the results of the much deeper drilling (see “assays pending” in image above).

If those results come back positive also, it could be a game-changer for Nevgold.

Why?

The Two-Zone System Significance

The intact, 2-zone LSE system at Nutmeg is very encouraging and not one that is seen often.

Many times, the upper part of the system has been eroded over centuries due to weathering and or concealed by fault block movement.

Normally these LSEs either have the top part of the system or the bottom part of the system remaining. Very rarely do you have both parts of the system intact, like at Nutmeg.

This not only means that there will be more near-surface gold to find, but they also have a deeper high-grade feeder structure at approximately 300-500 meters below surface.

And with a known 1.1 million ounces of gold at surface already, it’s like having a cake with icing and a large cherry (potential high-grade zone at depth) on top (or, in this case, on the bottom).

The known expression of the recently completed (2020) 1.1 million ounce resource boundary at Nutmeg is already 2,300 meters long by 650 meters wide and over 100 meters thick.

That’s a very large mineralized system!

And given the recent drill results, the NevGold team now believes that there is another 100 meters of vertical thickness not included in the current resource, as well as significant untested lateral extent.

In other words, the team at Nevgold thinks they can easily double, or even triple, the 1.1 million ounce resource.

But that’s not all.

Some of the deep drilling results from NevGold’s latest release indicate that NevGold may be close to the source of all of the fluids and that source is usually related to the high-grade feeder structure which is part of the system NevGold is exploring.

In Hole 3, NevGold hit two separate vein/breccia zones over 11 meters and 7.5 meters wide, respectively, that could be part of that high-grade feeder structure. Assays are pending for these two areas – (results within the next month), so they’re onto it.

As NevGold learns more about the deeper part of the system, they could potentially hit a feeder system that could host grades as high as 1oz per tonne, with widths between 5-20 metres!

Which leads us to the next topic: grade.

Grade is King

As our readers know, when it comes to mining, grade is king.

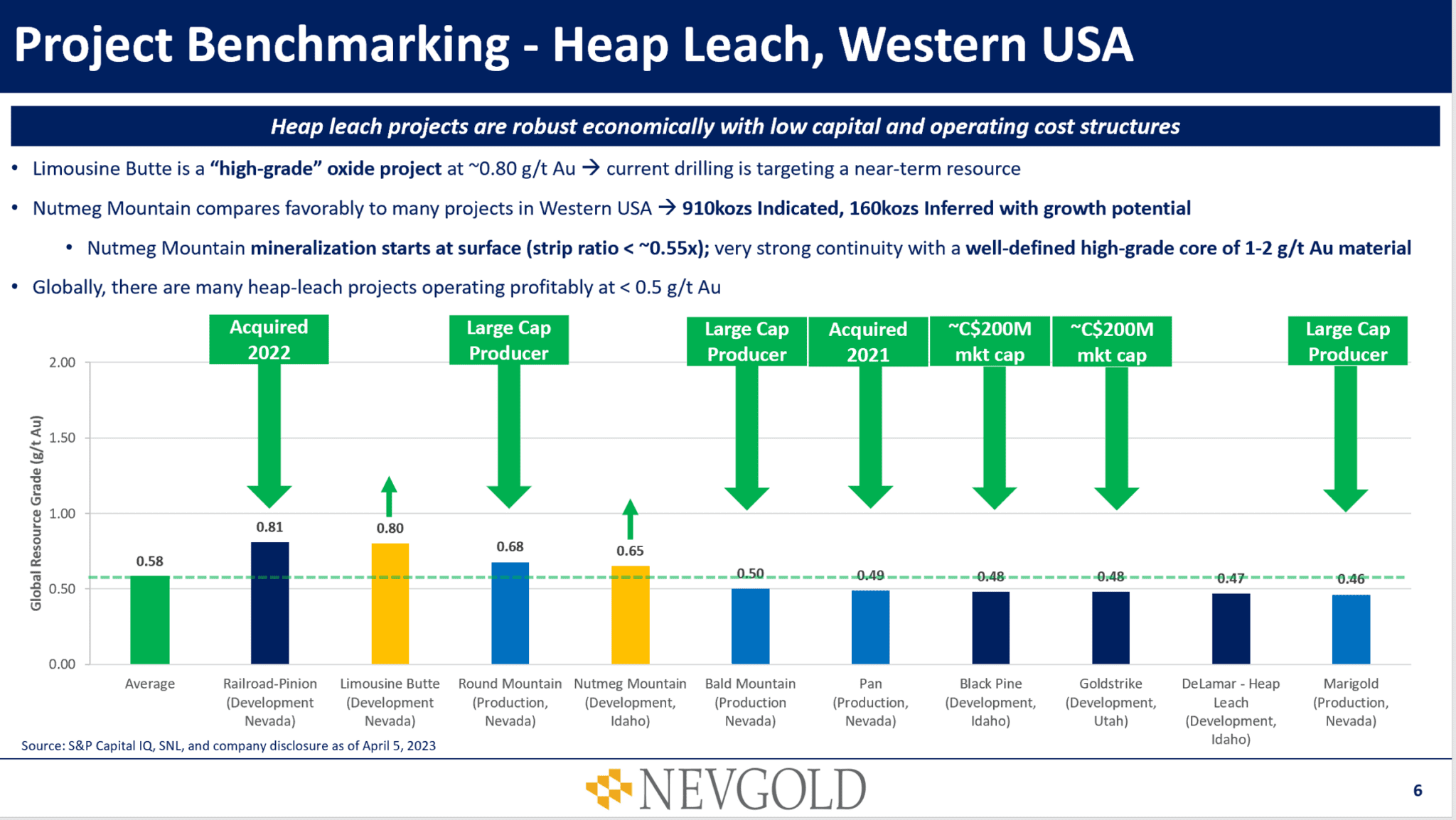

While the gold grades intercepted in the Nutmeg resource, ranging between 0.7-0.75 g/t Au, don’t seem spectacular, they are actually considered high-grade for heap-leach projects.

More significant is that NevGold recently intercepted 79.3 meters at 0.72 g/t Au from 10 meters depth, including 13.4 meters at 2.32 g/t Au from 26 meters depth.

Those are very good numbers.

For comparison, many projects in the Western USA have grades less than 0.5 g/t Au (see below figure).

Strip Ratio

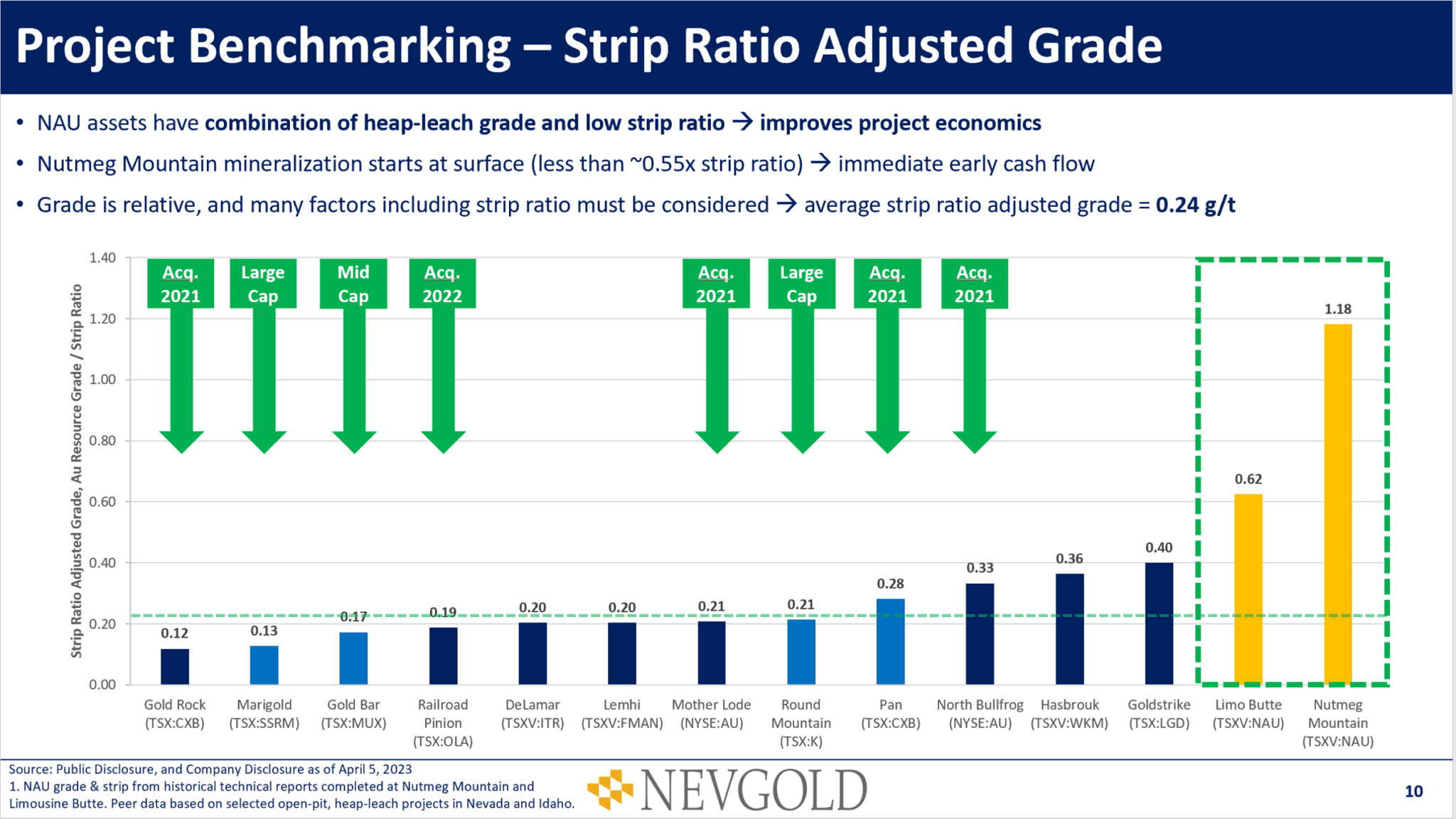

Another important consideration is the strip ratio and how close the gold is to surface.

The strip ratio refers to the amount of waste material (overburden) that must be removed to extract a given amount of valuable material (ore). It is defined as the ratio of the volume of waste material to the volume of ore in an open-pit mine.

For example, if a mine has a strip ratio of 3:1, it means that for every 3 units of waste material that must be removed to access the ore, only 1 unit of ore can be extracted.

A higher strip ratio generally means that the mining operation is less profitable, as more resources must be expended to remove the waste material before reaching the valuable material.

The gold at Nutmeg starts at surface, which means less material to remove to get the gold out.

When you combine gold grade with strip ratio, Nutmeg’s profitability prospects get even better.

The average project in the Western USA has a strip-ratio adjusted grade of 0.24 g/t. The strip adjusted grade at Nutmeg is 1.18x (over 4.9x), and Limousine Butte (Nevgold’s Nevada asset, more in a bit) is 0.62 (over 2.5x), potentially making NevGold’s projects much more profitable compared to its peers.

When we adjust grade for strip ratio at other projects in the Western USA (see below figure), Nutmeg has some of the highest grades around.

Looking at comparable projects in the US, many of them are either producing gold now, or have recently been acquired. In fact, two of the above projects (North Bullfrog and Pan) belonged to our past (Corvus Gold) and present (Calibre Mining) Equedia Portfolio companies.

As such, you can see why we are shareholders of Nevgold.

These numbers further build the case that the current Nutmeg resource is a high-grade, heap-leach project in the Western USA with a strong potential to get much bigger.

NevGold inaugural drilling at Nutmeg just commenced this year, and these are only the first batch of results.

But another three holes are completed, and more assays are still pending from the initial holes. We could be in store for some fireworks in the coming weeks.

And this is only one of Nevgold’s projects.

Limousine Butte, Nevada

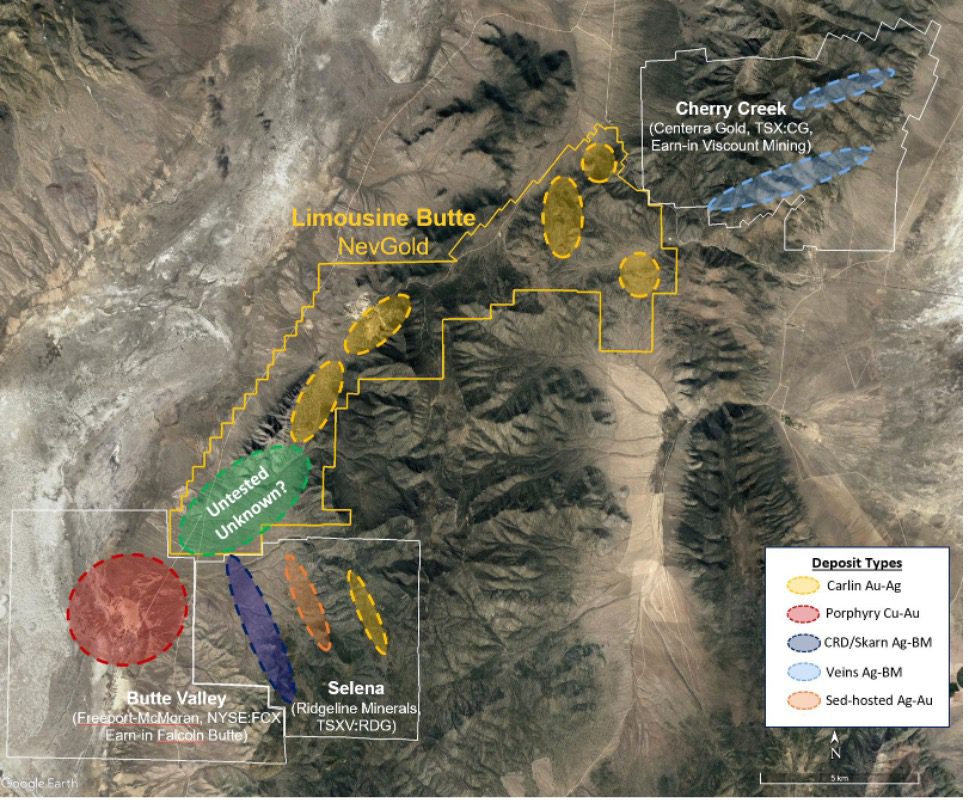

NevGold has another flagship project, the Limousine Butte project in Nevada.

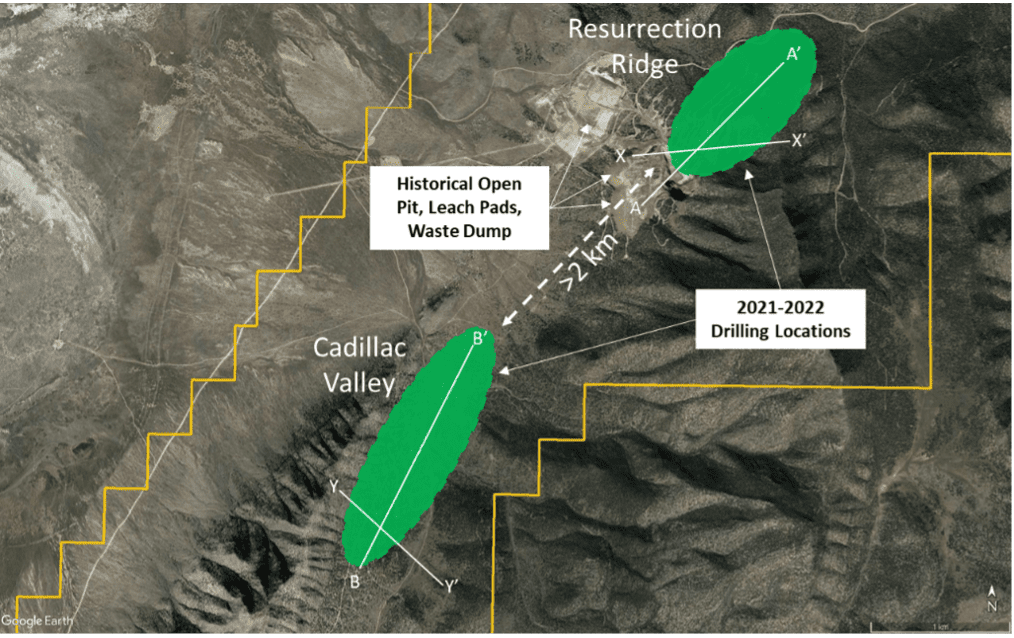

Limousine Butte is a gold exploration project (6,650 ha or 66.5 km2) that sits approximately 65 miles (104km) to the northeast of Ely, Nevada. The project was a past producer with the Golden Butte mine, which yielded approximately 100,000 ounces of gold in 1989-1990.

Last year, NevGold drilled nearly 10,000 meters at Limousine Butte, returning exceptional near-surface oxide gold results.

In fact, the team has told me they are well on their way to delivering a potential 1.25-1.5 million ounce resource here.

Limousine Butte is a traditional Carlin-type gold deposit that is seen all through Nevada – a jurisdiction that almost always carries a premium.

The one differentiating factor is that much of Limousine Butte has not been drilled out, and the project’s footprint is growing with each drill hole.

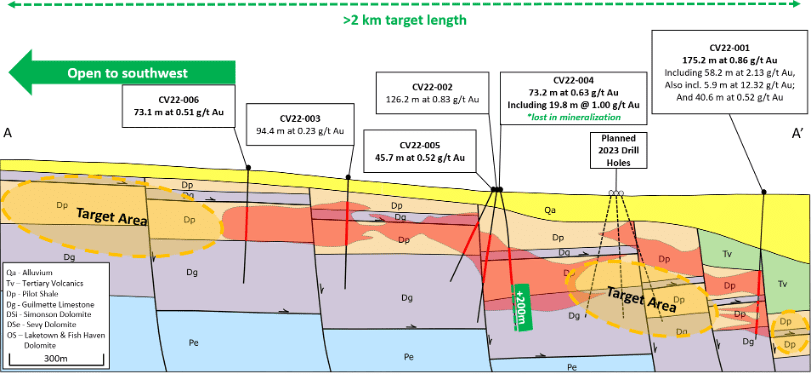

The focus of the 2022 drilling was on the Resurrection Ridge and Cadillac Valley target areas.

Resurrection Ridge was a past producer and mined about 100,000 ounces of gold in 1989-1990. And as gold miners know, there is no better place to find more gold than right next to a mine.

And that is exactly what NevGold did in 2022.

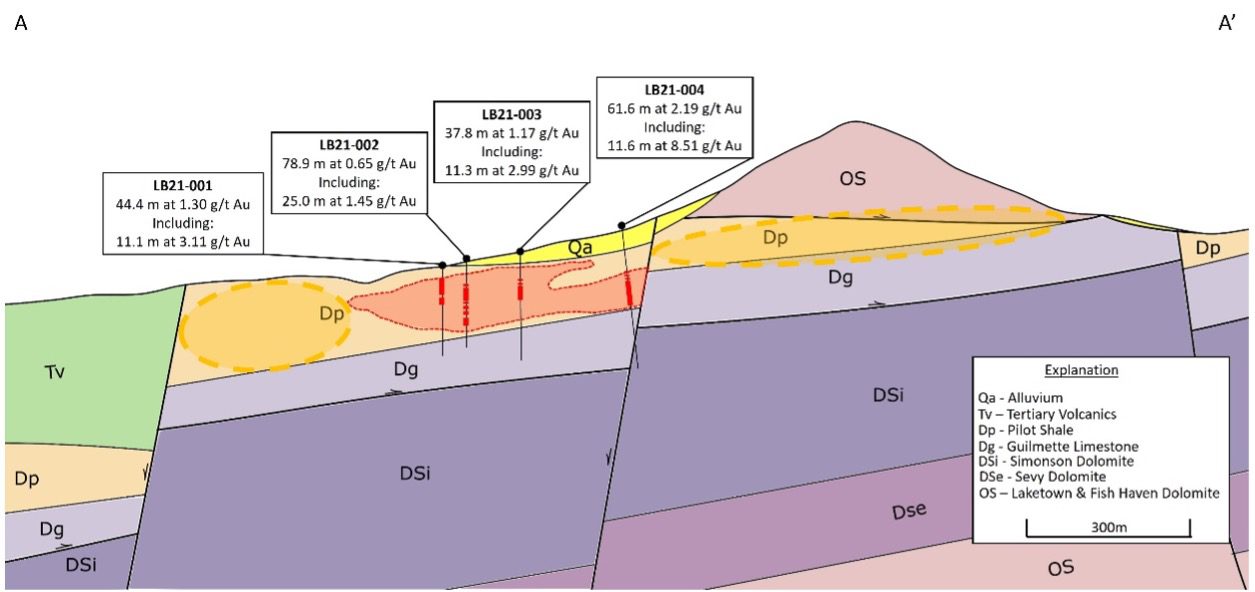

They drilled a large number of positive holes at both the Resurrection Ridge and Cadillac Valley target areas with key intercepts including 61.6 meters at 2.19 g/t Au oxide including 11.6 meters at 8.51 g/t Au oxide (Resurrection Ridge) and 44.4 meters at 1.30 g/t Au oxide including 11.1 meters at 3.11 g/t Au oxide (Resurrection Ridge), and 175.2m @ 0.86 g/t Au oxide, including 58.2m @ 2.13 g/t Au oxide, also including 5.9m @ 12.32 g/t Au oxide (Cadillac Valley), and 126.2m @ 0.83 g/t Au oxide (Cadillac Valley).

2022 Resurrection Ridge Drill Results

2022 Cadillac Valley Drill Results

Those are high-grade numbers with long intercepts, especially for a near-surface oxide gold project.

It’s no wonder the district around Limousine Butte is heating up.

One of the world’s largest copper producers, Freeport-McMoran (NYSE: FCX), is conducting a large drill program adjacent to NevGold’s southeast, and they think they are onto the next large copper discovery in the Western USA. This could be a complete game-changer for the district.

NevGold believes they control the strongest land position next to its neighbours, which is a great position to be in.

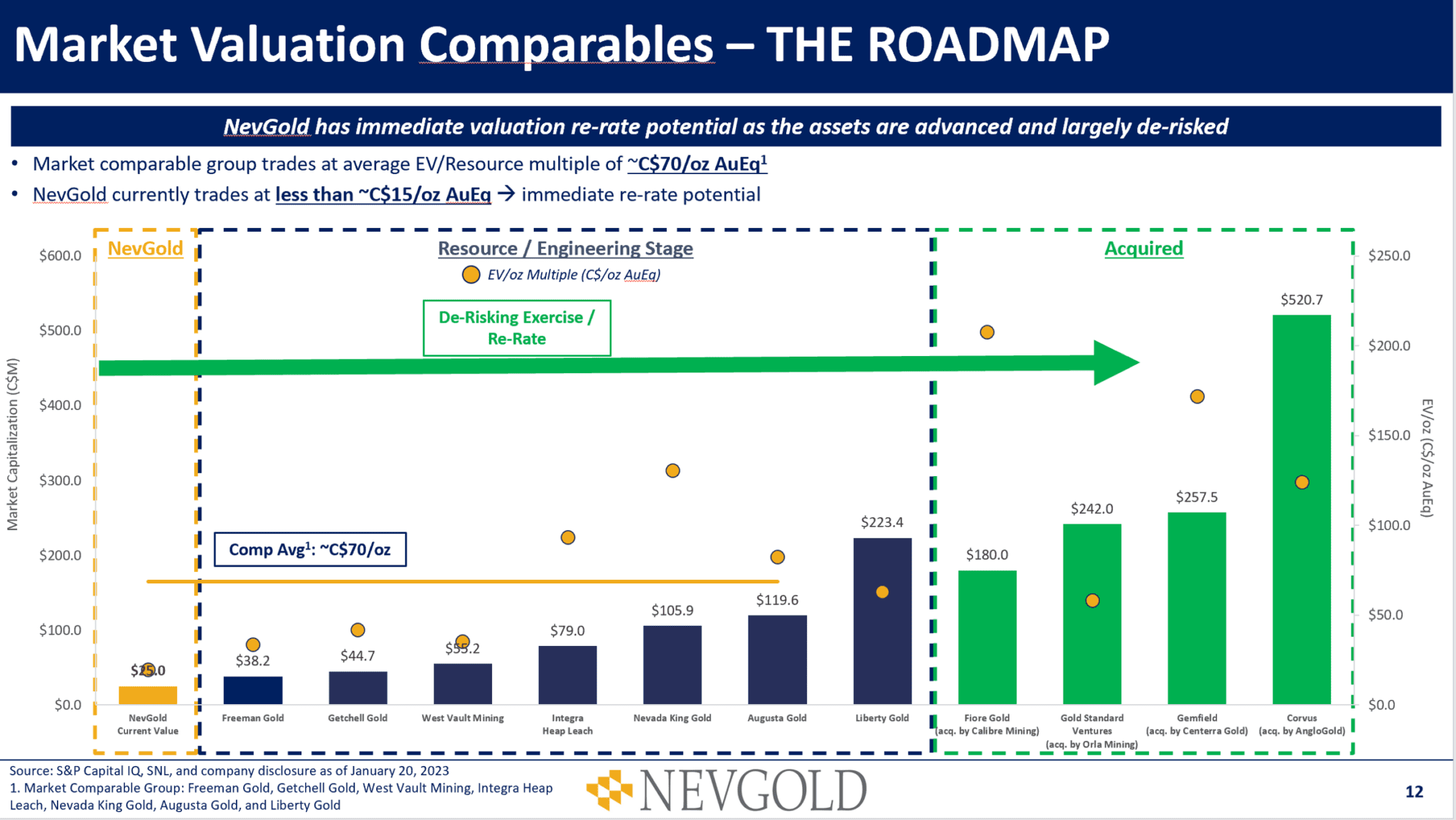

How to Value Juniors

For those new to junior explorers, let me give you a quick 101 on how the market values these stocks.

If you had to put a fair price tag on an average S&P 500 company, you’d probably use an earnings multiple, such as P/E or EV/EBITDA. These metrics weigh the company’s earnings against its stock price, which is useful for the likes of P&G or Coca-Cola.

In the world of junior miners, things are different.

The mines aren’t that far along in development to project cash flows or earnings.

So, at this stage, the miner’s valuation is not so much about how much money it’s raking in as it is about how much gold they are potentially sitting on.

For those reasons, investors often use a metric called EV/oz to value junior miners. The metric takes the company’s enterprise value and divides it by the total resources of gold in the ground.

What does that mean for NevGold?

NevGold is trading at an approximate C$25 million market cap today, or less than C$15/oz in the ground.

Peer companies with gold resources in the Western USA trade at C$70/oz in the ground.

That’s a massive difference and provides a strong argument for a re-rate of its share price.

But that’s not all.

NevGold plans to drill Nutmeg and Limousine Butte this year in an attempt to hit the 3-million-ounce mark.

If they’re successful, the company could rise to a C$200 million valuation based on comps.

That’s 8X where it trades today!

And that’s assuming gold prices don’t go higher.

No Risk, No Reward

Of course, like every investment, there are risks – and Nevgold is no different.

Gold prices could fall, and drilling might miss.

Ultimately, junior exploration companies are mostly negative cash flow businesses. That means Nevgold will likely be diluted further as the company will need to raise additional capital or issue more stock to achieve its goals.

Furthermore, junior companies are less liquid than their large-cap counterparts, which means a little bit of buying can send shares higher, and a little bit of selling can send shares lower.

It’s important you conduct your own due diligence and value Nevgold based on your own assumptions.

As we have always said, success is defined by risk. And with risk comes the potential for failure but also the potential for success.

The higher the risk, the higher the reward.

As long-time Equedia readers know, large gains are not uncommon when you bet on early-stage miners at the right time.

Timing the Market

What’s happening now is eerily reminiscence of what happened nearly 50 years ago: devaluation of the dollar, rise in oil prices, UK in a recession (almost), real GDP growth decline, rise in inflation, and money printing.

In the year prior to the 1973 crash, stocks were doing incredibly well, with the DJIA gaining 15% in twelve months.

We’re seeing the same thing now.

As stock markets peaked in 1972, the bears kicked in, and stocks fell dramatically during that time. While stock markets rebounded eventually, the recovery was a slow process. The United States didn’t see the same level in real terms until August 1993: over twenty years after the 1973-74 crash began.

While stocks lost nearly half their value during that time, many gold mining shares easily quadrupled in value – some of them far more than that. The surge in the gold and silver sector was dramatic, and it changed the lives of the investors who took the risk to participate when no one else would.

Recent market events are pointing to a major surge in gold mining stocks in the next few years, and as a result, this year may be one of the best opportunities in the last decade to own them.

The next few weeks will be critical for NevGold. Don’t blink. You may miss something big.

Nevgold

Canadian Trading Symbol: NAU

US Trading Symbol: NAUFF

German Trading Symbol: 5E50

Disclaimer:

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. We are biased towards Nevgold (NAU) because the Company is an advertiser on www.equedia.com. We currently own shares of NAU. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in NAU or trading in NAU securities. NAU and its management have no control over our editorial content and any opinions expressed in this article are our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us. For a complete disclosure of the compensation received by us from NAU, please review our Terms of Service and full disclaimer at www.equedia.com/terms-of-use/.

I would like to know more about investing in gold