If you knew something was worth nearly $1 billion, would you pay $500 million?

How about $100 million? Or even $50 million?

What about for less than $40 million?

Well, theoretically, you could buy a piece of it at that value. Right now.

That’s because – at the time of this writing – this company has a market cap of less than C$40 million (US$30mm).

But I don’t think it will stay at this value much longer – especially after the announcement this company just made.

An announcement that values its asset at nearly C$1 billion!

I am talking about after-tax value, too.

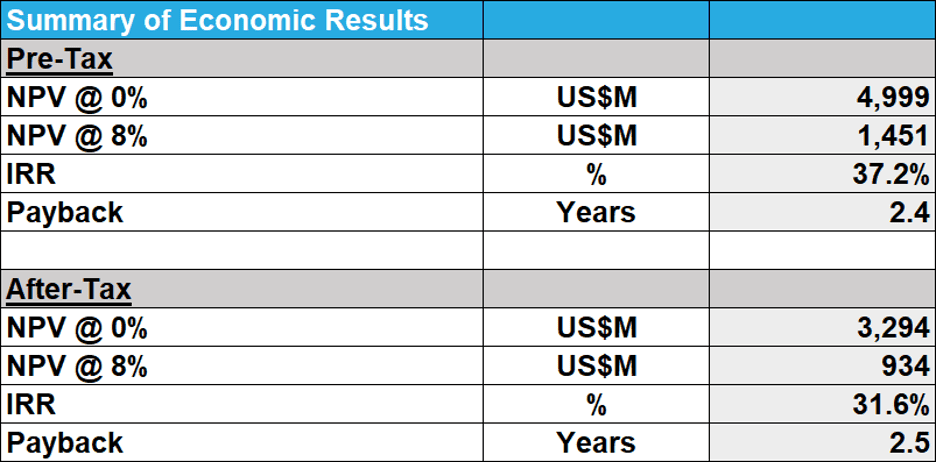

According to the announcement, the net present value (NPV) of this company’s asset is nearly $5 billion before taxes.

With a discount rate of 8%, it has a NPV of $1.45 billion.

Factor in taxes, and the NPV is $3.29 billion. With a discount rate of 8%, it has an NPV of $934 million – nearly $1 billion in value!

And because it JUST made this announcement, we’ll jump right into it.

Because time is of the essence.

This company is…

Lithium South Development Corporation

(TSX-V: LIS) (OTCQB: LISMF) (Frankfurt: OGPQ)

Canadian stock symbol: LIS

US Stock Symbol: LISMF

German Stock Symbol: OGPQ

Lithium South Development Corporation just announced positive results from an independent Preliminary Economic Assessment (“PEA”) for its Hombre Muerto North Lithium Project (“HMN Lithium Project”) near Salta, Argentina.

For more information on what a PEA is and how to value mining stocks, see our Letter, “When Things Turn Around: Mining 101.”

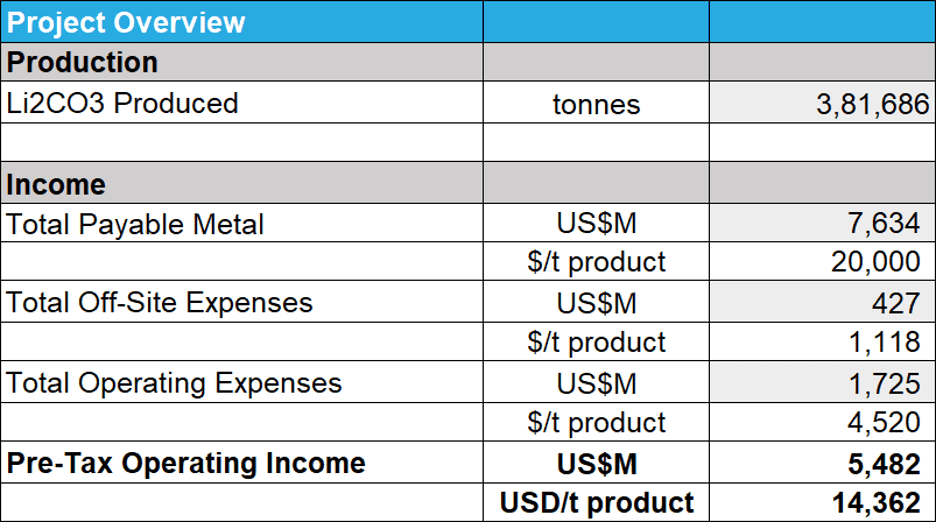

The recently announced PEA by LIS is based on 15,600 tonnes per year of lithium carbonate technical grade production, and its results highlight attractive economics associated with the project, including a short payback and exceptional Internal Rate of Return:

After-tax NPV of US$934 million with an Internal Rate of Return (IRR) of 31.6%

PEA based on a mine life of 25 years with a 2.5-year payback

PEA based on a production rate of 15,600 tonnes of lithium carbonate technical grade per year

Processing based on simple and proven solar evaporation technology

If you haven’t read our original report, please do so by CLICKING HERE.

When considering the economics of a mining project, there are obviously many factors, all of which can change depending on the significance and risks of each project.

Generally, in the mining world, an IRR of 20% is considered good, and a payback period of 3-5 years is considered pretty good.

Having said that, both the IRR and payback period of Lithium South Development’s HMN Lithium Project would be considered excellent.

Take a look:

For a company whose market cap is currently less than $40 million, these numbers are very good.

So good, in fact, you might think there is a catch.

And there is – but it might not matter (more on this shortly.)

Lithium Pricing

The PEA assumed a lithium price of $US20,000/tonne (t), assuming a 2029 production start-up.

However, the price of lithium has been volatile in recent months, declining from a peak of approximately US$85,000/t in November 2022 and stabilizing to around US$13,000/t in 2024.

The selected price for the PEA was based on current published market analysis and by benchmarking the price assumptions found in multiple technical reports from similar brine lithium projects.

The benchmarking exercise in the PEA provided a long-term price range of US$20,000 to US$25,000/t, with an average of US$22,400/t over seven projects.

This, it’s reasonable to assume that in 2029, the price of lithium carbonate technical grade could be US$20,000/t.

In fact, we bet that the price of lithium carbonate will be much higher by 2029.

According to the Shanghai Metals Market today, the lithium carbonate technical grade price has already bounced higher, trading in the range of CNY101,000-111,000/t. That’s an average price of CNY106,000/t, or around US$14,725/t.

In other words, if you believe the lithium carbonate technical grade price will be US$20,000/t or higher in 2029, then it is fair to assume the PEA numbers are VERY good.

And we predict it will be.

Another Shot: The Lithium Bottom?

There are rare opportunities for investors to get a second chance.

For example, in late 2022, the price of Bitcoin fell to less than US$17,000; today, it’s over $63,500.

And we feel lithium could do something similar.

The lithium market has taken a bit of a tumble in the past few months.

First, the demand for electric vehicles (EVs) in China, one of the biggest and fastest-growing EV markets, has slowed down.

On the supply side, global lithium production is expected to rise, with big mines coming online in Australia and Chile.

Meanwhile, a near-term global slowdown in electric car demand is forcing car and battery makers to cut costs.

The EV market is still growing, just not as fast as everyone thought and not in a linear fashion.

This negative sentiment has led to a rapid decline in the price of lithium, dropping over 80% from its highs last year.

Does that mean we should stay away from lithium? Or, more importantly, lithium projects with robust economics?

As Warren Buffett once said, “Be fearful when others are greedy, and greedy only when others are fearful.”

The latter could very well be the case for lithium today.

We know EVs are here to stay. We know the world’s largest car makers have spent far too much time and money building EVs. We know the world is still on a path to sustainable energy.

In other words, not only are EVs here to stay, but the market for energy storage will continue to expand.

That means we’ll need more lithium!

And when the price of a commodity drops, production slows. Why would producers continue to produce if they’re losing money?

As a result, we feel the lithium market is at an inflection point, and we might be in front of a general lithium price rebound. We’re already seeing this in the charts.

Perhaps it’s time to load up again?

Get a more in-depth look at Lithium South by reading our original report.

Lithium South Development Corp

Canadian Stock Symbol: LIS

US Stock Symbol: LISMF

Germany Stock Symbol: OGPQ

The information contained herein is provided solely for the reader’s general knowledge. The information is not intended to be a comprehensive review of all matters and developments concerning Lithium South Development Corporation (LIS). All information is offered on a “best intentions” basis. No securities commission or other regulatory authority in Canada or any other country or jurisdiction has in any way passed upon this information and no representation or warranty is made by LIS and Equedia to that effect.

This presentation may include “forward looking statements.” All statements, other than statements of historical fact, included herein, including without limitation, statements regarding exploration results, future plans, or objectives of LIS.

Some of the statements herein are forward looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. LIS and Equedia do not make any representations, warranties or guarantees, express or implied, regarding the accuracy, completeness, timeliness, noninfringement, or merchantability or fitness for a particular purpose or use of any information contained in presentation.

Furthermore, the information in no way should be construed or interpreted as, or as a part of, an offering or solicitation of securities. Investors are advised to discuss all of their stock purchases with a registered securities broker or personal finance professional prior to investing. No obligation, responsibility or liability shall be incurred by LIS and Equedia or any of its officers, directors, employees or agents for any loss or damage whatsoever, whether incidental, special, indirect, consequential, punitive, exemplary, or for lost profits in connection with, caused by or arising from any delays, inaccuracies, errors or omissions in or infringement by, or from any use of, or reliance on such information contained in this presentation.

THIS PRESENTATION IS FOR DISCUSSION PURPOSES ONLY.

Qualified Person Statements

Peter Ehren is an independent Lithium Consultant. He has more than two decades of experience in the industry. He started his interest in the lithium business during his master’s thesis at Technical University of the Delft where he investigated for BHP Minerals the recovery of lithium from geothermal brine (Salton Sea), applying a Direct Lithium Extraction (“DLE”) technology. After his thesis he worked for SQM as a process engineer and R&D manager till 2007. Since 2007 he started to work as independent consultant in the lithium, boron and potassium industry. He is a world expert in solar evaporation systems, phase chemistry and process developments. Additionally, his experience covers product applications, OPEX and CAPEX estimation, process simulations, engineering, R&D and product development. He has worked in lithium basins and production facilities worldwide. He is a Chartered Professional (AusIMM) and QP for NI 43-101 and JORC.

Dr. Mark King, Ph.D., F.G.C., P.Geo., of Groundwater Insight, Inc., is the QP for resource estimation components of the PEA., as such term is defined by NI 43-101. Dr. King has extensive experience in salar environments and has been a QP on numerous lithium brine projects, ranging from early exploration to production. Dr. King is independent from the Company and has reviewed and approved the technical information mentioned in this press release.

Richard Goodwin, P.Eng., Project Manager for JDS Energy and Mining, Inc., is independent of Lithium South and a QP as defined under Canadian National Instrument 43-101. Mr. Goodwin is a mining engineer and study manager with over 30 years of experience managing mining operation and projects in various commodities such as base metals, precious metals, PGMs, and diamonds in various domestic and international locations. Mr. Goodwin is responsible for the PEA results, participated directly in the production of this press release, and directly related information in this press release, and approves of the technical and scientific disclosure contained herein.

Lithium South Development Corp’s news release on its PEA contains certain “forward-looking statements” within the meaning of Section 21E of the United States Securities and Exchange Act of 1934, as amended. Except for statements of historical fact relating to the Company, certain information contained herein constitute forward-looking statements. Forward-looking statements are based upon opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors which could cause actual results to differ materially from those projected in the forward-looking statements. The reader is cautioned not to place undue reliance on forward- looking statements. We seek safe harbor.

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. We are biased towards Lithium South Development Corp (LIS) because the Company is an advertiser on www.equedia.com. We currently own shares of LIS and have been granted options by LIS. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in LIS or trading in LIS securities. LIS and its management have no control over our editorial content and any opinions expressed in this article are our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us. For a complete disclosure of the compensation received by us from LIS, please review our Terms of Service and full disclaimer www.equedia.com/terms-of-use/.