RIP 60/40: Alternatives (Part 3)

This is the final installment of RIP 60/40. (If you missed the first two letters, read them here and here.)

Last week, we touched on:

- the dangers of a 60/40 portfolio comprised of only bonds and stocks

- why, in the long run, rising rates aren’t that dangerous for stocks, and why this asset will still play a key role in a portfolio

- why bonds will bleed as long as rates rise, and what you can do to minimize losses while keeping bonds as a hedge against stocks

- how portfolio managers are rebalancing their portfolios into alternatives

Last time, we left off at the explosive growth of alternative investments taking over old-school portfolios. So today, I’ll wrap up RIP 60/40 with a cheat sheet for the most promising alternatives available to all individual investors.

We’ll go over their role in a portfolio, key myths, as well as the risk and opportunities in this paradigm shift.

Alternative Investment 1: Gold

Let’s begin with history’s most time-tested yet still largely “alternative” asset: gold.

Although the metal doesn’t generate income, has limited industrial use, and is no longer legal tender, it does play an important—often overlooked—role in every portfolio: it offers an unmatched store of value.

Consider this…

For over 3,000 years, gold has successfully beaten inflation and grown in value. It has outlived every stock and currency. And over the past 15 years, it has handed a better return than the S&P 500 during its longest bull market.

It’s also a great portfolio diversifier because it often moves in the opposite direction of risk assets.

In other words, gold is like a homeowner’s insurance for the portfolio.

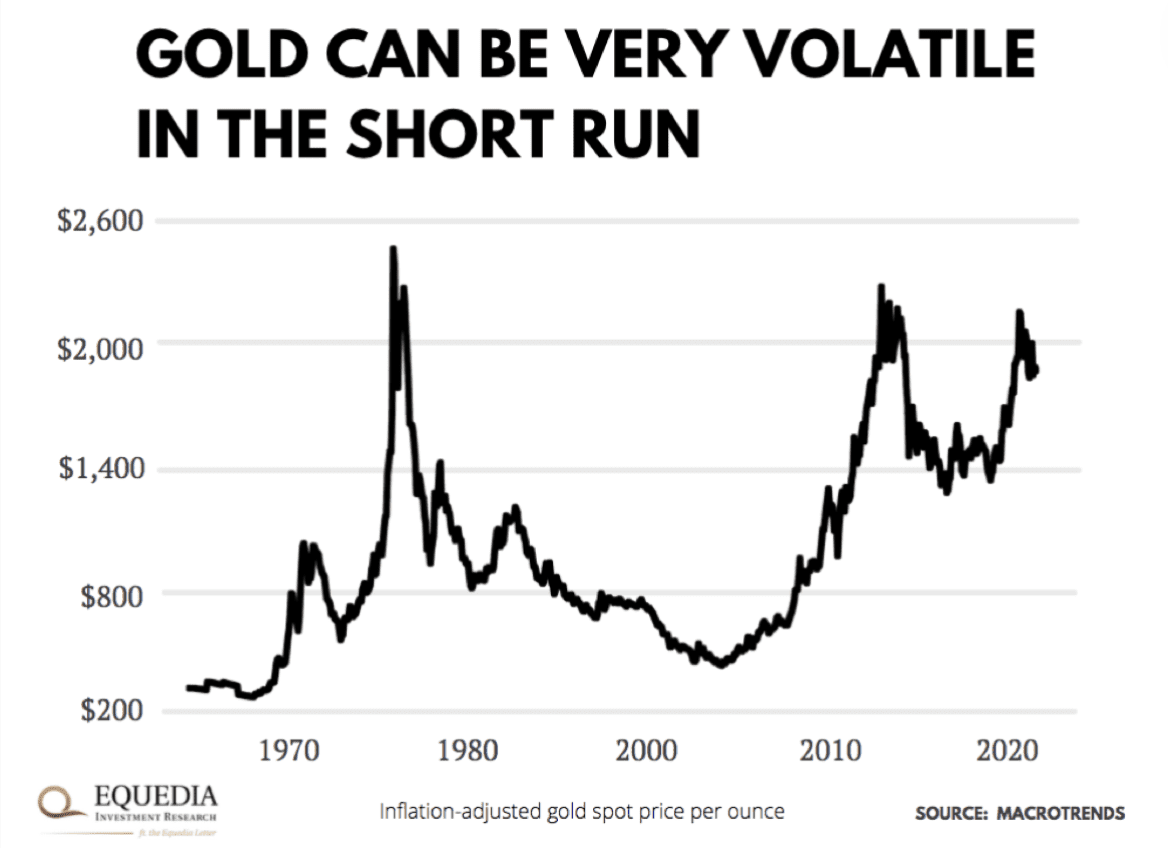

The catch is gold’s price can be very volatile in the shorter term. In fact, over the past 18 years, gold on average has been much more volatile than risky stocks. And many investors don’t have decades left to recoup losses.

Take a look at these wild price swings:

In the shorter term, volatility is a double-edged sword. If you time it right, you can make a lot of money. But there’s always a risk it will catch you off guard and beat your portfolio to a pulp.

Can you anticipate these downturns?

You can… if you ignore the biggest myth about gold, i.e., that inflation drives gold prices.

It does not. For the most part, real interest rates dictate where gold prices are headed.

Here’s a quick explanation from my The Gold and Inflation Peg is Wrong letter:

”For the most part, gold doesn’t have anything to do with inflation. And most of the time, it doesn’t move in tandem with inflation.

What gold really pays attention to is real interest rates. In the market, that’s the interest on “risk-free” debt minus the inflation rate.

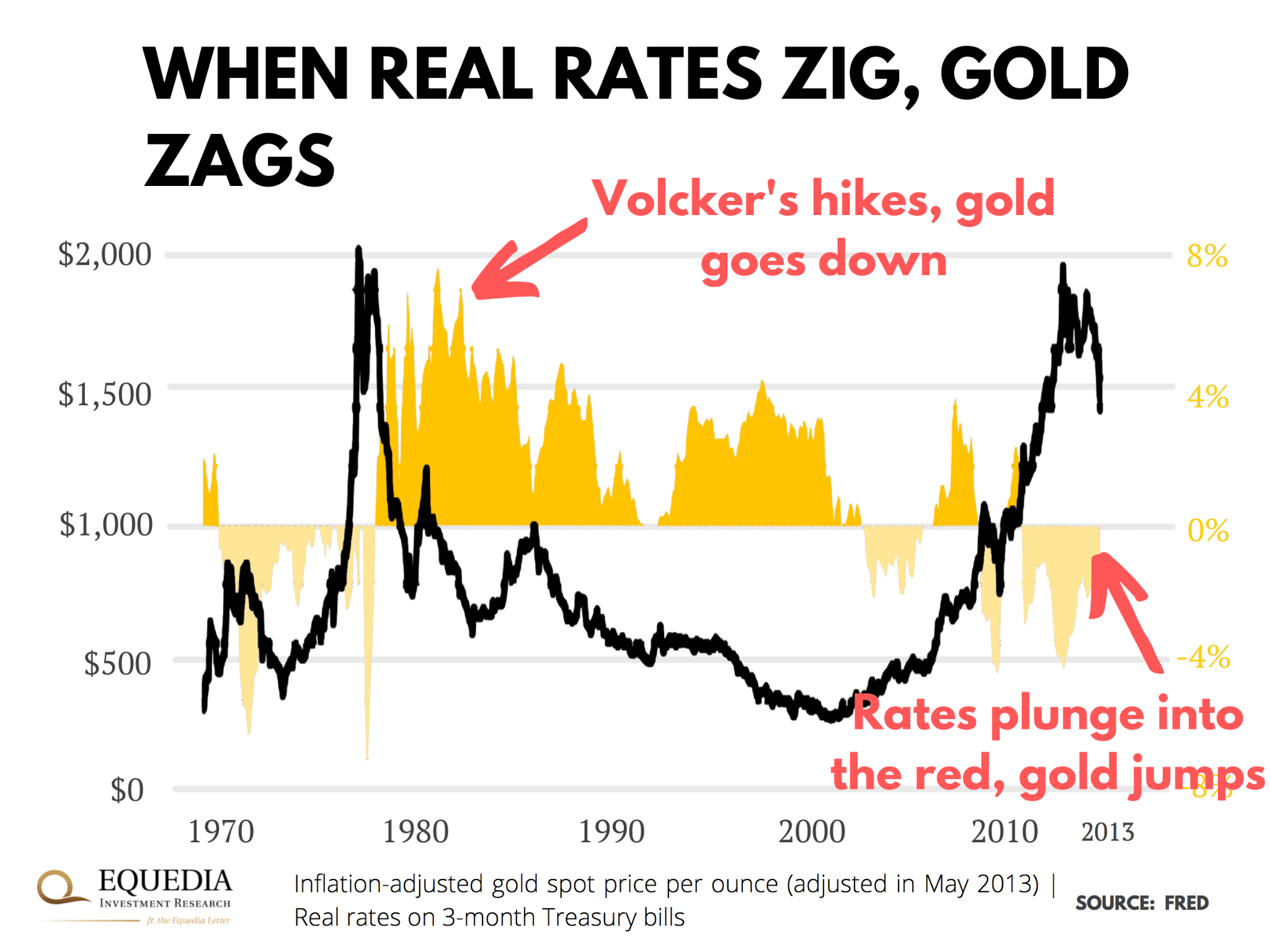

Take a look at this chart which shows gold’s near-perfect inverse relationship with real rates on 3-month Treasuries (common benchmark):

“

“

And there’s a very simple logical explanation behind this relationship:

“Like any other asset class, gold fights for a place in a portfolio with other investments. But unlike most investments, gold doesn’t generate earnings or income.

That means holding this metal comes with higher opportunity costs. Or put another way, the more you earn from, say, stocks or bonds, the less you want to invest in a metal that doesn’t earn a thing.

This is where real rates come in.

When real interest rates grow, so do bond interest rates and investors’ income from this asset class.

As the appeal of bonds grows, investors move more of their portfolios to this asset class. In turn, demand for gold falls—and so does its price.”

Now the question is, how fast and much will the Fed slap on brakes to rein in inflation? This is the most important question, and the answer will determine real rates and, in turn, gold prices.

Pros

- Gold is the most time-tested store of value

- Its inverse relationship with risk assets, which can offset downturns in overvalued risk assets

Cons

- Gold can be very volatile in the shorter term, and its price is currently close to all-time highs

- Central banks are planning to tighten, which will raise real interest rates. We just don’t know how high

Alternative Investment 2: Bitcoin

Next on our list is bitcoin. (Order intentional.)

Not long ago, Wall Street elites laughed off this cryptocurrency as the biggest fad in history. But over the pandemic, it has transformed from a fringe speculative investment into a maturing asset class with a clear purpose.

In light of unprecedented printing, fund managers are increasingly adopting bitcoin as an alternative inflation hedge. In fact, Goldman Sachs recently predicted bitcoin will beat out gold in terms of “safe haven” demand in the long haul.

This is key. And despite our skepticism, we discussed why Bitcoin could outperform back in 2013.

Via The New Currency Movement:

“If you think that Bitcoin is simply just a novel idea, think again. This is a New Currency Movement.”

Forget about a decentralized currency that will free society from capitalist autocrats. The Fed won’t let it happen. EVER. Bitcoin’s biggest shot is to become an alternative store of value to gold.

And that makes a lot of sense when you think about it.

As an investment, bitcoin and gold are very similar. Like gold, bitcoin has little utility. Its supply is decentralized and limited. And its value depends on supply and demand instead of arbitrary monetary policy.

It also costs money to “mine” them.

If bitcoin became a mainstream safe haven, that would be enough to open the floodgates of institutional money. In fact, that alone would take it well into seven figures by many estimates.

Let’s do some back-of-the-envelope math.

For starters, bitcoin supply is nearly maxed out. As I write this, 90% (18.9 million out of 21 million) of bitcoin is already mined. Which means there’s not much to add on the supply side.

Meanwhile, there’s multi-trillion-dollar demand for safe-haven assets.

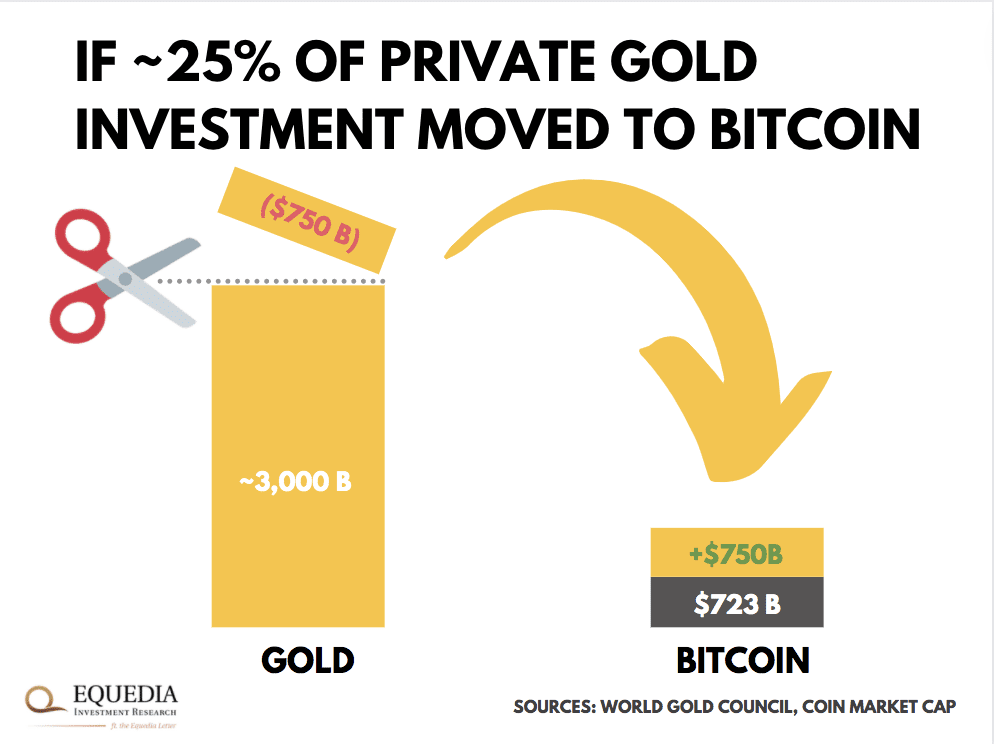

According to World Gold Council, investors held nearly $3 trillion in gold last quarter. Meanwhile, despite rampant speculation in crypto, there’s still just $733 billion parked in bitcoin.

In other words, bitcoin makes up around one-fourth of “safe-haven” demand. If investors moved another 25% of their gold holdings to bitcoin, the cryptocurrency could double or more.

Here’s what that looks like:

Can bitcoin pull it off? Still hard to tell – especially since rising super powers like China have banned it.

Its Achilles’ heel is volatility: it behaves more like a speculative asset than a safe haven. Not to mention, it’s still very much in its infancy, with just 13 years and one recession as a track record for an asset class.

That said, many influential investors, including its harshest critics, are coming around to it. And despite rampant speculation, there’s still only a very small percentage of investors who own the cryptocurrency.

So, if the “modern safe haven” narrative plays out, there’s still plenty of upside.

There’s also the view that, unlike our bank bail-in acts (which can essentially take your money), governments can’t take your bitcoin wallets.

Note that we are not touching on other cryptos because the majority of them are plagued with rampant speculation, scams, and shilling. If you missed it, read my letter Pump and Dump Crypto, to see how easily this market is manipulated.

Pros

- Bitcoin has huge upside potential

- It’s the most reliable cryptocurrency to diversify into digital assets

- It’s, in theory, harder for government to take it away

Cons

- Bitcoin still has a short track record as an asset class

- It still behaves like a risk asset instead of a safe haven

Alternative Investment 3: Real Estate

Another alternative (in a portfolio) is real estate.

It’s the third-largest asset class. It’s a great portfolio diversifier and one of the most reliable income sources. Yet, it’s grossly underutilized in portfolios due to one deep-rooted misconception:

“My home is an investment.”

It’s not.

Your home is an expense because it’s you who pays the “rent.” It requires regular mortgage payments, real estate taxes, insurance payments, and all sorts of other upkeep expenditures.

Even if it appreciates in value and you flip it for a profit, you’ll have to buy another house—likely bigger and in a similarly priced neighborhood—at the same appreciated price.

This illusion is the reason many investors are underweight real estate. And that’s a shame because, over the past 40 years, real estate has proven to be an invaluable portfolio addition.

(Side note: there are many ways to invest in real estate, each with its own nuances. But for simplicity reasons, here we’ll focus on publicly listed real estate via REITs. If you are new to these funds, here’s a good primer.)

Consider this:

- REITs have beaten the S&P 500 since 1972 (source)

- Adding as little as 5% of REITs to your stock/bond portfolio improves returns and reduces volatility (source)

- REITs are a great inflation hedge because they can increase rents and pass extra income on to their shareholders. In fact, in all but two of the last 20 years, REITs beat CPI (source)

- REITs vastly outperform bonds and stocks when rates rise (source)

Another important REIT feature is that this asset class is immune to speculative booms and busts in the stock market.

Take the dot-com craze, for example. When the bubble popped and stocks sank, REITs not only held ground, they grew by double digits.

That’s especially important today.

During the pandemic, tech stocks ballooned to valuations we haven’t seen since dot com. Today they make up a record portion of the stock market. So, a broader selloff in tech could bring down an entire market with it.

Case in point: have you seen the market lately? That’s the air hissing out of the tech bubble.

Pros

- Real estate is a great inflation hedge and source of income

- It performs great when rates rise in a sustainable way

Cons

- Certain types of real estate have already appreciated big time during lockdowns

- There’s a downturn risk if the Fed surprises with higher rates than expected

- Be careful with REITS that grew only as a result of low rates and are overleveraged

Alternative Investments 4: Private markets

So far, the alternatives we looked at reside in liquid public markets. But there’s a whole ‘nother universe of private investments that opens the door to more exotic investments: from venture capital to collectibles.

Why do private markets matter, anyway?

Two reasons:

- although these investments are less liquid and often riskier, they are not that crowded (= better valuations), and

- they are largely uncorrelated to public markets (= diversification).

Take venture capital, which is an investment in early-stage companies.

Since 2001, venture capital funds have averaged a 20% return, according to an index compiled by Cambridge Associates. That’s double the return of the tech-heavy Nasdaq over that period.

Not only that, this asset class didn’t flinch even in the thick of the worst tech routs.

For example, in the dot-com crash, stocks in the Nasdaq lost 78% of their value. At the same time, VC funds kept chugging higher—as if nothing had happened.

Not long ago, this asset class was only available to the rich.

It all changed in 2016 when Congress passed the so-called “Regulation Crowdfunding” bill. It allowed individual investors to invest as little as $250 in private companies through crowdfunding campaigns.

Venture capital is a great example, but it’s just one subset of private investments.

We hope to introduce you to one of these ideas later this year.

There’s a myriad of platforms that let you build a diversified portfolio in anything from peer-to-peer loans and collateralized real estate debt to wines and even Picasso artworks. Just Google.

Pros

- Historically greater returns

- Great diversifier for the bond/stock portfolio

Cons

- Less liquid

- Many private investments have a relatively short track record

- Higher risk

- Becoming more crowded with poor performers due to Regulation Crowdfunding

Change = Bargains

I’ve warned you… there won’t be easy answers.

That’s because portfolio construction doesn’t come down to a one-size-fits-all formula. Like a diet or exercise plan, it very much depends on the person following it.

An 80% allocation to stocks or 5% to crypto may be conservative for a 20-year-old. But for someone who is one foot into retirement, it’s like lighting a match near a gunpowder barrel.

That said, if you take away only one thing from this series, let it be this:

After decades of reckless monetary policy, we are on the cusp of the Great Reset. It will be a tectonic shift that will rewrite the investment playbook from the ground up. And so things that worked in the past 40 years may not work in the next.

I’m hoping this series has shed some light on the earthshaking shifts behind the headlines—and given you a little food for thought about how to fix up your portfolio in a more holistic way.

Just remember, change—be it a market migration, downturn, or complete “reset”—is nothing to fear. Instead, it’s a chance to snap once-in-a-lifetime bargains. And you can bet things will be on sale very soon.

Ivan and I have got you covered here…

Be prepared,

Carlise Kane

Disclosure: We own gold, Bitcoin, real estate, and have many holdings in private markets.

Thanks for sharing your thoughts and information on you

last couple of letters.

I found them very interesting and informative.

Thanks Carlisle again for keeping me on your list and

keep up the the good letters!

lets say i take a small position in a venture capital offer……what do i get? shares? a digital letter that i own a %of this entity? and how do i trade this position…..can i trade? do i wait for an ipo?…….lots of questions no answers……i know doctor google is out there……at 76 years old……i do not need three thousand hits….targeted ads..etc………..could you do a letter that goes into more detail on venture capital ……that addresses my and i am sure other human concerns…….i read every one of your newsletters and always come away with logically understood insights……….thanks

No shortage of alt coins to buy.That should keep Bitcoin from rising to infinity,just because there is some limit on numbers produced.Actually,there is a limit on the number of just about everything.