NewCore Gold

(TSX-V: NCAU)

Scratching the Golden Surface

We recently took a look at a report prepared by Cormark Securities that featured Newcore Gold (TSX-V: NCAU). Essentially, the report highlighted the development/production upside of 3 oxide gold deposits, collectively known as the Enchi gold project in Ghana.

Sometimes when you read reports written by mining analysts, the “sizzle” gets lost in the steak. Let me explain.

Normal valuation metrics were applied, and a strong case was made on the basis of NAV (Net Asset Value) and EV/oz (Enterprise Value/Ounces). A gold price that remains in its current recent range elevates the value of near-surface oxide reserves and resources. This is only natural.

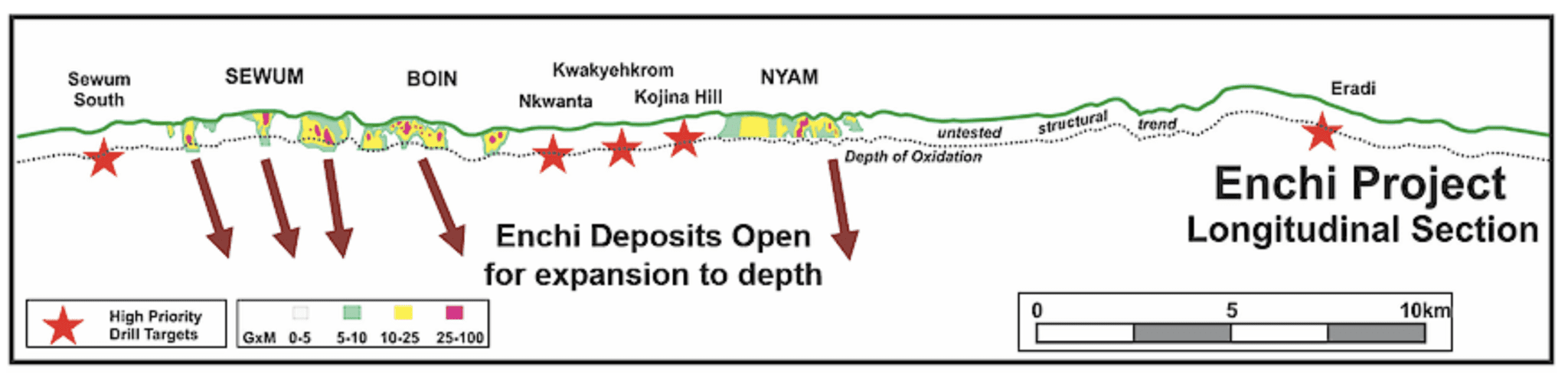

It is a relatively simple technical challenge to place an oxide gold deposit into production – provided that the stripping ratio is favorable, metallurgy is straight-forward, and adequate infrastructure is available. These considerations have been met at the Enchi project, although the near-vertical nature of the deposits limits the use of open-pit mining past a certain depth.

There is excellent exploration potential to develop further oxide resources along strike.

Now here is where it gets interesting.

The mining analyst report contains one simple sentence (the “sizzle”) that got me excited to learn more about NewCore Gold. Here is what was noted:

“Most resources and reserves of mines on the Bibiani Trend lie below 200 m.”

As important as this observation was, the preceding sentence summarized exploration like this:

“Drilling at Enchi has averaged about 125 m from surface and has not gone deeper than 200 m.”

It often helps to compare the geology of other nearby projects to get a better understanding of the potential of certain gold assets.

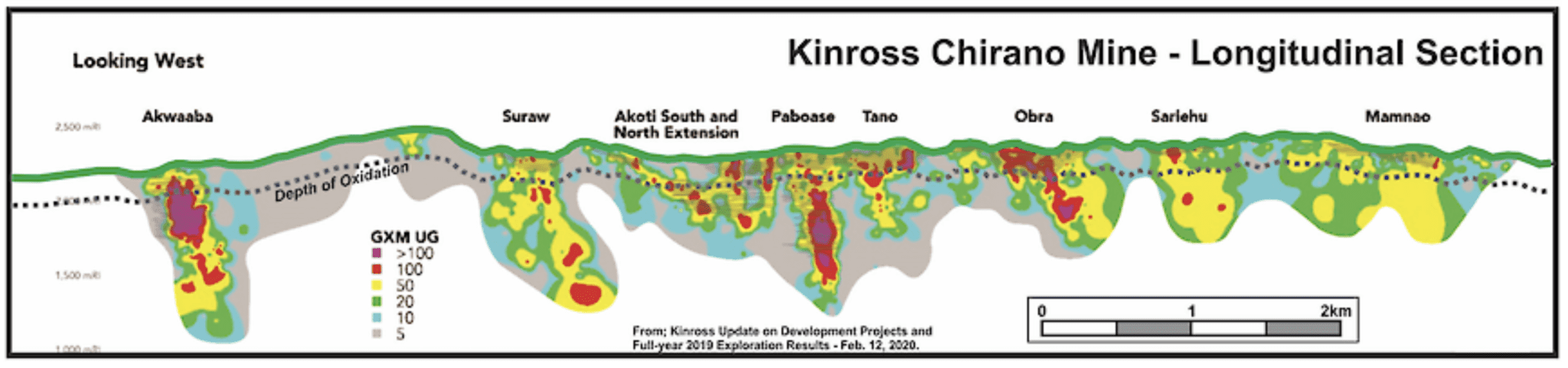

Just 50km north of Enchi lies Kinross’s Chirano Mine. Take a look:

The Chirano zones are similar to those found at Enchi, including known zones Boin, Sewum and Nyam. Like Chirano, the zones at Enchi have lower grade gold at surface, where previous drilling has averaged only 125 metres. The zones remain open to depth.

It’s worth noting that without any further exploration, Chirano’s mine life is expected to end in 2022. With a mill capacity of approximately 3.5 million tonnes per year at Chirano, surely Kinross would like more resources to feed it.

Given that Newcore’s Enchi is only 50km’s away, it could be a potential target for Kinross – especially with further exploration success.

So there it is. The risk/reward calculation is evident. Newcore is, in a way, a “one-way bet.” The oxide deposits’ upside and their immediate production potential protect against not finding depth extensions to yet undrilled sulphides.

This is where the hidden bonus of having a seasoned management group starts to emerge.

Take a moment and read through the NewCore list of Management & Directors:

https://newcoregold.com/about/our-team/

This management group is more than capable of meeting every challenge. It will be worth the wait to see how they approach unlocking the value of the Enchi gold project.

There is room to grow resources both along strike and at depth.

Regular readers of Equedia has seen this group in action twice before: once with Newmarket Gold ($1 billion take over by Kirkland Lake Gold), and a second time with Calibre Mining (Nicaragua’s largest gold producer). Will the third time be the “charm”?

One thing is sure; this management group does not let the grass grow under their feet.

They are “alpha achievers.”

Summary and Wrap-up

Several mining analysts at brokerage firms that specialize in identifying resource opportunities are united in their view that NewCore Gold is on a golden mission to succeed. So far, Cormark, Haywood, Raymond James, and Stifel/GMP have initiated coverage on the Company. More are sure to follow.

A top-notch exploration/development team, with a laser-targeted exploration approach, is now active in a prolific gold belt in Africa’s largest gold producing nation.

We like their chances of finding one of the large mult-million-ounce gold deposits the trend is so well known to host.

We’ll be keeping our eyes on this one.

*It is worth noting that a private placement that took place a few months ago is about to come free trade soon this month. We’ll be looking for weakness during this time as a potential buying opportunity.

-John Top

Disclosure: We do not own shares of Newcore at the time of this writing, but Newcore is an advertiser.