Dear Reader,

The world’s most powerful financial institutions are buying it at record-pace.

If this continues, it will be the biggest purchase not seen in over 60 years.

In fact, even countries like Serbia have joined.

Just last month, Serbia purchased nearly half a billion dollars of this.

Meanwhile, ETF holdings for it just hit an all-time high in Q3.

In case you didn’t already guess, I am talking about gold.

A Special Moment

It’s been over four years since I introduced you to an investment idea in the gold sector.

The last time I did, that company was bought out for nearly C$600 million – a potential return of over 400% in just over a year.

The gold idea before that?

That company was bought out for over C$1 billion – also just a year later from when I made the initial introduction.

That’s why I couldn’t be more excited today.

Today, after four long and extremely patient years, I am finally ready to introduce you to my next “golden” idea.

The Biggest in the Country

I am about to introduce you to a company whose management team has made investors hundreds of millions and discovered billions of dollars worth of gold.

But it’s just some exploration gold company looking to strike it big.

And it’s not a gold company attempting to develop a mine – because we know how long and how much money that takes.

I am talking about a company that is on track to produce over US$50 million worth of gold* in this quarter alone!

*at current gold price.

After four long years, this company had to be something special.

And it is.

Let me tell you why.

How in the World?

A few months ago, a report came across my desk that immediately got my attention.

It detailed an unusually special situation on how one junior exploration company may not only have the firepower to outperform its peers in this market, but also take advantage of a unique opportunity that many of its peers can’t touch.

It was the one of the most promising deals I have seen in a long time – nearly four years to be precise.

It was so good that I knew there had to be a catch.

And there was: It wasn’t a done deal.

For the deal to go through, the company needed to raise a whopping C$100 million – not exactly an easy thing to do in this capital-constrained environment.

How many junior mining companies do you know of that have raised that kind of capital recently?

Not many, I presume…

But that wasn’t the hard part.

The hard part was convincing the owner of a basket of cash-flow producing assets with nearly four billion dollars* worth of gold in the ground and over $560 million spent, to merge their assets into a junior explorer that didn’t even have the C$100 million yet!

(*based on the total combination of reserves, inferred, measured and indicated resources at today’s gold price, priced in USD.)

Now, this may seem like a tall order: Why would anyone want to merge nearly four billion dollars worth of gold in the ground and tens of millions in revenue every year, into a junior explorer that didn’t even have the $100 million?

Well, let me tell you.

This deal wasn’t sent to me from just any junior exploration team.

It came from a group that has done it many times over; one that has made investors hundreds of millions along the way.

And that’s where the story begins.

Back-to-Back Champions?

Much of what you just read may sound strangely similar to a story I wrote about five years ago.

Five years ago, I introduced readers of this Letter to a group of individuals that negotiated an incredible deal to merge $7 billion worth of gold assets into a shell company that had nothing more than the anticipation of a C$25 million bankroll.

At the time, the junior gold market was taking a turn for the worse, and exploration companies were failing. There simply weren’t the exits there used to be for development companies within the mining sector.

And no exits meant no capital.

To even have a chance of a success in the gold sector, you needed to be a producer.

After looking at hundreds of assets and spending hundreds of thousands of their own money, this team finally settled on a project.

They found a public company with three 100%-owned operating mines across Australia that collectively were producing more than 200,000 ounces annually.

But these assets had been mismanaged so many times by so many people that no one else was willing to back them or even talk about them.

The assets were outstanding, but a bad barber with the sharpest scissors still won’t give you a good haircut. Such was the case with the Australian company’s management. Furthermore, 80% of the company was owned by five hedge funds down in New York.

In other words, it really wasn’t a public company at all; it operated more like a semi-private entity. As a result, there was no liquidity and very little institutional coverage.

But THIS team saw the diamond in the rough.

They saw a mismanaged world-class gold producer with massive exploration and discovery potential.

And they took advantage of it.

They negotiated a deal to merge the assets into a new Company for a measly $25 million.

But how?

Because of the people.

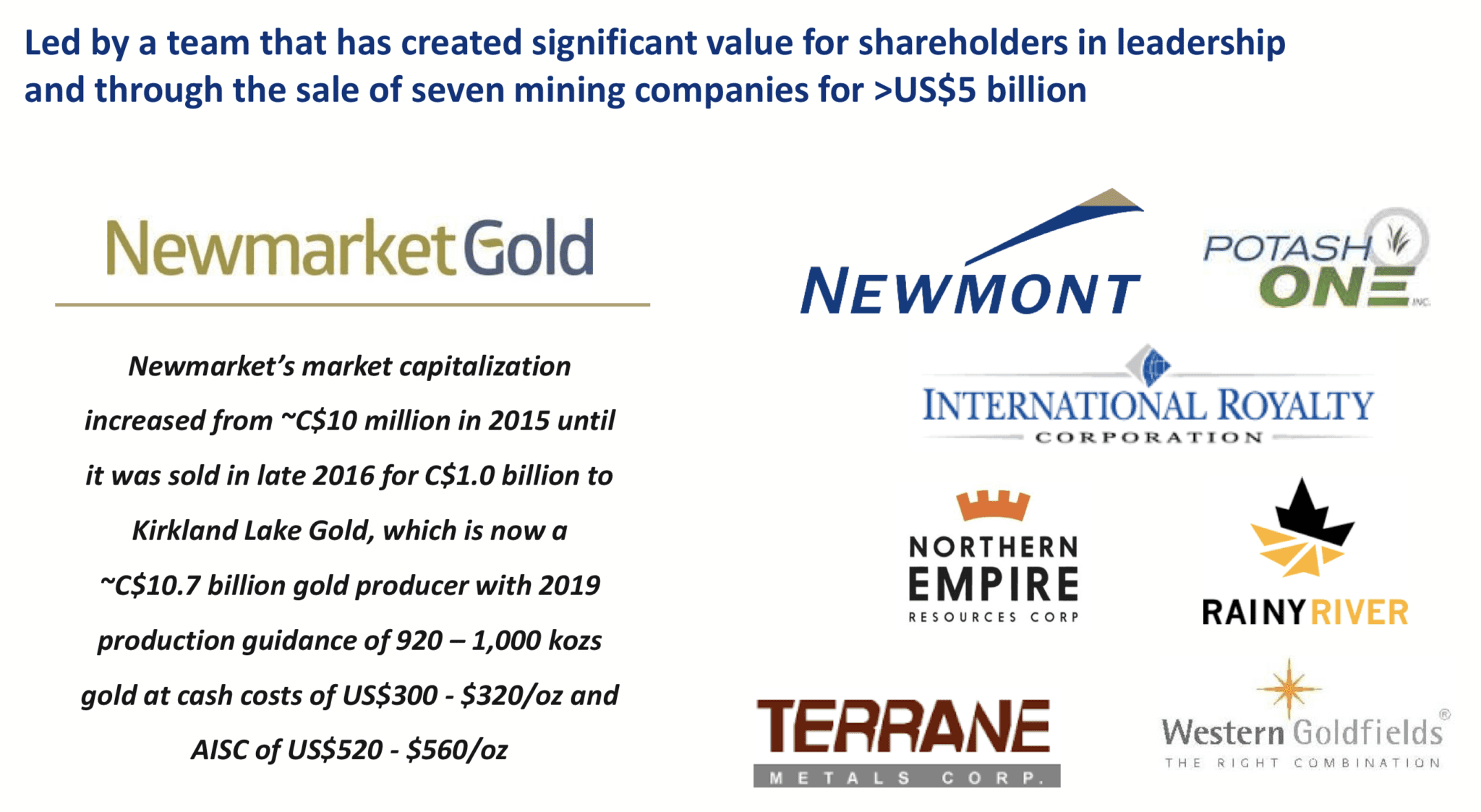

This team of individuals has collectively founded, managed, and sold mining companies with a combined value of nearly $30 billion at the time.

They not only turned the Australian mines around through significant improvement in operations but did exactly what they thought they could do: make a massive discovery.

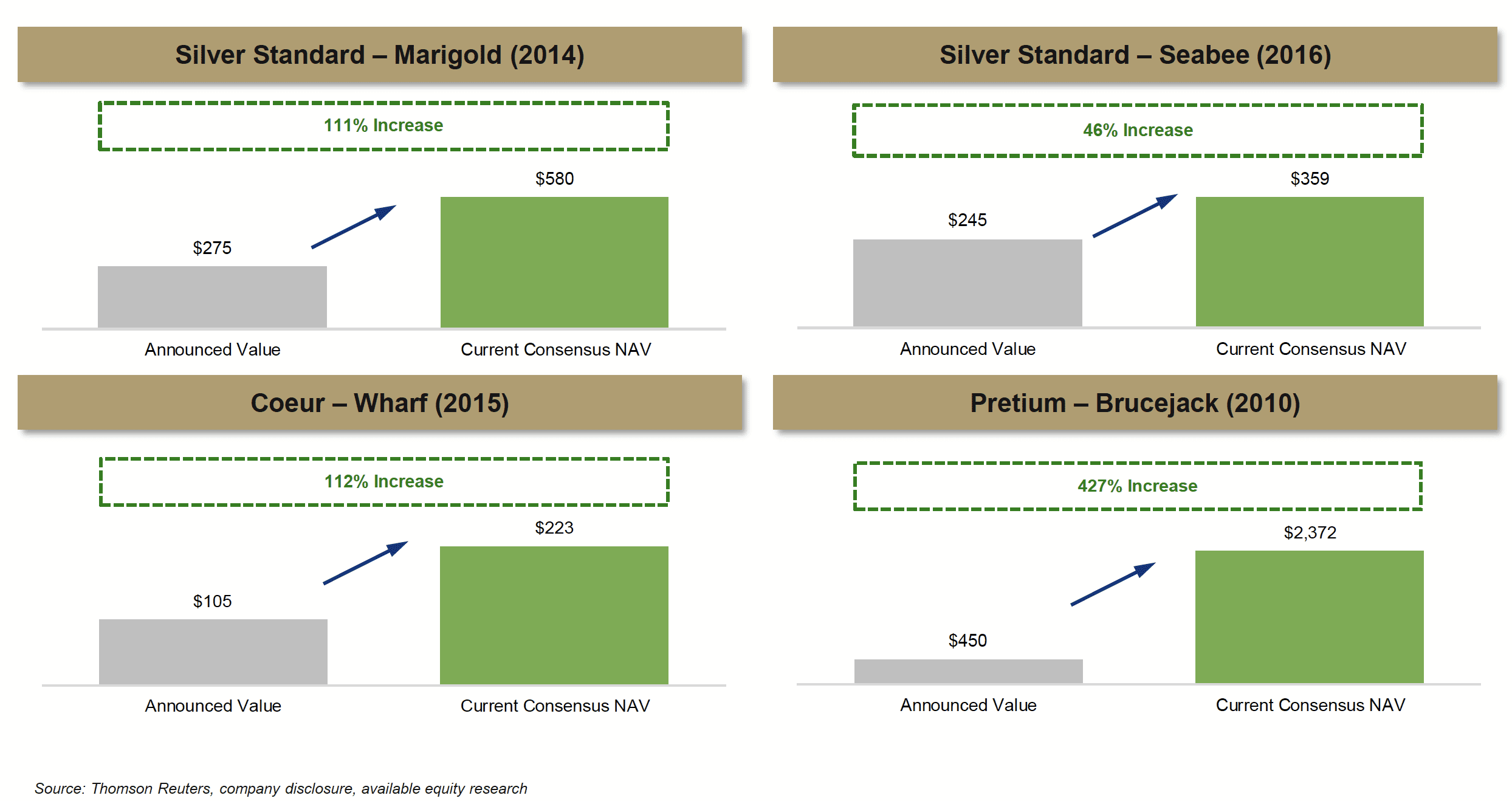

In less than a year, this team turned that twenty-five-million-dollar acquisition into a sale of the assets just over a year later for over $1 billion.

That Company was Newmarket Gold.

A Massive Win

I first introduced Newmarket Gold (Newmarket) to readers back on July 26, 2015, when it was trading at C$0.82.

In September 2016, Canada’s Kirkland Lake Gold announced that it would acquire Newmarket for roughly C$1 billion – valuing Newmarket at C$5.28 per share.

That’s a gain of more than 540% in barely over a year.

But that’s not all.

The team at Newmarket didn’t look at the deal as an exit – they looked at it as a way to bring even more value to existing shareholders.

And boy, were they right.

Since that transaction, Kirkland Lake Gold has been one of the best performing gold stocks.

Today, Kirkland Lake is worth over C$65* per share.

*as at November 20, 2019.

If you were a Newmarket shareholder and held on, each one of your shares today could be worth over $30*.

That’s a potential return of 3558% from the $0.82 per share.

*based on a 0.475 consolidation.

A $10,000 investment could have become $355,800.

A $100,000 investment could have become $3,558,000.

I bet anyone who sold early is kicking themselves – including myself.

But here’s the good news.

We have a second chance.

What if I told you that there was an opportunity to once again participate alongside this super successful team?

What if I told you that you could participate at the same price levels – even cheaper in some cases – than the dream team involved in this deal?

Well, you can.

Betting on Themselves

The core founders of the company I am about to introduce have not only invested millions of their own money, but some have an average cost base (ACB) of between C$0.80-C$1.00.

Today, shares of this Company trade for C$0.75 – coincidentally around the same price as Newmarket when I first introduced it.

After many years of silence – this same team believes they have found another winner.

And I believe them.

Only this time, the team is even bigger and better than before.

Introducing…

Calibre Mining Corp.

(TSX: CXB) (OTCQX: CXBMF)

Calibre Mining Corp. (Calibre) is company with gold assets in Nicaragua, comprised of many of the same core individuals that created and sold Newmarket Gold.

Over the past few years, they have been patiently looking for another winner.

Under a similar formula of success as the one deployed at Newmarket, they began searching for gold-producing assets with the potential for massive exploration upside. They looked at hundreds of projects.

But to their surprise, and perhaps fate, there was one sitting right in their own backyard.

B2 Gold (B2) is a company worth over C$5 billion*. It owned and operated two gold mines in Nicaragua, but have since shifted their primary focus on mining in Africa and even the Philippines. To maximize value for shareholders, B2 felt it should focus its resources and expertise to the much larger mines in Africa.

*as at November 20, 2019.

And with good reasons: it seemed that no matter how strong the drill results were or how consistent gold production was at its mines in Nicaragua, B2 received little to no increase in incremental value for investors. Nicaragua was, after all, on the other side of the world. And with an expected 600,000 ounces/yr of gold production in Africa alone, along with around 200,000 ounces/yr in the Philippines, it only made sense for B2 to focus its efforts on the Eastern Hemisphere.

The guys at B2 are smart. So they quietly began looking for a suitor that could maximize the value of the assets for their shareholders.

In came the guys at Calibre.

While Calibre didn’t have the necessary capital at the time to do the deal, they did have one key element that allowed them to get the deal done: a winning team.

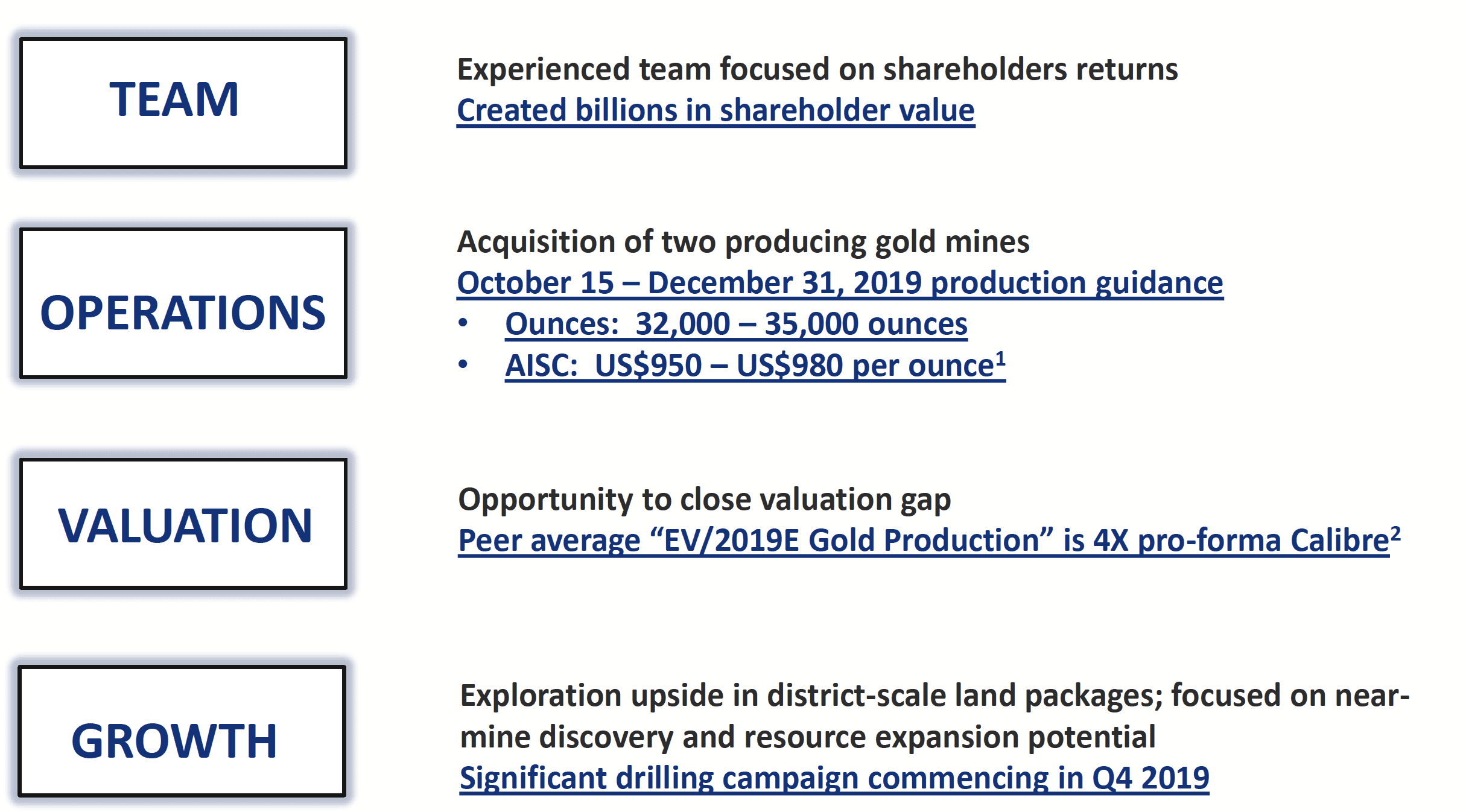

Take a look:

A deal was struck between the two groups, whereby B2 would sell Calibre the portfolio of Nicaragua assets for US$100 million.

But cash alone wouldn’t be enough to maximize shareholder value for B2; after all, B2 knows that massive upside remains at Nicaragua – especially with the Calibre team.

B2 wanted to maintain that upside for its shareholders, so it took part of that $100 million in direct equity.

Shortly after that deal was struck, the team at Calibre raised over C$100 million and closed it last month.

B2 now owns 34% of Calibre, and Calibre now owns 100% of the assets – with CDN$45 million of cash to spare.

So just what did Calibre buy?

A Cash Flow Machine

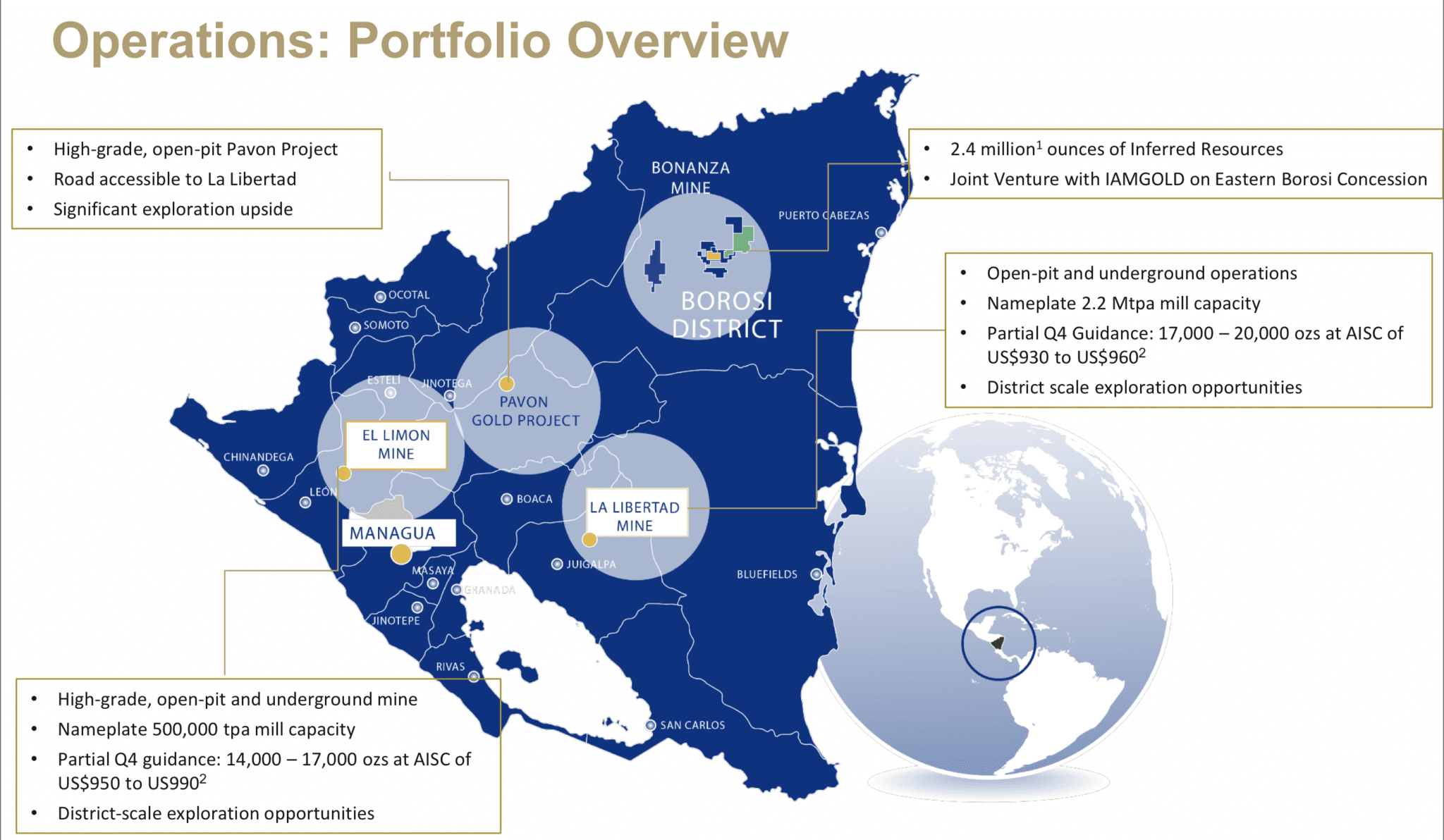

Calibre now owns two operating gold mines: La Libertad and El Limon.

For nearly a decade, the La Libertad and El Limon Mines have been responsible for a large percentage of Nicaragua’s gold exports. In fact, they are the largest exporters of gold in the country today.

In addition, the two mines are collectively also the largest individual exporting operations in the country.

Considering that gold is now the third-largest export for Nicaragua, that’s a big deal.

Just how big?

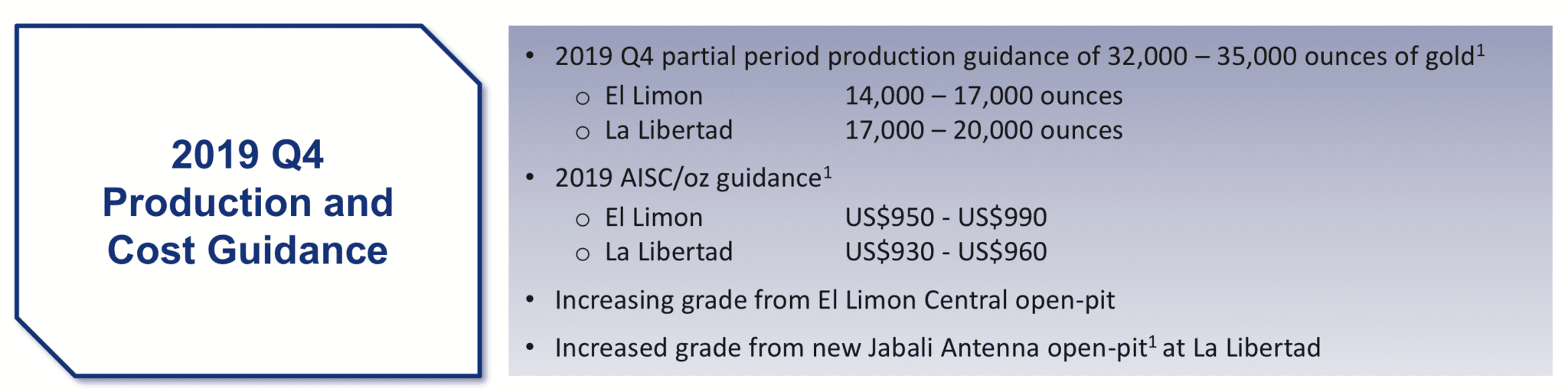

From October 15 to the end of this year, the two mines are expected to produce between 32,000 – 35,000 ounces of gold with All-In Sustaining Costs (AISC) between US$950-980 per ounce of gold.

With the price of gold nearing US$1500, Calibre could be spitting out around $18 million of operating cash flow over the next few months, with potential revenues of over $50 million by the end of this year.

And that’s not even a full quarter of production*!

*Calibre misses the first couple of weeks of production for Q4, as the assets belonged to B2.

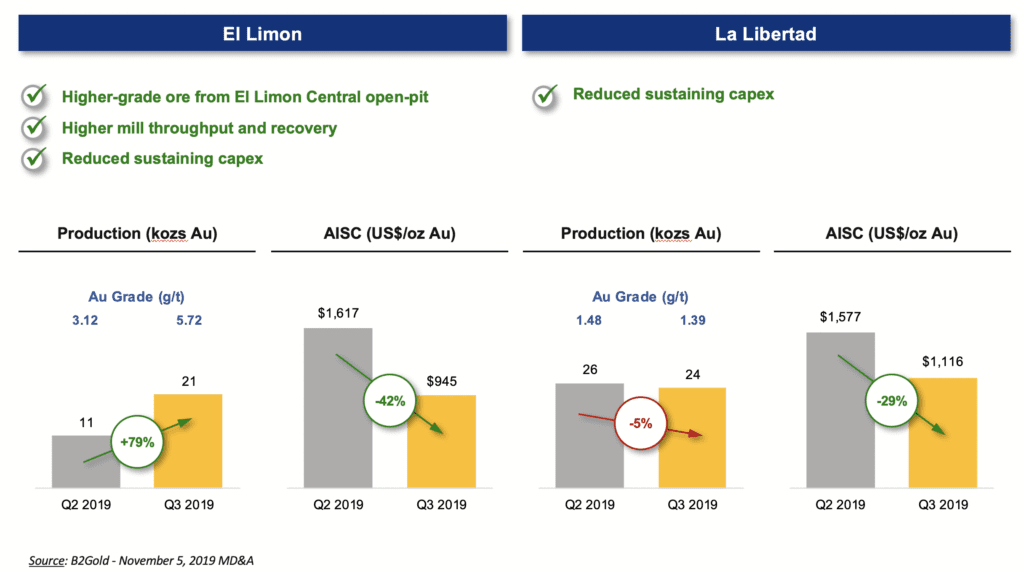

Furthermore, operations at the two mines have already been improving in Q3 under B2: sustaining capex at both mines have been reduced, they’re pulling out higher-grade ore from the El Limon Central open-pit, and getting higher mill throughput and recovery at El Limon.

But the best part isn’t that Calibre is making money right out of the gates with better results; the best part is what these assets could become…

The Two Producers: El Limon and La Libertad

Both El Limon and La Libertad are low sulphidation epithermal gold type systems – a type of gold system known to have created some of the world’s premier gold mines and is very well understood by geologists.

In fact, these systems can be quite extensive with very high grades and can extend for up to 500 meters from surface when they’re formed.

And from a geological perspective, the mineralization at El Limon and La Libertad is likely less than 10 million years old – an extremely young age for a mineralized system.

Why is that significant?

Mineralization can be hundreds of millions of years old. The older the system, the more time it has for faulting deformation and erosion to take place.

In other words, the older the system, the more likely you are to end up with structurally complex deposits – the more complex the system, the harder it is to track the gold and the more costly it may become when you’re trying to mine it since much of it may have eroded.

For example, when you’re looking for gold deposits, you’re also looking for mineralogy: How clean is the ore? Is it recoverable?

Both El Limon and La Libertad are getting metallurgical recoveries greater than 90% – likely benefitting from being such a young system.

But that’s not all.

The deeper you go down a system, the more deleterious elements you’ll likely find – elements such as mercury, antimony, and other base metals such as galena, sphalerite, lead, and zinc.

And since much of those elements have yet to be found at the mines, it leads to the belief that Calibre is still fairly high in the system – and that’s where you want to be.

That – along with the young age of the systems – means that a lot of mineralization is preserved, and the erosional level is not that deep.

Therefore, the depth extent can be quite extensive; as I said earlier, up to 500 meters on these types of systems. Calibre isn’t even half way there yet. More on this in bit.

Given that both El Limon and La Libertad are already substantial low sulphidation epithermal deposits – having produced around 3.5 million ounces and 1.3 million ounces, respectively – it shows us there’s likely still tons of upside.

And that’s precisely what we want.

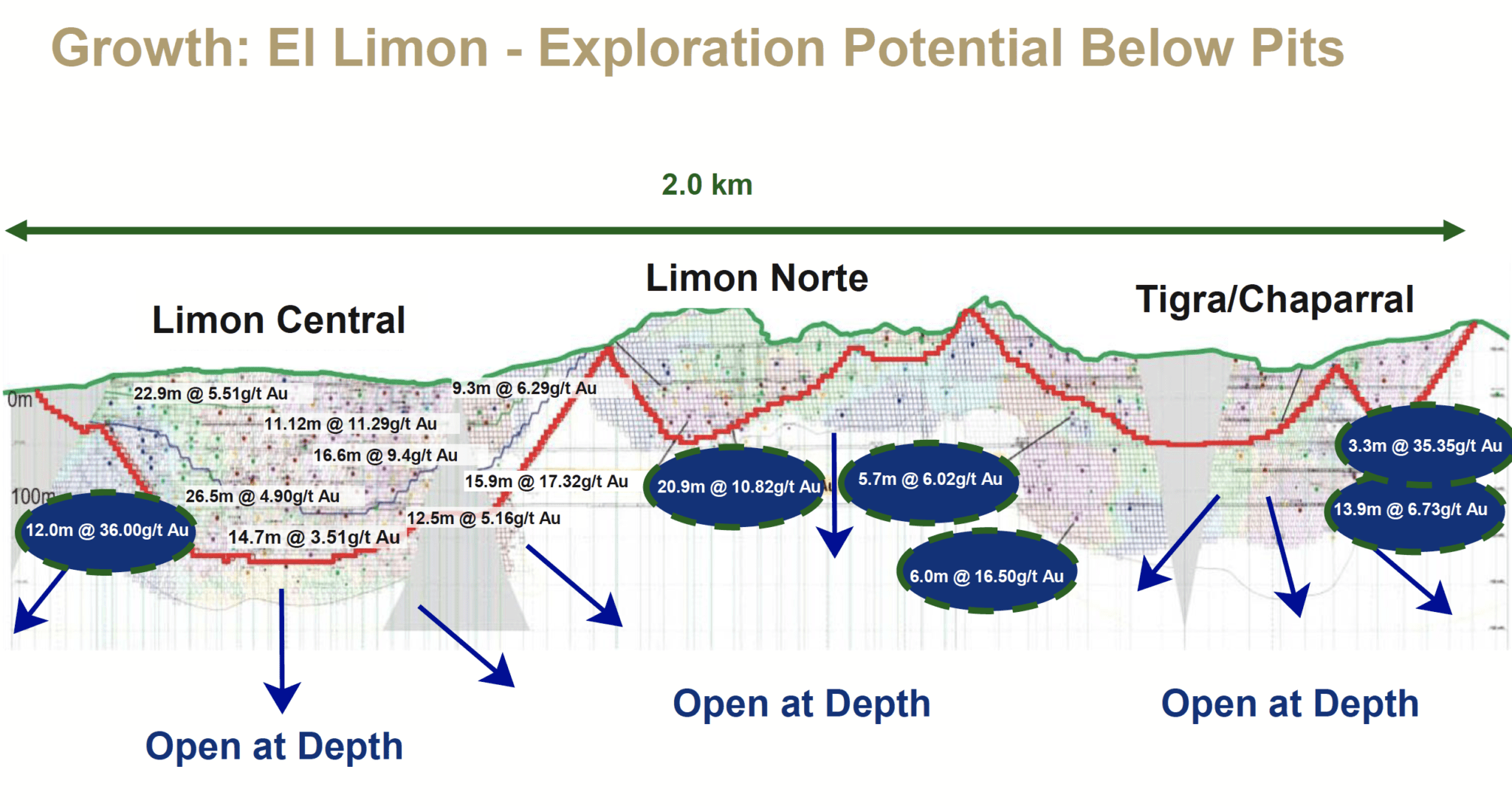

El Limon

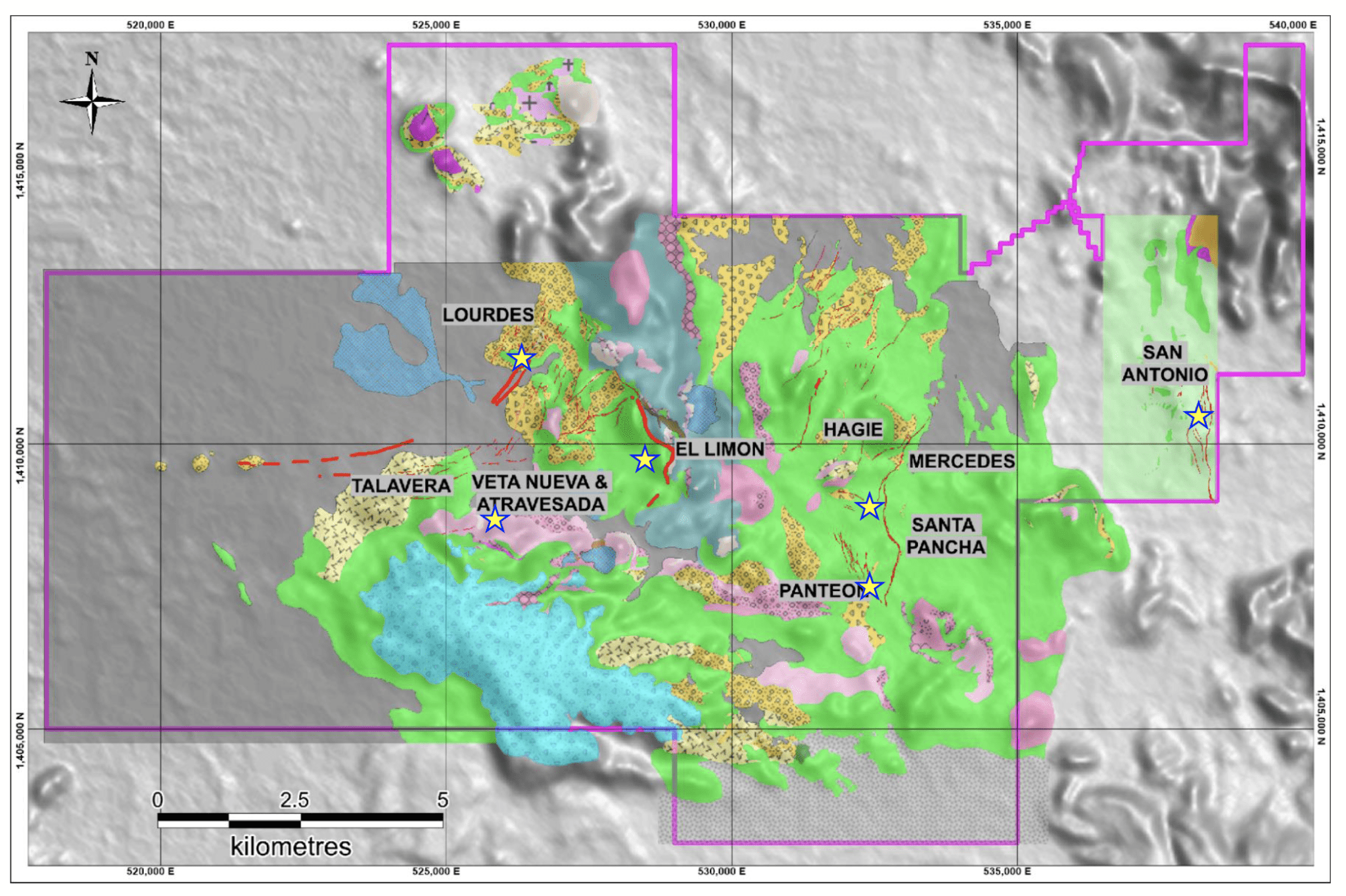

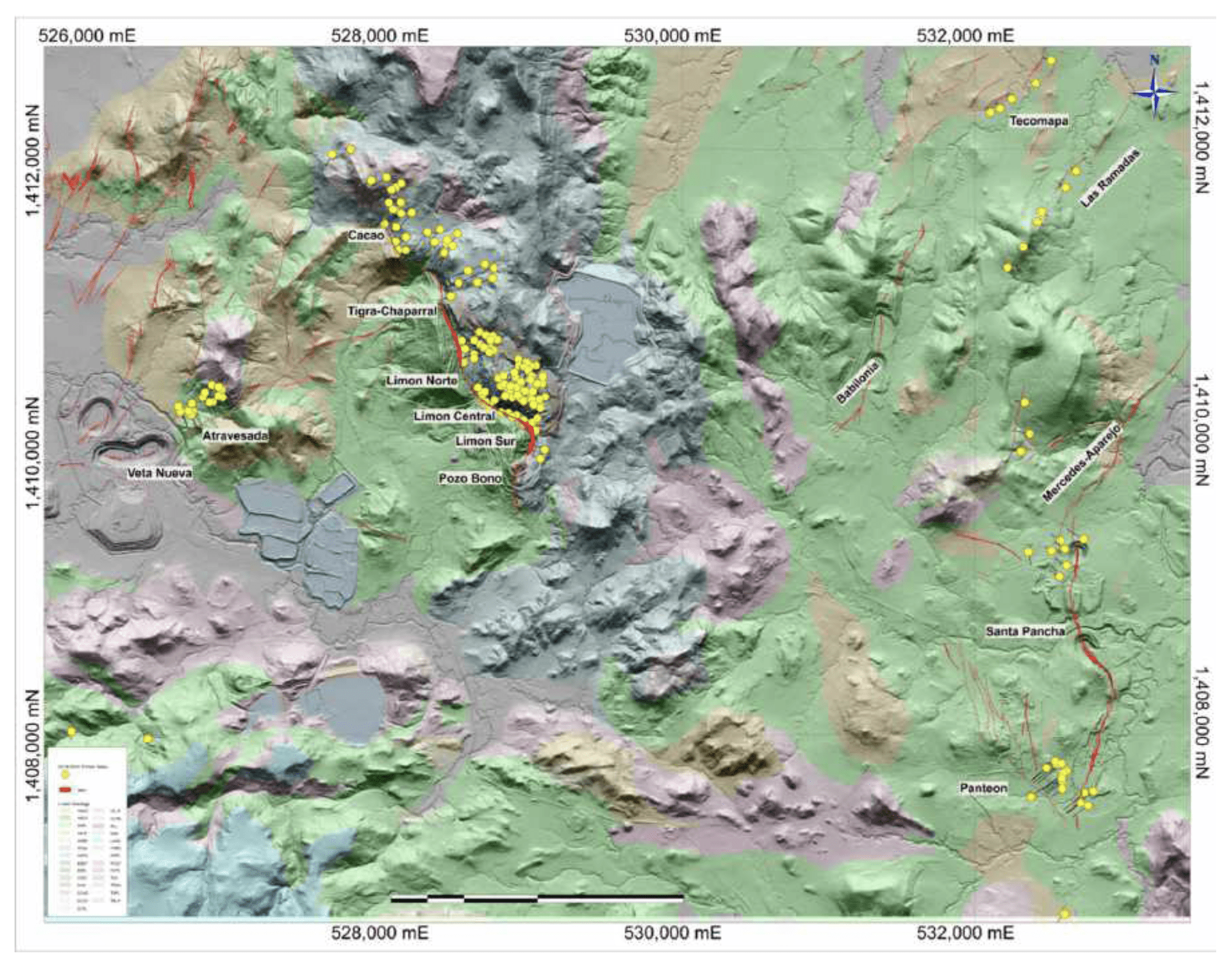

El Limon is a high-grade, open-pit and underground mine with a 500,000 tpa mill capacity and district-scale exploration opportunity. It currently sits right in the middle of many well-known resources whose potential have yet to be unlocked.

Take a look:

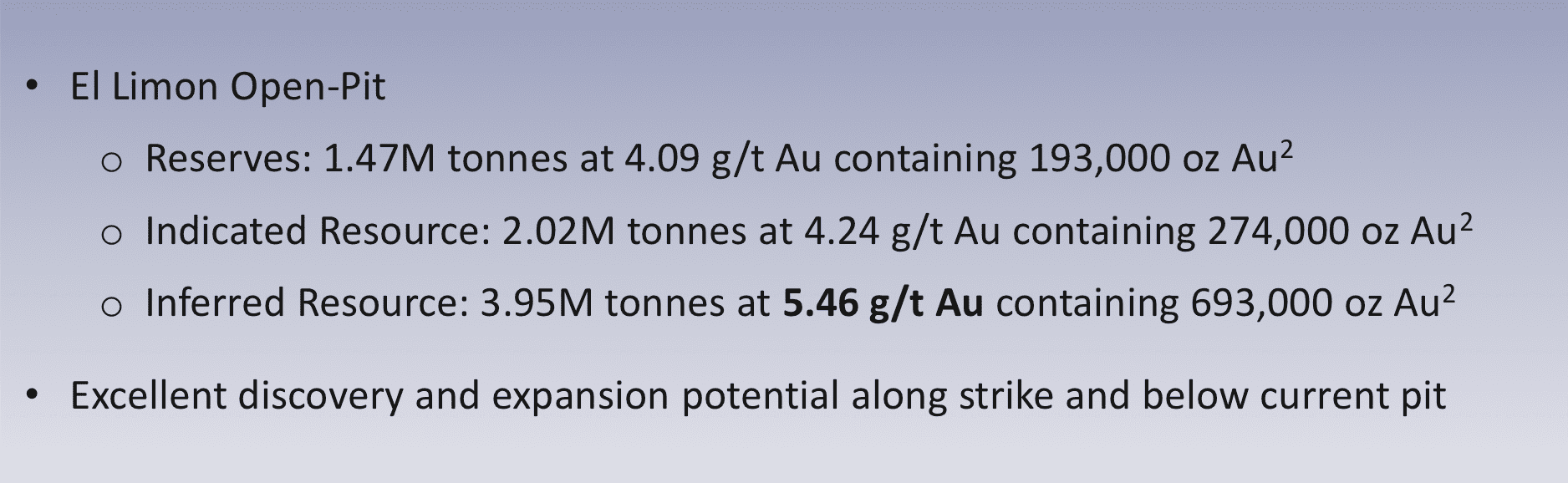

This is what we know of El Limon right now:

Those yellow dots are drill holes where they have found mineralization, and Veta Nueva is currently being mined and developed along with El Limon Central.

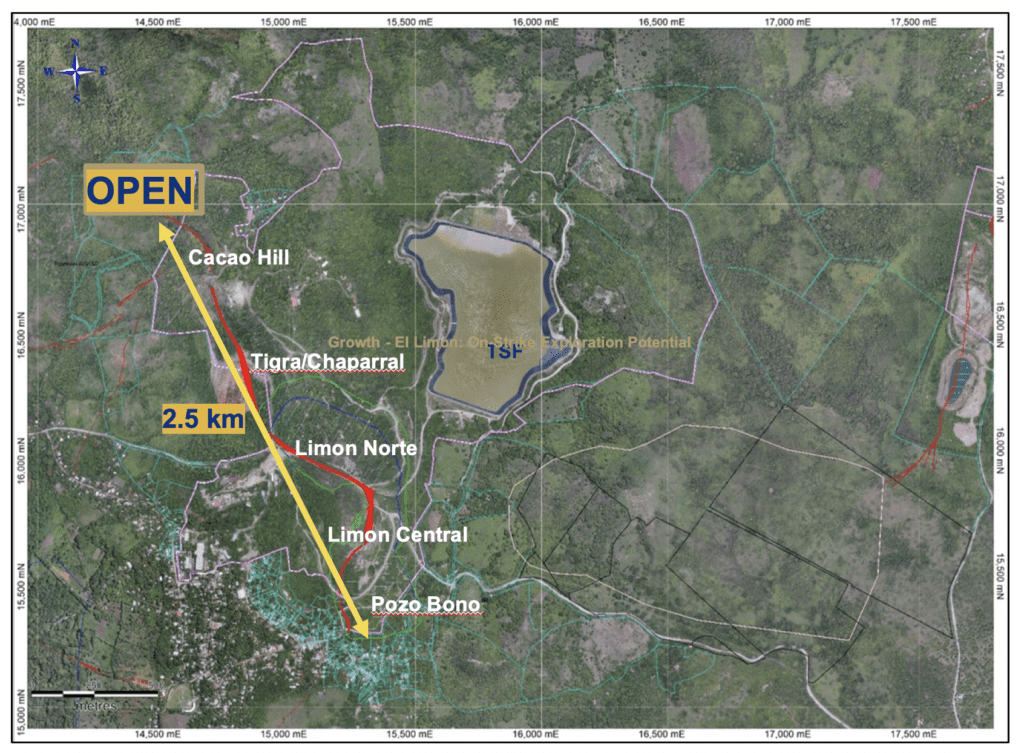

Here is another view:

As you can see, there’s around 2.5km of on-strike potential – meaning that they have, through drilling, discovered a very long system.

Calibre is currently processing ore from Limon Central, which represents only about 500m of the 2.5km strike. At Central, they’re mining down to about 150-175m deep in an open-pit situation and drilled to around 250m thus far. Yet, it’s still open at depth with excellent grades.

What’s significant is that the vein system at Limon Central swells up to 30-meter widths, which is not necessarily usual for these types of systems and certainly not usual to have the type of grade and widths in an open pit-style configuration.

Remember, these systems can go as deep as 500m.

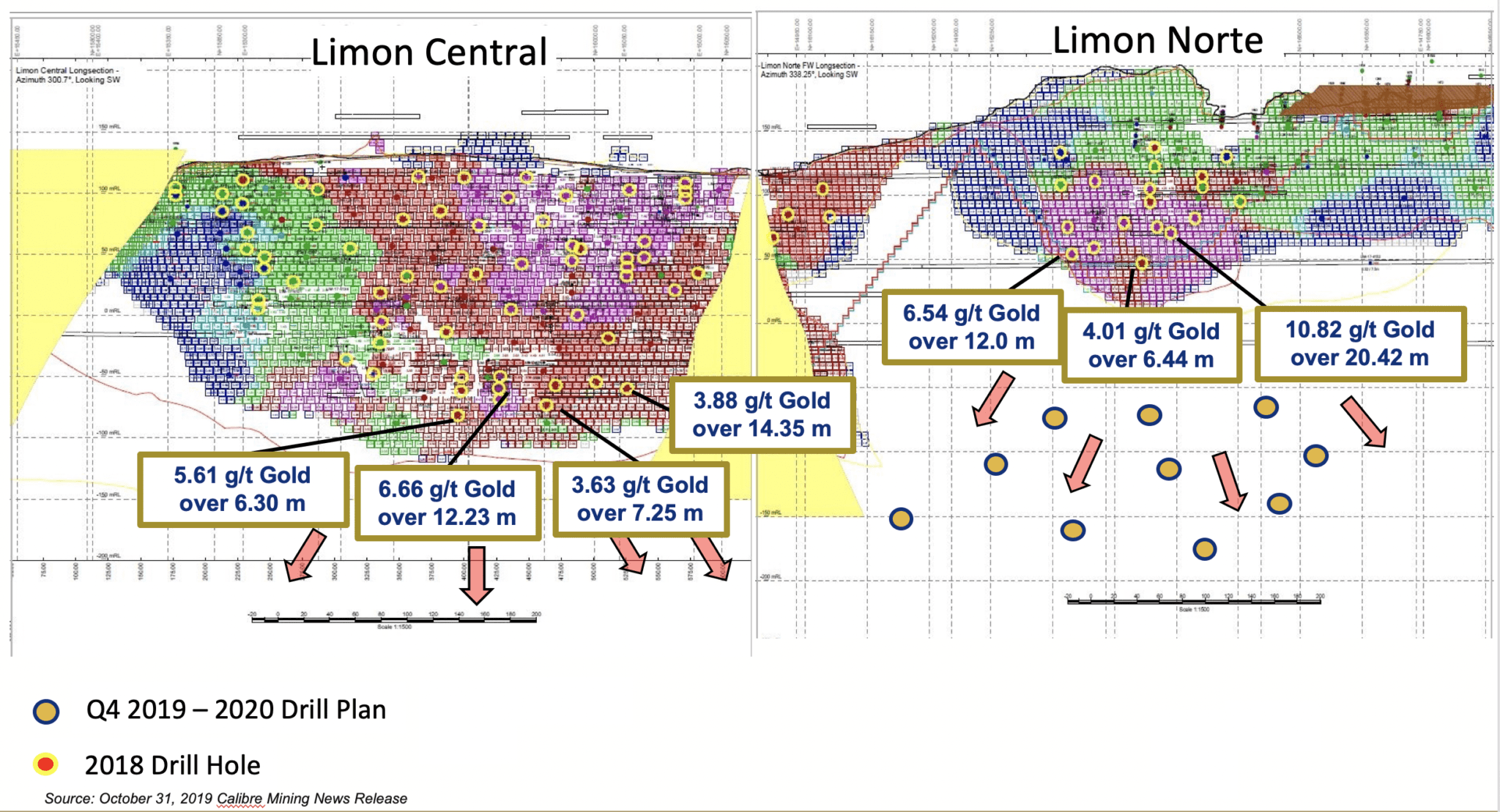

Just take a look at some of the grades at the deeper holes Calibre recently released:

- 6.66 g/t Au over 12.23m ETW (LIM-18-4299);

- 3.88 g/t Au over 14.35m ETW (LIM-18-4309);

- 5.61 g/t Au over 6.30m ETW (LIM-18-4295); and

- 3.63 g/t Au over 7.25m ETW (LIM-18-4303).

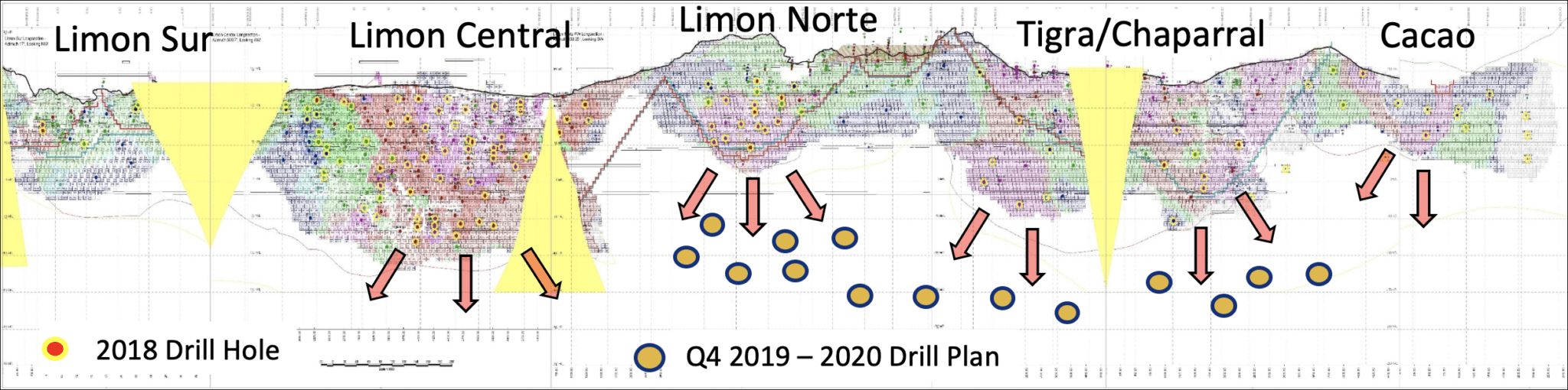

Now take a look at this:

As you can see, the depth extent of Limon Central is significantly greater than Limon Norte, which is the deposit to the north.

However, that’s merely a function of drilling; meaning they simply haven’t drilled enough to see how deep Limon Norte goes.

And if you look at the more detailed sections of Limon Norte, you’ll see excellent grades, such as:

- 10.82 g/t Au over 20.42m ETW (LIM-18-4359);

- 6.54 g/t Au over 12.00m ETW (LIM-18-4241); and

- 4.01 g/t Au over 6.44m ETW (LIM-18-4310).

The Limon Norte ore-shoot has been defined to a depth of only 150 vertical metres (60% of the depth of Limon Central thus far) and shows potential for expansion at depth.

In other words, when they drill Limon Norte below the intercepts already discovered and it comes back showing similarities to Limon Central, it could be massive.

And that’s precisely what Calibre just announced it would do: target extensions at Limon Norte.

But that’s not all.

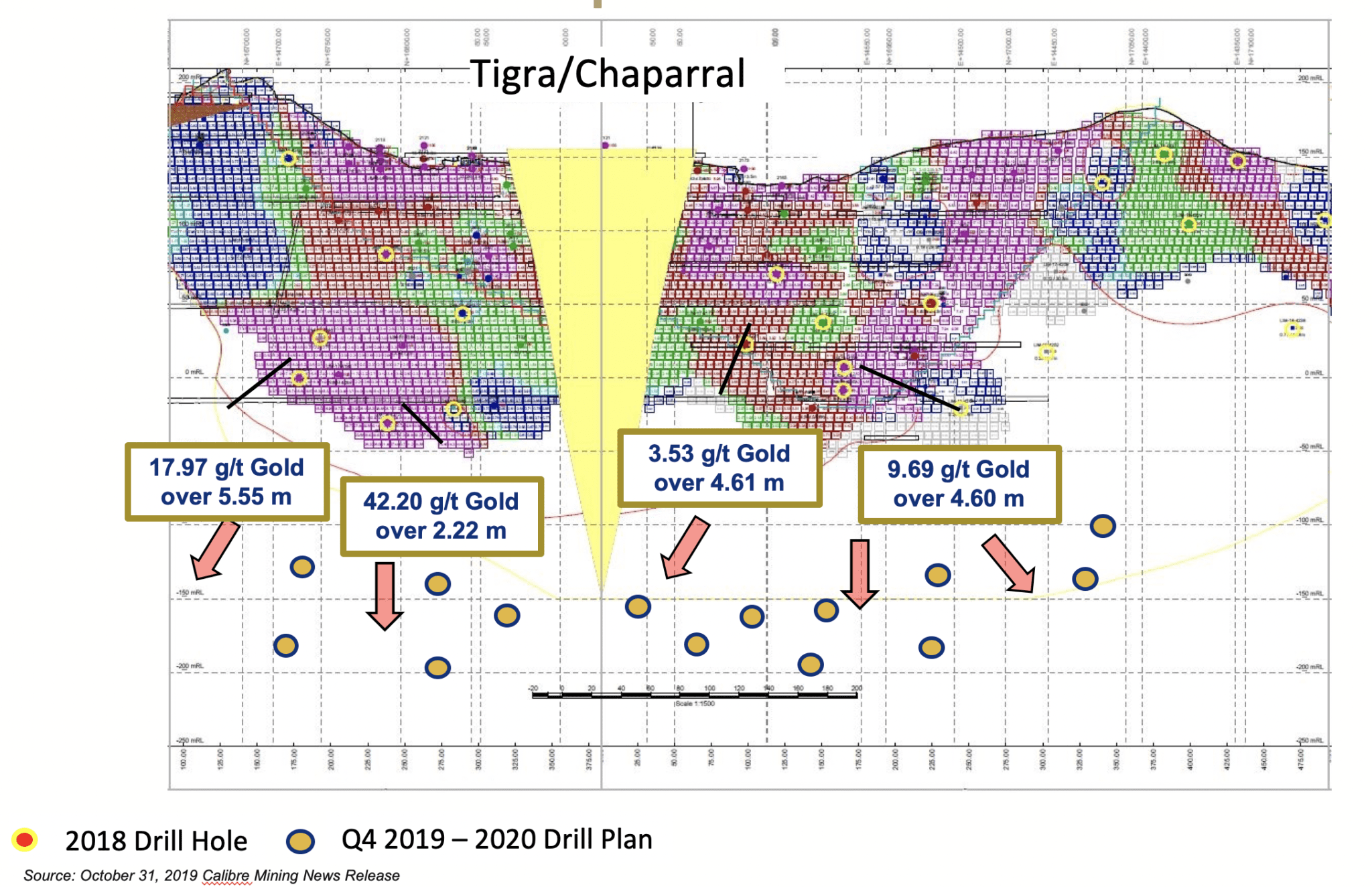

In addition to those targets, Calibre announced it would drill at other extremely promising targets as well, including Tigra-Chaparral and Atravesada.

Tigra-Chaparral

The Tigra-Chaparral zone has been drilled to a depth of 200 vertical metres with two high-grade ore shoots currently open at depth to the north and south. Highlights of deep holes drilled in 2018 include:

- 17.97 g/t Au over 5.55m ETW (LIM-18-4281);

- 9.69 g/t Au over 4.60m ETW (LIM-18-4232);

- 42.20 g/t Au over 2.22m ETW (LIM-18-4272); and

- 3.53 g/t Au over 4.61m ETW (LIM-18-4231).

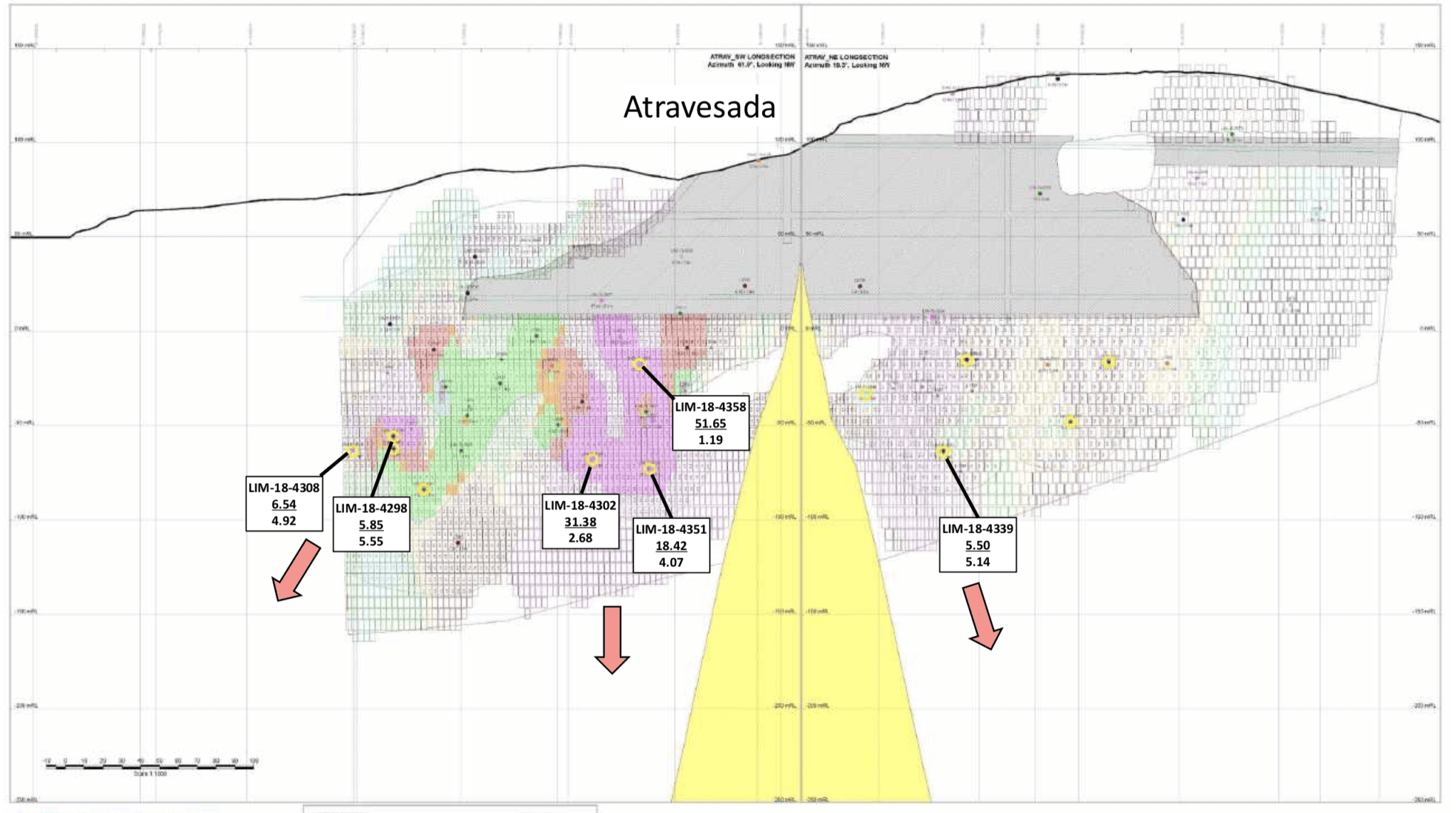

Atravesada

Atravesada is a partially developed underground deposit that lies just 200m from Veta Nueva.

The Atravesada ore-shoot has been drilled to a depth of 200 vertical metres and mineralization is currently open at depth across the 400-metre-wide ore-shoot.

Take a look:

I could go on but I think you get the point: there is serious potential upside to this string of pearls at El Limon.

And remember: what really drove the share price at Newmarket was their continued drilling success. If Calibre can replicate that success – even to a small degree – it could mean a massive win for Calibre shareholders.

And that’s just at El Limon.

Let’s not forget about La Libertad.

La Libertad

The La Libertad Mine is an open pit and underground operation with a processing plant that can treat approximately 2.25 million tonnes per annum (tpa).

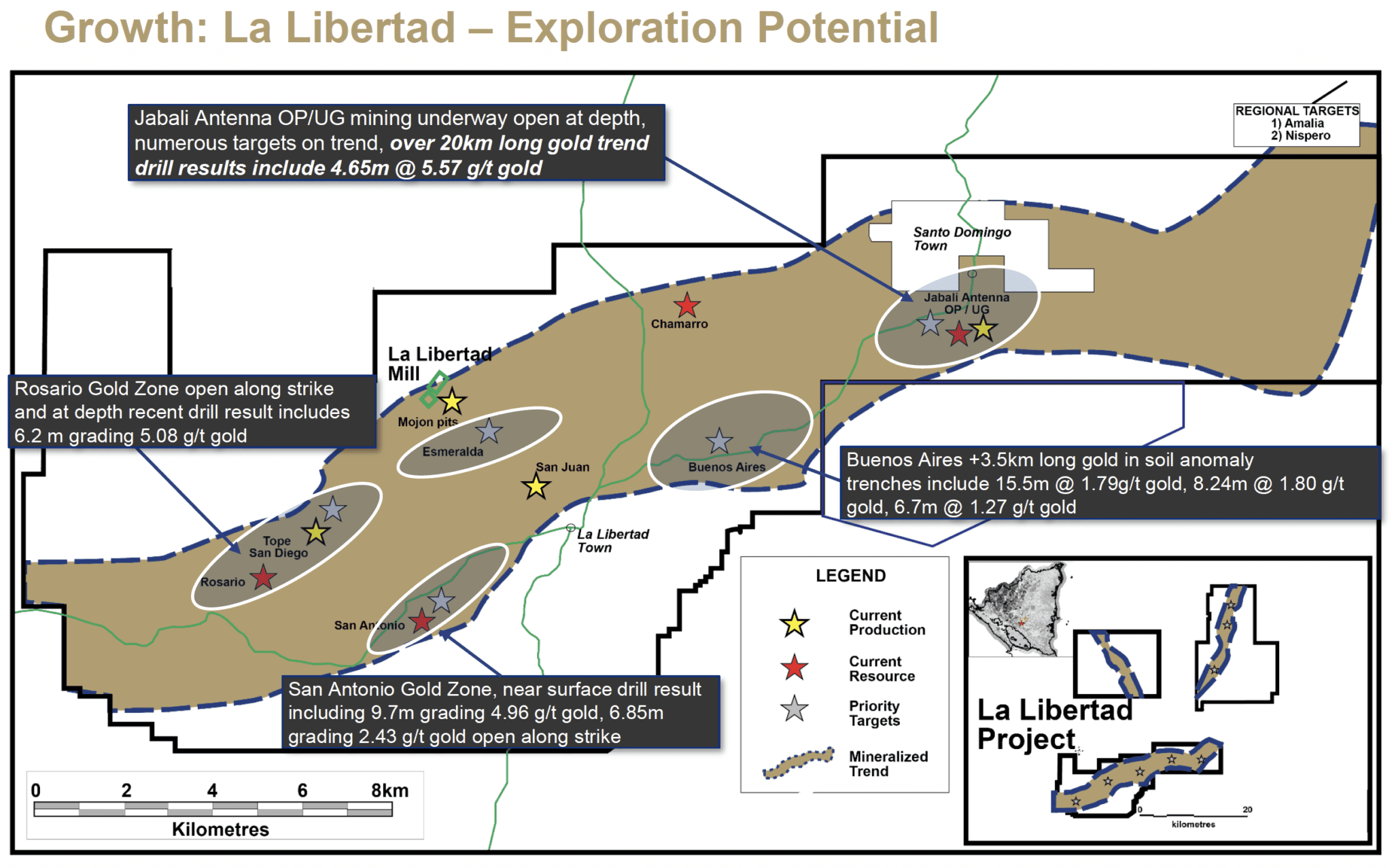

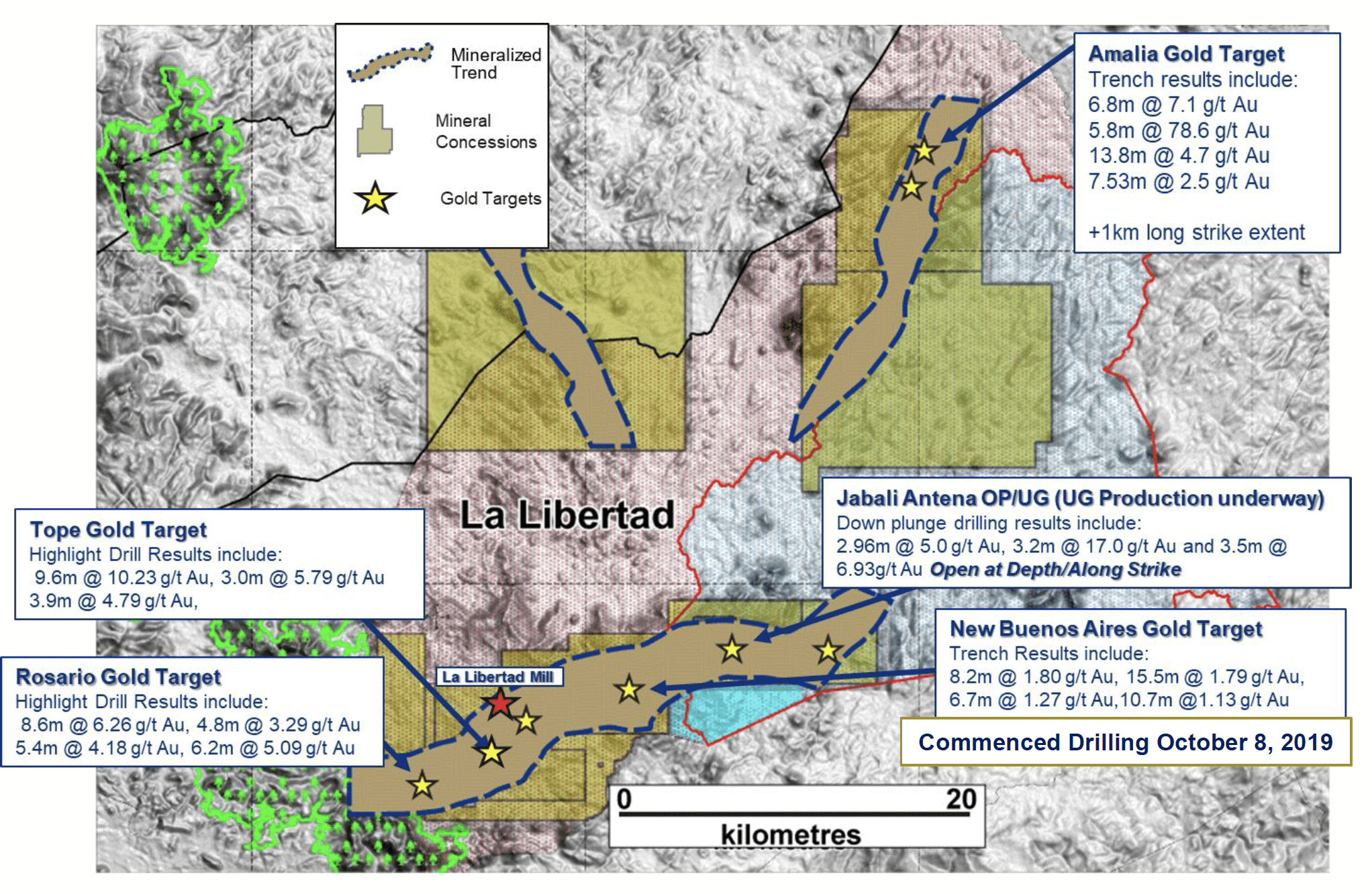

It sits in a gold district that covers an area of approximately 150 km2, with many promising targets.

Take a look:

As you can see, these past drill results show tremendous potential.

For example, the New Buenos Aires Gold Target vein structure stretches for 3.5km. That’s almost as big of a footprint as the biggest deposit found to date at La Libertad: the Mojón vein system that produced nearly 500,000 ounces of gold.

And it’s never been drilled!

Trench results thus far have yielded incredible results, and drilling has already been planned for later this year.

That means Calibre could potentially find yet another massive deposit near the La Libertad Mill.

Then there’s the Amalia Gold target that also has great trench results such as:

- 5.8m @ 78.6 g/t Au

- 13.8m @ 4.7 g/t Au

- 6.8m @ 7.1 g/t Au

And that, too, has never been drilled!

That means there is significant blue sky potential at La Libertad.

Given that La Libertad currently has a smaller resource than El Limon, I suspect much of the drilling for Calibre will be focused on expanding the resources at La Libertad and making discoveries there – especially with the capacity the mill there has to offer.

And new discoveries, combined with the backstop of production, is what propelled Newmarket to continually hit new highs – even after its billion-dollar buyout.

If Calibre can replicate that slightly, it could mean massive rewards for shareholders.

But there’s more.

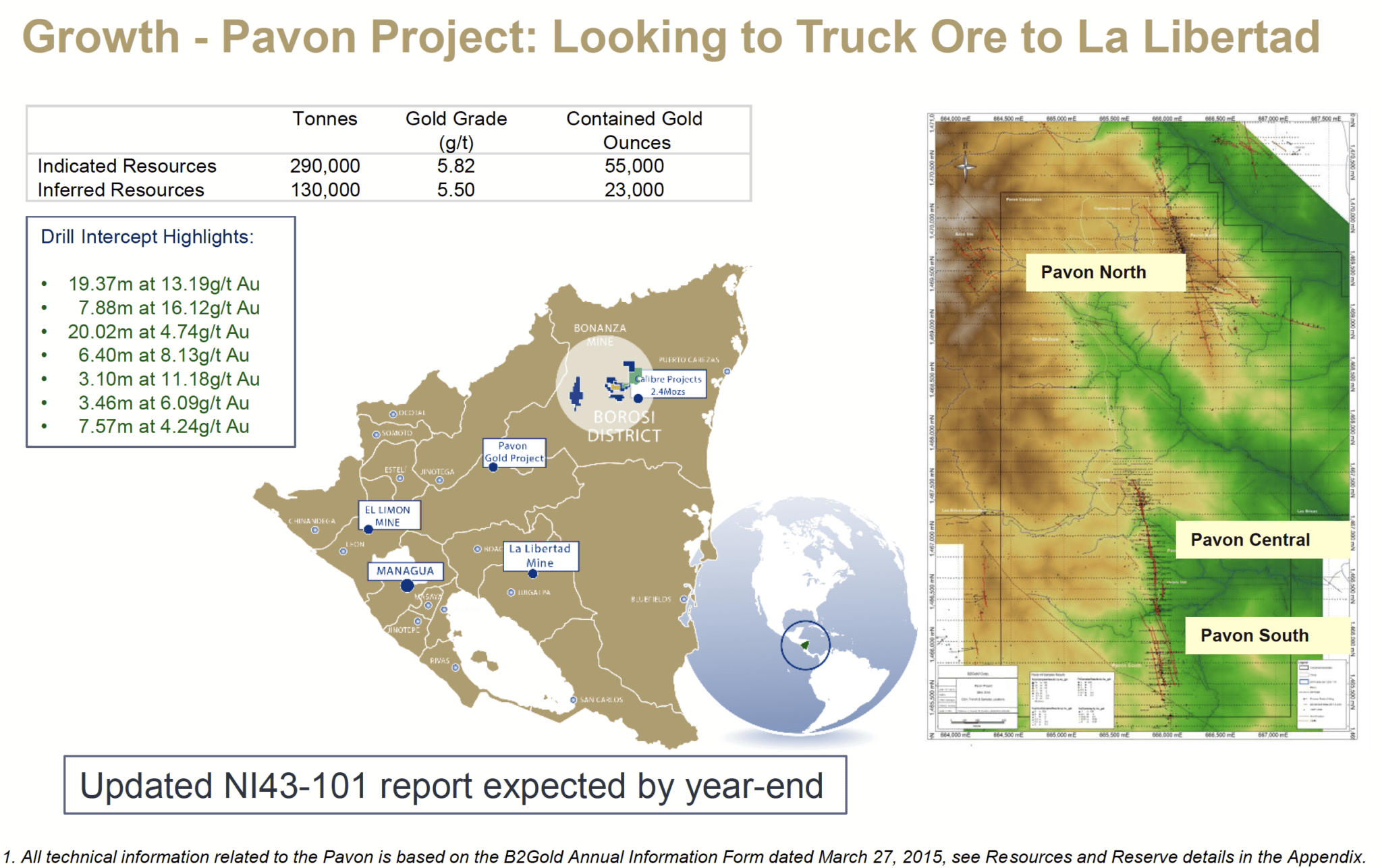

The Pavon Gold Project

The Pavon property is located approximately 227 km from the El Limon Mine and 300 km from the La Libertad mine. It currently has a small resource of 78,000 ounces of gold.

Seventy one historical diamond drill holes totalling approximately 10,700 metres tested veins occurring over a strike length of six kilometres, with results that include 10.3 g/t gold over 16.8 metres in one hole to the north and up to 6.7 g/t gold over 11 metres in one hole to the south.

Take a look:

All drilling to date has been less than 100m vertically from surface and is open along strike and down plunge.

In prior years, B2 internally studied the potential to open-pit mine at Pavon and truck the high-grade material to El Limon.

Here’s the exciting part:

The geological brain trust at Calibre, which includes Doug Hurst, Ray Threlkeld, and Doug Forster, have collectively helped discover more than a hundred million ounces of gold. And I am not just talking about your average gold discovery; I am talking about the discovery of economic ounces of gold that have been mined or ended up in production companies.

When you consider that most geologists never discover any economic ounces of gold, you can see just how highly skilled this group truly is.

Management recently visited the Pavon project with boots on the ground and believe there is excellent untapped potential to quickly advance this project.

And that’s precisely why they’re reviewing this potential opportunity as we speak.

In fact, Calibre is working on an updated NI 43-101 resource estimate for Pavon and the report could come out anytime now.

In other words, in just a few short weeks, Calibre could add even more resources to its Nicaragua portfolio – ounces the market doesn’t even know about.

That’s in addition to the millions they already have.

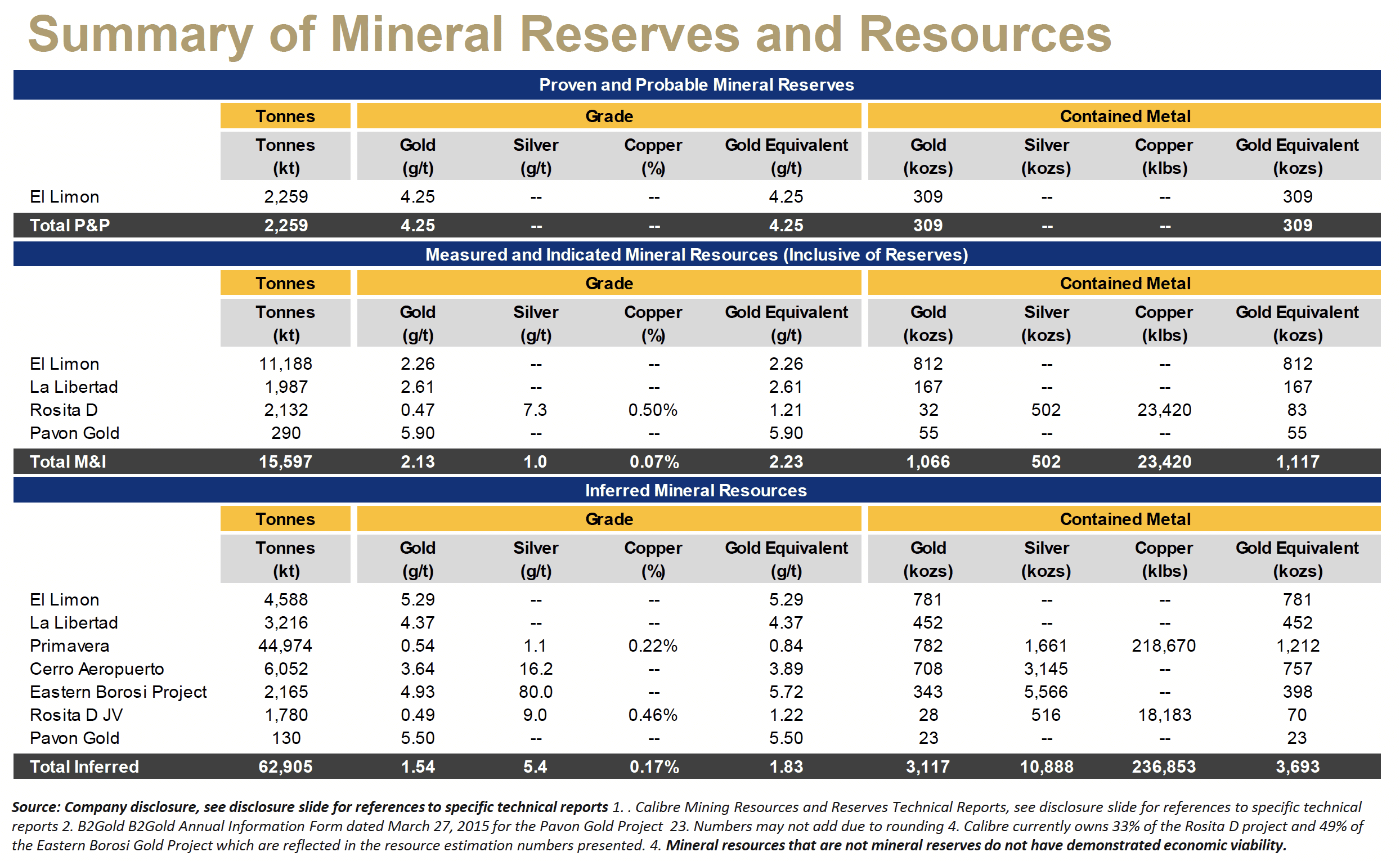

Backstop Assets: Millions of Ounces

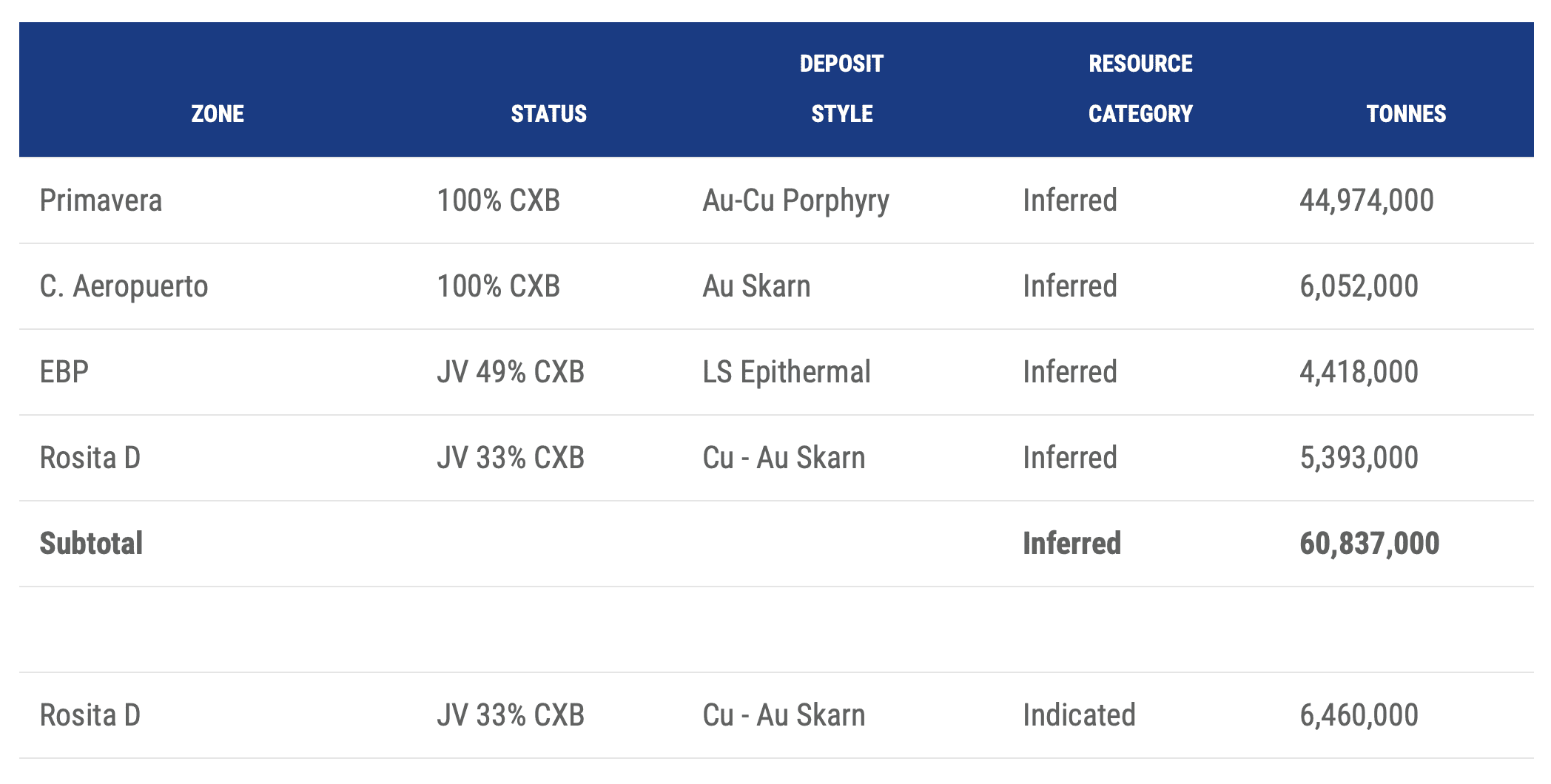

In addition to the El Limon and La Libertad gold resources, Calibre owns a massive gold inventory across its Nicaragua assets.

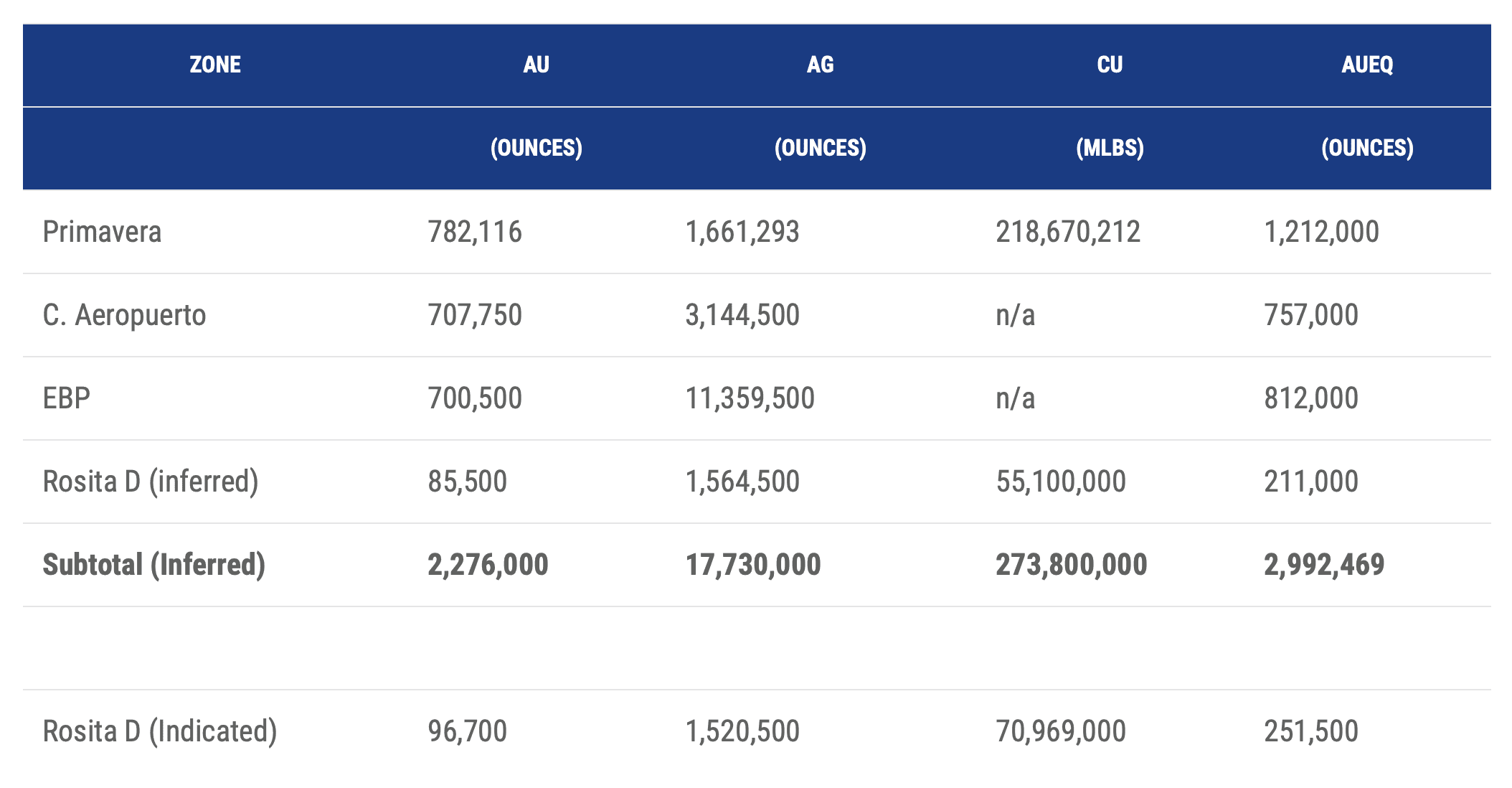

Within the projects currently owned 100% by Calibre Mining, in 49% joint venture with IAMGOLD, and in 33% in joint venture with Santa Rita Mining, inferred resource total is 60,837,000 tonnes grading 1.53 g/t AuEq containing 2,992,469 ounces of gold equivalent.

Additionally within the Rosita D JV (33% Calibre) indicated resources host 251,500 gold equivalent ounces:

C

That 5,021,175 of potential gold-equivalent resource could be worth over $7.3 billion* at today’s gold price.

(*Coincidentally, that’s slightly more than the value of the Australian gold assets when the team at Calibre initially took it over with Newmarket.)

And that number could swell in the coming weeks when the anticipated new resource for the Pavon Project is released.

Together, these resources are part of a land package with many district-scale opportunities, representing one of the biggest in all of South America.

Of course, none of this would matter if Calibre couldn’t advance these assets.

But luckily for shareholders, that’s precisely what this team is great at.

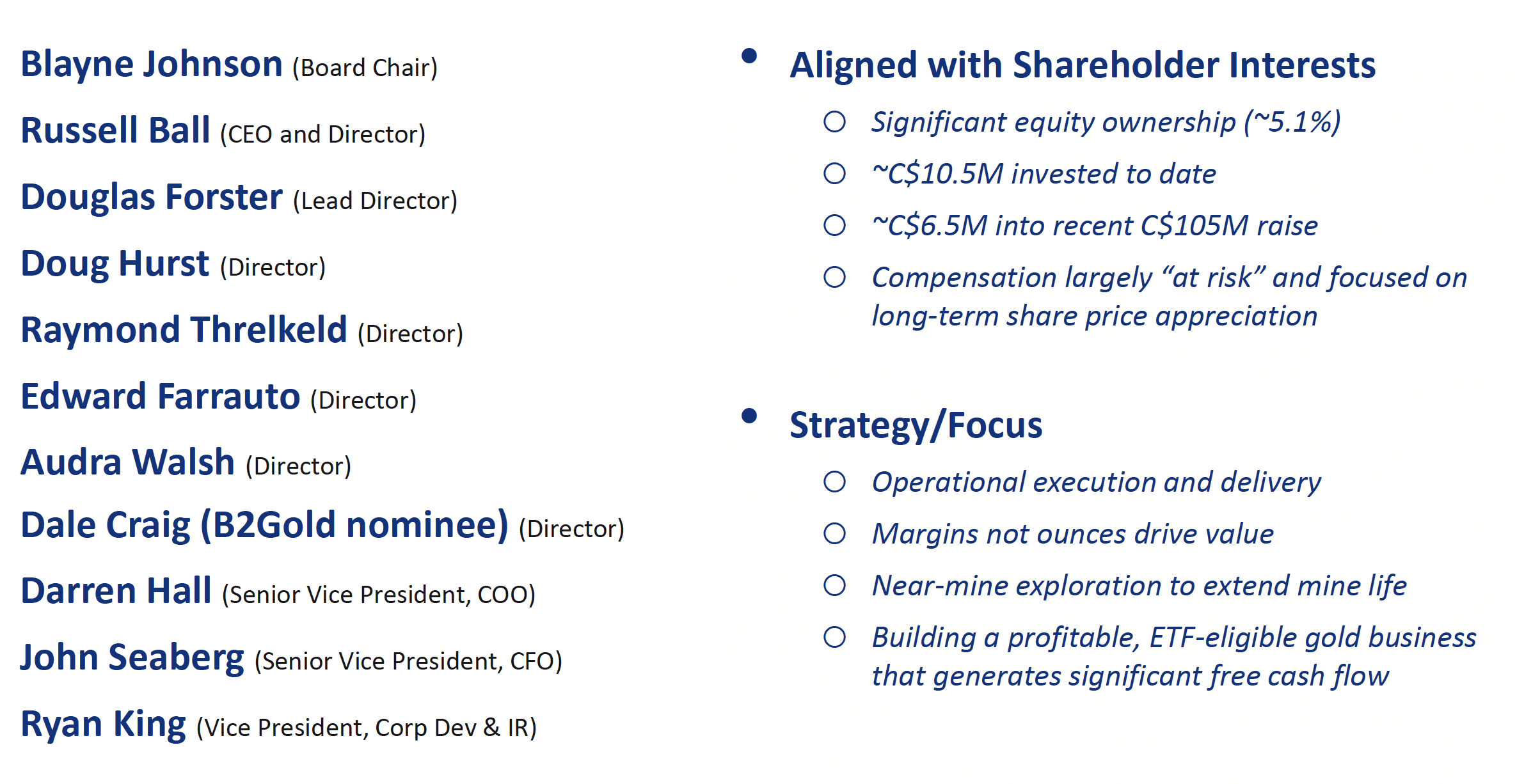

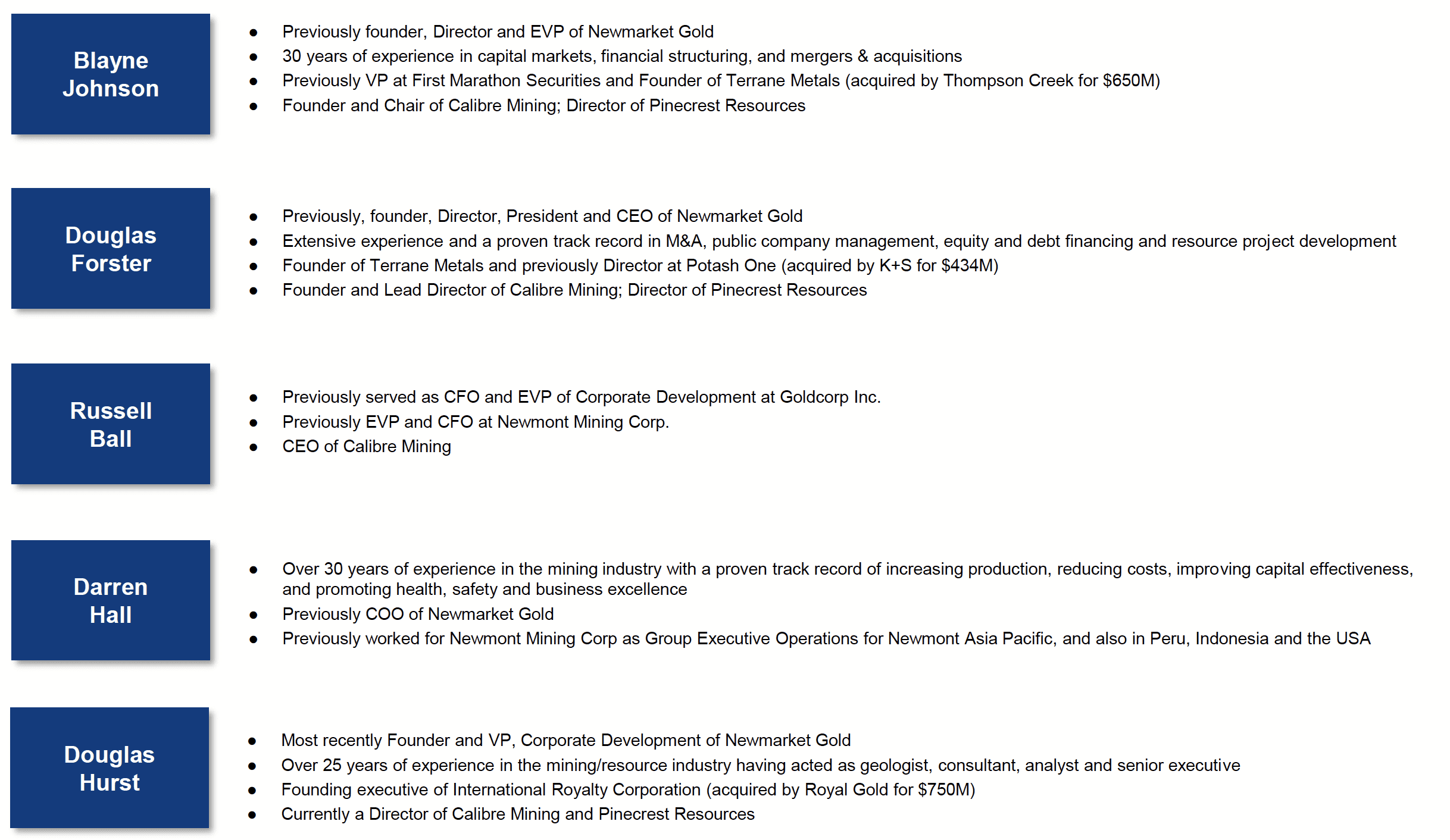

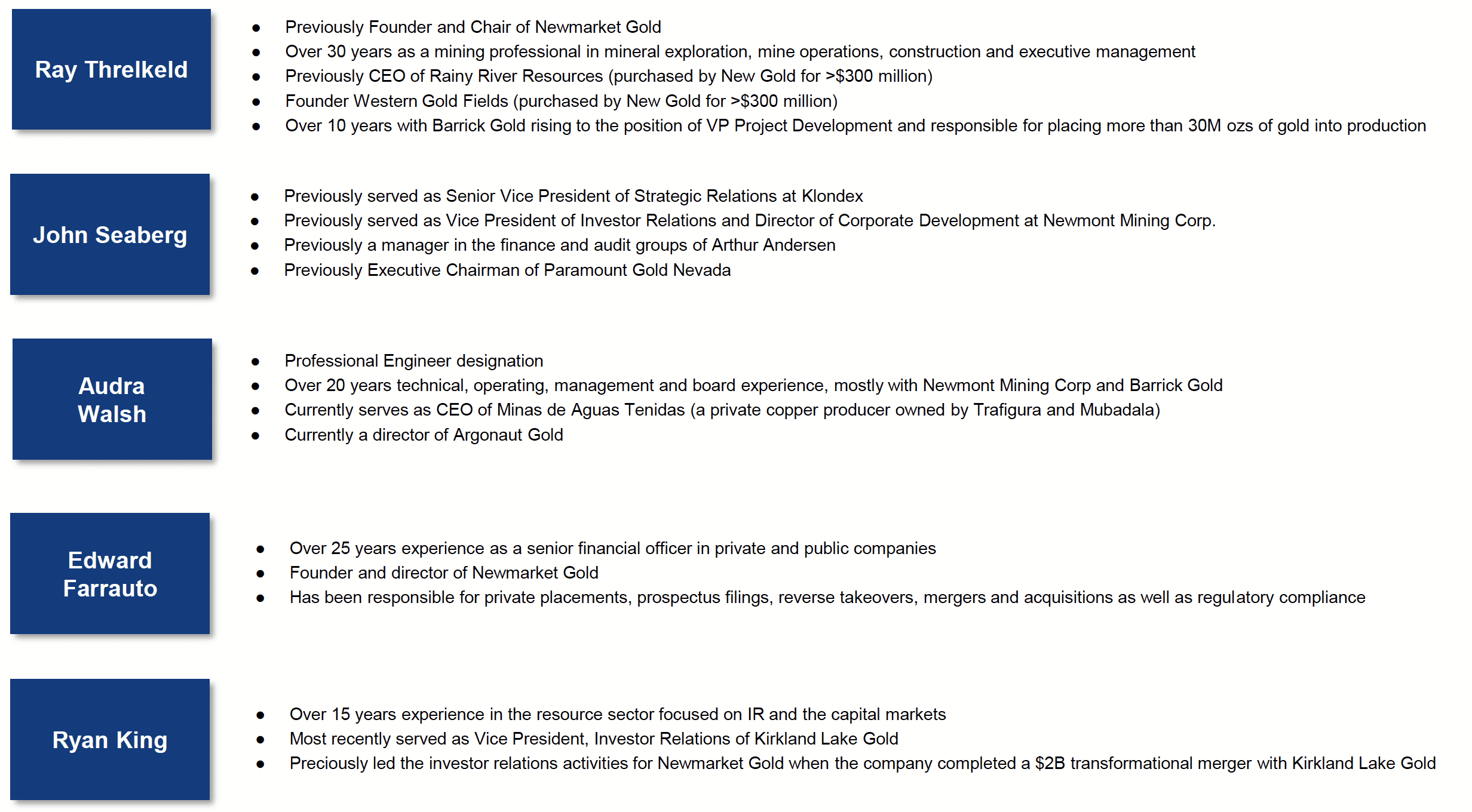

Management Team

The team at Calibre is second-to-none.

They turned a ten-million-dollar company to one worth well over a billion in just over a year.

But this time, the team is even better.

In addition to the core team from Newmarket, Calibre also pulled in a couple of seniors from the biggest gold companies in the world.

Here are just some of the names involved:

- Doug Forster: A man involved with numerous successes, including Terrane Metals, which was acquired by Thompson Creek in 2010 for $750 million and Potash One, which was acquired by K+S in 2011 for $434 million.

- Blayne Johnson: A man involved in the acquisitions and buyouts of over a billion dollars, and helped his firm transact over $5 billion of equity financings

- Russell Ball: An executive who served over 19 years with Newmont Mining and became CFO of one of the largest gold companies in the world ($30 billion-plus market cap).

- Raymond Threlkeld: A man that has been responsible for putting more than 60 million ounces of gold into production

- Doug Hurst: A founding executive of International Royalty Corporation from 2003 to 2006 and a director of the company until 2010, when the company was purchased by Royal Gold for $700 million.

- Darren Hall: Ex-Chief Operating Officer of Kirkland Lake Gold, which acquired Newmarket Gold, becoming one of the best-performing gold stocks in the past few years.

- Lukas Lundin (significant shareholder): A billionaire who sold billions of dollars worth of assets to major gold producers, including the $7.1 billion sale of Red Back Mining in 2010.

Together, the principals and large shareholders of Calibre have founded, managed, and sold mining companies with a combined value of over $30 billion!

Take a look:

Add in Russell Ball and Darren Hall and that number swells to over $60 billion!

If there’s anyone who can take Calibre’s Nicaragua assets to the next level, it’s these guys.

More importantly, they’re not just a team of explorers hoping to strike it big. They’re a team of wealth creators whose sole focus is to make money for shareholders.

I don’t say this lightly.

Most dealmakers in this industry structure deals in a way where they have the lowest cost base.

These guys, on the other hand, put the deal together so that everyone – including shareholders today – get to participate in their potential success right alongside them. And all with a lower cost base then some of the founders.

That’s saying a lot – especially considering they have put millions of their own money into the deal.

Most importantly, it shows just how confident they are about what they can do.

From Zero to Hero

With Newmarket, the founding team at Calibre reduced the debt from $35 million to zero.

…They went from having essentially no cash at all, to a hundred million in cash.

…They went from having no analyst coverage, to more than 10 analysts covering the stock.

…They went from a non ETF-traded stock, to one of the most liquid stocks in the sector.

…Then they sold the company to Kirkland Lake for $1 billion.

And they did that all in 14 months.

No wonder they’re confident.

Right now, Calibre has no analyst coverage. But next month, they’re sending more than a dozen representatives from financial institutions to look at their assets.

I am not sure how many will end up covering the story, but if their confidence is any indication of success, then I suspect we’re going to see institutions begin to participate in their potential upside.

Especially since some of the biggest institutions are now eagerly searching out gold deals…

Conclusion

Earlier, I told you how central banks have once again become net buyers of gold this year.

But they’re not the only ones.

Over the last year, billionaires from all around the world have been pouring their money back into gold.

Billionaires such as David Einhorn, Stanley Druckenmiller, Ray Dalio, Jeffrey Gundlach, Paul Tudor Jones, and Lord Jacob Rothschild are all known to have big positions in gold.·

And last year, Egyptian Billionaire transferred half of his nearly $6 billion of wealth into gold.

This year, billionaire Sam Zell sold his real estate holdings and bought gold for the first time.

Billionaire Thomas Kaplan said gold could go to $5000.

In other words, some of the smartest money in the world are once again believers that gold is on the verge of a meteoric rise.

Gold is often viewed as one of the best protection against the aggressively loose monetary and fiscal policies of governments and central banks.

And it’s no surprise that central banks around the world have, and continues to, print an astronomical amount of money.

The more we have, the less its worth.

On the other hand, the world’s gold supply is diminishing as a result of less production.

Gold production from existing sources is expected to peak this year.

According to S&P Intelligence, by 2022, gold output is likely to decline as falling production from depleted operations start outpacing output at new or restarted mines. Furthermore, according to their report, more than 15% of gold production by 2024 will be coming from mines that are not yet producing.

In other words, as the demand for gold picks up, current production supply may not be enough to keep up.

And we know what happens to prices when demand outruns supply.

But here’s the thing…

If you buy gold today and it climbs to $2000/oz, you’re up around 30%.

Not bad.

But I bet the gold producer index – all costs being equal to today – will almost certainly climb higher than gold itself.

Why?

Gold is up around 15% over the last 6 months.

Meanwhile, the Gold Miners Index (GDX) is up over 32% in that same time; more than double the return of gold itself.

If you believe the price of gold is going higher, the gold producers are a better bet.

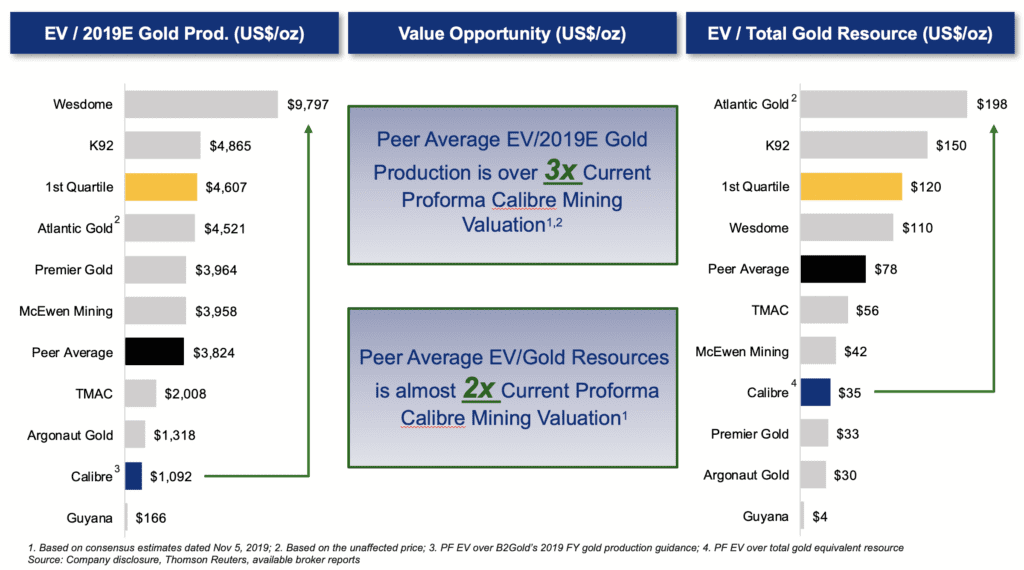

Calibre is a new gold producer with no institutional following and, as such, is trading significantly lower than their peers.

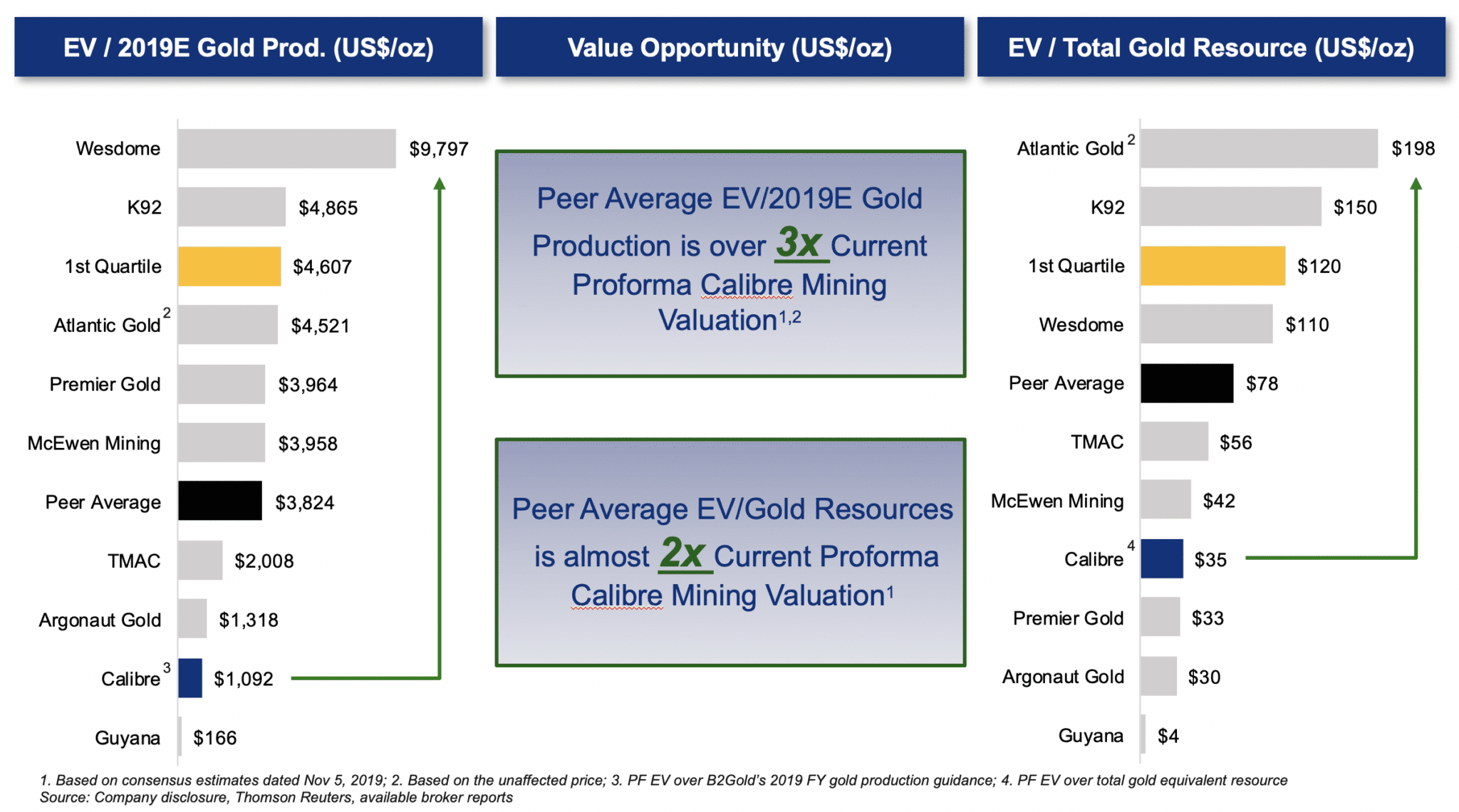

Take a look:

If Calibre can show a quarter of production that’s inline with its forecast, there’s little reason to believe why it shouldn’t be trading at a price similar to it peers – even higher given management’s ability to execute.

Calibre’s peer average of EV(enterprise value)/gold resources is more than 2x its current proforma valuation, and over 3x that based on the peer average of EV/2019E gold production.

In other words, catching-up to its peers alone can reap significant rewards for shareholders today.

Combine that with the potential for Calibre to make new discoveries, increase resources, and extend mine life, and we have a very strong investment thesis.

That’s why I have invested a small fortune into Calibre.

Big institutions are now positioning themselves for the next gold bull market.

Are you?

Seek the truth,

Ivan Lo

The Equedia Letter

www.equedia.com

Disclosure:

Equedia.com and Equedia Network Corporation are not registered as investment advisers, broker-dealers or other securities professionals with any financial or securities regulatory authority. Remember, past performance is not indicative of future performance. This article also contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this article. Just because many of the companies in our previous Equedia Reports have done well, doesn’t mean they all will. We are biased towards Calibre Minning Corp (CXB) because the Company is an advertiser on www.equedia.com. We currently own shares of CXB and have been granted options by CXB. You can do the math. Our reputation is built upon the companies we feature. That is why we invest in every company we feature in our Equedia Special Report Editions. It’s your money to invest and we don’t share in your profits or your losses, so please take responsibility for doing your own due diligence and consult your own professional advisers before investing in CXB or trading in CXB securities. CXB and its management have no control over our editorial content and any opinions expressed in this article are our own. We’re not obligated to write a report on any of our advertisers and we’re not obligated to talk about them just because they advertise with us. For a complete disclosure of the compensation received by us from CXB, please review our Terms of Service and full disclaimer at www.equedia.com/terms-of-use/.

Forward-Looking Statements from Calibre Materials

Disclosure from Calibre Mining Presentation

Opportunity for Superior Returns

Opportunity for Superior Returns

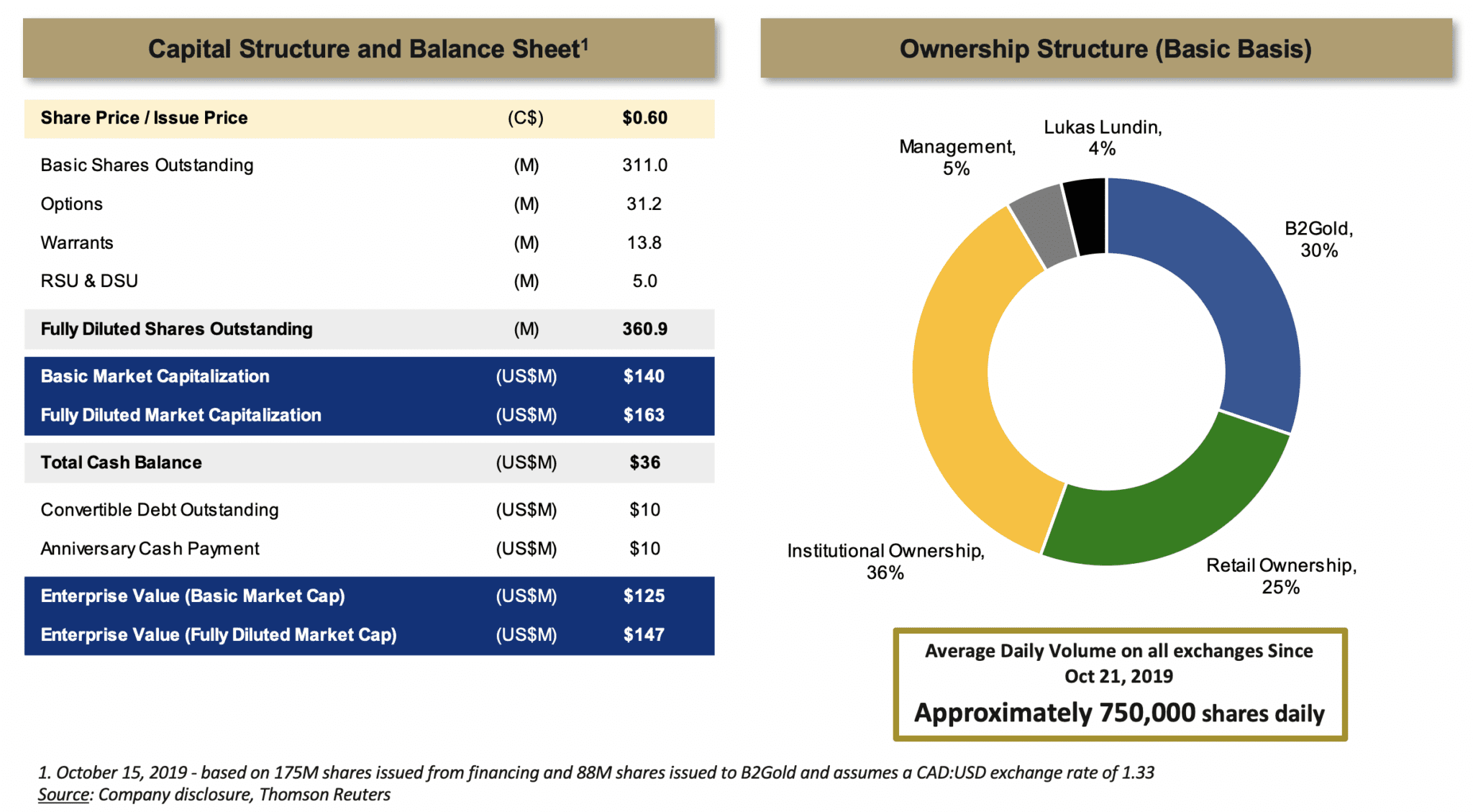

Valuation

*Convertible Debt Outstanding has been converted. B2 Gold ownership is now up to 34%.

Significant Re-rating Potential

Favorable Mining Jurisdiction

Experienced Team

Great article Ivan,

On the subject of gold, perhaps you can take a moment to tell your long-time readers what to do with the shares of First Mining Gold Corp. that you recommended so enthusiastically well over a year ago. I know that you’re probably very busy writing these new and exciting exposés so you may not have had the time to check up on that company’s share price, but you may be interested to know that it has declined approximately 65% since you promoted it, this is an environment where the price of gold is trending upward. I just re-read your letter on First Mining – it was hard to resist. Let’s pile into Calibre now.

send me more info

I’d rate the assets to be located in one of the high risk countries due to growing political instability, high unemployment, rampant crime, and a labour force that doesn’t have the skills required. The risk may even get higher depending on what the guy in the White House does. The article should address these risks before I get interested. What are the mines doing to gain local support – investing in training for jobs? medical? education? etc. Without a lot of local support risks rise. Then there’s the issue of pollution from gold mines – they have a bad reputation & ethical investors want to know more about this issue as any smell of trouble will be problematic for such a small company. Bottom line is – the article sounds too good on the positives without delving into risks.

You make some great points, David. There are certainly geopolitical risks in almost every country, especially when it comes to mining – including Canada.

However, these mines have been in operation for a decade now and the risks you mentioned have not yet come to fruition – including lack of a labour force, among others.

As far as rampant crime, Nicaragua actually has the lowest murder rates in Central America, and crime rates in other categories have dropped significantly over the last few years.

And being the one of the largest exporters of the country, the mines certainly contribute to the overall economy of the nation. In the coming months, I believe Calibre will highlight this in future media.

Hi Rick,

Thanks for your comment. First Mining Gold was introduced many years ago. After our introduction, the stock climbed to $1.18, and held around a $1 for more than a year – so it was a great trade for our readers.

Unfortunately, like most gold exploration companies, the stock fell along with the price of gold – of which, I believe manipulation had a big part to do with it. Which is also why I wanted focus on a producer with our latest gold play – as they will be the ones to climb first with the rising price of gold.

I haven’t followed First Mining for some time, as they have had many management changes there, and hope that you would’ve taken profits along the way. We’re not familiar with the new management team, so can’t really comment on their ability to succeed.

The hardest thing about trading stocks is knowing when to sell. A successful owner of a brokerage firm once told me that I should never get emotional with stocks and always take profits along the way, because we can never guess the bottom or the top. I still have a hard time selling stocks and taking that advice has not been easy. But mostly, I should have.

Of course, in the case of Newmarket Gold, holding on for all of these years would have been the right thing to do – yet, I sold a little early! But in the case of First Mining, taking profits over the course of the year would’ve been the smarter thing to do.

Thank you for ur advice pertaining to gold. Very informative. Am looking forward to ur weekly letter.

I’m very interested

Trulife Distribution – Nutrition Distribution helps our clients achieve success in a complex, competitive retail environment. Our team of nutrition industry experts takes care of everything from importation compliance to marketing, sales and distribution at the ground level. There is no need to navigate the complicated intricacies of the American market when we have already done the work. Let us use our experience to expand your brand and put your product into the hands of American consumers. https://trulifedist.com/

Trulife Distribution – Nutrition Distribution helps our clients achieve success in a complex, competitive retail environment. Our team of nutrition industry experts takes care of everything from importation compliance to marketing, sales and distribution at the ground level. There is no need to navigate the complicated intricacies of the American market when we have already done the work. Let us use our experience to expand your brand and put your product into the hands of American consumers. https://trulifedist.com/