Do Baby Boomers Impact the Labor Force Participation Rate?

A look at Unemployment, Margin Debt, and Institutional Selling

Dear Readers,

We end the week with yet another misinterpreted statistic.

The United States Bureau of Labor and Statistics (BLS) released April’s jobs data and it shows that job increases far exceeded the expected number, sending the unemployment rate down to 6.3%.

The total employment, according to the establishment survey (where businesses are asked how many people they hired in the month), is now less than 100K jobs away from where it was back in December 2007. Wow.

Could employment levels in United States really be back near the levels prior to the 2008 crash? After all, it has been six years.

Not so fast.

I have talked about the discrepancies of the jobs data many times. Those who haven’t read those entries can find a few here:

The April jobs data from the BLS is just another fabrication of what’s really happening in the U.S; a sort of creative accounting-type conclusion on jobs.

It appears that the United States is now nearing the Fed’s 5.5% target unemployment rate at super speed. But what about those who continue to leave the workforce?

We know the unemployment rate is derived from those who are participating in the workforce, i.e. those who want work.

So how many people actually want to work?

Another Look at Labor Participation

The labor force participation rate dropped from 63.2% to 62.8%, the lowest it has been since January 1978!

Coincidently, that’s the same percentage drop (0.4%) as the unemployment rate (from 6.7% to 6.3%).

The difference?

The 0.4% drop in unemployment was a result of 288k new jobs, while the 0.4% drop in the labor participation rate means a whopping 800k people left the workforce.

Hmm…

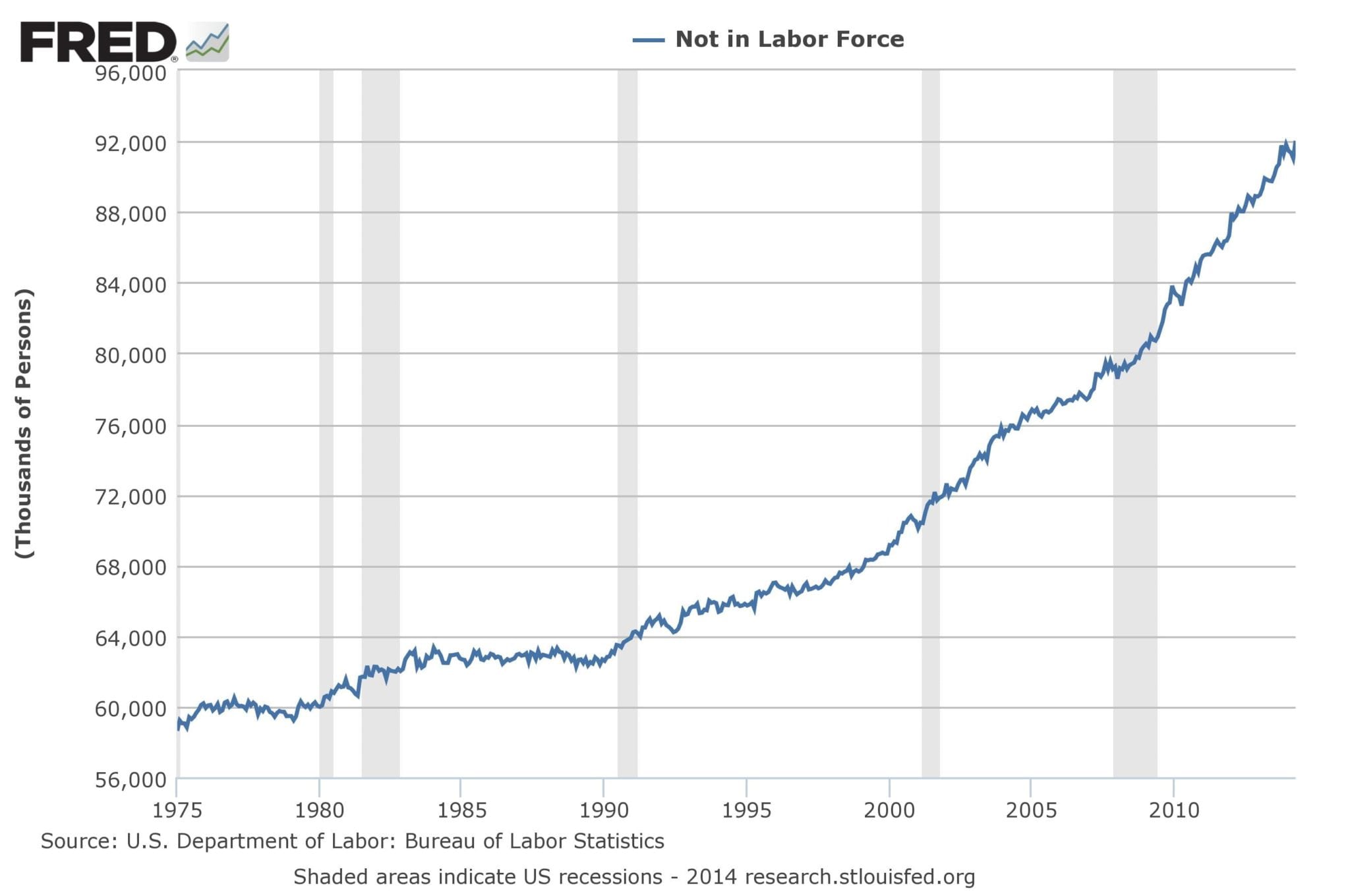

Every year millions of people leave the workforce and those not in the labor force in the U.S. has increased every year for the past decades.

That’s nothing new.

However, the speed in which this number has grown since 2008 has been remarkable.

Just take a look:

Do Baby Boomers Impact the Labor Force Participation Rate?

The argument for the stunning number of those leaving the workforce is that the participation rate is being pushed down by demographic trends, in particular retiring baby boomers.

There’s no question that the baby boomer generation represents a vast number of the United States population. But if the above argument is true, it would mean three things:

- More people will be on Social Security in the U.S. than ever, which means less people working and more people collecting a government paycheck.

- Ditto on Medicare and Medicaid (see Unemployment vs. Employment)

- The number of younger citizens entering the workforce is not growing as fast as those leaving the workforce.

Points 1 and 2 are obvious and inevitable. As a matter of fact, it’s happening as we speak.

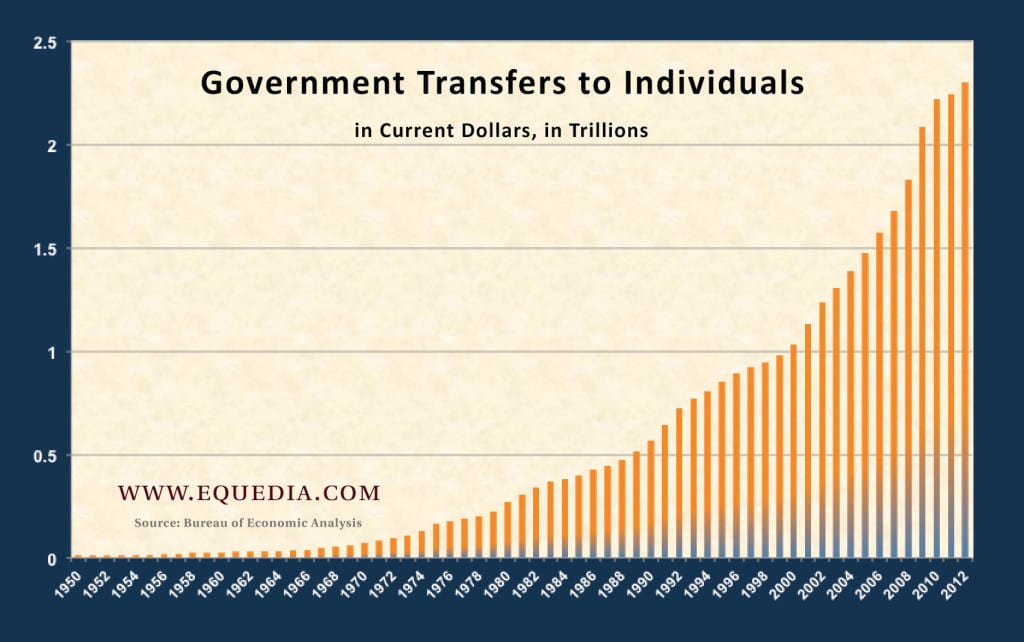

Here’s a chart from a past letter showing government transfers to individuals, with the majority (nearly 90%) coming from income maintenance (entitlements based on poverty or income status), Medicaid, Medicare, Social Security, and unemployment insurance:

But what about Point #3? Are the amount of people entering the workforce really that much smaller than the baby boomers leaving, as many of the arguments related to baby boomers being the cause of the declining labor participation rate suggest?

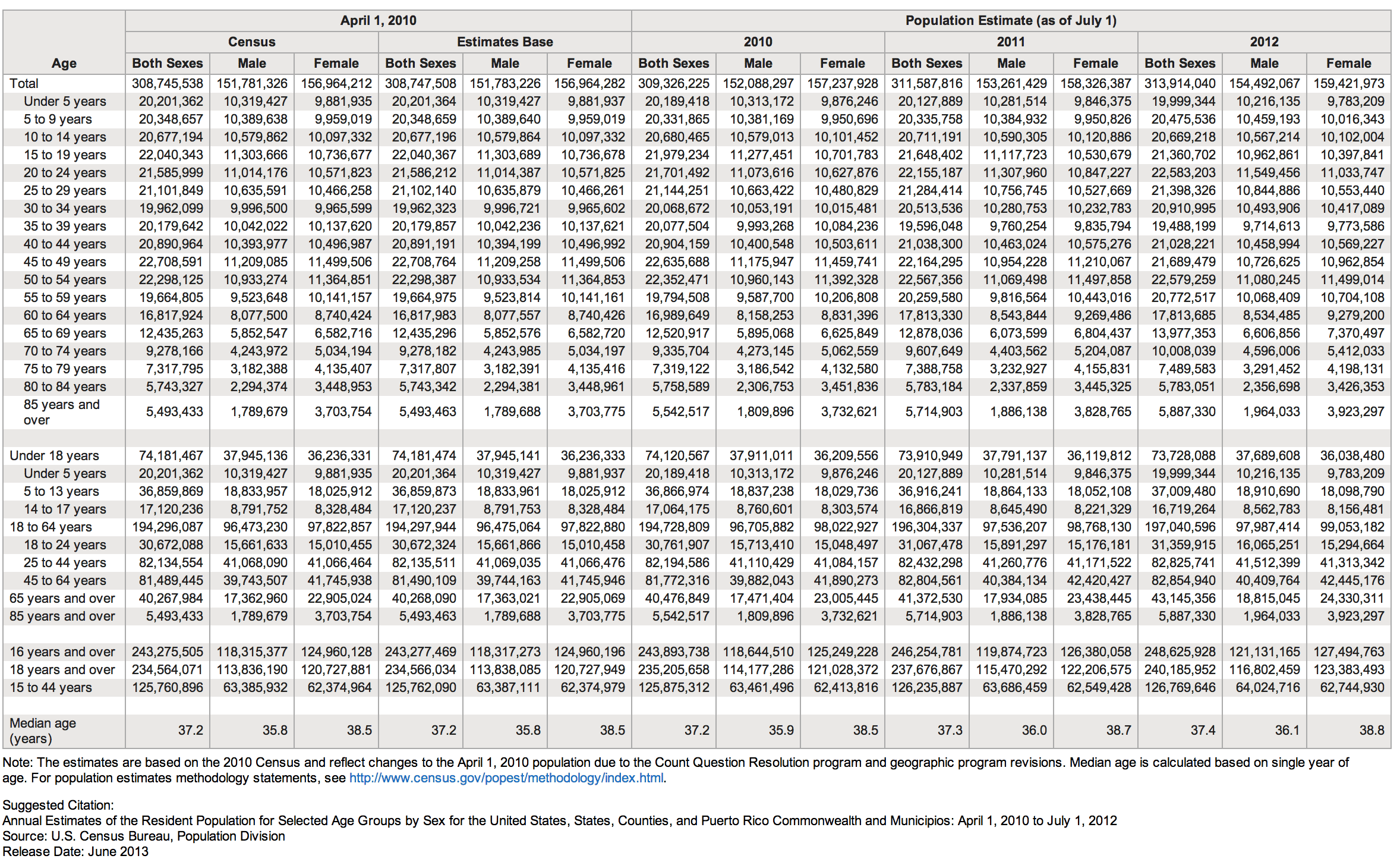

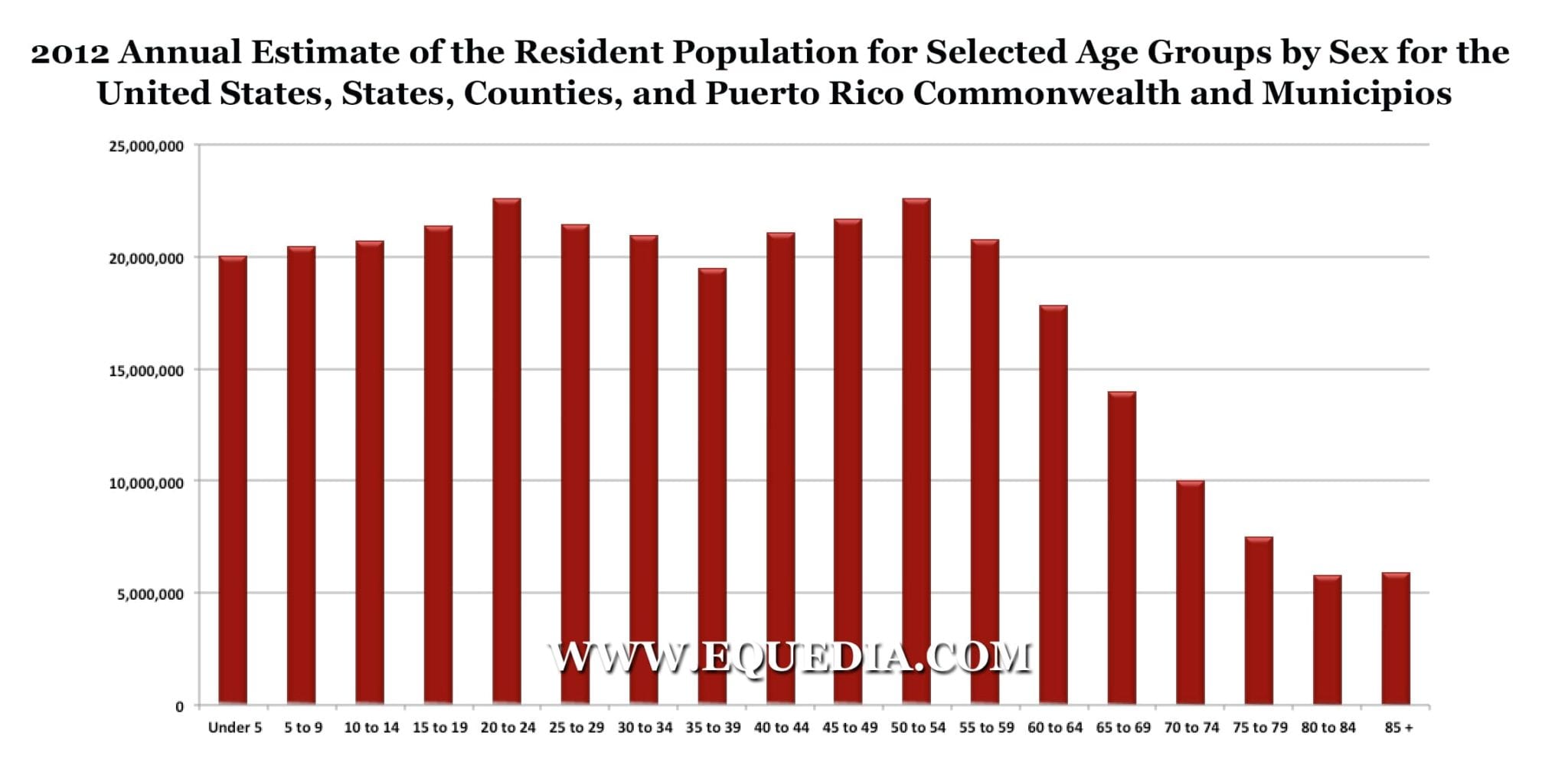

Let’s take a look at the population estimates released July 2013 (you may want to click on the image for a closer look):

If we simply focus on the year 2012 population estimates of the United States, and without going into complex and exact calculations, you will see that the amount of Americans for every five year age gap is almost the same up to age 60 and above, after which the population starts to decline:

The population for those aged 20-24 (about the time when people begin to really look for jobs) is almost identical to the population of those aged 50-54 (about when people really start considering leaving the workforce).

In other words, according to these estimates, there should be as many Americans replacing every baby boomer that leaves the workforce over the next 60 years.

Even the BLS is, “puzzled why so many unemployed people are not looking for jobs.”

And here the media continues to talk about economic number fudging in China…

What do you think? Are baby boomers really the reason for the declining participation rate?

CLICK HERE to Share Your Opinion

Another Shocking Look at Margin Debt

The stock market is still climbing and I still say it’s the amount of leverage and risk that’s been manipulated into the system.

The Fed’s goal is to ensure people take risks; to make people believe that the world is a better place because there’s more money available the Fed exists.

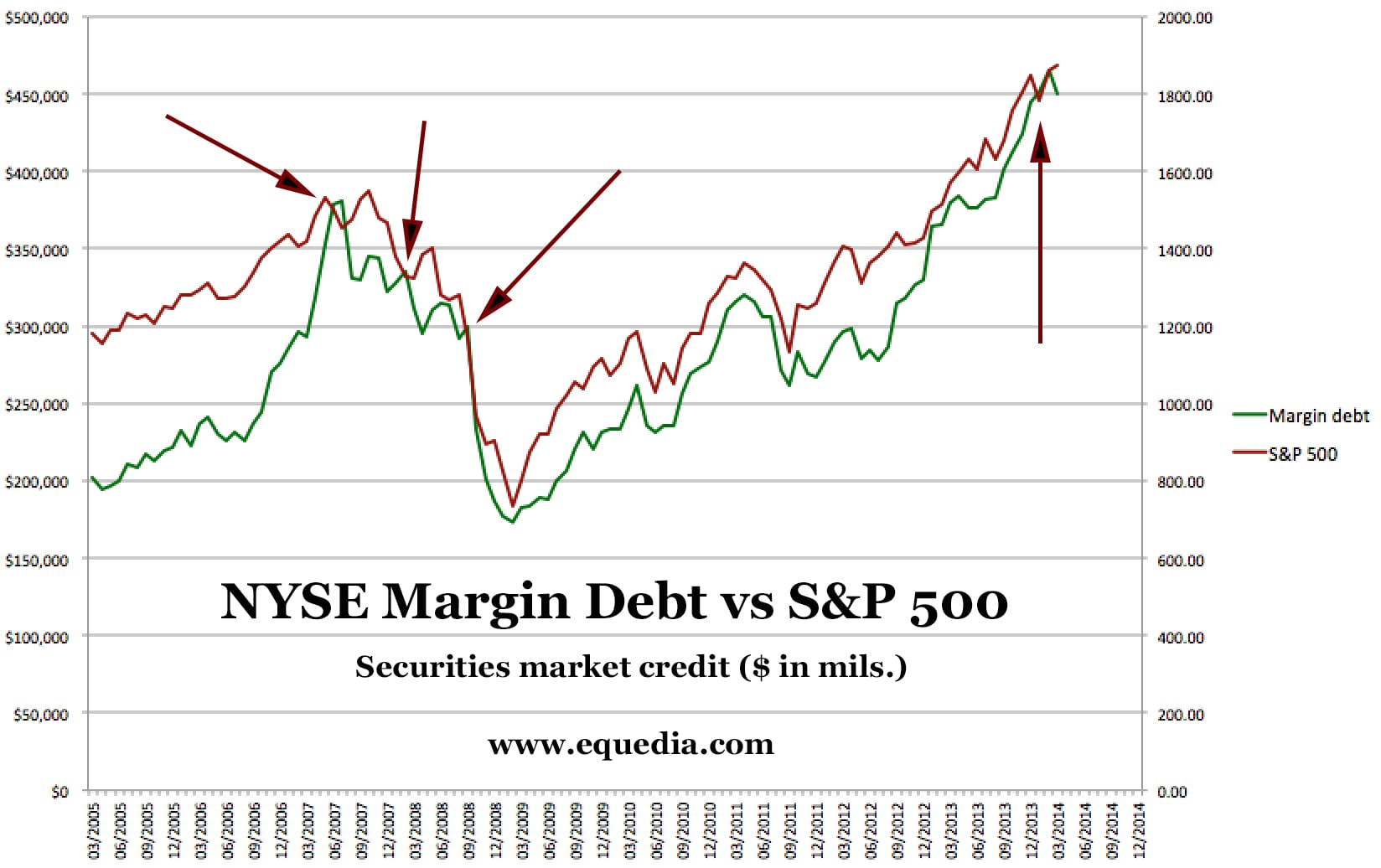

Over the past few years, I have talked about the ever-increasing amount of Margin Debt (the amount of money that someone borrows to make bets on stocks) at the NYSE, which continues to set new record highs.

A few years ago, the amount of money people were borrowing to buy stocks on the NYSE rose back to pre-2008 levels.

Since then margin debt levels have continued to rise, right alongside the S&P 500. This clearly shows that the stock market continues to be propped up through leverage.

But there is an important factor that many have overlooked; I’ve talked about this before, but we should really be taking a closer look now.

Back in February, NYSE margin debt levels hit an all-time high of nearly $466 billion. It sounds like a lot – and it is – but if the market keeps going, it’s not necessarily a terrible sign because it shows confidence in the market.

However, it’s not the record high margin debt levels I am worried about; it’s the fact that for the first time since the crash of 2008 that margin debt levels have crossed the performance of the S&P 500 on a relative basis.

Take a look:

In the last decade, every time NYSE margin debt levels have crossed the S&P 500 on a relative basis, the S&P 500 has fallen dramatically in the following months.

Is the recent cross a sign of things to come? Keep a VERY close eye on this gauge.

How the Market Works

In many past letters, I have explained how the stock market works; how the retail investor is always the one that gets burned.

When stocks suck, institutions put fear into the retail investor forcing stocks even lower. As they head lower and no one wants them, institutions starts accumulating, buying stocks back up. As this uptrend continues, retail investors decide to get back into the game and the retail fund flows enter the market leading us to higher highs.

If you have been following my letters over the past five years, you will have picked up on this strategy many times. It’s why I said the S&P 500 would soar passed 1800.

Stocks are now at a point where the value is in the trend of the market, as opposed to true fundamentals.

This usually signals a time when institutions begin to sell-off into the liquidity created by the retail investor.

So let’s take a look at the recent data from Bank of America, the second largest holding Company in the United States and one of the largest companies in the world, and see what it’s doing:

This chart from Zerohedge shows that net sales of U.S. equities were mainly due to institutional clients, who have now sold stocks for the last five consecutive weeks and remain the biggest net sellers year-to-date.

According to Bank of America, institutional clients have been the biggest seller on their books since January and the 4th most on record in the last week. Meanwhile, retail clients continued to buy into their selling.

Just some food for thought.

Anyone calculating the people on welfare or disability. Both nos. have skyrocketed under Obama!

How about the food stamp participation rate.

All the markets and figures are manipulated to suit the powers that be.There are no free markets anymore.

Why is that U.S Dept of Statistics does not know what you say on Unemployment statistics? This is pretty serious stuff.

Their job is to lie on behalf of the Fed. Not to tell the truth!

I will not ride this market to new highs anymore. We’re in

for a gradual correction and it should begin before this summer.

Correct me if I’m wrong but didn’t a lot of people considering retirement in 2008 get their investments whacked bigtime? And to add insult to injury, their savings are making paltry returns because of ultra-low interest rates. What I do know for a fact is that many in their 60’s have decided to continue working. We’ve even seen news articles saying some believe the old should be quitting their jobs to make room for the young. The impact of boomers on the participation rate in negligible in my humble opinion. More likely, there are simply not enough jobs to find and people have given up looking.

Agree with you 100%. Private investor is always late to the party. Thanks for the education. and I hope that readers take note on your advice. The pattern is clear..I have personally followed some indicators that have worked quiet well on major turns and have not seen them yet. However a correction between now and end of October would be nice.Warren Buffet makes money buying low yet the majority of folks continue to buy high. It is also due to the fact that the education passed on to folks is to hold on (PS: I don,t want to take a dip on my income level.please) (read between the lines))..One should always protect your Investment asset as much one can and educate ourselves in so doing.. In over twenty years of observing markets this I have concluded. There is more money to be made when markets correct.Only if one has a plan to buy in..

24% CANADIAN POPULATION TO RETIRE by 2024. Government better start taking this figure seriously and invest the pension fund wisely. Interesting enough in 2001 when government decided based on professional advise to Invest our CPP funds there were so clear so many sings indicating a major Bear just ahead.. Now you know how I feel about politicians and goverment.

I don,t see the unemployment figure of 6.3% in US making sense.Economics have not changed that much to affect such a decrease..Its mostly likely——accounting decoration

THANKS AGAIN FOR THE CONTINUE EDUCATION

Peace………………………

From the Equedia Letter …

This census data showing Median age (bottom of table) may be misleading. Median is calculated by arranging data numbers in value order and then locating the middle piece of data.

example: There are thirteen numbers. Our middle number will be the sixth number:

3, 5, 7, 12, 13, 14, 21, 29, 39, 40, 56, 60, 90

The median value of this set of numbers is 21.

The Mean or average would be:

example:

Add the numbers: 3, 5, 7, 12, 13, 14, 21, 29, 39, 40, 56, 60, 90

Divide by how many numbers (there are 13 numbers):

The Mean is 389/13 = 29.9

I think the census data might show an interesting difference if the mean (average) age had been calculated and reported.

I’ve been saying this for the last 5 years…that baby boomers retiring,(including myself)especially in Canada, is the magic bullet that’s bringing the unemployment levels down.

Can you imagine if there was no pensions, or retirement savings plans for the baby boomers, and families were still producing 5 to 7 kids per family.

We’d be back in the depressing thirties.

Obamas getting a free ride on the economy, thanks to the baby boomers.

The unemployment levels will continue to fall for the next 10 years, as the younger workers replace the older retiring workers.

If you stop working and rely for income on rents, I doubt you are counted as being in the labour force even though you are producing a good. Can anyone confirm? If so, then it’s the boomers not the young.

Also, I would suspect a LOT of people are earning something off the internet without having a ‘job’. I saw one page today for a footloose Canuk who seems to make $$ by advising folks how to quit. Not a lot but enough for his travels, or so he claims.

Also, in light of realities here, I think quite a number of young grads are heading over to Asia to teach English. I know one such person who has even managed to find a real job, almost in his field in China. Now I tell every young person I meet to follow this trail.

As you get older, you need less as long as you are healthy. All they have to do to fix the system is to cut off health care over a certain age (palliative only) and slash public sector wages/benefits/pensions. Like what’s the use of putting a new kidney in a 75 year old (and making the kids pay)? Someone else’s kid too, since our birth rate is far below replacement.

Just some happy thoughts on a nice spring day!!! Shall we meet in Kunming, Chiang Rai or Reyjkavik? Given what they’re doing with Canada, I doubt this joint will be worth sticking around for long. Eh?

I get pleasure from, result in I found exactly what I was having a look for.

You have ended my four day long hunt! God Bless you

man. Have a great day. Bye

Have you ever considered publishing an ebook or guest authoring on other websites?

I have a blog based on the same information you discuss and would love

to have you share some stories/information. I know my visitors

would value your work. If you are even remotely interested, feel free to send me an e-mail.