To answer why did crypto crash, you have to first ask who crashed it.

But first…

It was September 1992.

The UK was grappling with a recession fueled by double-digit interest rates and an overvalued pound. The government had to do something, but its hands were mostly tied.

Since the pound was part of the European Exchange Rate Mechanism (ERM), it had to keep a fixed rate with ERM currencies. That meant the Bank of England (BoE) couldn’t lower rates at will because that would depreciate the pound and break the peg.

As a workaround, the BoE slashed its rates while simultaneously tapping its foreign exchange reserves to buy the pound to offset the devaluing effect of lower interest rates.

That’s when George Soros saw his once-in-a-lifetime opportunity.

Soros knew the UK’s foreign reserves wouldn’t last in the face of a severe sell-off. So, he conspired with his Wall Street buddies to borrow billions of pounds just so he could dump them all at once.

Sure enough, the Soros plot to destroy the currency worked. The BoE’s reserves ran out, and the pound dropped the peg – immediately shedding a quarter of its value.

Then Soros and his accomplices repaid their loans using a devalued pound and pocketed mind-blowing profits.

Soros alone earned over a billion dollars. In a single day!

Meanwhile, Great Britain lost over three billion pounds.

This day, known as Black Wednesday, went down as the single most audacious heist in modern history.

Until now…

Black Wednesday 2.0: Why Did Crypto Crash?

You might be wondering: why did crypto crash?

A few weeks ago, someone ripped a page from Soros’s playbook and re-enacted it in crypto.

As you probably witnessed, two of the largest cryptos, TerraUSD and Luna, blew up in smoke—wiping out over $40 billion of capital.

Ivan and I aren’t fanboys of these cryptocurrencies, and I predicted something like that would happen sooner or later. But, however useless, these cryptos didn’t die from “natural causes.”

The liquidity dry-up was so fierce and fast that only a coordinated attack could have caused such a blowup.

In fact, there’s talk of an undisclosed wallet that raked in over $815 million from this implosion, and probably many others, too. Of course, the mainstream media quickly laughed this off as a “conspiracy theory” – the new term for something so “obvious” yet too sinister to believe.

But are $815 million trades pulled off simply by chance?

“Obviously” not.

So who could have done something on such a grand scale? Soros?

The answer lies in the “obvious.”

Outside of billionaires playing for a trade, who benefits most from a crash in crypto?

In fact, Ivan has predicted this many times before.

In just a bit, I’ll show you how this plot could be part of the plan to quietly introduce the digital dollar we discussed last week.

But first, to get some context, let’s go over the mechanics of what happened.

What are Luna and TerraUSD?

What makes this attack even more suspicious is that the cryptocurrencies in question aren’t some shitcoins built on a joke; they are so-called “stablecoins” that at least had some theoretical utility.

As the name suggests, stablecoins were meant to provide the technological benefits of a democratic cryptocurrency without its inherent volatility by holding a peg to a traditional asset, such as fiat or gold.

The first stablecoins were straightforward. They used real assets held in reserves as collateral. For example, the world’s largest stablecoin today, Tether, is backed by dollars and Treasuries.

But then, crypto advocates slammed this governance model as being at odds with the ethos of decentralized finance. That’s because, in the end, it’s still the centralized authority that keeps the books.

So a new breed of stablecoins was born—algorithmic stablecoins.

Instead of holding reserves, these stablecoins maintained a peg through an algorithm.

For example, TerraUSD (UST), one of the victims of this implosion, was meant to hold a 1-to-1 peg with the dollar. And it did so through an algorithm that creates arbitrages between it and its sister crypto Luna.

In short, when UST dropped its peg, the algorithm incentivized traders to buy or sell Luna against TerraUSD, which eventually brought UST to the dollar parity and let traders earn the spread in the process.

Via Not Boring:

“If $UST is trading at $0.99, arbitrageurs can buy it and redeem it for $1 of $LUNA, pocketing $0.01. This is called the contraction phase because demand for $UST is falling.

Of course, when $UST is trading at $1.01, arbitrageurs can do the inverse–trade $1 of $LUNA for 1 $UST, and pocket $0.01. This is called the expansion phase because demand for $UST is expanding. Note that another form of arbitrage also exists–simply selling 1 $UST for $1.01 of $USDC.”

That’s the “monetary policy” the world’s third-largest stablecoin ran on. Yes, it is decentralized and all, and it works on paper. But in reality, its fate hinges on the condition that everyone keeps their end of the deal – a simple yet difficult feat to achieve when greed is involved.

And that’s where big money saw a soft spot they could tear apart.

Engineered Crypto “Bank Run”

It all began in late March.

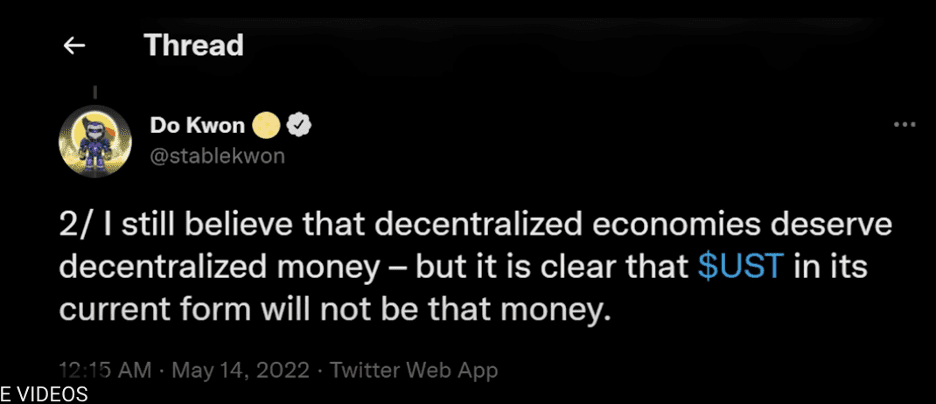

Terra’s blockchain founder, Do Kown, started a Bitcoin reserve fund called Luna Foundation Guard (LFG). It served as an extra safeguard to backstop the TerraUSD in case the algorithm fails.

(It’s like a crypto Fed, which is ironic because, by creating a centralized reserve system, they were, in effect, mimicking the governance of the dollar, the most centralized currency there is. )

In all, LFG accumulated 80,000 bitcoins worth around $3.3 billion at the time.

Meanwhile, according to a widely circulated analysis, an undisclosed crypto kingpin borrowed and shorted 100k bitcoins (worth over $4 billion). At the same time, they built a $1 billion position in its victim currency, TerraUSD.

The heist began on May 8 when the attacker offloaded one-third of its UST position, which created a liquidity shock. UST couldn’t absorb it and slightly drifted from its peg to 99 cents.

The trader then doubled down and offloaded the rest of $650 million in UST. UST fully de-pegged to ~$0.6. And, over a week-long “bank run,” the cryptocurrency lost nearly all its value.

Meanwhile, its sister coin Luna was dragged down with UST—crashing from its all-time high of $116 to a mere $0.0001864…

As Terra’s cryptos went into free fall, the LFG started dumping billions of dollars’ worth of bitcoin and bought UST to defend the peg. In turn, bitcoin lost nearly 20% of its value over the course of this crash – or $125 billion in value.

How to Crash a Crypto

In layman, think of it as an engineered bank run meant to destroy a bank’s stock and then profit from it.

You borrow billions of dollars and deposit them with the bank, while at the same time, you short the stock of that bank. Then you put in a withdrawal request for the amount the bank surely doesn’t have on hand.

The bank’s trust is lost as it doesn’t have enough money on hand to repay its deposit.

Other clients of the bank race to get their money out, and a bank run follows. Its stock crashes, and you bag a ton of money from your short position while taking a much smaller loss on the money deposited with the bank.

The same analysis estimates that the mystical trader could have raked in $815 million from this heist – even after deducting all losses incurred from selling sinking TerraUSD assets.

There aren’t details on where they covered [bitcoin short position], obviously, but if they were able to cover (or buy back) the entire position at ~$32k (instead of $40k plus where it was before this trade), that means they made over ~$952mm on the short [bitcoin] position alone. On the $350mm of $UST curve dumps, I don’t think they took much of a loss. Let’s assume 3% or just -$11m. And let’s assume that all the Binance dumps were done at 80c; that’s another -$125mm cost of doing business, for a total profit of $815mm (before borrowing cost).

Meanwhile, individual investors in UST and Luna lost around $42 billion from the crypto crash, according to blockchain analytics firm Elliptic.

The devastation is real. Since the implosion, there have been dozens of accounts of suicides and foreclosures in the crypto community.

So Who’s Behind the Crypto Crash?

This whole crypto crash is under investigation—which will get deliberately bogged down in red tape as always—but I have a few guesses.

We are talking consolidated positions worth billions of dollars. That means it wasn’t a natural market reaction or a collective move like meme stocks. It was a big player that had enough money and will to reduce $40 billion in assets to dust.

That’s right, “reduce to dust.”

I’m convinced this attack wasn’t so much about making money as it was about wiping those stablecoins off the face of the earth.

So if you want to know why did crypto crash, you should be asking: who crashed it?

Who on Wall Street would give a damn about such a niche market? Especially when many, including billionaire VCs, are invested.

How about those who are now throwing their weight behind it and want to monopolize the money flow—just as they did with traditional assets?

(Read my recent letter to learn more)

For example, this April, two of America’s biggest asset managers, BlackRock and Fidelity, plowed hundreds of millions of dollars into the world’s fastest-growing stablecoin, the USD coin (USDC).

“Circle Internet Financial Ltd., the issuer of USD Coin, the second-largest stablecoin, landed $400 million in funding from a group that includes BlackRock Inc. and Fidelity Management and Research LLC, in a sign of traditional finance’s growing acceptance of the exploding cryptocurrency industry.”

Aside from holding a stake in the coins, these asset managers oversee its $50+ billion dollar reserves and make a bunch of money off it.

Via Techcrunch:

”In addition to the capital raise, BlackRock has entered a strategic partnership with Circle to be its primary asset manager of USDC cash reserves and explore capital market applications for its stablecoin, among other objectives. “Our broader strategic partnership with BlackRock, announced today, will allow us to explore new use cases where USDC may be an efficient resource in the financial services value chain,” Jeremy Allaire, co-founder and CEO of Circle, told TechCrunch.”

Could the “hit” have been ordered by someone higher up in the food chain? By design, the USDC seems like a beta test of the digital dollar.

Think about it.

USDC is not tied to a single blockchain. It’s backed by the dollar and Treasury reserves. And Capitol Hill already pulls strings on it like a puppet. Here’s what its founder said during a recent interview with Forbes:

”Given the market and regulator demand, we made the change [switch to dollar and Treasury reserves] and have had a tremendous response. I think the interesting question embedded in your question is what does the future look like? I think that’s a policy question. And that is at the heart of the policy work that’s happening with the US Treasury Department, Congress and in other places.”

Not only that, while USDC’s reserves aren’t yet sitting in the Fed’s vaults, they are already regulated by Wall Street, which, as we well know, is the de-facto custodian of the Fed.

And now, with the help of Wall Street, this stablecoin is quietly infiltrating the traditional financial system.

Via Forbes:

“Speaking to Forbes, CEO of Circle, Jeremy Allaire said the partnership will “explore ways to apply USDC in traditional capital markets.” Though Allaire added that the relationship has been developing for almost a year he did not disclose what percentage of the stablecoin’s reserves BlackRock is managing or other details of the partnership.”

Now, you could say that the destruction of TerraUSD would have a spillover effect on other stablecoins. But as we discussed, TerraUSD was backed by an algorithm while Wall Street’s USDC has actual reserves.

So, if anything, this implosion will only cement USDC’s (potentially the digital dollar in disguise) position in stablecoins because investors will likely shy away from its algorithmic peers.

Just as Ivan predicted many, many years ago:

Via “Is Bitcoin the New Stimulus?“:

“…there could be a reason why governments around the world are letting cryptocurrencies run rampant:

-

- To temporarily infuse free money into the system “off-the-books.”

- To implement Cryptocurrencies on their own once the technology is proven and accepted (or once it fails and they step in to save the day).”

Gaslighting a Generation of Conformists

Now to be clear…

I don’t care much about these specific cryptocurrencies or adrenaline junkies who lost their shirts while gambling on them. They knew the risk, and they got what they were looking for. A crypto crash was inevitable.

But I do care about people for whom these investments were more than a gamble. Those who bought into them as a way to stand up against the all-controlling Fed and its elite-favoring policy.

That’s because, after such wipeouts, they might lose faith in any democratic monetary governance model—even that which could actually work.

Maybe that was the plan all along: gaslight the masses by letting them believe in something so badly, then deliberately destroy it to raise a generation of hopeless conformists.

Boy, was Ivan right. And that means the elites will be stepping in soon…

Seek the truth and be prepared,

Carlisle Kane

you speak of Ivan quite a bit. Is he still alive.? I assume he wrote the letter before you?

Look forward to your letter each week . It is superb.

Thank you.

I would never ever invest in any crypto ccys or products. This is a scam that will end badly…Crash, or no crash there is no value in these! My two cents…

Just kike the f’ing FED/bankster parasites and their political and presstitutes stooges that are in a criminally insane ponzi, casino la la land…

Meanwhile, back in the real world… Sanctions to the right, tariffs to the left and blaming everyone else for the criminal insanity of their ponzi ‘economies’ and military messes – oops, sorry “spreading freedumb and demonocracy” – don’t the parasites, their political stooges with their slimy, “souled” out presstitutes realize that all those pathetic, childish tantrums only show just how broke, desperate and fracked up the “united” states of murica and king-CONNED-om (along with most of their bitch slapped stooges) really are?!?!

“Reality is the which, even if you stop believing in it, does NOT go away…” https://www.youtube.com/watch?v=89JWQQIahtQ

I’m in the camp of ‘Those who bought into them as a way to stand up against the all-controlling Fed and its elite-favoring policy.’, and your position seems quite plausible as even a donkey such as I found something rather fishy about the big meltdown. You didn’t however say anything about how people such as I should view cryptos now, and what to do with our holdings, and that would be much appreciated, especially since it seems the equity and bond markets seem to be melting down as well, inflation appears likely to get quite horrible, and all the other things that seem to be disasters-in-the-making.

Revelation 13

15 The second beast was given power to give breath to the image of the first beast, so that the image could speak and cause all who refused to worship the image to be killed.

16 It also forced all people, great and small, rich and poor, free and slave, to receive a mark on their right hands or on their foreheads,

17 so that they could not buy or sell unless they had the mark, which is the name of the beast or the number of its name.

18 This calls for wisdom. Let the person who has insight calculate the number of the beast, for it is the number of a man.[e] That number is 666.

Who is Ivan?

Okay so there are no longer any institutions that people have any faith in. What a sad day. We have to sue under the freedom of information act to find out the side effects of an experimental vaccine. Once upon a time (sounds like a fairy tale) in America, people had so much faith in their government that parents volunteered their children by the thousands to help find a cure for Polio.

Someone ought to tell soros he is approaching 100 and will NEVER be able to take even ONE DOLLAR with him!

Thanks for sharing this article about crypto crash. By the way which cryptocurrency can I buy in this year?