Warren Buffet just exposed Wall Street’s dirtiest secret.

At Berkshire Hathaway’s annual meeting, he called out bankers for stoking market speculation and turning corporate America into “poker chips.”

Then, his right-hand man Munger chipped in:

“We have people who know nothing about stocks being advised by stockbrokers who know even less… It’s an incredible, crazy situation. I don’t think any wise country would want this outcome. Why would you want your country’s stock to trade on a casino?”

While I don’t agree with everything these guys say, they hit the nail on the head this time.

Wall Street is effectively a croupier that distributes bets. It doesn’t care whether they are good or bad bets because the house always comes out as the winner. So, the more bets, the bigger take.

It’s no wonder Ivan said the banks were pouring money into retail investors and snapping up trading platforms in his letter,”Rise of the Retail Investor,” back in October 2020.

But many people don’t realize this.

That’s because Hollywood has fed us a very different image of Wall Street. Not only is it grossly over-romanticized, but it never shows the investors’ losses – only the wins of Wall Street.

And that’s our topic for today.

What is “Wall Street”?

“Wall Street” is such a general term that many slap it on any institution that handles bigger flows of trades. But there are actually two sides of Wall Street doing polar-opposite jobs.

There’s the buy-side and the sell-side.

The buy-side buys stuff. Asset managers like pension funds, mutual funds, or hedge funds pool investors’ money and invest it in stocks, bonds, and other securities on their behalf.

The sell-side, well, sells stuff. They are the “sales agents” of public companies—aka investment bankers—who auction off their stocks, bonds, and other securities to the buy-side.

So, Wall Street, the likes of JPMorgan that are quoted all over the media, are mostly the sell-side. Like all Wolf of Wall Street-like blockbusters, they don’t earn those $500,000 bonuses by flipping stocks.

Instead, they broker corporate America.

Catching the Crumbs off the Table of Capitalism

So, how exactly do investment bankers make money?

First, as I’ve just touched on, they help companies raise money by selling their securities to asset managers. For example, every company hires an investment banker to underwrite its IPO or issue a new batch of bonds.

In return, these banks earn fat commissions and advisor fees.

Do you know how many times I’ve heard investment bankers tell me they could care less about the companies they sell because their commission check is always there? One too many.

The second big source of revenue is trading.

But again, unlike many fantasize Wall Street fantasies, these bankers don’t trade for profit. Instead, they act as a “private broker” for the buy-side (in financial lingo: the over-the-counter market).

For example, how does an asset manager sell $10 million of Apple bonds when there’s no easily accessible liquid public exchange for bonds? They call up a trader at, say, JPMorgan, who hooks them with another asset manager whose willing to buy Apple bonds.

(If there’re not enough buyers, these traders buy those bonds themselves, hedge them with derivatives to avoid market risk, and hold them on their books until they come up.)

Then, just like your broker, they earn the spread. Only bigger.

In other words, Wall Street is market agnostic. It makes money no matter whether the market is up or down.

As Buffet poetically put it: “Wall Street makes money, one way or another, catching the crumbs that fall off the table of capitalism.”

The caveat is that they have to catch those crumbs.

How Wall Street really lands clients

You may think that a great track record is how Wall Street lands their clients, but there is much more to it than that.

Wall Street has a rep for lavish outings and gifts to lure in clientele.

To give you a taste, during its last crackdown, the SEC found out that mid-sized investment bank Jefferies budgeted over $1.5 million a year for its vice president’s “entertainment” expenses.

Via FT:

“He used the money to court five Fidelity traders, paying for private flights to Turks and Caicos, Bermuda, and Puerto Rico, as well as vintage wines, golf outings, and trips to Wimbledon and the US Open tennis tournament. He also paid $75,000 towards a lavish Miami bachelor party for a Fidelity trader. “Investors deserve, and the integrity of the market requires that traders select brokers based on the quality of their trade execution and not the lavishness of their gifts,” said Walter Ricciardi, the SEC’s deputy enforcement director.”

That must have been fun. But no fancy party or lift on a private jet can beat the dearest favor a Wall Street banker can make for his clients: giving them access to insider scoops.

As middlemen, Wall Street bankers rub elbows with both public companies and asset managers who invest with them. And that gives them the power to hook them up in enlightening gatherings.

Of course, there are laws.

Executives can’t (explicitly) disclose market-sensitive information. But there are a lot of gray areas here, i.e., there’s no law that says you can’t discuss “hypothetical” ideas.

Besides, those people excel at picking up soft information, such as tones, body language, and other clues—all of which can help them foresee events that affect stock prices.

The result is that corporate access has become a booming back channel of insider information. There’s even an academic study that proves asset managers who meet with execs tend to outperform those who don’t. While we agree this should be a part of due diligence, how many retail investors actually get the chance to speak with the execs of large cap stocks?

In other words, Wall Street always knows where the “crumbs” are because they’re told where it is.

Here’s how it works.

Wall Street Misleads Investors to Win “Flow”

Wall Street has a long tradition of rating public companies to “help” investors make better decisions.

Analysts from sell-side banks keep an eye on certain stocks. And each quarter, they grade them with one of the three ratings—buy, sell, or hold—along with a price target.

These grades draw a lot of eyeballs. Half the CNBC coverage is basically what Wall Street “buys” and “sells,” There are even subscription services that supposedly help you cash in on their ratings.

The thing is, investing based on them is like asking a car salesman if you should buy a car.

That’s because the people who rate stocks don’t earn a living off the accuracy of their calls (empirical evidence). Instead, most of their money comes from bringing in “the flow”—investment banking clients.

…which presents a moral dilemma.

On the one hand, your designation binds you to put out objective stock ratings. On the other, your paycheck depends on sucking up to executives—the people behind the stocks you’re rating.

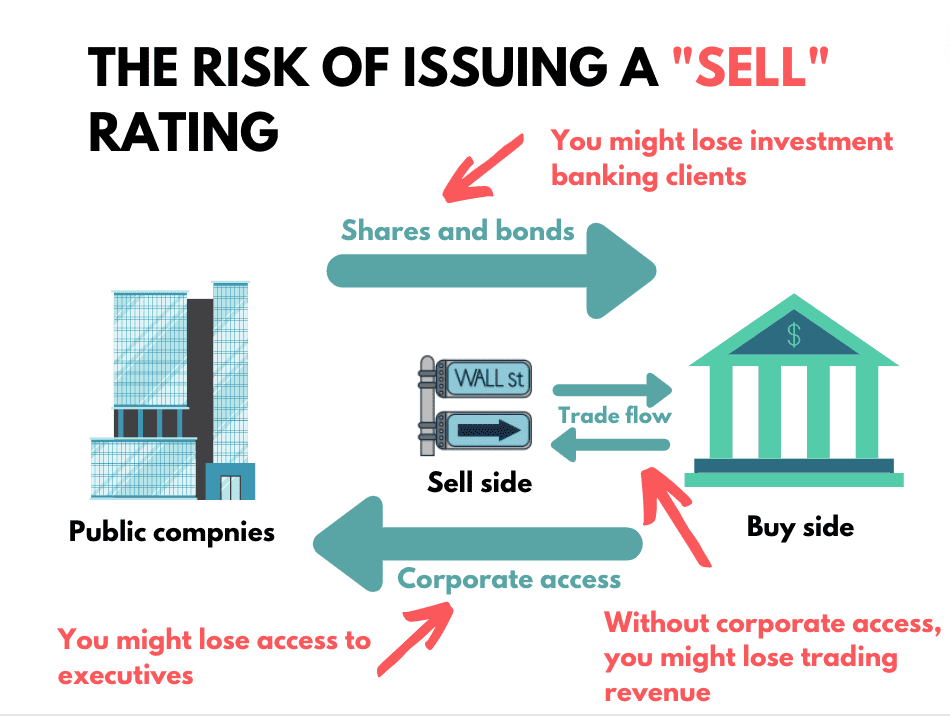

This is why Wall Street largely glosses up ratings out of fear of losing corporate access:

“There’s a tendency to be a little more timid about bad news… If you stick your neck out and break bad news, you get a backlash from owners of the stock,” Tobias Levkovich, chief U.S. equity strategist for Citigroup told CBS News.

In other words, that’s a massive conflict of interest that looks like this:

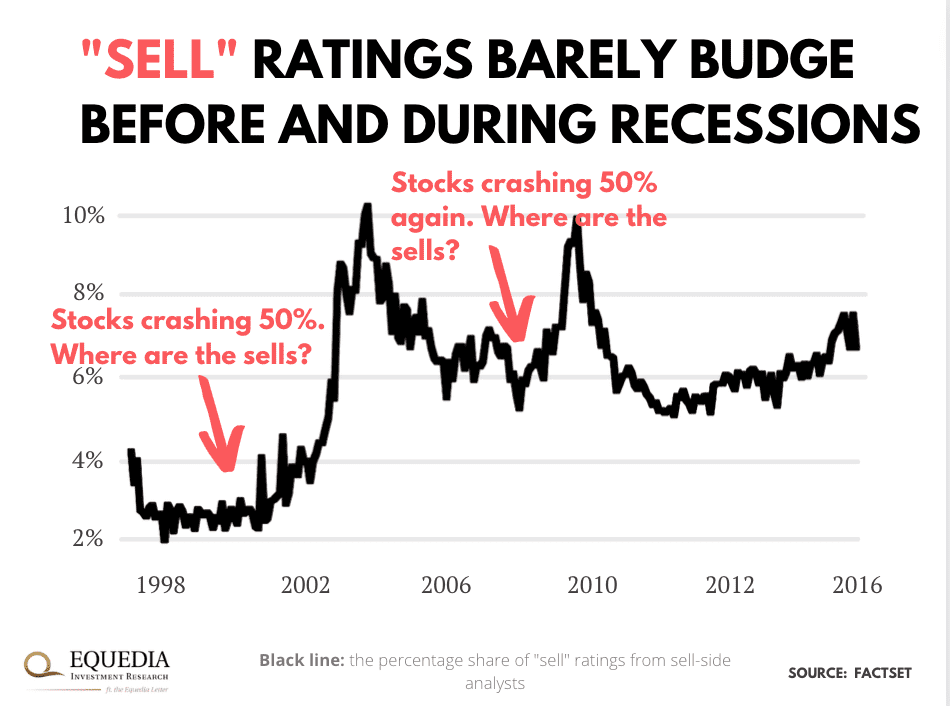

That’s why only ~5% of all ratings are “sells.”

That’s right, five measly percent.

But that’s not all.

The ratio of buy/sell/hold ratings barely budges, even in market crashes:

That’s why “buy” ratings, on average, underperform the market.

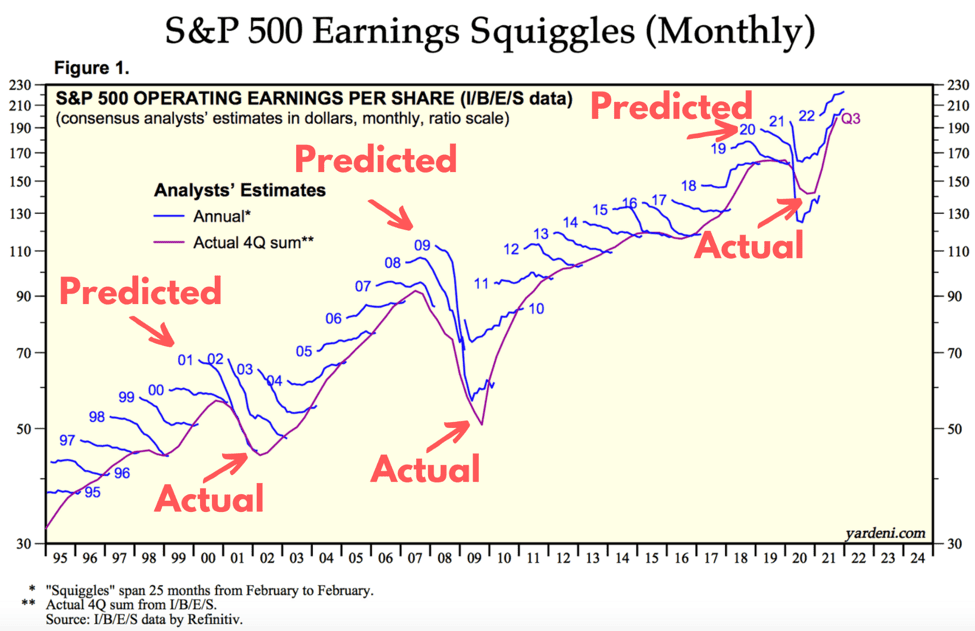

That’s why Wall Street’s earnings estimates overshoot most of the time.

But there is one thing they do consistently: failing to predict a single recession on record.

As I wrote in “The Fallacy of New Year Predictions”:

“It’s funny how financial experts like to bang on the “economy is cyclical” drum. Yet when they predict the markets, they always extrapolate as if the economy moves in one perpetual direction.

Take a look at the Wall Street earnings projections. They’ve never anticipated a turning point:

If you traded based on these extrapolations, you’d have lost your shirt in every recession.”

Don’t Take Advice from People Who Have No Skin in This Game

Keep this in mind when you tune in to CNBC next time.

Those Wall Street suits… they often make these big, bold—and often reassuring— predictions. Yet, they have no skin in this game. Nor are they risking their rep for making a bad call.

That’s because they aren’t in the business of making good calls. They are in the business of brokering stocks and bonds in bulk.

And as long as the money is tricklin’ in, they win one way or another.

-Carlisle Kane

Well, how about the greedy exchanges that promote high velocity trading which whip saws the market where the exchanges earn money from them and from those that get to see all the transactions before the general public? Nothing but a scam on the general public! Such trading should be outlawed.

Reminds me of a co-worker who came back from his broker who was recommending he buy a particular stock. As he waited for his broker to get off the phone he heard the broker recommending that his client sell the same stock. In other words if you own it you should sell it and if you don’t own it you should buy it!

Brokerage houses issue buy recommendations because everyone is a potential customer whereas sell recommendations only have owners of the stock as potential customers.

Take your investments out of stock market immediately UNLESS you know how to profit when stocks fall using PUTS options on the SPY (SP500) QQQ (NASDAQ) IWM (RUSSELL 2000) pay close attention to the VIX (investors fear index) and CPI reading (next one scheduled for this Wednesday which I would bet money (if I had any) will send the markets tumbling even further. Good luck to all and this isn’t investment advice (contact your money hungry so called FIDUCIARY pay a huge fee to be a financial advisor whose robbing you and makes you feel like 5% return is alot…… Give me a $100k and I will have you $300k in a month. Just saying good luck to all. Msg me for more real shit that wall street DONT WANT YOU TO KNOW

This post is a more polite way of describing Wall Street as explained in this ~ 2-minute clip from the hit movie “The Wolf of Wall Street”

See: https://www.youtube.com/watch?v=xbBD7VIJ4cc

I think you are correct in your assessment of Wall Street and generally as well.

It’s your stock picks that I find very poor: example, the recent Hapbee Tech. which instantly became a big loser.

ffgg

I’m just not finding the same benefit from these newsletters that were the hallmark of Ivans writing. Those stood out as he would really go out on a limb and not always about just investing but crappy world things too. I find the content now is not much different than A motley Fool or Seeking Alpha release in that mostly its been read before elsewhere and you gotta comb through it for crumbs of useful intel at best. I used to always open them, now , I don’t rush to do that.

While your letter’s input is valid and comprehensively true, it lacks on anlysing the reasons that a system such as the one developed and followed so religiousely in this country and beyond actually offer the parameters and conditions for such untrustworthy schemes to be excuted in the light of day and without any reprucussions for those individuals or institutions that carry them out.

What makes such an obviousely illegal behaviour possible in the first place?

I think that every investor likes to believe that they are investing in the success of the companies behind the stocks that they invest in. After all wasn’t that the intent of the stock markets in the first place? And wasn’t it also the intention to help companies with new ideas and innovations get off the ground and to not only launch their companies but to help them expand once established. The investors were rewarded for the risk that they took.

The road to hell as they say is paved with good intentions. We have witnessed the stock markets being turned into gambling casino’s where the retail investor only makes money for as long as the house needs their money.

Eventually the only the banksters, and their friends end up winning as you point out in this article.

Well said. Thanks for the update and warning