Buying a Home Today – An Inflationary Tale

There is a small postal outlet near me that also sells miscellaneous “knick-knacks” – last-minute gifts, inexpensive jewelry items, clothing, some stationery supplies, birthday cards, and various booklets. On one rack, there is an interesting display of history. Almost every year going back to the 1930s is represented in a booklet that contains a walk down memory lane.

And what a walk it is!

For me, I was interested in 1972. High school was finishing, and it was time to see what came next.

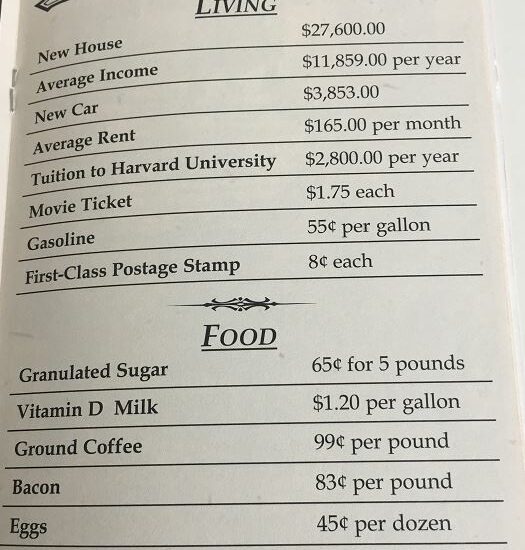

Here is the price of a few hand-picked items that show what a person needed to make in order to afford them:

Apart from the jaw-dropping prices for food and gas, our focus immediately shifts to the price of an average home versus the average salary.

In 1982, the average home cost $27,600. Most homes were purchased using what used to be known as a “conventional mortgage” that required a 25% down payment. That meant you would need $6,900 to borrow $20,700 for a home worth $27,600. Simple.

In order to qualify, banks required that you could afford 30% of your annual gross income towards the mortgage payments.

Using the average income of $11,859 meant $3558 had to be set aside each year to repay principal and interest on a $20,700 mortgage loan. Simple.

And affordable.

Do you see how homeownership made sense and was broadly available?

In other words, there really was a “middle class” that could afford to buy a home and keep up with the payments.

In summary, if someone opted for a 30-year mortgage at the prevailing rate of 7.4%, over a 10-year term, average monthly mortgage payments would be about $140. That meant the average homebuyer could easily qualify because 30% of their average monthly salary was more than double that sum at $295.

Even when mortgage rates spiked up in the early 1980s to double-digit levels and the 10-year term needed to be renewed, homeowners could still make their payments without fear of losing their homes.

Bumping up the interest rate to 12% for another 10-year term puts the monthly payments at around $185.

Can You Afford a House?

Now imagine if we took the current environment and mirrored it to the requirements of 1972.

Let’s see how far our average wages take us – even in this depressed interest rate environment.

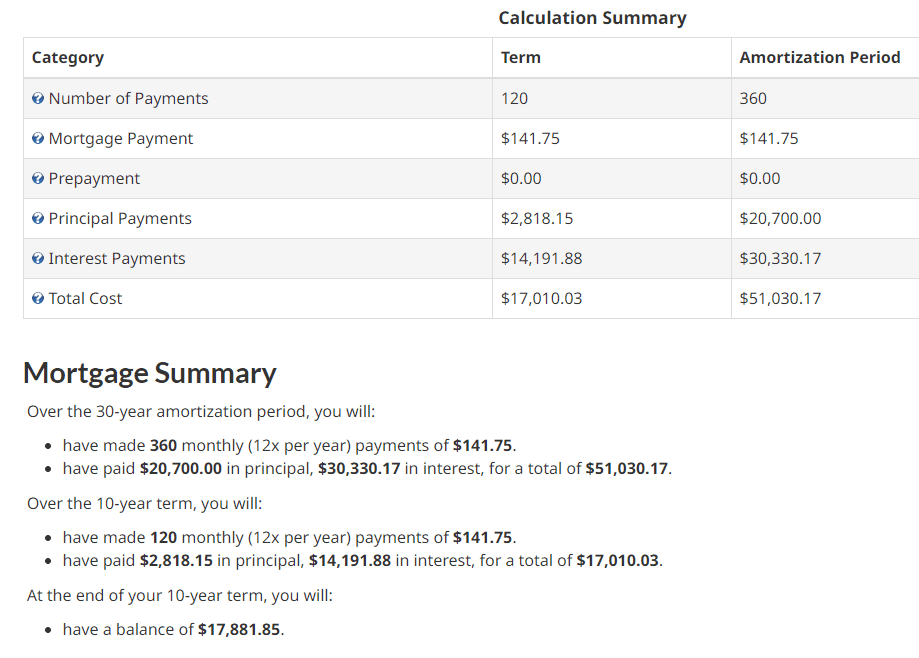

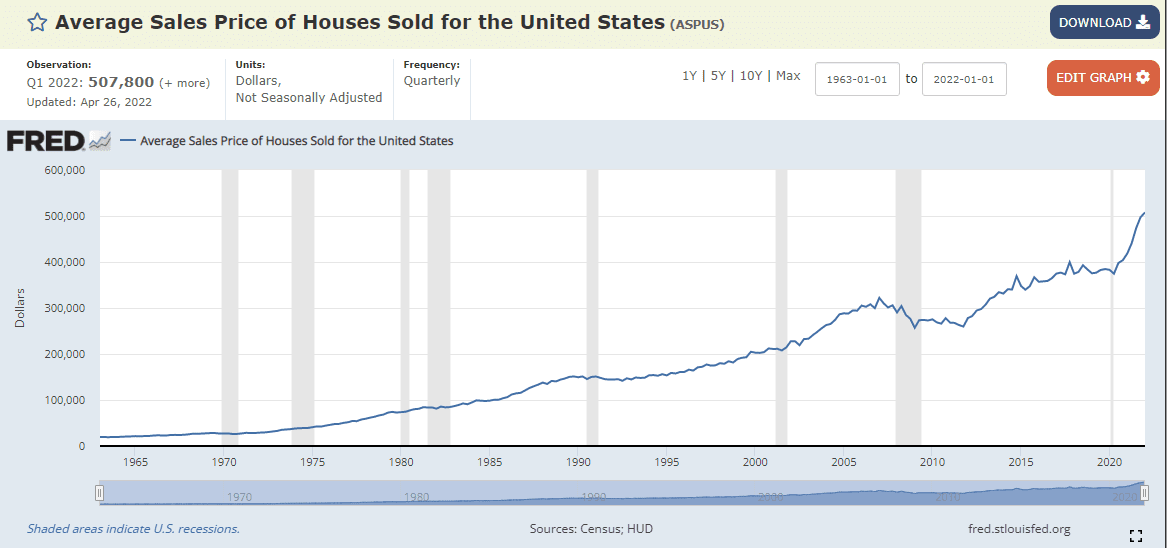

According to the St. Louis FED interactive chart, in 2022 Q1, the average US home is $507,000.

The US Bureau of Labor Statistics reports that the annual salaried worker makes $53,490 per year.

Let’s say the “Bank of Mom and Dad” helps out and puts down the 25% ($126,750) to get a conventional mortgage. That means a mortgage of $380,250 is required.

What are the mortgage payments for this amount at current rates?

The interest rate for a 30-year amortization period currently sits around 5%. Monthly payments would be around $2030 per month.

Our $53,490 annual average salary works out to be $4460 per month.

So, what would a 1972 “mortgage specialist” at the bank say about this?

They take 30% of your monthly salary at $1340 per month and ask you how you will come up with the additional $690 per month to meet the monthly obligations of $2030.

In other words, despite interest rates being far lower than they were in 1972, the bank would reduce all of the math to something that we can all understand: “DECLINED.”

What is this lesson on the subject of homeownership illustrate?

Inflation is a hidden thief.

Asset prices have risen steadily since 1972.

Does anyone remember what happened just prior to that year?

In August 1971, the French government lined up at the gold window to exchange a big bunch of US Dollars for a little bit of gold. US President Nixon said no, and that was the end of the gold standard. US currency was no longer convertible to gold.

The lifting of this restriction meant that the US Government could create an unlimited amount of US dollar debt.

And…in time…they sure did.

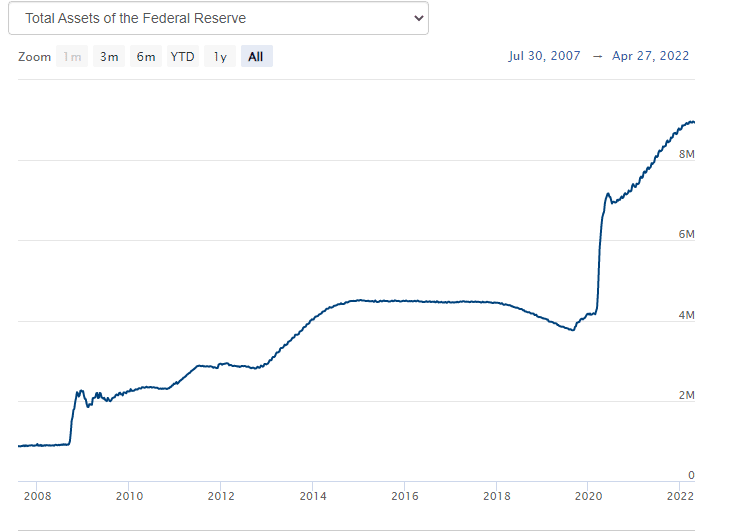

Take a look at the recent graph showing the total assets of the FED:

Now take a look at home prices between 1972 to 1982?

They more than doubled.

Here is an interactive link that shows the average home price, based on sales, for each quarter since the early 1960s:

https://fred.stlouisfed.org/series/ASPUS

On May 4, 2022, I watched and listened to the FED Chairman as he explained how it was necessary to continue raising rates to combat inflation. The stock market rose by almost 1,000 points. Commodity prices rose across the board. Market pundits praised the FED because uncertainty had been replaced by certainty; two more 50 bps were coming and then, after August, a reassessment in September. The very next day, the markets tanked.

Where does this leave the average salaried worker who is already almost $700/month behind in his simple quest to qualify for a mortgage and buy an average home?

We know the answer.

Higher interest rates simply move the goalposts further down the field away from our potential home buyer.

As the supporters of the Great Reset will tell you: you’ll own nothing and be happy.

For the average worker, homeownership was once affordable; then, it became difficult, and now, near impossible.

The 50-year period from the 1970s to now has shredded the dream of owning a home for an entire generation. It’s not going to happen – the numbers just don’t make sense.

Now Millennials hear words like stagflation and phrases like “runaway inflation,” but they can not understand them. There really is no substitute for experience.

Summary and Wrap-Up

Baby Boomers used to appreciate their jobs – after all, the job paid for their apartment or house. A mortgage was a commitment, a promise to pay.

Fifty years ago, jobs were regarded as security. They meant something. Employers and employees understood this and respected it.

For those of us who were “burdened with homeownership debt” at such a young age in the 1970s, it was the best financial path we could follow….but it sure didn’t feel like it at the time!

Imagine being young today, thinking that homeownership will never happen—no wonder the younger generation doesn’t want to work anymore.

For the younger generation: The next time your government leader says they will spend more money to create jobs, you’ll know they’re actually making it harder for you to ever own a home.

So don’t listen to them when they say they’re spending money to help you; they’re not helping – they’re only making you more reliant on them.

– John Top, the technical trader